Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Case Study: Financial Analysis

Caricato da

abraamTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Case Study: Financial Analysis

Caricato da

abraamCopyright:

Formati disponibili

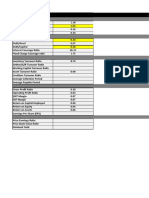

Financial Analysis

Case Study

Year 1995 Year 1996 Year 1997 Year 1998 Year 1999 Year 2000

1 The Liquidity ratios :

* Current ratio = Current assets #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Current Liabilities

* Quick ratio = Current assets - Inv. #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Current Liabilities

The Liquidity ratios shows the ability of the Co. to cover its short term liabilities

2 The Activity ratios :

* Inventory turnover = Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Inventory

* F.A. turnover = Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

net F.A.

* Total Assets turnover = Sales #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Total assets

In general the Activity ratios gives a better indication of the Co. situation year on year

3 The Leverage ratio :

* Indebtedness ratio = Total Lib. #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Total Equity

Shows the companies dept capacity and financial resources

4 The Profitability ratios :

* Profit margin over sales = Net Income #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Sales

* Return on total assets = Net Income #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Total assets

* Return on equity = Net Income #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Comm. Equity

Shows how profitable the firm is

General Comment

Ratios are useful, they give you guidelines to identify the problem, but never offer you the solution

Potrebbero piacerti anche

- How Would Have a Low-Cost Index Fund Approach Worked During the Great Depression?Da EverandHow Would Have a Low-Cost Index Fund Approach Worked During the Great Depression?Nessuna valutazione finora

- Finance ToolsDocumento5 pagineFinance ToolsAlvin Ilham NurcahyaNessuna valutazione finora

- Copy and Paste Income Statement Below in A2 Cell in Blue!!!Documento3 pagineCopy and Paste Income Statement Below in A2 Cell in Blue!!!Jc TambauanNessuna valutazione finora

- Cheatsheet ALK PajakDocumento24 pagineCheatsheet ALK PajakMat TamatNessuna valutazione finora

- Financial Ratios PLDT and GlobeDocumento3 pagineFinancial Ratios PLDT and GlobeRosejane EMNessuna valutazione finora

- ValorisationDocumento10 pagineValorisationpgNessuna valutazione finora

- Sax 12Documento9 pagineSax 12adzida-1Nessuna valutazione finora

- Fsa 3Documento10 pagineFsa 3adzida-1Nessuna valutazione finora

- Ratios CalculatorDocumento1 paginaRatios CalculatorAhmad EssamNessuna valutazione finora

- Fundamental WorksheetDocumento1 paginaFundamental WorksheetHendrawan SaputraNessuna valutazione finora

- Ratios Table FormatDocumento2 pagineRatios Table FormatAwrangzeb AwrangNessuna valutazione finora

- Stock ScreenerDocumento3 pagineStock Screenerhfsjkfhk jfkhsjkhsNessuna valutazione finora

- DuponttemplateDocumento6 pagineDuponttemplatecuongaccNessuna valutazione finora

- Financial Statement Analysis in ExcelDocumento1 paginaFinancial Statement Analysis in ExcelRaymond100% (1)

- Fsa 4Documento9 pagineFsa 4adzida-1Nessuna valutazione finora

- Ratios - Financial AnalysisDocumento6 pagineRatios - Financial AnalysisMohamed EzzatNessuna valutazione finora

- Current AssetsDocumento23 pagineCurrent Assetsadzida-1Nessuna valutazione finora

- Uraian 2011 % Neraca Aktiva: Analisa Laporan Keuangan Pt. AskrindoDocumento33 pagineUraian 2011 % Neraca Aktiva: Analisa Laporan Keuangan Pt. AskrindoJanah JuliawatiNessuna valutazione finora

- Accounting Ratios Excel TemplateDocumento4 pagineAccounting Ratios Excel TemplateMAZIN SALAHELDEENNessuna valutazione finora

- FADM Midterm Formula BankDocumento3 pagineFADM Midterm Formula BankSHREYANessuna valutazione finora

- Asset Allocation ToolDocumento3 pagineAsset Allocation Toolsewanti2Nessuna valutazione finora

- 3 Hous AnalysisDocumento5 pagine3 Hous AnalysisEduardo Lopez-vegue DiezNessuna valutazione finora

