Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Contract Ps3 18

Caricato da

JohnCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Contract Ps3 18

Caricato da

JohnCopyright:

Formati disponibili

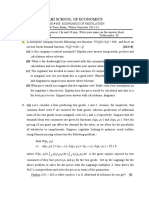

Contract Theory (Summer 18) 3-1 Prof. Dr. Klaus M.

Schmidt

Problem Set 3

Please hand in your individual solutions on Monday, April 30, before

class. Don’t forget to keep a copy of your solutions for yourself! At most

one problem set may be handed in late.

Question 1

(Final Exam 03/04) The risk neutral company “Microhard” wants to employ

a risk neutral programmer. If the programmer works the amount of time t

per week Microhard profits increase by π(t) = t. The programmer has a

cost function

c(t, θ) = θt2 ,

where the parameter θ ∈ { 14 , 12 } is private knowledge of the programmer.

“Microhard” estimates that the probability of low costs (θ = 14 ) is p and

that the probability of high costs (θ = 12 ) is (1 − p). The programmer has an

outside option of U = 0 and Microhard can commit to a “Take-it-or-leave-it”

offer of a menu of possible contracts. Each contract i specifies the weekly

working time ti and a corresponding total wage wi .

a) Derive the first best working time for each type of programmer and

show how a social planner could achieve it by a simple wage scheme.

b) State the problem of the profit maximizing company and explain briefly

why we can restrict the analysis to direct mechanisms.

c) Show which constrains must be binding in the optimum and which

constraints can be ignored.

d) Derive the optimal incentive contract.

e) Let p = 12 . Calculate Microhard’s and the programmer’s profits under

the optimal incentive contract conditional on θ.

f) Under which circumstances would Microhard like to renegotiate ex

post the signed contract from part d)?

g) Describe intuitively the consequences if Microhard cannot credibly

commit not to renegotiate the signed contract.

Contract Theory (Summer 18) 3-2 Prof. Dr. Klaus M. Schmidt

Question 2

Consider a monopolist faced with a continuum of consumers indexed by θ ∈

[θ, θ]. Each consumer is characterized by a thrice continuously differentiable

utility function given by

1

U (q, x | θ) = θq − q 2 + x ,

2

where x is the quantity consumed of good 1 (a numeraire good) and q is the

quantity consumed of good 2 (the good produced by the monopolist).

The parameter θ specifies the consumer’s tastes (known only to him) for

good 2. Assume that θ is uniformly distributed on [θ, θ] and that θ − θ = 1.

The consumers are endowed with a sizable amount of good 1, x, so that

their behavior is always characterized by their first-order conditions. The

monopolist has a linear cost function given by C(q) = c · q.

a) Let q F B (θ), θ ∈ [θ, θ], be the consumption profile that corresponds to

an interior first best efficient allocation. Show that q F B (·) is increasing

in θ.

b) Let {q(θ), t(θ)} be a differentiable revelation mechanism that induces

consumer θ to reveal his type truthfully. More precisely, if he an-

nounces θ, he receives a quantity of q(θ) of good 2 and must pay an

amount t(θ) of good 1. Moreover, assume that the monopolist must

guarantee to each consumer a positive increment in utility given by

1

θq(θ) − q(θ)2 − t(θ) ≥ 0 ∀θ ∈ [θ, θ] .

2

Characterize the set of implementable allocations subject to this con-

straint.

c) Write the optimization program for the monopolist who maximizes

expected profits and who is required to supply his product to all con-

sumers. Show that the optimal profile q ∗ (θ) is increasing in θ. Inter-

pret the optimal revelation mechanism as a nonlinear pricing scheme.

Contract Theory (Summer 18) 3-3 Prof. Dr. Klaus M. Schmidt

Question 3

Air Shangri-la is the only airline allowed to fly between the islands of

Shangri-la and Nirvana. There are two types of passengers, tourists and

business. Business travelers are willing to pay more than tourists. The air-

line, however, cannot tell directly whether a ticket purchaser is a tourist or

a business traveler. The two types do differ, though, in how much they are

willing to pay to avoid having to purchase their tickets in advance. (Passen-

gers do not like to commit themselves in advance to traveling at a particular

time.)

More specifically, the utility levels of each of the two types net of the price

of the ticket, P , for any amount of time W prior to the flight that the ticket

is purchased are given by

Business : uB (P, W ) = v − θB P − W,

T ourist : uT (P, W ) = v − θT P − W,

where 0 < θB < θT and (P, W ) ∈ R2+ . The outside option of not buying a

ticket is 0 for both types.

