Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bab 20 Direct Costing PDF

Caricato da

Sandi SetiawanTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Bab 20 Direct Costing PDF

Caricato da

Sandi SetiawanCopyright:

Formati disponibili

Cost Accounting 13th ed, Carter and Usry.

Bab 20 Standar Costing: Incorporating … Hal 20 - 1

Supported by Nugraha Corporation

CHAPTER 20

DIRECT COSTING, COST VOLUME PROFIT ANALYSIS, AND

THE THEORY OF CONSTRAINTS

Direct costing = variable costing = marginal costing : cost yang dibebankan ke produk adalah

variable manufacturing cost saja (DM, DL, var FOH), sedangkan fixed manufacturing cost

(fixed FOH) menjadi period expenses.

Contribution margin = marginal income : sales – variable cost (manufacturing + non

manufacturing)

Ilustrasi:

Per Unit Total % of Sales

Sales (10.000 unit) $70 $700.000 100

Less variable cost 42 420.000 60

Contribution margin $28 $280.000 40

Less fixed cost 175.000 25

Operating income $105.000 15

Efek direct costing pada income statement

Ilustrasi:

QST Co. memproduksi satu macam produk dengan kapasitas normal 20.000 unit per triwulan.

Data:

Direct material $30 per unit

Direct labor 22 per unit

Variable FOH 8 per unit

Total direct cost $60 per unit

Budgeted Fixed FOH 300.000 per triwulan

Fixed marketing dan administrative expenses 200.000 per triwulan

Tarif fixed FOH (kapasitas normal) 15 per unit

Variable marketing expenses 5 per unit

FOH dibebankan berdasarkan jumlah unit yang diproduksi.

Harga jual 100 per unit

Material variances, labor variances, dan FOH controllable variance:

Triwulan I $15.000

Triwulan II 9.000

Triwulan III 14.000

Triwulan IV 17.000

Variance dianggap tidak material dan ditutup ke COGS.

WIP awal dan akhir nol.

Standard cost digunakan untuk menghitung finished good.

Standar cost tahun ini sama dengan tahun lalu.

Finished good awal 4.000 unit.

Data rencana produksi, produksi actual, dan penjualan:

Triwulan I Triwulan II Triwulan III Triwulan IV

Planned production 20.000 20.000 20.000 20.000

Supported by Nugraha Corporation

Cost Accounting 13th ed, Carter and Usry. Bab 20 Standar Costing: Incorporating … Hal 20 - 2

Actual production 20.000 18.000 20.000 22.000

Actual sales 20.000 20.000 18.000 18.000

Unit cost dengan absorption costing:

Direct material $30

Direct labor 22

Variable FOH 8

Fixed FOH 15

Total direct cost $75

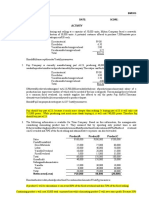

QST Corporation

Quarterly Income Statement

Absorption Costing Basis

For the Year 20A

First Second Third Fourth

Quarter Quarter Quarter Quarter

Sales $2.000.000 $2.000.000 $1.800.000 $1.800.000

Standard cost of COGS 1.500.000 $1.500.000 $1.350.000 $1.350.000

Material, labor, and controllable var 15.000 9.000 14.000 17.000

Volume variances 0 30.000 0 (30.000)

Adjusted COGS $1.515.000 $1.539.000 $1.364.000 $1.337.000

Gross profit $ 485.000 $ 461.000 $ 436.000 $ 463.000

Marketing and adm. expenses 300.000 300.000 290.000 290.000

Operating income $ 185.000 $ 161.000 $ 146.000 $ 173.000

Volume variance dihitung sebagai berikut:

First Second Third Fourth

Quarter Quarter Quarter Quarter

Budgeted fixed FOH $300.000 $300.000 $300.000 $ 300.000

Actual production 20.000 18.000 20.000 22.000

Fixed FOH rate X $15 X $15 X $15 X $15

Applied fixed FOH $300.000 $270.000 $300.000 $ 330.000

Volume var, unfavorable (favorabl) $ 0 $ 30.000 $0 $(30.000)

