Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Relevant Cost Examples EMBA-garrison Ch.13

Caricato da

Aarti JCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Relevant Cost Examples EMBA-garrison Ch.13

Caricato da

Aarti JCopyright:

Formati disponibili

Problem 13-21 (45 minutes)

1. Only the avoidable costs are relevant in a decision to drop the Model C3

lawnchair product. The avoidable costs are:

Direct materials..................................................... R122,000

Direct labor........................................................... 72,000

Fringe benefits (20% of direct labor)....................... 14,400

Variable manufacturing overhead............................ 3,600

Product manager’s salary....................................... 10,000

Sales commissions (5% of sales)............................ 15,000

Fringe benefits (20% of salaries and commissions). . 5,000

Shipping................................................................ 10,000

Total avoidable cost............................................... R252,000

The following costs are not relevant in this decision:

Cost Reason not relevant

Building rent and maintenance All products use the same

facilities; no space would be

freed if a product were

dropped.

Depreciation All products use the same

equipment so no equipment

can be sold. Furthermore, the

equipment does not wear out

through use.

General administrative expenses Dropping the Model C3

lawnchair would have no effect

on total general administrative

expenses.

Having determined the costs that can be avoided if the Model C3

lawnchair is dropped, we can now make the following computation:

Sales revenue lost if the Model C3 lawnchair is dropped... R300,000

Less costs that can be avoided (see above)..................... 252,000

Decrease in overall company net operating income if

the Model C3 lawnchair is dropped............................... R 48,000

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 13 1

Problem 13-21 (continued)

Thus, the Model C3 lawnchair should not be dropped unless the

company can find more profitable uses for the resources consumed by

the Model C3 lawnchair.

2. To determine the minimum acceptable level of sales, we must first

classify the avoidable costs into variable and fixed costs as follows:

Variable Fixed

Direct materials................................................

R122,000

Direct labor......................................................

72,000

Fringe benefits (20% of direct labor)................. 14,400

Variable manufacturing overhead...................... 3,600

Product managers’ salaries................................ R10,000

Sales commissions (5% of sales)....................... 15,000

Fringe benefits

(20% of salaries and commissions)................. 3,000 2,000

Shipping........................................................... 10,000

Total costs....................................................... R240,000 R12,000

The Model C3 lawnchair should be retained as long as its contribution

margin covers its avoidable fixed costs. Break-even analysis can be used

to find the sales volume where the contribution margin just equals the

avoidable fixed costs.

The contribution margin ratio is computed as follows:

Contribution margin

CM ratio =

Sales

R300,000-R240,000

= = 20%

R300,000

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 13 2

Problem 13-21 (continued)

The break-even sales volume can be found using the break-even

formula:

Fixed costs

Break-even point =

CM ratio

R12,000

= = R60,000

0.20

Therefore, as long as the sales revenue from the Model C3 lawnchair

exceeds R60,000, it is covering its own avoidable fixed costs and is

contributing toward covering the common fixed costs and toward the

profits of the entire company.

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 13 3

Case 13-31 (90 minutes)

1. The lowest price Wesco could bid for the one-time special order of

20,000 pounds (20 lots) without losing money would be $24,200—the

relevant cost of the order, as shown below.

Direct materials:

AG-5: 300 pounds per lot × 20 lots = 6,000 pounds.

Substitute BH-3 on a one-for-one basis to its total of 3,500

pounds. If BH-3 is not used in this order, it will be salvaged

for $600. Therefore, the relevant cost is.............................. $ 600

The remaining 2,500 pounds would be AG-5 at a cost of

$1.20 per pound................................................................ 3,000

KL-2: 200 pounds per lot × 20 lots = 4,000 pounds at $1.05

per pound.......................................................................... 4,200

CW-7: 150 pounds per lot × 20 lots = 3,000 pounds at

$1.35 per pound................................................................ 4,050

DF-6: 175 pounds per lot × 20 lots = 3,500 pounds. Use

3,000 pounds in inventory at $0.60 per pound ($0.70

market price – $0.10 handling charge), and purchase the

remaining 500 pounds at $0.70 per pound........................... 2,150

Total direct materials cost..................................................... 14,000

Direct labor: 25 DLHs per lot × 20 lots = 500 DLHs. Because only 400

hours can be scheduled during regular time this month, overtime

would have to be used for the remaining 100 hours.

