Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Fundamentals of Financial Management-1.Briarcliff Stove Company-13 Capital Budgeting Techniques

Caricato da

Rajib DahalCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Fundamentals of Financial Management-1.Briarcliff Stove Company-13 Capital Budgeting Techniques

Caricato da

Rajib DahalCopyright:

Formati disponibili

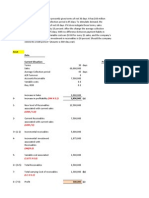

Self-Correction Problems 1.

Briarcliff Stove Company is considering a new product line to supplement

its range line. It is is anticipated that new product line will involve cash investment

of $700,000.00 at time 0 and $1,000,000.00 in year 1. After tax cash flows of $250,000

are expected in year 2, $300,000 in year 3, $350,000 in year 4, and $400,000 year

thereafter through year 10. Although the product line might be viable after 10 years,

the company prefers to be conservative and end all calculations at that time.

a- If the required rate of return is 15 percent, what is the net present value of the project?

is it acceptable?

b- What is the internal rate of return?

c- What would be the case if the required rate of return were 10 percent? This Model is prepared by Rajib Dahal. If you need

d- What is the project's payback period? excelsheet calculation, please contact me at my email at

rajib.dahal@nu.edu.kz/rajib.dahal@gmail.com

Discount rate: 15% 13 Capital Budgeting Techniques, Part V: Investment in Capital Assets, Self-Correction Problems at Page No. 346

Discounted Cash Flow Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Years 0 1 2 3 4 5 6 7 8 9 10

Cash Investment (700,000) (1,000,000)

Cash inflows 250,000 300,000 350,000 400,000 400,000 400,000 400,000 400,000 400,000

Discount factor 1.00 0.87 0.76 0.66 0.57 0.50 0.43 0.38 0.33 0.28 0.25

Discounted Cash flow (700,000) (869,565) 189,036 197,255 200,114 198,871 172,931 150,375 130,761 113,705 98,874

NPV (117,645)

a. When the required rate of return is 15%, the NPV is negative. So, the project will not be acceptable.

b.IRR The cash flows relevant for computing IRR are: (700,000) (1,000,000) 250,000 300,000 350,000 400,000 400,000 400,000 400,000 400,000 400,000

So, IRR 13.20%

c. When the discount rate is 10%, the NPV is positive and the project is acceptable. See the computation below.

IRR when discount rate is 10%: IRR is independant of discount rate. It depends on cashflows and will not change from 13.20% as computed in b.

Discounted Cash Flow Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Years 0 1 2 3 4 5 6 7 8 9 10

Cash Investment (700,000) (1,000,000)

Cash inflows 250,000 300,000 350,000 400,000 400,000 400,000 400,000 400,000 400,000

Discount factor 1.00 0.91 0.83 0.75 0.68 0.62 0.56 0.51 0.47 0.42 0.39

Discounted Cash flow (700,000) (909,091) 206,612 225,394 239,055 248,369 225,790 205,263 186,603 169,639 154,217

NPV 251,850

d. Project payback Period (PBP) 6 years as by that time, the project recovers 1.7 mn US$ which it has invested in year 0 and 1.

Computation of PBP: Total Cash outflows (1,700,000)

Year of Cash inflows Amount Cumulative amount

2 250,000.00 250,000.00

3 300,000.00 550,000.00

4 350,000.00 900,000.00

5 400,000.00 1,300,000.00

6 400,000.00 1,700,000.00 As can be seen from the computation, the cashinflows at the end of 6 years match the cash outflows of years 0 and 1 and therefore, PBP is 6 years.

Potrebbero piacerti anche

- Correction of ErrorDocumento3 pagineCorrection of ErrorAna Rosario OnidaNessuna valutazione finora

- Chapter 12: Global Marketing StrategiesDocumento4 pagineChapter 12: Global Marketing StrategiesAdam SmithNessuna valutazione finora

- Control Weaknesses (CASH RECEIPTS)Documento1 paginaControl Weaknesses (CASH RECEIPTS)Justine Ann VillegasNessuna valutazione finora

- What Is The Relevance of The Research-Based View of The Firm To Strategic Management in A Global EnvironmentDocumento1 paginaWhat Is The Relevance of The Research-Based View of The Firm To Strategic Management in A Global EnvironmentENVplus100% (3)

