Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Table of Content

Caricato da

adnan04Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Table of Content

Caricato da

adnan04Copyright:

Formati disponibili

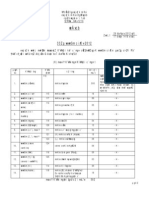

Table of content

Particulars Page

No.

Chapter 01 Introduction 1-3

1.1 Introduction 1

1.2 Objective of the Study 2

1.3 Methodology 2

1.4 Sources of Data 2

1.5 Method of data analysis 4

1.6 Scope of Report 3

1.6 Limitations of the Report 3

Chapter 4-8

Overview of Companies

02

2.1 Overview 4

2.2 Energy Sector Structure of Bangladesh 4

2.3 Corporate Goal 5

2.4 Analysis of Goal Strategies 7

2.5 Corporate Social Responsibility 7

Chapter Capital Structure 9-29

03

3.1 Capital Structure 9

3.2 Company’s cost of equity 10

3.3 Company’s cost of Debt 10

3.4 Determining WACC 12-14

3.5 Capital Structure Analysis 15-23

3.6 Factor Affecting Capital Structure (Checklist) 24-29

Chapter Dividend Policy 30-40

04

4.1 Dividend Policy 30-31

4.2 The Dividends Puzzle: Stylized Facts 32

4.3 Scenario of Dividend Distribution of Summit Power Limited 33

4.4 Scenario of Dividend Distribution of Baraka Power Limited 34

4.5 Dividend Policy Analysis 35

4.6 Factors affecting Dividend Policy (Checklist) 36-38

4.7 The stylized facts of the dividend behavior 39-40

Chapter Credit Risk Grading (CRG) 40-44

05

5.1 Credit Risk Grading 41

5.2 Functions of Credit Risk Grading 41

5.3 Use of Credit Risk Grading 41

5.4 Credit Risk Grading Score of Summit Power Ltd & Baraka 42

Power Ltd

5.5 Bankruptcy Prediction 43-45

5.6 Z-score for Summit Power Limited 45

5.7 Z-score for Baraka Power Limited 46

Chapter 06 Findings & Recommendation 47-48

6.1 Findings and Recommendation 47-48

Chapter 07 Conclusion 49

7.1 Conclusion 49

7.2 Appendix

7.2.1 Appendix-A

7.2.2 Appendix-B

7.2.3 Appendix-C

7.2.4 Appendix-D

Potrebbero piacerti anche

- Making The Business Case For Software AssuranceDocumento119 pagineMaking The Business Case For Software AssuranceSoftware Engineering Institute Publications100% (3)

- Daewoo Express PakistanDocumento123 pagineDaewoo Express Pakistanshahidzaman80% (5)

- # Project ContentsDocumento2 pagine# Project ContentsLakshmi PrabhuNessuna valutazione finora

- Guidelines for Investigating Chemical Process IncidentsDa EverandGuidelines for Investigating Chemical Process IncidentsNessuna valutazione finora

- Financial Performance of Niloy Motors LimitedDocumento55 pagineFinancial Performance of Niloy Motors LimitedA H LabuNessuna valutazione finora

- Trust, Complexity and Control: Confidence in a Convergent WorldDa EverandTrust, Complexity and Control: Confidence in a Convergent WorldNessuna valutazione finora

- Loan Policy Document 2019-20 Part-A PDFDocumento176 pagineLoan Policy Document 2019-20 Part-A PDFSamiran DebnathNessuna valutazione finora

- SCDL Project PDFDocumento139 pagineSCDL Project PDFadnanshaikh09100% (1)

- WYJS Report Appendix 2 270617Documento44 pagineWYJS Report Appendix 2 270617farmersproduce6Nessuna valutazione finora

- Credit Rating Prediction: Using Self-Organizing MapsDocumento173 pagineCredit Rating Prediction: Using Self-Organizing MapsIrina AlexandraNessuna valutazione finora

- Credit Rating Prediction: Using Self-Organizing MapsDocumento173 pagineCredit Rating Prediction: Using Self-Organizing MapsIrina AlexandraNessuna valutazione finora

