Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Docs RQD For Transfer

Caricato da

pankaj sharma0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

34 visualizzazioni1 paginaCghfgh

Titolo originale

Docs Rqd for Transfer

Copyright

© © All Rights Reserved

Formati disponibili

DOC, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCghfgh

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

34 visualizzazioni1 paginaDocs RQD For Transfer

Caricato da

pankaj sharmaCghfgh

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

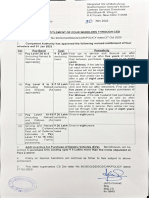

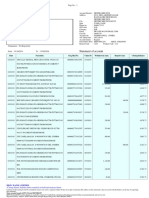

HOME LOAN DOCUMENTS APPLICABLE TO ALL

1. Application duly filled by the borrower

2. 2 photographs of each applicant

3. Proof of identity (pan card / passport / voter id / driving license )

4. Proof of residence (passport, voter’s id, aadhaar)

5. Last sis months bank A/c statements for all bank accounts held by the applicants.

6. Loan a/c statement for the last 1 year if any previous loan exists.

7. Signature identification from present bankers

8. Personal asset liability statement in the bank’s standard format along with supporting.

FOR SALARIED EMPLOYEES

1. Salary slip for the latest three months

2. Copy of Identity card issued by the employer

3. form 16 for the last 2 years

4. Employer certificate / appointment letter / increment letter (duly attested by the employer

COMPLETE CHAIN OF PROPERTY DOCUMENTS plus

In case of TAKE OVER LOAN FROM OTHER BANK

1 Original Sanction letter of Financer, Loan Agreement Letter from the financer

2 A/c statement of the bank/financier for entire tenure of the loan

3 list of original documents held by the financial institution

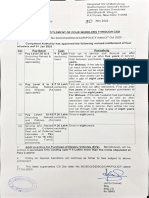

RATE OF INTEREST 9.4% for gents and 9.35% for lady applicant

PROCESSING FEES 0.35% of the Loan amount + 14.5% Service Tax

OTHER CHARGES COLLECTED (for non tie-up cases)

REGION < 50 LACS > 50 LACS > 1 CRORE

DELHI 5400/- + 2600/- 8300/- 18100/-

GURGAON 3800/- + 1800/- 5200/- 8900/-

NOIDA / GZB 3800/- + 1800/- 5600/- 9700/-

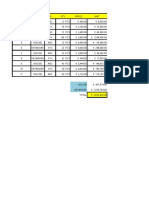

EMI AS BELOW

@9.35% @9.4%

MONTHS

Women Gents

120 1286 1289

132 1215 1218

144 1158 1161

156 1110 1113

168 1069 1072

180 1035 1038

192 1006 1009

204 980 984

216 958 962

228 939 942

240 922 926

300 863 867

360 829 834

For any assistance please contact

A M Kumar,

SBI – Region I,

Parliament Street,

New Delhi – 110 001,

Phone : 9873035343

Potrebbero piacerti anche

- Income Tax Chart 2016-17Documento1 paginaIncome Tax Chart 2016-17Basavaraju K R100% (1)

- File 3Documento3 pagineFile 3Ivan GrahamNessuna valutazione finora

- CCBA Exam: Questions & Answers (Demo Version - Limited Content)Documento11 pagineCCBA Exam: Questions & Answers (Demo Version - Limited Content)begisep202Nessuna valutazione finora

- TroubleshootingDocumento39 pagineTroubleshootingTrí NguyễnNessuna valutazione finora

- Authenticating Digital EvidenceDocumento36 pagineAuthenticating Digital Evidenceatty_gie3743Nessuna valutazione finora

- Risk Assessment Instruments To Predict Recidivism of Sex Offenders: Practices in Washington StateDocumento12 pagineRisk Assessment Instruments To Predict Recidivism of Sex Offenders: Practices in Washington StateWashington State Institute for Public PolicyNessuna valutazione finora

- DOM - Instrument Calibration and MaintenanceDocumento6 pagineDOM - Instrument Calibration and Maintenancepankaj sharmaNessuna valutazione finora

- DOM - Instrument Calibration and MaintenanceDocumento6 pagineDOM - Instrument Calibration and Maintenancepankaj sharmaNessuna valutazione finora

- Function Blocks Overview CENTUM VP PDFDocumento286 pagineFunction Blocks Overview CENTUM VP PDFrameshNessuna valutazione finora

- Material Safety Data SheetDocumento5 pagineMaterial Safety Data SheetAndrews N. Mathew100% (1)