400 DLHs × $14.00 per DLH.................................................. 5,600

100 DLHs × $21.00 per DLH.................................................. 2,100

Total direct labor cost........................................................... 7,700

Overhead: This special order will not increase fixed overhead costs.

Therefore, only the variable overhead is relevant.

500 DLHs × $3.00 per DLH................................................... 1,500

Total relevant cost of the special order..................................... $23,200

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 13 4

Case 13-31 (continued)

2. In this part, we calculate the price for recurring orders of 20,000 pounds

(20 lots) using the company’s rule of marking up its full manufacturing

cost. This is not the best pricing policy to follow, but is a common

practice in business.

Direct materials: Because the initial order will exhaust existing

inventories of BH-3 and DF-6 and new supplies would have to be

purchased, all raw materials should be charged at their expected

future cost, which is the current market price.

AG-5: 6,000 pounds × $1.20 per pound............................... $ 7,200

KL-2: 4,000 pounds × $1.05 per pound................................ 4,200

CW-7: 3,000 pounds × $1.35 per pound.............................. 4,050

DF-6: 3,500 pounds × $0.70 per pound............................... 2,450

Total direct materials cost................................................... 17,900

Direct labor: 90% (i.e., 450 DLHs) of the production of a batch can be

done on regular time; but the remaining production (i.e., 50 DLHs) must

be done on overtime.

Regular time 450 DLHs × $14.00 per DLH............................ 6,300

Overtime premium 50 DLHs × $21.00 per DLH..................... 1,050

Total direct labor cost......................................................... 7,350

Overhead: The full manufacturing cost includes both fixed and variable

manufacturing overhead.

Manufacturing overhead applied:

500 DLHs × $13.50 per DLH............................................. 6,750

Full manufacturing cost......................................................... 32,000

Markup (40% × $32,000)...................................................... 12,800

Selling price (full manufacturing cost plus markup)................. $44,800

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 13 5

Case 13-32 (120 minutes)

1. The product margins computed by the accounting department for the

drums and bike frames should not be used in the decision of which

product to make. The product margins are lower than they should be

due to the presence of allocated fixed common costs that are irrelevant

in this decision. Moreover, even after the irrelevant costs have been

removed, what matters is the profitability of the two products in relation

to the amount of the constrained resource—welding time—that they

use. A product with a very low margin may be desirable if it uses very

little of the constrained resource. In short, the financial data provided by

the accounting department are useless and potentially misleading for

making this decision.

2. Students may have answered this question assuming that direct labor is

a variable cost, even though the case strongly hints that direct labor is a

fixed cost. The solution is shown here assuming that direct labor is

fixed. The solution assuming that direct labor is variable will be shown in

part (4).

Solution assuming direct labor is fixed

Manufactured

Purchased

WVD WVD Bike

Drums Drums Frames

Selling price..................................... $149.00 $149.00 $239.00

Less variable costs:

Materials....................................... 138.00 52.10 99.40

Variable manufacturing overhead.... 0.00 1.35 1.90

Variable selling and administrative. . 0.75 0.75 1.30

Total variable cost............................ 138.75 54.20 102.60

Contribution margin.......................... $ 10.25 $ 94.80 $136.40

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 13 6

Case 13-32 (continued)

3. Since the demand for the welding machine exceeds the 2,000 hours that

are available, products that use the machine should be prioritized based

on their contribution margin per welding hour. The computations are

carried out below under the assumption that direct labor is a fixed cost

and then under the assumption that it is a variable cost.

