Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

IGNOU Elements of Income Tax Question Paper Free Download B.com June 2017

Caricato da

Rainy Goodwill0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

232 visualizzazioni4 pagineGoodwill tuition centre Thevara 9846710963 9567902805

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoGoodwill tuition centre Thevara 9846710963 9567902805

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

232 visualizzazioni4 pagineIGNOU Elements of Income Tax Question Paper Free Download B.com June 2017

Caricato da

Rainy GoodwillGoodwill tuition centre Thevara 9846710963 9567902805

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

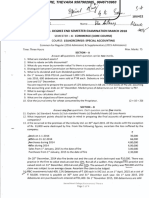

GOODWILL TUITION CENTRE, THEVARA, ERNAKULAM PH 9846710963

No. of Printed Pages : 8 ECO-011

BACHELOR'S DEGREE PROGRAMME

Term-End Examination

June, 2017

0000I

(ELECTIVE COURSE : COMMERCE)

ECO-011 : ELEMENTS OF INCOME TAX

Time : 2 hours Maximum Marks : 50

Note : Question no 1 is compulsory. Attempt any three

questions from the remaining questions.

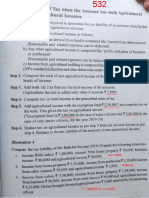

1. On the basis of the following information,

compute the taxable income of Mr. Saurabh

under the head 'Salaries' for the assessment

year 2017-18 : 14

(p.m.)

(i) Basic Pay 40,000

(ii) Dearness Pay 11,000

(iii) Dearness Allowance 13,000

(iv) Entertainment Allowance 2,800

(v) Hill Area Allowance 1,450

(vi) Tribal Area Allowance 750

(vii) Own contribution towards

Statutory Provident Fund 12,500

ECO-011 1 P.T.O.

(viii) Employer's contribution in

Provident Fund excess of 12%

of salary 12,500

(ix) Interest credited to Provident

Fund in whole year @ 13% 16,500

(x) House Rent Allowance of

whole year 29,600

Mr. Saurabh is an officer of the Forest

Department of the Government of UP. He is

employed at a place at the height of

1,100 metres above sea level. He is paying

2,800 p.m. as house rent.

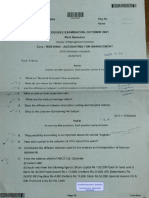

2. Define the term 'perquisites' with examples.

Explain the method of valuation of furnished

rent free accommodation provided by the

employer to a non-government employee. 4+8

3. (a) Define annual value and state the

deductions that are allowed from the

annual value in computing the income from

house property.

(b) From the following information, compute the

annual value of a house : 6+6

Municipal Value (M.V.) 1,50,000

Fair Rent 1,80,000

Standard Rent 1,60,000

Actual Rent 20,000 (p.m.)

Municipal Tax paid

by the owner 20% of M.V.

Unrealised Rent 40,000

ECO-011 2

GOODWILL TUITION CENTRE, THEVARA, ERNAKULAM PH 9846710963

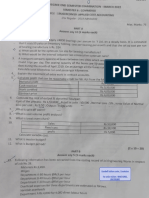

4. (a) Define the term 'capital assets' as per

Section 2(14) of the Income Tax Act and state

the assets that are not included therein.

(b) Shri Mahesh Joshi has a house which is let

out for residential purpose. He had

purchased this house for 66,500 in

1987 — 88. He sold this house on

15th June, 2014 for 5,70,000. He had

purchased some jewellery in 1987 — 88 for

73,150. On 22nd February, 2015 he sold

this jewellery for 6,28,000. You have to

determine the taxable capital gains of Shri

Mahesh for the assessment year 2015 — 16.

Cost inflation index are as follows :

1987 — 88 = 150, 2014 — 15 = 1024. 8+4

5. (a) Calculate income from other sources for the

assessment year 2017 — 18 from the

information given below :

I. Winnings from lottery 1,00,000

II. Amount received from

horse race winnings 35,000

III. Gift received :

(i) Received 20,000 as gift from

his friend

(ii) Received 1,00,000 as gift from

his elder brother

ECO-011 3 P.T.O.

