Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

QUIZ Advance

Caricato da

Fenny MarietzaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

QUIZ Advance

Caricato da

Fenny MarietzaCopyright:

Formati disponibili

QUIZ

1. On November 1, 2010, Dorsey Company sold inventory to a company in England. The sale

was for 600,000 British pounds and payment will be received on February 1, 2011. On

November 1, Dorsey entered into a forward contract to sell 600,000 British pounds on

February 1 at the forward rate of $1.65. Spot rates for the British pound are as follows:

November 1 $1.61

December 31 1.67

February 1 1.62

Dorsey has a December 31 fiscal year-end.

Required:

Compute each of the following:

1. The dollars to be received on February 1, 2011, from selling the 600,000 pounds to the

exchange dealer.

2. The dollars that would have been received from the account receivable if Dorsey had not

hedged the sale contract with the forward contract.

3. The discount or premium on the forward contract.

4. The transaction gain or loss on the exposed asset related to the sale in 2010 and 2011.

5. The transaction gain or loss on the forward contract in 2010 and 2011.

2. On December 1, 2010, Derrick Corporation agreed to purchase a machine to be manufactured

by a company in Brazil. The purchase price is 1,150,000 Brazilian reals. To hedge against

fluctuations in the exchange rate, Derrick entered into a forward contract on December 1 to

buy 1,150,000 reals on April 1, the agreed date of machine delivery, for $0.375 per real. The

following exchange rates were quoted:

Forward Rate

Date Spot Rate (Delivery on 4/1)

December 1 0.390 0.375

December 31 0.370 0.373

April 1 0.385 --

Required:

Prepare journal entries necessary for Derrick during 2010 and 2011 to account for the

transactions described above.

3. On October 1, 2010, Nance Company purchased inventory from a foreign customer for

750,000 units of foreign currency (FCU) due on January 31, 2011. Simultaneously, Nance

entered into a forward contract for 750,000 units of FC for delivery on January 31, 2011, at

the forward rate of $0.75. Payment was made to the foreign customer on January 31, 2011.

Spot rates on October 1, December 31, and January 31, were $0.72, $0.73, and $0.76,

respectively. Nance amortizes all premiums and discounts on forward contracts and closes its

books on December 31.

Required:

A. Prepare all journal entries relative to the above to be made by Nance on October 1, 2010.

B. Prepare all journal entries relative to the above to be made by Nance on December 31,

2010.

C. Compute the transaction gain or loss on the forward contract that would be recorded in

2011. Indicate clearly whether the amount is a gain or loss.

4. On October 1, 2010, Kline Company shipped equipment to a foreign customer for a foreign

currency (FC) price of FC 3,000,000 due on January 31, 2011. All revenue realization criteria

were satisfied and accordingly the sale was recorded by Kline Company on October 1.

Simultaneously, Kline entered into a forward contract to sell 3,000,000 FCU on January 31,

2011 for $1,200,000. Payment was received from the foreign customer on January 31, 2011.

Spot rates on October 1, December 31, and January 31 were $0.42, $0.425, and $0.435,

respectively. Kline amortizes all premiums and discounts on forward contracts and closes its

books on December 31.

Required:

Prepare all journal entries relative to the above to be made by Kline during 2010 and 2011.

Potrebbero piacerti anche

- How To Buy A House For 1 Euro in Italy?: Practical bookDa EverandHow To Buy A House For 1 Euro in Italy?: Practical bookNessuna valutazione finora

- ch12 - F MDocumento8 paginech12 - F MAhmed Osama ElgebalyNessuna valutazione finora

- SOAL LATIHAN MK - AKL - FC TransactionsDocumento4 pagineSOAL LATIHAN MK - AKL - FC Transactionscaca natalia100% (1)

- Exercise Advanced Accounting SolutionsDocumento14 pagineExercise Advanced Accounting SolutionsMiko Victoria Vargas75% (4)

