Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805

Caricato da

Rainy GoodwillTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805

Caricato da

Rainy GoodwillCopyright:

Formati disponibili

Name.... .6.t..1-d.g. ,.-J.

u630

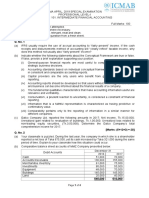

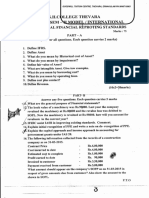

B. COM DEGREE END SEMESTER EXAMINATION . MARCH 2018

SEMESTER - 5: COMMERCE (CORE COURSE)

COURSE: USCRCOMtT: ACCOUNTING FOR MANAGERIAL DECISIONS

(For Supplementory - 20L4 Admission)

Time: Three Hours Max. Marks:75

PART A

Answer all questions. Each question carries 1 mark.

VWhat are financial statements?

>A\Nhat are Common Size Statements?

/,

3.)gthat is ROI?

4..v7ffiis EPS?

SJlhat is working capital?

6. What is interim dividend?

7,{$lhat do you mean by cash flow?

e\fnat

\ are operating activities?

g.X{Vhat is cost centre?

10. What is EVA? (1x 10 = 10)

PART B

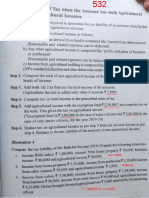

Answer any eight questions' Each question carries 2 marks.

/

f frr/Wfrat are the components of financial statement?

L2. Difierentiate between horizontal analysis and vertical analysis of financial statements.

13. Name any four profitability ratios in relation to investment'

14. What are quick assets?

ts. iabulate Gross Profit Ratio;

' Total Sales- Rs. 5,20,000, Sales return- Rs. 20,000, Cost of goods sold- Rs. 4,00,000

116, Give any two differences between fund flow statement and balance sheet.

.l

t

t/ Calculate working capital:

I

i

Cash- Rs. 30,000

Account Receivables - Rs. 70,000

trade

Stock in - Rs. 1,50,000

Account Payables - Rs. 90,000

PaYable - Rs. 20,000

\Frest

lf\hat do you mean by flow of funds?

19. Write any two limitations of cash flow statement.

20. Which are the various types of responsibility centres? (2x8-16)

Sacred l-leart Coliege {Autc ^ c'-,cus) Thevsrc

?age'J. c, :

GOODWILL TUITION CENTRE, THEVARA 9567902805, 9846710963

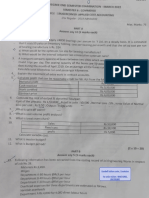

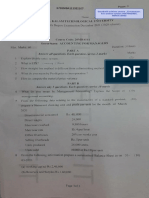

PART C

Answer any five questions. Each question carries 5

marks.

21. Explain the rimitations of financiar statement

anarysis.

Zl-Dif{erentiate between Fund Flow Statement and Cash Flow

Statement.

23. what is current ratio? what are the components of current ratio?

24' rroffiefollowing information, prepare a comparative income statement of Java

Ltd.

-/

20L4 2015

Sales nO% of cost of goods sold L20% of cost of goods sold

sold

Cost of goods Rs. 20,00,000 Rs. 25,00,000

lndirect expenses ro% of gross profit L0% of gross profit

lncome tax of profit before tax

SO% 50% of profit before tax

25. The following information of a company is given:

Current ratio- 2.5: L Acid test ratio_ L.5: 1, Current liabilities- Rs. 50,000

Find out:

a. Current assets

b. Liquid assets

c. lnve ntory ,

ZA.3l6l"te funds from operations as on 31,t March, 2015:

i. Net profit for the year ended 31't March, 5015- Rs.

G,50,000.

ii.Gain on the sale of building_Rs. 35,500.

iii' Goodwillappears in the books at Rs. 1,80,000.

out of that ::o%hasbeen written off durin

year.

iv. old machinery worth Rs. g,000 has been sord for Rs. 6,500 during the year.

v. Rs. 7,25,000 have been transferred

to General Reserve.

vi' Depreciation has been provided during the year on

machinery and furniture at 20% w

total cost is Rs. 6,50,000.

27 ' Find out a) Debtors Turnover Ratio and b) Average

collection period from the following

information:

31.03.2014 31.03.20L5

Rs. Rs.

