Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bargain Sale Addendum

Caricato da

jbw1688574Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Bargain Sale Addendum

Caricato da

jbw1688574Copyright:

Formati disponibili

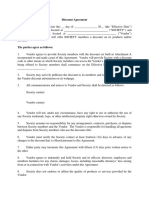

ADDENDUM TO REAL ESTATE PURCHASE CONTRACT

This document is for informational purposes only and does not constitute an indication of interest to enter into, discuss

or negotiate, any type of transaction or to purchase or sell any property.

This Addendum is to the contract attached hereto between __________________________ Church, as Buyer

for 123456 Main Street, Anytown, Ohio, and the undersigned Seller.

1. TERMS: It is intended that this transaction be structured so that the Seller will qualify under the rules of the

Internal Revenue Code for a tax deductible Bargain Sale to______________________________ Church (“Buyer”), an

Ohio not-for-profit corporation qualified as a 501(c)(3) charitable organization.

2. VALUATION: The Buyer acknowledges that the Seller has listed the property for sale at $___________________.

If the Seller obtains an independent qualified appraisal validating the value for the subject property, the Seller may

claim a charitable tax deduction for the amount by which such appraised value is in excess of the net purchase price to

be paid to Seller by the Buyer, The Buyer shall pay to Seller $___________________, which is the net purchase price.

Seller intends to make a charitable contribution to the Buyer pursuant to the Internal Revenue Code for the amount by

which the fair market value of the Property exceeds the net purchase price.

3. DUE DILIGENCE: During the Due Diligence Period, through sixty (90) days after the date of acceptance of this

contract, Buyer shall have the right, personally or through its authorized agents or representatives to enter upon the

Property and at its sole cost, to conduct such tests, appraisals, environmental studies, inspections, surveys, and

otherwise investigate the Property to determine if the Property is suitable for the purposes of Buyer. The Seller agrees,

within ten (10) days of its acceptance, to deliver to Purchaser all available maps, surveys, drawings, borings and other

data in its possession pertinent to the Property and all contracts, agreements, commitments, permits and approvals

pertaining to the Property, including, but not limited to, leases, copies of all soils, wetlands and environmental reports

and studies with regard to the Property. If Buyer shall, for any reason in Buyer’s sole discretion, disapprove or shall be

dissatisfied with any aspect of the Property or any part thereof, then Buyer shall be entitled to exercise its right to not

close, whereupon this Agreement shall automatically terminate and expire at such time and Buyer and the Seller shall

have no further obligations or liabilities to each other hereunder.

4. MISCELLANEOUS: Seller is responsible for establishing, for federal tax purposes, the amount of the charitable

contribution associated with Seller's sale of the Property to Buyer. The fair market value of the Property must be

established and substantiated by an "independent qualified appraisal" (as defined under IRS regulations) prepared for

Seller at its expense. Seller has obtained (or will obtain before closing) and rely solely upon the advice of Seller's own

tax professionals regarding (i) the availability of a tax deduction in connection with the proposed transaction and (ii)

the requirements for appraisals and other documentation to substantiate the value of the contribution. In the event of

any conflict between the terms of this addendum and the contract, this addendum will supersede. Seller acknowledges

that the Buyer and Broker are not providing tax and/or legal advice in connection with this transaction. It is

recommended that all parties be represented by legal counsel.

Buyer: _______________________________ Church

By:__________________________________ Date:________________

Seller:

By:__________________________________ Date:________________

Potrebbero piacerti anche

- Sample Affinity Partner ContractDocumento3 pagineSample Affinity Partner Contractconcon_hernandezNessuna valutazione finora

- Month-To-Month Lease AgreementDocumento16 pagineMonth-To-Month Lease Agreementfunky good100% (1)

- 15 Day NoticeDocumento1 pagina15 Day NoticeAnonymousNessuna valutazione finora

- Wholesale Real Estate Purchase ContractDocumento4 pagineWholesale Real Estate Purchase ContractansonNessuna valutazione finora

- Sales Agreement Fix Uas GlobalDocumento5 pagineSales Agreement Fix Uas Globalsulistyo rachmad wibowoNessuna valutazione finora

- Alaska Property Management Agreement PDFDocumento4 pagineAlaska Property Management Agreement PDFDrake MontgomeryNessuna valutazione finora

