Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Introduction to Corporate Finance Principles and Goals

Caricato da

Rupal Dalal0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

11 visualizzazioni4 paginehkfglkg

Titolo originale

1

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentohkfglkg

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

11 visualizzazioni4 pagineIntroduction to Corporate Finance Principles and Goals

Caricato da

Rupal Dalalhkfglkg

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

1.

Introduction of Corporate Finance

1.1 Corporate Finance

Corporate finance can be defined as a body of knowledge that deals with the

following three issues.

What long term strategic investments a firm should undertake?

What long term financing alternatives that a firm should use to raise capital

to finance its long term strategic investments?

How much short term cash flow does a company need to ensure smooth day

you day operations of firm?

Long term strategic investments decisions are also known as the capital

budgeting decisions.

Long term strategic financing decisions involve a decision on mix of debt and

equity financing for the company and are known as capital structure decision.

Dividend policy decision also falls into this category.

Management of short term cash flows relate to working capital management.

The above mentioned three issues are discussed and analyzed within the basic

framework of time value of money and principle of risk and return. Moreover, the

financial statement analysis helps the management moving toward the right path in

interest of shareholders.

Thus we can define corporate finance as a study of the principles, policies and

institution that shape corporate financial decision.

Corporate finance displays the movements of funds (money, capital, and other

financial assets,), by which the company gets involved into quantitative and

qualitative money relations with different entrepreneurial subjects, employees and all

other subjects of its financial environment.

Foreign Interest

Tax

Investor

Other costs

Firm Output Revenue - Profit

Market

Reinvestment

+

Owner

Dividends

Corporate Money Flow

Corporate finance is a segment of finance which deals with the decision taken

by the different corporations. Corporate finance studies and analyzes the tools that

mandatory in arriving at such corporate finance is the maximization of corporative

value by minimizing corporate risk. In corporate finance, we analyze the long term

and short-term decision. It includes:

Capital investments decision

Working capital management

Financial risk management

1.2 Principles of Corporate Finance

Some principles of finance are:

Time value of money

Compensation of risk

Do not put your eggs in one basket

Markets are smart

No arbitrage

1. Time value of money

The opportunity to earn a return on invested funds means that a dollar today is

worth more than a dollar in future. A dollar today represents present value and a

dollar in future represents future value.

2. Compensation of risk

Risk is the chance of financial loss and variability of return. Investors expected

compensation forbearing risk.

3. Do not put your eggs in one basket

Investor can achieve a more favorable trade off between risk and return by

diversifying their portfolios.

High risk High return

Low risk Low return

4. Markets are smart

Competition for information tends to make market efficient.

5. No arbitrage

Arbitrage opportunities are extremely scarce. Arbitrates is the practices of

taking advantages of price differential b/w two or more markets. Arbitrates

opportunity means the opportunity to buy an assets at a low price then immediately

selling it on a different market for a higher price. Like as if one person buys assets of

Rs.100 and sale it to Rs.200, the difference of Rs.100 shows arbitrage profit.

1.3 Financial Manager’s Goals

There are some goals of financial managers.

Maximize profit

Maximize shareholder’s wealth

Stakeholders focus

1. Maximize profit

Earning reflect past performance, rather than current or future performance.

Ignore the timings of profit.

Ignore cash flows.

Ignore risk.

Earning per shares is backward looking, dependent on accounting

principles.

2. Maximize shareholder’s wealth

Maximizes stock price, not profits.

Shareholders as residual claimants, have better incentives to maximize firm

value.

A firm’s stock price reflects the timing, magnitude, and risk of cash flows

that investors expect a firm to generate over time.

3. Stakeholders focus

Stakeholders are those persons who have some economic interest in the

business like as government, employees, suppliers, customers, etc.

Many firms seek to preserve the interest of other stakeholders, such as

employees, customers, tax authorities and communities where the firm

operates.

Doing so provide long term benefits to shareholders and is in line with the

primary goal of maximizing shareholders wealth.

