Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Nelson Extra

Caricato da

Kailash KumarCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Nelson Extra

Caricato da

Kailash KumarCopyright:

Formati disponibili

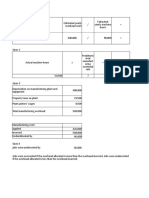

The presentation of income statement & retained earning account is not appropriate

According to accounting standard the income statement include all the expense &

revenue for the period it prepared. In addition to normal items of revenue &

expenditure, it should include the extraordinary items for the period as a

comprehensive income & expenditure.

Thus the income statement is either made as comprehensive income statement or made

in two parts:

An income statement displaying items of profit & loss, and

A statement of comprehensive income that begins with profit & loss & display

component of comprehensive income & expenditure.

In the Nerwin Company presentation all items are shown together which a wrong

presentation is. The normal items should be segregate from the irregular items.

Threfore the first three :

a)Selling, general, and administrative expenses-should be reported in income before

extraordinary items as this is material

b) loss on sale of equipment-this is an extraordinary item and should be reported

separately because nelson is not in the business of purchase and sale of euipment

c)Adjustment required for correction of an error-again this is an extraordinary

item and hence reported separately

According to IAS 1 requires an entity to present a statement of changes in equity

as a separate component of the financial statements. The statement must show: [IAS

1.106]

�total comprehensive income for the period, showing separately amounts attributable

to owners of the parent and to non-controlling interests

�the effects of retrospective application, when applicable, for each component

�reconciliations between the carrying amounts at the beginning and the end of the

period for each component of equity, separately disclosing:

profit or loss

each item of other comprehensive income

transactions with owners, showing separately contributions by and

distributions to owners and changes in ownership interests in subsidiaries that do

not result in a loss of control

The following amounts may also be presented on the face of the statement of changes

in equity, or they may be presented in the notes: [IAS 1.107]

�amount of dividends recognized as distributions, and

�the related amount per share

According to IAS 1 the company should disclose the dividend per share in the notes

to financial statement. EPS should not be disclosed in the notes to the financial

statement.

Hence EPS should be disclosed on the face of income statement not in the notes

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, ADocumento17 pagineOn January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, AKailash KumarNessuna valutazione finora

- DBT Cope Ahead PlanDocumento1 paginaDBT Cope Ahead PlanAmy PowersNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Prince Corporation Acquired 100 Percent of Sword CompanyDocumento2 paginePrince Corporation Acquired 100 Percent of Sword CompanyKailash Kumar50% (2)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Jennys FroyoDocumento16 pagineJennys FroyoKailash Kumar100% (2)

- Silven Industries, Which Manufactures and Sells A Highly Successful Line of Summer Lotions and Insect RepellentsDocumento5 pagineSilven Industries, Which Manufactures and Sells A Highly Successful Line of Summer Lotions and Insect RepellentsKailash KumarNessuna valutazione finora

- The Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekDocumento4 pagineThe Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekKailash KumarNessuna valutazione finora

- Is A Construction Company Specializing in Custom PatiosDocumento8 pagineIs A Construction Company Specializing in Custom PatiosKailash KumarNessuna valutazione finora

- The Balance Sheet at December 31, 2018, For Nevada Harvester Corporation Includes The Liabilities Listed BelowDocumento4 pagineThe Balance Sheet at December 31, 2018, For Nevada Harvester Corporation Includes The Liabilities Listed BelowKailash KumarNessuna valutazione finora

- Thompson Industrial Products Inc Is A DiversifiedDocumento4 pagineThompson Industrial Products Inc Is A DiversifiedKailash KumarNessuna valutazione finora

- (Identifying The Appropriate Net Asset Classification) For Each of The Following Transactions, Identify The Net Asset Classification (Documento4 pagine(Identifying The Appropriate Net Asset Classification) For Each of The Following Transactions, Identify The Net Asset Classification (Kailash KumarNessuna valutazione finora

- Fernandez Corp. Invested Its Excess Cash in Available-For-Sale Securities During 2014.Documento3 pagineFernandez Corp. Invested Its Excess Cash in Available-For-Sale Securities During 2014.Kailash KumarNessuna valutazione finora

- Pastore Drycleaners Has Capacity To Clean UpDocumento4 paginePastore Drycleaners Has Capacity To Clean UpKailash KumarNessuna valutazione finora

- Crane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoDocumento2 pagineCrane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoKailash KumarNessuna valutazione finora

- O-Level Accounting Paper 2 Topical and yDocumento343 pagineO-Level Accounting Paper 2 Topical and yKailash Kumar100% (3)

- Paragraph Blue Corporation Acquired Controlling Ownership of Sentence Skyler Corporation On December 31, 20X3, and A Consolidated Balance Sheet Was Prepared Immediately.Documento2 pagineParagraph Blue Corporation Acquired Controlling Ownership of Sentence Skyler Corporation On December 31, 20X3, and A Consolidated Balance Sheet Was Prepared Immediately.Kailash KumarNessuna valutazione finora

- Diamond Hardware Uses The Periodic Inventory SystemDocumento7 pagineDiamond Hardware Uses The Periodic Inventory SystemKailash KumarNessuna valutazione finora

- Bracey Company Manufactures and Sells One ProductDocumento2 pagineBracey Company Manufactures and Sells One ProductKailash KumarNessuna valutazione finora

- Kristen Lu Purchased A Used Automobile ForDocumento1 paginaKristen Lu Purchased A Used Automobile ForKailash KumarNessuna valutazione finora