QST Corporation

Quarterly Income Statement

Direct Costing Basis

For the Year 20A

First Second Third Fourth

Quarter Quarter Quarter Quarter

Sales $2.000.000 $2.000.000 $1.800.000 $1.800.000

Standard cost of COGS 1.200.000 $1.200.000 $1.080.000 $1.080.000

Material, labor, and controllable var 15.000 9.000 14.000 17.000

Volume variances 0 30.000 0 (30.000)

Adjusted COGS $1.215.000 $1.209.000 $1.094.000 $1.097.000

Gross contribution margin $ 785.000 $ 791.000 $ 706.000 $ 703.000

Variable marketing expenses 100.000 100.000 90.000 90.000

Contribution margin $ 685.000 $ 691.000 $ 616.000 $ 613.000

Fixed marketing and adm. exp 200.000 200.000 200.000 200.000

Total fixed expenses $ 500.000 $ 500.000 $ 500.000 $ 500.000

Supported by Nugraha Corporation

Cost Accounting 13th ed, Carter and Usry. Bab 20 Standar Costing: Incorporating … Hal 20 - 3

Operating income $ 185.000 $ 191.000 $ 116.000 $ 113.000

Costs Assigned to Inventory

Jumlah unit ending inventory:

First Second Third Fourth

Quarter Quarter Quarter Quarter

Unit in beginning inventory 4.000 4.000 2.000 4.000

Unit produced during period 20.000 18.000 20.000 22.000

Units available for sale 24.000 22.000 22.000 26.000

Less units sold 20.000 20.000 18.000 18.000

Units in ending inventory 4.000 2.000 4.000 8.000

Cost ending inventory:

First Second Third Fourth

Quarter Quarter Quarter Quarter

Units in ending inventory 4.000 2.000 4.000 8.000

Standard full cost per unit x$ 75 x$ 75 x$ 75 x$ 75

Cost end. inv—absorption costing $300.000 $150.000 $300.000 $600.000

Units in ending inventory 4.000 2.000 4.000 8.000

Standard variable cost per unit x$ 60 x$ 60 x$ 60 x$ 60

Cost end. inv—direct costing $240.000 $120.000 $240.000 $480.000

Selisih $ 60.000 $ 30.000 $ 60.000 $120.000

Rekonsiliasi operating income antara absorption costing dan direct costing:

Perbedaan operating income antara absorption costing dan direct costing disebabkan oleh:

Fixed FOH pada absorption costing dibebankan ke inventory sedangkan pada direct costing

menjadi expense.

First Second Third Fourth

Quarter Quarter Quarter Quarter

Op. income – absorption costing $185.000 $ 161.000 $146.000 $173.000

Op. income – direct costing $185.000 $ 191.000 $116.000 $113.000

Selisih $ 0 $ (30.000) $ 30.000 $ 60.000

Inv. Change – absorption costing

Ending inv. $300.000 $ 150.000 $300.000 $600.000

Beg. Inv 300.000 300.000 150.000 300.000

Increase (decrease) $ 0 $(150.000) $150.000 $300.000

Inv. Change – direct costing

Ending inv. $240.000 $120.000 $240.000 $480.000

Beg. Inv 240.000 240.000 120.000 240.000

Increase (decrease) $ 0 $(120.000) $120.000 $240.000

Selisih $ 0 $ (30.000) $ 30.000 $ 60.000

Atau: (quantity produced – quantity sold) x tariff fixed FOH

First Second Third Fourth

Quarter Quarter Quarter Quarter

Unit produced 20.000 18.000 20.000 22.000

Unit sold 20.000 20.000 18.000 18.000

Increase (decrease) 0 (2.000) 2.000 4.000

Supported by Nugraha Corporation

Cost Accounting 13th ed, Carter and Usry. Bab 20 Standar Costing: Incorporating … Hal 20 - 4

Fixed FOH rate – absorption costing x$15 x$ 15 x$ 15 x$ 15

Selisih operating income $0 $30.000 $30.000 $60.000

Cost-Volume-Profit Analysis (CVP)

CVP dibuat berdasarkan hubungan akuntansi:

Profit = Total revenues – (Total variable costs + Total fixed costs)

Total revenues = Total variable costs + Total fixed costs + Profit

R = F + (V x R) +

R = Total sales revenue

F = Total fixed cost

V = Variable cost per dollar of sales revenue (total variable cost / sales)

= Total profit

R = F + (V x R) +

R – (V x R) = F+

R (1 – V) = F+

R = (F + ) / (1 – V)

R = Total fixed cost + profit / Contribution margin per sales dollar

Jika profit = 0 (break event point) maka

R(BE) = F / (1 – V)

R(BE) = Total fixed cost / Contribution margin per sales dollar

Contribution margin per sales dollar = contribution margin ratio (C/M) = bagian dari tiap dollar

penjualan untuk menutup fixed cost dan menghasilkan laba.

