Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Sponge Iron Industry B K Oct 06 PDF

Caricato da

didwaniasTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Sponge Iron Industry B K Oct 06 PDF

Caricato da

didwaniasCopyright:

Formati disponibili

Batlivala & Karani B&K Securities

SECTOR U P D A T E 4th October 2006

Sponge Iron Industry – Growing with Steel

Indian economy is one of the fastest growing economies of the world

with 7.5-8% expected Real GDP growth. Steel demand is expected to

double by 2012 on rising demand from infrastructure and construction

sector. About 48% of steel is made through secondary route (Electric

route) which uses mix of sponge iron and scrap in steel making.

We see the demand of sponge iron to remain buoyant driven by growth

in steel production.

Production of steel scrap in India is low at 15-20% of its consumption

due to longer product life cycle, as the country is in developing phase and

the consumption pattern is tilted in favour of infrastructure and

construction rather than consumer durables. Therefore, secondary steel

makers have to depend on imported steel scrap. Coal based sponge iron

is fast replacing imported steel scrap due to low cost of production as

non-coking coal and iron ore (two critical raw materials) are domestically

available and its production is rising.

The growth of gas based sponge iron has been limited due to poor

availability and higher cost of gas. Essar Steel, Ispat Industries and Vikram

Ispat are the only producers in India who came up in 1990s on western

coast of India.

The future of sponge iron will belong to the players who have their

captive sources of raw materials which will insulate them from market

fluctuations. Presently, only Jindal Steel & Power and Monnet Ispat have

captive resources of both iron ore and coal. Tata Sponge has recently

acquired 115 mn tonnes mineable coal deposit in Orissa which will get

functional by FY09.

Key industry data (Sponge Iron production)

(Mn tonnes) FY06 FY12E CAGR (%)

Gas based 4.5 7.1 8

Coal based 7.3 16.3 14

Total 11.8 23.4 12

% of Coal based 61.6 69.6 –

Sanjay Jain Ashish Kejriwal

sanjay.jain@bksec.com ashish.kejriwal@bksec.com

Tel.: 91-22-4007 6217 Tel.: 91-22-4007 6216

B&K RESEARCH OCTOBER 2006

Investment arguments

The production of sponge iron (Direct Reduced Iron/Hot Briquetted Iron) started in late

1970’s with one small sponge iron plant in the public sector in Andhra Pradesh viz. Sponge

Iron India Limited. During last decade, due to growth in domestic steel demand, a vigorous

growth in domestic steel production led by the secondary steel making sector, relatively low

cost of investment and ease of setting up of a sponge iron plant, availability of mineral

resources, frequent problems of scrap (affordability and availability), the sponge iron industry

has grown manifold and India became the world leader in sponge iron production in 2003.

Growth in steel production

The demand for steel continues to rise due to boom in infrastructure and construction

industry. The production of crude steel has grown at a CAGR of 9% during FY01-06 and

reached at 41.3 MT in FY06.

Increasing crude steel production

45

40 Crude steel production

35

30

(mn tons)

25

20

15

10

5

0

FY01

FY02

FY03

FY04

FY05

FY06

Source: SAIL

The production of steel through the secondary route (EAF, IF), using hot metal (pig iron),

sponge iron/scrap as their basic raw materials, accounts for approx. 48% of the total steel

Domestically available raw

materials would continue to output and has grown at a CAGR of 18% during FY01-05. The trend is expected to continue

drive growth due to rising availability of coal based sponge iron produced from domestically available raw

material. The flue gases generated in sponge iron making are utilised for production of power

for captive consumption.

Increasing production through the secondary route

(Mn tonnes) FY01 FY02 FY03 FY04 FY05 CAGR (%)

Crude steel production 26.9 28 30.4 34.2 38.5 9

Main producers 17.3 17.8 19.0 20 20.0 4

Secondary producers 9.6 10.2 11.5 14.2 18.5 18

EAF 5.3 5.9 6.7 8.2 10.2 –

IF units 4.3 4.3 4.8 6 8.2 –

% share of secondary producers 36 36 38 42 48 –

Source: JPC

SPONGE IRON INDUSTRY 2

B&K RESEARCH OCTOBER 2006

Continued substitution demand for scrap

Proportion of sponge iron in secondary production is expected to go up. Production of steel

scrap in India is low at 15-20% of its consumption due to longer product life cycle, as the

country is in developing phase and the consumption pattern is tilted in favour of infrastructure

Sponge iron replacing

imported steel scrap due to and construction. Domestic availability of scrap is low, as the ship-breaking industry (main

low cost of production source of indigenous scrap generation) isn’t getting enough ships for breaking. Therefore,

secondary steel makers have to depend on imported steel scrap. Coal based sponge iron is

fast replacing imported steel scrap due to low cost of production, as non-coking coal and iron

ore (two critical raw materials) are domestically available and its production is rising.

Increasing share of sponge iron by secondary producers

(%) 00-01 01-02 02-03 03-04 04-05 05-06

Sponge iron 30 30 38 43 50 60

Scrap/Pig iron 70 70 62 57 50 40

Source: AML Steel

As Indian steel producers have to depend on import of scrap, the domestic prices of sponge

iron align with the landed price of scrap.

Scrap vs. DRI prices

300 16,000

250 14,000

Sponge iron price move in line 12,000

200

with landed cost of steel 10,000

scrap 150 8,000

100 6,000

Scrap Shredded fob Rotterdam $/ton (LHS) 4,000

50 DRI prices , Kolkata (Rs /ton incl. excis e & taxes , RHS) 2,000

0 -

1996

1998

2000

2002

Feb-03

Jun-03

Oct-03

Dec-03

Feb-04

Jun-04

Oct-04

Dec-04

Feb-05

Jun-05

Oct-05

Dec-05

Feb-06

Jun-06

Apr-03

Aug-03

Apr-04

Aug-04

Apr-05

Aug-05

Apr-06

Source: Metal Bulletin, JPC

SPONGE IRON INDUSTRY 3

B&K RESEARCH OCTOBER 2006

Overview

The Indian sponge iron industry has seen a rapid and powerful growth in the coal based

sponge iron segment in the country, while the gas based segment is restricted mainly to 3

producers namely Essar Steel, Vikram Ispat and Ispat Industries due to expensive and limited

supply of natural gas. Moreover, the cost of setting a gas based sponge iron unit is very high

which is not feasible for small players. The demand of sponge iron in India has grown at a

CAGR of 10% over the last 10 years.

Production – Processes & Technologies

In India, mainly coal based rotary kilns and gas based shaft furnace reactors are used for

producing sponge iron.

Coal based process

Sponge iron produced by Coal based plants are of smaller size, requires low capital investment. Sponge iron is produced

reducing iron ore using by reducing iron ore using non-coking coal. Iron ore lumps and non-coking coal are charged

non-coking coal

into a rotary kiln in requisite proportion along with fluxes. Coal plays a dual role in the process

by acting as a redundant as well as fuel for providing heat to maintain the requisite temperature

inside the kiln at 950°-1050°C. The reduction process occurs in solid state. Waste heat from

spent gases is utilised to produce power.

Gas based process

Requires high capital Gas based plants are of relatively larger sizes, require higher capital investment and uses

investment, sponge iron Midrex and HYL-III technologies for reducing iron ore pellets with natural gas as the redundant

produced by reducing iron ore

in the reactor. The difference between the two technologies is the process of reforming and

pellets using natural gas

use of the spent gas. The Midrex uses CO2 (+ steam) based reforming of the natural gas while

HYL-lll uses mainly the H2O reforming process. The specific consumption of various raw

materials for production of 1 tonne sponge iron (by Midrex process) include iron oxide 1.49

tonnes, natural gas of 2.5 GCal and 100 KWh of electricity. The hematite ore pellets/lumps

should possess 67% Fe minimum.