The proportion of travelers who are tourists is λ. Assume that the costs

of transporting a passenger is c, where c < v/θT , and that there are no

capacity constraints.

a) Formulate the optimal (profit-maximizing) price discrimination prob-

lem mathematically that Air Shangri-la would want to solve.

b) Show that in the optimal solution, tourists are indifferent between

buying a ticket and not going at all.

c) Show that in the optimal solution, business travelers never buy their

ticket prior to the flight (i.e., WB = 0) and that they are just indifferent

between doing this and buying when tourists buy. Do not try to solve

the full program to show this!

d) Show that in the optimal solution, tourists will strictly prefer to buy

a tourists ticket rather than a business ticket (if there is a separating

contract, i.e.).

e) Now fully solve for the optimal price discrimination scheme. How

does it depend on the underlying parameters λ, θB , θT , and c? Under

what circumstances will Air Shangri-la choose to serve only business

travelers?

Potrebbero piacerti anche

- The University of Zambia ZCAS UniversityDocumento4 pagineThe University of Zambia ZCAS Universitycaleb chipetaNessuna valutazione finora

- 2011 MT1Documento2 pagine2011 MT1adamNessuna valutazione finora

- Pset1 2014Documento4 paginePset1 2014Gualtiero AzzaliniNessuna valutazione finora

- Exercises 3Documento3 pagineExercises 3dabuliemeiyoudianNessuna valutazione finora

- Growth Model: Part 1Documento14 pagineGrowth Model: Part 1z_k_j_vNessuna valutazione finora

- Delhi School of EconomicsDocumento2 pagineDelhi School of EconomicsadamNessuna valutazione finora

- Delhi School of Economics:, P) and D, P) - Here TheDocumento2 pagineDelhi School of Economics:, P) and D, P) - Here TheadamNessuna valutazione finora

- Delhi School of EconomicsDocumento2 pagineDelhi School of EconomicsadamNessuna valutazione finora

- This Study Resource Was: Economics 302Documento2 pagineThis Study Resource Was: Economics 302SmartunblurrNessuna valutazione finora

- Macro Questionss12Documento8 pagineMacro Questionss12paripi99Nessuna valutazione finora

- Problem2 2017Documento3 pagineProblem2 2017aNessuna valutazione finora

- Danthine ExercisesDocumento22 pagineDanthine ExercisesmattNessuna valutazione finora

- Public Good, Externality and Market ImperfectionsDocumento41 paginePublic Good, Externality and Market ImperfectionsZaeem Zaheer QureshiNessuna valutazione finora

- JHU Spring2009 FinalExamDocumento17 pagineJHU Spring2009 FinalExamJB 94Nessuna valutazione finora

- Optimality of Reinsurance Treaties Under A MeanDocumento12 pagineOptimality of Reinsurance Treaties Under A Meansamah djedaietNessuna valutazione finora

- Gra 65161 - 202020 - 20.11.2020 - QPDocumento5 pagineGra 65161 - 202020 - 20.11.2020 - QPHien NgoNessuna valutazione finora

- Macroeconomics 1 PS7 SolutionsDocumento16 pagineMacroeconomics 1 PS7 SolutionsTaib MuffakNessuna valutazione finora

- Seminar 3 - SolutionsDocumento13 pagineSeminar 3 - SolutionsDavidBudinasNessuna valutazione finora

- Economics 106P Ucla E. Mcdevitt Study Questions Set #2 PricingDocumento8 pagineEconomics 106P Ucla E. Mcdevitt Study Questions Set #2 PricingZhen WangNessuna valutazione finora

- Solving DSGE Models Using DynareDocumento11 pagineSolving DSGE Models Using DynarerudiminNessuna valutazione finora

- Solving DSGE Models Using DynareDocumento11 pagineSolving DSGE Models Using DynarerudiminNessuna valutazione finora

- 28d8633c121419cda48c0d9a622614d6_27f68bd319e3aca1d3f97af3bbb90014Documento9 pagine28d8633c121419cda48c0d9a622614d6_27f68bd319e3aca1d3f97af3bbb90014deepakdohare1011Nessuna valutazione finora

- Mikro II Sommer 2021 ReDocumento5 pagineMikro II Sommer 2021 ReMikkel HolmNessuna valutazione finora

- Some Notes On The Revelation Principle: 1 Direct and Indirect MechanismsDocumento10 pagineSome Notes On The Revelation Principle: 1 Direct and Indirect MechanismsSuliman AlmojelNessuna valutazione finora

- Problem Set 1 "Working With The Solow Model"Documento26 pagineProblem Set 1 "Working With The Solow Model"keyyongparkNessuna valutazione finora

- PDF ImpDocumento10 paginePDF ImpstudiessNessuna valutazione finora

- Note On Continuous Time Optimization: Econ 204A - Henning BohnDocumento9 pagineNote On Continuous Time Optimization: Econ 204A - Henning BohnHector RubiniNessuna valutazione finora

- Microeconomics I - MidtermDocumento6 pagineMicroeconomics I - Midtermcrod123456Nessuna valutazione finora