Ilustrasi

Total sales revenues at normal capacity $6.000.000

Total fixed costs 1.600.000

Total variable costs at normal capacity 3.600.000

Sales price per unit 400

Variable costs per unit 240

R(BE) = F / (1 – V)

= 1.600.000 / (1 – (3.600.000 / 6.000.000) atau $1.600.000/(1-240/400)

= 1.600.000 / 0,40

= $4.000.000

Unit terjual = $4.000.000 / $400 = 10.000 unit

Jika menginginkan profit $400

R = (F + ) / (1 – V)

= 1.600.000 + 400.000/ (1 – (3.600.000 / 6.000.000)

atau $1.600.000 + 400.000 / (1 – 240 / 400)

= 2.000.000 / 0,40

= $5.000.000

Unit terjual = $5.000.000 / $400 = 12.500 unit

Supported by Nugraha Corporation

Cost Accounting 13th ed, Carter and Usry. Bab 20 Standar Costing: Incorporating … Hal 20 - 5

R = F + (V x R) +

Revenue = Unit sales price x quantity product sold

Variable cost = Variable cost per unit x quantity product sold

PxQ = F + (C x Q) +

P = Sales price per unit

Q = Quantity of product sold

C = Variable cost per unit

PxQ = F + (C x Q) +

(P x Q) - (C x Q) = F +

Q x (P – C) = F +

Q = F + /P-C

Jika profit = 0 Q (BE) = F / P – C

Menggunakan ilustrasi di atas:

Q (BE) = F / P – C = 1.600.000 / 400 – 240 = 1.600.000 / 160 = 10.000 unit

Target profit $400.000:

Q = F + / P – C = 1.600.000 + 400.000 / 400 – 240 = 2.000.000 / 160 = 12.500 unit

Multiple Products

Product Unit Sales Price Variable Cost per Unit Expected Sales Mix

A $180 $100 1

B 110 70 2

V = variable cost/sales revenue = 100 + (2 x 70) / 180 + (2 x 110) = 240 / 400 = 0,60

R (BE) = F / 1 – V = 1.600.000 / 1 – 0,60 = 1.600.000 / 0,40 = $4.000.000

Berapa unit?

1 hypothetical paket berisi 1 unit A dan 2 unit B

Q = R / P = 4.000.000 / 400 = 10.000 hypothetical paket A: 10.000 unit, B: 20.000 unit.

Menghitung unit langsung:

Ilustrasi: F = $1.600.000, = $400.000, sales mix seperti di atas

Q = F + / P – C = 1.600.000 + 400.000 / 400 – 240 = 2.000.000 / 160 = 12.500 paket

A: 12.500 unit, B: 25.000 unit.

Margin of Safety

Mengindikasikan berapa banyak sales bisa turun dari target supaya tidak menderita kerugian.

Margin of safety ratio (M/S) = Sales – Sales (BE) / Sales

Ilustrasi: sales $5.000.000, sales(BE) $4.000.000

Margin of safety: $5.000.000 – $4.000.000 = $1.000.000

M/S = 5.000.000 – 4.000.000 / 5.000.000 = 20%

Profit ratio, Contribution Margin ratio, dan Margin of safety

Profit ratio = profit / sales

C/M = sales – variable cost / sales = P x Q – V x Q / P x Q = Q (P – V) / PQ = (P – V)/P

Supported by Nugraha Corporation

Cost Accounting 13th ed, Carter and Usry. Bab 20 Standar Costing: Incorporating … Hal 20 - 6

M/S = sales – sales(BE) / sales = {(F + ) / (1 – V)} – { F / (1 – V)} / sales

= { / (1 – V)} / sales

Hubungan:

C/M x M/S = (P – V)/P x { / (1 – V)} / sales

Profit ratio = Contribution margin ratio x Margin of safety ratio

PR = C/M x M/S

Ilustrasi: C/M = 40%, M/S = 20% PR = 40% x 20% = 8%.

