Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Finance Beta - India

Caricato da

g95734070 valutazioniIl 0% ha trovato utile questo documento (0 voti)

34 visualizzazioni4 pagineBeta values of India's finance industries

Copyright

© © All Rights Reserved

Formati disponibili

XLS, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoBeta values of India's finance industries

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLS, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

34 visualizzazioni4 pagineFinance Beta - India

Caricato da

g9573407Beta values of India's finance industries

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLS, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

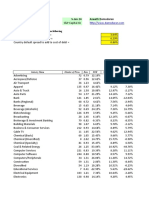

Date updated: 5-Jan-18

Created by: Aswath Damodaran, adamodar@stern.nyu.edu

What is this data? Beta, Unlevered beta and other risk measures India

Home Page: http://www.damodaran.com

Data website: http://www.stern.nyu.edu/~adamodar/New_Home_Page/data.html

Companies in each industry: http://www.stern.nyu.edu/~adamodar/pc/datasets/indname.xls

Variable definitions: http://www.stern.nyu.edu/~adamodar/New_Home_Page/datafile/variable.htm

Do you want to use marginal or effective tax rates in unlevering betas? Marginal

If marginal tax rate, enter the marginal tax rate to use 30.00%

Effective

Industry Name Number of firms Beta D/E Ratio Tax rate Unlevered beta Cash/Firm value Unlevered beta corrected for cash HiLo Risk Standard deviation of equity

