Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

2008 Scope of The Term "Di

Caricato da

nicole hinanayTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

2008 Scope of The Term "Di

Caricato da

nicole hinanayCopyright:

Formati disponibili

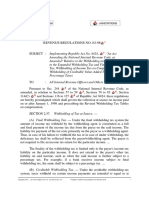

March 18, 2008

REVENUE MEMORANDUM CIRCULAR NO. 024-08

SUBJECT : Clarifying the Scope of the Term "Direct Costs and Expenses"

that Should Comprise the "Cost of Services" for Purposes of

Computing the Gross Income Subject to the 2% Minimum

Corporate Income Tax (MCIT) Under Section 27 (E) and

Section 28 (A) (2) of the 1997 National Internal Revenue

Code, as Amended

TO : All Internal Revenue Officers and Others Concerned

As provided for by Section 27 (E) and Section 28 (A) (2) of the 1997 Tax

Code, as amended, in computing the gross income subject to the 2% MCIT for

sellers of services, "'gross income' means gross receipts less sales returns,

allowances, discounts and cost of services. 'Cost of services' shall mean all

direct costs and expenses necessarily incurred to provide the services

required by the customers and clients including (A) salaries and employee

benefits of personnel, consultants and specialists directly rendering the

service and (B) cost of facilities directly utilized in providing the service such

as depreciation or rental of equipment used and cost of supplies: . . .".

As can be gleaned from the above definition of "cost of services" of the

sellers of services, "direct costs and expenses" shall only pertain to those costs

exclusively and directly incurred in relation to the revenue realized by the

sellers of services. In fine, these refer to costs which are considered

indispensable to the earning of the revenue such that without such costs, no

revenue can be generated. Thus, expenses and other costs dispensed outside

the ambit of what has been defined herein as "direct costs and expenses" are

not items allowed for inclusion to "cost of services", for purposes of computing

the gross income subject to the 2% MCIT. 1uptax08

All internal revenue officers are hereby enjoined to give this Circular as

wide a publicity as possible. CcSEIH

(SGD.) LILIAN B. HEFTI

Commissioner of Internal Revenue

CD Technologies Asia, Inc. © 2016 cdasiaonline.com

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Cesarini Case ExampleDocumento4 pagineCesarini Case ExampleSamantha Hwey Min DingNessuna valutazione finora

- Revenue Regulation 2-98Documento128 pagineRevenue Regulation 2-98Agnes Bianca MendozaNessuna valutazione finora

- Taxation Law ReviewerDocumento6 pagineTaxation Law ReviewerAlex RabanesNessuna valutazione finora

- Your CFO Guy - 7 Chart TemplatesDocumento6 pagineYour CFO Guy - 7 Chart TemplatesOaga GutierrezNessuna valutazione finora

- Credtrans First Set of Cases Til CommodatumDocumento60 pagineCredtrans First Set of Cases Til Commodatumnicole hinanayNessuna valutazione finora

- G.R. No. 179090 Sanchez V PeopleDocumento10 pagineG.R. No. 179090 Sanchez V Peoplenicole hinanayNessuna valutazione finora

- Sales Chapter X DigestDocumento8 pagineSales Chapter X Digestnicole hinanayNessuna valutazione finora

- G.R. No. 174205 Araneta V PeopleDocumento7 pagineG.R. No. 174205 Araneta V Peoplenicole hinanayNessuna valutazione finora

- SMART V Aldecoa - HinanayDocumento6 pagineSMART V Aldecoa - Hinanaynicole hinanayNessuna valutazione finora

- People v. MartiDocumento6 paginePeople v. Martinicole hinanayNessuna valutazione finora

- Velasquez Rodriguez CaseDocumento2 pagineVelasquez Rodriguez Casenicole hinanayNessuna valutazione finora

- Sally Go-Bangayan, vs. Benjamin Bangayan, JR,: Petitioner RespondentDocumento7 pagineSally Go-Bangayan, vs. Benjamin Bangayan, JR,: Petitioner Respondentnicole hinanayNessuna valutazione finora

- 25 Mazer vs. SteinDocumento2 pagine25 Mazer vs. Steinnicole hinanayNessuna valutazione finora

- ST ND NDDocumento12 pagineST ND NDnicole hinanayNessuna valutazione finora

- Greatwork Nietzsche's Philosophy & The Anti-ChristDocumento12 pagineGreatwork Nietzsche's Philosophy & The Anti-Christnicole hinanayNessuna valutazione finora