Composition of Coal and Gas based Sponge Iron

(%) Fe (Metallic) Metallisation Carbon Sulphur Phosphorus Size

Coal based 81-84 90 (+/-2) 0.2-0.3 .025-.03 max .05-.06 max 3-30 mm

Gas based 86.5 93+ 1.5-3 .015 max .04 max 6-200 mm

India has been the world’s largest producer of sponge iron since 2003 producing 11.8 mn

tonnes in FY06, registering a growth of 15% over the last year. This has been due to rapid and

powerful growth in the coal based sponge iron segment in the country.

SPONGE IRON INDUSTRY 4

B&K RESEARCH OCTOBER 2006

Sponge iron (DRI/HBI) production

(Mn tonnes) FY04 FY05 FY06 FY07E FY08E FY09E FY10E FY11E FY12E

Gas based 4 5 5 6 7 7 7 7 7

Coal based 4 6 7 10 12 13 15 16 16

Total 8 10 12 16 19 20 22 23 23

Growth (%) 17 27 15 32 20 7 8 7 1

% of Coal based 51 55 62 62 63 65 67 69 70

Source: B&K Estimates

Sponge Iron production

18

16 Gas Based Coal Based

14

production (mtpa)

12

Gap expected to widen further 10

in coming years 8

6

4

2

0

FY07E

FY08E

FY09E

FY10E

FY11E

FY12E

FY04

FY05

FY06

Source: JPC & B&K Estimates

The share of coal based DRI production has increased from about 37% in FY01 to about

62% in FY06 and the gap is expected to widen further in the coming years.

SPONGE IRON INDUSTRY 5

B&K RESEARCH OCTOBER 2006

Raw materials scenario

Non-coking coal

Non-coking coal is the basic raw material for coal based sponge iron plant. Although, India

has a vast reserves of non-coking coal (about 221 bn tonnes out of which proven reserves

Vast reserves of non-coking are about 79 bn tonnes) but of inferior quality with higher percentage of ash content. The

coal but of inferior quality high ash content is a major problem for sponge iron producers, as higher coal consumption is

with higher percentage of ash

needed in order to affect the same degree of reduction. Over 75% of non-coking coal

content

production is the lower D, E, and F grade. Generally, with 1% increase in the ash content,

production capacity decreases by about 2.5%. According to industry estimates, calibrated

non-coking coal (grade B/C) requirement is about 1-1.2 tonnes per tonne of sponge iron

produced but if low grade (grade D/E/F) coal is being used, then the coal required will go up

to as much as 2.5 tonnes or more.

The non-coking coal with a higher % of ash content needs to be washed and should be

Players located near coal brought it to a level of 25% or less for use in sponge iron kilns which adds to the cost. Freight

mines charges by railways constitutes about 30-40% of the total cost of non-coking coal. So, it’s

beneficial for the DRI (Direct Reduced Iron)/sponge iron producers to set up plants near

coal mines so as to save on transportation costs. Therefore, most of the players are located in

Chhattisgarh, Orissa and West Bengal region.

Many big players have already acquired captive coal blocks or are in the process of acquiring

it. But small players which are numerous in India have to depend on the market. Coal India

Limited has introduced the system of E-auction and supply of coal through Multi Commodity

Increasing coal prices put exchange for the core sector other than the power utilities. So, now the prices are market

pressure on the margins of driven which will inevitably interrupt consistent supplies for producers who depend on market.

the players

Higher ash content and increasing coal prices due to demand-supply mismatch put pressure

on the margins of the players. Some players like Tata Sponge Iron Limited started importing

low ash content non-coking coal and blend it with high ash content domestic non-coking coal.

Although, imported non-coking coal is very expensive vis-à-vis domestic one but in order to

improve the efficiency of the kilns, large players have started doing so.

Iron ore

Coal based sponge iron plants normally use 100% lump ores with Fe content greater than

62% while the gas based plants normally use a feed mix of iron ore pellets and lumps of

around 67% Fe content. According to industry norm, about 1.6 tonnes of calibrated lump

iron ore (5-18mm, Fe: Minimum 62%) is required to produce 1 tonne of sponge iron.

India has vast reserves of medium grade iron ore (hematite ores, Fe: 62-65%) which are

mainly located in the states of Orissa, Jharkhand, Chhattisgarh, Karnataka and Goa region.

SPONGE IRON INDUSTRY 6

B&K RESEARCH OCTOBER 2006

Recoverable reserves of hematite as on 1.4.2000

(Mn tonnes) High Grade Medium Grade Low Grade Others Total

(Fe+65%) (Fe 62-65%) (Fe<62%)

Chhattisgarh 461 562 463 417 1,903

Orissa 548 1,857 508 291 3,204

Vast reserves of medium Jharkhand 44 1,754 873 188 2,859

grade iron ore available in

Karnataka 215 583 79 90 966

India

Goa Region 0 133 392 56 581

Others 30 134 146 104 406

Total 1,298 5,023 2,461 1,146 9,919

% share in total 13 51 25 12 100

Source: IBM, Nagpur

Increasing prices

About 54% of the total domestic production is exported in FY05 due to better realisation at

the global level owing to the higher demand of steel worldwide, in particular China. The price

at the domestic level is also moving northward.

Iron Ore

(MT) FY03 FY04 FY05

Production 99 121 145

Export 48 63 78

% of production exported 48 52 54

Source: IBM & MMTC

Dolomite

Dolomite acts in the coal based process as a desulphuriser, removing sulphur from the feed

mix during the reduction process. It constitutes a very small proportion of total raw materials

required in the process and doesn’t have much impact on the cost.

Natural gas

Availability of natural gas Natural gas is used in gas based sponge iron units mainly through two processes in India

restricted to western part of namely Midrex and HYL-III. Availability of natural gas is restricted to the western part of the

country

country which has favoured the growth of the gas based units there. High price of natural gas

in India is increasing the cost of production of the gas based producers.

Power generation

Power generation through waste heat from spent gases at very low cost is one of the biggest

advantages the coal based sponge iron unit is enjoying with. This would help the companies

in reducing the cost of production and earn additional income by selling the surplus power.

SPONGE IRON INDUSTRY 7

B&K RESEARCH OCTOBER 2006

Captive power position

(Unit: KWh) Module-wise power position

Module (TPA) Power generation Own consumption Surplus power

Additional income to Coal 150,000 10-12 3.5 6.5

based sponge iron plant 100,000 7-8 3 5

30,000 2-2.5 1.5 1

Source: JPC

Raw material facility

More than 80% of the sponge iron producers are small producers (installed capacity of less

than 60,000 TPA) and have to depend on the market for basic raw materials. Producers are

unable to utilise their capacity to the fullest and are on the verge of closure amidst fluctuating

and increasing prices of raw materials, shortage of power facilities and lack of infrastructure.

Integrated players having captive raw materials are at advantageous position.

Regional overview

State/Region Total No. Captive power Coal Iron ore

of units generation linkage source

Chhattisgarh 38 8 24 7

Orissa 33 4 24 2

West Bengal 30 0 23 2

Jharkhand 11 2 5 2

Karnataka 13 1 1 3

Andhra Pradesh 12 1 6 1

Tamil Nadu 2 0 2 1

Goa 3 0 1 1

Maharashtra 5 0 2 1

Others 56 0 0 0

Total 203 16 88 20

Source: JPC

Raw material availability and regional production

Chhattisgarh alone accounts for about 38% of total coal based sponge iron production.

Besides, production is largely concentrated in Eastern region (Orissa, West Bengal and

Jharkhand) contributing about 39% in total coal based production in FY05 due to their

proximity to basic raw materials – iron ore and non-coking coal. The industry is virtually non-

existent in North India due to scarcity of raw materials. Gas based producers are located in

Western India only due to their proximity to natural gas. The whole production is consumed

domestically. This scenario is unlikely to change in the coming years due to increasing domestic

demand by the secondary producers.

