Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Cash Back Titanium Cards

Caricato da

Ashutosh SinghCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cash Back Titanium Cards

Caricato da

Ashutosh SinghCopyright:

Formati disponibili

1

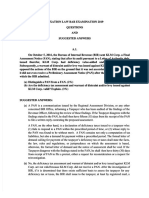

Cash Back Gold & Silver Cards

Description of Charges

Fees applicable for both Primary and Additional Card members will be

Joining & Annual Fees

communicated at the time of sourcing

The rate of interest varies between 3.10% per month (i.e. 37.20%

annualized) and 3.50% per month (i.e. 42.0% annualized). This rate is

Interest Rate / Service Charge dynamic and changes periodically based on parameters like repayment

pattern, utilization, spends etc.

The maximum interest rate, in the event of default, is 3.5% per month or

42% annualized

2.5% on advanced amount (subject to a minimum of Rs.500 and US$7.5 at

Cash Advance fee

International ATMs)

Rs.300 for current balance upto Rs.10000

Late Payment Charge (per month) Rs.600 for current balance from Rs.10001 – 25000

Rs.950 for current balance above 25000

Over Credit Limit charge 2.5% of the amount over the Credit Limit (Subject to a minimum of Rs.500)

Cheque/ECS Bounce Charge Rs.500 per returned cheque/ECS

2.5% (subject to a minimum of Rs.10) Waived at Indian Oil outlets for

Petrol Transaction Charge

transactions done on Citibank EDCs

Railway Ticket Booking or 2.5% of transaction value (subject to a minimum of Rs.25)

Cancellation Surcharge (Counter

booking)

Railway Ticket Booking Surcharge 1.8% of transaction value for regular transactions;

(Internet booking) 2.8% of transaction value for 3 EMI transaction

Card Replacement Charge Rs.100

Statement Request (beyond 3

Rs.100

months)

Outstation Cheque Charge Upto Rs.10000 - Rs.50 per cheque

(Charge based on the value of the Rs.10001 to Rs.100000 - Rs.100 per cheque

cheque/instrument) Above Rs.100001 - Rs.150 per cheque

Foreign Currency Transaction Mark up of 3.5% (service taxes as applicable)

Cash deposit at Citibank branches Rs 250

towards credit card repayment

Cash deposit at Citibank ATMs Rs 100

towards credit card repayment (

Service tax (including Swachh Bharat Cess and Krishi Kalyan Cess), as notified by the Government of India, is

applicable on all fees, interest and other charges and is subject to change, as per relevant regulations of the

Government of India.

Ver GCG/ 05/2016

Modified Date: 15-June-2016

Potrebbero piacerti anche

- Titanium Cash BackDocumento1 paginaTitanium Cash Backkay50Nessuna valutazione finora

- BusinessGold ChargesDocumento1 paginaBusinessGold ChargesShivam VinothNessuna valutazione finora

- Key Fact Statement CorporateDocumento7 pagineKey Fact Statement CorporateRAM MAURYANessuna valutazione finora

- Key-Fact-Statement NewDocumento2 pagineKey-Fact-Statement NewSaravanaSaravananNessuna valutazione finora

- Key Fact StatementDocumento2 pagineKey Fact StatementJohn AdariNessuna valutazione finora

- Key Fact StatementDocumento2 pagineKey Fact StatementsanjayNessuna valutazione finora

- Schedule of Charges - Citi Prestige CardDocumento2 pagineSchedule of Charges - Citi Prestige CardVarun SidanaNessuna valutazione finora

- Schedule of Charges - Citi Rewards Credit Card: As On The Date of Levy of The ChargeDocumento2 pagineSchedule of Charges - Citi Rewards Credit Card: As On The Date of Levy of The ChargemurugesaenNessuna valutazione finora

- RBL Mitc FinalDocumento16 pagineRBL Mitc FinalVivekNessuna valutazione finora

- SUPERCARD Most Important Terms and Conditions (MITC)Documento14 pagineSUPERCARD Most Important Terms and Conditions (MITC)Diwana Hai dilNessuna valutazione finora

