Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Alishba Baig

Caricato da

M shahjamal Qureshi0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

20 visualizzazioni3 paginebook1

Copyright

© © All Rights Reserved

Formati disponibili

XLSX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentobook1

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

20 visualizzazioni3 pagineAlishba Baig

Caricato da

M shahjamal Qureshibook1

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

DATA

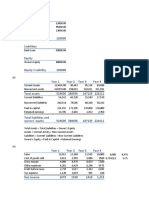

sales grow by 6% INCOME STATEMENT 2013

interest rate is 11% sales 455150

dividend grow at 8% expenses (ex dep. & ammortization) 386878

depreciation and ammortization 14565

EBIT 53707

interest expense on LTD 11880

interest expense on line of credit 0

EBT 41827

taxes (40%) 16731

net income 25096

common dividends (regular dividend) 12554

special dividends

ratios 2014 BALANCE SHEET 2013 ratios 2014

482459 ASSETS

0.85 410091 cash 18206 0.04 19298

0.08 15439 accounts receivables 100133 0.22 106141

56929 inventories 45515 0.1 48246

13200 total current assets 163854 173685

0 fixed assets 182060 0.4 192984

43729 total assets 345914 366669

17492

26238 LIABILITIES AND EQUITY

13558 accounts payable 31861 0.07 33773

acuurals 27309 0.06 28948

line of credit 0 0

total current liabilties 59170 62721

LTD 120000 120000

total liabilties 179170 182721

common stock 60000 60000

retained earnings 106745 119424

total common equity 166745 179424

total liabilties and equity 345915 362145

increase in assets 20755

increase in liabilities 3551

change in common equity 12679

AFN 4525

33773

28948

4525

67246

120000

187246

60000

119424

179424

366670

Potrebbero piacerti anche

- Bridgewater Daily Observations 4.28.2009 - A Modern D-Day ProcessDocumento0 pagineBridgewater Daily Observations 4.28.2009 - A Modern D-Day ProcessChad Thayer V100% (2)

- Worksheet 2 Statement of Financial Position Question With SolutionDocumento3 pagineWorksheet 2 Statement of Financial Position Question With SolutionNayaz EmamaulleeNessuna valutazione finora

- Cash and Accrual BasisDocumento5 pagineCash and Accrual BasisLeisleiRago100% (1)

- Total Operating Expenses Operating Income or Loss: BreakdownDocumento9 pagineTotal Operating Expenses Operating Income or Loss: BreakdownAhmed EzzNessuna valutazione finora

- Manual Auto Fibo PhenomenonDocumento17 pagineManual Auto Fibo PhenomenonRodrigo Oliveira100% (1)

- Atlas Honda: Financial ModellingDocumento19 pagineAtlas Honda: Financial ModellingSaqib NasirNessuna valutazione finora

- Attock CementDocumento18 pagineAttock CementDeepak MatlaniNessuna valutazione finora

- Balance Sheet: Total Equity and LiabilitiesDocumento11 pagineBalance Sheet: Total Equity and LiabilitiesSamarth LahotiNessuna valutazione finora

- Module-10 Additional Material FSA Template - Session-11 vrTcbcH4leDocumento6 pagineModule-10 Additional Material FSA Template - Session-11 vrTcbcH4leBhavya PatelNessuna valutazione finora

- Accounts AssignsmentDocumento8 pagineAccounts Assignsmentadityatiwari8303Nessuna valutazione finora

- Chapt 17-18 Suyanto - DDocumento8 pagineChapt 17-18 Suyanto - DZephyrNessuna valutazione finora

- Amazon Vs Wal-MartDocumento21 pagineAmazon Vs Wal-MartunveiledtopicsNessuna valutazione finora

- Workshop 3 - Cash Flow 1234 Company StudentsDocumento2 pagineWorkshop 3 - Cash Flow 1234 Company StudentsMaria DominguezNessuna valutazione finora

- FAM Assignment - Rupasree Dey - 01-20-108Documento10 pagineFAM Assignment - Rupasree Dey - 01-20-108Rupasree DeyNessuna valutazione finora

- Project EngieDocumento32 pagineProject EngieVijendra Kumar DubeyNessuna valutazione finora