Advertising 3 0.69 1.23% 21.08% 0.69 0.08% 0.69 0.4689 42.09%

Aerospace/Defense 4 1.60 0.08% 24.97% 1.60 0.00% 1.60 0.2882 37.84%

Air Transport 5 0.84 32.69% 5.11% 0.69 5.54% 0.73 0.4224 37.27%

Apparel 315 0.97 25.04% 17.47% 0.82 4.07% 0.86 0.3515 40.24%

Auto & Truck 12 1.88 10.77% 17.51% 1.75 4.09% 1.82 0.2610 27.67%

Auto Parts 94 1.66 6.31% 23.53% 1.59 1.20% 1.61 0.3664 36.20%

Bank (Money Center) 37 2.52 46.80% 19.29% 1.90 11.29% 2.14 0.2608 29.25%

Banks (Regional) 1 1.83 25.30% 0.00% 1.56 57.69% 3.68 0.3295 30.91%

Beverage (Alcoholic) 19 0.60 2.64% 19.59% 0.59 0.08% 0.59 0.3849 34.94%

Beverage (Soft) 3 0.78 14.23% 27.07% 0.71 0.02% 0.71 0.3735 38.12%

Broadcasting 14 1.12 2.98% 17.47% 1.10 1.37% 1.11 0.3096 33.64%

Brokerage & Investment Bank 150 0.65 81.18% 16.67% 0.41 7.52% 0.45 0.4292 43.40%

Building Materials 45 1.19 11.32% 19.15% 1.10 0.79% 1.11 0.3740 41.76%

Business & Consumer Service 31 0.42 4.76% 16.83% 0.40 2.70% 0.41 0.3772 35.36%

Cable TV 8 1.19 15.09% 4.45% 1.07 3.20% 1.11 0.3348 29.45%

Chemical (Basic) 129 1.40 8.62% 20.78% 1.32 0.97% 1.34 0.3823 39.11%

Chemical (Diversified) 11 1.92 10.54% 19.27% 1.79 2.23% 1.83 0.2792 30.29%

Chemical (Specialty) 132 1.26 8.82% 22.54% 1.18 1.03% 1.20 0.3431 38.64%

Coal & Related Energy 4 1.10 0.25% 17.26% 1.10 18.32% 1.35 0.2659 20.89%

Computer Services 102 0.83 3.10% 16.14% 0.81 3.48% 0.84 0.3624 38.09%

Computers/Peripherals 9 0.22 16.78% 4.03% 0.20 5.32% 0.21 0.3743 46.02%

Construction Supplies 88 1.90 15.11% 18.77% 1.72 0.66% 1.73 0.3447 35.71%

Diversified 12 1.84 4.42% 14.02% 1.78 0.39% 1.79 0.3231 32.73%

Drugs (Biotechnology) 8 1.33 6.37% 12.24% 1.27 1.97% 1.29 0.4595 42.89%

Drugs (Pharmaceutical) 144 1.23 15.61% 17.96% 1.11 3.29% 1.15 0.3137 36.12%

Education 21 1.08 10.94% 20.12% 1.00 3.24% 1.03 0.3326 41.23%

Electrical Equipment 96 1.38 11.45% 17.45% 1.28 0.97% 1.29 0.3666 38.76%

Electronics (Consumer & Offic 7 1.41 11.71% 4.69% 1.31 1.76% 1.33 0.5216 49.78%

Electronics (General) 19 0.71 5.04% 12.99% 0.68 3.09% 0.71 0.3784 36.94%

Engineering/Construction 125 1.71 50.35% 17.76% 1.26 2.32% 1.29 0.3686 42.06%

Entertainment 49 0.79 29.47% 11.23% 0.66 1.12% 0.67 0.4044 42.17%

Environmental & Waste Servi 3 1.86 4.13% 15.39% 1.81 1.07% 1.83 0.4546 57.77%

Farming/Agriculture 44 1.22 16.86% 14.42% 1.09 0.81% 1.10 0.3865 40.33%

Financial Svcs. (Non-bank & 194 0.89 94.72% 19.94% 0.54 1.53% 0.55 0.3963 36.17%

Food Processing 163 1.37 4.13% 16.76% 1.33 1.67% 1.35 0.3816 42.18%

Food Wholesalers 23 0.58 8.16% 17.83% 0.55 45.46% 1.01 0.4432 43.97%

Furn/Home Furnishings 27 0.97 6.54% 20.16% 0.93 1.46% 0.94 0.3769 36.30%

Green & Renewable Energy 13 1.24 16.83% 5.80% 1.11 3.05% 1.14 0.3578 41.22%

Effective

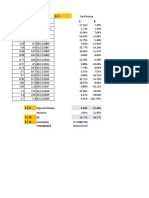

Industry Name Number of firms Beta D/E Ratio Tax rate Unlevered beta Cash/Firm value Unlevered beta corrected for cash HiLo Risk Standard deviation of equity

Healthcare Products 6 0.61 35.50% 11.78% 0.49 0.26% 0.49 0.2811 43.19%

Healthcare Support Services 14 0.29 1.04% 20.98% 0.29 2.41% 0.30 0.3553 30.77%

Heathcare Information and T 10 1.15 7.31% 10.90% 1.09 0.92% 1.10 0.3381 37.89%

Homebuilding 1 NA 0.00% 35.04% #VALUE! 0.00% #VALUE! 0.1321 NA

Hospitals/Healthcare Facilities 16 0.81 10.77% 23.31% 0.76 0.21% 0.76 0.2301 29.70%