- Key Fact Statement and MITCDocumento23 pagineKey Fact Statement and MITCSumeet ShelarNessuna valutazione finora

- HBL Credit Card SummaryDocumento3 pagineHBL Credit Card SummaryMubin AshrafNessuna valutazione finora

- Service Charges and Fees - Credit CardDocumento5 pagineService Charges and Fees - Credit Cardr.il.e.y.monro.e.60Nessuna valutazione finora

- Key Fact StatementDocumento2 pagineKey Fact StatementBNREDDY PSNessuna valutazione finora

- Mitc For Amazon Pay Credit CardDocumento7 pagineMitc For Amazon Pay Credit Cardsomeonestupid19690% (1)

- Ready Line SOC Jan June 2024Documento1 paginaReady Line SOC Jan June 2024umarNessuna valutazione finora

- RBI SERVICE CHARGES GUIDELINESDocumento11 pagineRBI SERVICE CHARGES GUIDELINESJithin VijayanNessuna valutazione finora

- Account Tariff Structure Basic Savings AccountDocumento1 paginaAccount Tariff Structure Basic Savings Accountgaddipati_ramuNessuna valutazione finora

- Mitc For Amazon Pay Credit CardDocumento7 pagineMitc For Amazon Pay Credit CardBlain Santhosh FernandesNessuna valutazione finora

- Mitc RupifiDocumento13 pagineMitc RupifiKARTHIKEYAN K.DNessuna valutazione finora

- MITCs AND FEESDocumento5 pagineMITCs AND FEESLoesh WaranNessuna valutazione finora

- Lending MITC EnglishDocumento29 pagineLending MITC EnglishDhiren PatilNessuna valutazione finora

- Upcoming Changes to Meezan Bank Schedule of Charges Jan-Jun 2019Documento1 paginaUpcoming Changes to Meezan Bank Schedule of Charges Jan-Jun 2019Ahsan IqbalNessuna valutazione finora

- Bajaj Tiger CC MITC NewDocumento12 pagineBajaj Tiger CC MITC NewMinatiNessuna valutazione finora

- Preferred AccountDocumento2 paginePreferred AccountaurummaangxinchenNessuna valutazione finora

- Mojo Platinum Credit Card: INR 1000 INR 1000Documento4 pagineMojo Platinum Credit Card: INR 1000 INR 1000Saksham Goel100% (2)

- Charges Axis Bank Reserve Credit CardDocumento1 paginaCharges Axis Bank Reserve Credit CardAjmer KonjurorsNessuna valutazione finora

- Premium Fees ChargesDocumento1 paginaPremium Fees ChargesrupeshrajNessuna valutazione finora

- July 2013: Current, Call and Savings AccountsDocumento1 paginaJuly 2013: Current, Call and Savings AccountsBala MNessuna valutazione finora

- MITC - Scapia Credit Card - 15-June-2023Documento5 pagineMITC - Scapia Credit Card - 15-June-2023BhushanNessuna valutazione finora

- SuperCard MITC PDFDocumento47 pagineSuperCard MITC PDFPrudhvi RajNessuna valutazione finora

- Schedule of Charges - Retail (India)Documento2 pagineSchedule of Charges - Retail (India)John PeterNessuna valutazione finora

- Crest Mitc LowDocumento12 pagineCrest Mitc LowswastikNessuna valutazione finora

- Schedule of Charges - Citi Rewards Credit Card: Returned Payment Charge (Cheque / ECS / ACH / SI Bounce Charge)Documento2 pagineSchedule of Charges - Citi Rewards Credit Card: Returned Payment Charge (Cheque / ECS / ACH / SI Bounce Charge)CA Sumit GargNessuna valutazione finora

- Description of Charges AU Bank Credit Cards - Altura, Altura Plus, Vetta, ZenithDocumento2 pagineDescription of Charges AU Bank Credit Cards - Altura, Altura Plus, Vetta, ZenithMohitNessuna valutazione finora

- HBL Credit Card Summary BoxDocumento2 pagineHBL Credit Card Summary Boxshani908Nessuna valutazione finora