- MBA ResearchDocumento50 pagineMBA ResearchSha AntoNessuna valutazione finora

- Fielder Budget & Forecasting - TechnicalDocumento74 pagineFielder Budget & Forecasting - TechnicalKiran PNessuna valutazione finora

- Performance Information HandbookDocumento78 paginePerformance Information HandbookJohannes Abraham SteneveldtNessuna valutazione finora

- An Empirical Study On The Factors Affecting Job Satisfaction.Documento73 pagineAn Empirical Study On The Factors Affecting Job Satisfaction.Fariha KabirNessuna valutazione finora

- Kentrade Strategic Plan 2022 2025Documento90 pagineKentrade Strategic Plan 2022 2025Digichange AgronomistsNessuna valutazione finora

- Internship Report Bank IslamicDocumento53 pagineInternship Report Bank Islamicnizihunzai80% (5)

- Letter of Transmittal Letter of Endorsement Acknowledgements Executive SummaryDocumento3 pagineLetter of Transmittal Letter of Endorsement Acknowledgements Executive SummaryTaslima AktarNessuna valutazione finora

- BDPW3103 Introductory Finance - Vapr20Documento196 pagineBDPW3103 Introductory Finance - Vapr20Sobanah Chandran100% (2)

- 1920 2 PFS FR12 RevisedFinalPaper GamutanDocumento314 pagine1920 2 PFS FR12 RevisedFinalPaper GamutanGee Marie Gayle100% (1)

- BMMF5103: Managerial FinanceDocumento182 pagineBMMF5103: Managerial FinanceIam Abdiwali100% (1)

- Business Financial Planning With Microsoft Excel (2023)Documento224 pagineBusiness Financial Planning With Microsoft Excel (2023)maxchanvannakNessuna valutazione finora

- Particulars Numbe R: Janata Bank LTD: at A GalanceDocumento52 pagineParticulars Numbe R: Janata Bank LTD: at A GalanceTareq AlamNessuna valutazione finora

- New On The Horizon Sustainability Reporting 1652522507Documento66 pagineNew On The Horizon Sustainability Reporting 1652522507mauroNessuna valutazione finora

- MTB PDFDocumento92 pagineMTB PDFtutulNessuna valutazione finora

- Index STPDocumento3 pagineIndex STPRituraj solankiNessuna valutazione finora

- Internship ReportDocumento44 pagineInternship ReportRAihan AhmedNessuna valutazione finora

- ASTRO MALAYSIA HOLDING BERHAD - Company Report MGT657 JBA249 5CDocumento54 pagineASTRO MALAYSIA HOLDING BERHAD - Company Report MGT657 JBA249 5CLuqmanulhakim JohariNessuna valutazione finora

- Nabil Bank Limited: Tribhuvan UniversityDocumento7 pagineNabil Bank Limited: Tribhuvan UniversityBijaya DhakalNessuna valutazione finora

- Chapter No. Name of Topic NoDocumento3 pagineChapter No. Name of Topic NoMavis HumtsoeNessuna valutazione finora

- Sustainability Reporting Proposals NothDocumento66 pagineSustainability Reporting Proposals NothFrank PereiraNessuna valutazione finora

- BBTX4203 Taxation II - Eaug20Documento296 pagineBBTX4203 Taxation II - Eaug20MUHAMMAD ZAKI BIN BASERI STUDENTNessuna valutazione finora

- SIDBI - Surgical Cotton & Bandage Gauze - VirudhunagarDocumento97 pagineSIDBI - Surgical Cotton & Bandage Gauze - VirudhunagarArega GenetieNessuna valutazione finora

- BBFS4103Documento206 pagineBBFS4103Ct CtzudafiqNessuna valutazione finora

- 05 ContentDocumento11 pagine05 ContentNikhil ShuklaNessuna valutazione finora

- Electricity Distribution Services Asset Management Tool Workshop Draft Report June 2011Documento44 pagineElectricity Distribution Services Asset Management Tool Workshop Draft Report June 2011Carlos Manuel ParionaNessuna valutazione finora

- Internship Report 15303025 (Revised)Documento61 pagineInternship Report 15303025 (Revised)Araf AfsahNessuna valutazione finora