Hotel/Gaming 51 1.11 25.46% 18.06% 0.94 3.70% 0.98 0.3185 33.48%

Household Products 31 0.63 0.97% 20.96% 0.63 0.32% 0.63 0.3034 27.41%

Information Services 17 1.50 2.10% 22.33% 1.48 3.15% 1.52 0.3347 40.94%

Insurance (General) 1 2.26 61.03% 30.79% 1.58 0.78% 1.60 0.3422 26.39%

Insurance (Life) 4 1.19 0.07% 14.89% 1.19 0.98% 1.20 0.1574 27.13%

Insurance (Prop/Cas.) 2 NA 0.76% 20.08% #VALUE! 9.54% #VALUE! 0.1500 NA

Investments & Asset Manage 79 0.62 58.21% 13.01% 0.44 2.68% 0.45 0.4091 37.18%

Machinery 138 1.29 2.62% 23.62% 1.27 1.87% 1.29 0.3636 36.35%

Metals & Mining 32 1.54 16.73% 23.75% 1.38 0.53% 1.39 0.3820 45.88%

Office Equipment & Services 11 0.61 0.57% 16.06% 0.61 3.27% 0.63 0.3189 33.23%

Oil/Gas (Integrated) 0 0.00 NA 0.00% #VALUE! #DIV/0! #DIV/0! 0.0000 0.00%

Oil/Gas (Production and Explo 9 1.88 9.07% 22.41% 1.77 0.09% 1.77 0.2670 30.18%

Oil/Gas Distribution 9 1.59 30.12% 16.84% 1.31 4.35% 1.37 0.3240 34.26%

Oilfield Svcs/Equip. 20 1.80 21.55% 18.68% 1.56 0.19% 1.57 0.3170 39.97%

Packaging & Container 60 1.15 25.69% 19.60% 0.97 1.80% 0.99 0.3681 42.60%

Paper/Forest Products 53 0.83 53.52% 14.99% 0.61 0.66% 0.61 0.3912 42.00%

Power 34 1.48 33.06% 16.25% 1.20 0.58% 1.21 0.3040 29.52%

Precious Metals 3 1.14 41.51% 17.06% 0.88 3.51% 0.92 0.3263 45.37%

Publishing & Newspapers 19 0.68 9.27% 21.84% 0.64 2.35% 0.66 0.2951 24.38%

R.E.I.T. 0 0.00 NA 0.00% #VALUE! #DIV/0! #DIV/0! 0.0000 0.00%

Real Estate (Development) 109 1.03 31.47% 18.23% 0.84 1.95% 0.86 0.3770 41.11%

Real Estate (General/Diversifi 18 2.14 55.57% 22.36% 1.54 3.23% 1.59 0.4537 41.40%

Real Estate (Operations & Ser 21 0.22 10.53% 12.34% 0.20 0.43% 0.20 0.3368 34.66%

Recreation 14 1.00 37.33% 15.55% 0.79 1.56% 0.80 0.3250 40.95%

Reinsurance 1 NA 0.00% 11.60% #VALUE! 20.11% #VALUE! 0.0860 NA

Restaurant/Dining 8 0.86 20.19% 23.44% 0.75 5.98% 0.80 0.4074 33.34%

Retail (Automotive) 2 0.86 56.24% 42.92% 0.62 9.56% 0.68 0.3111 36.34%

Retail (Building Supply) 1 NA 6.66% 34.97% #VALUE! 0.14% #VALUE! 0.6254 NA

Retail (Distributors) 152 0.54 62.16% 15.60% 0.37 2.94% 0.39 0.4289 40.02%

Retail (General) 5 2.08 13.45% 19.96% 1.90 0.58% 1.91 0.5154 37.21%

Retail (Grocery and Food) 3 1.29 2.11% 31.99% 1.27 0.05% 1.27 0.5176 69.52%

Retail (Online) 8 0.85 1.68% 13.67% 0.84 6.98% 0.90 0.3430 51.77%

Retail (Special Lines) 15 1.46 6.30% 15.10% 1.40 0.44% 1.40 0.4283 56.48%

Rubber& Tires 16 1.52 16.19% 20.08% 1.36 1.27% 1.38 0.3073 32.68%

Semiconductor 8 1.39 19.38% 13.15% 1.22 0.75% 1.23 0.4525 56.32%

Semiconductor Equip 0 0.00 NA 0.00% #VALUE! #DIV/0! #DIV/0! 0.0000 0.00%

Shipbuilding & Marine 17 1.59 24.88% 22.65% 1.35 1.66% 1.37 0.3126 36.61%

Shoe 11 1.41 2.31% 21.68% 1.39 0.05% 1.39 0.3771 35.72%

Software (Entertainment) 0 0.00 NA 0.00% #VALUE! #DIV/0! #DIV/0! 0.0000 0.00%

Software (Internet) 14 0.33 1.11% 13.89% 0.32 0.66% 0.33 0.4273 38.20%

Software (System & Applicati 68 1.08 9.78% 15.59% 1.01 5.93% 1.07 0.3635 43.32%

Steel 158 1.51 56.48% 16.35% 1.08 1.65% 1.10 0.4122 44.83%

Effective

Industry Name Number of firms Beta D/E Ratio Tax rate Unlevered beta Cash/Firm value Unlevered beta corrected for cash HiLo Risk Standard deviation of equity

Telecom (Wireless) 5 1.91 105.88% 10.00% 1.10 0.43% 1.10 0.4180 41.26%

Telecom. Equipment 21 1.36 8.68% 22.25% 1.28 2.73% 1.32 0.3858 39.55%

Telecom. Services 7 0.87 14.77% 4.19% 0.78 1.59% 0.80 0.3452 31.39%

Tobacco 5 1.58 0.02% 25.30% 1.58 0.01% 1.58 0.2665 34.31%

Transportation 26 1.51 35.95% 15.23% 1.21 1.28% 1.22 0.2811 37.53%

Transportation (Railroads) 2 1.09 0.07% 13.98% 1.09 0.00% 1.09 0.2194 20.62%

Trucking 10 0.60 9.71% 28.49% 0.56 0.75% 0.57 0.3285 38.17%

Utility (General) 0 0.00 NA 0.00% #VALUE! #DIV/0! #DIV/0! 0.0000 0.00%

Utility (Water) 2 1.06 16.03% 34.86% 0.96 3.89% 0.99 0.1724 38.79%

Total Market 3511 1.16 26.35% 18.04% 0.98 3.31% 1.02 0.3686 38.79%

Total Market (without financia 3043 1.12 17.29% 18.11% 1.00 2.02% 1.02 0.3645 #VALUE!