Annual credit sales 5,00,000 6,00,000

Debtors in the beginning 90,000 1,00,000

Debtors at the end L,00,000 L,20,000

(5xs-

GOODWILL TUITION CENTRE, THEVARA 9567902805, 9846710963

u630

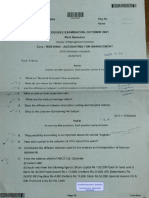

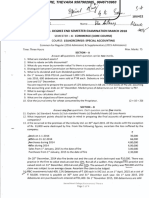

PART D

Answer any two questions. Each question carries 12 marks.

28' Define Responsibility Accounting. Explain the features of Responsibility

Accounting.

29. The financial statement of AB Ltd. for the year 2015 reveal the following:

Current ratio 3,.75

1,.25

Equity capital of Rs. 10 each Rs. 60,000

Net current assets Rs.30,300

Fixed assets as a percentage of shareholders'equity 60%

G ross p rof it rat i o 20%

stock turnove r ratio (based on cost on 31.12.2015) o times

Average age of outsta n ding de btors 2 months

Net profit as a percentage of issued capital 1,6%

on31'.12.2015 the current assets consist of stock, debtors and bank balance. you

are required

to prepare:

a. Trading and Profit and Loss Account for the year ended 31,.1,2.20L5 and

b. Balance Sheet as on 31.12 .2O1-S

30' The following are the summaries of the Balance sheets of Praveen Ltd. as at

31st December, 20i-4

and 2015:

Lio bilities 2014 2015 Assets 201,4 ZA1"S

Rs. Rs. Rs. Rs.

Sharecapital 2,0A,000 2,5A,000 Land 2,00,000 L,9a,000

General reserve 50,000 60,000 plant 1,50,000 1,,74,000

P & L Account 30,500 30,600 stock 1,00,000 74,000)LA

Short term loan 70,000 Debiors 90,000*___ 6/i.200 D Cts

Creditors L,50,000 L,35,200?^- Cash 500 600 L.\

Provision for tax 30,000 35,occ Bank 8.000 (e

5,30,500 5 10,E00 s.10 800

Additionol in'crq' ci : -,

- \-&

a. Depreciation on plant was written off Rs. 14,000 in 2Al5 \'l ett t\

b. Dividend of Rs . 20,000 was paid durin g 2a1,5

c. lncome tax provision made during the year was Rs. 25,000

d. A piece of land has been sold during the year at ccst.

You are required to prepare

a statement showing sources and applications of f und for the

year 2015 and a Schedule of Changes in Working Capital.

11. Explain the various methods and techniques used in fi,rancial analysis. (1,2x2=24)

*****r<*rt<**

St:res' riecrt .SciieEz (l,ltcr,J- _- -

?.,/crr

r-.fF

::_t

,-

; r' a: ..i a*,.-: .!

a,)-- u J

-*:

*

GOODWILL TUITION CENTRE, THEVARA 9567902805, 9846710963

Potrebbero piacerti anche

- Management AccountingDocumento2 pagineManagement AccountingMateen PathanNessuna valutazione finora

- Merged File - QP, Answers & Notes - CompressedDocumento176 pagineMerged File - QP, Answers & Notes - CompressedMEGHA VNessuna valutazione finora

- Framework QnaDocumento5 pagineFramework QnaKhushal SoniNessuna valutazione finora

- 15A52301 Managerial Economics & Financial AnalysisDocumento2 pagine15A52301 Managerial Economics & Financial AnalysisGeorgekutty FrancisNessuna valutazione finora

- Mefa Question BankDocumento6 pagineMefa Question BankShaik ZubayrNessuna valutazione finora

- Adobe Scan 01 Jul 2023Documento5 pagineAdobe Scan 01 Jul 2023Faisal NawazNessuna valutazione finora

- Write Briefly: Total No. of Pages:03Documento3 pagineWrite Briefly: Total No. of Pages:03Kîràn ShèttyNessuna valutazione finora

- Questions Related To Project Segment ReportDocumento14 pagineQuestions Related To Project Segment ReportOm Prakash Sharma100% (1)

- 01 Leverages FTDocumento7 pagine01 Leverages FT1038 Kareena SoodNessuna valutazione finora

- Accounting AndFinancial Management 2015-16Documento4 pagineAccounting AndFinancial Management 2015-16Ashish AgarwalNessuna valutazione finora