GOODWILL TUITION CENTRE, THEVARA, ERNAKULAM PH 9846710963

(iii) Received 1,40,000 as gift on

his marriage

(iv) Received 80,000 as gift from

his NRI friend

(v) Another gift of 18,000

received from his friend

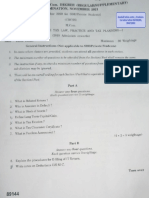

(b) Explain the rule regarding grossing up of

interest on tax-free commercial securities. 8+4

6. Write short notes on any two of the following : 2x6=12

(a) Casual Income

(b) Partly Agricultural Income

(c) Exemption regarding Children Education

and Hostel Allowance

(d) Bond Washing Transaction

GOODWILL TUITION CENTRE, THEVARA, ERNAKULAM PH 9846710963

ECO-011 4

Potrebbero piacerti anche

- IT Income From Other Sources Pt-2Documento7 pagineIT Income From Other Sources Pt-2syedfareed596Nessuna valutazione finora

- Accounting For Managers Sample PaperDocumento10 pagineAccounting For Managers Sample Paperghogharivipul0% (1)

- CA Inter Adv Accounts (New) Suggested Answer Dec21Documento30 pagineCA Inter Adv Accounts (New) Suggested Answer Dec21omaisNessuna valutazione finora

- Legal EnvironmentDocumento1 paginaLegal EnvironmentrajendrakumarNessuna valutazione finora

- M/s Alag Pre Post SolutionDocumento2 pagineM/s Alag Pre Post SolutionAyush VermaNessuna valutazione finora

- 11 CaipccaccountsDocumento19 pagine11 Caipccaccountsapi-206947225Nessuna valutazione finora

- MTP1 May2022 - Paper 5 Advanced AccountingDocumento24 pagineMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNessuna valutazione finora

- CBSE Class 11 Accountancy - Cash BookDocumento2 pagineCBSE Class 11 Accountancy - Cash BookMayankJhaNessuna valutazione finora

- Income From House PropertyDocumento26 pagineIncome From House PropertySuyash Patwa100% (1)

- 02 Per. Invest 26-30Documento5 pagine02 Per. Invest 26-30Ritu SahaniNessuna valutazione finora

- Single Entry (F. Y. B.com) Sem.1Documento13 pagineSingle Entry (F. Y. B.com) Sem.1Jignesh Togadiya0% (2)

- Xii Mcqs CH - 4 Change in PSRDocumento4 pagineXii Mcqs CH - 4 Change in PSRJoanna GarciaNessuna valutazione finora

- Job CostingDocumento18 pagineJob CostingBiswajeet DashNessuna valutazione finora

- Cost Sheet and TenderDocumento8 pagineCost Sheet and Tenderanupsuchak50% (2)

- Cost and Management Accounting NOTESDocumento72 pagineCost and Management Accounting NOTESAnshul BajajNessuna valutazione finora

- 19732ipcc CA Vol2 Cp3Documento43 pagine19732ipcc CA Vol2 Cp3PALADUGU MOUNIKANessuna valutazione finora

- Marginal Costing and Its Application - ProblemsDocumento5 pagineMarginal Costing and Its Application - ProblemsAAKASH BAIDNessuna valutazione finora

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocumento25 pagineCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNessuna valutazione finora

- Not For Profit Organisation: Basic ConceptsDocumento48 pagineNot For Profit Organisation: Basic Conceptsmonudeep aggarwalNessuna valutazione finora

- Ratio Analysis Rohit D. AkolkarDocumento21 pagineRatio Analysis Rohit D. AkolkarRajendra Gawate100% (1)

- Accounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaDocumento53 pagineAccounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaHarikrishna100% (1)

- Underwriting of Shares & Debentures - CWDocumento32 pagineUnderwriting of Shares & Debentures - CW19E1749 BALAJI MNessuna valutazione finora

