Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Letters of Credit

Caricato da

suy uyTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Letters of Credit

Caricato da

suy uyCopyright:

Formati disponibili

Letters of Credit

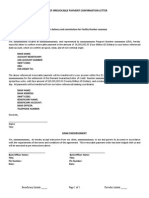

TEMENOS T24

Letters of Credit

User Guide

Information in this document is subject to change without notice.

TEMENOS T24 User Guide Page 40 of 215

No part of this document may be reproduced or transmitted in any form or by any means,

electronic or mechanical, for any purpose, without the express written permission of TEMENOS Holdings NV.

Copyright 2005 TEMENOS Holdings NV. All rights reserved.

Letters of Credit

Table of Contents

Introduction.............................................................................................................................................. 4

Application Overview ........................................................................................................................... 4

PRODUCTS......................................................................................................................................... 4

Setting up the System ...................................................................................................................... 5

The definition of LC.TYPES ............................................................................................................. 9

LC.CLAUSES - Standard clauses for inclusion in letters of credit................................................. 11

LC.ENRICHMENT - Enrichments for codes used in Trade Finance ............................................. 12

LC.ADVICE.TEXT - standard narrative for use in Trade Finance ................................................. 13

LC.TXN.TYPE.CONDITION - Default Trade Finance charges ...................................................... 14

Delivery .......................................................................................................................................... 15

Letters of Credit – Soft Delivery ..................................................................................................... 34

LC Parameter ................................................................................................................................. 41

Appendix 1 - Trade Finance Delivery Setup .................................................................................. 44

LETTER.OF.CREDIT....................................................................................................................... 102

Overview of Input and Processing ............................................................................................... 104

Example Import LC from the Issuing Bank perspective ............................................................... 104

Export Letters of Credit ................................................................................................................ 116

Collections.................................................................................................................................... 116

Trade Finance accounting............................................................................................................ 118

Limits ............................................................................................................................................ 118

Collateral ...................................................................................................................................... 119

Delivery ........................................................................................................................................ 119

Enquiry Facilities .......................................................................................................................... 121

Reporting Facilities....................................................................................................................... 122

Special Facilities........................................................................................................................... 124

Multiple Debits.............................................................................................................................. 126

Tiered Rates and Sight Discount ................................................................................................. 158

Figure 87 – Discount Balances .................................................................................................... 166

Online Maturity ............................................................................................................................. 166

Backdated Maturity....................................................................................................................... 167

Collection Amendments ............................................................................................................... 169

On Amendment of an Export Collection....................................................................................... 176

LC Amendments........................................................................................................................... 177

Partial Confirmation...................................................................................................................... 181

Limit with Provision....................................................................................................................... 186

Expiry Date roll-over for Collection Documents ........................................................................... 187

TEMENOS T24 User Guide Page 2 of 198

Letters of Credit

Pre-advice Limit............................................................................................................................ 188

Soft-Delivery for Operation ‘T’...................................................................................................... 188

Partial and Trans Shipment Tags................................................................................................. 189

Scheduling Messages .................................................................................................................. 189

Inward Processing of Letter of Credit........................................................................................... 189

Shipping Guarantee ..................................................................................................................... 193

Expiry Date roll-over for Collection Documents ........................................................................... 195

Trade Finance work files .............................................................................................................. 195

EB.DUPLICATE.TYPE ................................................................................................................. 197

TEMENOS T24 User Guide Page 3 of 198

Letters of Credit

Introduction

Application Overview

The T24 Trade Finance application supports the recording and administration of Letters of Credit (LC)

and documentary collections. The application is fully integrated with the rest of the T24 system, taking

advantage of the T24 limits processing, accounting, position management, and customer portfolio and

security features. It compliments other T24 banking applications such as foreign exchange, which

support other aspects of Trade Finance.

Trade Finance transactions can be handled in any currency. Drawings made under an LC can also be

in a different currency to the parent LC. Charges taken under an LC can also be denominated in a

currency different from both the LC and the drawing. Foreign currency entries will automatically update

positions where required.

Users can create many different types of LC’s using the LC.TYPES application, where combinations

of the major features of an LC can be set up, e.g. Import or Export, sight or usance, payment or

acceptance, confirmed or unconfirmed.

Discount accruals can be performed on a periodic frequency specified by the user. This can be daily,

weekly, monthly, or any other frequency. Charge accruals are performed monthly.

The system will automatically produce and despatch all advices, covering letters, Letter of Credit

documents, and S.W.I.F.T messages necessary for the type of LC, Documentary Collection or

Drawing being processed. The advices, documents, and covering letters can easily be redefined or

amended with the T24 Delivery application. Each LC type may have its own application format

designed in DE.FORMAT.PRINT and selected in the LC.TYPES record.

Inward delivery of S.W.I.F.T message types is accommodated for message types MT700, MT710,

MT705, MT710 and MT711 using the application LC.IN.PROCESSING. This process will create

unauthorised contracts on the LC files ready for completion and (subject to any necessary corrections)

authorisation.

The DRAWINGS application has a flexible payment and reimbursement mechanism whereby funds

can be collected or paid via a number of intermediaries, and even be paid to parties not involved in the

LC (third parties or agents). T24 will automatically produce the payment instructions necessary for

these facilities.

PRODUCTS

The Trade Finance application supports the following products and product characteristics.

Letters of credit

Pre-advised Letters of Credit

TEMENOS T24 User Guide Page 4 of 198

Letters of Credit

Export letters of credit revocable or irrevocable, confirmed or unconfirmed

Import letters of credit revocable or irrevocable

Transferable Letters of Credit

Payments at sight, acceptance or deferred

Discounting of acceptances

Multiple drawings

Documentary collections

Documents against payment

Documents against acceptance

Discounting of acceptance collections

Clean collections

The Trade Finance module consists of two closely related applications, LETTERS.OF.CREDIT and

DRAWINGS, which work together to provide a wide range of support for Trade Finance business.

The LETTER.OF.CREDIT application records the initial liability of an LC (i.e. the amount of the

facility) or the request to make a collection. The DRAWINGS application makes the actual payments

and drawings under the LC or collection.

If, for example, we were the bankers for an importer who wishes to finance a deal with an LC, it would

be input, initially, to the LETTER.OF.CREDIT application. This would automatically check and

update the customer’s credit limit, advise the various parties by S.W.I.F.T or printed advice, take any

initial charges, etc. When we are then requested to make a payment under the LC this would be input

in the DRAWINGS application, which will make any necessary accounting entries, send all required

payment messages, advise the various parties and reduce the LC by the drawing amount.

Documents that will be printed via DELIVERY The outward messages for an LC may be previewed at

input stage.

NB. A LETTER.OF.CREDIT has to exist before a DRAWING can be made.

Setting up the System

It would be nice if we could provide a fully set-up system ready for use in any bank, but in today’s

market it would be impossible due to the many specialist roles a bank can take in Trade Finance.

Indeed it is the flexibility of the Trade Finance module that allows the bank to customise its files for the

role(s) it intends to cover today, or in the future. The next section will give a brief indication of the set-

up order to implement a basic Trade Finance system.

The Parameter file - LC.PARAMETERS

TEMENOS T24 User Guide Page 5 of 198

Letters of Credit

The first level file in most T24 modules is a parameter file which provides the user with the option to

specify where in T24 accounting entries are passed; what accrual cycles are set; and the transaction

codes to use. This file is called LC.PARAMETERS and there is just one record called SYSTEM.

Figure 1 – LC.PARAMETER

TEMENOS T24 User Guide Page 6 of 198

Letters of Credit

Figure 2 - LC.PARAMETER

TEMENOS T24 User Guide Page 7 of 198

Letters of Credit

Figure 3 – LC.PARAMETER file

Figure 4 – LC.PARAMETER file

The user can define at the product level, the type of rounding that should take place while debiting or

crediting customer’s account in drawings application in the field ROUND.RULE.

TEMENOS T24 User Guide Page 8 of 198

Letters of Credit

Figure 5 LC.PARAMETER

The definition of LC.TYPES

This file is used to set the type of LC and the way T24 will treat the transaction through its various

phases from opening, drawing and to maturity. The records provided with the T24 installation should

be treated as a starting point and each one must be reviewed/amended and new ones entered

according to the type of Trade Finance business you are involved in.

