Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

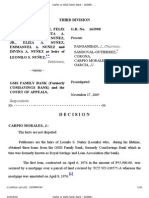

BA NT & SA v. CA

Caricato da

iwamawiCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

BA NT & SA v. CA

Caricato da

iwamawiCopyright:

Formati disponibili

Bank of America NT & SA v.

CA 234 SCRA 302 (July 21, 1994) filed a petition for review with the CTA.

Petitioner: Bank of America NT & SA Petitioner: Bank argues that the 15% branch profit remittance

Respondent: Commissioner of Internal Revenue tax on the basis of the above provision should be assessed on

Topic: Tax on Branch Profit Remittances the amount actually remitted abroad, which is to say that the

15% profit remittance tax itself should not form part of the tax

Doctrine: Where the law does not qualify that the tax is base.

imposed and collected at source based on profit to be

remitted abroad, that qualification should not be read into the Respondent: CIR holds that in computing the 15% remittance

law. tax, the tax should be inclusive of the sum deemed remitted.

Facts: BIR Computation

Petitioner is a foreign corporation duly licensed to Net Profit After

Income Tax But Branch Profit

engage in business in the Philippines with Philippine branch Before Profit Tax Tax Remittance

office at Makati. On July 20, 1982, it paid 15% branch profit Remittance Rate Tax

remittance tax in the amount of P7,538,460.72 on profit from

Regular

its regular banking unit operations and P445,790.25 on profit Banking Unit

from its foreign currency deposit unit operations or a total of Ops 50,256,404.82 15% 7,538,460.72

P7,984,250.97. The tax was based on net profits after income Foreign

tax without deducting the amount corresponding to the 15% Currency

Deposit Unit

tax.

Ops 2,971,935 15% 445,790.25

Total Branch

Petitioner filed a claim for refund with the Bureau of Profit

Internal Revenue of that portion of the payment which Remittance

corresponds to the 15% branch profit remittance tax, on the Tax 53,228,339.82 15% 7,984,250.97

ground that the tax should have been computed on the basis

of profits actually remitted, which is P45,244,088.85, and not

on the amount before profit remittance tax, which is

P53,228,339.82. Without awaiting BIR’s decision, petitioner

Petitioner Computation CTA: petitioner

Branch Profit

Branch Profit Tax Remittance CA: respondent

Remittance Rate Tax

Regular Issue: Whether the 15% remittance tax should be computed

Banking Unit based on the amount actually remitted abroad or the total

Ops 6,555,183.24 15% 983,277.49

Foreign

amount actually applied for by the branch with the Central

Currency Bank of the Philippines as profit to be remitted abroad

Deposit Unit

Ops 387,643.70 15% 58,146.56 Held: Petitioner- actual amount remitted abroad

Total Branch

Profit The Court noted that in cases of ad valorem tax, the

Remittance tax paid or withheld is not deducted from the tax base. Such

Tax 6,942,826.94 15% 1,041,424.04

impositions as the ordinary income tax, estate and gift taxes,

and the value added tax are generally computed in like

Net Profit Total Branch Branch Profit Profit Actually manner. In these cases, however, it is so because the law, in

After Income Profit Remittance Remitted defining the tax base and in providing for tax withholding,

Tax Remittance Tax Abroad

clearly spells it out to be such.

53,228,339.82 -6,942,826.94 -1,041,424.04 45,244,088.84

However, there is nothing in Sec. 24(b)(2)(ii) of the

NIRC, which indicates that the 15% tax on branch profit

Relevant Law: remittance is on the total amount of profit to be remitted

Section 24(b)(2)(ii) of the National Internal Revenue Code abroad which shall be collected and paid in accordance with

1982: the tax withholding device provided in Sections 53 and 54 of

Sec. 24. Rates of tax on corporations. . . . the Tax Code.

(b) Tax on foreign corporations. . . .

