Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chart Income Tax Rate

Caricato da

Xela Lauren0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

31 visualizzazioni4 pagineincome tax rate

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoincome tax rate

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

31 visualizzazioni4 pagineChart Income Tax Rate

Caricato da

Xela Laurenincome tax rate

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

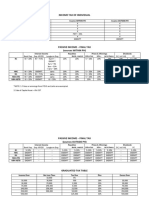

INCOME TAX RATES FOR INDIVIDUAL TAXPAYERS

Kind of taxpayer Source Tax Rate Deductions Scope

Resident Citizen Within and 5%-32% (Graduated Allowed Compensation Income,

without the Income tax rate) Business Income

Philippines

Non resident Within 5%-32% Allowed Compensation Income,

citizen Business Income

Resident Alien Within 5&-32% Allowed Compensation Income,

Business Income

Non Resident Within 5%-32% Allowed Compensation Income,

Alien (ETB) Business Income

Non Resident Within 25% Not GR: ALL INCOME

Alien (NETB) EX: Sale of shares of stock in

a domestic corporation and

real property

Special Classes It depends. not Compensation Income

1. employed by 15% preferential tax rate

ROHQ/RHQ If Resident

2. employed in Citizen: Provided,

OBU Within and

3.employed by Without 1. Position and

petroleum Function test:

service If Others: must be holding

contractor and WITHIN ONLY managerial and

sub contractor technical position

2. Compensation

Threshold Test: at

least 975 000

3. Exclusivity Test:

not a mere

consultant

NO PAIN, NO GAIN, NO TAX!

Kind of PASSSIVE INCOME (Sec 24, B (1) )

taxpayer Interest in Interest in Long term Royalties Royalties Prizes Prizes not Other

Bank Expanded Deposit (meaning, on books, exceeding exceeding Winnings

deposits, Foreign Substitutes income literary 10, 000 10, 000 (except

Deposit Currency not pre- from use works and PCSO and

Substitutes Deposit terminated of musical Lotto=

, System within 5 property) Compositio exempt)

trust funds years n

or similar

arrangeme

nts (not

loan)

Resident 20% 7.5% exempt 20% 10% 20% 5%-32% 20%

Citizen

Non 20% exempt exempt 20% 10% 20% 5%-32% 20%

resident

citizen

Resident 20% 7.5% exempt 20% 10% 20% 5%-32% 20%

Alien

Non 20% exempt exempt 20% 10% 20% 5%-32% 20%

Resident

Alien (ETB)

Non 25% exempt 25% 25% 25% 25% 25% 25%

Resident

Alien

(NETB)

Special It depends. It depends. It depends. It depends. It depends. It It It

Classes depends. depends. depends.

1. If Resident If Resident If Resident If Resident If Resident

employed Citizen, Citizen, Citizen, Citizen, Citizen,

If Resident If Resident If Resident

by Non citizen, Non Non Non Citizen, Citizen, Citizen,

ROHQ/RH resident resident resident resident resident

Non Non Non

Q citizen, alien : 7.5% citizen, citizen, citizen,

resident resident resident

2. resident resident resident resident

citizen, citizen, citizen,

employed alien, non If non- alien (ETB): alien, Non alien, non

resident resident resident

in OBU resident resident Exempt resident resident

alien, non alien, non alien, non

3.employe alien (ETB): citizen/alie alien (ETB): alien, resident resident resident

d by 20% n: exempt If Non 20% (ETB): 10%

alien alien alien

petroleum Resident (ETB): (ETB): 5%- (ETB): 20%

service If Non Alien If Non If Non 20% 32%

contractor Resident (NETB) Resident Resident If Non

and sub Alien Alien Alien If Non If Non Resident

contractor (NETB) 25% (NETB) (NETB) Resident Resident Alien

25% 25% 25% Alien Alien (NETB)

(NETB) (NETB) 25%

25% 25%

NO PAIN, NO GAIN, NO TAX!

Kind of taxpayer DIVIDENDS (income from investment)

Cash and/or Property Stock Dividend Liquidating Dividend

dividends

Resident Citizen 10% exempt 5%-32%

Non resident 10% Exempt 5%-32%

citizen

Resident Alien 10% Exempt 5%-32%

Non Resident Alien 20% Exempt 5%-32%

(ETB)

Non Resident Alien 25% Exempt 25%

(NETB)

Special Classes It depends. Exempt It depends.

