Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

IIM Nagpur 2018 Project Finance Reading Requirements

Caricato da

Saksham GoyalDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

IIM Nagpur 2018 Project Finance Reading Requirements

Caricato da

Saksham GoyalCopyright:

Formati disponibili

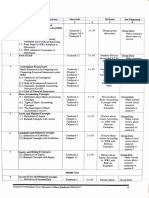

IIM Nagpur 2018

PROJECT FINANCE

READING REQUIREMENTS

Reading No. of

Sl Module Contents Requirements Sessions

No. (of 90

minutes

each)

1. Introduction – Project financing – its history, This is a Post-

and Project and transformation over the read module 2 sessions

Finance years, requirement for PF,

Overview traditional financing avenues Chapter 1 (Para

and current trends. 1)

– PF distinguished from other

forms of financing - Cases

2. Project – Structuring of a project - This is a Post-

Structures, types of structures read module 2 sessions

Stakeholders – Recourse and Non-recourse Chapter 1 (note

and their Structures in Project diagrams on

Roles Financing – Discussions and Page 18)

Case study Case Study is

a Pre-Read

Will be

provided in

advance)

3 Project – Project Sponsors, Project This is a Pre- 1 sessions

Stakeholders Consortium – roles and read module

responsibilities, key Chapter 2 –

contractual relationships para 2.1

– Infrastructure Projects –

Special features, various Chapter 3 (upto

models under Infrastructure para 3.4)

Projects.

4 Project – Project Financing – Concepts, This is a Post-

Finance Financing Consortium. read module 2 sessions

Markets and – Project term loans, Bond Chapter 3 (Para

Financing Issues, Sub-ordinated debt, 3.5)

Structures Lease Finance – introduction, Chapter 2

structure and standard (Paras 2.3 to

features and contractual 2.11)

Pratap Giri S., FCA, FCS

Adjunct Faculty

IIM Nagpur 2018

aspects.

– Project Loan syndication General

Reading of

Chapter 9

– Equity Financing in Projects Chapter 4 (Para

4.6 and Table

4.2)

5. Risk – Risk Factors in Projects This is a Pre-

Analysis and – Stages and types of risk read Module 2 sessions

Mitigation in – Risk Evaluation Chapter 8

Projects – Risk Mitigation (Paras 8.2 till

– Discussions and Case Study the end)

Read the Table

8.5 on Risk

Matrix

carefully

Case Study is

a pre-read.

Will be

provided in

advance)

Text Book

Case Page 211

to be

discussed in

Class.

6. Project Due – Introduction to Project This is a Pre-

Diligence Appraisal read Module 3 sessions

and – Sponsors and Management Chapter 5

Financial Appraisal (Paras 5.6 and

Evaluation – Technical Appraisal 5.7)

– Market Appraisal Chapter 6

(Paras 6.2 to

6.4, para 6.7.1,

6.7.5, 6.7.8,

– Financial Appraisal and 6.7.9, 6.10 and

Viability Analysis - NPV, IRR, 6.11)

DSCR, BEP, ROCE, WACC Chapter 4

(Paras 4.2 and

– Sensitivity Analysis

4.4)

Pratap Giri S., FCA, FCS

Adjunct Faculty

IIM Nagpur 2018

– Special Financing Features in

Infrastructure Projects Chapter 3 (Para

3.5)

7. Financial – Excel based spreadsheet This is a Post- 3 sessions

Modelling modelling with live case read module

Template study Material to be

Case Study – Additional Work out Case to be provided by the

provided for self-study – not to be Instructor

discussed in class.

8. Project – Introduction to Structured This is a Post-

Finance Project Finance – Products read module 2 sessions

Structuring and Methodology PPTs to be

– International and Indian Case provided by the

Studies and Discussions Instructor

– Wrap Up

Total no. of sessions 17

Pratap Giri S., FCA, FCS

Adjunct Faculty

Potrebbero piacerti anche

- SDH / SONET Explained in Functional Models: Modeling the Optical Transport NetworkDa EverandSDH / SONET Explained in Functional Models: Modeling the Optical Transport NetworkNessuna valutazione finora

- Project Appraisal and Financing Course OutlineDocumento3 pagineProject Appraisal and Financing Course OutlineSaksham GoyalNessuna valutazione finora

- Project Appraisal and Financing IIM Nagpur - Full Course OutlineDocumento3 pagineProject Appraisal and Financing IIM Nagpur - Full Course OutlineSaksham GoyalNessuna valutazione finora