1.4 Scope of Corporate Finance

Financial managers should seek to maximize shareholder’s wealth by

performing the basic functions of corporate finance. Select instruments for which the

marginal benefits exceed the marginal cost.

Potrebbero piacerti anche

- Finance Notes Lesson 4Documento2 pagineFinance Notes Lesson 4moorthyvaniNessuna valutazione finora

- FM 1-3Documento53 pagineFM 1-3zeleke fayeNessuna valutazione finora

- Need of Knowing Finance - A Managerial Perspective: Unit - 1 FINANCIAL MANAGEMENT (Corporate Finance)Documento24 pagineNeed of Knowing Finance - A Managerial Perspective: Unit - 1 FINANCIAL MANAGEMENT (Corporate Finance)shaik masoodNessuna valutazione finora

- Introduction To Managerial Finance: 1) Essay QuestionsDocumento22 pagineIntroduction To Managerial Finance: 1) Essay QuestionsMohamed Diab100% (1)

- Corprate Finance BBM 312Documento53 pagineCorprate Finance BBM 312jemengich100% (1)

- Financial Management IDocumento62 pagineFinancial Management Ihasenabdi30Nessuna valutazione finora

- Unit - I Introduction To FinanceDocumento49 pagineUnit - I Introduction To FinanceShivam PalNessuna valutazione finora

- Financial Management Teaching Material1Documento72 pagineFinancial Management Teaching Material1Semere Deribe100% (2)

- BUP FM Lecture 1 OverviewDocumento3 pagineBUP FM Lecture 1 OverviewKhandaker Tanvir AhmedNessuna valutazione finora

- FM Notes CFM 200Documento72 pagineFM Notes CFM 200Nickson ulamiNessuna valutazione finora

- Finance MarketDocumento18 pagineFinance Markettp0603069Nessuna valutazione finora

- Sbaa 3004Documento71 pagineSbaa 3004mohanrajk879Nessuna valutazione finora

- FM I Chapter OneDocumento12 pagineFM I Chapter Onenegussie birieNessuna valutazione finora

- Fm-I Chap-I EditedDocumento29 pagineFm-I Chap-I Editedtibebu5420Nessuna valutazione finora

- (Week 2) Lesson 1:: Lesson Number: Topic: Introduction To Financial ManagementDocumento9 pagine(Week 2) Lesson 1:: Lesson Number: Topic: Introduction To Financial ManagementMark Dhel VillaramaNessuna valutazione finora

- CHAPTER FM I final docxDocumento14 pagineCHAPTER FM I final docxgenenegetachew64Nessuna valutazione finora

- DMBA 202 Financial ManagementDocumento427 pagineDMBA 202 Financial ManagementParas ThakanNessuna valutazione finora

- MCO 106 UNIT-1 Business Finance 2023Documento14 pagineMCO 106 UNIT-1 Business Finance 2023daogafugNessuna valutazione finora

- Finance, ITS DEFINITION, IMPORTANCE AND FUNCTIONDocumento20 pagineFinance, ITS DEFINITION, IMPORTANCE AND FUNCTIONJhon GonzalesNessuna valutazione finora

- FINANCIAL MANAGEMENT Study PaperDocumento102 pagineFINANCIAL MANAGEMENT Study PaperPriyank TripathyNessuna valutazione finora

- FM1 IntroDocumento27 pagineFM1 IntroZenedel De JesusNessuna valutazione finora

- FM8 Module 4Documento5 pagineFM8 Module 4Kim HeidelynNessuna valutazione finora

- Business Finance 1 ÖZETDocumento23 pagineBusiness Finance 1 ÖZETÖmer Faruk AYDINNessuna valutazione finora