- Template Idr - 20218989Documento22 pagineTemplate Idr - 20218989xhamayu bawonoNessuna valutazione finora

- Financial Statement Analysis: Liquidity RatiosDocumento17 pagineFinancial Statement Analysis: Liquidity RatiosPurehoney ManufacturersNessuna valutazione finora

- NAME (Last & First) NAME (Spouse) Phone 17-Mar-11: - Financial Analysis SummaryDocumento122 pagineNAME (Last & First) NAME (Spouse) Phone 17-Mar-11: - Financial Analysis SummaryOliver DotsonNessuna valutazione finora

- Sales Conversion & Close Rate CalculatorDocumento16 pagineSales Conversion & Close Rate Calculatorsunny niNessuna valutazione finora

- CGAP Appraisal Format SpreadsheetDocumento26 pagineCGAP Appraisal Format SpreadsheetsayaraviNessuna valutazione finora

- MBA TemplateDocumento15 pagineMBA TemplateMehwish KhanNessuna valutazione finora

- Aomi SHRM Mis Cumulative21Documento52 pagineAomi SHRM Mis Cumulative21Edy BebyNessuna valutazione finora

- Trade Journal 33Documento48 pagineTrade Journal 33harry StockTradersNessuna valutazione finora

- Trade Journal Overview: $0.00 0 $0.00 0 #DIV/0! 0 #DIV/0!Documento48 pagineTrade Journal Overview: $0.00 0 $0.00 0 #DIV/0! 0 #DIV/0!Seagal UmarNessuna valutazione finora

- Trade JournalDocumento48 pagineTrade Journalmathgtr25Nessuna valutazione finora

- Ki Mô ChiDocumento100 pagineKi Mô ChiNguyễn Ngọc MinhNessuna valutazione finora

- Trade Journal V2Documento48 pagineTrade Journal V2MaxNessuna valutazione finora

- Forecast MIS ReportDocumento9 pagineForecast MIS ReportSameer SinghNessuna valutazione finora

- Legendary Marketer Data TrackerDocumento2 pagineLegendary Marketer Data TrackerjayNessuna valutazione finora

- Trade JournalDocumento48 pagineTrade Journalnetizen viewerNessuna valutazione finora

- Inventory Days 85 Receivable Days 20 Payable Days 90: Working Capital Cycle ExampleDocumento2 pagineInventory Days 85 Receivable Days 20 Payable Days 90: Working Capital Cycle ExampleRif QueNessuna valutazione finora

- FOREX Journal 2.0Documento51 pagineFOREX Journal 2.0Maniarasan ParameswaranNessuna valutazione finora

- Break-Even Sales Analysis:: For The Next 12 MonthsDocumento3 pagineBreak-Even Sales Analysis:: For The Next 12 MonthsMochamad ChandraNessuna valutazione finora

- How To Use A Profit & Loss StatementDocumento3 pagineHow To Use A Profit & Loss StatementJinney Abadano AlilingNessuna valutazione finora

- Financial Analysis Using RatiosDocumento12 pagineFinancial Analysis Using Ratiossamar RamadanNessuna valutazione finora

- Name of The Company: Scrip Code:: Statement Showing Shareholding PatternDocumento16 pagineName of The Company: Scrip Code:: Statement Showing Shareholding PatternvirusjackNessuna valutazione finora

- Margin & ROI ComparisonsDocumento6 pagineMargin & ROI ComparisonsNeeraj DaniNessuna valutazione finora

- CHO2 - Financial Tools and PlanningDocumento13 pagineCHO2 - Financial Tools and Planningsbb anbwNessuna valutazione finora

- Rrif Rp2014 EngDocumento15 pagineRrif Rp2014 EngchristieSINessuna valutazione finora

- Ratio Analysis Formula Excel TemplateDocumento5 pagineRatio Analysis Formula Excel TemplateKazi AsaduzzmanNessuna valutazione finora

- Calculadora Financiera PersonalDocumento1 paginaCalculadora Financiera PersonalJUAN SEBASTIAN CRUZ CASTILLONessuna valutazione finora

- Personal Financial StatementDocumento1 paginaPersonal Financial StatementsureshNessuna valutazione finora

- Income Analysis: Should Be IncreasingDocumento1 paginaIncome Analysis: Should Be IncreasingDungNessuna valutazione finora