(2) (ii) Tax on branch profit and remittances. — The statute employs "Any profit remitted abroad by a

Any profit remitted abroad by a branch to its head office shall branch to its head office shall be subject to a tax of fifteen

be subject to a tax of fifteen per cent (15%) . . . ." per cent (15%)" — without more. Nowhere is there said of

"base on the total amount actually applied for by the branch

with the Central Bank of the Philippines as profit to be

remitted abroad, which shall be collected and paid as

provided in Sections 53 and 54 of this Code." Where the law

does not qualify that the tax is imposed and collected at

source based on profit to be remitted abroad, that

qualification should not be read into the law.

In the 15% remittance tax, the law specifies its own tax

base to be on the "profit remitted abroad." There is absolutely

nothing equivocal or uncertain about the language of the

provision. The tax is imposed on the amount sent abroad, and

the law (then in force) calls for nothing further.

Potrebbero piacerti anche

- Caltex Philippines, Inc. V COADocumento1 paginaCaltex Philippines, Inc. V COAHarvey Leo RomanoNessuna valutazione finora

- Villegas vs. SubidoDocumento6 pagineVillegas vs. Subidorols villanezaNessuna valutazione finora

- Lee Yeung Case DigestDocumento3 pagineLee Yeung Case DigestKuthe Ig TootsNessuna valutazione finora

- SSS GsisDocumento9 pagineSSS GsisEliza FloresNessuna valutazione finora

- Bicerra vs. TenezaDocumento1 paginaBicerra vs. TenezaLorenzo HammerNessuna valutazione finora

- GSIS vs. City TreasurerDocumento1 paginaGSIS vs. City TreasurerRodney SantiagoNessuna valutazione finora

- CIR Vs Central Luzon Drug CorpDocumento8 pagineCIR Vs Central Luzon Drug CorpCollen Anne PagaduanNessuna valutazione finora

- Pascual vs. Secetary of Public Works 110 Phil 331 GR L - 10405Documento6 paginePascual vs. Secetary of Public Works 110 Phil 331 GR L - 10405norzeNessuna valutazione finora

- Digest Office of The Ombudsman V Samaniego 2008Documento3 pagineDigest Office of The Ombudsman V Samaniego 2008Lea Gabrielle FariolaNessuna valutazione finora

- Director of Lands v. IAC, 219 SCRA 339Documento4 pagineDirector of Lands v. IAC, 219 SCRA 339FranzMordenoNessuna valutazione finora

- BASCO v. PAGCOR, G.R. No. 91649Documento2 pagineBASCO v. PAGCOR, G.R. No. 91649Arvhie Santos100% (1)

- San Beda College of Law Memory Aid in TaDocumento127 pagineSan Beda College of Law Memory Aid in TaKim OrquizaNessuna valutazione finora

- Commissioner Vs CastanedaDocumento6 pagineCommissioner Vs CastanedaLizzette Dela PenaNessuna valutazione finora

- July 18 - SPIT NotesDocumento8 pagineJuly 18 - SPIT NotesMiggy CardenasNessuna valutazione finora

- 'PH Bank Secrecy Laws Strictest in The World Along With LebanonDocumento12 pagine'PH Bank Secrecy Laws Strictest in The World Along With LebanonjealousmistressNessuna valutazione finora

- Commissioner of Internal Revenue Vs The Court of Appeals, The Court of Tax Appeals and Ateneo de Manila UniversityDocumento2 pagineCommissioner of Internal Revenue Vs The Court of Appeals, The Court of Tax Appeals and Ateneo de Manila UniversityRae Angela GarciaNessuna valutazione finora

- TAx DigestDocumento1 paginaTAx DigestRanvylle AlbanoNessuna valutazione finora

- G.R. No. 96605. May 8, 1992 Facts:: Marcoso vs. Court of AppealsDocumento5 pagineG.R. No. 96605. May 8, 1992 Facts:: Marcoso vs. Court of AppealsChrisel Joy Casuga SorianoNessuna valutazione finora