- CH 1Documento25 pagineCH 1malo baNessuna valutazione finora

- Summary Corporate Finance (David Hillier, Lain Clacher, Stephen Ross, Randolph Westerfield, Bradford Jordan)Documento44 pagineSummary Corporate Finance (David Hillier, Lain Clacher, Stephen Ross, Randolph Westerfield, Bradford Jordan)Akash JhaNessuna valutazione finora

- FM MBA Study MaterialDocumento28 pagineFM MBA Study MaterialJayakrishnan PillaiNessuna valutazione finora

- Introduction To Financial ManagementDocumento23 pagineIntroduction To Financial ManagementLifeatsiem Rajpur100% (6)

- BFN Note CombineDocumento50 pagineBFN Note CombineTimilehin GbengaNessuna valutazione finora

- Exm - 32142 Finance ManagementDocumento15 pagineExm - 32142 Finance Managementkalp ach50% (2)

- Financial Management Chapter 1Documento11 pagineFinancial Management Chapter 1Ruiz, CherryjaneNessuna valutazione finora

- Introduction To Financial ManagementDocumento31 pagineIntroduction To Financial ManagementzewdieNessuna valutazione finora

- Ratio Analysis of HEAT PROCESS INSTRUMENTSDocumento71 pagineRatio Analysis of HEAT PROCESS INSTRUMENTSuday manikantaNessuna valutazione finora

- chp1 Financial ManagementDocumento14 paginechp1 Financial ManagementHuda ShahNessuna valutazione finora

- Introduction to FinanceDocumento13 pagineIntroduction to FinanceNicole TaysonNessuna valutazione finora

- Micro Finance: Ii Sem McomDocumento46 pagineMicro Finance: Ii Sem McomRekha MadhuNessuna valutazione finora

- PBF 01Documento24 paginePBF 01Masum BillahNessuna valutazione finora

- CH - 1 (FM) PDFDocumento8 pagineCH - 1 (FM) PDFKanha KumarNessuna valutazione finora

- Advanced Corporate Finance (ACFN - 551) (Credit Hours: 3) : Departmet of Accounting and FinanceDocumento85 pagineAdvanced Corporate Finance (ACFN - 551) (Credit Hours: 3) : Departmet of Accounting and FinanceMikias DegwaleNessuna valutazione finora

- Chapter 1Documento7 pagineChapter 1HananNessuna valutazione finora

- Finance Chapter 1Documento32 pagineFinance Chapter 1Tamzid Ahmed AnikNessuna valutazione finora

- Internal Assignment Financial Management: T K Tushar 20191BBL0097 To: Prof. Leena GeorgeDocumento6 pagineInternal Assignment Financial Management: T K Tushar 20191BBL0097 To: Prof. Leena Georgewemoot 2019Nessuna valutazione finora

- Corporate Finance Study MaterialDocumento139 pagineCorporate Finance Study Materialdanielnebeyat7Nessuna valutazione finora

- Introduction of FMDocumento8 pagineIntroduction of FMMayuraa ShekatkarNessuna valutazione finora

- Introduction to Financial Management ChapterDocumento13 pagineIntroduction to Financial Management Chapterriajul islam jamiNessuna valutazione finora

- CF CHP 1Documento21 pagineCF CHP 1Dev Bahadur BudhaNessuna valutazione finora

- Bme 5 PrelimsDocumento4 pagineBme 5 PrelimsIrish DionisioNessuna valutazione finora

- Financial ManagementDocumento27 pagineFinancial ManagementEvarish CarmonaNessuna valutazione finora

- Financial Management PGDM Study MaterialDocumento152 pagineFinancial Management PGDM Study MaterialSimranNessuna valutazione finora

- Financial Management Basics - Objectives, Meaning and Scope ExplainedTITLE Guide to Financial Management Concepts - Definitions, Functions and GoalsDocumento10 pagineFinancial Management Basics - Objectives, Meaning and Scope ExplainedTITLE Guide to Financial Management Concepts - Definitions, Functions and GoalsSaksham MathurNessuna valutazione finora