- Tristar Production Company Began Operations On SeptemberDocumento2 pagineTristar Production Company Began Operations On SeptemberKailash KumarNessuna valutazione finora

- Bethany's Bicycle CorporationDocumento15 pagineBethany's Bicycle CorporationKailash Kumar100% (2)

- La Femme Accessories Inc Produces Womens HandbagsDocumento1 paginaLa Femme Accessories Inc Produces Womens HandbagsKailash KumarNessuna valutazione finora

- James Kimberley President of National Motors Receives A BonusDocumento1 paginaJames Kimberley President of National Motors Receives A BonusKailash KumarNessuna valutazione finora

- 2-13 White Company Has Two Departments Cutting and Finishing. The Company Uses A Job-OrderDocumento2 pagine2-13 White Company Has Two Departments Cutting and Finishing. The Company Uses A Job-OrderKailash KumarNessuna valutazione finora

- Smith Foundry in Colomus Ohio Uses A PredeterminedDocumento2 pagineSmith Foundry in Colomus Ohio Uses A PredeterminedKailash KumarNessuna valutazione finora

- ENTRAPRENEURSHIPDocumento29 pagineENTRAPRENEURSHIPTanmay Mukherjee100% (1)

- Assignment 2 Malaysian StudiesDocumento4 pagineAssignment 2 Malaysian StudiesPenny PunNessuna valutazione finora

- Ob AssignmntDocumento4 pagineOb AssignmntOwais AliNessuna valutazione finora

- Is Electronic Writing or Document and Data Messages Legally Recognized? Discuss The Parameters/framework of The LawDocumento6 pagineIs Electronic Writing or Document and Data Messages Legally Recognized? Discuss The Parameters/framework of The LawChess NutsNessuna valutazione finora

- Intro To Law CasesDocumento23 pagineIntro To Law Casesharuhime08Nessuna valutazione finora

- GooseberriesDocumento10 pagineGooseberriesmoobin.jolfaNessuna valutazione finora

- Cct4-1causal Learning PDFDocumento48 pagineCct4-1causal Learning PDFsgonzalez_638672wNessuna valutazione finora

- Living Greyhawk - Greyhawk Grumbler #1 Coldeven 598 n1Documento2 pagineLiving Greyhawk - Greyhawk Grumbler #1 Coldeven 598 n1Magus da RodaNessuna valutazione finora

- LEWANDOWSKI-olso 8.11.2015 OfficialDocumento24 pagineLEWANDOWSKI-olso 8.11.2015 Officialmorpheus23Nessuna valutazione finora

- SHS StatProb Q4 W1-8 68pgsDocumento68 pagineSHS StatProb Q4 W1-8 68pgsKimberly LoterteNessuna valutazione finora

- Elements of PoetryDocumento5 pagineElements of PoetryChristian ParkNessuna valutazione finora

- Psychology Research Literature Review ExampleDocumento5 paginePsychology Research Literature Review Exampleafdtsebxc100% (1)

- Holophane Denver Elite Bollard - Spec Sheet - AUG2022Documento3 pagineHolophane Denver Elite Bollard - Spec Sheet - AUG2022anamarieNessuna valutazione finora

- Fort - Fts - The Teacher and ¿Mommy Zarry AdaptaciónDocumento90 pagineFort - Fts - The Teacher and ¿Mommy Zarry AdaptaciónEvelin PalenciaNessuna valutazione finora

- Queen of Hearts Rules - FinalDocumento3 pagineQueen of Hearts Rules - FinalAudrey ErwinNessuna valutazione finora

- You Are The Reason PDFDocumento1 paginaYou Are The Reason PDFLachlan CourtNessuna valutazione finora

- Literatures of The World: Readings For Week 4 in LIT 121Documento11 pagineLiteratures of The World: Readings For Week 4 in LIT 121April AcompaniadoNessuna valutazione finora

- Academic Decathlon FlyerDocumento3 pagineAcademic Decathlon FlyerNjeri GachNessuna valutazione finora

- MagmatismDocumento12 pagineMagmatismVea Patricia Angelo100% (1)

- Chemical BondingDocumento7 pagineChemical BondingSanaa SamkoNessuna valutazione finora

- Iluminadores y DipolosDocumento9 pagineIluminadores y DipolosRamonNessuna valutazione finora

- 30rap 8pd PDFDocumento76 pagine30rap 8pd PDFmaquinagmcNessuna valutazione finora

- лк CUDA - 1 PDCnDocumento31 pagineлк CUDA - 1 PDCnОлеся БарковськаNessuna valutazione finora

- A Practical Guide To Transfer Pricing Policy Design and ImplementationDocumento11 pagineA Practical Guide To Transfer Pricing Policy Design and ImplementationQiujun LiNessuna valutazione finora

- Task 1: MonologueDocumento4 pagineTask 1: MonologueLaura Cánovas CabanesNessuna valutazione finora

- CALIDocumento58 pagineCALIleticia figueroaNessuna valutazione finora

- Best Interior Architects in Kolkata PDF DownloadDocumento1 paginaBest Interior Architects in Kolkata PDF DownloadArsh KrishNessuna valutazione finora

- Introduction To Emerging TechnologiesDocumento145 pagineIntroduction To Emerging TechnologiesKirubel KefyalewNessuna valutazione finora

- Damodaram Sanjivayya National Law University VisakhapatnamDocumento6 pagineDamodaram Sanjivayya National Law University VisakhapatnamSuvedhya ReddyNessuna valutazione finora