- Particulars Sanman Savings Bank Account Standard Charges (RS.)Documento2 pagineParticulars Sanman Savings Bank Account Standard Charges (RS.)Bella BishaNessuna valutazione finora

- Mitc 8271022000045Documento6 pagineMitc 8271022000045Kumar KumarNessuna valutazione finora

- SUPERCARD Most Important Terms and Conditions (MITC)Documento17 pagineSUPERCARD Most Important Terms and Conditions (MITC)jinesh vgNessuna valutazione finora

- Personal Banking Charges ScheduleDocumento1 paginaPersonal Banking Charges ScheduleSaravanan ParamasivamNessuna valutazione finora

- Important TNCDocumento20 pagineImportant TNCsanthoshsk3072002Nessuna valutazione finora

- 16 SOBC Booklet Excluding FED ENG 081221 2Documento61 pagine16 SOBC Booklet Excluding FED ENG 081221 2Faizan WahidNessuna valutazione finora

- EmiratesNBD Credit Card Fees ChargesDocumento2 pagineEmiratesNBD Credit Card Fees ChargesHanif MohammmedNessuna valutazione finora

- Soc ChangesDocumento2 pagineSoc Changesabdulsubhanyousaf76Nessuna valutazione finora

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Documento2 pagineMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNessuna valutazione finora

- Rca SocDocumento3 pagineRca SocKrishna Kiran VyasNessuna valutazione finora

- Supercard Most Important Terms and ConditionsDocumento26 pagineSupercard Most Important Terms and Conditionstauseef21scribdNessuna valutazione finora

- Applicable Fees and Charges On Credit CardDocumento3 pagineApplicable Fees and Charges On Credit CardAbbasNessuna valutazione finora

- AMERICAN EXPRESS CORPORATE CARD MITCDocumento17 pagineAMERICAN EXPRESS CORPORATE CARD MITCKrisNessuna valutazione finora

- Schedule of Charges-MDB Visa Credit CardsDocumento2 pagineSchedule of Charges-MDB Visa Credit CardsBM TASINNessuna valutazione finora

- RBL BankDocumento17 pagineRBL BankorekishNessuna valutazione finora

- SUPERCARD Most Important Terms and Conditions (MITC)Documento44 pagineSUPERCARD Most Important Terms and Conditions (MITC)Chouhan Akshay SinghNessuna valutazione finora

- Notification FinalDocumento4 pagineNotification FinalBrahmanand DasreNessuna valutazione finora

- Corporate Finance: Credit CardsDocumento24 pagineCorporate Finance: Credit Cardsusmanahmadqadri100% (2)

- Fees and Charges GuideDocumento3 pagineFees and Charges GuideShashank AgarwalNessuna valutazione finora

- RBL MITC FinalDocumento43 pagineRBL MITC Finalharshitgupta000000Nessuna valutazione finora

- BoB Credit Card Revised T&C Jan2020Documento1 paginaBoB Credit Card Revised T&C Jan2020Imran AhmadNessuna valutazione finora

- From Kotak WebsiteDocumento20 pagineFrom Kotak WebsiteHimadri Shekhar VermaNessuna valutazione finora

- Name: Lodymer A. Gasalao Problem #: Page #: 159 Self-Service Laundry General Journal Date Particulars P.R. DebitDocumento12 pagineName: Lodymer A. Gasalao Problem #: Page #: 159 Self-Service Laundry General Journal Date Particulars P.R. DebitAnonnNessuna valutazione finora

- G.R. No. L-28896Documento7 pagineG.R. No. L-28896Klein CarloNessuna valutazione finora

- Salary Sheet & Pay Slip - To Be PracticeDocumento5 pagineSalary Sheet & Pay Slip - To Be PracticeumeshNessuna valutazione finora

- BIR Form 2306 Certificate of Final Tax Withheld At SourceDocumento4 pagineBIR Form 2306 Certificate of Final Tax Withheld At SourceBen Carlo RamosNessuna valutazione finora