- Unit 1 FMDocumento7 pagineUnit 1 FMpurvang selaniNessuna valutazione finora

- AGENCY PROBLEM - Management Versus StockholdersDocumento31 pagineAGENCY PROBLEM - Management Versus StockholdersRk BainsNessuna valutazione finora

- FM Unit IDocumento15 pagineFM Unit ILakshmi RajanNessuna valutazione finora

- Understanding the Concepts and Functions of Business FinanceDocumento15 pagineUnderstanding the Concepts and Functions of Business Financejennie martNessuna valutazione finora

- Researh MethodogyDocumento18 pagineResearh Methodogysailesh vasa100% (1)

- Finance Management FundamentalsDocumento16 pagineFinance Management FundamentalsGLOBAL INFO-TECH KUMBAKONAMNessuna valutazione finora

- Defination of Financial Management ? Functions ?Documento16 pagineDefination of Financial Management ? Functions ?Arin majumderNessuna valutazione finora

- FM Unit1.Documento166 pagineFM Unit1.shaik masoodNessuna valutazione finora

- MAKE UpDocumento5 pagineMAKE UpPiyush RohitNessuna valutazione finora

- R'Documento1 paginaR'Rupal DalalNessuna valutazione finora

- Concolicc04 PDFDocumento21 pagineConcolicc04 PDFRupal DalalNessuna valutazione finora

- Concolicc04 PDFDocumento21 pagineConcolicc04 PDFRupal DalalNessuna valutazione finora

- Investment and financial planning for retail investorsDocumento50 pagineInvestment and financial planning for retail investorsRupal DalalNessuna valutazione finora

- UNIVERSITY OF MUMBAI (NITIN Singh)Documento53 pagineUNIVERSITY OF MUMBAI (NITIN Singh)Rupal DalalNessuna valutazione finora

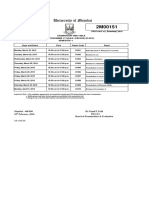

- University of Mumbai: (Summer)Documento1 paginaUniversity of Mumbai: (Summer)Rupal DalalNessuna valutazione finora

- University of Mumbai: ConfidentialDocumento3 pagineUniversity of Mumbai: ConfidentialRupal DalalNessuna valutazione finora

- Indirect TaxDocumento3 pagineIndirect TaxRupal DalalNessuna valutazione finora

- 4.182 Bachelor of Management Studies BMS Semester III and IV PDFDocumento117 pagine4.182 Bachelor of Management Studies BMS Semester III and IV PDFRupal DalalNessuna valutazione finora

- University of Mumbai: (Summer)Documento1 paginaUniversity of Mumbai: (Summer)Rupal DalalNessuna valutazione finora

- University of Mumbai: (Summer)Documento1 paginaUniversity of Mumbai: (Summer)Rupal DalalNessuna valutazione finora

- Taxation - Direct and Indirect - Chapter 4 PPT MkJy53msNBDocumento32 pagineTaxation - Direct and Indirect - Chapter 4 PPT MkJy53msNBRupal DalalNessuna valutazione finora

- Study Paper On Holding Company ValuationsDocumento40 pagineStudy Paper On Holding Company ValuationssdNessuna valutazione finora

- The Ultimate Guide To Profitable Option SellingDocumento72 pagineThe Ultimate Guide To Profitable Option Sellingsatyansh blackNessuna valutazione finora

- Chilean Equity DashboardDocumento6 pagineChilean Equity DashboardFrancisco CourbisNessuna valutazione finora

- PitchBook 2018 PE OutlookDocumento12 paginePitchBook 2018 PE OutlookryanNessuna valutazione finora

- Investment Plans in IndiaDocumento70 pagineInvestment Plans in IndiaNitesh Singh100% (1)

- The Books of Binkerton Corporation Carried The Following Account Balances PDFDocumento1 paginaThe Books of Binkerton Corporation Carried The Following Account Balances PDFFreelance WorkerNessuna valutazione finora