- Personal Financial StatementDocumento1 paginaPersonal Financial StatementEnrico Kyle CacalNessuna valutazione finora

- Personal Financial StatementDocumento1 paginaPersonal Financial StatementMiko ChavezNessuna valutazione finora

- Income Analysis: Should Be IncreasingDocumento1 paginaIncome Analysis: Should Be IncreasingAnonymous gpNr8cLWNessuna valutazione finora

- Personal Financial StatementDocumento1 paginaPersonal Financial StatementC44974049段承志Nessuna valutazione finora

- Gaap Compliant 1cqhive15 - 163052Documento8 pagineGaap Compliant 1cqhive15 - 163052DGLNessuna valutazione finora

- Personal Financial StatementDocumento1 paginaPersonal Financial StatementkunaldasguptaaNessuna valutazione finora

- Personal Financial StatementDocumento1 paginaPersonal Financial StatementDharmaMaya ChandrahasNessuna valutazione finora

- Personal Financial StatementDocumento1 paginaPersonal Financial Statementloserr1Nessuna valutazione finora

- Ratio Analysis: Company NameDocumento8 pagineRatio Analysis: Company NameRajesh GourNessuna valutazione finora

- Input For Financial Drivers WorksheetDocumento2 pagineInput For Financial Drivers WorksheetYakraj SharmaNessuna valutazione finora

- FrameworkDocumento97 pagineFrameworkabraamNessuna valutazione finora

- Financial Ratios ComprehensiveDocumento38 pagineFinancial Ratios ComprehensiveabraamNessuna valutazione finora

- Strategy PDFDocumento33 pagineStrategy PDFabraam100% (1)

- Coperhensive Stracture 2010Documento54 pagineCoperhensive Stracture 2010abraamNessuna valutazione finora

- H.R Management SummaryDocumento17 pagineH.R Management SummaryabraamNessuna valutazione finora

- Egypt PEST AnalysisDocumento11 pagineEgypt PEST Analysisabraam100% (1)

- A Case Study Strategic Audit: (XYZ Company Inc.)Documento27 pagineA Case Study Strategic Audit: (XYZ Company Inc.)abraamNessuna valutazione finora

- Chapter 9 AssignmentDocumento4 pagineChapter 9 AssignmentabraamNessuna valutazione finora

- Arab Academy For Science, Technology & Maritime Transport Advanced Management Institute (AMI)Documento10 pagineArab Academy For Science, Technology & Maritime Transport Advanced Management Institute (AMI)abraamNessuna valutazione finora

- Gulf Upstream Manufacturing Company - 2009 Case Notes Prepared By: Dr. Victor Sohmen Case Author: C.P. RaoDocumento19 pagineGulf Upstream Manufacturing Company - 2009 Case Notes Prepared By: Dr. Victor Sohmen Case Author: C.P. RaoabraamNessuna valutazione finora

- Case 10 KPCDocumento19 pagineCase 10 KPCabraamNessuna valutazione finora

- Case 01 Moderna TextilesDocumento20 pagineCase 01 Moderna Textilesabraam100% (1)

- Investing and Financing Decisions and The Balance Sheet: Answers To QuestionsDocumento47 pagineInvesting and Financing Decisions and The Balance Sheet: Answers To QuestionsabraamNessuna valutazione finora

- Financial Accounting Assignment 1 (Chapter 1&2) Prepared by Abraam Fahmy & Amany FayekDocumento6 pagineFinancial Accounting Assignment 1 (Chapter 1&2) Prepared by Abraam Fahmy & Amany FayekabraamNessuna valutazione finora

- IFRS Illustrative Financial Statements (Dec 2019) FINALDocumento290 pagineIFRS Illustrative Financial Statements (Dec 2019) FINALCozy Shoy100% (1)

- OTC Exchange of IndiaDocumento2 pagineOTC Exchange of Indiaarshad89057Nessuna valutazione finora

- Case Study: Economic Value AddedDocumento2 pagineCase Study: Economic Value AddedJulio Cajas VissoniNessuna valutazione finora

- Accounting For Special Transactions ReviewerDocumento6 pagineAccounting For Special Transactions ReviewerKaye Mariz TolentinoNessuna valutazione finora