- Format & Guidelines For MBA Project Report PreparationDocumento20 pagineFormat & Guidelines For MBA Project Report PreparationMehak BhargavNessuna valutazione finora

- Personal Financial Planning: Strategies For Successful Practice ManagementDocumento122 paginePersonal Financial Planning: Strategies For Successful Practice ManagementharshNessuna valutazione finora

- Table of Content MainDocumento5 pagineTable of Content MainDrubo SoburNessuna valutazione finora

- Strama Smart Ormita 03092020Documento253 pagineStrama Smart Ormita 03092020Ronnel TiendaNessuna valutazione finora

- Topic: An Analysis of Performance Appraisal System of Janata Bank LimitedDocumento2 pagineTopic: An Analysis of Performance Appraisal System of Janata Bank LimitedjonyNessuna valutazione finora

- C P 1. An Overview of Indian Economy 1Documento2 pagineC P 1. An Overview of Indian Economy 1Kirthana ShankarNessuna valutazione finora

- Dividend Policy and Its Impact On Share PriceDocumento103 pagineDividend Policy and Its Impact On Share PriceBijendra Malla88% (25)

- Travel Tourism in Bangladesh: A Study On Regent Tours & TravelDocumento72 pagineTravel Tourism in Bangladesh: A Study On Regent Tours & TravelNahidNessuna valutazione finora

- Sadia Internship Report NewDocumento61 pagineSadia Internship Report NewMd. Imran HossainNessuna valutazione finora

- Strategic Planning: © 247campus - Co.Uk. All Rights ReservedDocumento55 pagineStrategic Planning: © 247campus - Co.Uk. All Rights ReservedShayan Ahmed AnsariNessuna valutazione finora

- Internship Report On General Banking of Islami Bank Bangladesh LimitedDocumento85 pagineInternship Report On General Banking of Islami Bank Bangladesh LimitedM Rashedul Islam RashedNessuna valutazione finora

- Strategic Audit Report TNB Latest 1 PDFDocumento64 pagineStrategic Audit Report TNB Latest 1 PDFpqcmgtNessuna valutazione finora

- 3 - Table of ContentsDocumento1 pagina3 - Table of ContentsSohelNessuna valutazione finora

- Education Service Experience From The Aspects of Students'Documento34 pagineEducation Service Experience From The Aspects of Students'M. Nizam100% (1)

- ASA FPC Resource Book PDFDocumento170 pagineASA FPC Resource Book PDFksm256Nessuna valutazione finora

- AckmidtocDocumento9 pagineAckmidtocraakesh_rrNessuna valutazione finora

- Yusliza Binti MD YussoffDocumento34 pagineYusliza Binti MD YussoffTs-Radzif Omar50% (2)

- Independent Progress Review of The CSH PPA Between Oxfam and DFIDDocumento123 pagineIndependent Progress Review of The CSH PPA Between Oxfam and DFIDOxfamNessuna valutazione finora

- Independent Progress Review of The CSH PPA Between Oxfam and DFIDDocumento123 pagineIndependent Progress Review of The CSH PPA Between Oxfam and DFIDOxfamNessuna valutazione finora

- E Vswks Cöwewa I BXWZ Wefvm Evsjv 'K E VSK Cöavb KVH©VJQ XVKVDocumento1 paginaE Vswks Cöwewa I BXWZ Wefvm Evsjv 'K E VSK Cöavb KVH©VJQ XVKVadnan04Nessuna valutazione finora

- Mar 222020 BRPD 05Documento3 pagineMar 222020 BRPD 05Tim McCartyNessuna valutazione finora

- Bangladesh Bank Head Office Dhaka: Foreign Exchange Policy DepartmentDocumento1 paginaBangladesh Bank Head Office Dhaka: Foreign Exchange Policy DepartmentamirentezamNessuna valutazione finora

- (A) There Is Bonafide Business Relationship Between The Remitter(s) and The Supplier(s)Documento1 pagina(A) There Is Bonafide Business Relationship Between The Remitter(s) and The Supplier(s)adnan04Nessuna valutazione finora

- Foreign Exchange Policy Department: Enhancement of Loan Limit From Export Development FundDocumento1 paginaForeign Exchange Policy Department: Enhancement of Loan Limit From Export Development Fundadnan04Nessuna valutazione finora