The LC.TYPES record defines:

• Whether the transaction is:

o Import or Export, Transferable, Confirmed or a Collection;

o Back to back and with what type, Standby.

• a payment method - by Payment, Acceptance, Negotiation or Direct Credit.

• a group of message formats.

• and exceptions to field defaulting rules.

For example as the bankers to an Importer we need to have an LC.TYPE for any pre-advices, an

LC.TYPE for the actual advices, and possibly an LC.TYPE for adding confirmations. There are some

screenshots below of some examples:

TEMENOS T24 User Guide Page 9 of 198

Letters of Credit

Figure 5 – LC.TYPES Record

Figure 6 – LC.TYPES Record

In conjunction with the LC.TYPES key, T24 uses an operation type to decide the event, accounting

and charges that need to be applied. The codes are entered both in the OPERATION field in the

LETTER.OF.CREDIT transaction and as part of the key to the charges conditions file

LC.TXN.TYPE.CONDITION covered later in this document. In a similar manner the DRAWINGS

transaction uses the DRAWINGS.TYPE after the LC.TYPES to find a matching

LC.TXN.TYPE.CONDITION.

These codes are:

TEMENOS T24 User Guide Page 10 of 198

Letters of Credit

Figure 7 – LC.TYPES key codes

So you can now see how the flexibility of the Trade Finance module begins to take place and

empowers you to create the settings for the business you conduct now with the ability to expand to

meet future business requirements. The use of the LC.TYPE is essential in building the foundation of

the Trade Finance set-up to accommodate transactions from clean collections through to complex

documentary credits.

The following types of letter of credit are provided as an example:

Figure 8 – Types of Letter of Credit

LC.CLAUSES - Standard clauses for inclusion in letters of credit

Standard LC clauses are held on this table, it holds static information for use in the mapping and

construction of LC advices and documents generated by transactions within the T24. They can be

included in a Letter of Credit or Collection by the use of a code, avoiding the need for retyping.

TEMENOS T24 User Guide Page 11 of 198

Letters of Credit

Figure 9 – LC.CLAUSES Record

The clauses are input in the field ADDITIONL.CONDS where the user may enter free-format text. The

codes defined in LC.CLAUSES can be invoked in CLAUSES.TEXT. These are then expanded into

the actual text, which may be modified for the contract. Note it is the text itself, which is stored, so if

the record is changed at a later date the text that was valid at data entry time is preserved. It is the full

text from both the user input and a client or counter party would never see the LC.CLAUSES that

appears on the delivery advices and the code words.

LC.ENRICHMENT - Enrichments for codes used in Trade Finance

The Trade Finance application makes extensive use of short codes (such as O for open) to enable

fast and accurate input. However these codes would not be understood if referred to elsewhere, for

example if printed on CUSTOMER confirmations. The LC.ENRICHMENT application holds longer

descriptions for these codes and abbreviations giving the opportunity to expand the meaning of each

of these codes into the users own terms.

For example the response ‘Y’ to certain fields such as REVOCABLE Y/N. allows the user to create a

transaction more speedily. But the text required for advices needs to be expanded to ‘This LC is

Revocable’. The file is fully multi-lingual.

A single code may have different meanings when used in different places in the Trade Finance

application. Each place where a code may be used is identified in the LC.ENRICHMENT application.

The screenshot below shows the texts substituted for ‘Y’ under several circumstances.

TEMENOS T24 User Guide Page 12 of 198

Letters of Credit

Figure 10 – LC.ENRICHMENT

In the above example the code ‘Y’ when used in the REVOCABLE field on LETTER.OF.CREDIT

means ‘revocable’, but when used in the PART.SHIPMENTS field it means ‘part-shipments allowed’.

NB: Some of the single letter codes, such as I, A, Y etc, must be input with a preceding full stop (.)

because they can be confused by T24 function codes. For example to S(ee) the enrichment for ‘Y’ you

must input:

LC.ENRICHMENTS.Y

LC.ADVICE.TEXT - standard narrative for use in Trade Finance

The LC.ADVICE.TEXT application holds static narrative information data for use in the printed

advices and documents. It enables the short codes to be entered (encouraging fast and accurate

input) but full and descriptive text is substituted and may be modified within the contract. The

application is fully multi-lingual.

Figure 11 – LC.ADVICE.TEXT application

We have now covered the major static data tables used for Trade Finance in T24.

TEMENOS T24 User Guide Page 13 of 198

Letters of Credit

LC.TXN.TYPE.CONDITION - Default Trade Finance charges

The LC.TXN.TYPE.CONDITION table is used to define default charges for Trade Finance products.

In essence you would translate the table of charges and commissions that you apply for Trade

Finance deals to this table. This would ensure that when a specific deal type is entered the correct

charges, fees and commissions are applied in accordance with your scale of fees.

Charges can be defined for each product (as defined on the LC.TYPES application), for each

operation on those products (such as pre-advising, opening and amending the letter of credit etc.),

and for each drawing and type of drawing made under an LC product.

The key to an LC.TXN.TYPE.CONDITION record is the LC.TYPE followed by either the

OPERATION for LETTER.OF.CREDIT, or the DRAWING.TYPE for DRAWINGS.

Figure 12 - LC.TXN.TYPE.CONDITION Record

Whenever a transaction is input via the LETTER.OF.CREDIT (including documentary collections) or

DRAWINGS applications, a key is built up of the current LC.TYPE and the current OPERATION (for

LCs), or the DRAWING.TYPE (for drawings). This key is then used to retrieve a record from the

LC.TXN.TYPE.CONDITION file in order to set up all the default charges for the current transaction.

These settings are used for general customers. To amend the default charges for special clients or

those belonging to a pre-defined group you need to set up the condition group files:

LC.GEN.CONDITION The general conditions

LC.GROUP.CONDITION The group conditions

These impact the file CUSTOMER.CHARGE where the effect of these can be seen and additional

changes made. See the section later in this document for further details.

For DRAWINGS the LC.TYPE is from the parent LETTER.OF.CREDIT record.

TEMENOS T24 User Guide Page 14 of 198

Letters of Credit

Delivery

Fixed message type production (Old method)

The message types listed here are those incorporated in the original Trade Finance product. This

section is maintained for backward compatibility. For details on the newer recommended method of

operation using soft delivery consult 0 Flexible message type production (Soft delivery) (below)

The Trade Finance application automates the production of SWIFT messages in the 700 and 400

ranges (700 for Letters of Credit and 400 for Documentation Collections. The system also generates

MT100 and MT200 series messages for payments.

The following SWIFT message types are available:

• MT400 - Advice of Payment

• MT410 – Acknowledgement

• MT412 - Advice of Acceptance

• MT700 - Issue of a Documentary Credit

• MT701 – Issue of a Documentary Credit (second message)

• MT705 - Pre - Advice of a Documentary Credit

• MT707 - Amendment to a Documentary Credit

• MT710 - Advice of a Third Bank’s Documentary Credit

• MT711 – Advice of a Third Bank’s Documentary Credit

(second messdage)

• MT720 – Transfer of a Documentary Credit

• MT732 - Advice of Discharge

• MT734 - Advice of Refusal

• MT740 - Authorisation to Reimburse

• MT742 - Reimbursement Claim

• MT747 - Amendment to an Authorisation to Reimburse

• MT750 - Advice of Discrepancy

• MT752 - Authorisation to Pay, Accept or Negotiate

• MT754 - Advice of Payment / Acceptance / Negotiation

• MT756 – Advice of Reimbursement or Payment

• MT910 - Confirmation of Credit

Summary of messages generated

The following messages are automatically generated in the circumstances defined:

TEMENOS T24 User Guide Page 15 of 198

Letters of Credit

Figure 13 - Summary of automatically generated messages

Messages generated for a Letter of Credit

The following messages are generated for the various types of Letter of Credit and Documentary

Collection transactions:

If there are charges to be taken for each transaction, the system generates the following SWIFT

messages.