Effective

Marginal

Potrebbero piacerti anche

- Date Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsDocumento7 pagineDate Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsvicoraulNessuna valutazione finora

- YouTube Video explaining risk measures for industriesDocumento7 pagineYouTube Video explaining risk measures for industriesSindy JimenezNessuna valutazione finora

- BetasDocumento4 pagineBetasRICARDO ANDRES ROJAS ALARCONNessuna valutazione finora

- Date Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsDocumento6 pagineDate Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsJose Hines-AlvaradoNessuna valutazione finora

- Bottom-Up BetaDocumento15 pagineBottom-Up BetaMihael Od SklavinijeNessuna valutazione finora

- IAS 36 WACC Calculation ExampleDocumento36 pagineIAS 36 WACC Calculation ExampleJessyRityNessuna valutazione finora

- Bottom up unlevered beta calculationDocumento18 pagineBottom up unlevered beta calculationTimothy NguyenNessuna valutazione finora

- Betas by SectorDocumento2 pagineBetas by SectorTrose Li100% (1)

- Tabla 01 - Beta Del SectorDocumento2 pagineTabla 01 - Beta Del SectorGambi LopezNessuna valutazione finora

- BetasDocumento1 paginaBetaslu acoriNessuna valutazione finora

- BetasDocumento8 pagineBetasHillary DayanNessuna valutazione finora

- Betas DamodaranDocumento2 pagineBetas DamodaranFabiola Brigida Yauri QuispeNessuna valutazione finora

- Date Updated: 5-Jan-14 Aswath DamodaranDocumento3 pagineDate Updated: 5-Jan-14 Aswath DamodaranHillary DayanNessuna valutazione finora

- Bottom Up Unlevered BetaDocumento12 pagineBottom Up Unlevered BetaUyen HoangNessuna valutazione finora

- Betas by Industry and Sector AnalysisDocumento4 pagineBetas by Industry and Sector AnalysisVanessa José Claudio IsaiasNessuna valutazione finora

- BetasDocumento7 pagineBetasWendy FernándezNessuna valutazione finora

- BetasDocumento7 pagineBetasJulio Cesar ChavezNessuna valutazione finora

- Gloria-Grupo 5Documento424 pagineGloria-Grupo 5giban mendozaNessuna valutazione finora

- CSR Budget and Financial Performance Cleaned v3Documento89 pagineCSR Budget and Financial Performance Cleaned v3Nobita Trót Yêu XukaNessuna valutazione finora

- Indicadores 2023 08Documento21 pagineIndicadores 2023 08Maria Fernanda TrigoNessuna valutazione finora

- Examen FinalDocumento44 pagineExamen FinalBETTY STEFFANY PAZ CELISNessuna valutazione finora

- Aggregate Market Data for Various IndustriesDocumento3 pagineAggregate Market Data for Various IndustriesVadinee TailorNessuna valutazione finora

- Date Updated: 5-Jan-14 Aswath Damodaran: To Update This Spreadsheet, Enter The FollowingDocumento9 pagineDate Updated: 5-Jan-14 Aswath Damodaran: To Update This Spreadsheet, Enter The FollowingTony BrookNessuna valutazione finora

- Industry Financial RatiosDocumento6 pagineIndustry Financial RatiosAndres ZNessuna valutazione finora

- BetasDocumento10 pagineBetasVilmaCastilloMNessuna valutazione finora

- Betas DamodaranDocumento312 pagineBetas DamodaranJoseLuisTangaraNessuna valutazione finora

- Industry Name Number of Firms ROC Reinvestment Rate Expected Growth in EBITDocumento3 pagineIndustry Name Number of Firms ROC Reinvestment Rate Expected Growth in EBITruchi gulatiNessuna valutazione finora