- University of The Philippines College of Law: Relevant FactsDocumento4 pagineUniversity of The Philippines College of Law: Relevant FactsJB GuevarraNessuna valutazione finora

- TAXATION 1 - Hopewell Power V CommissionerDocumento3 pagineTAXATION 1 - Hopewell Power V CommissionerSuiNessuna valutazione finora

- Davao Sawmill and OthersDocumento16 pagineDavao Sawmill and OthersjmNessuna valutazione finora

- 10 Da-596-06Documento3 pagine10 Da-596-06Cheska VergaraNessuna valutazione finora

- Belgica Vs OchoaDocumento4 pagineBelgica Vs OchoaAli NamlaNessuna valutazione finora

- Cir Vs Hawaiian Phil Co - DigestDocumento2 pagineCir Vs Hawaiian Phil Co - DigestRona Rosos100% (1)

- Case DigestsDocumento3 pagineCase DigestsAnna Dela VegaNessuna valutazione finora

- Basic Principles of A Sound Tax SystemDocumento6 pagineBasic Principles of A Sound Tax SystemCrisanta MarieNessuna valutazione finora

- 408 Supreme Court Reports Annotated: Salcedo vs. Court of AppealsDocumento10 pagine408 Supreme Court Reports Annotated: Salcedo vs. Court of AppealsMirzi Olga Breech SilangNessuna valutazione finora

- Icard Vs Council of Baguio Facts:: ViresDocumento41 pagineIcard Vs Council of Baguio Facts:: ViresNLainie OmarNessuna valutazione finora

- Admin Law Cantillo V ArrietaDocumento1 paginaAdmin Law Cantillo V ArrietaKlaire EsdenNessuna valutazione finora

- AsdasdasdasdDocumento43 pagineAsdasdasdasdbarrystarr1Nessuna valutazione finora

- CIR vs. CE Luzon 190198Documento1 paginaCIR vs. CE Luzon 190198magenNessuna valutazione finora

- Asuncion v. YriateDocumento2 pagineAsuncion v. YriateAira Vanessa CagascasNessuna valutazione finora

- Tuzon V CA - CMDocumento3 pagineTuzon V CA - CMjustinegalangNessuna valutazione finora

- Case Digest - Belgica v. Executive SecretaryDocumento2 pagineCase Digest - Belgica v. Executive SecretaryJay BustaliñoNessuna valutazione finora

- Pepsi-Cola Vs ButuanDocumento2 paginePepsi-Cola Vs ButuanKim CajucomNessuna valutazione finora

- BPI Leasing v. Court of AppealsDocumento7 pagineBPI Leasing v. Court of AppealsMp CasNessuna valutazione finora

- Loc Goc Comp2Documento31 pagineLoc Goc Comp2Fernando BayadNessuna valutazione finora

- Kmu VS NedaDocumento3 pagineKmu VS NedaJay MarieNessuna valutazione finora

- Case Digests For Loc Gov Local TaxationDocumento7 pagineCase Digests For Loc Gov Local TaxationChristelle EleazarNessuna valutazione finora

- Factoran Vs CADocumento5 pagineFactoran Vs CALisa BautistaNessuna valutazione finora

- I.3 Gaston Vs Republic Planter GR No. 77194 03151988 PDFDocumento3 pagineI.3 Gaston Vs Republic Planter GR No. 77194 03151988 PDFbabyclaire17Nessuna valutazione finora

- Case Digest - Pascual v. Secretary. of Public Works, G.R. No. L-10405, 29 December 1960 1Documento2 pagineCase Digest - Pascual v. Secretary. of Public Works, G.R. No. L-10405, 29 December 1960 1RJ fiel VaalNessuna valutazione finora

- 20 G.R. No. L-42557 People V ReodicaDocumento1 pagina20 G.R. No. L-42557 People V ReodicaCovidiaNessuna valutazione finora

