Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

#Dominion Insurance V CA

Caricato da

Kareen BaucanTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

#Dominion Insurance V CA

Caricato da

Kareen BaucanCopyright:

Formati disponibili

[G. R. No. 129919.

February 6, 2002]

DOMINION INSURANCE CORPORATION, petitioner, vs. COURT OF APPEALS, RODOLFO S. GUEVARRA, and

FERNANDO AUSTRIA, respondents.

FACTS: Private respondent Rodolfo S. Guevarra instituted a civil action for sum of money against petitioner

Dominion Insurance Corporation. Guevarra sought to recover the sum of P156,473.90 which he claimed to have

advanced in his capacity as manager of defendant to satisfy certain claims filed by petitioner’s clients. Guevarra claimed

that he paid out of his personal money in settling the claims of the clients of petitioner Dominion. Petitioner denied

liability to Guevarra. Petitioner instituted a third-party complaint against Fernando Austria who was its Regional

Manager for Central Luzon.

The RTC ruled in favor of Guevarra and ordered Dominion to pay the former.

ISSUES:

(1) whether respondent Guevarra acted within his authority as agent for petitioner- NO

(2) whether respondent Guevarra is entitled to reimbursement of amounts he paid out of his personal money in settling

the claims of several insured- YES

RULING:

1.) NO.

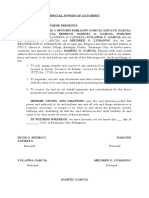

A perusal of the Special Power of Attorney would show that petitioner (represented by third-party defendant Austria)

and respondent Guevarra intended to enter into a principal-agent relationship. Despite the word special in the title of

the document, the contents reveal that what was constituted was actually a general agency. The terms of the agreement

read:

That we, FIRST CONTINENTAL ASSURANCE COMPANY, INC., a corporation duly organized and existing under and by

virtue of the laws of the Republic of the Philippines, xxx represented by the undersigned as Regional Manager, xxx

do hereby appoint RSG Guevarra Insurance Services represented by Mr. Rodolfo Guevarra xxx to be our Agency

Manager in San Fdo., for our place and stead, to do and perform the following acts and things:

1. To conduct, sign, manager (sic), carry on and transact Bonding and Insurance business as usually pertain to a Agency

Office, or FIRE, MARINE, MOTOR CAR, PERSONAL ACCIDENT, and BONDING with the right, upon our prior written

consent, to appoint agents and sub-agents.

2. To accept, underwrite and subscribed (sic) cover notes or Policies of Insurance and Bonds for and on our behalf.

3. To demand, sue, for (sic) collect, deposit, enforce payment, deliver and transfer for and receive and give effectual receipts

and discharge for all money to which the FIRST CONTINENTAL ASSURANCE COMPANY, INC., may hereafter become

due, owing payable or transferable to said Corporation by reason of or in connection with the above-mentioned appointment.

4. To receive notices, summons, and legal processes for and in behalf of the FIRST CONTINENTAL ASSURANCE

COMPANY, INC., in connection with actions and all legal proceedings against the said Corporation.

The agency comprises all the business of the principal, but, couched in general terms, it is limited only to acts of

administration.

A general power permits the agent to do all acts for which the law does not require a special power. Thus, the acts

enumerated in or similar to those enumerated in the Special Power of Attorney do not require a special power of

attorney.

Article 1878, Civil Code, enumerates the instances when a special power of attorney is required. The pertinent portion

that applies to this case provides that:

Article 1878. Special powers of attorney are necessary in the following cases:

(1) To make such payments as are not usually considered as acts of administration;

(15) Any other act of strict dominion.

The payment of claims is not an act of administration. The settlement of claims is not included among the acts

enumerated in the Special Power of Attorney, neither is it of a character similar to the acts enumerated therein. A

special power of attorney is required before respondent Guevarra could settle the insurance claims of the

insured.