- Business & Profession Q - A 02.9.2020Documento42 pagineBusiness & Profession Q - A 02.9.2020shyamiliNessuna valutazione finora

- DepreciationDocumento15 pagineDepreciationYash AggarwalNessuna valutazione finora

- Corporate Accounting ProblemDocumento6 pagineCorporate Accounting ProblemparameshwaraNessuna valutazione finora

- 36 - Problems On Cost Sheet1Documento5 pagine36 - Problems On Cost Sheet1pat_poonam0% (1)

- Ratio AnalysisDocumento42 pagineRatio AnalysiskanavNessuna valutazione finora

- Chapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsDocumento53 pagineChapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsMercy GamingNessuna valutazione finora

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocumento158 pagineRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.Nessuna valutazione finora

- Profit Prior To Incorporation: Important Points of Our Notes/BooksDocumento6 pagineProfit Prior To Incorporation: Important Points of Our Notes/BooksmaheshNessuna valutazione finora

- Chapter-4 Overheads Cost Under Absorption Costing MethodDocumento36 pagineChapter-4 Overheads Cost Under Absorption Costing MethodAdi PrajapatiNessuna valutazione finora

- Chapter 2 - Company Account - Issue of Debenture - Volume IIDocumento29 pagineChapter 2 - Company Account - Issue of Debenture - Volume IIVISHNUKUMAR S VNessuna valutazione finora

- Investment Accounting ProblemsDocumento7 pagineInvestment Accounting Problemspritika mishraNessuna valutazione finora

- Foreign Currency QuestionsDocumento2 pagineForeign Currency QuestionsAbhijeetNessuna valutazione finora

- Practice Accounts Prime PDFDocumento56 paginePractice Accounts Prime PDFShraddha NepalNessuna valutazione finora

- Operating Costing Questions (FINAL)Documento4 pagineOperating Costing Questions (FINAL)Tejas YeoleNessuna valutazione finora

- Financial Accounting For Managers Author: Sanjay Dhamija Financial Accounting For Managers Author: Sanjay DhamijaDocumento23 pagineFinancial Accounting For Managers Author: Sanjay Dhamija Financial Accounting For Managers Author: Sanjay Dhamijashweta sarafNessuna valutazione finora

- 68 Practical Questions of House PropertyDocumento14 pagine68 Practical Questions of House PropertyshrikantNessuna valutazione finora

- IT Capital Gains Pt-1Documento25 pagineIT Capital Gains Pt-1syedfareed596Nessuna valutazione finora

- Budgetary Contro1Documento138 pagineBudgetary Contro1shubham singhNessuna valutazione finora

- Accountancy ImpQ CH04 Admission of A Partner 01Documento18 pagineAccountancy ImpQ CH04 Admission of A Partner 01praveentyagiNessuna valutazione finora

- PDF Document E64dfec87bb0 1Documento75 paginePDF Document E64dfec87bb0 120BRM051 Sukant SNessuna valutazione finora

- 18415compsuggans PCC FM Chapter7Documento13 pagine18415compsuggans PCC FM Chapter7Mukunthan RBNessuna valutazione finora

- IPCC - FAST TRACK MATERIAL - 35e PDFDocumento69 pagineIPCC - FAST TRACK MATERIAL - 35e PDFKunalKumarNessuna valutazione finora

- CA Notes Sale of Goods On Approval or Return Basis PDFDocumento14 pagineCA Notes Sale of Goods On Approval or Return Basis PDFBijay Aryan Dhakal100% (1)

- Cost Accs Reconciliation Extra SumsDocumento7 pagineCost Accs Reconciliation Extra Sumspurvi doshiNessuna valutazione finora

- Assignment Cost Sheet SumsDocumento3 pagineAssignment Cost Sheet SumsMamta PrajapatiNessuna valutazione finora

- As 7 Construction ContractDocumento5 pagineAs 7 Construction ContractPankaj MeenaNessuna valutazione finora

- CA Foundation Accounts Recodring of Transactions StudentsDocumento57 pagineCA Foundation Accounts Recodring of Transactions StudentsRockyNessuna valutazione finora