TEMENOS T24 User Guide Page 16 of 198

Letters of Credit

MT790 - Advice of charges debited

MT791 - Request for payment of charges

Input of a new Letter of Credit

When an Import Letter of Credit is opened, the system will produce an MT700 and a printed document

(1700). If a third party Reimbursement Bank has been specified, then an MT740 will also be

generated. For an Export Letter of Credit opened, the system will produce an MT730 and a printed

acknowledgement (1730). If the LC is to be advised through another bank and this has been specified,

then an MT710 is also generated. The system produces an MT705 for a Pre-Advised Letter of Credit.

Amendment of a Letter of Credit

When an Import Letter of Credit is amended the system produces an MT707. If a third party bank has

been specified, then an MT747 is also generated. An amendment to an Export Letter of Credit

produces an MT707.

Input or amendment of a Documentary Collection

There is no message generation on the input / amendment of a Documentary collection. Messages

are only produced for this when a Documentary Collection Drawing is entered.

Messages generated for drawings under Letters of Credit

The following messages are generated for the various types of drawings under Letters of Credit and

Documentary Collection transactions.

If there are any charges to be taken for each transaction then the system will generate the following

SWIFT messages:

MT790 - Advice of charges debited

MT791 - Request for payment of charges

For each Drawing type entered, the system will generate a standard covering letter to be sent to the

relevant parties with the associated documents.

Input or amendment of an Acceptance or Deferred Payment

On input of a Drawing relating to an Import Letter of Credit, an MT754 is generated. If a Drawing

relating to an Export Letter of Credit is entered then an MT754 is generated unless reimbursement is

from a third party reimbursement bank, in which case an MT742 is sent. If the Drawing is input as a

Collection, then an MT752 is sent, or if the collection is to be paid under reserve an MT732 is sent. If

the acceptance is discounted, then an MT910 is also generated.

TEMENOS T24 User Guide Page 17 of 198

Letters of Credit

Input or amendment of a sight payment

On input of a Drawing of an Import Letter of Credit, an MT752 is generated. If a Drawing of an Export

Letter of Credit is entered then an MT754 is generated unless reimbursement is from a third party

reimbursement bank, in which case an MT742 is sent. If the Drawing is input as a Collection, then an

MT752 is sent, however, if the collection is to be paid under reserve an MT732 is sent

Input or amendment of a collection

On input of a collection, an MT750 is sent. If the collection is to be paid under reserve then an MT910

will also be sent.

Input or amendment of a collection chase

No messages will be sent for input or amendment of a collection chase.

SWIFT 2006 changes

LETTERS OF CREDIT application has been amended to incorporate the new SWIFT 2006 changes.

The following messages have been amended to incorporate these changes, MT700,MT705, MT707,

MT710, MT720 and MT740.

Message Types Short description of the modification

700, 710, 720 Addition of new mandatory field 40E Applicable Rules.

740, Addition of new mandatory field 40F Applicable Rules.

Deletion of two fields 44A Loading on Board/Dispatch/Taking in Charge

700, 705, 707, 710, 720

At/From and 44B For Transportation To

Addition of four fields: 1> 44A Place of Taking in charge/dispatch from place

of receipt. 2> 44E Port of Loading/Airport of Departure 3> 44F Port of

700, 705, 707, 710, 720

Discharge/Airport of Destination 4> 44B Place of Final Destination/For

Transportation To/Place of Delivery

Two new fields have been added to the LC application to accommodate SWIFT Tag

40E.APPLICABLE.RULE.CODES, which will store a 6 digit code or the option of inputting OTHR .

APPLICABLE.RULE.DESCRIPTION is a no-input field unless OTHR is used in

APPLICABLE.RULE.CODES .APPLICABLE.RULE.DESC will describe the condition.

To accommodate SWIFT Tags 44E and 44F two new fields have also been added.

TEMENOS T24 User Guide Page 18 of 198

Letters of Credit

Flexible message type production (Soft delivery)

This is the preferred method of selecting message types to be produced at events in the life cycle of a

LETTER.OF.CREDIT transaction. The above section on fixed message types can be used as a

general guide to what is necessary, but each installation will have different requirements. Therefore,

this is the method you should use if setting up a new Trade Finance system.

Delivery and Document production is one of the most important areas in the Trade Finance application.

The bank has to send different messages to the different parties involved. For example, when the

bank issues a Letter of Credit, the message MT-700 will be sent to the advising bank, and mail

notification will be sent to the applicant, who is normally the bank’s client. T24 previously made

assumptions about what messages were to be produced at various stages in the deal life cycle in the

LETTER.OF.CREDIT and DRAWINGS application. Soft delivery allows the user to choose the

messages to be triggered by activities in the life cycle of a deal.

LETTER.OF.CREDIT and DRAWINGS employ the delivery mechanism through EB.ACTIVITY

and EB.ADVICES for the delivery process. With this method, you can have as many messages as

you want for each type of operation. You can also specify when a message should be produced.

The new functions include:

Message types to be produced are based on the EB.ADVICES file. The key to this file is defined by

a condition of activity code and LC.TYPE. Possible activity codes are listed in this document. This

approach gives the users or implementers flexibility to add new messages or amend the existing

messages with minimum effort.

EB.ACTIVITY, EB.MESSAGE.CLASS and EB.ADVICES records are released to ensure that

existing messages continue to be produced and appear as before (backward compatibility).

• A button on the T24 browser triggers the print preview function.

• The preview function will show all message types, including payments.

• The user can control production of classes of message at transaction level.

• For usance delivery, it is possible to specify a number of days prior to maturity at the

activity level or transaction level.

• There is full audit trail of messages, which have been produced or inhibited.

• Additional message types required by SWIFT for very long messages (MT700 - 701,

MT710 - 711 and MT720 - 721) are supported.

• Tag Descriptions are displayed in the SWIFT message preview.

Concepts

The LC application often involves messages to several parties using maybe different formats and

media. Stages in the transaction life cycle affect messages to be sent. For example, when you issue

a Letter of Credit, you have to send the MT700 SWIFT message to the advising bank and notification

letter to the customer (Importer) and if there is a nominated reimbursing bank, you have to send an

MT740 SWIFT message.

TEMENOS T24 User Guide Page 19 of 198

Letters of Credit

Basic Concept

The activities have been designed to satisfy foreseeable message requirements at each step in the life

of the transaction. The activity is a 4-digit number, which is composed of three main parts:

• First digit indicates Operation.

• Second digit indicates Type of Application.

• And the last two digits indicate detail activity related to that operation.

For example, 1000 is Opening, together with 800 for Import type of LC and 01 for opening

Input/Authorisation function (1000+800+1 = 1801) signifies Import LC issuing activity when we should

send message 700.

One Activity/One Meaning

By doing this, it may appear that there will be many activities for each type and step of operations.

Most of them are redundant. It is usually sufficient to concentrate on the last two digits. For example,

LC opening (OPERATION = ‘O’) may produce an activity with 4 possible activities

1101 – Outward Collection

1201 – Inward Collection

1401 – Export LC

1801 – Import LC

LC and Drawing Activity Lists

LC-1000 LC Pre-advice/Opening

The 1000 series will represent the opening and pre-advice operation in LETTER.OF.CREDIT

application.

TEMENOS T24 User Guide Page 20 of 198

Letters of Credit

Figure 14 - LC and Drawing Activity List

Opening / Pre-advice Detail Activity (1000 series)

Figure 15 - Opening/Pre-advice Detail Activity (1000 series)

LC-2000 LC Amendment / Charges / Tracing

The 2000 series is used for the Amendment and Collection Tracer operation in the

LETTER.OF.CREDIT application.

TEMENOS T24 User Guide Page 21 of 198

Letters of Credit

Figure 16 - LC 2000 LC Amendment/Charges Tracing

Amendment/Direct Charges/Tracer Detail Activity (2000 series).

Figure 17 - Amendment/Direct Charges/Tracer Detail Activity (2000 series)

LC-3000 DR Sight Payment

The 3000 series is used for the Sight Payment type in the DRAWINGS application. This is not only

related to an SP drawing operation, but also the possible operations, which arise due to this non-

usance payment.