Respondent Guevarras authority to settle claims is embodied in the Memorandum of Management

Agreement dated February 18, 1987 which enumerates the scope of respondent Guevarras duties and responsibilities

as agency manager for San Fernando, Pampanga, as follows:

xxx xxx xxx

1. You are hereby given authority to settle and dispose of all motor car claims in the amount of P5,000.00 with prior approval

of the Regional Office.

2. Full authority is given you on TPPI claims settlement.

xxx xxx xxx

In settling the claims mentioned above, respondent Guevarras authority is further limited by the written standard authority

to pay, which states that the payment shall come from respondent Guevarras revolving fund or collection. The authority to

pay is worded as follows:

This is to authorize you to withdraw from your revolving fund/collection the amount of PESOS __________________ (P )

representing the payment on the _________________ claim of assured _______________ under Policy No. ______ in that

accident of ___________ at ____________.

It is further expected, release papers will be signed and authorized by the concerned and attached to the corresponding

claim folder after effecting payment of the claim.

(sgd.) FERNANDO C. AUSTRIA

Regional Manager

The instruction of petitioner as the principal could not be any clearer. Respondent Guevarra was authorized to pay

the claim of the insured, but the payment shall come from the revolving fund or collection in his possession.

Having deviated from the instructions of the principal, the expenses that respondent Guevarra incurred in the settlement

of the claims of the insured may not be reimbursed from petitioner Dominion. This conclusion is in accord with Article

1918, Civil Code, which states that:

The principal is not liable for the expenses incurred by the agent in the following cases:

(1) If the agent acted in contravention of the principals instructions, unless the latter should wish to avail himself of the

benefits derived from the contract;

xxx xxx xxx

2.) YES.

While the law on agency prohibits respondent Guevarra from obtaining reimbursement, his right to recover may still be

justified under the general law on obligations and contracts.

Article 1236, second paragraph, Civil Code, provides:

Whoever pays for another may demand from the debtor what he has paid, except that if he paid without the knowledge or

against the will of the debtor, he can recover only insofar as the payment has been beneficial to the debtor.

In this case, when the risk insured against occurred, petitioners liability as insurer arose. This obligation was

extinguished when respondent Guevarra paid the claims and obtained Release of Claim Loss and Subrogation

Receipts from the insured who were paid.

Thus, to the extent that the obligation of the petitioner has been extinguished, respondent Guevarra may demand for

reimbursement from his principal. To rule otherwise would result in unjust enrichment of petitioner.

Potrebbero piacerti anche

- (AGENCY) (Dominion Insurance v. CA)Documento2 pagine(AGENCY) (Dominion Insurance v. CA)Alyanna Apacible100% (3)

- Orient Air Vs Court of Appeals Case Digest On AgencyDocumento1 paginaOrient Air Vs Court of Appeals Case Digest On Agencykikhay1175% (4)

- Domingo Vs DomingoDocumento1 paginaDomingo Vs DomingodmcfloresNessuna valutazione finora

- Yun Kwan Byung V PagcorDocumento3 pagineYun Kwan Byung V Pagcorsigfridmonte100% (3)

- Coleongco v. Claparols (1964)Documento2 pagineColeongco v. Claparols (1964)Jenny Mary DagunNessuna valutazione finora

- Pahud v. CADocumento2 paginePahud v. CAMika AurelioNessuna valutazione finora

- CMS Logging v. CADocumento3 pagineCMS Logging v. CApurplebasketNessuna valutazione finora

- Cosmic Lumber Corporation vs. CA and Perez Digested CaseDocumento1 paginaCosmic Lumber Corporation vs. CA and Perez Digested Casemansikiabo50% (2)

- Salao V. Salao: Salao v. Salao Digest - Obligations and Contracts P. 13Documento2 pagineSalao V. Salao: Salao v. Salao Digest - Obligations and Contracts P. 13VanityHugh100% (1)

- Manila Memorial Park Cemetery v. Linsangan - DigestDocumento2 pagineManila Memorial Park Cemetery v. Linsangan - Digestcmv mendoza100% (1)

- Cervantes V CA DigestDocumento2 pagineCervantes V CA DigestKareen BaucanNessuna valutazione finora