- Baf Sem Vi Sample Multiple Choice QuestionsDocumento26 pagineBaf Sem Vi Sample Multiple Choice Questionsharesh100% (1)

- Brs Practise SheetDocumento1 paginaBrs Practise Sheetapi-252642432Nessuna valutazione finora

- Chapter 9 Accounting For Branches Including Foreign Branches PDFDocumento61 pagineChapter 9 Accounting For Branches Including Foreign Branches PDFAkshansh MahajanNessuna valutazione finora

- Ipcc Cost Accounting RTP Nov2011Documento209 pagineIpcc Cost Accounting RTP Nov2011Rakesh VermaNessuna valutazione finora

- Branch AccountsDocumento4 pagineBranch Accountsnavin_raghuNessuna valutazione finora

- Cost Sheet QuestionsDocumento5 pagineCost Sheet QuestionsDrimit GhosalNessuna valutazione finora

- Admission of PartnerDocumento3 pagineAdmission of PartnerPraWin KharateNessuna valutazione finora

- Banking CompaniesDocumento34 pagineBanking CompaniesLodaNessuna valutazione finora

- 120 Income Tax - IIDocumento21 pagine120 Income Tax - IIPriya Dharshini PdNessuna valutazione finora

- Income Tax II Illustration IFOS PDFDocumento5 pagineIncome Tax II Illustration IFOS PDFSubramanian SenthilNessuna valutazione finora

- Income Tax Law and PracticeDocumento4 pagineIncome Tax Law and PracticeShruthi VijayanNessuna valutazione finora

- Income Tax 5th Sem B.com November 2022 Question Paper Rajagiri College MGUDocumento3 pagineIncome Tax 5th Sem B.com November 2022 Question Paper Rajagiri College MGURainy GoodwillNessuna valutazione finora

- MGU CBCSS Sixth Sem Applied Cost Accounting Question Paper March 2018 Free Download Goodwill Tuition Centre For Accountancy 9846710963 9567902805Documento4 pagineMGU CBCSS Sixth Sem Applied Cost Accounting Question Paper March 2018 Free Download Goodwill Tuition Centre For Accountancy 9846710963 9567902805Rainy GoodwillNessuna valutazione finora

- Second Semester October 2022 Financial Accounting 2 Question Paper MGUDocumento5 pagineSecond Semester October 2022 Financial Accounting 2 Question Paper MGURainy GoodwillNessuna valutazione finora

- Income Tax 1 B.com St. Alberts College Mgu 5th Semester Question Paper Free Download October 2022Documento4 pagineIncome Tax 1 B.com St. Alberts College Mgu 5th Semester Question Paper Free Download October 2022Rainy GoodwillNessuna valutazione finora

- Agriculture Income - Income TaxDocumento5 pagineAgriculture Income - Income TaxRainy GoodwillNessuna valutazione finora

- October 22 Semester 3 Corporate Accounting S H College, Thevara Question PaperDocumento4 pagineOctober 22 Semester 3 Corporate Accounting S H College, Thevara Question PaperRainy GoodwillNessuna valutazione finora

- Cost Accounting 5th Sem October 2018 Goodwill Tuition Centre Thevara Question Paper CbcssDocumento4 pagineCost Accounting 5th Sem October 2018 Goodwill Tuition Centre Thevara Question Paper CbcssRainy GoodwillNessuna valutazione finora

- MGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Documento4 pagineMGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Rainy GoodwillNessuna valutazione finora

- Degree (CBCSS) Examination - Model Question Paper 2016 Applied Costing MG UniversityDocumento4 pagineDegree (CBCSS) Examination - Model Question Paper 2016 Applied Costing MG UniversityRainy GoodwillNessuna valutazione finora

- Accounting For Management SCMS Question PapersDocumento7 pagineAccounting For Management SCMS Question PapersRainy GoodwillNessuna valutazione finora