TEMENOS T24 User Guide Page 22 of 198

Letters of Credit

Figure 18 - LC 3000 DR Sight Payment

LC- 4000 DR Usance Payment

The 4000 series is used for the usance Payment type in the DRAWINGS application. This is not just

related to an ‘AC’ or ‘DP’ drawing operation, but rather the possible operations, which arise due to this

usance payment.

TEMENOS T24 User Guide Page 23 of 198

Letters of Credit

TEMENOS T24 User Guide Page 24 of 198

Letters of Credit

Figure 19 - LC 4000 DR Usance Payment

Sight and Usance Drawing Detail Activity (3000 and 4000 series)

Figure 20 - Sight and Usance Drawing Detail Activity (3000 and 4000 series)

LC- 5000 Draw Negotiation

TEMENOS T24 User Guide Page 25 of 198

Letters of Credit

Figure 21 - LC 5000 Draw Negotiation

Message Class Control in LC

To capture every step and type of operation, you may end up with hundreds of activities which would

eventually be difficult to set up and maintain. To address this problem, rather than using only activity,

we keep the number of activities small but sufficient and employ message class to control required

messages.

ACTIVITY and CLASS allow compromise between automatic (default) and user control (semi-

automatic). The system will try to default a sensible CLASS to an activity, and populate the

information on the LC transaction. You can then take control of the class to choose whether you want

to produce the messages suggested by the system.

As far as delivery is concerned, the user will be liberated to send and preview the message under soft-

delivery, literally unlimited though. It was carefully designed to accommodate the message generation

in accordance with the type of transaction and the party involved. Therefore, only specific class will be

triggered if the condition falls due. The existing user may take this for granted, since the

EB.ADVICES will be pre-set in the same way as the message used to be generated. A table shown

below will indicate the usage of the internal class in the Trade Finance module:

TEMENOS T24 User Guide Page 26 of 198

Letters of Credit

Figure 22 - Message Class Control in LC

TEMENOS T24 User Guide Page 27 of 198

Letters of Credit

Figure 23 - Message Class Control in LC

LC.PARAMETERS

To incorporate the LC message class keyword to EB.MESSAGE.CLASS, we have introduced three

new fields, BACKWARD.DELIVERY, LC.CLASS.TYPE, and EB.CLASS.NO. The first one will notify the

system whether backward compatibility is required. If set to YES or blank (default YES), the system

will go through the old mapping program and make it available for the mapping process, in which case,

the soft delivery will function seamlessly for the existing users and at the same time, its versatility is

also available for them. The ‘NO’ option is recommended for a new implementation, since it will

enable message production to run 200 – 400% faster.

LC.CLASS.TYPE and EB.CLASS.NO will retain a one-to-one mapping between the internal keyword

and the user defined message class. In this way you can control message classes to be produced at

transaction level.

TEMENOS T24 User Guide Page 28 of 198

Letters of Credit

Figure 24 - LC Parameter Input screen

BACKWARD.COMPATIBILITY for LC Soft Delivery

To maintain compatibility with the fixed delivery of LC's there is a switch in LC.PARAMETERS.

When this is set to YES, then the handoff record is in the old format if the associated mapping record

is of the form nnn.LC.1. If the mapping does not have "1" as its extension, then the rules for mapping

are as described below. This makes it possible to migrate gradually from fixed message operation to

full soft delivery.

TEMENOS T24 User Guide Page 29 of 198

Letters of Credit

DE.MAPPING for LC Soft Delivery

LC:

Handoff Record 1 : contains the current record (R.NEW)

Handoff Record 2 : contains backup of LC record (R.OLD)

Handoff Record 3 :

Handoff Record 4 : contains the main or Parent LC records, if any

Handoff Record 5 : Changed Field during Amendment

Handoff Record 6 : contains the LOCAL.REF of the current record.

Handoff Record 7 : is assigned to the charge sets and the special SWIFT required fields.

Handoff Record 8 :

Handoff Record 9 : is left for user definition.

DR:

Handoff Record 1 : contains the current record (R.NEW)

Handoff Record 2 : contains backup of DRAWINGS record (R.OLD)

Handoff Record 3 : Corresponding LC record

Handoff Record 4 : contains the main or Parent LC records, if any

Handoff Record 5 :

Handoff Record 6 : contains the LOCAL.REF of the current record.

Handoff Record 7 : is assigned to the charge sets and the special SWIFT required fields.

Handoff Record 8 :

Handoff Record 9 : User defined

The HANDOFF header information resides in REC8 with the following format:

REC8<1> : COMPANY

REC8<2> : CUS.COMPANY

REC8<3> : APP.FORMAT

REC8<4> : MESSAGE.TYPE

REC8<5> : CURRENCY

REC8<6> : DEPARTMENT

REC8<7> : TRANS.REF

REC8<8> : CUSTOMER

REC8<9> : LANGUAGE

REC8<10> : ACCOUNT

REC8<11> : VALUE.DATE

TEMENOS T24 User Guide Page 30 of 198

Letters of Credit

REC8<12> : AMOUNT

REC8<13>:

REC8<14>:

REC8<15>:

REC8<16>:

Customising printed delivery output

All communication for third parties (called messages) generated by the Trade Finance module can be

despatched using a number of techniques. The most common of which are via Swift and printed

output. The use of printed output is particularly common in Trade Finance due to the number of

parties to a contract who are not banks and thus are not on the Swift network.

Trade Finance takes full advantage of T24’s sophisticated ability to customise printed output in order

to enable each user of the application to produce third party printed documentation that reflects their

own requirements. Full information on customising printed delivery is in the Delivery section of the

user guide (under DE.FORMAT.PRINT).

In the following example, an amendment has been made to a Letter of Credit. T24 has been set to

produce both a printed amendment advice and a Swift 707 message. Both are shown below.

TEMENOS T24 User Guide Page 31 of 198

Letters of Credit

Figure 25 - Customising printed delivery output

.{1:F01STDPLATXXXXX.SN: ISN.}{2:I707ABCDGBXXXXXXN}{3:{108:xxxxx}}{4:

:20/TRANSACTION REFE: TF9502000104

:21/REF. TO RELATED: NONREF

:31C/MATURITY DATE O: 950101

:30/DATE CONTRACT AG: 950120

:26E/:

:59/BENEFICIARY CUST: MANCO PLC

12 THE BULLRING

BIRMINGHAM BH6 2EF

Delivery preview

There is a delivery preview button on the toolbar. It is active when the delivery preview is available.

TEMENOS T24 User Guide Page 32 of 198

Letters of Credit

TEMENOS T24 User Guide Page 33 of 198

Letters of Credit

Figure 26 - Delivery Preview Screen

Letters of Credit – Soft Delivery

Background

Delivery and Document production is one of the most important areas in Trade Finance where the

banks have to send different messages to different parties involved. For example, when the bank

issues a Letter of Credit, the message MT-700 will be sent to the Advising Bank, and mail notification

will be sent to the Applicant, which is normally the bank’s client. However, as far as the delivery is

concerned, it has been difficult to produce the message, which T24 does not generate, due to the fact

that it has already been pre-defined or hard coded inside the LETTER.OF.CREDIT and

DRAWINGS application. To address this issue therefore, we have decided to incorporate the soft

delivery concept into these applications to pass the delivery control to the user, which will elevate the

difficulty of sending the new type of the message to the correspondences.

In our re-engineering process, we try to standardise how the applications produce their deliveries by

introducing three new tables, so-called EB.ACTIVITY, EB.MESSAGE.CLASS and EB.ADVICES.

The first one will contain all the possible activities related to that application, where the second one will

retain message class description. Hence, it will also facilitate user’s control at transaction level, and

TEMENOS T24 User Guide Page 34 of 198

Letters of Credit

the last one will be tiding the activity and message class to delivery message, i.e. 700, 730, etc., which

is going to be produced. By employing this new mechanism, the user can decide on which message,

and when he/she wants it to be produced.