Profit = Margin of safety dollars x C/M = $1.000.000 x 40% = $400.000

Profit = Sales x PR = $5.000.000 x 8% = $400.000

P20-3 Absorption Costing vs Direct Costing

Placid Co. menggunakan standard cost berikut: (100% dari kapasitas normal; 50.000 unit per

tahun)

Direct materials $2

Direct labor 3

Variable FOH 1

Fixed FOH 3

$9

Harga jual $16

Variable commercial expense 1

Fixed commercial expense 99.000

Unit diproduksi 51.000 unit

Unit terjual 48.000 unit

WIP awal dan akhir Tidak ada

Variable cost variance $1.000 Unfavorable

Seluruh variance ditutup ke COGS pada akhir periode.

Diminta:

1. Buat income statement dengan dasar absorption costing

2. Buat income statement dengan dasar direct costing

3. Hitung selisih operating income berdasarkan absorption costing dan direct costing dan

buat rekonsiliasi.

P20-6 Break-Even and Cost-Profit Analysis

Data biaya untuk memproduksi dan menjual 5.000 unit adalah:

Direct materials $60.000

Direct labor 40.000

Variable FOH 20.000

Fixed FOH 30.000

Variable marketing and administrative expense 10.000

Fixed marketing and administrative expense 15.000

Diminta:

1. Hitung jumlah unit untuk mencapai BEP apabila harga jual $38.50 per unit.

2. Hitung jumlah unit yang harus dijual untuk mendapatkan profit $18.000 dengan harga

jual $40 per unit.

3. Tentukan harga jual pada tingkat penjualan 5.000 unit untuk mendapatkan profit 20%

dari sales.

Supported by Nugraha Corporation

Cost Accounting 13th ed, Carter and Usry. Bab 20 Standar Costing: Incorporating … Hal 20 - 7

Supported by Nugraha Corporation

Potrebbero piacerti anche

- Hampton Freeze, Inc. Balance Sheet 31-Dec-16 AssetsDocumento23 pagineHampton Freeze, Inc. Balance Sheet 31-Dec-16 AssetsAman ShahNessuna valutazione finora

- Budget TemplateDocumento21 pagineBudget TemplateUmar SulemanNessuna valutazione finora

- Week 5 Tutorial Solutions for Unit 4 Costing MethodsDocumento10 pagineWeek 5 Tutorial Solutions for Unit 4 Costing MethodsSheenam SinghNessuna valutazione finora

- Baims-1618315565 202 PDFDocumento3 pagineBaims-1618315565 202 PDFShahadNessuna valutazione finora

- Examples FMA - 5Documento10 pagineExamples FMA - 5DaddyNessuna valutazione finora

- Chapter 7 Homework ADocumento2 pagineChapter 7 Homework ALong BuiNessuna valutazione finora

- 202-0101-001 - ARIF HOSEN - Management Accounting Assignment 1Documento11 pagine202-0101-001 - ARIF HOSEN - Management Accounting Assignment 1Sayhan Hosen Arif100% (1)

- Individual Assignment Case Chapter 6 - Aisyah Nuralam 29123362Documento5 pagineIndividual Assignment Case Chapter 6 - Aisyah Nuralam 29123362Aisyah NuralamNessuna valutazione finora

- Variable & Absorption Costing Income Statements with Constant Sales & Variable ProductionDocumento17 pagineVariable & Absorption Costing Income Statements with Constant Sales & Variable ProductionApurvAdarshNessuna valutazione finora

- Financial Control - 2 - Variances - Additional Exercises With SolutionDocumento9 pagineFinancial Control - 2 - Variances - Additional Exercises With SolutionQuang Nhựt100% (1)

- Chapter 5&6 Case 2Documento3 pagineChapter 5&6 Case 2Erlangga DharmawangsaNessuna valutazione finora

- Chapter 2 and 3 Standard Costing & Fundamentals of Variance AnalysisDocumento23 pagineChapter 2 and 3 Standard Costing & Fundamentals of Variance AnalysisFidelina CastroNessuna valutazione finora