- Purchaser Due Diligence Checklist PDFDocumento5 paginePurchaser Due Diligence Checklist PDFsdagnihotriNessuna valutazione finora

- Earnest Money ContractDocumento3 pagineEarnest Money ContractKapil KaroliyaNessuna valutazione finora

- Lease Takeover Notification FormDocumento1 paginaLease Takeover Notification FormNithish SajiNessuna valutazione finora

- Illinois Property Management Agreement PDFDocumento3 pagineIllinois Property Management Agreement PDFDrake MontgomeryNessuna valutazione finora

- Resid Buyertenant Rep Agreement - 1114 ts43235Documento5 pagineResid Buyertenant Rep Agreement - 1114 ts43235api-209878362Nessuna valutazione finora

- New York Property Management Agreement PDFDocumento12 pagineNew York Property Management Agreement PDFDrake MontgomeryNessuna valutazione finora

- Influencer Terms Agreement: Sample Template Provided byDocumento2 pagineInfluencer Terms Agreement: Sample Template Provided byImranKhanNessuna valutazione finora

- Contract With ST Vincent de PaulDocumento22 pagineContract With ST Vincent de PaulMegan BantaNessuna valutazione finora

- Land Exchange Agreement FormDocumento7 pagineLand Exchange Agreement FormrachelNessuna valutazione finora

- 047-1 Response Motion SanctionsDocumento19 pagine047-1 Response Motion SanctionsEzekiel KobinaNessuna valutazione finora

- Purchase Agreement (Template)Documento4 paginePurchase Agreement (Template)RickNessuna valutazione finora

- Assignment of Residential Real Estate Purchase and Sale AgreementDocumento1 paginaAssignment of Residential Real Estate Purchase and Sale AgreementData Really CoolNessuna valutazione finora

- Authority To Sell LetterDocumento1 paginaAuthority To Sell LetterDanica RafolsNessuna valutazione finora

- Exclusive Right To Sell Listing AgreementDocumento9 pagineExclusive Right To Sell Listing Agreementj4dprints deocampoNessuna valutazione finora

- Optionpurchaserealestate PDFDocumento3 pagineOptionpurchaserealestate PDFWalter BoninNessuna valutazione finora

- Seller DeclarationDocumento3 pagineSeller DeclarationAnonymous oQVQtYRQfNessuna valutazione finora

- Real Estate Letter of IntentDocumento2 pagineReal Estate Letter of IntentTegnap NehjNessuna valutazione finora

- Agreement PDocumento3 pagineAgreement Pdoina slamaNessuna valutazione finora

- Contract of Purchase and Sale.3A Ave PDFDocumento6 pagineContract of Purchase and Sale.3A Ave PDFAnonymous mzVoNSNessuna valutazione finora

- Addendum - As Is Where IsDocumento8 pagineAddendum - As Is Where Issteveterrell68Nessuna valutazione finora

- Request For Quotation 2805Documento2 pagineRequest For Quotation 2805Anonymous WXJTn0Nessuna valutazione finora

- Sale of Used VehicleDocumento4 pagineSale of Used VehicleAbhinav GoelNessuna valutazione finora

- One Page Contract Purchase FillableDocumento1 paginaOne Page Contract Purchase Fillablepopi569Nessuna valutazione finora

- Hire Purchase AgreementDocumento4 pagineHire Purchase AgreementJosphine WaruiNessuna valutazione finora

- Timeshare Sale and Purchase Agreement: - in UNITDocumento3 pagineTimeshare Sale and Purchase Agreement: - in UNITNarvin100% (2)

- Addendum To LeaseDocumento1 paginaAddendum To LeaseNick VidoniNessuna valutazione finora

- Asset Purchase Agreement by and Among Meredith Corporation, Gormally Broadcasting, LLC and Gormally Broadcasting Licenses, LLCDocumento50 pagineAsset Purchase Agreement by and Among Meredith Corporation, Gormally Broadcasting, LLC and Gormally Broadcasting Licenses, LLCmnwilliaNessuna valutazione finora

- Sale Ageement Part CompressedDocumento4 pagineSale Ageement Part CompressedMOHIB100% (1)

- Catering Agreement: PartiesDocumento3 pagineCatering Agreement: PartiesDian MunozNessuna valutazione finora