1. employed by

ROHQ/RHQ If Resident Citizen, Non If Resident Citizen, Non

2. employed in OBU resident citizen, resident resident citizen, resident

3.employed by alien: 10% alien, non resident alien

petroleum service (ETB): 5%-32%

contractor and sub If non resident alien (ETB):

contractor 20% If Non Resident Alien (NETB)

25%

If Non Resident Alien (NETB)

25%

Kind of Taxpayer CAPITAL GAINS (INCOME FROM INVESTMENT ASSET)

Capital Gains from Shares of Capital Gains from Sale of Real Other Capital Gains from

Stock NOT traded in the Property (Provided it is located in bonds, debentures etc.

Stock Exchange the Philippines and classified as

capital asset)

Resident Citizen 5%-32%

Non resident 5%-32%

citizen

Resident Alien 5%-32%

Non Resident Alien Not over 100,000 = 5% 5%-32%

(ETB)

Non Resident Alien Over 100,000 = 10% 6% (on gross income) 25%

(NETB)

Special Classes (on net capital gains) It depends.

1. employed by

ROHQ/RHQ If Resident Citizen, Non

2. employed in OBU resident citizen, resident

3.employed by alien, non resident alien

petroleum service (ETB): 5%-32%

contractor and sub

contractor If Non Resident Alien (NETB)

25%

NO PAIN, NO GAIN, NO TAX!

NO PAIN, NO GAIN, NO TAX!

Potrebbero piacerti anche

- FOREIGN EARNED INCOME EXCLUSION - #1 Tax Break for US Expats and Digital NomadsDa EverandFOREIGN EARNED INCOME EXCLUSION - #1 Tax Break for US Expats and Digital NomadsNessuna valutazione finora

- Revenue Regulations No. 2-98 Withholding Tax GuideDocumento16 pagineRevenue Regulations No. 2-98 Withholding Tax GuideLea Samantha GallardoNessuna valutazione finora

- PWC (2015) - 48 - State-Owned Enterprises - Catalysts For Public Value Creation (PEs SOEs) PDFDocumento48 paginePWC (2015) - 48 - State-Owned Enterprises - Catalysts For Public Value Creation (PEs SOEs) PDFAna Bandeira100% (1)

- REO CPA Review: REO: Income Taxation - Final Withholding Tax TableDocumento2 pagineREO CPA Review: REO: Income Taxation - Final Withholding Tax TableCamille SingianNessuna valutazione finora

- Annual Training Calendar 2011-2012Documento10 pagineAnnual Training Calendar 2011-2012krovvidiprasadaraoNessuna valutazione finora

- Withholding Taxes Learning ObjectivesDocumento8 pagineWithholding Taxes Learning ObjectivesAce AlquinNessuna valutazione finora

- H04.1 - Final Income Tax TableDocumento2 pagineH04.1 - Final Income Tax Tablenona galidoNessuna valutazione finora

- Canadian International Taxation: Income Tax Rules for ResidentsDa EverandCanadian International Taxation: Income Tax Rules for ResidentsNessuna valutazione finora

- Wealth Management Planning: The UK Tax PrinciplesDa EverandWealth Management Planning: The UK Tax PrinciplesValutazione: 4.5 su 5 stelle4.5/5 (2)

- DOJ Circular No. 70Documento3 pagineDOJ Circular No. 70Sharmen Dizon Gallenero100% (1)

- Tax 2 - Finals NotesDocumento50 pagineTax 2 - Finals NotesAdi HernandezNessuna valutazione finora

- Class 17 - Dabhol Case Study PDFDocumento28 pagineClass 17 - Dabhol Case Study PDFBaljeetSinghKhoslaNessuna valutazione finora

- 2016 Revised Rules On Small ClaimsDocumento66 pagine2016 Revised Rules On Small ClaimsAngelica AbalosNessuna valutazione finora

- 2016 Revised Rules On Small ClaimsDocumento66 pagine2016 Revised Rules On Small ClaimsAngelica AbalosNessuna valutazione finora

- 2016 Revised Rules On Small ClaimsDocumento66 pagine2016 Revised Rules On Small ClaimsAngelica AbalosNessuna valutazione finora

- Final Tax LectureDocumento7 pagineFinal Tax LectureJefrey Jismen Ballesteros100% (1)

- RR 02-98 (Narrative Form)Documento20 pagineRR 02-98 (Narrative Form)saintkarri100% (5)

- A Report On Integrated Marketing Communication Plan For Dove Baby Care Products in IndiaDocumento14 pagineA Report On Integrated Marketing Communication Plan For Dove Baby Care Products in IndiaSukanya Bhattacharjee80% (5)