- Technologies for the Wireless Future: Wireless World Research Forum (WWRF)Da EverandTechnologies for the Wireless Future: Wireless World Research Forum (WWRF)Klaus DavidNessuna valutazione finora

- A2 2020 Pme 18Documento2 pagineA2 2020 Pme 18Jawad AhmadNessuna valutazione finora

- 2 Project Identification and Conceptualization: Version 2, 29 July 2014Documento32 pagine2 Project Identification and Conceptualization: Version 2, 29 July 2014Mac KYNessuna valutazione finora

- Course Outline General Information: Department of Business Studies, Karachi CampusDocumento8 pagineCourse Outline General Information: Department of Business Studies, Karachi CampusAli MehdiNessuna valutazione finora

- Quantitative MethodsDocumento8 pagineQuantitative MethodstmhoangvnaNessuna valutazione finora

- BUSADMIN 766 Supply Chain Management (15 Points) PDFDocumento8 pagineBUSADMIN 766 Supply Chain Management (15 Points) PDFtmhoangvnaNessuna valutazione finora

- IIM Kozhikode Project Finance Course OutlineDocumento5 pagineIIM Kozhikode Project Finance Course OutlinePressesIndiaNessuna valutazione finora

- Final RequirementDocumento2 pagineFinal RequirementAlven T BactadNessuna valutazione finora

- Sanima - Course Topics - ANDocumento5 pagineSanima - Course Topics - ANAbhushan NeupaneNessuna valutazione finora

- Sanima Course Topics AnDocumento5 pagineSanima Course Topics AnAbhushan NeupaneNessuna valutazione finora

- Portfolio and Risk AnalyticsDocumento7 paginePortfolio and Risk Analyticspooja pNessuna valutazione finora

- PSC Project Planning and AnalysisDocumento2 paginePSC Project Planning and AnalysisS Tariku GarseNessuna valutazione finora

- Bits Pilani, Dubai Campus Instruction Division: Second Semester 2012 - 2013 Course Handout (Part - II)Documento2 pagineBits Pilani, Dubai Campus Instruction Division: Second Semester 2012 - 2013 Course Handout (Part - II)Manikandan SuriyanarayananNessuna valutazione finora

- PR 1 Midterm ST2 TosDocumento5 paginePR 1 Midterm ST2 Tosedson vicenteNessuna valutazione finora

- Project ManagementDocumento1 paginaProject ManagementFlor Liz Mamani YucraNessuna valutazione finora

- CE 402 2023 Course PlanDocumento3 pagineCE 402 2023 Course PlanKANAKARATHNA Y.P.K.M.W.N.Nessuna valutazione finora

- Iso RISK AND OPPORTUNITY ASSESSMENT RECORDDocumento5 pagineIso RISK AND OPPORTUNITY ASSESSMENT RECORDMuhammad Awais89% (19)

- Gujarat Tech Ological U Iversity, Ahmedabad, Gujarat Course CurriculumDocumento4 pagineGujarat Tech Ological U Iversity, Ahmedabad, Gujarat Course CurriculumDarshit KotadiyaNessuna valutazione finora

- Engineering and Ethics SyllabusDocumento6 pagineEngineering and Ethics SyllabusSarah BurgenNessuna valutazione finora

- Wss5a Conceptual Framework BreakoutDocumento39 pagineWss5a Conceptual Framework BreakoutMohammedYousifSalihNessuna valutazione finora

- 1FIM-Financial Institutions and Markets-2023-24Documento10 pagine1FIM-Financial Institutions and Markets-2023-24OSHIN KUMARINessuna valutazione finora

- Syllabus: Course DescriptionDocumento4 pagineSyllabus: Course Descriptiontrisila handayaniNessuna valutazione finora

- Insta 75 Days Revision Plans For Prelims 2024 NewDocumento25 pagineInsta 75 Days Revision Plans For Prelims 2024 NewAmit NaskarNessuna valutazione finora

- IPHMT309Documento13 pagineIPHMT309Munish GargNessuna valutazione finora

- PM Pmbok 4Th Edition DocumentsDocumento1 paginaPM Pmbok 4Th Edition DocumentsXozanNessuna valutazione finora

- Cs Quantum ssg1Documento5 pagineCs Quantum ssg1Tsiory OrlandoNessuna valutazione finora

- Proposed Four-Storey Medical Center Building Using Encased Steel Composite Structure With Green Design in Mandaluyong CityDocumento192 pagineProposed Four-Storey Medical Center Building Using Encased Steel Composite Structure With Green Design in Mandaluyong CityJSD PAG-IBIG100% (4)