Solution assuming direct labor is fixed

Manufactured

WVD Bike

Drums Frames

Contribution margin per unit (above) (a)............. $94.80 $136.40

Welding hours per unit (b)................................. 0.4 hour 0.5 hour

Contribution margin per welding hour (a) ÷ (b)... $237.00 $272.80

per hour per hour

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 13 7

Case 13-32 (continued)

Since the contribution margin per unit of the constrained resource (i.e., welding time) is larger for the

bike frames than for the WVD drums, the frames make the most profitable use of the welding machine.

Consequently, the company should manufacture as many bike frames as possible up to demand and

then use any leftover capacity to produce WVD drums. Buying the drums from the outside supplier can

fill any remaining unsatisfied demand for WVD drums. The necessary calculations are carried out below.

Analysis assuming direct labor is a fixed cost

(a) (b) (c) (a) × (c) (a) × (b)

Unit Balance

Contri- Welding Total of Total

bution Time Welding Welding Contri-

Quantity Margin per Unit Time Time bution

Total hours available.................... 2,000

Bike frames produced.................. 1,600 $136.40 0.5 800 1,200 $218,240

WVD Drums—make..................... 3,000 $94.80 0.4 1,200 0 284,400

WVD Drums—buy........................ 3,000 $10.25 30,750

Total contribution margin............. 533,390

Less: Contribution margin from

present operations: 5,000

drums × $94.80 CM per drum.... 474,000

Increased contribution margin

and net operating income.......... $ 59,390

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 13 8

Case 13-32 (continued)

4. The computation of the contribution margins and the analysis of the

best product mix are repeated here under the assumption that direct

labor costs are variable.

Solution assuming direct labor is a variable cost

Manufactured

Purchased

WVD WVD Bike

Drums Drums Frames

Selling price..................................... $149.00 $149.00 $239.00

Less variable costs:

Materials....................................... 138.00 52.10 99.40

Direct labor................................... 0.00 3.60 28.80

Variable manufacturing overhead.... 0.00 1.35 1.90

Variable selling and administrative. . 0.75 0.75 1.30

Total variable cost............................ 138.75 57.80 131.40

Contribution margin.......................... $ 10.25 $ 91.20 $107.60

Solution assuming direct labor is a variable cost

Manufactured

WVD Bike

Drums Frames

Contribution margin per unit (above) (a)............. $91.20 $107.60

Welding hours per unit (b)................................. 0.4 hour 0.5 hour

Contribution margin per welding hour (a) ÷ (b)... $228.00 $215.20

per hour per hour

When direct labor is assumed to be a variable cost, the conclusion is

reversed from the case in which direct labor is assumed to be a fixed

cost—the WVD drums appear to be a better use of the constraint than

the bike frames. The assumption about the behavior of direct labor

really does matter.

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 13 9

Case 13-32 (continued)

Solution assuming direct labor is a variable cost

(a) (b) (c) (a) × (c) (a) × (b)

Unit Balance

Contri- Welding Total of Total

bution Time Welding Welding Contri-

Quantity Margin per Unit Time Time bution

Total hours available.................... 2,000

WVD Drums—make..................... 5,000 $91.20 0.4 2,000 0 $456,000

Bike frames produced.................. 0 $107.60 0.5 0 0 0

WVD Drums—buy........................ 1,000 $10.25 10,250

Total contribution margin............. 466,250

Less: Contribution margin from

present operations: 5,000

drums × $91.20 CM per drum.... 456,000

Increased contribution margin

and net operating income.......... $ 10,250

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 13 10

Case 13-32 (continued)

5. The case strongly suggests that direct labor is fixed: “The bike

frames could be produced with existing equipment and

personnel.” Nevertheless, it would be a good idea to examine how

much labor time is really needed under the two opposing plans.