- Sale Deed 1Documento9 pagineSale Deed 1smalhotra2414100% (1)

- Shimply Marketing and Distribution AgreementDocumento5 pagineShimply Marketing and Distribution AgreementUdit BhallaNessuna valutazione finora

- Sample Letter of Intent To PurchaseDocumento2 pagineSample Letter of Intent To PurchaseChairmanNessuna valutazione finora

- Legal Services Retainer AgreementDocumento6 pagineLegal Services Retainer Agreementyulia dewiNessuna valutazione finora

- Equipment Rental Agreement TemplateDocumento3 pagineEquipment Rental Agreement Templatemohamed hussien100% (1)

- Vie TH Sales Rep AgreementDocumento4 pagineVie TH Sales Rep AgreementJohnNessuna valutazione finora

- Buy Sell AgreementDocumento11 pagineBuy Sell AgreementZack ZalikaNessuna valutazione finora

- Contract Sample 2Documento4 pagineContract Sample 2cefuneslpezNessuna valutazione finora

- Purchase Sale ContractDocumento7 paginePurchase Sale ContractKapil Karoliya100% (2)

- Standard Purchase and Sale AgreementDocumento3 pagineStandard Purchase and Sale AgreementAnonymous TFrjMOfzNessuna valutazione finora

- Assignment of Contract: (Year)Documento1 paginaAssignment of Contract: (Year)kismadayaNessuna valutazione finora

- Event Vendor ContractDocumento2 pagineEvent Vendor ContractEvan FernandezNessuna valutazione finora

- Sales Agent and BrokerDocumento5 pagineSales Agent and BrokervylletteNessuna valutazione finora

- Checklist - Sale of A BusinessDocumento4 pagineChecklist - Sale of A BusinesskiranrauniyarNessuna valutazione finora

- Accenture Masters of Rural MarketsDocumento32 pagineAccenture Masters of Rural Marketszelast01Nessuna valutazione finora

- Letter of Intent - PurchaseDocumento1 paginaLetter of Intent - PurchaseEhtesham SiddiquiNessuna valutazione finora

- 105 - Fee Sharing AgrmntDocumento2 pagine105 - Fee Sharing AgrmntlitigantnetworkNessuna valutazione finora

- Binibining Pilipinas Charities, Inc. 2010 Binibining Pilipinas Beauty Pageant Official Application FormDocumento7 pagineBinibining Pilipinas Charities, Inc. 2010 Binibining Pilipinas Beauty Pageant Official Application FormJohn Heinrich FuegoNessuna valutazione finora

- Start-Up Sample Business PlanDocumento53 pagineStart-Up Sample Business PlanTaraNessuna valutazione finora

- Purchase Agreement Deed of SaleDocumento2 paginePurchase Agreement Deed of SaleHiddentribe Puregold kioskNessuna valutazione finora

- Asset Purchase AgreementDocumento25 pagineAsset Purchase AgreementNick Tal AlcantaraNessuna valutazione finora

- License Agreement TrialDocumento2 pagineLicense Agreement TrialSandi PermanaNessuna valutazione finora

- Sample Purchase AgreementDocumento8 pagineSample Purchase AgreementAlberto MoraisNessuna valutazione finora

- Auction: SampleDocumento6 pagineAuction: SampleOctavian CiceuNessuna valutazione finora

- Agreement To 1407 Greenway Avenue PDFDocumento5 pagineAgreement To 1407 Greenway Avenue PDFabdul kNessuna valutazione finora

- Supply Chain Key Performance Indicators PDFDocumento52 pagineSupply Chain Key Performance Indicators PDFErik VanNessuna valutazione finora

- Chapter 06 Cost-Benefit Analysis and Government InvestmentsDocumento21 pagineChapter 06 Cost-Benefit Analysis and Government InvestmentsClarissa BoocNessuna valutazione finora

- Afar Answer Key First PreboardDocumento3 pagineAfar Answer Key First PreboardMAS CPAR 93Nessuna valutazione finora

- SCM SummaryDocumento47 pagineSCM SummaryEmanuelle BakuluNessuna valutazione finora

- SiaHuatCatalogue2017 2018Documento350 pagineSiaHuatCatalogue2017 2018Chin TecsonNessuna valutazione finora

