Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Himes Letter

Caricato da

Alfonso RobinsonDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Himes Letter

Caricato da

Alfonso RobinsonCopyright:

Formati disponibili

� � � � � � � � � � � of tbe Wnlte))

� � � � � � �

WlafSbington, iJB(It 20515

January 26, 2010

The Honorable Barack H. Obama

President of the United States

The White House

1600 Pennsylvania Avenue, NW

Washington, DC 20500

Dear President Obama:

We write to urge you to extend the tax rates established in the Economic Growth and Tax

Relief Reconciliation Act of2001 and the Jobs and Growth Tax Relief Reconciliation Act of

2003 (2001 and 2003 tax cuts) for at least two years or until our economy fully recovers from

this devastating recession. The federal government has pursued many avenues to ensure our

economy recovers from this recession, but allowing the 2001 and 2003 tax rates to expire could

undermine any progress that has been made. As you draft the budget for Fiscal Year 2011, we

believe the 2001 and 2003 tax rates should be extended in order to provide additional stability for

individuals and small businesses as they continue to strengthen and grow our economy.

Allowing these tax rates to expire during this recession runs the risk of curtailing economic

expansion just when it begins to pick up and could lead to a "double dip" recession that would

result in even more hardship for the American people.

We are all concerned about ways to reduce the size of the federal deficit and strongly

support returning our nation to a path of fiscal stability. However, allowing the 2001 and 2003

tax rates to expire at the end of 20 10 before our economy fully recovers may significantly hinder

job growth. Returning to the pre-2001 tax policies could also reduce our ability to bring our

deficit under control over the long term by limiting economic expansion during this crucial

period.

As you know, the 2001 and 2003 tax cuts lowered rates on ordinary income, dividends,

and capital gains. These taxes are crucial to the engines of growth in our economy: our small

businesses. Because the vast majority of small business owners pay their taxes at the individual

level, allowing the current tax rates to remain in place will directly extend the benefit to their

businesses. It will also give small businesses some financial security as they make critical

decisions about their businesses.

According to a study conducted by the U.S. Department of Treasury in 2006, the tax

relief enacted in these provisions, together with reductions in short-term interest rates by the

Federal Reserve, helped stimulate economic growth and recovery after the 2001 recession.

Additional studies showed that without the tax relief passed in 2001, 2002, and 2003, as many as

3 million fewer jobs would have been created by the end of2004 and real GDP would have been

as much as 3.5 to 4.0 percent lower.

PRINTED ON I1[CYClED PArER

As small business owners nationwide struggle to keep their doors open, it is critical that

we maintain policies that foster job creation. In order to provide continued assistance to small

businesses and further stimulate the economy, we believe your budget should extend the 2001

and 2003 tax rates rather than overhaul the current tax code. We look forward to working with

you to enact policies that spur job growth, incentivize business expansion, and reduce the deficit

in a way that allows our economy to fully recover from this difficult economic period.

Sincerely,

Member of Congress

� � � � � � � �

Harry Mitchell

Member of Congress

Leonard Lance

Member of Congress

•

Frank atovil

Member of Congress

CC: The Honorable John M. Spratt, Jr., Chairman, House Committee on the Budget

The Honorable Paul Ryan, Ranking Member, House Committee on the Budget

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Case Study On Alibabas TaobaoDocumento8 pagineCase Study On Alibabas TaobaoChen ChengNessuna valutazione finora

- ITLP - Notes2Documento9 pagineITLP - Notes2Louis MalaybalayNessuna valutazione finora

- Case 4, BF - Goodrich WorksheetDocumento1 paginaCase 4, BF - Goodrich Worksheetisgigles157100% (2)

- International Trade and BusinessDocumento4 pagineInternational Trade and BusinessAmie Jane MirandaNessuna valutazione finora

- Seabank Statement FEB PDFDocumento1 paginaSeabank Statement FEB PDFMhd Aref SiregarNessuna valutazione finora

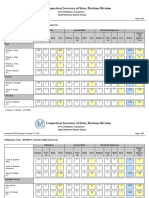

- Danbury November 2023 Municipal Election Returns (Amended)Documento91 pagineDanbury November 2023 Municipal Election Returns (Amended)Alfonso RobinsonNessuna valutazione finora