New Functionality

LETTER.OF.CREDIT and DRAWINGS will employ the new delivery mechanism through

EB.ACTIVITY and EB.ADVICES for its delivery process. With this method, the user can have as many

messages as he/she wants for each type of operation. Hence, the message can also be specified as

and when it should be produced. So the new functionality will include:

• Message types to be produced will be based on the EB.ADVICES file. The key to this file will be

defined by a condition of activity code and LC type. A list of possible activity codes is contained in

this document. This new approach will give the users or implementers flexibility to add new

messages or amend existing messages in the way they want it to be with minimum effort.

EB.ACTIVITY, EB.MESSAGE.CLASS and EB.ADVICES records will be released to ensure that

existing messages continue to be produced and appear as before (backward compatibility).

• The print preview function will be enhanced to trigger document previewing by a new preview

button on the T24 browser.(Not available at the present time).

• Preview Functionality will be available across the applications regardless of operation, type of

instrument or payment.

• User can control the class of the message at transaction level whether he/she wants to produce it

or not.

• For usance delivery, it is possible to specify number of days prior to maturity that the user wants

the message to be produced at the activity level or even transaction level.

• Providing full audit trail of message, which has or has not been produced.

• Extra messages may be produced if the original message exceeds the limited size available for

MT700, MT710 and MT720.

Providing the new generic application, EB.FREE.MESSAGE, where the user can produce any

messages at any time, with or without underlying transaction information. Effectively this new

capability will also allow sending the applicable message to unlimited of correspondence, if any.

• Displaying SWIFT Tag Description in correspond to SWIFT description on SWIFT preview.

LC Soft Delivery Conceptual

Unlike other types of operations, the user of the LC application is usually involved with several parties

with the need to produce different types of messages and media simultaneously. Each operation and

type of transaction also contribute to this complex situation. For example, when the user issues an LC,

he/she has to send the MT700 SWIFT message to the Advising Bank, and notification letter to his/her

customer (Importer). If there is a nominated Reimbursing Bank, the user has to communicate with the

bank via sending MT740 SWIFT message.

TEMENOS T24 User Guide Page 35 of 198

Letters of Credit

Basic Concept

Due to the mentioned fact, the activities have been designed based upon the needs of the message at

each step of the operation. Moreover, it has to be flexible enough as well as covering almost every

detail of the operation. To serve the requirement as such, the activity will be a 4-digit number, which is

composed of three main parts:

• First digit stands for Operation

• Second digit stands for Type of Instruments

• And the last two digit stands for detail activity related to that operation.

e.g. 1000 is Opening, together with 800, which indicate for import type of LC and 01, which is opening

the Input/Authorisation function (1000+800+1 = 1801). It will result as an import LC issuing activity,

where we should attach message 700. Effectively, the system will produce the MT700 and send it to

the advising bank.

One Activity/One Meaning

By doing this, it may look like there will be many activities for each type and step of operations. Most

of them are somehow redundant in the way that it is sufficient to only concentrate on the last two digits.

For example, LC opening (OPERATION = ‘O’) may produce an activity with 4 possible activities:

1101 - Outward Collection

1201 - Inward Collections

1401 - Export LC

1801 - Import LC

We will see that the first two digits are different to reflect the operation and type of instrument, but the

last digit which is representing the real activity, in which case ‘01’, stays the same across the operation.

LC and Drawing Activity Lists

LC-1000 LC Pre-advice/Opening

The 1000 series will represent the opening and pre-advice operation in the LETTER.OF.CREDIT

application.

TEMENOS T24 User Guide Page 36 of 198

Letters of Credit

Figure 27 - LC-1000 LC Pre-advice/Opening

Opening / Pre-advice Detail Activity (1000 series).

Figure 28 - Opening / Pre-advice Detail Activity (1000 series)

LC-2000 LC Amendment / Charges / Tracing

The 2000 series will represent the Amendment and Collection Tracer operation in the

LETTER.OF.CREDIT application.

TEMENOS T24 User Guide Page 37 of 198

Letters of Credit

Figure 29 - LC-2000 LC Amendment / Charges / Tracing

Amendment/Direct Charges/Tracer Detail Activity (2000 series).

Figure 30 - Amendment/Direct Charges/Tracer Detail Activity (2000 series)

LC-3000 DR Sight Payment

The 3000 series will represent the Sight Payment type in the DRAWINGS application. This is not only

a related ‘SP’ drawing operation, but rather the possible operations, which arise due to this non-

usance payment.

TEMENOS T24 User Guide Page 38 of 198

Letters of Credit

Figure 31 - LC-3000 DR Sight Payment

LC- 4000 DR Usance Payment

The 4000 series will represent the usance Payment type in the DRAWINGS application. This is not

only related to an ‘AC’ or ‘DP’ drawing operation, but rather the possible operations, which arise due to

this usance payment.

TEMENOS T24 User Guide Page 39 of 198

Letters of Credit

TEMENOS T24 User Guide Page 40 of 198

Letters of Credit

Figure 32 - LC- 4000 DR Usance Payment

Sight and Usance Drawing Detail Activity (3000 and 4000 series).

Figure 33 - Sight and Usance Drawing Detail Activity (3000 and 4000 series)

LC Parameter

Although Soft delivery is a generic mechanism providing great flexibility of message producing, it is not

entirely suitable to an application like LC’s. To capture every step and type of operation, it may end up

with hundreds of activities, which will eventually be enormously difficult to set-up and maintain. To

TEMENOS T24 User Guide Page 40 of 215

Letters of Credit

address this problem, rather than using only activity, we will keep the number of activities as small, but

sufficient as possible and employing message class to represent the required message.

Class Control in LC

The main driving concept of ACTIVITY and CLASS is that it lends itself to compromise between

automatic (default) and user control, so-called semi-automatic. In a sense, the system will try to

default a sensible CLASS tying to the corresponding activity, and populate the information on the LC

transaction. Consequently, the user can take control of the class to choose whether he/she wants to

produce the messages that are suggested by the system. Having mentioned that, the following

LC.MESSAGE.CLASS.TYPE are introduced to allow user controlled of delivery.

TEMENOS T24 User Guide Page 42 of 198

Letters of Credit

Figure 34 - Class Control in LC

SYSTEM Record

To incorporate the LC message class keyword to EB.MESSAGE.CLASS, we have introduced three

new fields, BACKWARD.DELIVERY, LC.CLASS.TYPE, and EB.CLASS.NO. The first one will notify the

system that whether backward compatibility is required. If set to YES or blank (default YES), the

TEMENOS T24 User Guide Page 43 of 198

Letters of Credit

system will go through the old mapping program and make it available for the mapping process, in

which case the soft delivery will function seamlessly for the existing users and at the same time, its

versatility is also available for them. The ‘NO’ option is recommended for a new implementation, since

it will run 200 – 400% time faster in terms of message producing.

The second and third one will retain a one-to-one mapping between the internal keyword and the user

defined message class. By matching as such, the message control will be made available to the user

at transaction level, in which case the users can manipulate the LC document production to

accomplish their tasks.

LC Soft Delivery Set-up

In spite of obtaining the sample of activity and advices from T24 upgrading, the user may or may not

follow up. However, it is worth knowing how to set LC soft delivery and its impact. Here is the

implementation road map:

Define message class using EB.MESSAGE.CLASS

Define LC activity using EB.ACTIVITY. Key consists of two parts, separated by dash (‘-‘). The first

part is the EB.SYSTEM.ID, which is defined in COMPANY record. The second part will be the activity

numbers, which are already mentioned elsewhere in this document.

Match LC message class with EB.MESSAGE.CLASS.ID. Without specifying this, user will not be

able to get the default message class returning by system or to manipulate the document production.

Attached required message, i.e. 700, 730, together with message class and mapping key in

EB.ADVICES. Key consists of two parts. The first part is the EB.ACTIVITY.ID. The second part is

LC.TYPES.ID, separated by dash (‘-‘), i.e. LC-1401-ECSC. It is an optional part, presumably, where

the user may tailor the message to a particular type of LC.

