Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

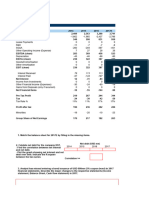

Financial Ratio: Balance Sheet As On 31st March 2014

Caricato da

nayan18900 valutazioniIl 0% ha trovato utile questo documento (0 voti)

8 visualizzazioni2 pagineThe company's total assets were Rs. 965 lakhs as of March 31, 2014 with fixed assets net of depreciation comprising the largest portion. Total liabilities were also Rs. 965 lakhs with share capital and reserves & surplus making up the majority. For the year ended March 31, 2014 the company had a net profit of Rs. 52 lakhs after earning a profit before tax of Rs. 110 lakhs on net sales of Rs. 904 lakhs.

Descrizione originale:

Titolo originale

Exercise3.1.xlsx

Copyright

© © All Rights Reserved

Formati disponibili

XLSX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThe company's total assets were Rs. 965 lakhs as of March 31, 2014 with fixed assets net of depreciation comprising the largest portion. Total liabilities were also Rs. 965 lakhs with share capital and reserves & surplus making up the majority. For the year ended March 31, 2014 the company had a net profit of Rs. 52 lakhs after earning a profit before tax of Rs. 110 lakhs on net sales of Rs. 904 lakhs.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

8 visualizzazioni2 pagineFinancial Ratio: Balance Sheet As On 31st March 2014

Caricato da

nayan1890The company's total assets were Rs. 965 lakhs as of March 31, 2014 with fixed assets net of depreciation comprising the largest portion. Total liabilities were also Rs. 965 lakhs with share capital and reserves & surplus making up the majority. For the year ended March 31, 2014 the company had a net profit of Rs. 52 lakhs after earning a profit before tax of Rs. 110 lakhs on net sales of Rs. 904 lakhs.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

Financial Ratio

Balance sheet as on 31st March 2014

Liabilities 31-Mar-14 31-Mar-14 Assets 31-Mar-14 31-Mar-14

Share Capital Fixed Assets Net

Equity 120 120 Gross Block 594 594

Preference 50 50 Less: Depreciation -365 -381

Reserves and Surplus 215 180 Intangible Assets 15 11

Secured Loans Investments 5 5

Debentures 50 50 Current Assets

Loans/Advances 101 100 Cash in bank 73 70

Unsecured Loans 30 20 Receivables 189 185

Current Liabilities Inventories 355 351

Sundry Creditors 330 340 Pre-paid Expenses 64 64

Provisions 69 69 Misc Exp/Losses 35 30

Total Liabilities 965 929 Total Assets 965 929

l Ratio

Income statement for year ended 31st March 2014

Particulars 31-Mar-14 31-Mar-14 31-Mar-13

Net Sales 904 847

Cost Of Goods Sold -714 -657

Stocks 366

Wages And Salaries 188

Other Manufacturing Expenses 160

Gross Profit 190 190

Operating Expenses: -96 -103

Selling And Admin Expenses 71

Depreciation 25

Operating Profit 94 87

Non-Operating Profit/Deficit 49 11

Profit Before Interest &Tax (EBIT) 143 98

Interest -33 -26

On Bank Borrowings/Loans 29

Debentures 4

Profit Before Tax 110 72

Tax -58 -36

Profit After Tax 52 36

Dividends: -17 -12

Equity 14

Preference 3

Retained Earnings(Reserve & Surplus) 35 24

Potrebbero piacerti anche

- Case Study 1 - Intel CorporationDocumento3 pagineCase Study 1 - Intel CorporationjkNessuna valutazione finora

- Comparative Study On Share Market & Mutual FundDocumento66 pagineComparative Study On Share Market & Mutual Fundpushprashantpa80% (35)

- Chapter 2 AnswersDocumento6 pagineChapter 2 AnswersPrueyGee50% (4)

- Statements of Financial Position As at 31 December 2009 and 2010Documento3 pagineStatements of Financial Position As at 31 December 2009 and 2010mohitgaba19Nessuna valutazione finora

- FinancialStatement 2016 I ACESDocumento73 pagineFinancialStatement 2016 I ACESHany BachmidNessuna valutazione finora

- 4 Years of Financial Data - v4Documento25 pagine4 Years of Financial Data - v4khusus downloadNessuna valutazione finora

- Lyon Corporation Cash Forecast For July, Year 6 Beginning Cash Balance 20Documento9 pagineLyon Corporation Cash Forecast For July, Year 6 Beginning Cash Balance 20leniNessuna valutazione finora