- Seven Heaven Corporation 2019 Adjusted Trial BalanceDocumento18 pagineSeven Heaven Corporation 2019 Adjusted Trial BalancePurpleKyla RosarioNessuna valutazione finora

- Consultant Skills and Communication BarriersDocumento10 pagineConsultant Skills and Communication Barrierssky dela cruzNessuna valutazione finora

- Assignment EFE MATRIXDocumento10 pagineAssignment EFE MATRIXabrarNessuna valutazione finora

- Wal-Mart's Strategies for Market DominanceDocumento9 pagineWal-Mart's Strategies for Market DominanceSalma ShampaNessuna valutazione finora

- Space Matrix BMWDocumento4 pagineSpace Matrix BMWmadalus123Nessuna valutazione finora

- MasterbudgetDocumento154 pagineMasterbudgetrochielanciolaNessuna valutazione finora

- F3ch2dilemna Socorro SummaryDocumento8 pagineF3ch2dilemna Socorro SummarySushii Mae60% (5)

- 15 ManagementDocumento69 pagine15 ManagementBelista25% (4)

- Sycip Gorres Velayo & Co.: HistoryDocumento5 pagineSycip Gorres Velayo & Co.: HistoryYonko ManotaNessuna valutazione finora

- Improve Cash Flow by Reducing Accounts ReceivableDocumento11 pagineImprove Cash Flow by Reducing Accounts ReceivableenkeltvrelseNessuna valutazione finora

- Sales and Collection Cycle AuditDocumento4 pagineSales and Collection Cycle Auditimpurespirit0% (1)

- Keme Chap 4Documento5 pagineKeme Chap 4Melissa Kayla Maniulit100% (1)

- Coca-Cola USA PESTLE Analysis (Presentation)Documento8 pagineCoca-Cola USA PESTLE Analysis (Presentation)anabia19Nessuna valutazione finora

- Strategic Management Analysis-WalmartDocumento26 pagineStrategic Management Analysis-WalmartooiNessuna valutazione finora

- Case Study of BMWDocumento3 pagineCase Study of BMWKath DayagNessuna valutazione finora

- Ac Solve PaperDocumento59 pagineAc Solve PaperHaseeb ShadNessuna valutazione finora

- Pre Finals Manacc 1Documento8 paginePre Finals Manacc 1Gesselle Acebedo0% (1)

- NPV - HelicopterDocumento3 pagineNPV - HelicopterAarti J. Kaushal100% (1)

- Case Study: MIR KISSDocumento2 pagineCase Study: MIR KISSClint Williams0% (1)

- India's largest sports goods manufacturer goes globalDocumento4 pagineIndia's largest sports goods manufacturer goes globalAnusha Ramesh33% (3)

- Practice Problems 1Documento1 paginaPractice Problems 1Ma Angelica Balatucan0% (1)

- ACR 107 Management Advisory Services ReviewDocumento102 pagineACR 107 Management Advisory Services ReviewPatrick Kyle AgraviadorNessuna valutazione finora

- D6Documento11 pagineD6lorenceabad07Nessuna valutazione finora

- Billcutterz.comDocumento8 pagineBillcutterz.comLekha Gupta33% (3)

- Part 4C (Quantitative Methods For Decision Analysis) 354Documento102 paginePart 4C (Quantitative Methods For Decision Analysis) 354Noel Cainglet0% (1)

- MA PresentationDocumento6 pagineMA PresentationbarbaroNessuna valutazione finora

- QUIZ REVIEW Homework Tutorial Chapter 5Documento5 pagineQUIZ REVIEW Homework Tutorial Chapter 5Cody TarantinoNessuna valutazione finora

- Audit Program - Capital StockDocumento4 pagineAudit Program - Capital StockNanette Rose HaguilingNessuna valutazione finora

- CHAPTER 4 Caselette Audit of Receivables PDFDocumento32 pagineCHAPTER 4 Caselette Audit of Receivables PDFDaniela BombezaNessuna valutazione finora

- Chapter 1Documento13 pagineChapter 1Ella Marie WicoNessuna valutazione finora

- Why Should An Accounting Professional Become Literate About Foreign Exchange?Documento3 pagineWhy Should An Accounting Professional Become Literate About Foreign Exchange?Bea LadaoNessuna valutazione finora