- Tax 1Documento4 pagineTax 1Aiza CabenianNessuna valutazione finora

- Individual Income Tax NOTESDocumento1 paginaIndividual Income Tax NOTESNavsNessuna valutazione finora

- Notes: Taxation On Individuals: Individual Taxpayers Are Natural Persons With Income Derived From WithinDocumento10 pagineNotes: Taxation On Individuals: Individual Taxpayers Are Natural Persons With Income Derived From WithinJohn BanzonNessuna valutazione finora

- Lesson 4 Final Income Taxation PDFDocumento4 pagineLesson 4 Final Income Taxation PDFErika ApitaNessuna valutazione finora

- Chapter 05 Final Income Taxation TableDocumento4 pagineChapter 05 Final Income Taxation TablejannyNessuna valutazione finora

- 02B Income Taxes: Clwtaxn de La Salle UniversityDocumento35 pagine02B Income Taxes: Clwtaxn de La Salle UniversityTrisha RuzolNessuna valutazione finora

- Tax Tables Latest Revisions 2022Documento2 pagineTax Tables Latest Revisions 2022Novyh Angelique CabreraNessuna valutazione finora

- 8 Passive Income of Individuals LAST TOPIC BEFORE MIDTERMDocumento5 pagine8 Passive Income of Individuals LAST TOPIC BEFORE MIDTERMArgie DeguzmanNessuna valutazione finora

- Other Winnings Except PCSO & LottoDocumento5 pagineOther Winnings Except PCSO & LottoEzi AngelesNessuna valutazione finora

- Tax RatesDocumento2 pagineTax RatesDelaney MiramNessuna valutazione finora

- Tax On Individuals Part 2Documento10 pagineTax On Individuals Part 2Tet AleraNessuna valutazione finora

- Passive Income Tax Rates for Residents and Non-ResidentsDocumento3 paginePassive Income Tax Rates for Residents and Non-ResidentsPamela Jean CuyaNessuna valutazione finora

- Tax CH 1 13Documento7 pagineTax CH 1 13Charmaine Contillo BasilioNessuna valutazione finora

- Tax ChartsDocumento33 pagineTax ChartsDavid TanNessuna valutazione finora

- 05c Computing Income TaxesDocumento32 pagine05c Computing Income TaxesGolden ChildNessuna valutazione finora

- Fit Income TaxDocumento8 pagineFit Income TaxadrianoedwardjosephNessuna valutazione finora

- Philippine Tax Law Changes SummaryDocumento13 paginePhilippine Tax Law Changes SummarykeyelNessuna valutazione finora

- Final Income Taxation 1Documento31 pagineFinal Income Taxation 1Princess Ann FranciscoNessuna valutazione finora

- Citizenship and Taxation StatusDocumento4 pagineCitizenship and Taxation StatusAisah ReemNessuna valutazione finora

- Business Law & Taxation Income Taxation (Individuals) Compilation of NotesDocumento4 pagineBusiness Law & Taxation Income Taxation (Individuals) Compilation of NotesJeremie R. PlazaNessuna valutazione finora

- Income TaxDocumento4 pagineIncome TaxLea Samantha GallardoNessuna valutazione finora

- Final Tax Rates Notes: General CoverageDocumento3 pagineFinal Tax Rates Notes: General CoverageDarius DelacruzNessuna valutazione finora

- Final Tax Rates Notes: General CoverageDocumento3 pagineFinal Tax Rates Notes: General CoverageDarius DelacruzNessuna valutazione finora

- Module 4 Philippine Income Taxation IndividualsDocumento80 pagineModule 4 Philippine Income Taxation IndividualsFlameNessuna valutazione finora

- Regular Business/Corporate Tax: DC RFC NRFCDocumento2 pagineRegular Business/Corporate Tax: DC RFC NRFCGrace Angelie C. Asio-SalihNessuna valutazione finora

- 2018 Income Tax RatesDocumento14 pagine2018 Income Tax RatesMaria Celiña PerezNessuna valutazione finora

- Income TaxationDocumento4 pagineIncome Taxationralfgerwin inesaNessuna valutazione finora

- Tax TablesDocumento3 pagineTax TablesJimbo HotdogNessuna valutazione finora

- Summary of Passive Income and Capital Gains Taxes - MaupoDocumento4 pagineSummary of Passive Income and Capital Gains Taxes - MaupoMae MaupoNessuna valutazione finora

- Source Final Tax: Interest Income or Yield From Local Currency Bank Deposits or Deposit SubstitutesDocumento3 pagineSource Final Tax: Interest Income or Yield From Local Currency Bank Deposits or Deposit SubstitutesJhon Ariel JulatonNessuna valutazione finora