- MAS311 Financial Management Exercises Financial Statement AnalysisDocumento4 pagineMAS311 Financial Management Exercises Financial Statement AnalysisLeanne QuintoNessuna valutazione finora

- Wa0002Documento3 pagineWa0002abdfaz951Nessuna valutazione finora

- 202 - FM Question PaperDocumento5 pagine202 - FM Question Papersumedh narwadeNessuna valutazione finora

- Tutorial 7 Solutions FinalDocumento5 pagineTutorial 7 Solutions FinalLuz Helena Molina PintoNessuna valutazione finora

- SYBBA Assignments (2019 Pattern) - Tri 4,5 & 6 - September 2021-1Documento12 pagineSYBBA Assignments (2019 Pattern) - Tri 4,5 & 6 - September 2021-1Vaidehi sonawaniNessuna valutazione finora

- Management Accounting - 1Documento4 pagineManagement Accounting - 1amaljacobjogilinkedinNessuna valutazione finora

- 134 Accounting Managers FreshersDocumento4 pagine134 Accounting Managers Freshersdchandru271Nessuna valutazione finora

- QP CODE: 22100973: Reg No: NameDocumento6 pagineQP CODE: 22100973: Reg No: NameSajithaNessuna valutazione finora

- Jaya College of Arts and Science Department of ManagDocumento4 pagineJaya College of Arts and Science Department of ManagMythili KarthikeyanNessuna valutazione finora

- Managenet AC - Question Bank SSDocumento18 pagineManagenet AC - Question Bank SSDharshanNessuna valutazione finora

- FM Eco Test BookDocumento73 pagineFM Eco Test BookkonaNessuna valutazione finora

- FMP (2nd) May2016Documento1 paginaFMP (2nd) May2016Vandana AhujaNessuna valutazione finora

- XII Commerce Q.papersDocumento14 pagineXII Commerce Q.papersDesai VivekNessuna valutazione finora

- MBM633, QB, Unit-4, 5Documento4 pagineMBM633, QB, Unit-4, 5Mayank bhardwajNessuna valutazione finora

- Paper12 SolutionDocumento21 paginePaper12 SolutionTW ALWINNessuna valutazione finora

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocumento29 paginePaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementPhein ArtNessuna valutazione finora

- Capital Intensive Labor Intensive: Required: Determine The FollowingDocumento2 pagineCapital Intensive Labor Intensive: Required: Determine The FollowingMahediNessuna valutazione finora

- 01 LeveragesDocumento11 pagine01 LeveragesZerefNessuna valutazione finora

- Bba FM 21Documento3 pagineBba FM 21Kundan JhaNessuna valutazione finora

- Loursl: - (L) : (Semester-II)Documento4 pagineLoursl: - (L) : (Semester-II)Riya AgrawalNessuna valutazione finora

- Management Accounting CompleteDocumento344 pagineManagement Accounting CompleteramNessuna valutazione finora

- 1 Financial Management Question PaperDocumento2 pagine1 Financial Management Question PaperHema LathaNessuna valutazione finora

- Financial Management Question PaperDocumento2 pagineFinancial Management Question PaperHema LathaNessuna valutazione finora

- Bba Sem Iii QBDocumento23 pagineBba Sem Iii QBSaima NishatNessuna valutazione finora

- 2012 Ii PDFDocumento23 pagine2012 Ii PDFMurari NayuduNessuna valutazione finora

- IIII : N6.of Pages:rfe ' Final ExaminationDocumento3 pagineIIII : N6.of Pages:rfe ' Final ExaminationkashualNessuna valutazione finora

- Corporate Accounting Question Paper March 2015 MG (CBCSS)Documento4 pagineCorporate Accounting Question Paper March 2015 MG (CBCSS)Sharon sharoNessuna valutazione finora

- Answer All Questions. Each Question Carries 2 MarksDocumento3 pagineAnswer All Questions. Each Question Carries 2 MarksAthul RNessuna valutazione finora

- Gujarat Technological UniversityDocumento6 pagineGujarat Technological UniversitymansiNessuna valutazione finora

- Financial Analysis - RATIOSDocumento55 pagineFinancial Analysis - RATIOSRoy YadavNessuna valutazione finora

- Acm 3Documento2 pagineAcm 3Ꮢ.Gᴀɴᴇsн ٭ʏт᭄Nessuna valutazione finora

- 71487bos57500 p8Documento29 pagine71487bos57500 p8OPULENCENessuna valutazione finora