- CH 11 Hull OFOD9 TH EditionDocumento20 pagineCH 11 Hull OFOD9 TH EditionJohn Paul TuohyNessuna valutazione finora

- UM Panabo College Accounting 2a ExamDocumento2 pagineUM Panabo College Accounting 2a ExamJessa BeloyNessuna valutazione finora

- DR A.P.J. Abdul Kalam Technical University Lucknow: Uttam Group of InstitutionsDocumento33 pagineDR A.P.J. Abdul Kalam Technical University Lucknow: Uttam Group of InstitutionsMayank jainNessuna valutazione finora

- Merchant Banking - A Comparative Analysis of Private and Government SectorDocumento7 pagineMerchant Banking - A Comparative Analysis of Private and Government SectorHarsh KbddhsjNessuna valutazione finora

- Investors' perception of India's derivatives marketDocumento9 pagineInvestors' perception of India's derivatives marketVishal SutharNessuna valutazione finora

- Solved The Federal Reserve Bank of ST Louis Publishes A WeeklyDocumento1 paginaSolved The Federal Reserve Bank of ST Louis Publishes A WeeklyM Bilal SaleemNessuna valutazione finora

- Extraordinary Shareholders' Meeting - 05.20.2016 - Appraisal Report KPMG (Cetip)Documento49 pagineExtraordinary Shareholders' Meeting - 05.20.2016 - Appraisal Report KPMG (Cetip)BVMF_RINessuna valutazione finora

- Financial Analysis of L&TDocumento7 pagineFinancial Analysis of L&TPallavi ChoudharyNessuna valutazione finora

- New Issue MarketDocumento31 pagineNew Issue MarketAashish AnandNessuna valutazione finora

- An Analytical Study On The Volatility of Securities Traded On Bse Sensex"Documento80 pagineAn Analytical Study On The Volatility of Securities Traded On Bse Sensex"Sagar Parekh75% (12)

- PWC Report-StartupsDocumento17 paginePWC Report-StartupsDhirendra TripathiNessuna valutazione finora

- Consolidated Financial Statement Practice 3-2Documento2 pagineConsolidated Financial Statement Practice 3-2Winnie TanNessuna valutazione finora

- Securities Brokering in The USDocumento8 pagineSecurities Brokering in The USJessyNessuna valutazione finora

- Reflection Paper - FINMARDocumento2 pagineReflection Paper - FINMAREidel PantaleonNessuna valutazione finora

- BLPAPI Core User GuideDocumento38 pagineBLPAPI Core User GuideAlex koNessuna valutazione finora

- COST OF CAPITAL - Basic FinanceDocumento21 pagineCOST OF CAPITAL - Basic FinanceAqib IshtiaqNessuna valutazione finora

- DerivativesDocumento41 pagineDerivativesmugdha.ghag3921Nessuna valutazione finora

- Final Project India BullsDocumento61 pagineFinal Project India BullsRanadip PaulNessuna valutazione finora

- Problem Set 1 Fundamentals of ValuationDocumento3 pagineProblem Set 1 Fundamentals of ValuationSerin SiluéNessuna valutazione finora

- Application On Demand and Supply c1l2Documento28 pagineApplication On Demand and Supply c1l2Mitzie Faye GonzalesNessuna valutazione finora

- Comparative Study of Mutual Funds in KarvyDocumento85 pagineComparative Study of Mutual Funds in KarvyFaishal JoadNessuna valutazione finora

- Discount of Commercial Papers at BanksDocumento5 pagineDiscount of Commercial Papers at BanksAmer IbrahimNessuna valutazione finora

- Trading Habits - 39 of The World's Most Powerful Stock Market Rules (PDFDrive)Documento62 pagineTrading Habits - 39 of The World's Most Powerful Stock Market Rules (PDFDrive)NalNessuna valutazione finora

- B 20170522Documento94 pagineB 20170522larryNessuna valutazione finora