- Understanding Key Accounting ConceptsDocumento1 paginaUnderstanding Key Accounting ConceptsRyan On StageNessuna valutazione finora

- ENGG951 Subject Outline Spring 2019Documento9 pagineENGG951 Subject Outline Spring 2019Manu MonNessuna valutazione finora

- Engineering Economics and Project FinancingDocumento149 pagineEngineering Economics and Project FinancingUmar FarouqNessuna valutazione finora

- Syllabus For BUSMGT 724 - Global Operations ManagementDocumento10 pagineSyllabus For BUSMGT 724 - Global Operations ManagementTho LeNessuna valutazione finora

- Analysis and Design of Jacket Offshore Platform Using SACS SoftwareDocumento49 pagineAnalysis and Design of Jacket Offshore Platform Using SACS SoftwareourgptplusNessuna valutazione finora

- Final Esia Report For Uniabuja Solar Hybrid Power Project in Abuja FCTDocumento392 pagineFinal Esia Report For Uniabuja Solar Hybrid Power Project in Abuja FCTLwin PhyoNessuna valutazione finora

- Seminar and Field TripDocumento2 pagineSeminar and Field TripEcho greenNessuna valutazione finora

- Business Algorithm and Data Structures For Information SystemsDocumento3 pagineBusiness Algorithm and Data Structures For Information SystemsMaduwanthanNessuna valutazione finora

- IndEA Framework 1.0Documento211 pagineIndEA Framework 1.0vinayNessuna valutazione finora

- Narrative Summary Objectively Verifiable Indicators Means of Verification Assumption/RiskDocumento1 paginaNarrative Summary Objectively Verifiable Indicators Means of Verification Assumption/Riskអ្នកប្រម៉ាញ់រឿង Spoiler MediaNessuna valutazione finora

- Syllabus Except Elective 8th SemDocumento6 pagineSyllabus Except Elective 8th SemNirmal Prasad PantaNessuna valutazione finora

- Synopsis of ProjectDocumento4 pagineSynopsis of ProjectOmkar BajareNessuna valutazione finora

- Introduction to Manufacturing Processes and Materials PropertiesDocumento5 pagineIntroduction to Manufacturing Processes and Materials PropertiesPutraNessuna valutazione finora

- Lean Engineering Concepts ENMG 642Documento11 pagineLean Engineering Concepts ENMG 642Yusef SobhiNessuna valutazione finora

- PGDM SFM 2020 21 FinalDocumento4 paginePGDM SFM 2020 21 FinalLiya Mary VargheseNessuna valutazione finora

- VII Semester Const MGMT and Project EngineeringDocumento2 pagineVII Semester Const MGMT and Project Engineeringसचिन खड्काNessuna valutazione finora

- BM 319 Revised SyllabusDocumento1 paginaBM 319 Revised Syllabusitsgsb13Nessuna valutazione finora

- Dr. Renuka SharmaDocumento7 pagineDr. Renuka Sharmarenuka sharmaNessuna valutazione finora

- FIDIC Contracts Training Course: Claim Management / Dispute ResolutionDocumento304 pagineFIDIC Contracts Training Course: Claim Management / Dispute Resolutionruwan susalithNessuna valutazione finora

- Project ManagementDocumento3 pagineProject Managementshrijya kafleNessuna valutazione finora

- ESE-2022 Basics of Project ManagementDocumento14 pagineESE-2022 Basics of Project ManagementNautiyal DeepanshuNessuna valutazione finora

- Name of The Faculty: Dr. Mohammed Iqbal Email Id Mobile No.: 7598438962Documento5 pagineName of The Faculty: Dr. Mohammed Iqbal Email Id Mobile No.: 7598438962SSNessuna valutazione finora

- PD1-Assessment Brief - CE4922Documento11 paginePD1-Assessment Brief - CE4922Miyuranga W.H.D.D. en17081344Nessuna valutazione finora

- Gtu Project ManagementDocumento4 pagineGtu Project ManagementBibin SajiNessuna valutazione finora

- Reinforced Concrete Course PlanDocumento6 pagineReinforced Concrete Course PlanAli EjazNessuna valutazione finora

- PROJECT ANALYSIS OutlineDocumento6 paginePROJECT ANALYSIS Outlinemekonnen yimamNessuna valutazione finora

- Business in Practice FTU Unit Schedule and Activities For SEM 1Documento13 pagineBusiness in Practice FTU Unit Schedule and Activities For SEM 1BinhMinh NguyenNessuna valutazione finora