- Principles of MicroeconomicsDocumento10 paginePrinciples of MicroeconomicsAnand AryaNessuna valutazione finora

- JHU Spring2009 FinalExamSolutionsDocumento14 pagineJHU Spring2009 FinalExamSolutionsJB 94Nessuna valutazione finora

- Take The Demand Curve and Double The Slope: MR 130-4QDocumento9 pagineTake The Demand Curve and Double The Slope: MR 130-4Qstatus worldNessuna valutazione finora

- A Simple Dynamic Economy: 2.1 General Principles For Specifying A ModelDocumento25 pagineA Simple Dynamic Economy: 2.1 General Principles For Specifying A ModelricrigarNessuna valutazione finora

- Pset3 2013Documento6 paginePset3 20136doitNessuna valutazione finora

- AssgnDocumento5 pagineAssgnMehvaish QadriNessuna valutazione finora

- Schema ComputDocumento13 pagineSchema ComputRossella GebbaniNessuna valutazione finora

- Musgrave, Curves: Musgrave FF.) Musgrave Musgrave (1989, FF.), (Hyman 1996) - Musgrave'sDocumento6 pagineMusgrave, Curves: Musgrave FF.) Musgrave Musgrave (1989, FF.), (Hyman 1996) - Musgrave'sSalah MuhammedNessuna valutazione finora

- Industrial OrganisationDocumento12 pagineIndustrial OrganisationRogelio MeloNessuna valutazione finora

- 2014 ZaDocumento5 pagine2014 ZaShershah KakakhelNessuna valutazione finora

- Exercises Web VersionDocumento15 pagineExercises Web VersionDavid SarmientoNessuna valutazione finora

- The Disney DilemmaDocumento21 pagineThe Disney DilemmaSasathorn SanguandeekulNessuna valutazione finora

- Assignment 2-2Documento2 pagineAssignment 2-2kfcsh5cbrcNessuna valutazione finora

- Math 07 Exercise11Documento1 paginaMath 07 Exercise11Pedro Ivo Camacho SalvadorNessuna valutazione finora

- IE54500 - Problem Set 1: 1. AffordabilityDocumento4 pagineIE54500 - Problem Set 1: 1. AffordabilityMNessuna valutazione finora

- Chapter 18Documento35 pagineChapter 18Ejust MassodNessuna valutazione finora

- EC202 Past Exam Paper Exam 2013Documento7 pagineEC202 Past Exam Paper Exam 2013FRRRRRRRTNessuna valutazione finora

- PS1 - IO - 2 Asd Qwe 1 23123015Documento3 paginePS1 - IO - 2 Asd Qwe 1 23123015DrutonNessuna valutazione finora

- Algorithmic Game Theory - No-Regret DynamicsDocumento9 pagineAlgorithmic Game Theory - No-Regret DynamicspokechoNessuna valutazione finora

- HW4Monopoly, Game TheoryDocumento3 pagineHW4Monopoly, Game TheoryShivani GuptaNessuna valutazione finora

- Firm Heterogeneity, Endogenous Markups, and Factor EndowmentsDocumento24 pagineFirm Heterogeneity, Endogenous Markups, and Factor EndowmentsHector Perez SaizNessuna valutazione finora

- Recitation 9 EconS501 Fall2010Documento9 pagineRecitation 9 EconS501 Fall2010Debjani ChowdhuryNessuna valutazione finora

- Robust Optimal Reinsurance and Investment Problem With P-Thinning Dependent and Default RisksDocumento11 pagineRobust Optimal Reinsurance and Investment Problem With P-Thinning Dependent and Default RisksIjbmm JournalNessuna valutazione finora

- Monopoly NotesDocumento15 pagineMonopoly NotesmylittlespammyNessuna valutazione finora

- Mec-001 Eng PDFDocumento82 pagineMec-001 Eng PDFnitikanehiNessuna valutazione finora

- Exercises Part2Documento9 pagineExercises Part2christina0107Nessuna valutazione finora

- Amd 03Documento20 pagineAmd 03MRINAL GAUTAMNessuna valutazione finora

- Monopoly Taxation and TarrifsDocumento9 pagineMonopoly Taxation and Tarrifslinhngoc9204Nessuna valutazione finora

- Tugas Pemodelan REVISEDocumento7 pagineTugas Pemodelan REVISEPegga AdeLaNessuna valutazione finora

- Module 3 Lecture 11Documento7 pagineModule 3 Lecture 11Swapan Kumar SahaNessuna valutazione finora

- Mathematical Formulas for Economics and Business: A Simple IntroductionDa EverandMathematical Formulas for Economics and Business: A Simple IntroductionValutazione: 4 su 5 stelle4/5 (4)