SPONGE IRON INDUSTRY 8

B&K RESEARCH OCTOBER 2006

Sponge iron production – Geographical distribution

Chhattisgarh, Orissa, West

Bengal and Jharkhand

contributing approx. 77% of

total Coal based DRI

production in FY05

SPONGE IRON INDUSTRY 9

B&K RESEARCH OCTOBER 2006

The Gas based Sponge Iron producers

Gas-based sponge iron is produced by Midrex process and HYL-III process using naphtha

or natural gas. This process is employed by Essar Steel, Ispat Industries and Vikram Ispat

(only Vikram Ispat uses HYL-III process). The entire sponge iron production of Vikram

Ispat is sold in the open market. Other gas based producers mainly consume it internally for

the production of steel.

Essar Steel

World’s largest gas based DRI Essar Steel operates the world’s largest gas based Direct Reduced Iron (DRI) plant with a

plant having production production capacity of 3.4 million tonnes per annum (MTPA) at Hazira, Gujarat (5 gas based

capacity of 3.4 MTPA

modules with Midrex technology). The plant uses state-of-the-art technology, which ensures

high quality raw material for the steel plant. DRI is produced in two forms, namely, Hot

Briquetted Iron (HBI) and Hot Direct Reduced Iron (HDRI).The HDRI system is an Essar

innovation that saves approx. 100 KWh/tonne of HDRI consumed by Electric Arc Furnace,

thus, utilising the 650° Celsius heat contained in the HDRI. The plant is supported by a

captive power plant of 32 MW, which operates at 100% capacity.

Raw materials linkages

Long-term linkages for iron • Iron ore – The company has a long-term contract with National Mineral Development

ore and natural gas Corporation for calibrated lump iron ore and fines. The company has 8 MTPA capacity

pelletisation plant at Visakhapatnam and 8 MTPA iron ore beneficiation plant at Bailadila.

• Natural gas – The company also has long-term contracts for the supply of gas with GAIL,

IOCL, BPCL, GSPC etc. But, the supply of gas is erratic. Normally, 125 KWh of electricity

is consumed and on an average 325 SM3 of natural gas is used for producing a unit of

HBI.

HBI produced for captive consumption

Essar uses the HBI-Electric Arc Furnace-Continuous caster-Hot strip mill route to strip

making. The company consumes almost entire HBI produced for making steel.

Sponge iron

4

3.5

3

2.5

mtpa

Production mainly for captive 2

consumption 1.5

1

0.5

0

FY01

FY02

FY03

FY04

FY05

FY06

Capacity Production Sales Captive cons.

Source: Essar Steel, annual reports

SPONGE IRON INDUSTRY 10

B&K RESEARCH OCTOBER 2006

Ispat Industries Ltd.

Ispat Industries Limited (IIL) (formerly known as Nippon Denro Ispat), promoted by the

Mittals of Ispat group, is one of the leading integrated steel makers in India. The company

commissioned its gas based single mega-module plant for making sponge iron in Dolvi, Raigarh

(Maharashtra) in 1994 using direct-reduction technology “Megamond series 1000 module”

from Midrex Corporation, US, the world leader in this field. The current installed capacity of

the plant is 1.6 MTPA.

Raw materials dependence

Less availability of natural • Iron ore – The company sources its iron ore pellets requirements from National Mineral

gas restricts plant to operate Development Corporation, as IIL has no captive iron ore mines.

at its enhanced capacity

• Natural gas – Natural gas is sourced from GAIL, India but IIL is getting less gas due to

overall shortage of gas supply in India. Therefore, the company is not able to operate the

plant at its enhanced capacity.

Captive consumption

Ispat Industries, being the producer of hot rolled coils in India, currently consumes almost

entire sponge iron produced internally. In FY06, the production of HBI got affected due to

lower availability of natural gas as well as due to shutdown of plant for 35 days during May-

June for capital repairs.

Sponge iron

1.8

1.6

1.4

1.2

1

mtpa

Production mainly for captive

0.8

consumption 0.6

0.4

0.2

0

FY01

FY02

FY03

FY04

FY05

FY06

Capacity Production Sales Captive cons .

Source: Ispat Industries, annual reports

SPONGE IRON INDUSTRY 11

B&K RESEARCH OCTOBER 2006

Vikram Ispat (Unit of Grasim Ind.)

Plant having capacity of 0.9 Vikram Ispat, a unit of Grasim Industries Ltd. is located at Salav village in Raigad, Maharashtra.

MTPA can produce both HBI The plant was set up in 1989 with a capacity of 0.75 MTPA of sponge iron in the form of

and DRI from the same

HBI, based on HYL-III technology from HYLSA, Mexico. In 1998, Oxygen Injection System

reactor

and DRI Cooling system was commissioned and the plant capacity was increased to 0.9

MTPA. The plant can produce both HBI and DRI from the same reactor.

Raw materials

• Iron ore in the form of pellets is sourced from Gujarat Industrial Investment Corporation

and lump ore from Bailadila .The company doesn’t have captive mines.

• Natural gas consisting of 90-95% methane is sourced from the piping network of GAIL,

India. The plant has been integrated with total energy concept (due to HYL III process)

with 8.7 MW power capacity.

Sponge iron

0.8

0.6

Entire production is sold in

mtpa

the open market 0.4

0.2

0

FY01

FY02

FY03

FY04

FY05

FY06

Capacity Production Sales

Source: Grasim Industries, annual reports

Less availability of natural gas rising input cost

In FY06, due to an acute shortage of natural gas (continuous reduction in the generation of

gas from ONGC wells over the last five years), the plant couldn’t be utilised properly and

hence production fell. In order to cater to the market demand, the plant has been using

supplementary energy sources like naphtha and propane which are 5-6 times costlier than

natural gas. The input cost has increased in multiples leaving the business margins bare

minimum.

No captive consumption

Vikram Ispat is the only gas based sponge iron player selling its entire production in the

market, as the company has no steel making facility. In FY06, sponge iron constitutes approx.

9% to the total turnover of the company.

SPONGE IRON INDUSTRY 12

B&K RESEARCH OCTOBER 2006

Coal based sponge iron producers

Jindal Steel & Power Ltd.

World’s largest coal based Jindal Steel & Power Limited (JSPL) with an installed capacity of 1.37 MTPA (10 kilns) in

sponge iron plant having Raigarh, Chhattisgarh is the world’s largest coal based sponge iron plant today. JSPL, being

capacity of 1.37 MTPA

integrated backwardly has its own captive raw material resources (iron ore & coal) and power

generation, which in turn has enabled the company to insulate itself from the market fluctuations

of raw material prices and to control quality and enhance production. Presently, JSPL is using

in-house Jindal technology for producing sponge iron.

Captive raw materials insulating JSPL from market fluctuations

• Iron ore: JSPL is operating a captive iron ore mine at Tensa in Orissa. The requirement of

iron ore is met from company’s Tensa mines.

• Non-coking coal: The total requirement of non-coking coal of +6-20 mm size is met from

the captive colliery (equipped with coal washery with the capacity of 6 MTPA) developed

by JSPL at Tamnar in Chhattisgarh. JSPL saves on transportation owing to having its

plant near captive coal mines.

• Dolomite: Dolomite is sourced from Baradwar in Chhattisgarh (about 70 km from Raigarh).

• Captive power generation: JSPL also saves on power front due to captive power generation

based on flue gases generated in sponge iron making.

Sponge iron

1.6

1.4 Capacity Production

Sales Captive cons .

1.2

Increased production of DRI 1

(mtpa)

will be used internally for 0.8

ramping up of production of 0.6

steel 0.4

0.2

0

FY01

FY02

FY03

FY04

FY05

FY06

*Increased capacity in FY05 to 1.37mtpa from 0.65mtpa

Source: JSPL, annual reports

Four new kilns for making sponge iron have been added in 2005 which has raised the

capacity from 0.65 MTPA to 1.37 MTPA. The increased production of sponge iron will be

consumed internally for ramping up production of steel.