- Diolosa V CADocumento2 pagineDiolosa V CABettinaaaNessuna valutazione finora

- Green Valley Vs IACDocumento1 paginaGreen Valley Vs IACFai Meile100% (1)

- Herrera VS Luy Kim GuanDocumento3 pagineHerrera VS Luy Kim GuanElla Marcelo100% (1)

- Manotok Brothers, Inc. vs. CADocumento2 pagineManotok Brothers, Inc. vs. CAMariella Grace Allanic0% (1)

- Domingo Vs DomingoDocumento2 pagineDomingo Vs DomingoJani Misterio100% (1)

- International Exchange Bank vs. BrionesDocumento3 pagineInternational Exchange Bank vs. BrionesLupin the Third78% (9)

- Herrera v. Luy Kim GuanDocumento3 pagineHerrera v. Luy Kim GuanBobby Olavides SebastianNessuna valutazione finora

- Spouses Villaluz Vs Land BankDocumento2 pagineSpouses Villaluz Vs Land Bankjovifactor100% (1)

- Sally Yoshizaki Vs Joy Trining Center of Aurora, Inc., G.R. No. 174978 DigestDocumento2 pagineSally Yoshizaki Vs Joy Trining Center of Aurora, Inc., G.R. No. 174978 DigestKarmille Buenacosa100% (2)

- 14-ATP-Escueta vs. LimDocumento2 pagine14-ATP-Escueta vs. LimJoesil DianneNessuna valutazione finora

- Rural Bank of Borbon (Camarines Sur), Inc. v. CADocumento2 pagineRural Bank of Borbon (Camarines Sur), Inc. v. CARuben100% (1)

- PAT Digest Shell Co V Firemen'sDocumento2 paginePAT Digest Shell Co V Firemen'sJanlucifer Rahl100% (2)

- (Digest) Angeles V PNRDocumento2 pagine(Digest) Angeles V PNRGRNessuna valutazione finora

- Rallos vs. Felix Go Chan & Sons Realty Corp., 81 SCRA 251 DigestDocumento2 pagineRallos vs. Felix Go Chan & Sons Realty Corp., 81 SCRA 251 DigestXuagramellebasi91% (11)

- Dy Buncio v. Ong Guan CanDocumento2 pagineDy Buncio v. Ong Guan CanKatrina Dino-PobleteNessuna valutazione finora

- 47 CMS Logging v. CADocumento2 pagine47 CMS Logging v. CAAnthony ChoiNessuna valutazione finora

- Pasno Vs Ravina DigestDocumento1 paginaPasno Vs Ravina DigestMary Kaye ValerioNessuna valutazione finora

- Municipal Council of Iloilo V EvangelistaDocumento2 pagineMunicipal Council of Iloilo V Evangelistasmtm06100% (1)

- British Airways Vs CADocumento2 pagineBritish Airways Vs CAsmtm06100% (2)

- Litonjua JR V EternitDocumento2 pagineLitonjua JR V Eternitaphrodatee100% (6)

- Bordador V LuzDocumento3 pagineBordador V Luzdarwin polido100% (1)

- Evangelista v. Abad SantosDocumento2 pagineEvangelista v. Abad SantosCourtney TirolNessuna valutazione finora

- Buncio and Co V Ong GuanDocumento1 paginaBuncio and Co V Ong GuanAbraham GuiyabNessuna valutazione finora

- Valera v. Velasco Case DigestDocumento3 pagineValera v. Velasco Case DigestNinya SaquilabonNessuna valutazione finora

- Morales v. CADocumento3 pagineMorales v. CAkdescallar100% (3)

- Republic Vs EvangelistaDocumento2 pagineRepublic Vs EvangelistaVanya Klarika Nuque100% (5)

- Digest of Manila Memorial Park Cemetery, Inc. v. Linsangan (G.R. No. 151319)Documento2 pagineDigest of Manila Memorial Park Cemetery, Inc. v. Linsangan (G.R. No. 151319)Rafael PangilinanNessuna valutazione finora