- Consumer ChoiceDocumento45 pagineConsumer ChoiceFazlul Amin ShuvoNessuna valutazione finora

- Planning Under Mixed EconomyDocumento10 paginePlanning Under Mixed EconomySurendra PantNessuna valutazione finora

- Joseph Nye, Soft PowerDocumento24 pagineJoseph Nye, Soft Powerpeter_yoon_14Nessuna valutazione finora

- Digital Divide - The NoteDocumento5 pagineDigital Divide - The NoteKelvin NTAHNessuna valutazione finora

- Use The Following Information For The Next 2 QuestionsDocumento4 pagineUse The Following Information For The Next 2 QuestionsGlen JavellanaNessuna valutazione finora

- Meaning and Definition of Audit ReportDocumento50 pagineMeaning and Definition of Audit ReportomkintanviNessuna valutazione finora

- Touch and GoDocumento10 pagineTouch and GoABDUL HADI ABDUL RAHMANNessuna valutazione finora

- Unit I - Logistics ManagementDocumento12 pagineUnit I - Logistics ManagementDeepesh PathakNessuna valutazione finora

- Postpaid Bill 8197545758 BM2229I010262570Documento4 paginePostpaid Bill 8197545758 BM2229I010262570Mohammad MAAZNessuna valutazione finora

- Paper2 HL G2 PDFDocumento5 paginePaper2 HL G2 PDFAntongiulio MiglioriniNessuna valutazione finora

- Pilar EEMDocumento17 paginePilar EEMjesusmemNessuna valutazione finora

- Linkedin 7 Ways Sales Professionals Drive Revenue With Social Selling en UsDocumento11 pagineLinkedin 7 Ways Sales Professionals Drive Revenue With Social Selling en UsJosiah PeaceNessuna valutazione finora

- (Company Name/Logo Here) : Sales Incentive Compensation Plan DocumentDocumento9 pagine(Company Name/Logo Here) : Sales Incentive Compensation Plan DocumentashokNessuna valutazione finora

- A Study On Corporate Social Responsibility (CSR) of Ncell: Raj Kumar Karki UNIVERSITY ROLL NO.: 1411001540Documento8 pagineA Study On Corporate Social Responsibility (CSR) of Ncell: Raj Kumar Karki UNIVERSITY ROLL NO.: 1411001540Raj0% (1)

- Assignment 2Documento2 pagineAssignment 2Rence MarcoNessuna valutazione finora

- Living in The IT ERADocumento25 pagineLiving in The IT ERAAntonio Vicente Chua83% (6)

- IBT Lesson3Documento17 pagineIBT Lesson3Melvin Ray M. MarisgaNessuna valutazione finora

- Case Study LeanDocumento2 pagineCase Study LeanAnkur DhirNessuna valutazione finora

- Fundamentals of Corporate Finance Canadian 9th Edition Brealey Test BankDocumento25 pagineFundamentals of Corporate Finance Canadian 9th Edition Brealey Test BankMadelineTorresdazb100% (61)

- CIR Vs ST Luke S Medical CenterDocumento6 pagineCIR Vs ST Luke S Medical CenterOlan Dave LachicaNessuna valutazione finora

- Cost Classification ExerciseDocumento3 pagineCost Classification ExerciseVikas MvNessuna valutazione finora

- Quiz Ibm 530 (Ans 13-18) ZammilDocumento5 pagineQuiz Ibm 530 (Ans 13-18) Zammilahmad zammilNessuna valutazione finora

- Chapter #12Documento36 pagineChapter #12PriyaGnaeswaranNessuna valutazione finora

- Anand Dani Project SAPMDocumento70 pagineAnand Dani Project SAPMJiavidhi SharmaNessuna valutazione finora

- Rabbit Fish Pond (Powerpoint)Documento36 pagineRabbit Fish Pond (Powerpoint)Allan DeGuzman Dela Vega50% (4)

- Partnership LiquidationDocumento11 paginePartnership LiquidationBimboy Romano100% (1)

- Leadership TeslaDocumento6 pagineLeadership TeslaKendice ChanNessuna valutazione finora

- Form Courier Bill of Entry - XIII (CBE-XIII) (See Regulation 5) Courier Bill of Entry For Dutiable Goods OriginalDocumento2 pagineForm Courier Bill of Entry - XIII (CBE-XIII) (See Regulation 5) Courier Bill of Entry For Dutiable Goods OriginalMohammed jawedNessuna valutazione finora

- B. Proportionate Sharing of Costs and Profit.: EngageDocumento2 pagineB. Proportionate Sharing of Costs and Profit.: EngageOliver TalipNessuna valutazione finora

- CFA Level 1 - V2 Exam 1 PMDocumento30 pagineCFA Level 1 - V2 Exam 1 PMHongMinhNguyenNessuna valutazione finora