Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Insurance Law

Caricato da

Abdul Qadir Juzer AeranpurewalaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Insurance Law

Caricato da

Abdul Qadir Juzer AeranpurewalaCopyright:

Formati disponibili

Subject Name INSURANCE LAW

BUSINESS LAW (HONS IV)

Subject Code 85 HLAW 304

Credit 4

Summary/Overview/Module The insurance idea is an old-institution of

transactional trade. Even from olden days

merchants who made great adventures gave

money by way of consideration, to other persons

who made assurance, against loss of their goods,

merchandise ships aid things adventured. The

rates of money consideration were mutually

agreed upon. Such an arrangement enabled other

merchants more willingly and more freely to

embark upon further trading adventures.

The operational framework of insurance idea is

provided by the general principles of contract.

The insurance policy, being a contract, is subject

to all the judicial interpretative techniques of

rules of interpretation as propounded by the

judiciary. Besides, the insurance idea has a

compensatory justice component.

Aim/Object This course is designed to acquaint the students

with the conceptual and operational parameters,

of insurance law.

Core learning outcomes At the end of the course the student is expected

/Objectives • to have a acquired a basic understanding

of the legal principles relating to insurance.

• to have acquired the skill to identify the

major regulatory issues that crop up with each

new insurance products being released in the

market.

Outline

Introduction

➢ Definition, nature and history of insurance.

Module I

➢ Concept of Insurance and law of contract and torts.

➢ Future of insurance in globalized economy.

➢ History and development of Insurance law in India.

➢ Insurance Regulatory Authority – role and functions.

General Principles of law of insurance

Module II

➢ Contract of Insurance - classification of contract of

insurance; nature of various insurance contracts and

parties thereto.

➢ Principle of good faith, non-disclosure, and

misrepresentation in insurance contracts.

➢ Insurable Interest; the risk insurable.

➢ Insurance policy, classification of policies, form and

contents, conditions of policy.

➢ Alteration of risks.

➢ Assignment of the subject matter.

Module III Life Insurance

➢ Nature and scope of life insurance, definition, kinds of

life insurance, the policy and formation of a life

insurance contract.

➢ Event insured against life insurance contract.

➢ Circumstances affecting the risk.

➢ Amounts recoverable under life policy.

➢ Persons entitled to payment.

➢ Settlement of claim and payment of money.

Marine Insurance

Module IV

➢ Nature and scope

➢ Classification of marine policies

➢ The Marine Insurance Act 1963

➢ Insurable interest, insurable value

➢ Marine insurance policy - conditions - express

warranties construction of terms of policy

➢ Voyage - deviation

➢ Perils of the sea

➢ Partial loss of ship and of freight, salvage, general

average, particular charges

➢ Measure of indemnity, total valuation, liability to third

parties.

Insurance against third party risks

Module V ➢ The Motor Vehicles Act, 1988 (Chapter VIII)

➢ Nature and scope, persons governed, definitions of

'use', 'drives', 'motor vehicle', requirements of policy,

statutory contract between insurer and drive rights of

third parties, limitations on third party's rights duty to

inform third party.

➢ Effect of insolvency or death on claims, insolvency

and death of parties, certificate of insurance

➢ Conditions to be satisfied

➢ Claims tribunal, constitution, functions, application for

compensation - who can apply? - procedure and

powers of claims tribunal - its award.

➢ Co-operative insurance (Motor Vehicles Rules)

Module VI

Social Insurance in India

➢ Important elements in social insurance, its need.

➢ Commercial insurance and social insurance

➢ Workmen's compensation - scope, risks covered,

industrial accidents, occupational diseases, cash

benefits, incapacity, amount of compensation, nature

of injuries, dependents, schedule.

➢ Old age, premature death and invalidity insurance or

pension insurance, public provident fund.

➢ Unemployment insurance

➢ Social insurance for people like seamen, circus

workers and agricultural, workers.

Module VII

Public Liability Insurance and Emerging Legislative

Trends

➢ The Scheme and authorities.

➢ Emerging legislative trends in India.

Recommended Resources: • McGee, The Modern Law of Insurance, 2nd

Ed., Lexis Nexis Butterworths Wadhwa Nagpur.