- Evsjv 'K E VSK: Cöavb KVH©VJQDocumento1 paginaEvsjv 'K E VSK: Cöavb KVH©VJQadnan04Nessuna valutazione finora

- Mar 022020 BRPDL 05Documento1 paginaMar 022020 BRPDL 05Tim McCartyNessuna valutazione finora

- Demutualization Act 2013Documento16 pagineDemutualization Act 2013adnan04Nessuna valutazione finora

- Foreign Exchange Policy Department: Bangladesh BankDocumento1 paginaForeign Exchange Policy Department: Bangladesh Bankadnan04Nessuna valutazione finora

- 41th BCS Advertisement - Final (Website) PDFDocumento18 pagine41th BCS Advertisement - Final (Website) PDFsopnil aliNessuna valutazione finora

- Banking ActivitiesDocumento20 pagineBanking Activitiesadnan04Nessuna valutazione finora

- Best Computer Mcqs Over 1000 by MD Khalil Uddin.Documento63 pagineBest Computer Mcqs Over 1000 by MD Khalil Uddin.subashnayak999Nessuna valutazione finora

- Sports Bar Business PlanDocumento13 pagineSports Bar Business Planadnan04Nessuna valutazione finora

- Presentation CanadaDocumento15 paginePresentation Canadaadnan04Nessuna valutazione finora

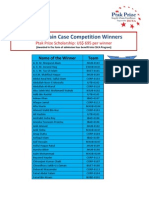

- Ptak Prize - 70 - Scholarship Winners ListDocumento5 paginePtak Prize - 70 - Scholarship Winners Listadnan04Nessuna valutazione finora

- Role of Treasury FunctionDocumento4 pagineRole of Treasury Functionadnan040% (1)

- Basel 3Documento18 pagineBasel 3adnan04Nessuna valutazione finora

- Literature ReviewDocumento2 pagineLiterature Reviewadnan04Nessuna valutazione finora

- Housing Market in CanadaDocumento7 pagineHousing Market in Canadaadnan04Nessuna valutazione finora

- Weávcb: 33Zg Wewmgm Cix V-2012Documento13 pagineWeávcb: 33Zg Wewmgm Cix V-2012kimbhutkimakarymailNessuna valutazione finora

- Test 10Documento3 pagineTest 10adnan04Nessuna valutazione finora

- Role of Treasury FunctionDocumento4 pagineRole of Treasury Functionadnan040% (1)

- PHONE EtiquetteDocumento14 paginePHONE Etiquetteroziahzailan100% (1)

- Guidelines To Write An Internship ReportDocumento2 pagineGuidelines To Write An Internship Reportadnan04Nessuna valutazione finora

- Department of Financial Institutions of BBDocumento1 paginaDepartment of Financial Institutions of BBadnan04Nessuna valutazione finora

- Chapter 11Documento6 pagineChapter 11adnan04Nessuna valutazione finora

- Performance AppraisalDocumento34 paginePerformance AppraisalbunkusaikiaNessuna valutazione finora

- What Does DuPont Analysis MeanDocumento1 paginaWhat Does DuPont Analysis Meanadnan04Nessuna valutazione finora

- Mr. Pervez Said. Handbook of Islamic Banking Products & Services.Documento138 pagineMr. Pervez Said. Handbook of Islamic Banking Products & Services.akram_tkdNessuna valutazione finora

- The Incidence of COVID-19 Along The ThaiCambodian Border Using Geographic Information System (GIS), Sa Kaeo Province, Thailand PDFDocumento5 pagineThe Incidence of COVID-19 Along The ThaiCambodian Border Using Geographic Information System (GIS), Sa Kaeo Province, Thailand PDFInternational Journal of Innovative Science and Research TechnologyNessuna valutazione finora

- MetLife CaseDocumento4 pagineMetLife Casekatee3847Nessuna valutazione finora

- Advancement of SGDocumento2 pagineAdvancement of SGkailasasundaramNessuna valutazione finora