SPONGE IRON INDUSTRY 13

B&K RESEARCH OCTOBER 2006

Monnet Ispat

Monnet Ispat Limited (MIL), promoted jointly by Sandeep Jajodia and Jindal Strips in 1990

manufactures sponge iron, steel billets and various finished steel products near Raipur in

Chhattisgarh. MIL is one of the largest coal-based sponge iron producer in India (installed

capacity: 0.3 MTPA) backed by captive resources of raw material viz. coal, iron ore and

captive power.

Production capacity expected Over the years, MIL has steadily ramped up capacities from 0.1 MTPA of sponge iron in

to increase to 0.8 MTPA by FY00 to 0.3 MTPA in FY04. MIL is setting up six sponge iron kilns (4 kilns of 350 TPD and

3QFY07

2 kilns of 100 TPD each) with total capacity of 0.5 MTPA which is expected to commence

production in the beginning of 3QFY07.

The company also has captive power plant at Raipur (60 MW) operating on flue gases from

sponge iron kilns which reduces company’s dependence on state electricity boards. MIL is

also in the process of installing 90 MW captive power plant at Raigarh operating on char and

coal fines from sponge iron plant and captive coal mine.

Backward integration gives competitive advantage

Captive coal mines insulate Coal Mine – Raigarh: This underground mine has extractable reserves of 86 mn tonnes

MIL from market fluctuations (estimated reserves are 126 mn tonnes). The quality of coal is better than open-cast mine.

of coal prices

MIL started the production of coal in April 2005 and is currently mining at the rate of 0.6

MTPA and plans to ramp it up to 1.2 MTPA in order to meet the increased demand of coal

from Raigarh project. Most of the company’s in-house requirements for coal would be met

from the captive sources.

Iron Ore Mine – Orissa: The mine has estimated 30 mn tonnes of extractable iron ore

reserves which will be entirely for captive use.

Sponge iron

0.4

0.3 Capacity Production

Sales Captive cons.

0.3

0.2

mtpa

0.2

0.1

0.1

0.0

FY01

FY02

FY03

FY04

FY05

FY06

Source: Monnet Ispat, annual reports

Over the years, MIL has started increasing the usage of sponge iron for captive consumption.

Sponge iron contributes approx. 25% to the total turnover of the company.

SPONGE IRON INDUSTRY 14

B&K RESEARCH OCTOBER 2006

Coal based sponge iron producers

Company Present capacity Production Coal cost/ Iron ore cost/ Remarks

(tonnes) (FY05) tonne DRI tonne DRI

Jindal Steel & Power 1,370,000 692,682 1,050 1,575 Captive raw materials, produces steel.

Tata Sponge Iron Ltd. 390,000 223,686 3,750 2,880 Acquired coal mines, get operational by FY09.

Monnet Ispat Ltd.* 300,000 240,133 1,375 2,400 Captive raw materials, iron ore mines get

operational soon. produces steel.

GSAL (India) Ltd. 220,000 68,967 3,479 5,526 No captive resources.

Raipur Alloy & Steel 210,000 91,767 2,800 6,400 Acquired iron ore & coal mines, will get

operational in future, produces steel.

Singhal Enterprises (P) 198,000 134,537 3,450 5,280 No captive resources.

Bihar sponge Iron Ltd. 180,000 140,998 3,250 4,370 No captive resources.

Sunflag Iron & Steel Co. 150,000 134,192 3,103 6,720 No captive resources, produces steel.

HEG Ltd. 120,000 87,141 3,019 5,965 No captive resources, produces steel.

Orissa Sponge Iron Ltd. 100,000 108,116 2,750 4,740 No captive resources, produces steel.

*Increasing its capacity to 800,000 tonnes in FY07.

Source: Industry sources.

Cost structure (Coal based sponge Iron producers)

Secured Future

Others

9000 Acquired coal

8000 mines Power

7000 d iron Fuel oil

6000 Acquire e s

5000 o r e m in Dolomite

(Rs)

4000 Non-CokingCoal

3000

2000 Iron Ore

1000

0

Linkage-Iron

Captive coal

Linkages(4th)

Captive Raw

Materials(1st)

mines(2nd)

ore(3rd)

Struggling to

No

Survive

Plants with

Source: B&K Research

Note: Jindal Steel & Power falls in 1st, Monnet Ispat in 2nd and Tata Sponge in 3rd category.

Players like JSPL having The players like Jindal Steel & Power who has captive raw materials incurred approx. Rs.

captive raw materials 2,900/tonne variable cost in making sponge iron against approx. Rs. 8,800/tonne for players

produce at a very low cost and

having no captive raw material sources. Monnet Ispat has acquired iron ore mines to reduce

have a secured future

its variable cost/tonne of sponge iron further. Tata Sponge is moving towards second level,

as the company has recently acquired coal mines which will insulate the company from the

market fluctuations and helps in reducing coal cost. Increasing prices of raw materials make

small players vulnerable and many players have shutdown temporarily.

Future prospects

The sponge iron industry has been posting strong growth over the last five-six years. The

growth of Indian sponge iron industry will be propelled mainly by coal based sponge iron

producers. This is due to availability of abundant raw material domestically and low capital

required in installing sponge iron plant. There is limited scope for new gas based sponge iron

SPONGE IRON INDUSTRY 15

B&K RESEARCH OCTOBER 2006

unit coming in near future. The existing 3 players may plan for further expansion but it

depends on the future availability of natural gas which is in short supply currently. The

availability of natural gas is expected to improve for Ispat Industries and Vikram Ispat by end

2007, as the Dahej-Uran gas pipeline is slated to be commissioned by then.

On the raw material front, the supply of basic inputs for coal based sponge iron, iron ore and non-

coking coal are abundant. But increasing iron ore prices and inferior quality of non-coking coal

Demand for sponge iron

expected to grow due to poses a problem for DRI producers. Increasing freight and power cost also poses problem for

availability of abundant raw small producers. Therefore, the future of sponge iron will belong to the players who have captive

material domestically, sources of raw materials which will insulate them from market fluctuations. Presently, only Jindal

growth being propelled by

Steel & Power and Monnet Ispat have captive resources of both iron ore and coal (production

Coal based DRI producers and

the future will belong to the from iron ore mines of Monnet Ispat will commence soon). Tata Sponge has recently acquired

players who have captive 115 mn tonnes mineable coal deposit in Orissa which will be functional by FY09.

sources of raw materials

The demand for sponge iron is expected to remain firm, as it directly depends on the demand

of steel which is expected to reach more than 110 mn tonnes by 2020. With increasing share

of secondary producers which uses mix of sponge iron and scrap in making steel and reduced

domestic availability of high quality scrap and its increasing cost, the future demand for

sponge iron looks promising.

SPONGE IRON INDUSTRY 16

B&K RESEARCH OCTOBER 2006

Global scenario

Global production of sponge iron (DRI/HBI) has been strong over the last decade. The steel

industry globally is using about 25% of the alternative iron sources like DRI/HBI to produce high

quality steels in the EAFs. DRI is now recognised as a high purity, top quality charge material

throughout the world which has been reflected by the strong growth of sponge iron (DRI/HBI)

production which has risen to 56 MTPA in 2005 as against about 40 MTPA in 2001.