- Financial ManagementDocumento20 pagineFinancial Managementsanthanaaknal22Nessuna valutazione finora

- Llours 1) 2) A ' Q1) : Aat,' - Alo 071 AccountingDocumento2 pagineLlours 1) 2) A ' Q1) : Aat,' - Alo 071 AccountingAkshayNessuna valutazione finora

- FM & Eco Grand Test 2Documento8 pagineFM & Eco Grand Test 2moniNessuna valutazione finora

- Management Accounting BankDocumento23 pagineManagement Accounting BankVaishnavi ChoudharyNessuna valutazione finora

- Master of Business Administration Semester - I Subject Code& Name - Mba104 & Financial and Management Accounting AssignmentDocumento8 pagineMaster of Business Administration Semester - I Subject Code& Name - Mba104 & Financial and Management Accounting AssignmentÑýì Ñýì ÑâìñgNessuna valutazione finora

- Bcom 2 Sem Financial Accounting 2 20101139 Nov 2020Documento5 pagineBcom 2 Sem Financial Accounting 2 20101139 Nov 2020Akhil AbrahamNessuna valutazione finora

- Bangalore University Previous Year Question Paper AFM 2020Documento3 pagineBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNessuna valutazione finora

- Question Bank - Management AccountingDocumento7 pagineQuestion Bank - Management Accountingprahalakash Reg 113Nessuna valutazione finora

- Question CMA April 2019 SP Exam.Documento4 pagineQuestion CMA April 2019 SP Exam.F A Saffat RahmanNessuna valutazione finora

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocumento4 pagineLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNessuna valutazione finora

- FABVDocumento10 pagineFABVdivyayella024Nessuna valutazione finora

- Ii Puc AccountsDocumento3 pagineIi Puc AccountsShekarKrishnappaNessuna valutazione finora

- MBG-206 2019-20 - 1Documento4 pagineMBG-206 2019-20 - 1senthil.jpin8830Nessuna valutazione finora

- 12th Cbse Accounts Paper 10 06 2017Documento2 pagine12th Cbse Accounts Paper 10 06 2017Harpreet Singh SainiNessuna valutazione finora

- Corporate Accounting Ii 2020Documento4 pagineCorporate Accounting Ii 2020joe josephNessuna valutazione finora

- FM & Eco - Test 1Documento3 pagineFM & Eco - Test 1Ritam chaturvediNessuna valutazione finora

- Management Accounting Paper II Section ADocumento2 pagineManagement Accounting Paper II Section APriyank AgarwalNessuna valutazione finora

- Degree (CBCSS) Examination - Model Question Paper 2016 Applied Costing MG UniversityDocumento4 pagineDegree (CBCSS) Examination - Model Question Paper 2016 Applied Costing MG UniversityRainy GoodwillNessuna valutazione finora

- Income Tax 1 B.com St. Alberts College Mgu 5th Semester Question Paper Free Download October 2022Documento4 pagineIncome Tax 1 B.com St. Alberts College Mgu 5th Semester Question Paper Free Download October 2022Rainy GoodwillNessuna valutazione finora

- Income Tax 5th Sem B.com November 2022 Question Paper Rajagiri College MGUDocumento3 pagineIncome Tax 5th Sem B.com November 2022 Question Paper Rajagiri College MGURainy GoodwillNessuna valutazione finora

- October 22 Semester 3 Corporate Accounting S H College, Thevara Question PaperDocumento4 pagineOctober 22 Semester 3 Corporate Accounting S H College, Thevara Question PaperRainy GoodwillNessuna valutazione finora

- Agriculture Income - Income TaxDocumento5 pagineAgriculture Income - Income TaxRainy GoodwillNessuna valutazione finora

- Second Semester October 2022 Financial Accounting 2 Question Paper MGUDocumento5 pagineSecond Semester October 2022 Financial Accounting 2 Question Paper MGURainy GoodwillNessuna valutazione finora

- Goodwill Tuition Centre, Ernakulam For Online Tuition: 9846710963, 9567902805Documento4 pagineGoodwill Tuition Centre, Ernakulam For Online Tuition: 9846710963, 9567902805Rainy GoodwillNessuna valutazione finora

- MGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Documento4 pagineMGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Rainy GoodwillNessuna valutazione finora