- Breakdown 2Documento1 paginaBreakdown 2nicole hinanayNessuna valutazione finora

- Europe's Position in Global Manufacturing and The Role of Industrial Policy. Verein"Documento3 pagineEurope's Position in Global Manufacturing and The Role of Industrial Policy. Verein"nicole hinanayNessuna valutazione finora

- Accounting Assignment Chapter 13 Answers - 6Documento5 pagineAccounting Assignment Chapter 13 Answers - 6alexie aurelioNessuna valutazione finora

- Taxation Review LectureDocumento600 pagineTaxation Review LectureIan PalenNessuna valutazione finora

- Bpi Pera FaqDocumento7 pagineBpi Pera FaqHana DumpayanNessuna valutazione finora

- Ub23m03 561476Documento1 paginaUb23m03 561476Ratul KochNessuna valutazione finora

- Foundations of Financial Management 16th Edition Block Test BankDocumento35 pagineFoundations of Financial Management 16th Edition Block Test Bankwinifredholmesl39o6z100% (25)

- Chapter 12 v2Documento18 pagineChapter 12 v2Sheilamae Sernadilla GregorioNessuna valutazione finora

- Tax 3300 CH 1 5 NotesDocumento10 pagineTax 3300 CH 1 5 NotesHuijun HuangNessuna valutazione finora

- Income Tax Tan V Del Rosario: G.R. No. 109289Documento12 pagineIncome Tax Tan V Del Rosario: G.R. No. 109289MadzGabiolaNessuna valutazione finora

- Acc 6050: Accounting and Financial ReportingDocumento5 pagineAcc 6050: Accounting and Financial ReportingDEE0% (1)

- 3 Corporate Income Taxation - Intl Carrier NRFC and McitDocumento11 pagine3 Corporate Income Taxation - Intl Carrier NRFC and McitIvy ObligadoNessuna valutazione finora

- ENTREPRENEURSHIP QUARTER 2 MODULE 10 Computation-of-Gross-ProfitDocumento11 pagineENTREPRENEURSHIP QUARTER 2 MODULE 10 Computation-of-Gross-Profitrichard reyesNessuna valutazione finora

- TaxDocumento45 pagineTaxShing UyNessuna valutazione finora

- Analysis and Interpretation of DataDocumento35 pagineAnalysis and Interpretation of DataAswath ChandrasekarNessuna valutazione finora

- Tax 2 Group 2 NotesDocumento9 pagineTax 2 Group 2 NotesBetelguese AbaricoNessuna valutazione finora

- Ea 14Documento4 pagineEa 14Nicole BatoyNessuna valutazione finora

- Scope and Limitation of TaxationDocumento2 pagineScope and Limitation of TaxationBianca Viel Tombo CaligaganNessuna valutazione finora

- Lululemon 3Documento32 pagineLululemon 3sumaiyaramzan77655Nessuna valutazione finora

- Answer Key Tax 3rd ExamDocumento17 pagineAnswer Key Tax 3rd ExamCharlotte GallegoNessuna valutazione finora

- 2.7 Lesson 7Documento13 pagine2.7 Lesson 7Dark PrincessNessuna valutazione finora

- Tax 1 CorpDocumento16 pagineTax 1 CorpRen A Eleponio0% (1)

- Southern Luzon Drug Corporation Vs DSWDDocumento185 pagineSouthern Luzon Drug Corporation Vs DSWDjiru piao0% (1)

- 2017 45th NTRC Annual Report - v1 8 PDFDocumento171 pagine2017 45th NTRC Annual Report - v1 8 PDFPOC MMPA17Nessuna valutazione finora

- Handout 1Documento13 pagineHandout 1Krisha ErikaNessuna valutazione finora

- Gross Income: Gross Income' Shall Mean Gross Sales Less Sales Returns, Discounts and Allowances and Cost ofDocumento36 pagineGross Income: Gross Income' Shall Mean Gross Sales Less Sales Returns, Discounts and Allowances and Cost ofRichie SalubreNessuna valutazione finora

- Toshiba Information EquipmentDocumento2 pagineToshiba Information EquipmentGuile Gabriel AlogNessuna valutazione finora

- 1st Semester Transfer Taxation Module 2 Estate Taxation - Summary of Concept MapsDocumento5 pagine1st Semester Transfer Taxation Module 2 Estate Taxation - Summary of Concept MapsNah HamzaNessuna valutazione finora