- MENDOZA V SALINAS DigestDocumento2 pagineMENDOZA V SALINAS Digestclarisse lyka hattonNessuna valutazione finora

- Ac No. 10438Documento2 pagineAc No. 10438Xiena Marie Ysit, J.DNessuna valutazione finora

- Lopez Vs CSCDocumento4 pagineLopez Vs CSCChelle OngNessuna valutazione finora

- Evangelista Vs Alto SuretyDocumento2 pagineEvangelista Vs Alto SuretyJewel Ivy Balabag DumapiasNessuna valutazione finora

- 027-Lutz v. Araneta, 98 Phil 148Documento3 pagine027-Lutz v. Araneta, 98 Phil 148Jopan SJ100% (1)

- CIR vs. Eastern Telecommunications, 624 SCRA 340Documento12 pagineCIR vs. Eastern Telecommunications, 624 SCRA 340Machida AbrahamNessuna valutazione finora

- Bautista v. NTCDocumento2 pagineBautista v. NTCLaurice Claire C. PeñamanteNessuna valutazione finora

- Villanueva v. IloiloDocumento2 pagineVillanueva v. IloiloLau Nunez100% (1)

- Disomang Cop vs. Datumanong November 25, 2004 - TingaDocumento5 pagineDisomang Cop vs. Datumanong November 25, 2004 - TingaLeslie OctavianoNessuna valutazione finora

- 75 PALE Bernardo v. RamosDocumento2 pagine75 PALE Bernardo v. RamosJoesil Dianne SempronNessuna valutazione finora

- CIR V Castaneda DigestDocumento1 paginaCIR V Castaneda DigestKTNessuna valutazione finora

- 19 (S-DP) Lucena Grand Terminal V Jac LinerDocumento2 pagine19 (S-DP) Lucena Grand Terminal V Jac LinerMayoree FlorencioNessuna valutazione finora

- Cir Vs Bank of Commerce DigestDocumento3 pagineCir Vs Bank of Commerce Digestwaws20Nessuna valutazione finora

- Malaga vs. Penachos, 213 SCRA 516Documento12 pagineMalaga vs. Penachos, 213 SCRA 516Mak Francisco100% (1)

- NPC V CITY OF CABANATUAN Case DigestDocumento2 pagineNPC V CITY OF CABANATUAN Case DigestZirk TanNessuna valutazione finora

- Bank of America v. CA and CIR DigestDocumento2 pagineBank of America v. CA and CIR DigestNichole Lanuza50% (2)

- Case DigestDocumento6 pagineCase DigestAngelica CanivelNessuna valutazione finora

- Provincial Assessor of Marinduque vs. Court of AppealsDocumento4 pagineProvincial Assessor of Marinduque vs. Court of AppealsiwamawiNessuna valutazione finora

- Guerrero vs. Bihis DigestDocumento1 paginaGuerrero vs. Bihis Digestiwamawi100% (1)

- Pua v. DeytoDocumento2 paginePua v. DeytoiwamawiNessuna valutazione finora

- Leonardo v. NLRCDocumento2 pagineLeonardo v. NLRCiwamawi100% (1)

- Philippine British Assurance Company, Inc. vs. Republic of The Philippines - DoctrineDocumento1 paginaPhilippine British Assurance Company, Inc. vs. Republic of The Philippines - DoctrineiwamawiNessuna valutazione finora

- Asia Brewery, Inc. vs. Court of AppealsDocumento5 pagineAsia Brewery, Inc. vs. Court of AppealsiwamawiNessuna valutazione finora

- City of Lapu-Lapu vs. Philippine Economic Zone AuthorityDocumento5 pagineCity of Lapu-Lapu vs. Philippine Economic Zone AuthorityiwamawiNessuna valutazione finora

- Francisco Vs HRET: More Than Once Within A Period of One YearDocumento1 paginaFrancisco Vs HRET: More Than Once Within A Period of One YeariwamawiNessuna valutazione finora