World DRI production

70

60

50

40

( Mt)

30

20

10

2006E

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Source: Midrex Technologies, Inc & B&K estimates

EAF production – Increasing share in steel making

Increasing steel production The production through the EAF route has gone up from about 26.6% in 1988 of the global

through EAF route and low production to about 31.7% in 2005. Outside China, very few new blast furnaces have been

availability of scrap boost

built in recent years. EAF steelmaking continues to grow because of its capital and operating

demand for sponge iron

cost advantages vis-à-vis the integrated route. This growth results in increased demand for

EAF charge materials which includes scrap, DRI/HBI and pig iron. Since world steel production

was essentially flat from 1980-95, the growth rate of the obsolete scrap supply leveled off

which led to increase in their prices. Amidst these limitations, demand for DRI increased and

its use in EAFs increased by almost 12 MT in 2000-05. We expect this trend to continue in

future.

Geographical distribution

Sponge iron producers are mainly concentrated in Latin America (including Mexico), Middle

East and Asian region. Latin America is still the largest producers of DRI in the world but over

the last three years, their share has declined from 36% of total world DRI production to 34%

in 2005. This is due to increasing prices of natural gas and larger growth in the coal based DRI

production by Indian producers which led to overall increase in India’s share to 20%.

SPONGE IRON INDUSTRY 17

B&K RESEARCH OCTOBER 2006

Production – Geographical distribution

(Mn tonnes) 2000 2001 2002 2003 2004 2005

Latin America 16.0 14.1 16.0 17.0 19.0 19.3

Argentina 1.4 1.3 1.5 1.7 1.7 1.8

Brazil 0.4 0.4 0.4 0.4 0.4 0.4

Mexico 5.8 3.7 4.9 5.6 6.5 6.0

Peru 0.1 0.1 0.0 0.1 0.1 0.1

Trinidad & Tobago 1.5 2.3 2.3 2.3 2.4 2.1

Venezuela 6.7 6.4 6.9 6.9 7.8 9.0

Middle East/N. Africa 12.1 12.1 13.0 13.9 15.3 15.9

Egypt 2.1 2.4 2.5 2.9 3.0 2.9

Iran 4.7 5.0 5.3 5.6 6.4 6.9

Libya 1.5 1.1 1.2 1.3 1.6 1.7

Qatar 0.6 0.7 0.8 0.8 0.8 0.8

Saudi Arabia 3.1 2.9 3.3 3.3 3.4 3.6

Asia/Oceania 10.1 10.6 11.3 13.8 14.7 15.3

Australia 0.6 1.4 1.0 2.0 0.7 –

Myanmar 0.0 0.0 0.0 0.0 0.0 –

China 0.1 0.1 0.2 0.3 0.4 0.4

India 5.4 5.6 6.6 7.7 9.4 11.1

Indonesia 1.8 1.5 1.5 1.2 1.5 1.4

Malaysia 1.3 1.1 1.1 1.6 1.7 1.4

New Zealand 0.9 0.9 0.9 1.0 1.0 1.0

North America 2.7 0.1 0.7 0.7 1.3 0.8

Canada 1.1 – 0.2 0.5 1.1 0.6

US 1.6 0.1 0.5 0.2 0.2 0.2

Former USSR/Eastern Europe 1.9 2.5 2.9 2.9 3.1 3.3

Russia 1.9 2.5 2.9 2.9 3.1 3.3

Sub-Saharan Africa 1.5 1.6 1.6 1.5 1.6 1.8

South Africa 1.5 1.6 1.6 1.5 1.6 1.8

Western Europe 0.5 0.2 0.5 0.6 0.6 0.4

Germany 0.5 0.2 0.5 0.6 0.6 0.4

World Total 44.7 41.3 46.0 50.5 55.6 56.8

Source: Midrex Technologies, Inc.

SPONGE IRON INDUSTRY 18

B&K RESEARCH OCTOBER 2006

Major DRI Producing Blocs (2002) Major DRI Producing Blocs (2005)

6% 3% 1% 1% 6% 3%1% 1%

14% 36% 34%

20%

10% 7%

29% 28%

Latin America( including Mexico) Middle Eas t/ North Africa

As ia/ Oceania(excluding India) India

Former USSR/Eas tern Europe Sub-Saharan Africa

North America(US & Canada) Wes tern Europe

Source: Midrex Technologies, Inc

Production processes

85% of sponge iron produced Globally, about 85% of the sponge iron is produced through gas based process mainly in large

through gas based process in gas rich areas like Middle East, Latin America and Russia. Coal based process has increased

gas rich areas like Middle

from less than 10% in the 1990s to about 15% in 2005 due to the proliferation of small rotary

East, Latin America and

Russia kiln plants in India. Among different production processes, Midrex Technology continues to

dominate the world scenario with more than 60% market share since 1987.

World DRI capacity utilisation by process (2005)

40 140

35 120

Capacity & production

30 100

Utilisation(%)

25

80

20

60

15

10 40

5 20

0 0

Midrex HYL Finmet Coal-bas ed

Capacity(Mt) Production(Mt) Utilis ation (%)

Source: Midrex Technologies, Inc

India leads the way

Growth in Indian sponge iron Sponge iron growth in 2005 was entirely due to a number of small capacity rotary kilns

industry due to setting up started in India. India led the world in sponge iron production with 11.1 million tonnes

large number of small

followed by Venezuela with 8.9 million tonnes, Iran with 6.9 million tonnes and Mexico with

capacity rotary kilns

6.0 million tonnes in CY05.

SPONGE IRON INDUSTRY 19

B&K RESEARCH OCTOBER 2006

Top 5 Global DRI producers

16

14

Production (Mt)

12

10

8

6

4

2

0

2006E

2000

2001

2002

2003

2004

2005

India Vanezuela Iran Mexico Saudi Arabia

Source: Midrex technologies, Inc & B&K estimates

New capacity on the way

Even though very little sponge iron capacity has been added over the past few years outside of

India, the strong surge in its price has encouraged investment in new capacity. As at the end of first

quarter 2006, over 15 million tonnes of new gas based DRI capacity has been contracted (Midrex

process), the first of these plants will begin operation by late 2006. The newly contracted capacity

has been focused in areas where inexpensive natural gas is abundant, including the Middle East

and South America, as well as projects in Malaysia and Russia. This new investment was driven by

sustained high prices of alternate iron and of low residual, high quality scrap steel.

SPONGE IRON INDUSTRY 20

B&K RESEARCH OCTOBER 2006

Share Data Tata Sponge Iron (Rs. 113) Not Rated

Reuters code TTSP.BO

Tata Sponge Iron (TSIL) is the largest coal based sponge iron producer in Eastern India with

Bloomberg code IPIT IN total installed capacity of 390,000 TPA. The company is ideally located in close proximity of

Market cap. (US$ mn) 36 iron ore mines in Keonjhar, Orissa. Recently, the company has acquired a coal block on a 30-

6m avg. daily turnover (US$ mn) 0.3 year lease basis in Orissa along with two more associates and is expected to become operational

by FY09 which will help reducing the company’s coal cost significantly. The company has also

Issued Shares (mn) 15.4

increased its power generation facility from 7.5 MW to 26 MW which insulates its dependence

Performance (%) 1m 3m 12m

on state electricity boards and increase earnings by selling surplus power. We spoke to the

Absolute (4) (1) (36) management recently. Following are the key highlights:

Relative (10) (19) (56) • Increasing production through the secondary route

Major shareholders (%) Increase in steel production through the secondary route (EAF, IF), which uses hot metal

Promoters 41 (pig iron), sponge iron/scrap as their basic raw materials, accounts for 48% of the total

Institutions 3 steel output. It has grown at a CAGR of 18% during FY01-05. The trend is expected to

continue due to rising availability of coal based sponge iron produced from domestically

Public & Others 56

available raw material.

Relative performance • Sponge iron is fast replacing imported steel scrap in secondary steel making

350 Production of steel scrap in India is low at 15-20% of its consumption due to longer

300

250 product life cycle, as the country is in developing phase and the consumption pattern is

200

150 tilted in favour of infrastructure and construction rather than consumer durables.