• KSN Murthy & Dr. KVS Sarma, Modern Law

of Insurance, 4th Ed., Lexis Nexis Butterworths

Wadhwa Nagpur.

• Avtar Singh, The Law of Insurance, 2nd Ed.,

Eastern Book Company.

• John Birds, Birds’ Modern Insurance Law, 8th

Ed., Sweet & Maxwell.

• Howard N. Bennet, The Law of Marine

Insurance, Oxford, 2004.

Potrebbero piacerti anche

- 13 - Chapter 4 PDFDocumento74 pagine13 - Chapter 4 PDFRAGHAVENDRAENessuna valutazione finora

- 13 - Chapter 4 PDFDocumento74 pagine13 - Chapter 4 PDFRAGHAVENDRAENessuna valutazione finora

- Course Outline of BBA LLB, Semester - IX PDFDocumento58 pagineCourse Outline of BBA LLB, Semester - IX PDFAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- PianoDocumento18 paginePianoAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- Law of Corporate FinanceDocumento3 pagineLaw of Corporate FinanceAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- BibliographyDocumento2 pagineBibliographyAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- Insurance AssignmentDocumento5 pagineInsurance AssignmentAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- Moot ProblemDocumento26 pagineMoot ProblemAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- Law of Corporate FinanceDocumento3 pagineLaw of Corporate FinanceAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- AbuDocumento1 paginaAbuAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- 2Documento1 pagina2Abdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- Candidate's Name: Personal InformationDocumento13 pagineCandidate's Name: Personal InformationAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- Freedom of Speech and Expression Could Be Considered One of The Most Fundamental of All FreedomsDocumento5 pagineFreedom of Speech and Expression Could Be Considered One of The Most Fundamental of All FreedomsAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- Ismc-O12 DDocumento1 paginaIsmc-O12 DAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- ICSI Moot Stuff RDocumento8 pagineICSI Moot Stuff RAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- CS Executive Exam Time Table Dec 2017Documento1 paginaCS Executive Exam Time Table Dec 2017Abdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- Freedom of Speech and Expression Could Be Considered One of The Most Fundamental of All FreedomsDocumento3 pagineFreedom of Speech and Expression Could Be Considered One of The Most Fundamental of All FreedomsAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- Candidate's Name: Personal InformationDocumento13 pagineCandidate's Name: Personal InformationAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- Army Institute of Law National Moot Court Competition 2016: Team Code: Ck9Documento45 pagineArmy Institute of Law National Moot Court Competition 2016: Team Code: Ck9Abdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- Katte HaaluDocumento10 pagineKatte HaaluAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- Private International LawDocumento28 paginePrivate International LawAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- Pil StuffDocumento13 paginePil StuffAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- CPCDocumento33 pagineCPCAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- SLCUNM RespondentDocumento30 pagineSLCUNM RespondentchikpiaaNessuna valutazione finora

- Biswaranjan Pattanayak Memorial Moot Court Competition. Winning Memorial.Documento30 pagineBiswaranjan Pattanayak Memorial Moot Court Competition. Winning Memorial.Angswarupa Jen Chatterjee67% (3)

- Historical Development & Current TheoriesDocumento19 pagineHistorical Development & Current TheoriesAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- CPCDocumento33 pagineCPCAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- Petitioner Memo Final NUJSDocumento29 paginePetitioner Memo Final NUJSGurjinder SinghNessuna valutazione finora

- 2.circumstantial EvidenceDocumento39 pagine2.circumstantial EvidenceAbdul Qadir Juzer AeranpurewalaNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- PRU03Documento4 paginePRU03Paul MathewNessuna valutazione finora

- Unit III Sales and Retail ManagementDocumento16 pagineUnit III Sales and Retail ManagementMitali MishraNessuna valutazione finora

- 2012 Brochure Keltan Final en PDFDocumento20 pagine2012 Brochure Keltan Final en PDFJorge Zegarra100% (1)

- Disaster Management in Schools: Status ReportDocumento28 pagineDisaster Management in Schools: Status ReportRamalingam VaradarajuluNessuna valutazione finora