- Universal Declaration of Human RightsDocumento8 pagineUniversal Declaration of Human RightselectedwessNessuna valutazione finora

- Pro Line Sports Center, Inc. vs. Court of AppealsDocumento3 paginePro Line Sports Center, Inc. vs. Court of Appealsiwamawi100% (1)

- Contex Corp. vs. CIRDocumento1 paginaContex Corp. vs. CIRiwamawiNessuna valutazione finora

- Shangri-La International Hotel Management Ltd. vs. Court of AppealsDocumento2 pagineShangri-La International Hotel Management Ltd. vs. Court of Appealsiwamawi100% (1)

- Exxonmobil PetroleumDocumento1 paginaExxonmobil PetroleumiwamawiNessuna valutazione finora

- Meralco Securities Corp. vs. SavellanoDocumento2 pagineMeralco Securities Corp. vs. SavellanoiwamawiNessuna valutazione finora

- Exxonmobil Petroleum and Chemical Holdings, Inc. - Phil. Branch vs. Commissioner of Internal RevenueDocumento2 pagineExxonmobil Petroleum and Chemical Holdings, Inc. - Phil. Branch vs. Commissioner of Internal Revenueiwamawi100% (1)

- Matias V Salud (1958)Documento7 pagineMatias V Salud (1958)Henry C. Flordeliza100% (1)

- Matias V Salud (1958)Documento7 pagineMatias V Salud (1958)Henry C. Flordeliza100% (1)

- Succession Cases1 PDFDocumento42 pagineSuccession Cases1 PDFiwamawiNessuna valutazione finora

- Succession Cases1Documento58 pagineSuccession Cases1iwamawiNessuna valutazione finora

- Makati Sports Club, Inc. vs. ChengDocumento2 pagineMakati Sports Club, Inc. vs. Chengiwamawi100% (2)

- 209 - Suggested Answers in Civil Law Bar Exams (1990-2006)Documento124 pagine209 - Suggested Answers in Civil Law Bar Exams (1990-2006)ben_ten_1389% (19)

- Succession Cases1 PDFDocumento42 pagineSuccession Cases1 PDFiwamawiNessuna valutazione finora

- Art. 82 LaborDocumento3 pagineArt. 82 LaboriwamawiNessuna valutazione finora

- Kilosbayan Vs MoratoDocumento2 pagineKilosbayan Vs MoratoiwamawiNessuna valutazione finora

- Joya Vs PCGGDocumento1 paginaJoya Vs PCGGiwamawiNessuna valutazione finora

- Mariano Vs ComelecDocumento2 pagineMariano Vs ComeleciwamawiNessuna valutazione finora

- Joya Vs PCGGDocumento1 paginaJoya Vs PCGGiwamawiNessuna valutazione finora

- SANLAKAS Vs Executive SecretaryDocumento2 pagineSANLAKAS Vs Executive SecretaryiwamawiNessuna valutazione finora

- Kilosbayan Vs GuingonaDocumento2 pagineKilosbayan Vs GuingonaiwamawiNessuna valutazione finora

- Mariano Vs ComelecDocumento2 pagineMariano Vs ComeleciwamawiNessuna valutazione finora

- Nunez v. GSIS Family Bank-Later ProvisionDocumento16 pagineNunez v. GSIS Family Bank-Later ProvisionbrownboomerangNessuna valutazione finora

- Jean Jamailah Tomugdan JD - 2: Property Case Digests Makati Leasing and Finance Corp. Vs Wearever Textile Mills Inc.Documento4 pagineJean Jamailah Tomugdan JD - 2: Property Case Digests Makati Leasing and Finance Corp. Vs Wearever Textile Mills Inc.Jean Jamailah TomugdanNessuna valutazione finora

- Role of Banks in Economic DevelopmentDocumento11 pagineRole of Banks in Economic Developmentakashscribd01100% (5)