100 Therefore, secondary steel makers have to depend on imported steel scrap. Coal based

50

0 sponge iron is fast replacing imported steel scrap due to low cost of production, as non-

Dec-04

Nov-05

Mar-06

Jun-06

Oct-06

Apr-05

Aug-05

coking coal and iron ore (two critical raw materials) are domestically available and its

production is rising.

Tata Sponge Iron

(Actual) • Own power generation

Sens ex

By realising the importance of captive power plant for having an edge in the cost competitive

markets, recently TSIL has expanded its power generation facilities by installing two more

power plants (18.5 MW) in Kiln 1 and Kiln 3 increasing total capacity from 7.5 MW to 26

MW. The new 18.5 MW power plant is expected to get operational by October 2006.

TSIL’s total power requirement is about 10 MW for the current capacity. Sale of surplus

power (made an arrangement to sell 10-12 MW of power @ Rs. 3.15/unit) will contribute

additional revenue (approx. 160 mn per year) from FY07 itself.

• Captive coal block: A reality

Recently, TSIL has acquired a coal block on a 30-year lease basis in Orissa along with two

more associates. The estimated mineable coal deposit is about 115 mn tonnes. TSIL’s

share is 51%. The coal block is expected to become operational by the end of FY09. This

will insulate the company from volatility in non-coking coal prices and reduce its coal cost

significantly which presently constitutes about 44% of total expenses.

• Strategic location

TSIL is located at Bilaipada near Joda, in the Keonjhar District of Orissa. The plant is

ideally located in the close proximity of iron ore mines (25 kms away from plants) and

sponge iron consumers of Eastern region which saves on transportation cost.

SPONGE IRON INDUSTRY 21

B&K RESEARCH OCTOBER 2006

• Over capacity due to smaller players

The situation of over capacity exists due to emergence of many small coal based players

which keep a cap on the prices of sponge iron.

• Increasing prices of iron – ore and non-coking coal

Though, the company has leased out some mining assets to Tata Steel Ltd. for operation

of its Khondbond iron ore mine for its captive use and are better placed than the players

having no captive sources but then also the prices are expected to increase further due to

high demand both at domestic as well as global level, particularly from China which

squeezes the margin of the company. Non-coking coal prices are also increasing and we

expect the prices to be firm in near future.

Raw material cost

2,800

2,600

2,400

2,200

2,000

1,800

1,600

1,400

1,200

1,000

800

600 Coal (Rs /ton)

400 Iron Ore (Rs /ton)

200

0

FY07E

FY08E

FY00

FY01

FY02

FY03

FY04

FY05

FY06

Source: Company & B&K research

SPONGE IRON INDUSTRY 22

B&K RESEARCH OCTOBER 2006

Business background

Tata Sponge Iron (TSIL) was incorporated in 1982 as a Joint Venture of Tata Steel and

Industrial Promotion & Investment Corporation of Orissa Ltd. (IPCOL) for the production

of sponge iron, based on TISCO-Direct Reduction (TDR) Technology. The plant is located

at Bilaipada near Joda, in the Keonjhar district of Orissa. In 1991, Tata Steel acquired

IPICOLs stake and TSIL became its subsidiary.

Growth path

450

400 Production Capacity

350

300

(000 tons)

250

200

150

100

50

0

FY 86

FY 91

FY 98

FY 06

Source: Company

The plant was initially designed for a production capacity of 90,000 TPA and subsequently

the capacity was enhanced to 120,000 TPA in 1990-91 by entering into foreign collaboration

with Lurgi, Germany in 1987-89. The company later to meet the growing demand of sponge

iron doubled its capacity by adding another Kiln of equivalent capacity in 1998-99, bringing

the capacity to 240,000 TPA.

In December 2001, TSIL commissioned a 7.5 MW captive power plant to produce electricity

from the waste heat of exit gases of its Kiln No.2.

Capacity expansion

Increased installed capacity • Recently, TSIL expanded its capacity by installing 3rd Kiln having a capacity of 150,000

of sponge iron to 390,000 TPA TPA. As a result, the company’s sponge iron making facility has increased from 240,000

and captive co-power

TPA to 390,000 TPA. The facility commenced production from March 2006. Also, TSIL

generation facilities to 26 MW

has set up power generation facilities of 18 MW by recovering the waste heat of the kilns

which is expected to be operational from October 2006. The total cost incurred was

approx. Rs. 1.9 bn.

Acquired a coal block on 30 • Recently, TSIL has acquired a coal block on a 30 year lease basis in Orissa along with two

year lease basis in Orissa more associates (SPS Sponge Iron Ltd. and Messrs Scaw Industries Ltd.). The estimated

mineable coal deposit is about 115 mn tonnes. TSIL’s share is 51%. The coal block is

expected to become operational by the end of FY09. The total expected cost incurred on

coal mines is approx. Rs. 3 bn.

In-house TDR Technology

Tata Steel developed in-house technology based on Coal to produce sponge iron. It was the

first sponge iron plant in India to receive the ISO-9002 and the ISO-14000 certifications.

SPONGE IRON INDUSTRY 23

B&K RESEARCH OCTOBER 2006

Process

Rotary kiln cross-section

Source: Company

Iron ore (hematite) and non-coking coal are charged into a rotary kiln in requisite proportion

with dolomite to produce sponge iron. Coal plays a dual role in the process by acting as a

redundant as well as fuel for providing heat to maintain the requisite temperature inside the

kiln at 950°-1050°C. The reduction process occurs in solid state. In this reduction process,

coal is combusted in a controlled manner and it converts to carbon monoxide to remove

oxygen from the iron ore. At the end of the process, iron ore is optimally reduced and

discharged to a rotary cooler for cooling below 120°C and finally sponge iron comes out of

the kiln. Power is generated by using the waste heat of the hot spent gases of the kiln.

Source: Company

Valuations

Full ramp-up of 3rd kiln by October 2006 would provide volume CAGR of 38% during

FY06-08E. 26 MW of captive power and sale of approx. 10-12 MW surplus power would

Potential to grow earnings in add to earnings. Coal mines (expected to start by FY09) would reduce coal cost (currently

long-term

form 44% of total cost). At the current price of Rs. 113, the stock is trading at 6.2x FY07E

and 4.1x FY08E earnings. We feel that the company has potential to grow earnings in long-

term. We don’t have rating on the stock.

SPONGE IRON INDUSTRY 24

B&K RESEARCH OCTOBER 2006

Financials

Production

The company is poised for major growth in the production of sponge iron in the coming two

years post increasing its installed capacity to 390,000 TPA.

Production

Source: Tata Sponge, Annual Reports, B&K estimates

Revenues

Revenues of TSIL are expected to increase at 40% CAGR over the next two years due to

recent capacity expansion from 240,000 TPA to 390,000 TPA. The company has shown a

decline of 20% in its revenue in FY06 due to lesser production (due to higher ash content in

non-coking coal received by Coal India Limited which reduces productivity and increasing

prices of both iron ore and non-coking coal) as well as due to pressure on realisation front.

Net sales and growth

Source: Tata Sponge, Annual Reports, B&K estimates

Cost

The average cost of iron ore is expected to remain firm in the next two years. More of non-

coking coal is required due to higher % of ash content in it which needs to be washed to

reduce the ash content to an acceptable level which will increase its prices.

SPONGE IRON INDUSTRY 25

B&K RESEARCH OCTOBER 2006

Raw Material Cost

Source: Tata Sponge, Annual Reports, B&K estimates

Margins

Margins of the company have declined in FY06 due to lower realisation coupled with the

higher input prices. The company is targeting high growth in revenues to improve margins.

We expect realisation to be comparatively better in the next two years. Margins will be under

pressure due to higher iron ore and coal prices. The company has been allotted a coal mine in

Orissa but will be able to get advantage only from FY09.