- Account DetalsDocumento1 paginaAccount DetalsAbhishek J TNessuna valutazione finora

- PTEG Spoken OfficialSampleTest L5 17mar11Documento8 paginePTEG Spoken OfficialSampleTest L5 17mar11Katia LeliakhNessuna valutazione finora

- Aui2601 Exam Pack 2016 1Documento57 pagineAui2601 Exam Pack 2016 1ricara alexia moodleyNessuna valutazione finora

- DS WhitePaper Troubleshooting 3DEXPERIENCE ABEND SituationsDocumento26 pagineDS WhitePaper Troubleshooting 3DEXPERIENCE ABEND SituationsSam AntonyNessuna valutazione finora

- CHAPTER I KyleDocumento13 pagineCHAPTER I KyleCresiel Pontijon100% (1)

- Sap QM TutorialDocumento55 pagineSap QM TutorialRaja100% (1)

- Sap QM TutorialDocumento55 pagineSap QM TutorialRaja100% (1)

- March 20 Oct 20 PDFDocumento40 pagineMarch 20 Oct 20 PDFMalik MuzafferNessuna valutazione finora

- Branding ChallengeDocumento6 pagineBranding Challengejainipun19880% (1)

- (Walter Podolny, JR., John B. Scalzi) Construction PDFDocumento354 pagine(Walter Podolny, JR., John B. Scalzi) Construction PDFJuan Carlos CastroNessuna valutazione finora

- Retail Invoice: Iworld Business Soluon PV T. LTDDocumento3 pagineRetail Invoice: Iworld Business Soluon PV T. LTDВиктор РакушкинNessuna valutazione finora

- Maintenance Schedule For Gas Genset - GE JENBACHERDocumento5 pagineMaintenance Schedule For Gas Genset - GE JENBACHERrajputashi92% (12)

- Diet Agra Ii List Ur F Si 14820 PDFDocumento297 pagineDiet Agra Ii List Ur F Si 14820 PDFAmanda WilsonNessuna valutazione finora

- GroupsDocumento2 pagineGroupsrahultelanganaNessuna valutazione finora

- Group I ResultsDocumento3 pagineGroup I Resultsnavn76Nessuna valutazione finora

- Price List - Aura 01-12-2023Documento1 paginaPrice List - Aura 01-12-2023avantikagaikwad857Nessuna valutazione finora

- All Prime Grades Locational Adjustment Depot Credit PriceDocumento3 pagineAll Prime Grades Locational Adjustment Depot Credit PriceRaj JainNessuna valutazione finora

- DHA Quetta Smart City: Usman ImtiazDocumento2 pagineDHA Quetta Smart City: Usman ImtiazUsman ImtiazNessuna valutazione finora

- Quotation To: MR Kobi Address: Kasoa Ghana Currency: GH TEL: 0577553286 Marketing Executives: Patience Customer Ref: R/A/C/D 0481Documento5 pagineQuotation To: MR Kobi Address: Kasoa Ghana Currency: GH TEL: 0577553286 Marketing Executives: Patience Customer Ref: R/A/C/D 0481Kobby OwusuNessuna valutazione finora

- Metalpatti PricelistDocumento2 pagineMetalpatti PricelistJitendra JainNessuna valutazione finora

- ChitDocumento9 pagineChitprashanthNessuna valutazione finora

- QT ValleyDocumento1 paginaQT Valleymesin katakNessuna valutazione finora

- 87th Draw Rs.750Documento4 pagine87th Draw Rs.750awan446600Nessuna valutazione finora

- 4472 - Team Up General Trading - 30.03.2016 PDFDocumento2 pagine4472 - Team Up General Trading - 30.03.2016 PDFfekaduNessuna valutazione finora

- 21164price PP Jam Grades - 1.4.18Documento1 pagina21164price PP Jam Grades - 1.4.18dharmendrasinh zalaNessuna valutazione finora

- KGB N WorldDocumento6 pagineKGB N WorldSanjayNessuna valutazione finora

- Sarvar Khan BillDocumento1 paginaSarvar Khan BillRAM KRIPA AGENCIESNessuna valutazione finora

- Jan CSD Car Price List With BH RegDocumento18 pagineJan CSD Car Price List With BH Reggochristo5658Nessuna valutazione finora

- UntitledDocumento18 pagineUntitledVed Prakash PantNessuna valutazione finora

- Biznext Agent Proposal 2020-NewDocumento10 pagineBiznext Agent Proposal 2020-NewWilson ThomasNessuna valutazione finora

- DWC Price List (Is16098)Documento1 paginaDWC Price List (Is16098)ranjeet.globalgreenNessuna valutazione finora