- Case 3 Auto AssemblyDocumento3 pagineCase 3 Auto Assemblyuzumakhinaruto100% (1)

- Chap 2Documento24 pagineChap 2tome44100% (1)

- Solman Man AcctDocumento441 pagineSolman Man AcctEster Fetalino Pajuyo100% (7)

- Acct. 162 - EPS, BVPS, DividendsDocumento5 pagineAcct. 162 - EPS, BVPS, DividendsAngelli LamiqueNessuna valutazione finora

- Calculate Basic and Diluted EPSDocumento12 pagineCalculate Basic and Diluted EPSJoey WassigNessuna valutazione finora

- Marketing Strategy of Sab-FDocumento22 pagineMarketing Strategy of Sab-Fandrew ratemo0% (1)

- Accounts Receivable Accounts Payable: A. P19,500 GainDocumento6 pagineAccounts Receivable Accounts Payable: A. P19,500 GainTk KimNessuna valutazione finora

- Auditing Subsidiaries, Remote Operating Units and Joint VenturesDocumento56 pagineAuditing Subsidiaries, Remote Operating Units and Joint VenturesRea De VeraNessuna valutazione finora

- Tugas GSLC: No. Audit Procedures Audit Objective and Assertion Type of Test 1Documento2 pagineTugas GSLC: No. Audit Procedures Audit Objective and Assertion Type of Test 1JSKyungNessuna valutazione finora

- Chapter 13 SolutionsDocumento8 pagineChapter 13 Solutionsflyerfan3767% (3)

- Far 101 - Financial Accounting Process PDFDocumento4 pagineFar 101 - Financial Accounting Process PDFReyn Saplad Perales100% (1)

- AccountingDocumento3 pagineAccountingrenoNessuna valutazione finora

- Chaper 1 & 2Documento22 pagineChaper 1 & 2Nisa IstafadNessuna valutazione finora

- MAS 1 1st Long QuizDocumento6 pagineMAS 1 1st Long QuizHanna Lyn BaliscoNessuna valutazione finora

- Case 3.1 (Auto Assembly)Documento8 pagineCase 3.1 (Auto Assembly)Rahil Hemani100% (2)

- Auditor's report importanceDocumento5 pagineAuditor's report importanceRannah Raymundo100% (1)

- Quantitative Analysis BA 452 Supplemental Questions 9 TitleDocumento32 pagineQuantitative Analysis BA 452 Supplemental Questions 9 TitleCorina Nour0% (2)

- Responsibility Accounting & Transfer Pricing ConceptsDocumento5 pagineResponsibility Accounting & Transfer Pricing ConceptsadorableperezNessuna valutazione finora

- Existence or Occurrence Completeness Rights and Obligations Valuation or AllocationDocumento3 pagineExistence or Occurrence Completeness Rights and Obligations Valuation or AllocationReyes, Jessica R.Nessuna valutazione finora

- MODULE 3 - Chapter 6 (Trade Protectionism) PDFDocumento7 pagineMODULE 3 - Chapter 6 (Trade Protectionism) PDFAangela Del Rosario CorpuzNessuna valutazione finora

- Chapter 6 - Capital BudgetingDocumento12 pagineChapter 6 - Capital BudgetingParth GargNessuna valutazione finora

- Final Costing CalculationsDocumento33 pagineFinal Costing CalculationsErrist YuanJinNessuna valutazione finora

- 04-Revenue-Cost CashFlowDocumento7 pagine04-Revenue-Cost CashFlowdina mutia sariNessuna valutazione finora

- Girum Tsega PerfectDocumento13 pagineGirum Tsega PerfectMesi YE GINessuna valutazione finora

- Q No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyDocumento3 pagineQ No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyMuneeb Qureshi0% (1)

- Customs Duties On Imports of Books-Nepal-Recent ChangesDocumento4 pagineCustoms Duties On Imports of Books-Nepal-Recent ChangesRajib DahalNessuna valutazione finora

- Chapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyDocumento1 paginaChapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyRajib DahalNessuna valutazione finora