EBITDA and Margins EBITDA/ton, Cost/ton, Price/ton

Source: Tata Sponge, Annual Reports, B&K estimates

Capex

Recently, TSIL added a 150,000 TPA sponge iron unit and 18.5 MW waste gas recovery

based captive power plant with an investment of approx. Rs. 1.9 bn (expected to be fully

ramped up by October 2006). TSIL has also acquired a coal block on a 30 year lease basis in

Orissa along with two more associates. The company will use its reserves as well as take debt

to finance projects. The total expected cost incurred on coal mines is approx. Rs. 3 bn. The

company plans to spend approx. Rs. 400 mn for development of colliery in FY07.

SPONGE IRON INDUSTRY 26

B&K RESEARCH OCTOBER 2006

PAT and Margin

We expect PAT to increase by 38% CAGR in the next two years driven by higher volume

growth (due to capacity expansion) and sustainability on realisation front.

PAT and margin

Source: Tata Sponge, Annual Reports, B&K estimates

Improving quarterly results

Net sales

Source: Tata Sponge, Annual Reports

First quarter of FY07 shows some sign of improvement. Net sales starts increasing due to

installation of 3rd kiln of 150,000 tonnes capacity in the last two quarters. EBITDA and PAT

margin also improved on q-o-q basis. With improvement in prices, we expect the trend to

continue.

SPONGE IRON INDUSTRY 27

B&K RESEARCH OCTOBER 2006

EBITDA and margin PAT and margin

Source: Tata Sponge, Annual Reports

Raw material cost

Source: Tata Sponge, Annual Reports, B&K Estimates

SPONGE IRON INDUSTRY 28

B&K RESEARCH OCTOBER 2006

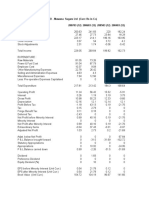

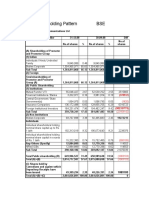

Income Statement Cash Flow Statement

Yr. ended 31 Mar. (Rs. m) FY05 FY06 FY07E FY08E Yr. ended 31 Mar. (Rs. m) FY05 FY06 FY07E FY08E

Net sales 2,304 1,852 2,720 3,618 Pre-tax profit 951 343 429 650

Growth (%) 36.2 (19.6) 46.9 33.0 Depreciation 71 75 93 105

Operating expenses (1,375) (1,546) (2,380) (3,127) Chg in working capital 358 (54) 44 (16)

Operating profit 929 306 340 491

Total tax paid (552) (88) (171) (230)

Other operating income 80 160

Cash flow from oper. (a) 828 276 396 509

EBITDA 929 306 420 651

Capital expenditure (300) (1,294) (639) (700)

Growth (%) 75.1 (67.1) 37.4 54.9

Cash flow from inv. (b) (300) (1,294) (639) (700)

Depreciation (72) (76) (95) (106)

Free cash flow (a+b) 528 (1,018) (243) (191)

Other income 94 113 120 125

Debt raised/(repaid) (1) 700 825 825

EBIT 952 344 445 670

Interest paid (1) (1) (16) (20) Dividend (incl. tax) (92) (116) (132) (70)

Pre-tax profit 951 343 429 650 Cash flow from fin. (c) (93) 583 693 755

(before non-recurring items) Net chg in cash (a+b+c) 434 (434) 450 563

Pre-tax profit 951 343 429 650

Key Ratios

(after non-recurring items)

Yr. ended 31 Mar. (%) FY05 FY06 FY07E FY08E

Tax (current + deferred) (342) (121) (152) (230)

Net profit 609 221 278 420 EPS (Rs) 39.5 14.4 18.0 27.3

Adjusted net profit 609 221 278 420 EPS growth 77.2 (63.6) 25.3 51.3

Growth (%) 77.2 (63.6) 25.3 51.3 EBITDA margin 40.3 16.5 15.0 17.2

Net income 609 221 278 420 EBIT margin 41.3 18.5 15.9 17.7

ROCE 73.2 17.4 15.2 16.6

Balance Sheet

Net debt/Equity (34.4) 46.3 62.9 65.0

Yr. ended 31 Mar. (Rs. m) FY05 FY06 FY07E FY08E

Current assets 799 498 1,017 1,758 Valuations

Investments 8 8 8 8 Yr. ended 31 Mar. (x) FY05 FY06 FY07E FY08E

Net fixed assets 1,165 2,384 2,930 3,525 PER 2.8 7.8 6.2 4.1

Total assets 1,972 2,890 3,955 5,292 PCE 2.5 5.8 4.7 3.3

Price/Book 1.3 1.2 1.0 0.9

Current liabilities 440 477 510 672 Yield (%) 6.2 3.6 3.6 3.6

Total Debt 7 707 1,532 2,357 EV/Net sales 0.6 1.3 1.0 0.8

Other non-current liabilities 205 235 235 235 EV/EBITDA 1.4 7.9 6.6 4.7

Total liabilities 652 1,419 2,277 3,264

Du Pont Analysis – ROE

Yr. ended 31 Mar. (x) FY05 FY06 FY07E FY08E

Share capital 154 154 154 154

Net margin (%) 26.4 12.0 10.2 11.6

Reserves & surplus 1,166 1,317 1,524 1,874

Asset turnover 1.3 0.8 0.8 0.8

Shareholders’ funds 1,320 1,471 1,678 2,028 Leverage factor 1.6 1.7 2.2 2.5

Total equity & liabilities 1,972 2,890 3,955 5,292 Return on equity (%) 56.6 15.9 17.6 22.7

SPONGE IRON INDUSTRY 29

B&K RESEARCH OCTOBER 2006

B&K Securities is the trading name of Batlivala & Karani Securities India Pvt. Ltd.

The information contained herein is confidential and is intended solely for the addressee(s). Any unauthorized access, use, reproduction, disclosure or

dissemination is prohibited. This information does not constitute or form part of and should not be construed as, any offer for sale or subscription of or any

invitation to offer to buy or subscribe for any securities. The information and opinions on which this communication is based have been complied or arrived

at from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to their accuracy, correctness and

are subject to change without notice. Batlivala & Karani Securities India P Ltd and/ or its clients may have positions in or options on the securities mentioned

in this report or any related investments, may effect transactions or may buy, sell or offer to buy or sell such securities or any related investments. Recipient/

s should consider this report only for secondary market investments and as only a single factor in making their investment decision. The information enclosed

in the report has not been whetted by the compliance department due to the time sensitivity of the information/document. Some investments discussed in this

report have a high level of volatility. High volatility investments may experience sudden and large falls in their value causing losses when the investment is

realized. Those losses may equal your original investment. Some investments may not be readily realizable and it may be difficult to sell or realize those

investments, similarly it may prove difficult for you to obtain reliable information about the value, risks to which such an investment is exposed. Neither B&K

Securities nor any of its affiliates shall assume any legal liability or responsibility for any incorrect, misleading or altered information contained herein.

Analysts Declaration:

We, Sanjay Jain & Ashish Kejriwal, hereby certify that the views expressed in this report accurately reflect our personal views about the subject securities and issuers.

We also certify that no part of our compensation was, is, or will be, directly or indirectly, related to the specific recommendation or view expressed in this report.

B & K SECURITIES INDIA PRIVATE LTD.

Equity Market Division: 12/14, Brady House, 2nd Floor, Veer Nariman Road, Fort, Mumbai-400 001, India. Tel.: 91-22-2289 4000, Fax: 91-22-2287 2767.

Registered Office: Room No. 3/4, 7 Lyons Range, Kolkata-700 001. Tel.: 91-033-2243 7902.

B&K Research is also available on Bloomberg <BNKI>, Thomson First Call & Investext.