- Industry Name Number of Firms Beta D/E Ratio Tax RateDocumento6 pagineIndustry Name Number of Firms Beta D/E Ratio Tax RateIngebusas IngebusasNessuna valutazione finora

- Clase 6 de Abril 2021Documento12 pagineClase 6 de Abril 2021Wendy Paola Arrieta EscobarNessuna valutazione finora

- Apartaments CostosDocumento28 pagineApartaments CostosAlbert BagesNessuna valutazione finora

- Market Cap (% of GDP)Documento56 pagineMarket Cap (% of GDP)Md. Real MiahNessuna valutazione finora

- Indic AdoresDocumento4 pagineIndic AdoresVicit LainezNessuna valutazione finora

- PSIC Industry VAT RatesDocumento4 paginePSIC Industry VAT RatesMark Aguinaldo50% (2)

- Hot-Accounts Google FinanceDocumento5 pagineHot-Accounts Google Financerbp_1973Nessuna valutazione finora

- BetasDocumento19 pagineBetasasesor2009Nessuna valutazione finora

- SectorDocumento2 pagineSectorMd. Real MiahNessuna valutazione finora

- Industry Name Number of Firms EBITDASG&A/Sales EBITDA/Sales EBIT/SalesDocumento6 pagineIndustry Name Number of Firms EBITDASG&A/Sales EBITDA/Sales EBIT/Salesruchi gulatiNessuna valutazione finora

- WebsiteDocumento8 pagineWebsiteThet Htar's NoteNessuna valutazione finora

- NadiDocumento7 pagineNadisamikriteshNessuna valutazione finora

- RATIOS (Common Size Balance Sheet)Documento4 pagineRATIOS (Common Size Balance Sheet)meenakshi vermaNessuna valutazione finora

- Main YearDocumento3 pagineMain YearKe ShuNessuna valutazione finora

- Covid DataDocumento4 pagineCovid DataBangur Palash KamalkishorNessuna valutazione finora

- Yuken IndiaDocumento18 pagineYuken IndiaVishalPandeyNessuna valutazione finora

- Company Name ROE (%) Payout Ratio (%) Retention Ratio (%) : Regression StatisticsDocumento19 pagineCompany Name ROE (%) Payout Ratio (%) Retention Ratio (%) : Regression StatisticsSHIKHA CHAUHANNessuna valutazione finora

- mktcapriskDocumento6 paginemktcapriskFabiana ArteagaNessuna valutazione finora

- Projections 2023Documento8 pagineProjections 2023DHANAMNessuna valutazione finora

- Country Operator ERAB PerformanceDocumento5 pagineCountry Operator ERAB PerformanceMuhammad ZainNessuna valutazione finora

- Accidentes Motocicletas: Regiondepartamentos. 2016 2017 2016 Casos FR Casos FR FRDocumento4 pagineAccidentes Motocicletas: Regiondepartamentos. 2016 2017 2016 Casos FR Casos FR FRjulio sanchezNessuna valutazione finora

- Product and Period CostsDocumento6 pagineProduct and Period CostsJasneet BaidNessuna valutazione finora

- Book17Documento8 pagineBook17Madhav GargNessuna valutazione finora

- Internship Portfolio OptimizationDocumento11 pagineInternship Portfolio OptimizationDinakaranNessuna valutazione finora

- Sector industry weights TSX JSI TSX60Documento2 pagineSector industry weights TSX JSI TSX60EarthlyPowers61Nessuna valutazione finora

- Kondisi Ekonomi P1 E (R) 1 2 3 4 5 6 7 R % R % R - E (R) R - E (R)Documento10 pagineKondisi Ekonomi P1 E (R) 1 2 3 4 5 6 7 R % R % R - E (R) R - E (R)Bella AngelinaNessuna valutazione finora

- Stock Screener203229Documento3 pagineStock Screener203229Sde BdrNessuna valutazione finora

- Deepshikha 1116 CFDocumento4 pagineDeepshikha 1116 CFDeepshikha DasguptaNessuna valutazione finora

- Casting CompareDocumento2 pagineCasting Compareprith.m217425Nessuna valutazione finora

- Factsheet Close Ended Mar 2020Documento114 pagineFactsheet Close Ended Mar 2020Aditya SharmaNessuna valutazione finora

- Midland EnergyDocumento7 pagineMidland EnergyNischal UpretiNessuna valutazione finora