- FOREXQUIZ2021Documento6 pagineFOREXQUIZ2021rodell pabloNessuna valutazione finora

- Forex&Derivative HODocumento7 pagineForex&Derivative HOMarielle SidayonNessuna valutazione finora

- CH 14Documento2 pagineCH 14tigger5191100% (1)

- Review Sessqergwtgwtegwtron 4 TEXTDocumento7 pagineReview Sessqergwtgwtegwtron 4 TEXTMelissa WhiteNessuna valutazione finora

- A. The Machine's Final Recorded Value Was P1,558,000Documento7 pagineA. The Machine's Final Recorded Value Was P1,558,000Tawan VihokratanaNessuna valutazione finora

- Daniels Company Engaged in The Following Transactions During 201Documento1 paginaDaniels Company Engaged in The Following Transactions During 201M Bilal SaleemNessuna valutazione finora

- AccountingDocumento5 pagineAccountingMaitet CarandangNessuna valutazione finora

- On December 1 2010 Sleezer Distributing Company Had The FollowDocumento1 paginaOn December 1 2010 Sleezer Distributing Company Had The FollowM Bilal SaleemNessuna valutazione finora

- Kisi-Kisi Soal Mid PA2Documento6 pagineKisi-Kisi Soal Mid PA2Anthie AkiraNessuna valutazione finora

- Soal 2Documento2 pagineSoal 2putriNessuna valutazione finora

- Classifying assets as current, non-current, cash, receivables, inventories or investmentsDocumento4 pagineClassifying assets as current, non-current, cash, receivables, inventories or investmentsAhsaan KhanNessuna valutazione finora

- ACC 5116 - MODULE 3 - Lecture NotesDocumento3 pagineACC 5116 - MODULE 3 - Lecture NotesCarl Dhaniel Garcia SalenNessuna valutazione finora

- Advance Acctg Foreign Currency ProblemsDocumento6 pagineAdvance Acctg Foreign Currency ProblemsManila John20% (5)

- Foreign ExchangeDocumento9 pagineForeign Exchangesmit9993Nessuna valutazione finora

- Foreiagn Chapter ThreeDocumento45 pagineForeiagn Chapter ThreeLidya AberaNessuna valutazione finora

- Practical Accounting 1 2011Documento17 paginePractical Accounting 1 2011abbey89100% (2)

- Chapter 11-Part 1 Share Transaction Soal 1Documento2 pagineChapter 11-Part 1 Share Transaction Soal 1Nicko Arisandiy0% (1)

- Be16 P16 2aDocumento7 pagineBe16 P16 2aLisa Hammerle ClarkNessuna valutazione finora

- Chapter 10Documento16 pagineChapter 10Kurt dela Torre0% (2)

- Review Sw4tgession 5 TEXTDocumento9 pagineReview Sw4tgession 5 TEXTMelissa WhiteNessuna valutazione finora

- Soal Kuis Uas - AklDocumento3 pagineSoal Kuis Uas - AklBastian Nugraha SiraitNessuna valutazione finora

- Chapter ThreeDocumento55 pagineChapter ThreeYeber MelkemiyaNessuna valutazione finora

- Accounting For Foreign Currency TransactionDocumento4 pagineAccounting For Foreign Currency TransactionDymphna Ann Calumpiano100% (2)

- Chapter 10 HW, Quiz, Practice ProblemsDocumento48 pagineChapter 10 HW, Quiz, Practice Problemsj lo100% (1)

- Tolbert Enterprises Inc Manufactures Bathroom Fixtures The Sto PDFDocumento1 paginaTolbert Enterprises Inc Manufactures Bathroom Fixtures The Sto PDFAnbu jaromiaNessuna valutazione finora

- Chapter 14Documento5 pagineChapter 14RahimahBawaiNessuna valutazione finora

- P7Documento2 pagineP7Andreas Brown0% (1)

- Soal Kuis Asistensi AK1 Setelah UTSDocumento6 pagineSoal Kuis Asistensi AK1 Setelah UTSManggala Patria WicaksonoNessuna valutazione finora