- ACCCOB3Documento10 pagineACCCOB3Jenine YamsonNessuna valutazione finora

- Absorption and Variable CostingDocumento2 pagineAbsorption and Variable CostingWafah HadjisalicNessuna valutazione finora

- Tutorial 4 SolutionsDocumento14 pagineTutorial 4 Solutionss11186706Nessuna valutazione finora

- Denton Company Income Statement Periode 1 - July, 2020Documento4 pagineDenton Company Income Statement Periode 1 - July, 2020Farrell FerenceNessuna valutazione finora

- Fundamentals of Variance AnalysisDocumento22 pagineFundamentals of Variance Analysissalsabila ry1Nessuna valutazione finora

- Ace Corporation: Names of Students: Section: BSA601 Date Activity NDocumento3 pagineAce Corporation: Names of Students: Section: BSA601 Date Activity NGoose ChanNessuna valutazione finora

- Ace Corporation: Names of Students: RENION, GABRIELA M. Section: BSA601 Date Activity NDocumento3 pagineAce Corporation: Names of Students: RENION, GABRIELA M. Section: BSA601 Date Activity NGoose ChanNessuna valutazione finora

- Cost Accounting & Financial Management Solved Paper Nov 2009, Chartered AccountancyDocumento16 pagineCost Accounting & Financial Management Solved Paper Nov 2009, Chartered AccountancyAnkit2020Nessuna valutazione finora

- Management Accounting 1Documento4 pagineManagement Accounting 1Tax TrainingNessuna valutazione finora

- Required:: CASE 6-19 The Case of The Plummeting Profits Lean ProductionDocumento3 pagineRequired:: CASE 6-19 The Case of The Plummeting Profits Lean Productionricky setiawanNessuna valutazione finora

- Accounting Act6Documento2 pagineAccounting Act6Eren YeagerNessuna valutazione finora

- Model Question For Account409792809472943360Documento8 pagineModel Question For Account409792809472943360yugeshNessuna valutazione finora

- PROBLEM 1. Duif Company: Under VariableDocumento6 paginePROBLEM 1. Duif Company: Under VariableUchayyaNessuna valutazione finora

- Session 9-10 Practice SumsDocumento17 pagineSession 9-10 Practice SumsAvina GargNessuna valutazione finora

- ABsorption Variable COSTINGDocumento12 pagineABsorption Variable COSTINGNaman SinghNessuna valutazione finora

- Information For Decision MakingDocumento33 pagineInformation For Decision Makingwambualucas74Nessuna valutazione finora

- CVP Analysis Marston Cooperation Budgeted Income StatementDocumento3 pagineCVP Analysis Marston Cooperation Budgeted Income StatementLankesh RautNessuna valutazione finora

- SCM 2ND SemDocumento9 pagineSCM 2ND SemRiki AsahiNessuna valutazione finora

- AccountingDocumento1 paginaAccountingErica RamosNessuna valutazione finora

- 20123400024Documento7 pagine20123400024Phạm Công KiênNessuna valutazione finora

- CH 22 Various Exercises Setup 27 Ed.Documento6 pagineCH 22 Various Exercises Setup 27 Ed.Kearrion BryantNessuna valutazione finora

- Acccob3 HW5Documento10 pagineAcccob3 HW5neovaldezNessuna valutazione finora

- 28 Solved PCC Cost FM Nov09Documento16 pagine28 Solved PCC Cost FM Nov09Karan Joshi100% (1)

- Enigma Corporation Cost of Goods SoldDocumento6 pagineEnigma Corporation Cost of Goods SoldEunice CoronadoNessuna valutazione finora

- Ammar Abbasi Assignment 5Documento8 pagineAmmar Abbasi Assignment 5Usman SiddiquiNessuna valutazione finora

- Hampton Freeze, Inc. Sales Budget For The Year Ended December 31,2015 QuarterDocumento15 pagineHampton Freeze, Inc. Sales Budget For The Year Ended December 31,2015 QuarterCzarina Abigail Fortun0% (1)

- Mgac CustomDocumento123 pagineMgac CustomJoana TrinidadNessuna valutazione finora

- Chapter # 8 Exercise & Problems - AnswersDocumento8 pagineChapter # 8 Exercise & Problems - AnswersZia UddinNessuna valutazione finora