- As The Capital Budgeting Director of Union Mills Inc.-Dcf ANALYSIS-DISCOUNTED CASH FLOWDocumento1 paginaAs The Capital Budgeting Director of Union Mills Inc.-Dcf ANALYSIS-DISCOUNTED CASH FLOWRajib Dahal100% (1)

- Appendix-11B-Replacement Project Analysis-A Lathe For Trimming Molded Plastics Was Purchased.Documento1 paginaAppendix-11B-Replacement Project Analysis-A Lathe For Trimming Molded Plastics Was Purchased.Rajib Dahal100% (2)

- Mississippi River Shipyards Is Considering The Replacement of An - Appendix 11B-3 Replacement Project AnalysisDocumento1 paginaMississippi River Shipyards Is Considering The Replacement of An - Appendix 11B-3 Replacement Project AnalysisRajib DahalNessuna valutazione finora

- Study Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Documento1 paginaStudy Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Rajib Dahal50% (2)

- The Dauten Toy Corporation-Appendix 11B-1-Replacement Project Analysis - Capital Budgeting - Cashflow Analysis-DCF-Discounted CashflowDocumento1 paginaThe Dauten Toy Corporation-Appendix 11B-1-Replacement Project Analysis - Capital Budgeting - Cashflow Analysis-DCF-Discounted CashflowRajib Dahal67% (3)

- Lobers Inc. Has Two Investment Proposals-Fundamentals of Financial Management-James C. Van Horne and John M. WachowiczDocumento1 paginaLobers Inc. Has Two Investment Proposals-Fundamentals of Financial Management-James C. Van Horne and John M. WachowiczRajib Dahal100% (1)

- Carbide Chemical Company-Replacement of Old Machines-Discounting of CashflowsDocumento1 paginaCarbide Chemical Company-Replacement of Old Machines-Discounting of CashflowsRajib Dahal50% (2)

- 3.the City of San Jose-Excel Modelling-Fundamentals of Financial Management-James C. Van Horne - John M. WachowiczDocumento1 pagina3.the City of San Jose-Excel Modelling-Fundamentals of Financial Management-James C. Van Horne - John M. WachowiczRajib Dahal50% (2)

- 3.the Acme Blivert Company-Fundamentals of Financial Management-James C. Van Horne and John M. WachowiczDocumento1 pagina3.the Acme Blivert Company-Fundamentals of Financial Management-James C. Van Horne and John M. WachowiczRajib Dahal100% (1)

- 2.carbide Chemical Company-Fundamentals of Financial Management-James C. Van Horne and John M. WachowiczDocumento1 pagina2.carbide Chemical Company-Fundamentals of Financial Management-James C. Van Horne and John M. WachowiczRajib DahalNessuna valutazione finora

- Thoma Pharmaceutical Company-Capital Budgeting and Estimating Cash Flows-Part V-Chapter 12Documento3 pagineThoma Pharmaceutical Company-Capital Budgeting and Estimating Cash Flows-Part V-Chapter 12Rajib Dahal75% (8)

- Thoma Pharmaceutical Company-Capital Budgeting and Estimating Cash Flows-Part V-Chapter 12Documento3 pagineThoma Pharmaceutical Company-Capital Budgeting and Estimating Cash Flows-Part V-Chapter 12Rajib Dahal75% (8)

- Esno Finial Fabricating-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsDocumento1 paginaEsno Finial Fabricating-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsRajib DahalNessuna valutazione finora

- Pilsudski Coal Company-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsDocumento1 paginaPilsudski Coal Company-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsRajib Dahal50% (2)

- Exchange Online Instruction GuideDocumento7 pagineExchange Online Instruction GuideKishor WaghmareNessuna valutazione finora

- CLEMENTE CALDE vs. THE COURT OF APPEALSDocumento1 paginaCLEMENTE CALDE vs. THE COURT OF APPEALSDanyNessuna valutazione finora

- TBM220Documento12 pagineTBM220ErikoNessuna valutazione finora

- Film Studies Origin and History of Arts and Film's PlaceDocumento27 pagineFilm Studies Origin and History of Arts and Film's PlaceNivetha SivasamyNessuna valutazione finora

- Lean Product Roadmaps Setting Direction While Embracing UncertaintyDocumento110 pagineLean Product Roadmaps Setting Direction While Embracing UncertaintyDoraPocoo100% (1)