- On December 1 2014 Boline Distributing Company Had The FollowingDocumento1 paginaOn December 1 2014 Boline Distributing Company Had The Followingtrilocksp SinghNessuna valutazione finora

- AC - IntAcctg1 Quiz 04 With AnswersDocumento2 pagineAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- Aber Corporation S Balance Sheet at December 31 2009 Is PresenDocumento1 paginaAber Corporation S Balance Sheet at December 31 2009 Is PresenM Bilal SaleemNessuna valutazione finora

- Soal Aset TetapDocumento3 pagineSoal Aset TetapNamla Elfa Syariati67% (3)

- Foreign Currency Transactions MCQsDocumento12 pagineForeign Currency Transactions MCQsObe Absin100% (1)

- On January 1 2011 Fox Acquired 70 of The Shares PDFDocumento1 paginaOn January 1 2011 Fox Acquired 70 of The Shares PDFhassan taimourNessuna valutazione finora

- Hyperinflation and Current Cost Accounting ProblemsDocumento4 pagineHyperinflation and Current Cost Accounting ProblemsMaan CabolesNessuna valutazione finora

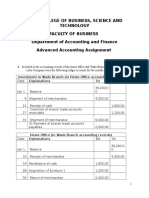

- Hope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentDocumento6 pagineHope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentShumebeza BaylleNessuna valutazione finora

- Bank Reconciliation, Inventory Valuation, Bond Issuance, and Patent Amortization Journal EntriesDocumento2 pagineBank Reconciliation, Inventory Valuation, Bond Issuance, and Patent Amortization Journal EntriesNaylisNessuna valutazione finora

- EXERCISES 1aDocumento1 paginaEXERCISES 1aCordel FernandoNessuna valutazione finora

- Various Inventory Issues The Following Independent Situations Re PDFDocumento1 paginaVarious Inventory Issues The Following Independent Situations Re PDFAnbu jaromiaNessuna valutazione finora

- Fund and Other Investments & DerivativesDocumento4 pagineFund and Other Investments & DerivativesShaira BugayongNessuna valutazione finora

- On January 1 2010 Weiser Corporation Had The Following Stockho PDFDocumento1 paginaOn January 1 2010 Weiser Corporation Had The Following Stockho PDFAnbu jaromiaNessuna valutazione finora

- Kuis UTS Genap Lab AKM II DoskoDocumento4 pagineKuis UTS Genap Lab AKM II DoskoYokka FebriolaNessuna valutazione finora

- She QuizDocumento2 pagineShe QuizRonnelson PascualNessuna valutazione finora

- Audit of Equity ONLYDocumento2 pagineAudit of Equity ONLYAstika Tamala Br TinjakNessuna valutazione finora

- Dodge City Realty Acts As An Agent in Buying SellingDocumento1 paginaDodge City Realty Acts As An Agent in Buying Sellingtrilocksp SinghNessuna valutazione finora

- Chapter 5 FOREX TransactionDocumento17 pagineChapter 5 FOREX TransactionAddi Såïñt GeorgeNessuna valutazione finora

- Timothy Monroe Opened A Law Office On January 1 2017 PDFDocumento1 paginaTimothy Monroe Opened A Law Office On January 1 2017 PDFAhsan KhanNessuna valutazione finora

- Adjusting Entries and Their EffectsDocumento2 pagineAdjusting Entries and Their EffectsShang BugayongNessuna valutazione finora

- S 0 TPM9 FHDocumento17 pagineS 0 TPM9 FHkrstn_hghtwrNessuna valutazione finora

- Financial Instruments RisksDocumento2 pagineFinancial Instruments RisksManraj LidharNessuna valutazione finora

- Chap 5 ExerciseDocumento2 pagineChap 5 ExerciseHồng PhongNessuna valutazione finora