- (A) Jorge Company CVP Income Statement (Estimated) For The Year Ending December 31, 2014Documento4 pagine(A) Jorge Company CVP Income Statement (Estimated) For The Year Ending December 31, 2014Kim QuyênNessuna valutazione finora

- Marginal Costing .. Feb 2020: Q. 1 Denton Company (Rupees in '000') 20x4 20x5Documento5 pagineMarginal Costing .. Feb 2020: Q. 1 Denton Company (Rupees in '000') 20x4 20x5신두Nessuna valutazione finora

- Marginal Costing vs Absorption Costing Profit ReconciliationDocumento4 pagineMarginal Costing vs Absorption Costing Profit ReconciliationFareha Riaz100% (2)

- Class Participation 7 Q 1: (3 Marks) : Trout Company Is Considering Introducing A New Line of Pagers Targeting The PreteenDocumento5 pagineClass Participation 7 Q 1: (3 Marks) : Trout Company Is Considering Introducing A New Line of Pagers Targeting The Preteenaj singhNessuna valutazione finora

- Income Statements for June CompanyDocumento3 pagineIncome Statements for June CompanyGoose ChanNessuna valutazione finora

- Exercise 5-11: B/E Analysis Target Profit Margin of Safety C/M RatioDocumento6 pagineExercise 5-11: B/E Analysis Target Profit Margin of Safety C/M RatioMaryane AngelaNessuna valutazione finora

- Costing Methods ComparisonDocumento24 pagineCosting Methods ComparisonJohn BernabeNessuna valutazione finora

- Unit IVDocumento14 pagineUnit IVkuselvNessuna valutazione finora

- ST ND RD THDocumento5 pagineST ND RD THNOVIDANessuna valutazione finora

- Finals Unit 4 Exercise - Variable and Absorption CostingDocumento2 pagineFinals Unit 4 Exercise - Variable and Absorption CostingMelo RiegoNessuna valutazione finora

- Case 7B FRC M. Gerry Naufal 29123123Documento7 pagineCase 7B FRC M. Gerry Naufal 29123123m.gerryNessuna valutazione finora

- Relevant Cost Exercise SolutionDocumento14 pagineRelevant Cost Exercise SolutionHimadri DeyNessuna valutazione finora

- ActivitiesDocumento4 pagineActivitiesUnknowingly AnonymousNessuna valutazione finora

- Jose Rizal Memorial State University Main Campus, Dapitan City College of Business and AccountancyDocumento6 pagineJose Rizal Memorial State University Main Campus, Dapitan City College of Business and AccountancyBernadette CaduyacNessuna valutazione finora

- CVPDocumento8 pagineCVPJessica EntacNessuna valutazione finora

- Build A Spreadsheet 11-43Documento4 pagineBuild A Spreadsheet 11-43anup akasheNessuna valutazione finora

- Final CH 5Documento5 pagineFinal CH 5worknehNessuna valutazione finora

- Chapter 5 Leverages - PracticeDocumento10 pagineChapter 5 Leverages - PracticeAkshat SinghNessuna valutazione finora

- 1G CVP ANALYSIS EXCEL SCDocumento49 pagine1G CVP ANALYSIS EXCEL SCAlmirah H. AliNessuna valutazione finora

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDa EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNessuna valutazione finora

- Bab 19 Standard Costing Incorporating Standards PDFDocumento8 pagineBab 19 Standard Costing Incorporating Standards PDFSandi SetiawanNessuna valutazione finora

- Bab 18 Standard Costing PDFDocumento8 pagineBab 18 Standard Costing PDFSandi SetiawanNessuna valutazione finora

- Bab 8 Costing by Product and Joint ProductDocumento4 pagineBab 8 Costing by Product and Joint Productammara_786Nessuna valutazione finora

- Bab 4 Cost System and Cost Accumulation PDFDocumento6 pagineBab 4 Cost System and Cost Accumulation PDFSandi SetiawanNessuna valutazione finora

- Bab 5 Job Order Costing PDFDocumento4 pagineBab 5 Job Order Costing PDFSandi SetiawanNessuna valutazione finora

- Mubadala - Base Prospectus PDFDocumento293 pagineMubadala - Base Prospectus PDFAngkatan LautNessuna valutazione finora