- Cost Accounting 5th Sem October 2018 Goodwill Tuition Centre Thevara Question Paper CbcssDocumento4 pagineCost Accounting 5th Sem October 2018 Goodwill Tuition Centre Thevara Question Paper CbcssRainy GoodwillNessuna valutazione finora

- Accounting For Management SCMS Question PapersDocumento7 pagineAccounting For Management SCMS Question PapersRainy GoodwillNessuna valutazione finora

- 6 Semester MGU Cost Accounting 2016 March Question PaperDocumento4 pagine6 Semester MGU Cost Accounting 2016 March Question PaperRainy GoodwillNessuna valutazione finora

- 2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805Documento4 pagine2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill0% (1)

- MGU CBCSS Sixth Sem Applied Cost Accounting Question Paper March 2018 Free Download Goodwill Tuition Centre For Accountancy 9846710963 9567902805Documento4 pagineMGU CBCSS Sixth Sem Applied Cost Accounting Question Paper March 2018 Free Download Goodwill Tuition Centre For Accountancy 9846710963 9567902805Rainy GoodwillNessuna valutazione finora

- Calicut Sreelaxmi QP 2022 March 23Documento4 pagineCalicut Sreelaxmi QP 2022 March 23Rainy GoodwillNessuna valutazione finora

- MGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFDocumento62 pagineMGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFRainy GoodwillNessuna valutazione finora

- MGU CBCSS March 2018 Sixth Sem Question Paper Income Tax Assessment and Procedure.Documento4 pagineMGU CBCSS March 2018 Sixth Sem Question Paper Income Tax Assessment and Procedure.Rainy GoodwillNessuna valutazione finora

- MGU B.com 1st Semester Financial Accounting Question Paper 2022 FebruaryDocumento6 pagineMGU B.com 1st Semester Financial Accounting Question Paper 2022 FebruaryRainy GoodwillNessuna valutazione finora

- IGNOU Elements of Income Tax Question Paper Free Download B.com June 2017Documento4 pagineIGNOU Elements of Income Tax Question Paper Free Download B.com June 2017Rainy GoodwillNessuna valutazione finora

- Final Accounts AdjustmentsDocumento7 pagineFinal Accounts AdjustmentsRainy GoodwillNessuna valutazione finora

- 6 Semester MGU Cost Accounting 2016 March Question PaperDocumento4 pagine6 Semester MGU Cost Accounting 2016 March Question PaperRainy GoodwillNessuna valutazione finora

- Advanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Documento7 pagineAdvanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Rainy GoodwillNessuna valutazione finora

- IFRS B.com SH College Model Question Paper 2017 March 2Documento2 pagineIFRS B.com SH College Model Question Paper 2017 March 2Rainy GoodwillNessuna valutazione finora

- Defence Accounts Department SAS Examination Question Paper Accountancy 2016 AugustDocumento10 pagineDefence Accounts Department SAS Examination Question Paper Accountancy 2016 AugustRainy GoodwillNessuna valutazione finora

- Cusat Question Paper Mba Accounting For Managers 2022 MarchDocumento3 pagineCusat Question Paper Mba Accounting For Managers 2022 MarchRainy GoodwillNessuna valutazione finora

- MGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFDocumento62 pagineMGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFRainy GoodwillNessuna valutazione finora

- 2018 March B.com Special Accounting Question Paper 4th Smester SH College Autonomous Goodwill Tuition Centre 9846710963 9567902805Documento4 pagine2018 March B.com Special Accounting Question Paper 4th Smester SH College Autonomous Goodwill Tuition Centre 9846710963 9567902805Rainy GoodwillNessuna valutazione finora

- MGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Documento4 pagineMGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Rainy GoodwillNessuna valutazione finora

- 2018 March B.com CBCSS Fifth Sem Special Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Documento4 pagine2018 March B.com CBCSS Fifth Sem Special Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNessuna valutazione finora

- CBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Documento4 pagineCBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill75% (4)

- 2018 March B.com 4th Sem SH College Autonomous March Corporate Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Documento4 pagine2018 March B.com 4th Sem SH College Autonomous March Corporate Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNessuna valutazione finora

- The Brazilian Economy in 20th CenturyDocumento16 pagineThe Brazilian Economy in 20th CenturyDaví José Nardy AntunesNessuna valutazione finora

- IJREAMV04I0440169Documento3 pagineIJREAMV04I0440169sravya thotapallyNessuna valutazione finora