- 2023-07-11 13-24-41-SL-Probability - On-Site Program Syllabus PDFDocumento5 pagine2023-07-11 13-24-41-SL-Probability - On-Site Program Syllabus PDFhyc825310Nessuna valutazione finora

- BeDocumento42 pagineBePratik NalgireNessuna valutazione finora

- Single MC Scheduling-ProblemDocumento1 paginaSingle MC Scheduling-ProblemSaksham GoyalNessuna valutazione finora

- Mathematical Modeling for Real-World Management ProblemsDocumento2 pagineMathematical Modeling for Real-World Management ProblemsSaksham GoyalNessuna valutazione finora

- Predictive Modelsfor Election Results - Full PaperDocumento11 paginePredictive Modelsfor Election Results - Full PaperSaksham GoyalNessuna valutazione finora

- Key Ratios Comparable Cos.Documento1 paginaKey Ratios Comparable Cos.Saksham GoyalNessuna valutazione finora

- GE's Talent Machine: Developing Leaders at GEDocumento15 pagineGE's Talent Machine: Developing Leaders at GEhyjwf100% (1)

- Corporate Valuations Preparation QuestionsDocumento3 pagineCorporate Valuations Preparation QuestionsSaksham GoyalNessuna valutazione finora

- 20 Session Financial Modelling - Rajiv BhutaniDocumento6 pagine20 Session Financial Modelling - Rajiv BhutaniSaksham GoyalNessuna valutazione finora

- Term IV CoursesDocumento3 pagineTerm IV CoursesSaksham GoyalNessuna valutazione finora

- Valuation - 10 Sessions Course OverviewDocumento1 paginaValuation - 10 Sessions Course OverviewSaksham GoyalNessuna valutazione finora

- BDMDMDocumento2 pagineBDMDMSaksham GoyalNessuna valutazione finora

- SCM Assignment 2:: 1. Decision ProblemDocumento1 paginaSCM Assignment 2:: 1. Decision ProblemSaksham GoyalNessuna valutazione finora

- Classification TreeDocumento1 paginaClassification TreeSaksham GoyalNessuna valutazione finora

- FSA Description T5Documento1 paginaFSA Description T5Saksham GoyalNessuna valutazione finora

- IMC Course Covers Promo Tools, Planning, Eco-SystemDocumento7 pagineIMC Course Covers Promo Tools, Planning, Eco-SystemSaksham GoyalNessuna valutazione finora

- The Value of Investment Banking Relationships - Research Paper IIDocumento36 pagineThe Value of Investment Banking Relationships - Research Paper IISaksham GoyalNessuna valutazione finora

- Management - Entrepreneurship For The Development Sector - Course OutlineDocumento2 pagineManagement - Entrepreneurship For The Development Sector - Course OutlineSaksham GoyalNessuna valutazione finora

- The Example Is Based On A Firm With Forecasted Revenues of 20Documento1 paginaThe Example Is Based On A Firm With Forecasted Revenues of 20Saksham GoyalNessuna valutazione finora

- BDMDM Course Outline 2018-19Documento4 pagineBDMDM Course Outline 2018-19Saksham GoyalNessuna valutazione finora

- Strategic Marketing - Course OutlineDocumento3 pagineStrategic Marketing - Course OutlineSaksham GoyalNessuna valutazione finora

- Advanced Marketing Research - 2017-18Documento3 pagineAdvanced Marketing Research - 2017-18Naveen ChoudhuryNessuna valutazione finora

- 20 Session Financial Modelling - Rajiv BhutaniDocumento6 pagine20 Session Financial Modelling - Rajiv BhutaniSaksham GoyalNessuna valutazione finora

- Supply Chain Management Course OutlineDocumento2 pagineSupply Chain Management Course OutlineSaksham GoyalNessuna valutazione finora

- Rural Marketing Course Outline PDFDocumento4 pagineRural Marketing Course Outline PDFSaksham GoyalNessuna valutazione finora

- Outline - Advanced Analytics 2017-19Documento2 pagineOutline - Advanced Analytics 2017-19Saksham GoyalNessuna valutazione finora

- Term IV CoursesDocumento3 pagineTerm IV CoursesSaksham GoyalNessuna valutazione finora

- 20 Session Financial Modelling - Rajiv BhutaniDocumento6 pagine20 Session Financial Modelling - Rajiv BhutaniSaksham GoyalNessuna valutazione finora