- Topic Digested By: Title of The Case Doctrine (Syllabus)Documento1 paginaTopic Digested By: Title of The Case Doctrine (Syllabus)Tricia SandovalNessuna valutazione finora

- Green Valley Poultry v. IACDocumento1 paginaGreen Valley Poultry v. IACAnonymous bOncqbp8yi100% (1)

- Danon vs. Brimo & Co DDocumento3 pagineDanon vs. Brimo & Co DJazem AnsamaNessuna valutazione finora

- International Films v. Lyric Film - DIGESTDocumento2 pagineInternational Films v. Lyric Film - DIGESTkathrynmaydevezaNessuna valutazione finora

- Orient Air Services V CADocumento3 pagineOrient Air Services V CAdarwin polidoNessuna valutazione finora

- Macondray & Co. vs. Sellner DigestDocumento2 pagineMacondray & Co. vs. Sellner Digestchan.aNessuna valutazione finora

- 1CBIC Vs Keppel ShipyardDocumento2 pagine1CBIC Vs Keppel ShipyardJana Felice Paler Gonzalez100% (1)

- Digest of Litonjua, Jr. v. Eternit Corp. (G.R. No. 144805)Documento2 pagineDigest of Litonjua, Jr. v. Eternit Corp. (G.R. No. 144805)Rafael Pangilinan100% (6)

- Veloso Vs CADocumento2 pagineVeloso Vs CAJohn Benedict Tigson100% (3)

- Digest Yu Eng Cho v. Pan American World Airways, Inc. 328 Scra 717Documento2 pagineDigest Yu Eng Cho v. Pan American World Airways, Inc. 328 Scra 717JureeBonifacioMudanza100% (1)

- De Castro Vs CA and ArtigoDocumento2 pagineDe Castro Vs CA and ArtigocinNessuna valutazione finora

- Heirs of Lim v. LimDocumento2 pagineHeirs of Lim v. LimGia DimayugaNessuna valutazione finora

- Digest of Eurotech Industrial Technologies, Inc. v. Cuizon (G.R. No. 167552)Documento2 pagineDigest of Eurotech Industrial Technologies, Inc. v. Cuizon (G.R. No. 167552)Rafael Pangilinan100% (1)

- 11 Public Works Vs Sing Juco Final Case DigestDocumento2 pagine11 Public Works Vs Sing Juco Final Case DigestTeresa CardinozaNessuna valutazione finora

- Eugenio Vs CADocumento2 pagineEugenio Vs CAsmtm06Nessuna valutazione finora

- BPI v. LaingoDocumento2 pagineBPI v. LaingoJen Sara Villa100% (2)

- Dela Pena Vs HidalgoDocumento3 pagineDela Pena Vs HidalgoPatrick RamosNessuna valutazione finora

- PATRIMONIO v. GutierrezDocumento2 paginePATRIMONIO v. Gutierrezdelayinggratification100% (1)

- Codal Provisions With Case DigestsDocumento31 pagineCodal Provisions With Case DigestsKurt YoungNessuna valutazione finora

- 005 Dominion Insurance Corp. v. CADocumento3 pagine005 Dominion Insurance Corp. v. CAjadelorenzoNessuna valutazione finora

- DOMINION INSURANCE CORP v. CADocumento3 pagineDOMINION INSURANCE CORP v. CAdelayinggratification100% (1)

- Dominion Insurance Corporation Vs CADocumento1 paginaDominion Insurance Corporation Vs CAdmcfloresNessuna valutazione finora

- Mining Laws (R.A. 7942 & 7076)Documento148 pagineMining Laws (R.A. 7942 & 7076)Kareen Baucan100% (2)

- FsajdnadjsadsaDocumento12 pagineFsajdnadjsadsaPatrick AllenNessuna valutazione finora

- Cayetano V MonsodDocumento15 pagineCayetano V MonsodKareen BaucanNessuna valutazione finora

- The Arbitration LawDocumento3 pagineThe Arbitration LawKareen BaucanNessuna valutazione finora