- FIn Data of Texmaco and MEPDocumento10 pagineFIn Data of Texmaco and MEPWasp_007_007Nessuna valutazione finora

- Ibf Kohat TextileDocumento32 pagineIbf Kohat TextileMuhammad Humayun KhanNessuna valutazione finora

- Exhibit 1Documento1 paginaExhibit 1Vijendra Kumar DubeyNessuna valutazione finora

- HUL Day 7Documento21 pagineHUL Day 7Juzer JiruNessuna valutazione finora

- Nel HydrogenDocumento23 pagineNel HydrogenJayash KaushalNessuna valutazione finora

- Income Statement: Particulars Revenue Gross ProfitDocumento6 pagineIncome Statement: Particulars Revenue Gross ProfitRohanMohapatraNessuna valutazione finora

- Talbros Relative - Students'Documento21 pagineTalbros Relative - Students'Deepak SaxenaNessuna valutazione finora

- Lecture 2 Answer 2 1564205851105Documento8 pagineLecture 2 Answer 2 1564205851105Trinesh BhargavaNessuna valutazione finora

- IRM Section B Group 1Documento12 pagineIRM Section B Group 1Keshav GoelNessuna valutazione finora

- Amazon SCM Finance DataDocumento2 pagineAmazon SCM Finance DataSagar KansalNessuna valutazione finora

- Profit & Loss - Infosys LTDDocumento2 pagineProfit & Loss - Infosys LTDRutuja PatilNessuna valutazione finora

- Balance2021 22 1Documento1 paginaBalance2021 22 1BudimanNessuna valutazione finora

- Drreddy - Ratio AnalysisDocumento8 pagineDrreddy - Ratio AnalysisNavneet SharmaNessuna valutazione finora

- MGMT90226 Business Acumen For Entrepreneurs Class 1: Use in Conjunction With Text Book Slides Albeb@unimelb - Edu.auDocumento28 pagineMGMT90226 Business Acumen For Entrepreneurs Class 1: Use in Conjunction With Text Book Slides Albeb@unimelb - Edu.auRafael KusumaNessuna valutazione finora

- Model 2 TDocumento6 pagineModel 2 TVidhi PatelNessuna valutazione finora

- Birla Sunlife Asset Management Company Limited: Current Ratio Current Assets/current LiabilitiesDocumento9 pagineBirla Sunlife Asset Management Company Limited: Current Ratio Current Assets/current LiabilitiesAkanksha08051990Nessuna valutazione finora

- Fine Foods Limited: FU Wang Food LimitedDocumento8 pagineFine Foods Limited: FU Wang Food LimitedS. M. Zamirul IslamNessuna valutazione finora

- F.anal 2Documento31 pagineF.anal 2Arslan QadirNessuna valutazione finora

- Investment (Valuation of Stock)Documento9 pagineInvestment (Valuation of Stock)Lim JaehwanNessuna valutazione finora

- Case 9 Fin315Documento20 pagineCase 9 Fin315gaiaNessuna valutazione finora

- Biocon Valuation - Nov 2020Documento35 pagineBiocon Valuation - Nov 2020Deepak SaxenaNessuna valutazione finora

- Financial Forecasting: Mutya L. SilvaDocumento11 pagineFinancial Forecasting: Mutya L. SilvaRobelyn LacorteNessuna valutazione finora

- Assets Liabilites and Owners' EquityDocumento5 pagineAssets Liabilites and Owners' EquityVinay JajuNessuna valutazione finora

- Trend Analysis and AppendixDocumento11 pagineTrend Analysis and AppendixAarju PoudelNessuna valutazione finora

- Ratio Analysis of Hindalco Industries LimitedDocumento13 pagineRatio Analysis of Hindalco Industries LimitedSmall Town BandaNessuna valutazione finora

- $ Million 2013 2012: Balance SheetDocumento3 pagine$ Million 2013 2012: Balance Sheetyash sarohaNessuna valutazione finora

- Hori, Trend, VertiDocumento10 pagineHori, Trend, VertiRishav BhattacharjeeNessuna valutazione finora

- Sources of FundsDocumento2 pagineSources of FundsKirti RawatNessuna valutazione finora