- Financial Case For MBADocumento60 pagineFinancial Case For MBASM AzaharNessuna valutazione finora

- Updated Excel Case StudyDocumento4 pagineUpdated Excel Case Studydheerajvish1995Nessuna valutazione finora

- CBSValuationChallenge InvestorsDocumento60 pagineCBSValuationChallenge InvestorsVkNessuna valutazione finora

- Vitrox q12013Documento12 pagineVitrox q12013Dennis AngNessuna valutazione finora

- Ajax Systems Pty LTD 2015 Profit & LossDocumento1 paginaAjax Systems Pty LTD 2015 Profit & LossgeorgiinaNessuna valutazione finora

- Chapter 5 Solution To Problems and CasesDocumento22 pagineChapter 5 Solution To Problems and Caseschandel08Nessuna valutazione finora

- Bài tập cá nhân chương 3 phần 1 - Quản trị tài chínhDocumento5 pagineBài tập cá nhân chương 3 phần 1 - Quản trị tài chính211124022108Nessuna valutazione finora

- MO QuestionDocumento2 pagineMO Questionlingly justNessuna valutazione finora

- Contoh FSDocumento2 pagineContoh FSSamuel SubiyantoNessuna valutazione finora

- Mid Term Solution 2021Documento5 pagineMid Term Solution 2021Ayush SrivastavaNessuna valutazione finora

- Comparative FSDocumento4 pagineComparative FSSuper GenerationNessuna valutazione finora

- Financial Statement Analysis: The Information MazeDocumento43 pagineFinancial Statement Analysis: The Information MazeJay DaveNessuna valutazione finora

- New Data Provided - : Millions of US DollarsDocumento1 paginaNew Data Provided - : Millions of US DollarsEngr ShahzadNessuna valutazione finora

- FM204Documento8 pagineFM204Vinoth KumarNessuna valutazione finora

- CFS PracticeDocumento10 pagineCFS Practicehafeez azizNessuna valutazione finora

- StarbuckDocumento202 pagineStarbuckThu Hiền KhươngNessuna valutazione finora

- Financial Numbers (A Comparison) (The Sector Vis-À-Vis The Selected Company)Documento7 pagineFinancial Numbers (A Comparison) (The Sector Vis-À-Vis The Selected Company)Sanath NaimpallyNessuna valutazione finora

- Corporate Financial Reporting & Analysis: Preparing and Understanding Balance SheetDocumento32 pagineCorporate Financial Reporting & Analysis: Preparing and Understanding Balance SheetMansi aggarwal 171050Nessuna valutazione finora

- 2020 6 Months Financial Statements Usd ImzaliDocumento57 pagine2020 6 Months Financial Statements Usd Imzalihero111983Nessuna valutazione finora

- Jeronimo Martins Colombia S.A.S. (Colombia)Documento6 pagineJeronimo Martins Colombia S.A.S. (Colombia)LAURA VALENTINA PEREZ RODRIGUEZNessuna valutazione finora

- Vitrox q42014Documento10 pagineVitrox q42014Dennis AngNessuna valutazione finora

- Class Handout-2Documento3 pagineClass Handout-2AdityaDhruvMansharamaniNessuna valutazione finora

- RTH Financial Statements Interim 2020 - FinalDocumento15 pagineRTH Financial Statements Interim 2020 - FinalPali GallNessuna valutazione finora

- Reading Financial Statements: Balance Sheet of Burns Ltd. (In TEUR) 31 Dec 20X5 31 Dec 20X4 Non-Current AssetsDocumento5 pagineReading Financial Statements: Balance Sheet of Burns Ltd. (In TEUR) 31 Dec 20X5 31 Dec 20X4 Non-Current AssetsSaransh ReuNessuna valutazione finora

- Data Section: Ratio Analysis Chisholm Company 2015 & 2016Documento16 pagineData Section: Ratio Analysis Chisholm Company 2015 & 2016Nguyen Dinh Quang MinhNessuna valutazione finora

- Netflix Inc.: Balance SheetDocumento16 pagineNetflix Inc.: Balance SheetLorena JaupiNessuna valutazione finora

- Bayerische Landesbank: Global Detailed FormatDocumento23 pagineBayerische Landesbank: Global Detailed FormatRawaaNessuna valutazione finora

- Cash Flow Questions RucuDocumento5 pagineCash Flow Questions RucuWalton Jr Kobe TZNessuna valutazione finora

