Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tax - CA Vs ALGUE

Caricato da

sujeeTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Tax - CA Vs ALGUE

Caricato da

sujeeCopyright:

Formati disponibili

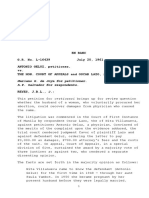

CIR vs. ALGUE, INC.

, and THE CTA SC agrees with CTA that the amount of the promotional fees was not

GR No. L-28896 February 17, 1988 excessive. The total commission paid by the Philippine Sugar Estate to the Algue

was P125,000.00. After deducting the said promotional fee, Algue still had a

balance of P50,000.00 as clear profit from the transaction. The amount of

Petitioner/s : COMMISSIONER OF INTERNAL P75,000.00 was 60% of the total commission. This was a reasonable proportion

Respondent/s : ALGUE, INC., and COURT OF TAX APPEALS which is in accord with the Sec 30 of the Tax Code which provides that “all the

Ponente: Cruz, J ordinary and necessary expenses paid or incurred during the taxable year in

carrying on any trade or business, including a reasonable allowance for salaries

DOCTRINE: or other compensation for personal services actually rendered are tax

Taxes are the lifeblood of the government but such collection should deductible.”and Revenue Regulations No. 2, Section 70 (1), which provides the

be made in accordance with law as any arbitrariness will negate the very test of deductibility in the case of compensation payments which should be

reason for government itself. It is therefore necessary to reconcile the reasonable and are, in fact, payments purely for service.

apparently conflicting interests of the authorities and the taxpayers so that the Algue has proved that the payment of the fees was necessary and

real purpose of taxation, which is the promotion of the common good, may be reasonable in the light of the efforts exerted by the payees in inducing investors

achieved. and prominent businessmen to venture in an experimental enterprise and

involve themselves in a new business requiring millions of pesos. This was no

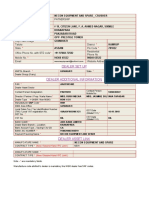

APPLICABLE LAWS: Revenue Regulations No. 2, Section 70 (1), Sec 30 Tax Code mean feat and should be, as it was, sufficiently recompensed.

It is said that taxes are what we pay for civilization society. Without

FACTS : taxes, the government would be paralyzed for lack of the motive power to

1. Algue Inc, a domestic corporation earned a commission of P126k for its activate and operate it. Hence, despite the natural reluctance to surrender

work in the creation of the Vegetable Oil Investment Corporation of the part of one's hard earned income to the taxing authorities, every person who is

Philippines and its subsequent purchase of the properties of the able to must contribute his share in the running of the government. The

Philippine Sugar Estate Development Company. government for its part, is expected to respond in the form of tangible and

2. P75k was declared by Algue Inc. as a tax deduction in the form of intangible benefits intended to improve the lives of the people and enhance

promotional fees. their moral and material values. This symbiotic relationship is the rationale of

3. Such fee was disallowed by BIR and later on issued a Delinquency letter taxation and should dispel the erroneous notion that it is an arbitrary method of

to Algue Inc. exaction by those in the seat of power.

4. Algue Inc. flied a letter of protest or request for reconsideration, SC held that the claimed deduction by the private respondent was

5. BIR did not take any action. permitted under the Internal Revenue Code and should therefore not have

6. Algue Inc. appealed with CTA been disallowed by the petitioner.

RULING OF THE LOWER COURTS: CONCLUSION: CTA Decision Affirmed.

CTA – ruled in favor of Algue Inc

CONTENTIONS OF CIR:

The claimed deduction of P75,000.00 was properly disallowed because

it was not an ordinary reasonable or necessary business expense. The petitioner

also claims that these payments are fictitious because most of the payees are

members of the same family in control of Algue. It is argued that no indication

was made as to how such payments were made, whether by check or in cash,

and there is not enough substantiation of such payments

ISSUE:

Whether or not the Collector of Internal Revenue correctly disallowed

the P75,000.00 deduction claimed by private respondent Algue as legitimate

business expenses in its income tax returns

RULING + RATIO:

Potrebbero piacerti anche

- Property ReviewerDocumento4 pagineProperty ReviewerM Grazielle EgeniasNessuna valutazione finora

- Boon or BaneDocumento5 pagineBoon or BanesujeeNessuna valutazione finora

- Transportation Law Bar QuestionsDocumento2 pagineTransportation Law Bar QuestionsLen Sor Lu100% (8)