- HCL - Praphul Gupta (JL18FS039)Documento18 pagineHCL - Praphul Gupta (JL18FS039)Akshay Yadav Student, Jaipuria Lucknow100% (1)

- BTVN Chap 03Documento14 pagineBTVN Chap 03Nguyen Phuong Anh (K16HL)Nessuna valutazione finora

- Financial Situation (2016-2018) GalaxoDocumento3 pagineFinancial Situation (2016-2018) GalaxoAmr MekkawyNessuna valutazione finora

- ForecastingDocumento9 pagineForecastingQuỳnh'ss Đắc'ssNessuna valutazione finora

- Pro Forma Balance Sheet and Income StatementDocumento2 paginePro Forma Balance Sheet and Income StatementMelinda AndrianiNessuna valutazione finora

- Chapter AssignmentDocumento3 pagineChapter AssignmentSwati PorwalNessuna valutazione finora

- FM Assignment 02Documento1 paginaFM Assignment 02Sufyan SarwarNessuna valutazione finora

- Question 2Documento4 pagineQuestion 2Ahsan MubeenNessuna valutazione finora

- Calculation of Ratios of Yum 2014 2015 1. Profitability RatiosDocumento7 pagineCalculation of Ratios of Yum 2014 2015 1. Profitability RatiosRajashree MuktiarNessuna valutazione finora

- Statement of Profit or Loss and Other Comprehensive Income: Rangpur Foundry LimitedDocumento6 pagineStatement of Profit or Loss and Other Comprehensive Income: Rangpur Foundry LimitedMD MOHAIMINUL ISLAMNessuna valutazione finora

- FOR THE YEAR 2016 - 2019: Statement of Financial PoitionDocumento32 pagineFOR THE YEAR 2016 - 2019: Statement of Financial Poitionsana shahidNessuna valutazione finora

- Section B Group 4 Assignment BNL StoresDocumento3 pagineSection B Group 4 Assignment BNL StoresMohit VermaNessuna valutazione finora

- Financial Statements Vodafone Idea LimitedDocumento6 pagineFinancial Statements Vodafone Idea LimitedRamit SinghNessuna valutazione finora

- Comparative Balance Sheet of BSNL LTDDocumento19 pagineComparative Balance Sheet of BSNL LTDsmarty19b100% (2)

- Chenab Limited Income Statement: Rupees in ThousandDocumento14 pagineChenab Limited Income Statement: Rupees in ThousandAsad AliNessuna valutazione finora

- BA AssignDocumento7 pagineBA Assignsyedaariba06Nessuna valutazione finora

- Accounting For Management: Group ProjectDocumento10 pagineAccounting For Management: Group ProjectYash BhasinNessuna valutazione finora

- Balance Sheet As On 31 December 2014-2016: Amount in Millions 2016 2015 2014 V 2016 2015Documento4 pagineBalance Sheet As On 31 December 2014-2016: Amount in Millions 2016 2015 2014 V 2016 2015sanameharNessuna valutazione finora

- Financial HighlightsDocumento1 paginaFinancial HighlightsAnushka SinhaNessuna valutazione finora

- Ratio Analysis of BRAC Bank LTDDocumento20 pagineRatio Analysis of BRAC Bank LTDSABRINA SULTANA100% (1)

- RNK 2017Documento42 pagineRNK 2017M shahjamal QureshiNessuna valutazione finora

- Cash+flow+estimation (14-1759)Documento9 pagineCash+flow+estimation (14-1759)M shahjamal QureshiNessuna valutazione finora

- The Effect of Agricultural Technology On The Speed of DevelopmentDocumento16 pagineThe Effect of Agricultural Technology On The Speed of DevelopmentM shahjamal QureshiNessuna valutazione finora

- Survey Questionnaire: Here Write The Name of You Dependent Variable-Main / The TopicDocumento3 pagineSurvey Questionnaire: Here Write The Name of You Dependent Variable-Main / The TopicM shahjamal QureshiNessuna valutazione finora

- Cash+flow+estimation (14-1759)Documento9 pagineCash+flow+estimation (14-1759)M shahjamal QureshiNessuna valutazione finora