- Goodwill Tuition Centre, Ernakulam For Online Tuition: 9846710963, 9567902805Documento4 pagineGoodwill Tuition Centre, Ernakulam For Online Tuition: 9846710963, 9567902805Rainy GoodwillNessuna valutazione finora

- MGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFDocumento62 pagineMGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFRainy GoodwillNessuna valutazione finora

- Calicut Sreelaxmi QP 2022 March 23Documento4 pagineCalicut Sreelaxmi QP 2022 March 23Rainy GoodwillNessuna valutazione finora

- MGU CBCSS March 2018 Sixth Sem Question Paper Income Tax Assessment and Procedure.Documento4 pagineMGU CBCSS March 2018 Sixth Sem Question Paper Income Tax Assessment and Procedure.Rainy GoodwillNessuna valutazione finora

- Cusat Question Paper Mba Accounting For Managers 2022 MarchDocumento3 pagineCusat Question Paper Mba Accounting For Managers 2022 MarchRainy GoodwillNessuna valutazione finora

- 6 Semester MGU Cost Accounting 2016 March Question PaperDocumento4 pagine6 Semester MGU Cost Accounting 2016 March Question PaperRainy GoodwillNessuna valutazione finora

- MGU B.com 1st Semester Financial Accounting Question Paper 2022 FebruaryDocumento6 pagineMGU B.com 1st Semester Financial Accounting Question Paper 2022 FebruaryRainy GoodwillNessuna valutazione finora

- Final Accounts AdjustmentsDocumento7 pagineFinal Accounts AdjustmentsRainy GoodwillNessuna valutazione finora

- 6 Semester MGU Cost Accounting 2016 March Question PaperDocumento4 pagine6 Semester MGU Cost Accounting 2016 March Question PaperRainy GoodwillNessuna valutazione finora

- IFRS B.com SH College Model Question Paper 2017 March 2Documento2 pagineIFRS B.com SH College Model Question Paper 2017 March 2Rainy GoodwillNessuna valutazione finora

- Advanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Documento7 pagineAdvanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Rainy GoodwillNessuna valutazione finora

- MGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFDocumento62 pagineMGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFRainy GoodwillNessuna valutazione finora

- 2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805Documento4 pagine2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill0% (1)

- Defence Accounts Department SAS Examination Question Paper Accountancy 2016 AugustDocumento10 pagineDefence Accounts Department SAS Examination Question Paper Accountancy 2016 AugustRainy GoodwillNessuna valutazione finora

- 2018 March B.com Special Accounting Question Paper 4th Smester SH College Autonomous Goodwill Tuition Centre 9846710963 9567902805Documento4 pagine2018 March B.com Special Accounting Question Paper 4th Smester SH College Autonomous Goodwill Tuition Centre 9846710963 9567902805Rainy GoodwillNessuna valutazione finora

- MGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Documento4 pagineMGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Rainy GoodwillNessuna valutazione finora

- 2018 March B.com CBCSS Fifth Sem Special Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Documento4 pagine2018 March B.com CBCSS Fifth Sem Special Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNessuna valutazione finora

- CBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Documento4 pagineCBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill75% (4)

- 2018 March B.com 4th Sem SH College Autonomous March Corporate Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Documento4 pagine2018 March B.com 4th Sem SH College Autonomous March Corporate Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNessuna valutazione finora

- PC-13518 - Aquaflow BrochureDocumento8 paginePC-13518 - Aquaflow Brochuremark nickeloNessuna valutazione finora

- Business in Inf Age1newDocumento13 pagineBusiness in Inf Age1newarchana_sree13Nessuna valutazione finora

- hrm4111 Recruitment and Selection Assignment Five Employment Contract Christina RanasinghebandaraDocumento3 paginehrm4111 Recruitment and Selection Assignment Five Employment Contract Christina Ranasinghebandaraapi-3245028090% (1)

- Session 13 - Brand Management PDFDocumento32 pagineSession 13 - Brand Management PDFpeeking monkNessuna valutazione finora