- Ock - 2qcy23Documento5 pagineOck - 2qcy23gee.yeap3959Nessuna valutazione finora

- Nyc-Battery-Park-City-Authority-Annual Report 2005Documento60 pagineNyc-Battery-Park-City-Authority-Annual Report 2005anovelli@100% (1)

- Reporting ERP Financials EhP3 - Map of Technical Objects - Printout VersionDocumento16 pagineReporting ERP Financials EhP3 - Map of Technical Objects - Printout Versionequispet8719Nessuna valutazione finora

- Chapter 11 Partnership FormationDocumento10 pagineChapter 11 Partnership FormationJo Faula BelleNessuna valutazione finora

- RRW 0004 20190725 (1) - 1Documento18 pagineRRW 0004 20190725 (1) - 1Ali WaliNessuna valutazione finora

- A Review of Philippine Foreign Policy Under The Ramos AdministrationDocumento16 pagineA Review of Philippine Foreign Policy Under The Ramos AdministrationMandeep Singh KohliNessuna valutazione finora

- Internship Report FinalDocumento51 pagineInternship Report FinalImtahanul IslamNessuna valutazione finora

- People Vs PetralbaDocumento3 paginePeople Vs PetralbaRaymart SalamidaNessuna valutazione finora

- SFAC 1 Objective of Financial ReportingDocumento18 pagineSFAC 1 Objective of Financial Reportingrhima_Nessuna valutazione finora

- Adro 2018Documento3 pagineAdro 2018meilindaNessuna valutazione finora

- Time Value of MoneyDocumento37 pagineTime Value of Moneyansary75Nessuna valutazione finora

- Mba 4 YerDocumento3 pagineMba 4 YerRashidNessuna valutazione finora

- Reading BeDocumento4 pagineReading BeheonhocaoNessuna valutazione finora

- Financial Plan (Weareverugo O'Lshop) : I. Projected Statement of Comprehensive IncomeDocumento2 pagineFinancial Plan (Weareverugo O'Lshop) : I. Projected Statement of Comprehensive Incomealexander alobaNessuna valutazione finora

- Notice of Winding Up Final 230420Documento1 paginaNotice of Winding Up Final 230420gopalkpsahuNessuna valutazione finora

- Notes - Contract CostingDocumento13 pagineNotes - Contract CostingBlessMarcKupiNessuna valutazione finora

- Fundamanetal Analysis of Automobile Industry (Tata Motors)Documento63 pagineFundamanetal Analysis of Automobile Industry (Tata Motors)Amit Sharma100% (1)

- IDBIDocumento10 pagineIDBIArun ElanghoNessuna valutazione finora

- Overview of Russian EconomyDocumento5 pagineOverview of Russian EconomyYbrantSachinNessuna valutazione finora

- International Finance 3 Sem SCDL Solved PaperDocumento46 pagineInternational Finance 3 Sem SCDL Solved PaperKabad SinghNessuna valutazione finora

- Currency Fluctuations - How They Effect The Economy - InvestopediaDocumento5 pagineCurrency Fluctuations - How They Effect The Economy - InvestopediaYagya RajawatNessuna valutazione finora

- 10-11-2011 Courtney Ray & Melody Ann Gillespie Original Complaint in Adversarial Action Filed Pursuant To 18 USC 241-242 18 USCDocumento49 pagine10-11-2011 Courtney Ray & Melody Ann Gillespie Original Complaint in Adversarial Action Filed Pursuant To 18 USC 241-242 18 USCcaljics100% (1)

- The Trading EdgeDocumento52 pagineThe Trading EdgeVitor Junior Oliveira Otazu100% (2)

- Revocable Living TrustDocumento1 paginaRevocable Living TrustTricia100% (1)

- FINANCING CYCLE AuditDocumento12 pagineFINANCING CYCLE AuditEl Yang100% (1)

- Knowledge-Based Financial Statement Fraud Detection System - Based On An Ontology and A Decision TreeDocumento1 paginaKnowledge-Based Financial Statement Fraud Detection System - Based On An Ontology and A Decision TreeDENIS LIZETH ROJAS MARTINNessuna valutazione finora

- Case StudyDocumento4 pagineCase StudyRam NutakkiNessuna valutazione finora

- Financial Performance of NBFCsDocumento13 pagineFinancial Performance of NBFCsAli Raza SultaniNessuna valutazione finora