- DDHJSKSHFHDDocumento307 pagineDDHJSKSHFHDCates TorresNessuna valutazione finora

- European Food Safety Authority FrameworkDocumento3 pagineEuropean Food Safety Authority FrameworksujeeNessuna valutazione finora

- Precuiationary PrinciopleDocumento3 paginePrecuiationary PrincioplesujeeNessuna valutazione finora

- Landmark JurisprudenceDocumento8 pagineLandmark JurisprudencesujeeNessuna valutazione finora

- Joint Department Circular NoDocumento4 pagineJoint Department Circular NosujeeNessuna valutazione finora

- Golden RiceDocumento2 pagineGolden RicesujeeNessuna valutazione finora

- Golden RiceDocumento2 pagineGolden RicesujeeNessuna valutazione finora

- Precuiationary PrinciopleDocumento3 paginePrecuiationary PrincioplesujeeNessuna valutazione finora

- Precuationary 2Documento2 paginePrecuationary 2sujeeNessuna valutazione finora

- Precuationary 2Documento2 paginePrecuationary 2sujeeNessuna valutazione finora

- Precuiationary PrinciopleDocumento3 paginePrecuiationary PrincioplesujeeNessuna valutazione finora

- Civil Service CasesDocumento38 pagineCivil Service CasessujeeNessuna valutazione finora

- Book Mark Final For Print ShortDocumento1 paginaBook Mark Final For Print ShortsujeeNessuna valutazione finora

- MONDENO Vs SILVOSADocumento1 paginaMONDENO Vs SILVOSAsujeeNessuna valutazione finora

- SigsnDocumento12 pagineSigsnsujeeNessuna valutazione finora

- Sunga V de GuzmanDocumento1 paginaSunga V de GuzmanLoisse VitugNessuna valutazione finora

- Labor Relations Finals ReviewerDocumento6 pagineLabor Relations Finals ReviewersujeeNessuna valutazione finora

- Nacoco Vs BacaDocumento21 pagineNacoco Vs BacasujeeNessuna valutazione finora

- Name of Feature Status Maritime EntitlementDocumento1 paginaName of Feature Status Maritime EntitlementsujeeNessuna valutazione finora

- Admin Law CasesDocumento200 pagineAdmin Law CasessujeeNessuna valutazione finora

- ToyotaDocumento3 pagineToyotasujeeNessuna valutazione finora

- The Issue: Chanroblesvirtuallaw Lib RaryDocumento3 pagineThe Issue: Chanroblesvirtuallaw Lib RarysujeeNessuna valutazione finora

- Crux Vs YoungDocumento34 pagineCrux Vs YoungsujeeNessuna valutazione finora

- Manual WritingDocumento11 pagineManual WritingsujeeNessuna valutazione finora

- Vios Receipt EditedDocumento2 pagineVios Receipt EditedsujeeNessuna valutazione finora

- WHEREFORE, Premises Considered, Judgment Is Rendered Confirming The Title of The Applicant RemmanDocumento3 pagineWHEREFORE, Premises Considered, Judgment Is Rendered Confirming The Title of The Applicant RemmansujeeNessuna valutazione finora

- Tax 1 CasesDocumento34 pagineTax 1 CasessujeeNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Crusades-Worksheet 2014Documento2 pagineCrusades-Worksheet 2014api-263356428Nessuna valutazione finora

- Start Up India AbstractDocumento5 pagineStart Up India Abstractabhaybittu100% (1)

- En Banc G.R. No. L-16439 July 20, 1961 ANTONIO GELUZ, Petitioner, vs. The Hon. Court of Appeals and Oscar Lazo, RespondentsDocumento6 pagineEn Banc G.R. No. L-16439 July 20, 1961 ANTONIO GELUZ, Petitioner, vs. The Hon. Court of Appeals and Oscar Lazo, Respondentsdoc dacuscosNessuna valutazione finora

- Beta Theta Pi InformationDocumento1 paginaBeta Theta Pi Informationzzduble1Nessuna valutazione finora

- 1625718679.non Teaching Applicant ListDocumento213 pagine1625718679.non Teaching Applicant ListMuhammad Farrukh HafeezNessuna valutazione finora