- Environmental Analysis and Technology for the Refining IndustryDa EverandEnvironmental Analysis and Technology for the Refining IndustryNessuna valutazione finora

- Paper 1Documento19 paginePaper 1Aarnaa singhNessuna valutazione finora

- 4835Documento23 pagine4835Barun SinghNessuna valutazione finora

- Rainwater Harvesting For Drylands and Beyond by Brad Lancaster Rainwater and Permaculture HandoutsDocumento5 pagineRainwater Harvesting For Drylands and Beyond by Brad Lancaster Rainwater and Permaculture Handoutsg9573407Nessuna valutazione finora

- Marksans IR Presentation Q4FY20Documento34 pagineMarksans IR Presentation Q4FY20g9573407Nessuna valutazione finora

- Mrks 2014Documento132 pagineMrks 2014g9573407Nessuna valutazione finora

- Training Manual: Water Food Energy Shelter SanitationDocumento195 pagineTraining Manual: Water Food Energy Shelter Sanitationg9573407Nessuna valutazione finora

- 13 Steps To Bloody Good Wealth (PDFDrive)Documento177 pagine13 Steps To Bloody Good Wealth (PDFDrive)g9573407Nessuna valutazione finora

- Thirty Third Annual Report 1Documento114 pagineThirty Third Annual Report 1g9573407Nessuna valutazione finora

- Grindwell AR 2019 20Documento196 pagineGrindwell AR 2019 20g9573407Nessuna valutazione finora

- (H. W. Schomerus, Humphrey Palmer, Mary Law) Saiva (BDocumento427 pagine(H. W. Schomerus, Humphrey Palmer, Mary Law) Saiva (BSiva Subramani100% (1)

- Marksans Investor Presentation Sept2020Documento34 pagineMarksans Investor Presentation Sept2020g9573407Nessuna valutazione finora

- Marksans IR Presentation Q1FY21Documento34 pagineMarksans IR Presentation Q1FY21g9573407Nessuna valutazione finora

- Sales BrochureDocumento2 pagineSales BrochureMalay Kr SinghNessuna valutazione finora

- PIIndustries-Aug14 17Documento3 paginePIIndustries-Aug14 17g9573407Nessuna valutazione finora

- Health Care Safe Hands... : Annual ReportDocumento72 pagineHealth Care Safe Hands... : Annual Reportg9573407Nessuna valutazione finora

- Marks Sans Pharma 13Documento92 pagineMarks Sans Pharma 13g9573407Nessuna valutazione finora

- Rfa 2017 en Us90130a1016 PDFDocumento160 pagineRfa 2017 en Us90130a1016 PDFg9573407Nessuna valutazione finora

- BOARD REPORT HIGHLIGHTSDocumento164 pagineBOARD REPORT HIGHLIGHTSpradipdeNessuna valutazione finora

- s40613 016 0045 5 PDFDocumento13 pagines40613 016 0045 5 PDFАлександр ЛогиновNessuna valutazione finora

- HarningVanderdonckt Interact2003 PDFDocumento110 pagineHarningVanderdonckt Interact2003 PDFg9573407Nessuna valutazione finora

- HarningVanderdonckt Interact2003 PDFDocumento110 pagineHarningVanderdonckt Interact2003 PDFg9573407Nessuna valutazione finora

- WETDocumento364 pagineWETChandrika DasNessuna valutazione finora

- Praud ThalesDocumento5 paginePraud Thalesg9573407Nessuna valutazione finora

- Higher Education in India 2009Documento88 pagineHigher Education in India 2009g9573407Nessuna valutazione finora

- IT - 413 HumanComputerInteractionHCI2010Documento45 pagineIT - 413 HumanComputerInteractionHCI2010Romeo BalingaoNessuna valutazione finora

- Direct To Home DTH Market in India 2009Documento38 pagineDirect To Home DTH Market in India 2009g9573407Nessuna valutazione finora

- Food Processing Industry in India 2009Documento34 pagineFood Processing Industry in India 2009g9573407Nessuna valutazione finora

- C15 DiagranmaDocumento2 pagineC15 Diagranmajose manuel100% (1)

- Service ManualDocumento14 pagineService ManualOlegNessuna valutazione finora

- 3.1. Optical Sources - LED - FOC - PNP - February 2022 - NewDocumento49 pagine3.1. Optical Sources - LED - FOC - PNP - February 2022 - NewyashNessuna valutazione finora