- Save Tigers Congress Letters DonationsDocumento1 paginaSave Tigers Congress Letters DonationsAna Maria Gerson TongcoNessuna valutazione finora

- North Country AutoDocumento4 pagineNorth Country Autorksp99999Nessuna valutazione finora

- A Study On Investors Perception Towards Share Market (Shriram Insight)Documento25 pagineA Study On Investors Perception Towards Share Market (Shriram Insight)akki reddyNessuna valutazione finora

- Invoice: Order SummaryDocumento1 paginaInvoice: Order SummaryELFIRA UTAMINessuna valutazione finora

- Quote Driven Market: Static Models: Stefano LovoDocumento49 pagineQuote Driven Market: Static Models: Stefano Lovoluca pilottiNessuna valutazione finora

- Jeff Cooper Explains His Methodology Behind The Opening Range Breakout Day TradeDocumento8 pagineJeff Cooper Explains His Methodology Behind The Opening Range Breakout Day TradeSIightlyNessuna valutazione finora

- Apex Corporation Hedging Foreign Exchange RiskDocumento3 pagineApex Corporation Hedging Foreign Exchange RisksweetishdevilNessuna valutazione finora

- PRUlink Fund Report 2017Documento440 paginePRUlink Fund Report 2017Barath KumarNessuna valutazione finora

- Review of The LiteratureDocumento44 pagineReview of The Literaturesneha shuklaNessuna valutazione finora

- Customer Satisfaction Study at HDFC BankDocumento104 pagineCustomer Satisfaction Study at HDFC Bankbb9780Nessuna valutazione finora

- CH 21Documento32 pagineCH 21maeconomics2010Nessuna valutazione finora

- Financial Markets Past Exam QuestionsDocumento5 pagineFinancial Markets Past Exam QuestionsDaniel MarinhoNessuna valutazione finora

- Forward RatesDocumento2 pagineForward RatesTiso Blackstar GroupNessuna valutazione finora

- Mathrubhumi Daily 12 July 2012Documento16 pagineMathrubhumi Daily 12 July 2012SanrasniNessuna valutazione finora

- A Step-By-Step Guide To The Prufund Smoothing ProcessDocumento6 pagineA Step-By-Step Guide To The Prufund Smoothing ProcessJános JuhászNessuna valutazione finora

- Financial Analysis of P&P Manufacturing CoDocumento4 pagineFinancial Analysis of P&P Manufacturing Coabegail CabralNessuna valutazione finora

- Evolution: - The Traditional Phase - The Transitional Phase - The Modern PhaseDocumento19 pagineEvolution: - The Traditional Phase - The Transitional Phase - The Modern PhasevijayluckeyNessuna valutazione finora

- Risk Parity and DiversificationDocumento11 pagineRisk Parity and DiversificationYashas IndalkarNessuna valutazione finora

- Curso Larry WilliansDocumento226 pagineCurso Larry WilliansJose Calachahuin100% (6)

- Study on Venezuela Currency CrisisDocumento6 pagineStudy on Venezuela Currency CrisisPiyush PalandeNessuna valutazione finora

- 3 - XV - Market EfficiencyDocumento23 pagine3 - XV - Market EfficiencyAditya NugrohoNessuna valutazione finora

- Naveen Synapsis 2Documento6 pagineNaveen Synapsis 2Naveen Kumar NcNessuna valutazione finora

- Markets and Commodity Figures: 05 September 2017Documento2 pagineMarkets and Commodity Figures: 05 September 2017Tiso Blackstar GroupNessuna valutazione finora

- Interest Rate Corridor For Knowledge SharingDocumento24 pagineInterest Rate Corridor For Knowledge SharingpisabandmutNessuna valutazione finora

- Market StructureDocumento17 pagineMarket Structuresid3011Nessuna valutazione finora

- Ki StrategyDocumento7 pagineKi StrategyRavindra ShindeNessuna valutazione finora

- Katalog BukuDocumento11 pagineKatalog BukuVeno AndriNessuna valutazione finora

- Project On Muthoot FinanceDocumento57 pagineProject On Muthoot FinanceHomework Ping100% (4)

- Muthoot Finance Rs. 5B NCD IssueDocumento3 pagineMuthoot Finance Rs. 5B NCD IssueKannan SundaresanNessuna valutazione finora