Direct Labor- Total Direct

Production Hours Per Unit Labor-Hours

Plan 1:

Bike frames.................. 1,600 1.6* 2,560

WVD drums................. 3,000 0.2** 600

3,160

Plan 2:

WVD drums................. 5,000 0.2** 1,000

* $28.80 ÷ $18.00 per hour = 1.6 hour

** $3.60 ÷ $18.00 per hour = 0.2 hour

Some caution is advised. Plan 1 assumes that direct labor is a

fixed cost. However, this plan requires 2,160 more direct labor-

hours than Plan 2 and the present situation. At 40 hours per week

a typical full-time employee works about 1,900 hours a year, so

the added workload is equivalent to more than one full-time

employee. Does the plant really have that much idle time at

present? If so, and if shifting workers over to making bike frames

would not jeopardize operations elsewhere, then Plan 1 is indeed

the better plan. However, if taking on the bike frame as a new

product would lead to pressure to hire another worker, more

analysis is in order. It is still best to view direct labor as a fixed

cost, but taking on the frames as a new product could lead to a

jump in fixed costs of about $34,200 (1,900 hours × $18 per

hour)—assuming that the remaining 260 hours could be made up

using otherwise idle time. See the additional analysis on the next

page.

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 13

Case 13-32 (continued)

Contribution margin from Plan 1:

Bike frames produced (1,600 × $136.40)........................ 218,240

WVD Drums—make (3,000 × $94.80)............................. 284,400

WVD Drums—buy (3,000 × $10.25)............................... 30,750

Total contribution margin............................................... 533,390

Less: Additional fixed labor costs...................................... 34,200

Net effect of Plan 1 on net operating income..................... $499,190

Contribution margin from Plan 2:......................................

WVD Drums—make (5,000 × $94.80)............................. $474,000

WVD Drums—buy (1,000 × $10.25)............................... 10,250

Net effect of Plan 2 on net operating income..................... $484,250

If an additional direct labor employee would have to be hired, Plan

1 is still optimal.

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 13

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 13

Potrebbero piacerti anche

- 1 - Sis40215 CPT Case Studies 3Documento61 pagine1 - Sis40215 CPT Case Studies 3Aarti J0% (2)

- Assignment Solution Question 2 and 3Documento8 pagineAssignment Solution Question 2 and 3Grace Versoni100% (4)

- Chapter 2 - Adapting Marketing To The New Economy Multiple Choice QuestionsDocumento14 pagineChapter 2 - Adapting Marketing To The New Economy Multiple Choice QuestionsMutya Neri CruzNessuna valutazione finora

- Hilton CH 15 Select SolutionsDocumento11 pagineHilton CH 15 Select SolutionsVivian50% (2)

- Chapter 6 HomeworkDocumento10 pagineChapter 6 HomeworkAshy Lee0% (1)

- Chapter 8 Solutions ExercisesDocumento25 pagineChapter 8 Solutions Exerciseswajeeda awadNessuna valutazione finora

- Management Accounting Individual AssignmentDocumento10 pagineManagement Accounting Individual AssignmentendalNessuna valutazione finora

- Organizational CultureDocumento21 pagineOrganizational CultureAarti JNessuna valutazione finora

- Solutions To Relevant Cost ProblemsDocumento13 pagineSolutions To Relevant Cost ProblemsAndrian VillanuevaNessuna valutazione finora

- Chap13 Decsioion MakingDocumento13 pagineChap13 Decsioion MakingHakim AliNessuna valutazione finora

- 2010 06 13 - 091545 - Case13 30Documento6 pagine2010 06 13 - 091545 - Case13 30Sheila Mae Llamada Saycon IINessuna valutazione finora

- Cornerstone Exercises Cornerstone Exercise 17.1Documento30 pagineCornerstone Exercises Cornerstone Exercise 17.1Nirwana PuriNessuna valutazione finora

- Optimize Housekeeping ProgramDocumento15 pagineOptimize Housekeeping ProgramFiras HamadNessuna valutazione finora

- SOLUTIONS OF EXERCISES_MANAGEMENT ACCOUNTING_CHAPTER 2_3_4Documento9 pagineSOLUTIONS OF EXERCISES_MANAGEMENT ACCOUNTING_CHAPTER 2_3_4ngochoangbich2004Nessuna valutazione finora