Appendix 1 - Trade Finance Delivery Setup

TEMENOS T24 User Guide Page 44 of 198

Letters of Credit

Main

TEMENOS T24 User Guide Page 45 of 198

Letters of Credit

MD 7xx series

TEMENOS T24 User Guide Page 46 of 198

Letters of Credit

4XX

TEMENOS T24 User Guide Page 47 of 198

Letters of Credit

MT700

TEMENOS T24 User Guide Page 48 of 198

Letters of Credit

TEMENOS T24 User Guide Page 49 of 198

Letters of Credit

MT701

TEMENOS T24 User Guide Page 50 of 198

Letters of Credit

MT705

TEMENOS T24 User Guide Page 51 of 198

Letters of Credit

MT707

TEMENOS T24 User Guide Page 52 of 198

Letters of Credit

MT710

TEMENOS T24 User Guide Page 53 of 198

Letters of Credit

MT711

TEMENOS T24 User Guide Page 54 of 198

Letters of Credit

MT720

TEMENOS T24 User Guide Page 55 of 198

Letters of Credit

MT721

MT730

TEMENOS T24 User Guide Page 56 of 198

Letters of Credit

MT732

MT734

TEMENOS T24 User Guide Page 57 of 198

Letters of Credit

MT740

TEMENOS T24 User Guide Page 58 of 198

Letters of Credit

MT742

TEMENOS T24 User Guide Page 59 of 198

Letters of Credit

MT747

TEMENOS T24 User Guide Page 60 of 198

Letters of Credit

MT750

TEMENOS T24 User Guide Page 61 of 198

Letters of Credit

MT752

TEMENOS T24 User Guide Page 62 of 198

Letters of Credit

MT754

TEMENOS T24 User Guide Page 63 of 198

Letters of Credit

MT756

MT760

TEMENOS T24 User Guide Page 64 of 198

Letters of Credit

MT767

MT768

TEMENOS T24 User Guide Page 65 of 198

Letters of Credit

MT769

TEMENOS T24 User Guide Page 66 of 198

Letters of Credit

MT400

TEMENOS T24 User Guide Page 67 of 198

Letters of Credit

MT410

MT412

TEMENOS T24 User Guide Page 68 of 198

Letters of Credit

MT420

TEMENOS T24 User Guide Page 69 of 198

Letters of Credit

MT430

MT900

TEMENOS T24 User Guide Page 70 of 198

Letters of Credit

MT910

TEMENOS T24 User Guide Page 71 of 198

Letters of Credit

MT100

TEMENOS T24 User Guide Page 72 of 198

Letters of Credit

MT100(MD)

TEMENOS T24 User Guide Page 73 of 198

Letters of Credit

MT202

TEMENOS T24 User Guide Page 74 of 198

Letters of Credit

MT202(MD)

TEMENOS T24 User Guide Page 75 of 198

Letters of Credit

MT210

Soft delivery functionality is now available in DR.DISC.AMENDMENTS

TEMENOS T24 User Guide Page 76 of 198

Letters of Credit

Appendix 2 – Trade Finance Accounting

Detailed Trade Finance accounting entries

This section outlines the accounting entries that can be passed for each event. The section has been split

into three. The first covers Import Letters of Credit, the second covers Export Letters of Credit and the

third covers charges.

Charges may be taken at any time but are shown here in a separate section to avoid repeating the

information against each transaction.

For each entry the following details are shown:

• The sign followed by the account group being updated.

• Entry type - Stmt, Categ or Special (see note below).

• Amount.

• Transaction code (see note below).

• Asset type for Special entries.

The codes shown in the entry type column are as follows:

• Stmt - statement entries on the STMT.ENTRY application.

• Categ - P&L entries on the CATEG.ENTRY application.

• Special - direct CRF entries on the RE.CONSOL.SPEC.ENTRY application.

Under the transaction code column the following is shown:

• If the entry type is Special the transaction code is shown.

• If the entry type is Stmt or Categ then one of the codes below will be shown. This indicates where the

actual numeric transaction code will be obtained.

For the following, the transaction code will be taken from the LC.PARAMETER file:

TEMENOS T24 User Guide Page 77 of 198

Letters of Credit

Figure 35 - Transaction Codes

For the following, the transaction code will be taken from the FT.CHARGE.TYPE or

FT.COMMISSION.TYPE record:

Figure 36 - Transaction Codes

For the contingent entries, the single sided entry is shown. This has been done so that when the option for

single sided contingent is used the entry shown will be the one raised.

Where the option to have self-balancing contingents is taken then the opposite signed entry will be raised.

The sign will be different and the asset type will have BL at the end otherwise the details will be the same.

Special entries will always be raised as part of the Close of Business processing.

The Stmt and Categ Entries will either be raised online or as part of the Close of Business.

Detailed below are examples of the accounting movements the system generates in respect of the

various types of letter of credit and documentary collection transactions.

The examples only indicate the basic ACCOUNT movements. Credit entries to "Profit and Loss"

account have not been shown. However, to give an illustration of a transaction incorporating profit and

loss entries please refer to Export Credit item "Sight Payment".

Import Letters of Credits

Detailed below are the entries generated for the various types of Imports in the date of input or value date.

TEMENOS T24 User Guide Page 78 of 198

Letters of Credit

Issue of an Import Letter of Credit

An LC is issued for 1 million:

Credit "Outstanding Credit Unused"

Special 1,000,000 NEW ISSUE

Amendment of an Import Letter of Credit

A Letter of Credit value is increased by 125,000:

Credit "Outstanding Credit Unused"

Special 125,000 INC ISSUE

Then an decrease of 110,000 on the LC value is made: -

Debit "Outstanding Credit Unused"

Special 110,000 DEC ISSUE

Sight payment under an Import Letter of Credit

On the value date a drawing for 300,000 is paid:

Debit "Outstanding Credit Unused"

Special 300,000 LIQ ISSUE

The following entries will always be raised online.

Credit nostro for payment to the remitting bank, beneficiary or customer

Stmt 300,000 PAYCR

Debit customer account for whom Letter of Credit was opened.

Stmt 300,000 PAYDR

Usance Acceptance

Documents (a drawing) for 100,000 payable in 90 days is accepted.

On the day of notification of acceptance received:

TEMENOS T24 User Guide Page 79 of 198

Letters of Credit

Debit "outstanding credit unused".

Special 100,000 LIQ ISSUE

Debit "customer’s liabilities for acceptance".

Special 100,000 NEW ACPTCONTRA

Credit "outstanding acceptances"

Special 100,000 NEW ACPTBANK

or "Acceptances executed by Head Office and branches"

Special 100,000 NEW ACPTHO

Or "Acceptances executed by subsidiaries"

Special 100,000 NEW ACPTSUBS

On the Maturity date of 90 Days :

Credit "Customer’s liabilities for acceptance".

Special 100,000 MAT ACPTCONTRA

Debit "Outstanding acceptances"

Special 100,000 NEW ACPTBANK

or "Acceptances executed by Head Office and branches"

Special 100,000 NEW ACPTHO

Or "Acceptances executed by subsidiaries"

Special 100,000 NEW ACPTSUBS

The following entries will be raised online if the status is changed to MA online. Otherwise entries will

be raised as part of the Close of Business processing.

Credit nostro through which payment will be made to the other bank.

Stmt 100,000 PAYCR

Debit customer account for whom the letter of credit was opened.

Stmt 100,000 PAYDR

TEMENOS T24 User Guide Page 80 of 198

Letters of Credit

Sight collection - paid

A drawing for 350,000 payable at sight is sent for collection/acceptance by the customer for whom the

Letter of credit was opened.

On the day the item is sent for collection:

Credit Items sent for collection"

Special 350,000 NEW COLL

If the documents (drawing) were to be sent ‘In Trust’:

Credit Items sent for collection"

Special 350,000 NEW TRCOLL

Debit "Outstanding credit unused".

Special 350,000 LIQ ISSUE

On day payment received :

Debit "Outstanding credit unused".

Special 350,000 LIQ ISSUE

Debit "Items sent for collection"

Special 350,000 PAY COLL

On day payment received if the documents were under Trust:

Debit "Items sent for collection"

Special 350,000 LIQ TRCOLL

The following entries will always be raised online.

Credit nostro through which payment will be made to the other bank.

Stmt 350,000 PAYCR

Debit customer account for whom the letter of credit was opened.