- CH 16Documento3 pagineCH 16vivienNessuna valutazione finora

- Embracing the Joie de Vivre: Your Guide to French Real Estate and a Bright Future Ahead ActiveDa EverandEmbracing the Joie de Vivre: Your Guide to French Real Estate and a Bright Future Ahead ActiveNessuna valutazione finora

- CH 02Documento9 pagineCH 02Omar YounisNessuna valutazione finora

- CH 01Documento11 pagineCH 01Ahmed FahmyNessuna valutazione finora

- Green Finance 11Documento17 pagineGreen Finance 11Fenny MarietzaNessuna valutazione finora

- QUIZ AdvanceDocumento1 paginaQUIZ AdvanceFenny MarietzaNessuna valutazione finora

- Advanced Accounting: Consolidated Financial Statements-Date of AcquisitionDocumento52 pagineAdvanced Accounting: Consolidated Financial Statements-Date of AcquisitiongoerginamarquezNessuna valutazione finora

- Ne Gash 2012Documento20 pagineNe Gash 2012Fenny MarietzaNessuna valutazione finora

- Accounting For Business CombinationDocumento60 pagineAccounting For Business CombinationFenny MarietzaNessuna valutazione finora

- Advanced Accounting: Introduction To Business Combinations and The Conceptual FrameworkDocumento52 pagineAdvanced Accounting: Introduction To Business Combinations and The Conceptual FrameworkPetraNessuna valutazione finora

- Analisis of Financial StatementDocumento5 pagineAnalisis of Financial StatementFenny MarietzaNessuna valutazione finora

- IFRS and Environmental AccountingDocumento25 pagineIFRS and Environmental AccountingRachellLieNessuna valutazione finora

- 10.1108@jfra 10 2012 0049 PDFDocumento17 pagine10.1108@jfra 10 2012 0049 PDFFenny MarietzaNessuna valutazione finora

- 8797 Unilever ARADocumento165 pagine8797 Unilever ARABilal BhattiNessuna valutazione finora

- 10.1108@jfra 10 2012 0049 PDFDocumento17 pagine10.1108@jfra 10 2012 0049 PDFFenny MarietzaNessuna valutazione finora

- Template ICOFeb-1Documento4 pagineTemplate ICOFeb-1Fenny MarietzaNessuna valutazione finora

- Whistleblowing in Organizations An Examination ofDocumento22 pagineWhistleblowing in Organizations An Examination ofFenny MarietzaNessuna valutazione finora

- Corporate TransparencyDocumento22 pagineCorporate TransparencyFenny MarietzaNessuna valutazione finora

- CH 06Documento48 pagineCH 06Fenny MarietzaNessuna valutazione finora

- CH 01Documento50 pagineCH 01IsuluapNessuna valutazione finora

- Safe Handling of Solid Ammonium Nitrate: Recommendations For The Environmental Management of Commercial ExplosivesDocumento48 pagineSafe Handling of Solid Ammonium Nitrate: Recommendations For The Environmental Management of Commercial ExplosivesCuesta AndresNessuna valutazione finora

- A Story Behind..: Dimas Budi Satria Wibisana Mario Alexander Industrial Engineering 5Documento24 pagineA Story Behind..: Dimas Budi Satria Wibisana Mario Alexander Industrial Engineering 5Owais AwanNessuna valutazione finora

- OF Ministry Road Transport Highways (Road Safety Cell) : TH THDocumento3 pagineOF Ministry Road Transport Highways (Road Safety Cell) : TH THAryann Gupta100% (1)

- 8086 ProgramsDocumento61 pagine8086 ProgramsBmanNessuna valutazione finora

- Challan Form OEC App Fee 500 PDFDocumento1 paginaChallan Form OEC App Fee 500 PDFsaleem_hazim100% (1)

- Earth & Life Science Q1 Module 2 - DESIREE VICTORINODocumento22 pagineEarth & Life Science Q1 Module 2 - DESIREE VICTORINOJoshua A. Arabejo50% (4)