- Tax Invoice/Bill of Supply: Jai Maa EnterprisesDocumento1 paginaTax Invoice/Bill of Supply: Jai Maa Enterprisesjai jawanNessuna valutazione finora

- View your monthly mobile statementDocumento5 pagineView your monthly mobile statementAyushree GuptaNessuna valutazione finora

- Ruales, Niel Patrick Chi: Contactcenter@osm - NoDocumento1 paginaRuales, Niel Patrick Chi: Contactcenter@osm - NoNiel RualesNessuna valutazione finora

- CIR vs Metro Star tax dispute presumptionDocumento2 pagineCIR vs Metro Star tax dispute presumptionShelomith PaddayumanNessuna valutazione finora

- 2019 Bar Questions and Suggested Answers PDFDocumento28 pagine2019 Bar Questions and Suggested Answers PDFKarl Shariff Ajihil100% (5)

- Catenary SpliceDocumento2 pagineCatenary SpliceSSE TRD JabalpurNessuna valutazione finora

- VAT Assessment and Collection Challenges in Akaki KalityDocumento21 pagineVAT Assessment and Collection Challenges in Akaki KalityFilmawit MekonenNessuna valutazione finora

- Accounting Cycle - Comprehensive ProblemDocumento29 pagineAccounting Cycle - Comprehensive ProblemTooba HashmiNessuna valutazione finora

- Memorandum of AgreementDocumento4 pagineMemorandum of AgreementMarvel FelicityNessuna valutazione finora

- Chola 31148 2019 7 Payslip PDFDocumento1 paginaChola 31148 2019 7 Payslip PDFDass Prakash100% (1)

- Bentleigh JN Football - INV2Documento1 paginaBentleigh JN Football - INV2timbyrne5Nessuna valutazione finora

- TD1Documento2 pagineTD1AmandaNessuna valutazione finora

- Tax FormDocumento2 pagineTax FormJorge LuissNessuna valutazione finora

- PWC - SEPA AnalysingDocumento24 paginePWC - SEPA AnalysingViệt Anh NguyễnNessuna valutazione finora

- XVIII. Soriano vs. Sec. of FinanceDocumento34 pagineXVIII. Soriano vs. Sec. of FinanceStef OcsalevNessuna valutazione finora

- Cpps May 2016Documento3 pagineCpps May 2016aNessuna valutazione finora

- Final Details For Order #407-5078757-1351518: Dispatched On 21 June 2020Documento1 paginaFinal Details For Order #407-5078757-1351518: Dispatched On 21 June 2020Rishav RajNessuna valutazione finora

- A, Traditional Tax System Prior To 1941-In The Axumite Kingdom, There Was A Practice of TraditionalDocumento7 pagineA, Traditional Tax System Prior To 1941-In The Axumite Kingdom, There Was A Practice of Traditionalliya100% (1)

- Wireless 2d Barcode Scanner 5818wDocumento7 pagineWireless 2d Barcode Scanner 5818wrohandev1001Nessuna valutazione finora

- Airtel Oct PDFDocumento3 pagineAirtel Oct PDFjohar MohammadNessuna valutazione finora

- {0B4DBCDB-793E-4B7D-8581-4F3A27A08329}Documento319 pagine{0B4DBCDB-793E-4B7D-8581-4F3A27A08329}ashes_xNessuna valutazione finora

- Cta 3D CV 09208 M 2021mar03 RefDocumento5 pagineCta 3D CV 09208 M 2021mar03 RefFirenze PHNessuna valutazione finora

- The Following Is River Tours Limited S Unadjusted Trial Balance atDocumento2 pagineThe Following Is River Tours Limited S Unadjusted Trial Balance atMiroslav GegoskiNessuna valutazione finora

- Paseo Realty - Development Corporation v. Court of Appeals, GR No. 119286, 2004Documento17 paginePaseo Realty - Development Corporation v. Court of Appeals, GR No. 119286, 2004citizenNessuna valutazione finora

- Tutorial 8 - Stamp Duty and Leasing - 2022Documento4 pagineTutorial 8 - Stamp Duty and Leasing - 2022Keat 98Nessuna valutazione finora