- Philippine Income Tax Classification GuideDocumento5 paginePhilippine Income Tax Classification GuideLouNessuna valutazione finora

- Income Taxation (With Create Bill Application) Com-Ex ReviewerDocumento4 pagineIncome Taxation (With Create Bill Application) Com-Ex Reviewerlonely ylenolNessuna valutazione finora

- W14 Module 12withholding TaxesDocumento7 pagineW14 Module 12withholding Taxescamille ducutNessuna valutazione finora

- Taxable Income Citizenship & Residency Inside RP Outside RP Tax Rate On Certain Passive Income On Citizen and Resident Alien Final TaxDocumento10 pagineTaxable Income Citizenship & Residency Inside RP Outside RP Tax Rate On Certain Passive Income On Citizen and Resident Alien Final TaxShasharu Fei-fei LimNessuna valutazione finora

- Income Tax Table - Part 1 and 2Documento8 pagineIncome Tax Table - Part 1 and 2Rebecca TatadNessuna valutazione finora

- San Beda College of Law: 2005 C B O Annex B T R CDocumento3 pagineSan Beda College of Law: 2005 C B O Annex B T R CRachel LeachonNessuna valutazione finora

- Income RC, NRC & RA Nranetb Interest Income DepositsDocumento3 pagineIncome RC, NRC & RA Nranetb Interest Income DepositsMichael AquinoNessuna valutazione finora

- Passive Incomes and Capital Gains Tax Rates in the PhilippinesDocumento1 paginaPassive Incomes and Capital Gains Tax Rates in the PhilippinesChimmy ParkNessuna valutazione finora

- Resident Citizen NRC, Ra, Nra-Etb Nra-Netb Regular Income Passive Income (Within The PH) Capital Gains Subject To CGTDocumento19 pagineResident Citizen NRC, Ra, Nra-Etb Nra-Netb Regular Income Passive Income (Within The PH) Capital Gains Subject To CGTKrizza TerradoNessuna valutazione finora

- Interest Income: Local Currency Bank DepositsDocumento4 pagineInterest Income: Local Currency Bank Depositsroel rhodael samsonNessuna valutazione finora

- FT TableDocumento4 pagineFT TableChantie BorlonganNessuna valutazione finora

- Income Tax of Individual: Books, Musical 10k or Less 10k++ Luck/chanceDocumento3 pagineIncome Tax of Individual: Books, Musical 10k or Less 10k++ Luck/chanceKatherine Jane UnayNessuna valutazione finora

- income taxDocumento2 pagineincome taxRenalyn Ps MewagNessuna valutazione finora

- Tax RatesDocumento6 pagineTax RatesStephany PolinarNessuna valutazione finora

- Tax Rates for Individuals, Capital Gains, Passive Income and Corporations from 2018-2022Documento9 pagineTax Rates for Individuals, Capital Gains, Passive Income and Corporations from 2018-2022Kyle SubidoNessuna valutazione finora

- Undergrad Review in Income TaxationDocumento17 pagineUndergrad Review in Income TaxationJamesNessuna valutazione finora

- Final Taxes RatesDocumento2 pagineFinal Taxes RatesPanda CocoNessuna valutazione finora

- Module No 3 - INCOME TAXATION PART1ADocumento6 pagineModule No 3 - INCOME TAXATION PART1APrinces S. RoqueNessuna valutazione finora

- HO4Passive Income - Revision 1Documento2 pagineHO4Passive Income - Revision 1Christopher SantosNessuna valutazione finora

- Real Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsDa EverandReal Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsNessuna valutazione finora

- Case - Digests - Wills - and - Succession - Docx Filename - UTF-8''Case Digests Wills and SuccessionDocumento15 pagineCase - Digests - Wills - and - Succession - Docx Filename - UTF-8''Case Digests Wills and SuccessionXela LaurenNessuna valutazione finora

- Rules On Capacity in Conflict of LawsDocumento6 pagineRules On Capacity in Conflict of LawsXela LaurenNessuna valutazione finora

- Summary of Alternative CrimesDocumento11 pagineSummary of Alternative CrimesXela LaurenNessuna valutazione finora

- Written Report PartDocumento3 pagineWritten Report PartXela LaurenNessuna valutazione finora

- Case DigestsDocumento4 pagineCase DigestsXela LaurenNessuna valutazione finora

- Written Report PartDocumento3 pagineWritten Report PartXela LaurenNessuna valutazione finora

