Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

BSP Circular No. 32-94

Caricato da

Ish GuidoteCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

BSP Circular No. 32-94

Caricato da

Ish GuidoteCopyright:

Formati disponibili

July 19, 1994

BSP CIRCULAR NO. 32-94

Pursuant to Monetary Board Resolution No. 602 dated July 1, 1994, the

following procedures shall be adopted for foreign borrowings of private

companies:

1. Submission of Foreign Borrowing Plans

Companies intending to borrow an amount equivalent to at least US$10

million shall advise the Bangko Sentral through the Management of External Debt

Department MEDD) of their foreign borrowing plans at least six months prior to

conduct of actual negotiations or award of mandate for medium and long term

loans, and one month for short-term loans, using forms prescribed for the purpose.

The timetable and any changes thereon shall be promptly communicated to the

Bangko Sentral for monitoring and programming purposes.

2. Filing of Applications

A. For Approval of Loans/Guarantees

1. Applications for approval of foreign loans/guarantees

shall be filed with MEDD at least fifteen (15) banking

days prior to target date of negotiation, complete with

the required documents, using the forms prescribed for

the purpose. Applications shall be filed not later than

11:30 AM on any banking day.

2. Processing fees shall be charged on all applications for

new loans/guarantees at the rate 1/50 of 1% of the total

loan/guarantee amount applied for, with a minimum fee

of US$400 and maximum of US$100,000. Applications

requested to be treated on a rush basis shall be charged

twice these rates. cdt

B. For Registration of Loans

1. Applications for registration of foreign loans not

required to be prior-approved shall be filed with MEDD

not later than 15 days from date of initial

Copyright 2018 CD Technologies Asia, Inc. Bangko Sentral ng Pilipinas 2017 1

drawdown/inward remittance using the prescribed form.

Proofs of inward remittance/utilization of the loan as

well as a copy of the loan agreement and other

documentary requirements shall be submitted together

with the application for registration.

2. Processing fees shall be charged on all applications for

registration of loans. The fee shall be computed on the

basis of the amount being registered at the rate of 1/100

of 1% with a minimum of US$200 and a maximum of

US$50,000.

C. For Registration of Guarantees and Other Contingent Liabilities

A processing fee of PhP1,000 shall be charged on all applications for

registration.

D. The above fees shall be paid in the peso equivalent thereof

converted at the BSP reference rate on the day preceding the

date of receipt of application, in Manager's Check or Cashier's

Check payable to the Bangko Sentral.

3. Reporting requirements

All foreign loans obtained by Philippine private sector borrowers from

offshore sources, with or without prior Bangko Sentral approval, shall be reported

for statistical purposes to MEDD, within 15 days from drawdown thereof,

indicating the repayment terms/particulars of the loan. Subsequent transactions

thereon shall likewise be reported within fifteen days from transaction date.

Failure to report such loans shall be a ground for imposition of appropriate

sanctions.

Accordingly, all foreign loans outstanding as of June 30, 1994 which have

been obtained without prior Bangko Sentral approval, shall be reported to MEDD

within thirty (30) days from date of publication of this Circular. The report shall

include information on the original amount of the loan, currency at which it is

denominated and payable, total amount drawn, principal amount paid, amount

outstanding, repayment terms (including due date), interest rate/other fees and

charges, names of creditor/s, and foreign and local guarantor/s (if any).

This Circular amends existing procedures and guidelines governing private

sector foreign borrowings, and shall be implemented in line with Circular No.

1389 dated April 13, 1993, as amended.

Copyright 2018 CD Technologies Asia, Inc. Bangko Sentral ng Pilipinas 2017 2

This Circular shall take effect immediately.

For the Monetary Board:

(SGD.) EDGARDO P. ZIALCITA

Officer-in-Charge

Copyright 2018 CD Technologies Asia, Inc. Bangko Sentral ng Pilipinas 2017 3

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Ruzol V SandiganbayanDocumento3 pagineRuzol V SandiganbayanIsh Guidote100% (2)

- Jakosalem V BaranganDocumento2 pagineJakosalem V BaranganIsh GuidoteNessuna valutazione finora

- Republic V SHAIDocumento3 pagineRepublic V SHAIIsh Guidote100% (1)

- Lopez V Pan American AirwaysDocumento2 pagineLopez V Pan American AirwaysIsh GuidoteNessuna valutazione finora

- Westmont V Dela RosaDocumento3 pagineWestmont V Dela RosaIsh GuidoteNessuna valutazione finora

- Maquiling V COMELECDocumento4 pagineMaquiling V COMELECIsh GuidoteNessuna valutazione finora

- Torralba V SibagatDocumento2 pagineTorralba V SibagatIsh Guidote100% (2)

- Monzon V RelovaDocumento10 pagineMonzon V RelovaIsh GuidoteNessuna valutazione finora

- San Pablo v. Pantranco South Express, Inc. (1987)Documento2 pagineSan Pablo v. Pantranco South Express, Inc. (1987)Ish GuidoteNessuna valutazione finora

- International Container Terminal Services V CADocumento2 pagineInternational Container Terminal Services V CAIsh GuidoteNessuna valutazione finora

- UP V Ferrer-CallejaDocumento3 pagineUP V Ferrer-CallejaIsh Guidote50% (2)

- Aliviado V P&GDocumento4 pagineAliviado V P&GIsh Guidote0% (1)

- Henry V Madison AerieDocumento1 paginaHenry V Madison AerieIsh GuidoteNessuna valutazione finora

- Sugbuanon Rural Bank V LaguesmaDocumento2 pagineSugbuanon Rural Bank V LaguesmaIsh GuidoteNessuna valutazione finora