- Week 6 - Lecture 2Documento38 pagineWeek 6 - Lecture 2RosaNessuna valutazione finora

- Fa Ii. ObjDocumento5 pagineFa Ii. ObjSonia ShamsNessuna valutazione finora

- Business ApplicationDocumento1 paginaBusiness ApplicationBảo Châu VươngNessuna valutazione finora

- The Basics of Capital Budgeting: Solutions To End-of-Chapter ProblemsDocumento18 pagineThe Basics of Capital Budgeting: Solutions To End-of-Chapter ProblemsRand S. Al-akamNessuna valutazione finora

- Indian Stock Market Basics For BeginnersDocumento24 pagineIndian Stock Market Basics For BeginnersPAWAN CHHABRIANessuna valutazione finora

- Sony Marketing MixDocumento3 pagineSony Marketing MixSaith UmairNessuna valutazione finora

- Accounting P1 May-June 2023 EngDocumento12 pagineAccounting P1 May-June 2023 EngKaren ErasmusNessuna valutazione finora

- CapitalbudgetingworksheetDocumento2 pagineCapitalbudgetingworksheetMr. Pravar Mathur Student, Jaipuria LucknowNessuna valutazione finora

- The Ewert Exploration Company Is Considering Two Mutually Exclusive Plans ForDocumento1 paginaThe Ewert Exploration Company Is Considering Two Mutually Exclusive Plans ForAmit PandeyNessuna valutazione finora

- Discount Cash Flow Analysis Chapter 9Documento46 pagineDiscount Cash Flow Analysis Chapter 9Sidra KhanNessuna valutazione finora

- Gakpo 18Documento2 pagineGakpo 18denekew lesemiNessuna valutazione finora

- Equity Analysis With Reference To Automobile IndustryDocumento79 pagineEquity Analysis With Reference To Automobile Industrysmartway projectsNessuna valutazione finora

- Practice Questions 3-11 - 2020Documento12 paginePractice Questions 3-11 - 2020MUHAMMAD AZAMNessuna valutazione finora

- Week 2 - Measures of Risks and ReturnsDocumento37 pagineWeek 2 - Measures of Risks and ReturnsAbdullah ZakariyyaNessuna valutazione finora

- Mutual Funds: Project Report OnDocumento40 pagineMutual Funds: Project Report OnShilpi_Mathur_7616Nessuna valutazione finora

- Topic 2 - Business CombinationsDocumento32 pagineTopic 2 - Business Combinationshayat_illusionNessuna valutazione finora

- Effective Regulation Part 5Documento20 pagineEffective Regulation Part 5MarketsWikiNessuna valutazione finora

- ACT1205 Online Quiz 14 Shareholders Equity - AUDITING AND ASSURANCE PRINCIPLES - CONCEPTS AND APPLICATIONSDocumento4 pagineACT1205 Online Quiz 14 Shareholders Equity - AUDITING AND ASSURANCE PRINCIPLES - CONCEPTS AND APPLICATIONSjau chiNessuna valutazione finora

- FS Emde 2019Documento152 pagineFS Emde 2019tri utomo ramadhani putraNessuna valutazione finora

- CMA II 2016 Study Materials CMA Part 2 MDocumento37 pagineCMA II 2016 Study Materials CMA Part 2 MJohn Xaver PerrielNessuna valutazione finora

- IBIG 03 03 Your Own DealsDocumento17 pagineIBIG 03 03 Your Own DealsіфвпаіNessuna valutazione finora

- BA 323 Study GuideDocumento7 pagineBA 323 Study GuideTj UlianNessuna valutazione finora

- Assignment 2 Asna202309001Documento3 pagineAssignment 2 Asna202309001Rameez KhanNessuna valutazione finora

- BAAAX3A and BAAAX3B Fin Acc 3 Study Guide - 2024 LBG ManuelDocumento20 pagineBAAAX3A and BAAAX3B Fin Acc 3 Study Guide - 2024 LBG Manuelmmatsepe04Nessuna valutazione finora

- Combined Leverage & Indifference PointDocumento3 pagineCombined Leverage & Indifference Point10.mohta.samriddhiNessuna valutazione finora

- Equinix - Initiation ReportDocumento27 pagineEquinix - Initiation ReportkasipetNessuna valutazione finora