- Written Report PartDocumento3 pagineWritten Report PartXela LaurenNessuna valutazione finora

- Alvarez vs. Intermediate Appellate CourtDocumento16 pagineAlvarez vs. Intermediate Appellate Courtleo.rosarioNessuna valutazione finora

- Table of Tax Rates For CorporationsDocumento11 pagineTable of Tax Rates For CorporationsXela LaurenNessuna valutazione finora

- Environmental Assessment Template Group MembersDocumento4 pagineEnvironmental Assessment Template Group MembersPaula NguyenNessuna valutazione finora

- River Bus Tours MapDocumento1 paginaRiver Bus Tours Mapkorgsv1Nessuna valutazione finora

- Main Theories of FDIDocumento22 pagineMain Theories of FDIThu TrangNessuna valutazione finora

- Irfz 24 NDocumento9 pagineIrfz 24 Njmbernal7487886Nessuna valutazione finora

- 2013 Visayas Power Supply and Demand Situation: Republic of The Philippines Department of EnergyDocumento10 pagine2013 Visayas Power Supply and Demand Situation: Republic of The Philippines Department of EnergyJannet MalezaNessuna valutazione finora

- Cash Inflow and OutflowDocumento6 pagineCash Inflow and OutflowMubeenNessuna valutazione finora

- Supply Chain-Case Study of DellDocumento3 pagineSupply Chain-Case Study of DellSafijo Alphons100% (1)

- Easy Rasam Recipe Made Without Rasam PowderDocumento6 pagineEasy Rasam Recipe Made Without Rasam PowderPrantik Adhar SamantaNessuna valutazione finora

- Ravikumar S: Specialties: Pre-Opening, Procurement, Implementing Best Practices, Budgets, CostDocumento2 pagineRavikumar S: Specialties: Pre-Opening, Procurement, Implementing Best Practices, Budgets, CostMurthy BanagarNessuna valutazione finora

- Hygeia International: I. Title of The CaseDocumento7 pagineHygeia International: I. Title of The CaseDan GabonNessuna valutazione finora

- India Is The Second Largest Employment Generator After AgricultureDocumento2 pagineIndia Is The Second Largest Employment Generator After AgriculturevikashprabhuNessuna valutazione finora

- Product MarketingDocumento2 pagineProduct MarketingAmirul AzwanNessuna valutazione finora

- Pension FORM A & T No. 260 Mize PensionersDocumento2 paginePension FORM A & T No. 260 Mize Pensionerssyed.jerjees.haiderNessuna valutazione finora

- E-Challan CCMT ChallanDocumento2 pagineE-Challan CCMT ChallanSingh KDNessuna valutazione finora

- Chapter 4 Transportation and Assignment ModelsDocumento88 pagineChapter 4 Transportation and Assignment ModelsSyaz Amri100% (1)

- How To Attack The Leader - FinalDocumento14 pagineHow To Attack The Leader - Finalbalakk06Nessuna valutazione finora

- Cash Forecasting For ClassDocumento24 pagineCash Forecasting For ClassShaikh Saifullah KhalidNessuna valutazione finora

- Advanced Accounting Part 2 Dayag 2015 Chapter 12Documento17 pagineAdvanced Accounting Part 2 Dayag 2015 Chapter 12crispyy turon100% (1)

- LC Financial Report & Google Drive Link: Aiesec Delhi IitDocumento6 pagineLC Financial Report & Google Drive Link: Aiesec Delhi IitCIM_DelhiIITNessuna valutazione finora

- European Culinary Management & Western Gastronomic CookeryDocumento6 pagineEuropean Culinary Management & Western Gastronomic CookeryJennifer MuliadyNessuna valutazione finora

- BDW94CDocumento7 pagineBDW94CWalter FabianNessuna valutazione finora

- Class XII - Economics Government Budget and The EconomyDocumento5 pagineClass XII - Economics Government Budget and The EconomyAayush GargNessuna valutazione finora

- Quality Improvement With Statistical Process Control in The Automotive IndustryDocumento8 pagineQuality Improvement With Statistical Process Control in The Automotive Industryonii96Nessuna valutazione finora

- Project EvaluationDocumento4 pagineProject EvaluationUkesh ShresthaNessuna valutazione finora

- Flydubai Menu Issue 09Documento11 pagineFlydubai Menu Issue 09Swamy RakeshNessuna valutazione finora

- SAP Project Systems OverviewDocumento6 pagineSAP Project Systems OverviewkhanmdNessuna valutazione finora