- FM Lab Week 8Documento2 pagineFM Lab Week 8M shahjamal QureshiNessuna valutazione finora

- BIPPDocumento2 pagineBIPPPrince Hadhey VaganzaNessuna valutazione finora

- Attorney Steven N. Malitz Litigation VictoriesDocumento15 pagineAttorney Steven N. Malitz Litigation VictoriesArnstein & Lehr LLPNessuna valutazione finora

- Court Appeals: Blic of The Philippines of Tax Quezon CityDocumento34 pagineCourt Appeals: Blic of The Philippines of Tax Quezon CityYna YnaNessuna valutazione finora

- Model RFQ Document For PPP ProjectDocumento67 pagineModel RFQ Document For PPP ProjectVineeth MenonNessuna valutazione finora

- Octis Monthly Newsletter 2015-02 PDFDocumento3 pagineOctis Monthly Newsletter 2015-02 PDFoctisadminNessuna valutazione finora

- Bodie Investments 12e IM CH01Documento4 pagineBodie Investments 12e IM CH01lexon_kbNessuna valutazione finora

- 205B - Company Law and Secretarial Practice-IDocumento21 pagine205B - Company Law and Secretarial Practice-IArchana100% (1)

- Asset Privatization Trust Vs SandiganbayanDocumento13 pagineAsset Privatization Trust Vs Sandiganbayandarts090Nessuna valutazione finora

- BA7062 EXIM Management Unit - I Important Questions: Part-A-MARKS 1. What Is DGFT?Documento5 pagineBA7062 EXIM Management Unit - I Important Questions: Part-A-MARKS 1. What Is DGFT?PranavNessuna valutazione finora

- Lafarge WAPCO GraphsDocumento17 pagineLafarge WAPCO GraphsNike AlabiNessuna valutazione finora

- Ments Questions Corp-LawDocumento7 pagineMents Questions Corp-LawIan Ray PaglinawanNessuna valutazione finora

- Working Capital ManagementDocumento11 pagineWorking Capital ManagementWonde BiruNessuna valutazione finora

- Sample Articles of Incorporation Stock CorpDocumento4 pagineSample Articles of Incorporation Stock CorpDarlon B. SerenioNessuna valutazione finora

- Niveshdaily: From Research DeskDocumento17 pagineNiveshdaily: From Research DeskADNessuna valutazione finora

- Financial SystemDocumento36 pagineFinancial SystemSrikanth BalakrishnanNessuna valutazione finora

- Todd Martin BSC Math Assuris Aug 29, 2016Documento4 pagineTodd Martin BSC Math Assuris Aug 29, 2016Todd MartinNessuna valutazione finora

- Form of Organization:: Special Provision Related To Free Trade ZoneDocumento19 pagineForm of Organization:: Special Provision Related To Free Trade Zonepadum chetryNessuna valutazione finora

- Financial Markets and Institution: Interest Rate and Term Structure of InterestDocumento48 pagineFinancial Markets and Institution: Interest Rate and Term Structure of InterestDavid LeowNessuna valutazione finora

- Accounting MCQ PART 3Documento10 pagineAccounting MCQ PART 3samuelkishNessuna valutazione finora

- BCL Nov06Documento15 pagineBCL Nov06api-3825774Nessuna valutazione finora

- Ratio Analysis - Montex PensDocumento28 pagineRatio Analysis - Montex Penss_sannit2k9Nessuna valutazione finora

- WTM/SR/CIS/WRO-ILO/ 45 / 03/2015: Page 1 of 16Documento16 pagineWTM/SR/CIS/WRO-ILO/ 45 / 03/2015: Page 1 of 16Shyam SunderNessuna valutazione finora

- Chapter 8 HomeworkDocumento4 pagineChapter 8 HomeworkJones RamosNessuna valutazione finora

- Pay For Performance 1Documento18 paginePay For Performance 1Sulaman SadiqNessuna valutazione finora

- UBL Balance Sheet AnalysisDocumento4 pagineUBL Balance Sheet AnalysisTahira KhanNessuna valutazione finora

- Central Banking and Financial RegulationsDocumento9 pagineCentral Banking and Financial RegulationsHasibul IslamNessuna valutazione finora