- WSM - Ziale - Commercial Law NotesDocumento36 pagineWSM - Ziale - Commercial Law NotesElizabeth Chilufya100% (1)

- Oliva - A Maturity Model For Enterprise Risk ManagementDocumento14 pagineOliva - A Maturity Model For Enterprise Risk ManagementErika FerreiraNessuna valutazione finora

- 3471A Renault EspaceDocumento116 pagine3471A Renault EspaceThe TrollNessuna valutazione finora

- Implementation of BS 8500 2006 Concrete Minimum Cover PDFDocumento13 pagineImplementation of BS 8500 2006 Concrete Minimum Cover PDFJimmy Lopez100% (1)

- 1654403-1 Press Fit ConnectorsDocumento40 pagine1654403-1 Press Fit ConnectorsRafael CastroNessuna valutazione finora

- SYKES - Telework Work Area AgreementDocumento2 pagineSYKES - Telework Work Area AgreementFritz PrejeanNessuna valutazione finora

- Plea Agreement of ThomasbergDocumento10 paginePlea Agreement of ThomasbergSal CoastNessuna valutazione finora

- Microeconomics Theory and Applications 12th Edition Browning Solutions ManualDocumento5 pagineMicroeconomics Theory and Applications 12th Edition Browning Solutions Manualhauesperanzad0ybz100% (26)

- OTDRDocumento57 pagineOTDRarijeetdguy3051100% (1)

- Cognizant Company FAQDocumento4 pagineCognizant Company FAQManojChowdary100% (1)

- Challenges Students Face in Conducting A Literature ReviewDocumento6 pagineChallenges Students Face in Conducting A Literature ReviewafdtunqhoNessuna valutazione finora

- Labor LawDocumento6 pagineLabor LawElden Cunanan BonillaNessuna valutazione finora

- LINDE Spare Parts ListDocumento2 pagineLINDE Spare Parts Listsharafudheen_s100% (2)

- By Daphne Greaves Illustrated by Michela GalassiDocumento15 pagineBy Daphne Greaves Illustrated by Michela GalassiLucian DilgociNessuna valutazione finora

- Compatibility Matrix For Cisco Unified Communications Manager and The IM and Presence Service, Release 12.5 (X)Documento31 pagineCompatibility Matrix For Cisco Unified Communications Manager and The IM and Presence Service, Release 12.5 (X)Flavio AlonsoNessuna valutazione finora

- Io TDocumento2 pagineIo TPrasanth VarasalaNessuna valutazione finora

- Hyundai Monitor ManualDocumento26 pagineHyundai Monitor ManualSamNessuna valutazione finora

- 03 Marine Multispecies Hatchery Complex Plumbing Detailed BOQ - 23.10.2019Documento52 pagine03 Marine Multispecies Hatchery Complex Plumbing Detailed BOQ - 23.10.2019samir bendreNessuna valutazione finora

- Fuel Supply Agreement - First DraftDocumento104 pagineFuel Supply Agreement - First DraftMuhammad Asif ShabbirNessuna valutazione finora

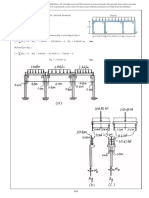

- Problemas Del Capitulo 7Documento26 pagineProblemas Del Capitulo 7dic vilNessuna valutazione finora

- FZCODocumento30 pagineFZCOawfNessuna valutazione finora

- Radioss For Linear Dynamics 10.0Documento79 pagineRadioss For Linear Dynamics 10.0Venkat AnumulaNessuna valutazione finora

- MN502 Lecture 3 Basic CryptographyDocumento45 pagineMN502 Lecture 3 Basic CryptographySajan JoshiNessuna valutazione finora

- The Mechanism of Notifying and Record Keeping Three Forms Are Used For Notifying and Record KeepingDocumento6 pagineThe Mechanism of Notifying and Record Keeping Three Forms Are Used For Notifying and Record KeepingRoger FernandezNessuna valutazione finora

- IT Quiz QuestionsDocumento10 pagineIT Quiz QuestionsbrittosabuNessuna valutazione finora

- MasafiDocumento2 pagineMasafiSa LaNessuna valutazione finora