Stmt 350,000 PAYDR

TEMENOS T24 User Guide Page 81 of 198

Letters of Credit

Sight collection - not paid

A drawing for 225,000 payable at sight is sent for collection to the customer for whom the Letter of Credit

was opened and it is not paid.

On the day it is sent for collection:

Credit "Items sent for collection"

Special 225,000 NEW COLL

On the day the documents are sent ‘In Trust’:

Credit "Items sent for collection"

Special 225,000 NEW TRCOLL

Debit "Outstanding credit unused".

Special 225,000 LIQ ISSUE

On the day that the notice of non-payment is received:

Debit "Items sent for collection"

Special 225,000 NCP COLL

On the day that the documents sent ‘In Trust’ are rejected:

Debit Items sent for collection"

Special 225,000 LIQ TRCOLL

Credit "Outstanding credit unused".

Special 225,000 REV ISSUE

Usance collection - accepted or paid

A drawing for 150,000 payable in 90 days is sent for collection to the customer for whom a Letter of Credit

was opened and is accepted or paid.

On the day that it is sent for collection:

TEMENOS T24 User Guide Page 82 of 198

Letters of Credit

Credit "Items sent for collection"

Special 150,000 NEW COLL

On the day the documents are sent for collection if the documents were ‘In Trust:

Credit "Items sent for collection"

Special 150,000 NEW TRCOLL

Debit "Outstanding credit unused".

Special 150,000 LIQ ISSUE

If payment is received on or after payment date the process will be the same as for a sight collection paid.

If acceptance is received before payment date then process will be as follows.

On the day the acceptance is received:

Debit "Items sent for collection"

Special 150,000 PAY COLL

Debit "Outstanding credit unused".

Special 150,000 LIQ ISSUE

Debit "Customer’s liabilities for acceptance".

Special 150,000 NEW ACPTCONTRA

Credit "Outstanding acceptances"

Special 150,000 NEW ACPTBANK

or "Acceptances executed by Head Office and branches"

Special 150,000 NEW ACPTHO

Or "Acceptances executed by subsidiaries"

Special 150,000 NEW ACPTSUBS

On the day the acceptance is received where the documents have been sent ‘In Trust’:

Debit "Items sent for collection"

Special 150,000 LIQ TRCOLL

TEMENOS T24 User Guide Page 83 of 198

Letters of Credit

Debit "Customer’s liabilities for acceptance".

Special 150,000 NEW ACPTCONTRA

Credit "Outstanding acceptances"

Special 150,000 NEW ACPTBANK

or "Acceptances executed by Head Office and branches"

Special 150,000 NEW ACPTHO

Or "Acceptances executed by subsidiaries"

Special 150,000 NEW ACPTSUBS

On the Maturity date of 90 Days:

Credit "Customer’s liabilities for acceptance".

Special 150,000 MAT ACPTCONTRA

Debit "Outstanding acceptances"

Special 150,000 NEW ACPTBANK

or "Acceptances executed by Head Office and Branches"

Special 150,000 NEW ACPTHO

Or "Acceptances executed by Subsidiaries"

Special 150,000 NEW ACPTSUBS

The following entries will be raised online if the status is changed to MA online, otherwise entries will

be raised as part of the Close of Business processing.

Credit nostro through which payment will be made to the other

bank.

Stmt PAYCR

150,000

Debit customer account for whom the letter of credit was opened.

Stmt 150,000 PAYDR

Usance collection - not accepted or paid

A drawing for 175,000 payable in 90 days is sent for collection to the customer for whom the Letter of

Credit was opened and it is not accepted or paid.

TEMENOS T24 User Guide Page 84 of 198

Letters of Credit

On the day the documents are sent for collection:

Credit "Items sent for collection"

Special 175,000 NEW COLL

On the day that the documents are sent ‘In Trust’:

Credit "Items sent for collection"

Special 175,000 NEW TRCOLL

Debit "Outstanding credit unused".

Special 175,000 LIQ ISSUE

On the day that the notice of non-payment/acceptance is received:

Debit "Items sent for collection"

Special 175,000 NCP COLL

On the day that the notice of non-payment/acceptance is received if the documents have been sent ‘In

Trust’:

Debit Items sent for collection"

Special 175,,000 LIQ TRCOLL

Credit "Outstanding credit unused".

Special 175,000 REV ISSUE

Maturity of letter of credit

When an LC matures with a balance of 250,000 yet to be drawn, then on the maturity date:

Debit "Outstanding credit unused".

Special 250,000 MAT ISSUE

Collection Documents

On the day that the documents are received:

TEMENOS T24 User Guide Page 85 of 198

Letters of Credit

Credit "Items sent for Collection"

Special 100,000 NEW COLL

On the day that the documents are received and are sent ‘in Trust’:

Credit "Items sent for Collection"

Special 100,000 NEW TRCOLL

On the day that the documents sent under Trust are accepted:

Credit "Items sent for Collection"

Special 100,000 NEW COLL

Debit “Items sent for Collection”

Special 100,000 LIQ TRCOLL

On the day that the documents sent ‘In Trust are rejected:

Debit "Items sent for Collection"

Special 100,000 DEC TRCOLL

On the day that the documents are paid:

Debit "Items sent for Collection"

Special 100,000 LIQ COLL

Export letters of credit

The split for Head Office or subsidiaries will be obtained from the sector code of the customer record for

bank for whom we are processing the Letter of Credit.

Request to advise only

Requested to advise a Letter of Credit which has been opened for 2 million. On the day that the Letter of

Credit is input to T24:

Credit "LC advised"

Special 2,000,000 NEW ADVICE

TEMENOS T24 User Guide Page 86 of 198

Letters of Credit

Request to Confirm

Requested to confirm a Letter of Credit, which has been opened for 1.5 million. On the day that the Letter

of Credit is input to T24:

Credit "Outstanding credit unused"

Special 1,500,000 NEW CONFIRM

Request to open

A Letter of Credit is issued for 1 million. On the day it is input to T24:

Credit "Outstanding credit unused"

Special 1,000,000 NEW OPEN

Request to change an Export Letter of Credit from Advised to Confirmed

We are originally requested to advice a Letter of Credit for 2.5 million. We are subsequently asked to

add our confirmation to the Letter of Credit.

On the day that the original Letter of Credit is input to T24:

Credit "LC advised"

Special 2,500,000 NEW ADVICE

On the day that the confirmation is added the Letter of Credit is amended:

Debit "LC advised"

Special 2,500,000 CON ADVICE

Credit "Outstanding credit unused"

Special 2,500,000 ADV CONFIRM

Amendment of an Export Letter of Credit

A letter of credit is increased by 125,000. On the day of increase:

Credit "LC advised” or "Outstanding credit unused"

Special INC ADVICE/CONFIRM/OPEN

125,000

TEMENOS T24 User Guide Page 87 of 198

Letters of Credit

A letter of credit is decreased by 110,000 on the day of decrease:

Debit "LC advised" or "Outstanding credit unused"

Special D ADVICE/CONFIRM/OPEN

110,000

When the Letter of Credit is partially confirmed for 1,000,000:

If the Original entry were:

Credit "LC advised"

Special 2,500,00 NEW ADVICE/CONFIRM

0

It would now appear as:

Credit "LC advised"

Special 1,500,00 NEW ADVICE

0

Credit "LC advised"

Special 1,000,00 NEW CONFIRM

0

Debit "LC advised"

Special 2,500,00 REV ADVICE/CONFIRMN

0

Sight payment under an Export Letter of Credit

A drawing for 300,000 payable at sight is made then on the day payment is made:

Debit "Outstanding credit unused"

Special LIQ ADVICE/CONFIRM

300,000

A drawing for 300,000 payable at sight is made where the available confirmed portion under a partially

confirmed LC is 200,000, then on the day payment is made:

Debit "Outstanding credit unused"

Special LIQ CONFIRM

200,000

TEMENOS T24 User Guide Page 88 of 198

Letters of Credit

Debit "Outstanding credit unused"

Special LIQ ADVICE

100,000

These entries will always be raised online.

Credit account of customer requesting payment.