- ATA212001Documento3 pagineATA212001Tarek DeghedyNessuna valutazione finora

- Engineering Mathematics Questions and AnswersDocumento9 pagineEngineering Mathematics Questions and AnswersZaky Muzaffar100% (1)

- UV-Visible Systems - Operational Qualification - Col23 PDFDocumento10 pagineUV-Visible Systems - Operational Qualification - Col23 PDFIsabelle PlourdeNessuna valutazione finora

- CS1 Entity Level Controls SolutionsDocumento16 pagineCS1 Entity Level Controls SolutionsPakistan Breaking News100% (6)

- Buy Wholesale China Popular Outdoor Football Boot For Teenagers Casual High Quality Soccer Shoes FG Ag Graffiti Style & FootballDocumento1 paginaBuy Wholesale China Popular Outdoor Football Boot For Teenagers Casual High Quality Soccer Shoes FG Ag Graffiti Style & Footballjcdc9chh8dNessuna valutazione finora

- Architech 06-2016 Room AssignmentDocumento4 pagineArchitech 06-2016 Room AssignmentPRC Baguio100% (1)

- Family School Project Lesson Plan AstrologyDocumento3 pagineFamily School Project Lesson Plan Astrologyapi-529488210Nessuna valutazione finora

- G2A Glitch DONT LEAK 2Documento7 pagineG2A Glitch DONT LEAK 2qDeficiencyNessuna valutazione finora

- Proposed 4way D54 Proposed 2way D56: Issue Date DescriptionDocumento3 pagineProposed 4way D54 Proposed 2way D56: Issue Date DescriptionADIL BASHIRNessuna valutazione finora

- EHR StandardsIndia - August 2013-32630521Documento54 pagineEHR StandardsIndia - August 2013-32630521kartiksinhNessuna valutazione finora

- AMX Prodigy Install ManualDocumento13 pagineAMX Prodigy Install Manualsundevil2010usa4605Nessuna valutazione finora

- BZY Series Tension Meter ManualDocumento29 pagineBZY Series Tension Meter ManualJORGE SANTANDER0% (1)

- APS PresentationDocumento32 pagineAPS PresentationRozack Ya ZhackNessuna valutazione finora

- C305 - QTO Workshop PDFDocumento90 pagineC305 - QTO Workshop PDFJason SecretNessuna valutazione finora

- Musk Founded Space Exploration Technologies Corporation, or Spacex, in 2002 With TheDocumento4 pagineMusk Founded Space Exploration Technologies Corporation, or Spacex, in 2002 With TheLauren Harris0% (1)

- JAMB Syllabus For BiologyDocumento27 pagineJAMB Syllabus For BiologyOluebube UchennaNessuna valutazione finora

- Movie Review of THORDocumento8 pagineMovie Review of THORSiva LetchumiNessuna valutazione finora

- Why You MeDocumento18 pagineWhy You MeFira tubeNessuna valutazione finora

- Sample Engagement LetterDocumento5 pagineSample Engagement Letterprincess_camarilloNessuna valutazione finora

- Epidemiological Triad of HIV/AIDS: AgentDocumento8 pagineEpidemiological Triad of HIV/AIDS: AgentRakib HossainNessuna valutazione finora

- Hazop Close Out ReportDocumento6 pagineHazop Close Out ReportKailash PandeyNessuna valutazione finora

- UntitledDocumento17 pagineUntitledSedat100% (1)

- January 11, 2019 Grade 1Documento3 pagineJanuary 11, 2019 Grade 1Eda Concepcion PalenNessuna valutazione finora

- Permutation, Combination & ProbabilityDocumento9 paginePermutation, Combination & ProbabilityVicky RatheeNessuna valutazione finora

- Cyrille MATH INVESTIGATION Part2Documento18 pagineCyrille MATH INVESTIGATION Part2Jessie jorgeNessuna valutazione finora

- Ijrpr2741 Study On Investor Perception Towards Stock Market InvestmentDocumento19 pagineIjrpr2741 Study On Investor Perception Towards Stock Market InvestmentAbhay RanaNessuna valutazione finora

- ROXAS FARM SCHOOL Trifold BrochureDocumento2 pagineROXAS FARM SCHOOL Trifold BrochureJude IledanNessuna valutazione finora