- Danbury November 2023 Municipal Election Returns (Amended)Documento91 pagineDanbury November 2023 Municipal Election Returns (Amended)Alfonso RobinsonNessuna valutazione finora

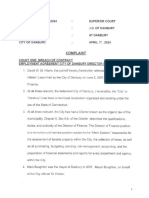

- 3 Lake Ave Extension LLC V City of Danbury Zoning Commission JudgementDocumento36 pagine3 Lake Ave Extension LLC V City of Danbury Zoning Commission JudgementAlfonso RobinsonNessuna valutazione finora

- Re-Elect Mayor Esposito SEEC 20 October 10 2023Documento75 pagineRe-Elect Mayor Esposito SEEC 20 October 10 2023Alfonso RobinsonNessuna valutazione finora

- Re-Elect Mayor Esposito SEEC 20 January 10Documento29 pagineRe-Elect Mayor Esposito SEEC 20 January 10Alfonso RobinsonNessuna valutazione finora

- St. Hiliare v City of Danbury (complaint)Documento91 pagineSt. Hiliare v City of Danbury (complaint)Alfonso RobinsonNessuna valutazione finora

- Roberto Alves SEEC 20 January 10 (Termination)Documento31 pagineRoberto Alves SEEC 20 January 10 (Termination)Alfonso RobinsonNessuna valutazione finora

- Alves For Danbury SEEC 20 April 10 2023Documento201 pagineAlves For Danbury SEEC 20 April 10 2023Alfonso RobinsonNessuna valutazione finora

- Alves For Danbury SEEC 20 July 10 2023Documento102 pagineAlves For Danbury SEEC 20 July 10 2023Alfonso RobinsonNessuna valutazione finora

- Re-Elect Mayor Esposito SEEC Form 20 January 10 2023Documento54 pagineRe-Elect Mayor Esposito SEEC Form 20 January 10 2023Alfonso RobinsonNessuna valutazione finora

- Governor Lamont Nominates 20 Jurists To Serve As Judges of The Connecticut Superior CourtDocumento5 pagineGovernor Lamont Nominates 20 Jurists To Serve As Judges of The Connecticut Superior CourtAlfonso RobinsonNessuna valutazione finora

- Danbury 2022 Head Moderators ReturnsDocumento7 pagineDanbury 2022 Head Moderators ReturnsAlfonso RobinsonNessuna valutazione finora

- Re-Elect Mayor Esposito SEEC Form 20 October 10 2022Documento32 pagineRe-Elect Mayor Esposito SEEC Form 20 October 10 2022Alfonso RobinsonNessuna valutazione finora

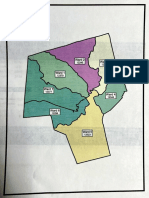

- Danbury Democrats Ward Reappointment Proposal (Plan A)Documento6 pagineDanbury Democrats Ward Reappointment Proposal (Plan A)Alfonso RobinsonNessuna valutazione finora

- Danbury Republican Party Ward Reapportionment Proposal (Plan B)Documento8 pagineDanbury Republican Party Ward Reapportionment Proposal (Plan B)Alfonso RobinsonNessuna valutazione finora

- Re-Elect Mayor Esposito SEEC 20 April 10 2023Documento88 pagineRe-Elect Mayor Esposito SEEC 20 April 10 2023Alfonso RobinsonNessuna valutazione finora

- To City of Danbury Election WardsDocumento13 pagineTo City of Danbury Election WardsAlfonso RobinsonNessuna valutazione finora

- Joe DaSilva For Judge of Probate, Danbury CT 2022Documento2 pagineJoe DaSilva For Judge of Probate, Danbury CT 2022Alfonso RobinsonNessuna valutazione finora

- 2022 Danbury Head Moderators Return DataDocumento118 pagine2022 Danbury Head Moderators Return DataAlfonso RobinsonNessuna valutazione finora

- Danbury 2021 Election TotalsDocumento9 pagineDanbury 2021 Election TotalsAlfonso RobinsonNessuna valutazione finora

- 2021 Danbury Head Moderator Return DataDocumento136 pagine2021 Danbury Head Moderator Return DataAlfonso RobinsonNessuna valutazione finora

- Alves For Danbury Form 20 January 10Documento37 pagineAlves For Danbury Form 20 January 10Alfonso RobinsonNessuna valutazione finora

- Dean Esposito Form 20 October 2021Documento104 pagineDean Esposito Form 20 October 2021Alfonso RobinsonNessuna valutazione finora