Potrebbero piacerti anche

- Rain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImproveDocumento8 pagineRain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImprovedidwaniasNessuna valutazione finora

- 0hsie F PDFDocumento416 pagine0hsie F PDFchemkumar16Nessuna valutazione finora

- Rbi Allowed Banks To Increase Limit From 10 To 15 PercentDocumento10 pagineRbi Allowed Banks To Increase Limit From 10 To 15 PercentdidwaniasNessuna valutazione finora

- Weekly Technical PicksDocumento4 pagineWeekly Technical PicksMaruthee SharmaNessuna valutazione finora

- Information Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsDocumento8 pagineInformation Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsdidwaniasNessuna valutazione finora

- Industry Report Card April 2018Documento16 pagineIndustry Report Card April 2018didwaniasNessuna valutazione finora

- APL Apollo Antique Stock Broking Coverage Aprl 17Documento17 pagineAPL Apollo Antique Stock Broking Coverage Aprl 17didwaniasNessuna valutazione finora

- Bandhan Bank Building Strong Franchise Through Retail FocusDocumento13 pagineBandhan Bank Building Strong Franchise Through Retail FocusdidwaniasNessuna valutazione finora

- Mawana FinancialsDocumento8 pagineMawana FinancialsdidwaniasNessuna valutazione finora

- Idfc QTR FinancialsDocumento2 pagineIdfc QTR FinancialsdidwaniasNessuna valutazione finora

- BandhanBank 15 3 18 PLDocumento1 paginaBandhanBank 15 3 18 PLdidwaniasNessuna valutazione finora

- Shareholding Pattern BSEDocumento3 pagineShareholding Pattern BSEdidwaniasNessuna valutazione finora

- Financials 7-11-08Documento6 pagineFinancials 7-11-08didwaniasNessuna valutazione finora

- Sensex AnalysisDocumento2 pagineSensex AnalysisdidwaniasNessuna valutazione finora

- MARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodayDocumento2 pagineMARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodaydidwaniasNessuna valutazione finora

- The Subprime Meltdown: Understanding Accounting-Related AllegationsDocumento7 pagineThe Subprime Meltdown: Understanding Accounting-Related AllegationsdidwaniasNessuna valutazione finora

- IDEA One PagerDocumento6 pagineIDEA One PagerdidwaniasNessuna valutazione finora

- IFLEX One PagerDocumento1 paginaIFLEX One PagerdidwaniasNessuna valutazione finora

- Citizens Guide 2008Documento12 pagineCitizens Guide 2008DeliajrsNessuna valutazione finora

- BHEL One PagerDocumento1 paginaBHEL One PagerdidwaniasNessuna valutazione finora

- 24 Jun 08 - BHELDocumento4 pagine24 Jun 08 - BHELdidwaniasNessuna valutazione finora

- Kpo VsbpoDocumento3 pagineKpo VsbposdNessuna valutazione finora

- IAG+ +India+Strategy+ (June+08)Documento17 pagineIAG+ +India+Strategy+ (June+08)api-3862995Nessuna valutazione finora

- 'A' Grade Turnaround: Associated Cement CompaniesDocumento3 pagine'A' Grade Turnaround: Associated Cement CompaniesdidwaniasNessuna valutazione finora

- IAG+ +India+Strategy+ (June+08)Documento17 pagineIAG+ +India+Strategy+ (June+08)api-3862995Nessuna valutazione finora

- HSBC Private Bank Strategy MattersDocumento4 pagineHSBC Private Bank Strategy MattersdidwaniasNessuna valutazione finora

- Income & Growth One Pager 06302008Documento2 pagineIncome & Growth One Pager 06302008didwaniasNessuna valutazione finora

- Sanjiv KaulDocumento18 pagineSanjiv KaulsdNessuna valutazione finora

- CKP PresentationDocumento39 pagineCKP PresentationdidwaniasNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- AWS CWI For NSRP at NSRP PDFDocumento7 pagineAWS CWI For NSRP at NSRP PDFTuấn PhạmNessuna valutazione finora

- Best Practices in PL/SQL: Karthikeyan MDocumento15 pagineBest Practices in PL/SQL: Karthikeyan MranusofiNessuna valutazione finora

- Panasonic Model TG6511FXDocumento82 paginePanasonic Model TG6511FXLakiLakicNessuna valutazione finora

- Hotpoint Service Manual Fridge FreezerDocumento36 pagineHotpoint Service Manual Fridge FreezerMANUEL RODRIGUEZ HERRERA100% (1)

- Mastertop TC 458 PDFDocumento3 pagineMastertop TC 458 PDFFrancois-Nessuna valutazione finora

- AHU-Guideline 01 General Requirements Fo PDFDocumento24 pagineAHU-Guideline 01 General Requirements Fo PDFkayden chinNessuna valutazione finora

- Manaul de Partes Bws 1 YmDocumento53 pagineManaul de Partes Bws 1 YmRobinson GuanemeNessuna valutazione finora

- Ktu Laca Solved Question PaperDocumento22 pagineKtu Laca Solved Question PaperSofiyaNessuna valutazione finora

- List of FEM Documents 2012Documento5 pagineList of FEM Documents 2012Gustavo AquinoNessuna valutazione finora

- Komatsu SAA6D114E-3D Engine ManualDocumento634 pagineKomatsu SAA6D114E-3D Engine ManualLuzioNetoNessuna valutazione finora

- Irf 744 PBFDocumento8 pagineIrf 744 PBFPosada Burgueño CarlosNessuna valutazione finora

- Manitou MI 50 D MI 100 D ENDocumento12 pagineManitou MI 50 D MI 100 D ENllovarNessuna valutazione finora

- PMOS RunsheetDocumento3 paginePMOS Runsheetkrishna_singhalNessuna valutazione finora

- Ce R&D/Dli-22/CHANDI/2010-2011 Ce R&D/Dli - 24/CHANDI/2010-2011Documento61 pagineCe R&D/Dli-22/CHANDI/2010-2011 Ce R&D/Dli - 24/CHANDI/2010-2011rajjjjjiNessuna valutazione finora

- Furniture Plans How To Build A Rocking ChairDocumento10 pagineFurniture Plans How To Build A Rocking ChairAntónio SousaNessuna valutazione finora

- Andrews General Usability HeuristicsDocumento1 paginaAndrews General Usability HeuristicsGhaniNessuna valutazione finora

- Topaz HTC English Manual PDFDocumento232 pagineTopaz HTC English Manual PDFRafael AdrianNessuna valutazione finora

- Open Gapps LogDocumento2 pagineOpen Gapps LogAgus Yudho PratomoNessuna valutazione finora

- Andhra Pradesh Technical ReportDocumento64 pagineAndhra Pradesh Technical ReportReashma PsNessuna valutazione finora

- Industrial Hose Products - DAYCODocumento200 pagineIndustrial Hose Products - DAYCOHebert CcahuanaNessuna valutazione finora

- CLC Blocks ProposolDocumento5 pagineCLC Blocks ProposolGyi TawNessuna valutazione finora

- SemaphoreDocumento29 pagineSemaphoreSaranya ThangarajNessuna valutazione finora

- Durehete 1055Documento5 pagineDurehete 1055alextentwenty100% (1)

- Satrack Full Report New2Documento17 pagineSatrack Full Report New2ammayi9845_930467904Nessuna valutazione finora

- JCL LC SLIDES01 FP2005 Ver1.0Documento51 pagineJCL LC SLIDES01 FP2005 Ver1.0api-27095622100% (2)

- Design DocumentDocumento10 pagineDesign DocumentLiza WoodsNessuna valutazione finora

- GaAs solar cell modeling improves efficiencyDocumento4 pagineGaAs solar cell modeling improves efficiencyTarak BenslimaneNessuna valutazione finora

- Thermocouple & PRT Cable Selection GuideDocumento15 pagineThermocouple & PRT Cable Selection Guidetees220510Nessuna valutazione finora

- ASTM D5199 Nominal ThicknessDocumento4 pagineASTM D5199 Nominal ThicknessCharleneTaneoNessuna valutazione finora