- Chapter 19 Alternate Problems Problem 19.1A: Alternate Problems For Use With Financial and Managerial Accounting, 12eDocumento12 pagineChapter 19 Alternate Problems Problem 19.1A: Alternate Problems For Use With Financial and Managerial Accounting, 12eKathryn Teo0% (1)

- MCFM Financial Exercises SolutionsDocumento25 pagineMCFM Financial Exercises SolutionsRam Kumar Chowdary VinjamNessuna valutazione finora

- Solman Mas 001Documento20 pagineSolman Mas 001Andrea Carmela PariñasNessuna valutazione finora

- HO3 Long 5 PagesDocumento5 pagineHO3 Long 5 PagesCarl Dhaniel Garcia SalenNessuna valutazione finora

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocumento5 pagineSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnAlfia aNessuna valutazione finora

- Jawab Latihan Sesi 8Documento2 pagineJawab Latihan Sesi 8Feni AlvitaNessuna valutazione finora

- Hilton CH 15 Select SolutionsDocumento11 pagineHilton CH 15 Select SolutionsPiyushSharmaNessuna valutazione finora

- Optimize Round Trampoline ProductionDocumento17 pagineOptimize Round Trampoline ProductionBảo Anh Phạm100% (1)

- CVP - SolutionsDocumento8 pagineCVP - SolutionsLaica MontefalcoNessuna valutazione finora

- Solution To Questions On Decision MakingDocumento27 pagineSolution To Questions On Decision Makingdanishbashir786Nessuna valutazione finora

- Cost-Volume-Profit Relationships: MANAGEMENT ACCOUNTING - Solutions ManualDocumento36 pagineCost-Volume-Profit Relationships: MANAGEMENT ACCOUNTING - Solutions ManualStephanie LeeNessuna valutazione finora

- Manacc Assignment 14-3: Make or Buy A ComponentDocumento7 pagineManacc Assignment 14-3: Make or Buy A ComponentCuster CoNessuna valutazione finora

- Chapter 19 - Relevant CostDocumento31 pagineChapter 19 - Relevant CostApril Manjares100% (2)

- 16 Ma7e Errata 062515Documento13 pagine16 Ma7e Errata 062515RahulNessuna valutazione finora

- Hilton CH 14 Select SolutionsDocumento10 pagineHilton CH 14 Select SolutionsHabib EjazNessuna valutazione finora

- Ab Costing CathDocumento5 pagineAb Costing CathRoy Mitz Aggabao Bautista VNessuna valutazione finora

- Standard Costs, Variable Costing Systems, Quality Costs, and Joint CostsDocumento21 pagineStandard Costs, Variable Costing Systems, Quality Costs, and Joint CostsGatorNessuna valutazione finora

- Chapter 4 AnswerDocumento23 pagineChapter 4 AnswerMethly Moreno100% (1)

- Requirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Documento6 pagineRequirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Aira Jaimee GonzalesNessuna valutazione finora

- Requirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Documento7 pagineRequirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Aira Jaimee GonzalesNessuna valutazione finora

- Relevant Costs For Decision Making: MANAGEMENT ACCOUNTING - Solutions ManualDocumento33 pagineRelevant Costs For Decision Making: MANAGEMENT ACCOUNTING - Solutions ManualClaire BarbaNessuna valutazione finora

- Problem 2Documento3 pagineProblem 2Mohammed Al ArmaliNessuna valutazione finora

- Cost-Management-Accounting-DEC-2023Documento4 pagineCost-Management-Accounting-DEC-2023Aash RedmiNessuna valutazione finora

- Cost Accounting Midterm Examination ReviewerDocumento7 pagineCost Accounting Midterm Examination ReviewerCj TolentinoNessuna valutazione finora

- Week 13 - In-class assignments and costing exercisesDocumento20 pagineWeek 13 - In-class assignments and costing exercisesadms examzNessuna valutazione finora