- Limiting and Excess Reactants Lesson PlanDocumento3 pagineLimiting and Excess Reactants Lesson Planapi-316338270100% (3)

- Dislocating The Sign: Toward A Translocal Feminist Politics of TranslationDocumento8 pagineDislocating The Sign: Toward A Translocal Feminist Politics of TranslationArlene RicoldiNessuna valutazione finora

- Syntax - English Sentence StructureDocumento2 pagineSyntax - English Sentence StructurePaing Khant KyawNessuna valutazione finora

- The Revival Strategies of Vespa Scooter in IndiaDocumento4 pagineThe Revival Strategies of Vespa Scooter in IndiaJagatheeswari SelviNessuna valutazione finora

- Course Title: Cost Accounting Course Code:441 BBA Program Lecture-3Documento20 pagineCourse Title: Cost Accounting Course Code:441 BBA Program Lecture-3Tanvir Ahmed ChowdhuryNessuna valutazione finora

- Oral READING BlankDocumento2 pagineOral READING Blanknilda aleraNessuna valutazione finora

- GUCR Elections Information 2017-2018Documento10 pagineGUCR Elections Information 2017-2018Alexandra WilliamsNessuna valutazione finora

- Mendoza CasesDocumento66 pagineMendoza Casespoiuytrewq9115Nessuna valutazione finora

- BSP Memorandum No. M-2022-035Documento1 paginaBSP Memorandum No. M-2022-035Gleim Brean EranNessuna valutazione finora

- Dalit LiteratureDocumento16 pagineDalit LiteratureVeena R NNessuna valutazione finora

- Sen. Jinggoy Estrada vs. Office of The Ombudsman, Et. Al.Documento2 pagineSen. Jinggoy Estrada vs. Office of The Ombudsman, Et. Al.Keziah HuelarNessuna valutazione finora

- 5.2.1 1539323575 2163Documento30 pagine5.2.1 1539323575 2163Brinda TNessuna valutazione finora

- 5.1 Physical Farming Constraints in Southern CaliforniaDocumento1 pagina5.1 Physical Farming Constraints in Southern CaliforniaTom ChiuNessuna valutazione finora

- APSEC Summary of Items Discussed in 4/2020 APSEC ForumDocumento15 pagineAPSEC Summary of Items Discussed in 4/2020 APSEC Forumyuki michaelNessuna valutazione finora

- ESL Brains - What Can AI Do For YouDocumento25 pagineESL Brains - What Can AI Do For YouprofegaordineNessuna valutazione finora

- REBECCA SOLNIT, Wanderlust. A History of WalkingDocumento23 pagineREBECCA SOLNIT, Wanderlust. A History of WalkingAndreaAurora BarberoNessuna valutazione finora

- Relation of Sociology with other social sciencesDocumento4 pagineRelation of Sociology with other social sciencesBheeya BhatiNessuna valutazione finora

- 20 Reasons Composers Fail 2019 Reprint PDFDocumento30 pagine20 Reasons Composers Fail 2019 Reprint PDFAlejandroNessuna valutazione finora

- C++ Project On Library Management by KCDocumento53 pagineC++ Project On Library Management by KCkeval71% (114)

- PDFDocumento2 paginePDFJahi100% (3)

- Service Manual Pioneer CDJ 2000-2 (RRV4163) (2010)Documento28 pagineService Manual Pioneer CDJ 2000-2 (RRV4163) (2010)GiancaNessuna valutazione finora

- Importance of Time Management To Senior High School Honor StudentsDocumento7 pagineImportance of Time Management To Senior High School Honor StudentsBien LausaNessuna valutazione finora

- The Mckenzie MethodDocumento24 pagineThe Mckenzie MethodMohamed ElMeligieNessuna valutazione finora

- It - Unit 14 - Assignment 2 1Documento8 pagineIt - Unit 14 - Assignment 2 1api-669143014Nessuna valutazione finora