- Kampus Merdeka BelajarDocumento17 pagineKampus Merdeka BelajarmartinNessuna valutazione finora

- Begun H Et Al., (2020) Effect of Obesity OnDocumento7 pagineBegun H Et Al., (2020) Effect of Obesity OnAna Flávia SordiNessuna valutazione finora

- NWEG5111 Ta 2020Documento6 pagineNWEG5111 Ta 2020muhammed shaheed IsaacsNessuna valutazione finora

- 6529XXXXXXXXXX34 01-05-2023 UnlockedDocumento2 pagine6529XXXXXXXXXX34 01-05-2023 UnlockedSath KNessuna valutazione finora

- Cambridge International General Certificate of Secondary EducationDocumento16 pagineCambridge International General Certificate of Secondary EducationSheimaNessuna valutazione finora

- Commonly Used AbbreviationsDocumento5 pagineCommonly Used AbbreviationsUzziel Galinea TolosaNessuna valutazione finora

- Liver Pancreas SpleenDocumento88 pagineLiver Pancreas SpleenGabi NaeNessuna valutazione finora

- Internal Control QuestionnaireDocumento2 pagineInternal Control Questionnairepeterpancanfly100% (2)

- Garment Manufacturing Process Flow From Buyer To ShipmentDocumento27 pagineGarment Manufacturing Process Flow From Buyer To Shipmenttallraj50% (2)

- Madurai Corporation Contempt CaseDocumento6 pagineMadurai Corporation Contempt Caseforpublic 2011100% (1)

- Short and Sweet Experiences With Homoeopathy!Documento3 pagineShort and Sweet Experiences With Homoeopathy!Homoeopathic Pulse100% (1)

- Therapy Format I. Therapy: News Sharing Therapy Date: July 28, 2021 II. Materials/EquipmentDocumento2 pagineTherapy Format I. Therapy: News Sharing Therapy Date: July 28, 2021 II. Materials/EquipmentAesthea BondadNessuna valutazione finora

- Dale Spender - Living by The Pen - Early British Women Writers (1992, Teachers College Press) - Libgen - LiDocumento276 pagineDale Spender - Living by The Pen - Early British Women Writers (1992, Teachers College Press) - Libgen - LiGime VilchezNessuna valutazione finora

- Paris Review - Robert Caro, The Art of Biography No. 5Documento19 pagineParis Review - Robert Caro, The Art of Biography No. 5Anonymous011100% (2)

- Atlas PCNLDocumento19 pagineAtlas PCNLaldillawrNessuna valutazione finora

- In-Circuit and In-Application Programming of The 89C51Rx+/Rx2/66x MicrocontrollersDocumento17 pagineIn-Circuit and In-Application Programming of The 89C51Rx+/Rx2/66x Microcontrollersv1swaroopNessuna valutazione finora

- PB95102141Documento58 paginePB95102141sharvan10Nessuna valutazione finora

- Possessives, pronouns and questions practiceDocumento6 paginePossessives, pronouns and questions practiceEma Mustafic100% (1)

- Veteran Resource Guide For Congressional District 9Documento27 pagineVeteran Resource Guide For Congressional District 9RepSinemaNessuna valutazione finora

- Hospital Waste Management ArticleDocumento5 pagineHospital Waste Management ArticleFarrukh AzizNessuna valutazione finora

- Journal of COMPLETE - Vol.1 No.1, 2020Documento65 pagineJournal of COMPLETE - Vol.1 No.1, 2020Sandryones PalinggiNessuna valutazione finora

- Collocations For StudentsDocumento3 pagineCollocations For StudentsOldemary Deschamps100% (1)

- Unity 400Documento61 pagineUnity 400Aitonix ScanNessuna valutazione finora

- Central Visayas RDP 2017 2022 Midterm Update 1Documento139 pagineCentral Visayas RDP 2017 2022 Midterm Update 1peachai143Nessuna valutazione finora

- Comparative Forms of Adjectives Esl Grammar Gap Fill Exercises WorksheetDocumento2 pagineComparative Forms of Adjectives Esl Grammar Gap Fill Exercises WorksheetAnonymous LELyuBoNessuna valutazione finora