- Mas Chap 13Documento23 pagineMas Chap 13Raz MahariNessuna valutazione finora

- A Chp6 TUTDocumento11 pagineA Chp6 TUTYong Jing YinNessuna valutazione finora

- Practice Question - Absorption & Variable Costing - May 2015Documento8 paginePractice Question - Absorption & Variable Costing - May 2015Muhammad Ali MeerNessuna valutazione finora

- MANAGEMENT ACCOUNTING SOLUTIONS MANUAL CHAPTER 19Documento16 pagineMANAGEMENT ACCOUNTING SOLUTIONS MANUAL CHAPTER 19bv123bvNessuna valutazione finora

- Sol ch14Documento10 pagineSol ch14Pradeep VarshneyNessuna valutazione finora

- Differential Costing Part IIDocumento9 pagineDifferential Costing Part IIxxpinkywitchxxNessuna valutazione finora

- Overhead Costing QuestionsDocumento5 pagineOverhead Costing Questionsfaith olaNessuna valutazione finora

- Problem 11-20A: Solutions (12/09)Documento1 paginaProblem 11-20A: Solutions (12/09)jnplnceNessuna valutazione finora

- Solutions Ch. 7 ABCDocumento11 pagineSolutions Ch. 7 ABCThanawat PHURISIRUNGROJNessuna valutazione finora

- Brief Exercise 6-1: Solutions (10/31)Documento3 pagineBrief Exercise 6-1: Solutions (10/31)jnplnceNessuna valutazione finora

- Sample Problems On Transfer Pricing and Responsibility Acctg 1Documento11 pagineSample Problems On Transfer Pricing and Responsibility Acctg 1Keyt's Collection PhNessuna valutazione finora

- ACC 3200 Quiz 8Documento7 pagineACC 3200 Quiz 8Jazzel MartinezNessuna valutazione finora

- Managerial Accounting 3rd Edition Braun Solutions ManualDocumento45 pagineManagerial Accounting 3rd Edition Braun Solutions Manualgenevievetruong9ajpr100% (28)

- Paper - 5: Advanced Management Accounting Questions Limiting FactorDocumento24 paginePaper - 5: Advanced Management Accounting Questions Limiting FactorMohit MaheshwariNessuna valutazione finora

- Paper - 5: Advanced Management Accounting Questions Limiting FactorDocumento24 paginePaper - 5: Advanced Management Accounting Questions Limiting FactorSrihariNessuna valutazione finora

- Solution To Chapter 2 E2 24,2 30, P2 40, 2 37 E2 32,28 (1 3 Parts) P2 43,2 54Documento7 pagineSolution To Chapter 2 E2 24,2 30, P2 40, 2 37 E2 32,28 (1 3 Parts) P2 43,2 54ReilpeterNessuna valutazione finora

- Cambridge O Level: 7115/22 Business StudiesDocumento12 pagineCambridge O Level: 7115/22 Business StudiesfallonNessuna valutazione finora

- MADM Session 2Documento5 pagineMADM Session 2Arvind Thatikonda0% (1)

- Optimize Profits from Special Orders with Differential Cost AnalysisDocumento39 pagineOptimize Profits from Special Orders with Differential Cost Analysisjogre11Nessuna valutazione finora

- Answer To Assignment #2 - Variable Costing PDFDocumento14 pagineAnswer To Assignment #2 - Variable Costing PDFVivienne Rozenn LaytoNessuna valutazione finora

- Problem 18 - 18 18 - 31 and 18 - 32Documento5 pagineProblem 18 - 18 18 - 31 and 18 - 32anon_459698449Nessuna valutazione finora

- Ashley LTD Is A Manufacturing Firm The Bookkeeper Supplies YouDocumento1 paginaAshley LTD Is A Manufacturing Firm The Bookkeeper Supplies YouMiroslav GegoskiNessuna valutazione finora

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisDa EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNessuna valutazione finora