Stmt PAYCR

300,000

Debit nostro through which payment will be received from the other

bank.

Stmt PAYDR

300,000

Note: A message (Swift, telex, etc.) will be sent to this bank to advise that payment has been made

under a letter of credit and requesting reimbursement.

Usance acceptance of an Export Letter of Credit

A drawing for 100,000 payable in 90 days is accepted.

On day of acceptance:

Debit "Outstanding credit unused".

Special 100,000 LIQ CONFIRM/ADVICE

Debit "Customer’s liabilities for acceptance".

Special 100,000 NEW ACPTCONTRA

Credit "Outstanding acceptances"

Special 100,000 NEW ACPT

A drawing for 100,000 payable in 90 days is accepted where the confirmed portion available under a

Partially confirmed LC is 75,000.

On day of acceptance:

TEMENOS T24 User Guide Page 89 of 198

Letters of Credit

Debit "Outstanding credit unused".

Special 75,000 LIQ CONFIRM

Debit "Outstanding credit unused".

Special 25,000 LIQ ADVICE

Debit "Customer’s liabilities for acceptance".

Special 100,000 NEW ACPTCONTRA

Credit "Outstanding acceptances"

Special 100,000 NEW ACPT

On the expiry date of 90 Days:

Credit "Customer’s liabilities for acceptance".

Special 100,000 MAT ACPTCONTRA

Debit "Outstanding acceptances"

Special 100,000 MAT ACPT

The following entries will be raised online if the status is changed to MA online. Otherwise entries will

be raised as part of the Close of Business processing.

Credit account of customer requesting payment.

Stmt 100,000 PAYCR

Debit nostro through which payment will be received from the other

bank.

Stmt 100,000 PAYDR

Discount of own acceptance

A drawing for 200,000 is accepted payable in 90 days and is then presented for discount.

On day of acceptance:

Debit "Outstanding credit unused".

Special 200,000 LIQ ISSUE

TEMENOS T24 User Guide Page 90 of 198

Letters of Credit

Debit "Customer’s liabilities for acceptance".

Special 200,000 NEW ACPTCONTRA

Credit "Outstanding acceptances"

Special 200,000 NEW ACPT

On day of discounting assume this to be the same as acceptance day and that the amount for discount is

75 per day, which gives a total of 6,750 over the 90 days:

The special entries will be raised as part of the Close of Business, but the Stmt entry will be raised

online.

Note, for the "Own acceptances discounted" and "Discount received not yet earned" the CRF key will

need to be created using the customer to whom the discount has been given.

Debit "Own acceptances discounted".

Special 200,000 NEW LIVEDB

Credit "Discount received not yet earned".

Special 6,750 CAP Discount category from LC Parameter.

Credit Account of customer request discount or suspense account.

Stmt 193,250 DISPY

At the first month end as part of the Close of Business run an accrual will be made for the current month

assuming 10 days in month 1:

Debit "Discount received not yet earned".

Special 750 ACC Discount category from LC Parameter.

Credit profit and loss for discount earned using the discount category code from

LC.PARAMETER.

Categ 750 DISPL

At the other two month ends as part of the Close of Business run an accrual will be made for the current

month assuming 31 days in each of the months:

TEMENOS T24 User Guide Page 91 of 198

Letters of Credit

Debit "Discount received not yet Earned".

Special ACC Discount category from LC Parameter.

2,325

Credit Profit and loss for discount earned using the discount category code from

LC.PARAMETER.

Categ 2,325 DISPL

On day expiry of 90 Days:

These entries will be raised as part of the Close of Business run:

Credit "Customer’s liabilities for acceptance".

Special 200,000 MAT ACPTCONTRA

Debit "Outstanding acceptances"

Special 200,000 MAT ACPT

Debit "Discount received not yet earned".

Special 1,350 ACC Discount category from LC Parameter

Credit P&L for discount earned using the category code from LC.PARAMETER.

Categ 1,350 DISPL

Credit "Own acceptances discounted".

Special 200,000 MAT LIVEDB

Debit nostro through which payment will be received from the other bank.

Stmt 200,000 PAYDR

Discount of own acceptance.

A drawing for 400,000 is accepted payable in 90 days and is then presented for discount.

On day of acceptance:

TEMENOS T24 User Guide Page 92 of 198

Letters of Credit

Debit "Outstanding credit unused".

Special 400,000 LIQ ISSUE

Debit "Customer’s liabilities for acceptance".

Special 400,000 NEW ACPTCONTRA

Credit "Outstanding acceptances"

Special 400,000 NEW ACPT

On day of discounting assume this to be the same as acceptance day and that the amount for

discount works out at being 150 per day giving a total of 13,500 over the 90 days and the extra load

amount is 50 per day giving a total of 4,500 over the 90 days:

The special entries will be raised during Close of Business, but the Stmt entry will be raised online.

Note for the "Own acceptances discounted" and "Discount received not yet earned" the CRF key will

need to be created using the customer to whom the discount has been given.

Debit "Own acceptances discounted".

Special 400,000 NEW LIVEDB

Credit "Discount received not yet earned".

Special 13,500 CAP Discount Category from LC

Parameter.

Credit "Discount (load) received not yet earned".

Special CAP Load Category from LC Parameter.

4,500

Credit account of customer request discount or suspense account.

Stmt DISPY

382,00

0

At the first month end as part of the Close of Business run an accrual will be made for the current

month assuming 10 days in month 1:

Debit "Discount received not yet earned".

Special ACC Discount category from LC Parameter.

1,500

TEMENOS T24 User Guide Page 93 of 198

Letters of Credit

Credit profit and loss for discount earned using the discount category code from LC

Parameter.

Categ 1,500 DISPL

Debit "Discount (load) received not yet earned".

Special 500 ACC Load category from LC Parameter.

Credit profit and loss for discount (load) earned using the load category code from LC

Parameter.

Categ 500 DISPL

At the other two month ends as part of the Close of Business run an accrual will be made for the

current month assuming 31 days in each of the months:

Debit "Discount received not yet earned".

Special ACC Discount category from LC Parameter.

4,650

Credit Profit and loss for discount earned using the discount category code from LC

Parameter.

Categ 4,650 DISPL

Debit "Discount (load) received not yet earned".

Special ACC Load category from LC Parameter.

1,550

Credit Profit and loss for discount (load) earned using the load category code from LC

Parameter.

Categ 1,550 DISPL

On day of expiry, of 90 Days, these entries will be raised as part of the Close of Business run:

Credit "Customer’s liabilities for acceptance".

Special 400,000 MAT ACPTCONTRA

Debit "Outstanding acceptances"

Special 400,000 MAT ACPT

TEMENOS T24 User Guide Page 94 of 198

Letters of Credit

Debit "Discount received not yet earned".

Special 2,700 ACC Discount category from LC Parameter.

Credit profit and loss for discount earned using the discount category code from LC

Parameter.

Categ 2,700 DISPL

Debit "Discount (load) received not yet earned".

Special 900 ACC Load category from LC Parameter.

Credit profit and loss for discount (load) earned using the load category code from LC

Parameter.

Categ 900 DISPL

Credit "Own acceptances discounted".

Special 400,000 MAT LIVEDB

Debit nostro through which payment will be received from the other bank.

Stmt 400,000 PAYDR

Sight collection – paid

A drawing for 350,000 payable at sight sent for collection to the Bank that opened the LC and payment

is made.

On day sent for collection:

Credit "Items sent for collection"

Special 350,000 NEW COLL

On day payment received:

Debit "Outstanding credit unused".

Special 350,000 LIQ ISSUE

Debit "Items sent for collection"

Special 350,000 PAY COLL

The following entries will always be raised online:

TEMENOS T24 User Guide Page 95 of 198

Letters of Credit

Credit account of customer requesting payment.

Stmt 350,000 PAYCR

Debit nostro through which payment was received from the other bank.

Stmt 350,000 PAYDR

Sight collection - not paid

A drawing for 225,000 payable at sight is sent for collection to the bank that opened the letter of credit

but it is not paid.

On day sent for collection:

Credit "Items sent for collection"

Special 225,000 NEW COLL