- Credit Transactions Outline (Gomez-Somera)Documento8 pagineCredit Transactions Outline (Gomez-Somera)Ish GuidoteNessuna valutazione finora

- Cruz V Mijares (CivPro Digest)Documento2 pagineCruz V Mijares (CivPro Digest)Ish Guidote0% (2)

- GSIS V Board of Commissioners - DigestDocumento2 pagineGSIS V Board of Commissioners - DigestIsh GuidoteNessuna valutazione finora

- Gabriel v. Secretary of Labor and Employment (2000)Documento2 pagineGabriel v. Secretary of Labor and Employment (2000)Ish GuidoteNessuna valutazione finora

- Groh V RamirezDocumento1 paginaGroh V RamirezIsh GuidoteNessuna valutazione finora

- League of Cities vs. COMELECDocumento5 pagineLeague of Cities vs. COMELECIsh Guidote100% (2)

- Introduction To Politics and GovernanceDocumento19 pagineIntroduction To Politics and GovernanceIsh Guidote100% (11)

- Duncan Association of Detailman v. Glaxo WellcomeDocumento3 pagineDuncan Association of Detailman v. Glaxo WellcomeIsh GuidoteNessuna valutazione finora

- Lim v. CADocumento1 paginaLim v. CAIsh GuidoteNessuna valutazione finora

- Market Outlook Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- CAPITAL-BOOK - Print 10 CopiesDocumento167 pagineCAPITAL-BOOK - Print 10 Copiessarthak jhaNessuna valutazione finora

- Chapter 4 - Exchange RateDocumento20 pagineChapter 4 - Exchange RateJuan Pablo León BenítezNessuna valutazione finora

- Real Time Gross Settlement System (RTGS) - An Overview: Information TechnologyDocumento6 pagineReal Time Gross Settlement System (RTGS) - An Overview: Information TechnologyReetesh ChandraNessuna valutazione finora

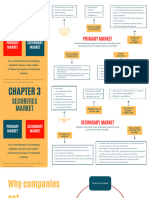

- Fin358 Chapter 3 Mind Mapping PDFDocumento4 pagineFin358 Chapter 3 Mind Mapping PDFSYED SYAHMIE RIFAIE SYED MOHD FADZLYNessuna valutazione finora

- Draft of The Letter To Be Obtained From The Builder On LetterheadDocumento1 paginaDraft of The Letter To Be Obtained From The Builder On LetterheadPrashant Sakorkar100% (1)

- Barter SystemDocumento18 pagineBarter SystemAvinash Sahu100% (2)

- FICO Frequently Used ReportsDocumento6 pagineFICO Frequently Used ReportssuphawanmNessuna valutazione finora

- Competing in Global MarketDocumento39 pagineCompeting in Global Marketagustina carolineNessuna valutazione finora

- Quiz Thị Trường Tài Chính Phái SinhDocumento25 pagineQuiz Thị Trường Tài Chính Phái SinhNguyễn Thế BảoNessuna valutazione finora

- Steps Taken by Indian Government To Enhance The Capital MarketDocumento1 paginaSteps Taken by Indian Government To Enhance The Capital MarketRajaDurai Ramakrishnan0% (1)

- Chapter 2 Financial Derivatives Use: A Literature ReviewDocumento68 pagineChapter 2 Financial Derivatives Use: A Literature ReviewAyushi SiriyaNessuna valutazione finora

- AntelopeDocumento2 pagineAntelopeVivek ShankarNessuna valutazione finora

- Valuation of AirThreadConnectionsDocumento3 pagineValuation of AirThreadConnectionsmksscribd100% (1)

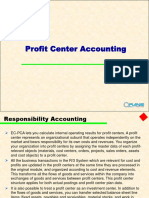

- Profit Center AccountingDocumento11 pagineProfit Center AccountingManish bhasinNessuna valutazione finora

- Swot Analysis of Canara BankDocumento6 pagineSwot Analysis of Canara Bankshwetachalke21100% (1)

- James16 Part BDocumento46 pagineJames16 Part BAnonymous JrCVpuNessuna valutazione finora

- Market For Currency FuturesDocumento35 pagineMarket For Currency Futuresvidhya priyaNessuna valutazione finora

- Breakeven AnalysisDocumento4 pagineBreakeven AnalysisSaugata Shovan HaiderNessuna valutazione finora

- FiboHenryZone Calculator SignDocumento52 pagineFiboHenryZone Calculator SignIrnick Nik100% (1)

- The Global Cost and Availability of CapitalDocumento41 pagineThe Global Cost and Availability of CapitalayurishiNessuna valutazione finora

- Triple Trouble2 (Mar09)Documento10 pagineTriple Trouble2 (Mar09)Jolin MajminNessuna valutazione finora

- Commercial PaperDocumento4 pagineCommercial PaperGaurav JainNessuna valutazione finora

- F 51124304Documento3 pagineF 51124304hanamay_07Nessuna valutazione finora

- Zerodha Vs EdelweissDocumento3 pagineZerodha Vs EdelweissAditya MukherjeeNessuna valutazione finora

- DemonetisationDocumento40 pagineDemonetisationAbhinav JainNessuna valutazione finora

- Options Theory For Professional TradingDocumento134 pagineOptions Theory For Professional TradingVibhats VibhorNessuna valutazione finora

- Forex Pair Performance Strength ScoreDocumento10 pagineForex Pair Performance Strength ScoreTradingSystem100% (1)

- Sapm Full Unit Notes PDFDocumento112 pagineSapm Full Unit Notes PDFnandhuNessuna valutazione finora