- BFMS Course OutlineDocumento5 pagineBFMS Course OutlineSaksham GoyalNessuna valutazione finora

- Compilation ReportDocumento4 pagineCompilation ReportFlorivee EreseNessuna valutazione finora

- Invitation To Bid: General GuidelinesDocumento26 pagineInvitation To Bid: General GuidelinespandaypiraNessuna valutazione finora

- An Introduction To The Nielsen CompanyDocumento17 pagineAn Introduction To The Nielsen CompanysinghbabitaNessuna valutazione finora

- 5 Case Digest Cir Vs Estate of TodaDocumento2 pagine5 Case Digest Cir Vs Estate of TodaChrissy Sabella0% (1)

- Fundamental and Technical Analysis - Technical PaperDocumento16 pagineFundamental and Technical Analysis - Technical PaperGauree AravkarNessuna valutazione finora

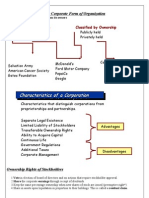

- The Corporate Form of OrganizationDocumento7 pagineThe Corporate Form of OrganizationRabie HarounNessuna valutazione finora

- Delhi Event CompaniesDocumento26 pagineDelhi Event CompaniesMirza Asif BaigNessuna valutazione finora

- A Project Report ON Cost Sheet Analysis OF Coca - Cola: Institute of Technology and ManagementDocumento11 pagineA Project Report ON Cost Sheet Analysis OF Coca - Cola: Institute of Technology and Managementkattyperrysherry33% (3)

- Jyoiti PathakDocumento53 pagineJyoiti PathakNitinAgnihotriNessuna valutazione finora

- RJR Nabisco LBODocumento14 pagineRJR Nabisco LBONazir Ahmad BahariNessuna valutazione finora

- Mandatory ELearning CIRCULAR+FOR+2016-17Documento8 pagineMandatory ELearning CIRCULAR+FOR+2016-17Urmi SenNessuna valutazione finora

- Private and Confidential Bank Statement SummaryDocumento3 paginePrivate and Confidential Bank Statement SummaryPromothesh MondalNessuna valutazione finora

- 2016 - Product Keys For Autodesk Products - Installation, Activation & Licensing - Autodesk Knowledge NetworkDocumento9 pagine2016 - Product Keys For Autodesk Products - Installation, Activation & Licensing - Autodesk Knowledge NetworkHerman MwakoiNessuna valutazione finora

- GDIC Performance EvaluationDocumento17 pagineGDIC Performance EvaluationZinnia khanNessuna valutazione finora

- RTGS Bank List in India Nov 2013Documento5.930 pagineRTGS Bank List in India Nov 2013yuviraj0810Nessuna valutazione finora

- ....Documento60 pagine....Ankit MaldeNessuna valutazione finora

- Stock MarketDocumento697 pagineStock MarketSachin SharmaNessuna valutazione finora

- Reliance Mutual Fund-FinalDocumento7 pagineReliance Mutual Fund-FinalTamanna Mulchandani100% (1)

- Function List of Car BrainDocumento39 pagineFunction List of Car BrainBogdan PopNessuna valutazione finora

- Direct Contracting Requirements Checklist PDFDocumento1 paginaDirect Contracting Requirements Checklist PDFKriston LipatNessuna valutazione finora

- The Story of The Cellular Phone Brand OrangeDocumento7 pagineThe Story of The Cellular Phone Brand Orangekristokuns100% (1)

- SA220Documento22 pagineSA220Laura D'souza0% (1)

- CIR Vs MarubeniDocumento2 pagineCIR Vs MarubeniJocelyn MagbanuaNessuna valutazione finora

- PIBM Assignment on Marico's Parachute Coconut Oil BrandDocumento10 paginePIBM Assignment on Marico's Parachute Coconut Oil BrandNikhil Gupta100% (1)

- Audit Procedures For CashDocumento24 pagineAudit Procedures For CashGizel Baccay100% (1)

- Ias 27 KPMGDocumento16 pagineIas 27 KPMGAgha AsadNessuna valutazione finora

- Atlas Copco and Sandvik Shank Adapter GuideDocumento11 pagineAtlas Copco and Sandvik Shank Adapter GuideSubhash KediaNessuna valutazione finora

- Request For Quotation - RFQ - PDFDocumento5 pagineRequest For Quotation - RFQ - PDFavmr0% (1)

- Notice of Auction and Sale HearingDocumento3 pagineNotice of Auction and Sale HearingChapter 11 DocketsNessuna valutazione finora