- Tax Invoice: GEEVEE GAS AGENCIES (0000117520)Documento1 paginaTax Invoice: GEEVEE GAS AGENCIES (0000117520)EaswarNessuna valutazione finora

- Kami Export - 《考遍天下無敵手全新制多益TOEIC模擬試題+解析【虛擬點讀筆版】》-題目 PDFDocumento1 paginaKami Export - 《考遍天下無敵手全新制多益TOEIC模擬試題+解析【虛擬點讀筆版】》-題目 PDFXinyu ShenNessuna valutazione finora

- Official Receipt PDFDocumento1 paginaOfficial Receipt PDFJohn Rey CastillanoNessuna valutazione finora

- Molson Brewing CompanyDocumento16 pagineMolson Brewing CompanyVictoria ColakicNessuna valutazione finora

- Intercompany Sale of InventoryDocumento35 pagineIntercompany Sale of InventoryAudrey LouelleNessuna valutazione finora

- 157 E.R. 709Documento5 pagine157 E.R. 709Tony GallacherNessuna valutazione finora

- Director of Forestry Vs MunozDocumento1 paginaDirector of Forestry Vs MunozLiliaAzcarragaNessuna valutazione finora

- Walt Disney: 2. Leadership Style-I. Have VisionDocumento3 pagineWalt Disney: 2. Leadership Style-I. Have Visiondhron choudharyNessuna valutazione finora

- Mcdonald'S: Market StructureDocumento5 pagineMcdonald'S: Market Structurepalak32Nessuna valutazione finora

- Dokumen - Tips Meyers Pharmaceutical CompanyDocumento7 pagineDokumen - Tips Meyers Pharmaceutical CompanySaktyHandarbeniNessuna valutazione finora

- Sustainable Entrepreneurship DefinedDocumento13 pagineSustainable Entrepreneurship Definedmsohaib7Nessuna valutazione finora

- Part 1Documento73 paginePart 1Harsh DhillonNessuna valutazione finora

- Ajay Singh Rawat, 202101, Dehradun, 12 Yrs, B Tech-Mech, QualityDocumento1 paginaAjay Singh Rawat, 202101, Dehradun, 12 Yrs, B Tech-Mech, Qualitypeter samuelNessuna valutazione finora

- h3453 Process Svcs SapDocumento2 pagineh3453 Process Svcs SaprazekrNessuna valutazione finora

- Rewards of EntrepreneurshipDocumento18 pagineRewards of EntrepreneurshipHemanidhi GuptaNessuna valutazione finora

- Bidder's Checklist of Requirements For Its Bid, Technical ProposalsDocumento2 pagineBidder's Checklist of Requirements For Its Bid, Technical ProposalsJoseph Santos GacayanNessuna valutazione finora

- Transportation Law TSN 1st ExamDocumento26 pagineTransportation Law TSN 1st ExamArvin Clemm NarcaNessuna valutazione finora

- Elaine Valerio v. Putnam Associates Incorporated, 173 F.3d 35, 1st Cir. (1999)Documento15 pagineElaine Valerio v. Putnam Associates Incorporated, 173 F.3d 35, 1st Cir. (1999)Scribd Government DocsNessuna valutazione finora

- Introduction To ERPDocumento24 pagineIntroduction To ERPAbdul WahabNessuna valutazione finora

- CV-JM Van StraatenDocumento5 pagineCV-JM Van StraatenJovan Van StraatenNessuna valutazione finora

- Final Exam Review-VrettaDocumento4 pagineFinal Exam Review-VrettaAna Cláudia de Souza0% (2)

- A2 Resource Profit ModelDocumento2 pagineA2 Resource Profit ModelIvy BaayNessuna valutazione finora

- Tender Evaluation Process NotesDocumento18 pagineTender Evaluation Process NotesAlan McSweeney100% (5)

- Curriculum - Application (Solution) Consultant SAP SCM - SAP ERP - Order Fulfillment (Sales Order Management)Documento3 pagineCurriculum - Application (Solution) Consultant SAP SCM - SAP ERP - Order Fulfillment (Sales Order Management)fiestamixNessuna valutazione finora

- P6mys 2013 Dec QDocumento11 pagineP6mys 2013 Dec QAtiqah DalikNessuna valutazione finora