- An Introduction To Competition LAW: Submitted byDocumento19 pagineAn Introduction To Competition LAW: Submitted byKareen BaucanNessuna valutazione finora

- PIL REPORT (Legation To Settlement of Disputes)Documento143 paginePIL REPORT (Legation To Settlement of Disputes)Kareen BaucanNessuna valutazione finora

- Social Contract TheoryDocumento3 pagineSocial Contract TheoryKareen BaucanNessuna valutazione finora

- EvidenceDocumento5 pagineEvidenceKareen BaucanNessuna valutazione finora

- Physical and Mental Examination of Persons: Rule 28Documento29 paginePhysical and Mental Examination of Persons: Rule 28Kareen BaucanNessuna valutazione finora

- Physical and Mental Examination of PersonsDocumento6 paginePhysical and Mental Examination of PersonsKareen Baucan100% (1)

- Civil Procedure Rules 1 - 71: General PrinciplesDocumento4 pagineCivil Procedure Rules 1 - 71: General PrinciplesKareen Baucan100% (1)

- PIL REPORT (Legation To Settlement of Disputes)Documento143 paginePIL REPORT (Legation To Settlement of Disputes)Kareen BaucanNessuna valutazione finora

- Rule 28: Physical and Mental Examination of PersonsDocumento10 pagineRule 28: Physical and Mental Examination of PersonsKareen BaucanNessuna valutazione finora

- Rule 28: Physical and Mental Examination of PersonsDocumento10 pagineRule 28: Physical and Mental Examination of PersonsKareen BaucanNessuna valutazione finora

- REPORTDocumento1 paginaREPORTKareen BaucanNessuna valutazione finora

- Case Digest - Marriage & Its IncidentsDocumento6 pagineCase Digest - Marriage & Its IncidentsKareen BaucanNessuna valutazione finora

- GROUP 6 Written ReportDocumento4 pagineGROUP 6 Written ReportKareen BaucanNessuna valutazione finora

- Rule 39 Sec. 5 & 6Documento16 pagineRule 39 Sec. 5 & 6Kareen BaucanNessuna valutazione finora

- Pollution From Stationary Sources & Pollution From Motor VehiclesDocumento10 paginePollution From Stationary Sources & Pollution From Motor VehiclesKareen BaucanNessuna valutazione finora

- GROUP 6 Written ReportDocumento4 pagineGROUP 6 Written ReportKareen BaucanNessuna valutazione finora

- 3rd Batch of CasesDocumento31 pagine3rd Batch of CasesKareen BaucanNessuna valutazione finora

- CONFLICTS OF LAWS TableDocumento9 pagineCONFLICTS OF LAWS TableKareen BaucanNessuna valutazione finora

- Business OrganizationDocumento4 pagineBusiness OrganizationKareen BaucanNessuna valutazione finora

- Banking Laws 2nd Batch of CasesDocumento30 pagineBanking Laws 2nd Batch of CasesKareen BaucanNessuna valutazione finora

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- INSURANCE LAW 4th Batch of CasesDocumento28 pagineINSURANCE LAW 4th Batch of CasesKareen BaucanNessuna valutazione finora

- Batas Pambansa Bilang 68 - Corporation CodeDocumento30 pagineBatas Pambansa Bilang 68 - Corporation CodeKareen BaucanNessuna valutazione finora

- Problem Areas in Legal EthicsDocumento5 pagineProblem Areas in Legal EthicsKareen Baucan100% (1)

- 2nd Case DigestDocumento4 pagine2nd Case DigestKareen BaucanNessuna valutazione finora

- INSURANCE LAW 1st Batch of CasesDocumento28 pagineINSURANCE LAW 1st Batch of CasesKareen BaucanNessuna valutazione finora

- PATDocumento2 paginePATCat VGNessuna valutazione finora

- U E O U E L: Nderstanding The Xecutor Ffice AND Se of The Xecutor EtterDocumento41 pagineU E O U E L: Nderstanding The Xecutor Ffice AND Se of The Xecutor Etterbigwheel8100% (12)