- MBF 22007Documento21 pagineMBF 22007Charles MarkeyNessuna valutazione finora

- Quarterly Report 20180331Documento15 pagineQuarterly Report 20180331Ang SHNessuna valutazione finora

- q1 Ifrs Usd Earnings ReleaseDocumento26 pagineq1 Ifrs Usd Earnings Releaseashokdb2kNessuna valutazione finora

- Unaudited Financial 0608Documento3 pagineUnaudited Financial 0608manish_khabarNessuna valutazione finora

- AsliDocumento14 pagineAsliSabir AbdirahmanNessuna valutazione finora

- Individual Assignment 3 Part 2Documento13 pagineIndividual Assignment 3 Part 2211124022108Nessuna valutazione finora

- Starbucks DataDocumento32 pagineStarbucks DatabrainsphereNessuna valutazione finora

- Income Statement (In MLN.) : Roic - Ai - AfiDocumento11 pagineIncome Statement (In MLN.) : Roic - Ai - AfiJoshua LeeNessuna valutazione finora

- UFL - QuestionDocumento6 pagineUFL - QuestionPatrick ThangNessuna valutazione finora

- As at 30st June 2016: Equity and LailblityDocumento15 pagineAs at 30st June 2016: Equity and LailblityAvantika SaxenaNessuna valutazione finora

- Financial Mod Ch-4Documento37 pagineFinancial Mod Ch-4zigale matebieNessuna valutazione finora

- Financial Analysis and Planning: Cash Flow and Fund Flow Statement Are Not There in SyllabusDocumento29 pagineFinancial Analysis and Planning: Cash Flow and Fund Flow Statement Are Not There in SyllabusHanabusa Kawaii IdouNessuna valutazione finora

- Financial Analysis and Planning: Cash Flow and Fund Flow Statement Are Not There in SyllabusDocumento29 pagineFinancial Analysis and Planning: Cash Flow and Fund Flow Statement Are Not There in SyllabusHanabusa Kawaii IdouNessuna valutazione finora

- FinanzasDocumento12 pagineFinanzasYamilet Maria InquillaNessuna valutazione finora

- Bhima and Brothers Bullion Private Limited FY19 FY18 FY17 FY16 Summary Income StatementDocumento2 pagineBhima and Brothers Bullion Private Limited FY19 FY18 FY17 FY16 Summary Income StatementKamlakar AvhadNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Stanley Gibbons Group PLCDocumento2 pagineStanley Gibbons Group PLCImran WarsiNessuna valutazione finora

- Cash Flow Explanatory SheetDocumento4 pagineCash Flow Explanatory SheetTony DarwishNessuna valutazione finora

- Pres Ratios DataDocumento24 paginePres Ratios Datasamarth chawlaNessuna valutazione finora

- Data Section: Ratio Analysis Chisholm Company 2015 & 2016Documento19 pagineData Section: Ratio Analysis Chisholm Company 2015 & 2016Hằngg ĐỗNessuna valutazione finora

- Just DialDocumento16 pagineJust DialDaksh MehraNessuna valutazione finora

- Part3Documento3 paginePart3Rakesh GyamlaniNessuna valutazione finora

- 032017Documento107 pagine032017Aditya MakwanaNessuna valutazione finora

- Financial ModelDocumento13 pagineFinancial ModelAdarsh ReddyNessuna valutazione finora

- Tempest Accounting and AnalysisDocumento10 pagineTempest Accounting and AnalysisSIXIAN JIANGNessuna valutazione finora

- File 11Documento1 paginaFile 11Anubhav DobhalNessuna valutazione finora

- Model Policies and Procedures for Not-for-Profit OrganizationsDa EverandModel Policies and Procedures for Not-for-Profit OrganizationsNessuna valutazione finora

- Exercise1 1Documento1 paginaExercise1 1nayan1890Nessuna valutazione finora

- Create A Macro That Shall List Down All Sheet Names in The Current Workbook Create Hyperlinked Index To Sheet NamesDocumento1 paginaCreate A Macro That Shall List Down All Sheet Names in The Current Workbook Create Hyperlinked Index To Sheet Namesnayan1890Nessuna valutazione finora

- Create Macro That Will Delete All Sheets of The Workbook, Except Current SheetDocumento1 paginaCreate Macro That Will Delete All Sheets of The Workbook, Except Current Sheetnayan1890Nessuna valutazione finora