- CostingDocumento3 pagineCostingAarti JNessuna valutazione finora

- Chapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Documento32 pagineChapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Judith DelRosario De RoxasNessuna valutazione finora

- American Finance Association, Wiley The Journal of FinanceDocumento8 pagineAmerican Finance Association, Wiley The Journal of FinanceAarti JNessuna valutazione finora

- Accounting Homework Help IliskimeDocumento1 paginaAccounting Homework Help IliskimeAarti JNessuna valutazione finora

- Ch03 Prob3-6ADocumento9 pagineCh03 Prob3-6AAarti J100% (1)

- Deegan Chapter 10Documento18 pagineDeegan Chapter 10Aarti JNessuna valutazione finora

- Saudi Vision2030Documento85 pagineSaudi Vision2030ryx11Nessuna valutazione finora

- Hi5019 Individual Assignment t1 2019 Qyuykqw5Documento5 pagineHi5019 Individual Assignment t1 2019 Qyuykqw5Aarti J50% (2)

- NCK - Annual Report 2017 PDFDocumento56 pagineNCK - Annual Report 2017 PDFAarti JNessuna valutazione finora

- Mgt201 Solved Subjective Questions Vuzs TeamDocumento12 pagineMgt201 Solved Subjective Questions Vuzs TeamAarti JNessuna valutazione finora

- Caltex Australia CTX 2017 Annual ReportDocumento127 pagineCaltex Australia CTX 2017 Annual ReportAarti JNessuna valutazione finora

- 2 Case - 2Documento10 pagine2 Case - 2Aarti JNessuna valutazione finora

- CR 1845Documento90 pagineCR 1845Aarti JNessuna valutazione finora

- CH 07 SMDocumento11 pagineCH 07 SMAarti JNessuna valutazione finora

- 6 Capital Market Intermediaries and Their RegulationDocumento8 pagine6 Capital Market Intermediaries and Their RegulationTushar PatilNessuna valutazione finora

- Case Study Ch03Documento3 pagineCase Study Ch03Munya Chawana0% (1)

- Mergers Don't Always Lead To Culture Clashes.Documento3 pagineMergers Don't Always Lead To Culture Clashes.Lahiyru100% (3)

- Philanthropy Hub Opens To Advisers Australian Share Valuations Overstretched'Documento2 paginePhilanthropy Hub Opens To Advisers Australian Share Valuations Overstretched'Aarti JNessuna valutazione finora

- TFTH C 636639530213947535 31700 2Documento55 pagineTFTH C 636639530213947535 31700 2Aarti JNessuna valutazione finora

- Investment Decision MethodDocumento44 pagineInvestment Decision MethodashwathNessuna valutazione finora

- Accounting Changes and Errors: HapterDocumento46 pagineAccounting Changes and Errors: HapterAarti JNessuna valutazione finora

- Coles Year in Review 2017Documento28 pagineColes Year in Review 2017Aarti JNessuna valutazione finora

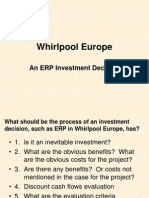

- The Whirlpool Europe Case: Investment On ERPDocumento8 pagineThe Whirlpool Europe Case: Investment On ERPAarti JNessuna valutazione finora

- Whirlpool EuropeDocumento19 pagineWhirlpool Europejoelgzm0% (1)

- MCK (McKesson Corporation) Annual Report With A Comprehensive Overview of The Company (10-K) 2013-05-07Documento139 pagineMCK (McKesson Corporation) Annual Report With A Comprehensive Overview of The Company (10-K) 2013-05-07Aarti J100% (1)

- ACCG315Documento4 pagineACCG315Joannah Blue0% (1)

- Investment in Debt and Equity SecuritiesDocumento2 pagineInvestment in Debt and Equity SecuritiesJoy GinesNessuna valutazione finora