- Audit Chap 4Documento54 pagineAudit Chap 4bezaNessuna valutazione finora

- Export PromotionDocumento16 pagineExport Promotionanshikabatra21167% (3)

- Is The Really Ford's Way Forward?Documento23 pagineIs The Really Ford's Way Forward?Gisela Vania AlineNessuna valutazione finora

- Chapter 04Documento29 pagineChapter 04Imran MunawerNessuna valutazione finora

- EY Capital Markets Innovation and The FinTech Landscape Executive SummaryDocumento9 pagineEY Capital Markets Innovation and The FinTech Landscape Executive SummaryCrowdfundInsider100% (1)

- Solucionario Curso de Extension 2010 bcrp-2Documento22 pagineSolucionario Curso de Extension 2010 bcrp-2guanabanNessuna valutazione finora

- Facebook Blueprint Study Guide (2019 Update) PDFDocumento65 pagineFacebook Blueprint Study Guide (2019 Update) PDFKhizar Nadeem Syed50% (2)

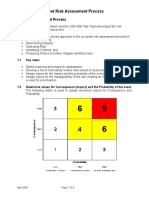

- 4 Fleet Risk Assessment ProcessDocumento4 pagine4 Fleet Risk Assessment ProcessHaymanAHMEDNessuna valutazione finora

- Activity 2 Lesson 1 - Operations and Productivity AssessmentDocumento3 pagineActivity 2 Lesson 1 - Operations and Productivity AssessmentGianne Ruth MabaoNessuna valutazione finora

- EEM MOD003477 Module GuideDocumento24 pagineEEM MOD003477 Module GuideSamar SalahNessuna valutazione finora

- People v. MoralesDocumento2 paginePeople v. MoralesRilianne ANessuna valutazione finora

- Scheme of WorkDocumento45 pagineScheme of WorkZubair BaigNessuna valutazione finora

- Iso Iatf 16949 FaqsDocumento3 pagineIso Iatf 16949 Faqsasdqwerty123Nessuna valutazione finora

- Accra Investments Corp Vs CADocumento4 pagineAccra Investments Corp Vs CAnazhNessuna valutazione finora

- Case SummaryDocumento3 pagineCase SummaryWilliam WeilieNessuna valutazione finora

- RetailfDocumento2 pagineRetailfAbhishek ReddyNessuna valutazione finora

- Keeping Information Safe: Privacy and Security Issues: Intellectual Property SocietyDocumento15 pagineKeeping Information Safe: Privacy and Security Issues: Intellectual Property SocietyipspatNessuna valutazione finora

- Nonprofit Director in Grand Rapids MI Resume Susan PutnamDocumento2 pagineNonprofit Director in Grand Rapids MI Resume Susan PutnamSusanPutnamNessuna valutazione finora

- Kertas Tugasan: (Assignment Sheet)Documento5 pagineKertas Tugasan: (Assignment Sheet)Danish HasanahNessuna valutazione finora

- Public ManagementDocumento1 paginaPublic ManagementDr. Syed Saqlain RazaNessuna valutazione finora

- KFC ProjectDocumento29 pagineKFC ProjectAsif AliNessuna valutazione finora

- Supernova Muhammad AliDocumento19 pagineSupernova Muhammad AliZafar NawazNessuna valutazione finora

- University of Madras: B.Sc. (Ism) and Bcom. (Informationsystemsmanagement) Degree Examinations, April 2014Documento6 pagineUniversity of Madras: B.Sc. (Ism) and Bcom. (Informationsystemsmanagement) Degree Examinations, April 2014Dolce UdayNessuna valutazione finora

- CLUB MEDICA Practice Set 2 1Documento74 pagineCLUB MEDICA Practice Set 2 1Robhy SorianoNessuna valutazione finora

- Pulido GraftDocumento4 paginePulido GraftJoan EvangelioNessuna valutazione finora

- Juan Pedro Gamondés: Purchasing & Procurement ProfessionalDocumento2 pagineJuan Pedro Gamondés: Purchasing & Procurement Professionaltuxedo_flyerNessuna valutazione finora