- A Guide For Commercial Importers: Importing Into The United StatesDocumento211 pagineA Guide For Commercial Importers: Importing Into The United Stateslockon31Nessuna valutazione finora

- Latest Dated 23.01.20 Progressive Lawyers SocietyDocumento298 pagineLatest Dated 23.01.20 Progressive Lawyers SocietyAnonymous oUoJ4A8xNessuna valutazione finora

- Special Power of Attorney: HENRIETTO TORRES ALACRITO, Likewise of Legal Age, Married, Filipino and A ResidentDocumento2 pagineSpecial Power of Attorney: HENRIETTO TORRES ALACRITO, Likewise of Legal Age, Married, Filipino and A ResidentMark TrayvillaNessuna valutazione finora

- Domingo vs. ReedDocumento9 pagineDomingo vs. Reedmario navalezNessuna valutazione finora

- Special Power of AttorneyDocumento2 pagineSpecial Power of AttorneyRio Design GroupNessuna valutazione finora

- Special Power of Attorney RodolfoDocumento2 pagineSpecial Power of Attorney Rodolfocris jaluageNessuna valutazione finora

- General Power of AttorneyDocumento2 pagineGeneral Power of AttorneyShashank ChaturvediNessuna valutazione finora

- Powers of Attorney Act, 1998 (Act 549)Documento5 paginePowers of Attorney Act, 1998 (Act 549)Claudia OwusuNessuna valutazione finora

- Sbi Power of AttorneyDocumento3 pagineSbi Power of AttorneyVitul RajNessuna valutazione finora

- Agency: DAV's Personal NotesDocumento26 pagineAgency: DAV's Personal NotesViktoria BorgoniaNessuna valutazione finora

- ATP Agency de Leon CasesDocumento24 pagineATP Agency de Leon CasesMacNessuna valutazione finora

- Special Power of AttorneyDocumento3 pagineSpecial Power of AttorneyMikko AcubaNessuna valutazione finora

- Special Power of AttorneyDocumento1 paginaSpecial Power of AttorneySam Dave SolasNessuna valutazione finora

- Exchange DeedDocumento5 pagineExchange DeedSatish Kumar GowdaNessuna valutazione finora

- Indictment in Vio at o Of: SealedDocumento11 pagineIndictment in Vio at o Of: SealedWSETNessuna valutazione finora

- Special Power of Attorney: Know All Men by These PresentsDocumento2 pagineSpecial Power of Attorney: Know All Men by These PresentsleozaldivarNessuna valutazione finora

- ATP Case Digests - Formalities of AgencyDocumento70 pagineATP Case Digests - Formalities of AgencyAbigail Tolabing100% (2)

- 1641192513271015 copyDocumento2 pagine1641192513271015 copymelchor latinaNessuna valutazione finora

- Agency - ReviewerDocumento8 pagineAgency - ReviewerMac MarcosNessuna valutazione finora

- Military Engineer Services: P&G ContdDocumento44 pagineMilitary Engineer Services: P&G Contdmvs srikarNessuna valutazione finora

- Poa UkDocumento4 paginePoa Ukbelu22adlNessuna valutazione finora

- SpaDocumento2 pagineSpaIan MadarangNessuna valutazione finora

- SPA To RepresentDocumento2 pagineSPA To RepresentMDD100% (1)

- SPA For Loan From BanksDocumento2 pagineSPA For Loan From BanksJohn Paul Macababbad67% (3)

- Corpo Full 28 50Documento202 pagineCorpo Full 28 50Huge Propalde EstolanoNessuna valutazione finora

- Special Power of Attorney Sample To SellDocumento2 pagineSpecial Power of Attorney Sample To Sellczabina fatima delica100% (2)

- General Power of Attorney - Sample-1Documento3 pagineGeneral Power of Attorney - Sample-1Humphrey NganyiNessuna valutazione finora

- 111.) Nocom Vs CamerinoDocumento3 pagine111.) Nocom Vs CamerinoJohnnyNessuna valutazione finora