- The Analysis On The Marketing Strategy of Luckin Coffee in ChinaDocumento4 pagineThe Analysis On The Marketing Strategy of Luckin Coffee in ChinaMai Ha AnhNessuna valutazione finora

- The Zola Bantu Book - The Eternal GospelDocumento151 pagineThe Zola Bantu Book - The Eternal GospelTwinomugisha Ndinyenka RobertNessuna valutazione finora

- Statement MAY2018 098010526-1Documento11 pagineStatement MAY2018 098010526-1Rishav BhardwajNessuna valutazione finora

- Variance Swaps PrimerDocumento104 pagineVariance Swaps PrimerVitaly ShatkovskyNessuna valutazione finora

- Dyer2013 PDFDocumento574 pagineDyer2013 PDFMiguel Alejandro Diaz CastilloNessuna valutazione finora

- HUL MBA ProjectsDocumento3 pagineHUL MBA ProjectsimskjainNessuna valutazione finora

- PcEx 2Documento2 paginePcEx 2Asad ZamanNessuna valutazione finora

- Implications for HUL's Supply Chain in Rural ExpansionDocumento2 pagineImplications for HUL's Supply Chain in Rural ExpansionVanshika Srivastava 17IFT017Nessuna valutazione finora

- WFS Item LabelingDocumento2 pagineWFS Item LabelingAhsanur KabirNessuna valutazione finora

- LLM Internship Brochure 2021 22 V 11Documento12 pagineLLM Internship Brochure 2021 22 V 11Bala KumaranNessuna valutazione finora

- 5684 SampleDocumento1 pagina5684 SampleChessking Siew HeeNessuna valutazione finora

- SOLUTION MANUAL Akm 1 PDFDocumento4 pagineSOLUTION MANUAL Akm 1 PDFRizka khairunnisaNessuna valutazione finora

- Workbook PDFDocumento116 pagineWorkbook PDFSuvodeep GhoshNessuna valutazione finora

- Course File For Marketing Management 1 NewDocumento19 pagineCourse File For Marketing Management 1 NewAjay SamyalNessuna valutazione finora

- Tesla Case SolutionDocumento2 pagineTesla Case SolutionMarutiNessuna valutazione finora

- Ind As 109 PDFDocumento5 pagineInd As 109 PDFashmit bahlNessuna valutazione finora

- @30digital Marketing On Hotel Busines PerformaceDocumento80 pagine@30digital Marketing On Hotel Busines Performaceassefamenelik1Nessuna valutazione finora

- CRM FinalDocumento54 pagineCRM FinalPrashant GuptaNessuna valutazione finora

- Best ADX Strategy Built by Professional TradersDocumento6 pagineBest ADX Strategy Built by Professional TradersSantosh ThakurNessuna valutazione finora

- Accounting Test Bank 2Documento73 pagineAccounting Test Bank 2likesNessuna valutazione finora

- Microeconomics CIA 1Documento10 pagineMicroeconomics CIA 1MeghnaNessuna valutazione finora

- LME Free Data ServiceDocumento2 pagineLME Free Data ServiceFaraz Dar100% (1)

- Principles of MicroeconomicsDocumento8 paginePrinciples of MicroeconomicsJoshua PatrickNessuna valutazione finora

- Fair Value ModelDocumento2 pagineFair Value ModelZes ONessuna valutazione finora

- Summer Internship Program 2009 HDFC Mutual Fund ReportDocumento63 pagineSummer Internship Program 2009 HDFC Mutual Fund ReportANEESHNessuna valutazione finora

- Zaresco N WH Tepaper: Zares F RST Token Ze Advert S NG AgencyDocumento7 pagineZaresco N WH Tepaper: Zares F RST Token Ze Advert S NG Agencymr ednderNessuna valutazione finora

- Business Economic Assignment Answers June 2022Documento9 pagineBusiness Economic Assignment Answers June 2022sanhitaNessuna valutazione finora

- HAIER - Sec BDocumento36 pagineHAIER - Sec BBibhutiNandaNessuna valutazione finora