- Báo Cáo Nghiên Cứu TMĐTDocumento66 pagineBáo Cáo Nghiên Cứu TMĐTAn NguyenNessuna valutazione finora

- BeerVM11e PPT Ch11Documento92 pagineBeerVM11e PPT Ch11brayanNessuna valutazione finora

- CHAPTER 12 Partnerships Basic Considerations and FormationsDocumento9 pagineCHAPTER 12 Partnerships Basic Considerations and FormationsGabrielle Joshebed AbaricoNessuna valutazione finora

- International Finance - Questions Exercises 2023Documento5 pagineInternational Finance - Questions Exercises 2023quynhnannieNessuna valutazione finora

- (Complaint Affidavit For Filing of BP 22 Case) Complaint-AffidavitDocumento2 pagine(Complaint Affidavit For Filing of BP 22 Case) Complaint-AffidavitRonnie JimenezNessuna valutazione finora

- Agra SocLeg Bar Q A (2013-1987)Documento17 pagineAgra SocLeg Bar Q A (2013-1987)Hiroshi Carlos100% (1)

- ACTBFAR Unit 2 Partnership Part 3 Partnership Operations Study GuideDocumento3 pagineACTBFAR Unit 2 Partnership Part 3 Partnership Operations Study GuideMatthew Jalem PanaguitonNessuna valutazione finora

- The Criminal Procedure (Identification) Act, 2022 A Constitutional CritiqueDocumento28 pagineThe Criminal Procedure (Identification) Act, 2022 A Constitutional CritiqueArunNessuna valutazione finora

- Assignment Strategic Management 1 - Page 69 Text BookDocumento2 pagineAssignment Strategic Management 1 - Page 69 Text BookRei VikaNessuna valutazione finora

- 1 Dealer AddressDocumento1 pagina1 Dealer AddressguneshwwarNessuna valutazione finora

- Upload 1Documento15 pagineUpload 1Saurabh KumarNessuna valutazione finora

- Additional Material For TX-ZWE 2021 FinalDocumento26 pagineAdditional Material For TX-ZWE 2021 Finalfarai murumbiNessuna valutazione finora

- Application Form For For Testing Labs ISO17025Documento14 pagineApplication Form For For Testing Labs ISO17025PK Jha100% (2)

- AMCTender DocumentDocumento135 pagineAMCTender DocumentsdattaNessuna valutazione finora

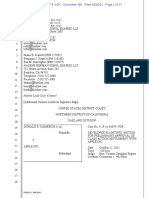

- Cameron, Et Al v. Apple - Proposed SettlementDocumento37 pagineCameron, Et Al v. Apple - Proposed SettlementMikey CampbellNessuna valutazione finora

- Main ProjectDocumento67 pagineMain ProjectJesus RamyaNessuna valutazione finora

- Receivable Financing IllustrationDocumento3 pagineReceivable Financing IllustrationVatchdemonNessuna valutazione finora

- MIH International v. Comfortland MedicalDocumento7 pagineMIH International v. Comfortland MedicalPriorSmartNessuna valutazione finora

- 2018.05.14 Letter To ATT On Their Payments To Trump Attorney Michael CohenDocumento4 pagine2018.05.14 Letter To ATT On Their Payments To Trump Attorney Michael CohenArnessa GarrettNessuna valutazione finora

- Bus Ticket Invoice 1465625515Documento2 pagineBus Ticket Invoice 1465625515Manthan MarvaniyaNessuna valutazione finora

- Avengers - EndgameDocumento3 pagineAvengers - EndgameAjayNessuna valutazione finora

- Appendix 1. Helicopter Data: 1. INTRODUCTION. This Appendix Contains 2. VERIFICATION. The Published InformationDocumento20 pagineAppendix 1. Helicopter Data: 1. INTRODUCTION. This Appendix Contains 2. VERIFICATION. The Published Informationsamirsamira928Nessuna valutazione finora

- Solicitor General LetterDocumento6 pagineSolicitor General LetterFallon FischerNessuna valutazione finora

- Carl Schmitt and Donoso CortésDocumento11 pagineCarl Schmitt and Donoso CortésReginaldo NasserNessuna valutazione finora

- 70ba5 Inventec KRUG14 DIS 0503Documento97 pagine70ba5 Inventec KRUG14 DIS 0503Abubakar Siddiq HolmNessuna valutazione finora