- Statement of Changes in Equity - Practice ExercisesDocumento2 pagineStatement of Changes in Equity - Practice ExercisesEvangeline Gicale25% (8)

- Questions in BCLTE 2019Documento3 pagineQuestions in BCLTE 2019mabel carmen100% (2)

- The Time Value of MoneyDocumento29 pagineThe Time Value of Moneymasandvishal50% (2)

- Assurance PC 1 PDFDocumento2 pagineAssurance PC 1 PDFrui zhangNessuna valutazione finora

- (Ebook) - 101 Money SecretsDocumento58 pagine(Ebook) - 101 Money Secretspatrick100% (4)

- Course Title: MICRO FINANCE Course Code: FIBA203 Credit Units: 3 Level: UGDocumento3 pagineCourse Title: MICRO FINANCE Course Code: FIBA203 Credit Units: 3 Level: UGchhaayaachitran akshuNessuna valutazione finora

- Capital Reserves and Bank ProfitabilityDocumento49 pagineCapital Reserves and Bank Profitabilityjen18612Nessuna valutazione finora

- Chapter 5 - Statement of Cash FlowsDocumento4 pagineChapter 5 - Statement of Cash FlowsArman100% (1)

- Anandham CaseDocumento17 pagineAnandham Casekarthick raj100% (1)

- PNB v. Ritratto - G.R. No. 142616 - 362 Scra 216Documento3 paginePNB v. Ritratto - G.R. No. 142616 - 362 Scra 216lord wally100% (1)

- Loyola PlansDocumento6 pagineLoyola PlansBodybliss ManNessuna valutazione finora

- Guingona vs. Carague Case DigestDocumento2 pagineGuingona vs. Carague Case Digestbern_alt100% (4)

- Non Current Liabilities San Carlos CollegeDocumento12 pagineNon Current Liabilities San Carlos CollegeRowbby Gwyn50% (2)

- Bachelor Thesis Marcella ClaaseDocumento26 pagineBachelor Thesis Marcella Claaseizzul_125z1419Nessuna valutazione finora

- Tender FormatDocumento8 pagineTender FormatSachin ShekhawatNessuna valutazione finora

- Direct Tax Summary Notes For IPCC JKQK1AK0Documento24 pagineDirect Tax Summary Notes For IPCC JKQK1AK0Vivek ShimogaNessuna valutazione finora

- Capital BudgetingDocumento83 pagineCapital BudgetingKaran SharmaNessuna valutazione finora

- QuestionnaireDocumento6 pagineQuestionnaireKenshin SophisticNessuna valutazione finora

- Lee v. SimandoDocumento2 pagineLee v. Simandokatrina_petillaNessuna valutazione finora

- Voluntary Municipal Disincorporation - Creative Solutions For Counties of The Second ClassDocumento36 pagineVoluntary Municipal Disincorporation - Creative Solutions For Counties of The Second ClassDave LemeryNessuna valutazione finora

- P6MYS AnsDocumento12 pagineP6MYS AnsLi HYu ClfEiNessuna valutazione finora

- Part I Interest Rates and Their Role in FinanceDocumento52 paginePart I Interest Rates and Their Role in FinanceHanako100% (1)

- JP Morgan ChaseDocumento13 pagineJP Morgan ChaseDasari BhaskarNessuna valutazione finora

- Falaknaz PresidencyDocumento12 pagineFalaknaz PresidencyAdnan AfzalNessuna valutazione finora

- 14 x11 Financial Management B Working Capital ManagementDocumento9 pagine14 x11 Financial Management B Working Capital ManagementAbegail Ara Loren33% (3)

- Money and BankingDocumento13 pagineMoney and BankingVirencarpediem0% (1)

- RSA Form: Request For Special ApprovalDocumento1 paginaRSA Form: Request For Special Approvaljohnny bellyNessuna valutazione finora