- Alves For Danbury Form 20 October 26 (7 Days Until Election)Documento35 pagineAlves For Danbury Form 20 October 26 (7 Days Until Election)Alfonso RobinsonNessuna valutazione finora

- Gartner Town Clerk Form 20 October 12Documento33 pagineGartner Town Clerk Form 20 October 12Alfonso RobinsonNessuna valutazione finora

- Chief Ridenhour Memo, Super 8 09.22.21Documento9 pagineChief Ridenhour Memo, Super 8 09.22.21Alfonso RobinsonNessuna valutazione finora

- 2012-2013 Danbury City Proposed Operating BudgetDocumento342 pagine2012-2013 Danbury City Proposed Operating BudgetAlfonso RobinsonNessuna valutazione finora

- Unit 3Documento4 pagineUnit 3Hồng Anh NguyễnNessuna valutazione finora

- Existing International Arrangements, Globalization and Foreign Investment, Introduction To FDIDocumento30 pagineExisting International Arrangements, Globalization and Foreign Investment, Introduction To FDIpranati sharmaNessuna valutazione finora

- Feenstra Taylor Chapter 11Documento26 pagineFeenstra Taylor Chapter 11f20213040Nessuna valutazione finora

- Depression and New Deal Guided NotesDocumento2 pagineDepression and New Deal Guided NotesWinnie sheuNessuna valutazione finora

- 300x Netflix USA by Jonathan OpDocumento11 pagine300x Netflix USA by Jonathan Op27999703210jNessuna valutazione finora

- Recent World Trade TrendsDocumento29 pagineRecent World Trade Trendsric19rockerNessuna valutazione finora

- National Bank of Pakistan - WikipediaDocumento4 pagineNational Bank of Pakistan - WikipediaAbdul RehmanNessuna valutazione finora

- Economics Contemporary Questions and AnswersDocumento12 pagineEconomics Contemporary Questions and AnswersSameer ShaikhNessuna valutazione finora

- Identifying and Addressing Social ProblemsDocumento26 pagineIdentifying and Addressing Social ProblemsAniaNessuna valutazione finora

- 27A1100001972546Documento2 pagine27A1100001972546Meet Communication ServicesNessuna valutazione finora

- GATT PresentationDocumento23 pagineGATT PresentationNesar UddinNessuna valutazione finora

- Lecture 11 Higher Financing AgenciesDocumento10 pagineLecture 11 Higher Financing AgenciesNEERAJA UNNINessuna valutazione finora

- Annexes A.1.2 To A.1.10 - SchedulesDocumento11 pagineAnnexes A.1.2 To A.1.10 - SchedulessheilaNessuna valutazione finora

- Nature and Scope of GST: by Amandeep DrallDocumento8 pagineNature and Scope of GST: by Amandeep DrallAman SinghNessuna valutazione finora

- Ebc 29Documento7 pagineEbc 29ViplavNessuna valutazione finora

- OP Jindal Lecture Series Overview by RaguramJi RajanDocumento18 pagineOP Jindal Lecture Series Overview by RaguramJi RajanAnkit KumarNessuna valutazione finora

- LK Exchange RateDocumento1 paginaLK Exchange RateCaine RodrigoNessuna valutazione finora

- ARVIND PRESS Tax InvoiceDocumento1 paginaARVIND PRESS Tax InvoiceSrishti GaurNessuna valutazione finora

- FABUMAN Economic Contribution of Family BusinessesDocumento13 pagineFABUMAN Economic Contribution of Family BusinesseselishasorianoNessuna valutazione finora

- PamphletDocumento6 paginePamphletBisi AgomoNessuna valutazione finora

- Phil Devt Plan 2017 - 2022Documento29 paginePhil Devt Plan 2017 - 2022Zheerica Ella Del CarmenNessuna valutazione finora

- Chapter 13Documento13 pagineChapter 13Haseeb Ahmed ShaikhNessuna valutazione finora

- International FinanceDocumento39 pagineInternational FinancesrinivasNessuna valutazione finora

- WTTC DataDocumento21 pagineWTTC Data1stabhishekNessuna valutazione finora

- Project Profile On Shaving CreamDocumento2 pagineProject Profile On Shaving CreamDarpan Ashokrao SalunkheNessuna valutazione finora