- CamScanner Scanned PDF DocumentDocumento205 pagineCamScanner Scanned PDF DocumentNabila Tsuroya BasyaNessuna valutazione finora

- Markard Et Al. (2012) PDFDocumento13 pagineMarkard Et Al. (2012) PDFgotrektomNessuna valutazione finora

- Logistic RegressionDocumento17 pagineLogistic RegressionLovedeep Chaudhary100% (1)

- L5 Isomerism 3Documento16 pagineL5 Isomerism 3Cheng FuNessuna valutazione finora

- Noor Hafifi Bin Jalal: Operating Code 1: Demand ForecastDocumento47 pagineNoor Hafifi Bin Jalal: Operating Code 1: Demand ForecastGopalakrishnan SekharanNessuna valutazione finora

- rfg040208 PDFDocumento2.372 paginerfg040208 PDFMr DungNessuna valutazione finora

- How COVID-19 Affects Corporate Financial Performance and Corporate Valuation in Bangladesh: An Empirical StudyDocumento8 pagineHow COVID-19 Affects Corporate Financial Performance and Corporate Valuation in Bangladesh: An Empirical StudyInternational Journal of Innovative Science and Research TechnologyNessuna valutazione finora

- Ammonium Nitrophosphate Production ProcessDocumento133 pagineAmmonium Nitrophosphate Production ProcessHit Busa100% (1)

- Sample COBOL ProgramsDocumento35 pagineSample COBOL Programsrahul tejNessuna valutazione finora

- 14.4 Demonstration of Leak Before Break Design Criteria For Pipes of PHT System PHWRDocumento2 pagine14.4 Demonstration of Leak Before Break Design Criteria For Pipes of PHT System PHWRRoman KrautschneiderNessuna valutazione finora

- Ahmed (2018)Documento9 pagineAhmed (2018)zrancourttremblayNessuna valutazione finora

- Non-Traditional Machining: Unit - 1Documento48 pagineNon-Traditional Machining: Unit - 1bunty231Nessuna valutazione finora

- Dialysis PowerpointDocumento10 pagineDialysis Powerpointapi-266328774Nessuna valutazione finora

- List of Steel Products Made in The UK PDFDocumento120 pagineList of Steel Products Made in The UK PDFAntonio MarrufoNessuna valutazione finora

- Boast 98Documento19 pagineBoast 98jghleivaNessuna valutazione finora

- Consular Assistance For Indians Living Abroad Through "MADAD"Documento12 pagineConsular Assistance For Indians Living Abroad Through "MADAD"NewsBharatiNessuna valutazione finora

- Fa2prob3 1Documento3 pagineFa2prob3 1jayNessuna valutazione finora

- Particulars Unit BOQ NO. BOQ QTY: Bill of Quantity Bill of QuantityDocumento8 pagineParticulars Unit BOQ NO. BOQ QTY: Bill of Quantity Bill of QuantityAbbasNessuna valutazione finora

- Plastic BanDocumento3 paginePlastic BanSangeetha IlangoNessuna valutazione finora

- Computer Assisted Language LearningDocumento9 pagineComputer Assisted Language Learningapi-342801766Nessuna valutazione finora

- Tax - CIR Vs Cebu Toyo DigestDocumento3 pagineTax - CIR Vs Cebu Toyo DigestDyannah Alexa Marie RamachoNessuna valutazione finora

- E-Leadership Literature ReviewDocumento36 pagineE-Leadership Literature ReviewYasser BahaaNessuna valutazione finora

- Installation Guide for lemonPOS POS SoftwareDocumento4 pagineInstallation Guide for lemonPOS POS SoftwareHenry HubNessuna valutazione finora

- Martek Navgard BnwasDocumento4 pagineMartek Navgard BnwasСергей БородинNessuna valutazione finora

- Inbound 2500783350734459126Documento3 pagineInbound 2500783350734459126SirjanNessuna valutazione finora

- MCT-MST Formative Report Form 2bashaer AwadDocumento9 pagineMCT-MST Formative Report Form 2bashaer Awadapi-315648941Nessuna valutazione finora

- Effective Postoperative Pain Management StrategiesDocumento10 pagineEffective Postoperative Pain Management StrategiesvenkayammaNessuna valutazione finora