- Create A Macro That Shall Change Selected Data's Case To Lower, Upper and Proper CaseDocumento1 paginaCreate A Macro That Shall Change Selected Data's Case To Lower, Upper and Proper Casenayan1890Nessuna valutazione finora

- The Richter Company A Technology Company Has Been Growing RapidlyDocumento1 paginaThe Richter Company A Technology Company Has Been Growing RapidlyHassan JanNessuna valutazione finora

- CH 1 Consolidation (SOFP)Documento25 pagineCH 1 Consolidation (SOFP)ranashafaataliNessuna valutazione finora

- 17Documento14 pagine17rishav098Nessuna valutazione finora

- Topic 8 Dividends and Dividend PolicyDocumento42 pagineTopic 8 Dividends and Dividend PolicyNajwa Alyaa binti Abd WakilNessuna valutazione finora

- Effects of Private Control of BusinessDocumento9 pagineEffects of Private Control of BusinessOluwarotimiNessuna valutazione finora

- Fidelity 03 Long Term InvestingDocumento4 pagineFidelity 03 Long Term InvestingfebrichowNessuna valutazione finora

- Paper Mills Limited: NoticeDocumento83 paginePaper Mills Limited: NoticesonuNessuna valutazione finora

- Cash Flows 500Documento41 pagineCash Flows 500MUNAWAR ALI100% (2)

- Venture Capital of IndiaDocumento14 pagineVenture Capital of IndiaNeel Ratan BhatiaNessuna valutazione finora

- Institute of Cost and Management Accountants of Pakistan Summer (May) 2011 ExaminationsDocumento3 pagineInstitute of Cost and Management Accountants of Pakistan Summer (May) 2011 ExaminationsHaseeb KhanNessuna valutazione finora

- Anthony Curmi Replies To Lino SpiteriDocumento2 pagineAnthony Curmi Replies To Lino Spiterisevee2081Nessuna valutazione finora

- Republic Planters Bank, Petitioner, vs. Hon. Enrique A. Agana, SR.Documento1 paginaRepublic Planters Bank, Petitioner, vs. Hon. Enrique A. Agana, SR.Patricia Nueva EspañaNessuna valutazione finora

- PSBA Vs LeanoDocumento2 paginePSBA Vs LeanoRM MallorcaNessuna valutazione finora

- Highly Confidential Quiz Bowl QuestionsDocumento3 pagineHighly Confidential Quiz Bowl QuestionsCy WallNessuna valutazione finora

- Cadbury's Formal Defense Against KraftDocumento56 pagineCadbury's Formal Defense Against KraftDealBookNessuna valutazione finora

- Equity MasterDocumento24 pagineEquity Mastersambasiva_gelivi6645100% (1)

- Chapter - Issue of Share For CPTDocumento8 pagineChapter - Issue of Share For CPTCacptCoachingNessuna valutazione finora

- Edmund Halvor of The Controller S Office of East Aurora CorporatDocumento1 paginaEdmund Halvor of The Controller S Office of East Aurora CorporatM Bilal SaleemNessuna valutazione finora

- Exercises Fin. Acc. ReportingDocumento2 pagineExercises Fin. Acc. ReportingMhea Ann Pauline ArsinoNessuna valutazione finora

- Fiinancial Analysis of Reckitt BenckiserDocumento10 pagineFiinancial Analysis of Reckitt BenckiserKhaled Mahmud ArifNessuna valutazione finora

- Screwed InvestorsDocumento1 paginaScrewed InvestorsIlene KentNessuna valutazione finora

- Lii Hen - Q1 (2017) 1Documento15 pagineLii Hen - Q1 (2017) 1Jordan YiiNessuna valutazione finora

- Project Reoprt On A Study On Investor's Preference With Special Focus On Demat Account at Ahmedabad CityDocumento88 pagineProject Reoprt On A Study On Investor's Preference With Special Focus On Demat Account at Ahmedabad CityMohit PandyaNessuna valutazione finora

- NIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Documento3 pagineNIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Anonymous KAIoUxP7Nessuna valutazione finora

- Enrone Case Study FindingsDocumento6 pagineEnrone Case Study Findingszubair attariNessuna valutazione finora

- BIR Ruling No 039-2002Documento2 pagineBIR Ruling No 039-2002Ton Ton Cananea100% (1)

- Unilever Nepal Limited (UNL)Documento19 pagineUnilever Nepal Limited (UNL)Niswarth Tola78% (9)