- ML110120Documento1 paginaML110120utpal sahaNessuna valutazione finora

- PL LGS 339-19Documento2 paginePL LGS 339-19Ashfaque HussainNessuna valutazione finora

- PL LGS 339-19Documento2 paginePL LGS 339-19Ashfaque HussainNessuna valutazione finora

- 11Documento60 pagine11San JayNessuna valutazione finora

- DL110320Documento1 paginaDL110320Aman RaiNessuna valutazione finora

- Nomor Nama Siswa L/P Urut Nisn / NisDocumento5 pagineNomor Nama Siswa L/P Urut Nisn / NisNgatmanNessuna valutazione finora

- Daily Visit ReportDocumento3 pagineDaily Visit ReportharishgnrNessuna valutazione finora

- Noti PDFDocumento499 pagineNoti PDFVvggyy UuhhjjNessuna valutazione finora

- 30 SepDocumento13 pagine30 SepSanjay KumarNessuna valutazione finora

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento11 pagineStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancePraveen KumarNessuna valutazione finora

- May CSD Car Price List With DL RegDocumento17 pagineMay CSD Car Price List With DL RegkhajaNessuna valutazione finora

- AAI Results and Provisionally Selected Candidated 2018Documento1 paginaAAI Results and Provisionally Selected Candidated 2018KshitijaNessuna valutazione finora

- Ja (FS)Documento1 paginaJa (FS)TopRankersNessuna valutazione finora

- Payment ReceiptDocumento1 paginaPayment ReceiptAdelina MwageniNessuna valutazione finora

- Payment ReceiptDocumento1 paginaPayment ReceiptAdelina MwageniNessuna valutazione finora

- 1st Prize 51 Lakhs/-: Incentive For Sikkim Baisakhi BumperDocumento1 pagina1st Prize 51 Lakhs/-: Incentive For Sikkim Baisakhi BumperSagarika SomNessuna valutazione finora

- Sales Confirmation: Alpha Trading S.P.A. Compagnie Tunisienne de NavigationDocumento1 paginaSales Confirmation: Alpha Trading S.P.A. Compagnie Tunisienne de NavigationimedNessuna valutazione finora

- Latestnews L070o5i203dz1vxb 1597820690 PDFDocumento1 paginaLatestnews L070o5i203dz1vxb 1597820690 PDFJyotirmoy SenguptaNessuna valutazione finora

- Credit Card Service and Price Guide: (Prices Are Exclusive of VAT)Documento2 pagineCredit Card Service and Price Guide: (Prices Are Exclusive of VAT)Jismin JosephNessuna valutazione finora

- Commission List 2022 PDFDocumento23 pagineCommission List 2022 PDFVishal Singh Chauhan Dogma SoftNessuna valutazione finora

- Elecon Single Roll Crusher CatalogueDocumento4 pagineElecon Single Roll Crusher Cataloguegunawansigi36Nessuna valutazione finora

- Dscaff Airman PDS-185, SDG-300 Sales QuoDocumento2 pagineDscaff Airman PDS-185, SDG-300 Sales Quojulian rameshNessuna valutazione finora

- Name: Goutam Mandal Roll No: 1916034 PGPEM-2019 Assignment-IIDocumento11 pagineName: Goutam Mandal Roll No: 1916034 PGPEM-2019 Assignment-IIGoutam MandalNessuna valutazione finora

- SL No. Policy Number TR Code End/Ren/Dec/Clm Year End/Ren/Dec/Clm Number A/C Particulars A/C Head (General Ledger) Credit Amount Debit Amount Amount ReceivedDocumento2 pagineSL No. Policy Number TR Code End/Ren/Dec/Clm Year End/Ren/Dec/Clm Number A/C Particulars A/C Head (General Ledger) Credit Amount Debit Amount Amount Receivedsandeep KalraNessuna valutazione finora

- SL No. Broker Branch Customer Name Saiba Control No. Last Year Control NumberDocumento8 pagineSL No. Broker Branch Customer Name Saiba Control No. Last Year Control NumberArkodip NeogiNessuna valutazione finora

- Data 8000Documento3.507 pagineData 8000Savan AnvekarNessuna valutazione finora

- GUVIDocumento1 paginaGUVIadminNessuna valutazione finora

- Agustus SeptemberDocumento2 pagineAgustus SeptemberRinto FahleviNessuna valutazione finora

- Gujarat Public Service Commission: Provisional Result (Addendum)Documento4 pagineGujarat Public Service Commission: Provisional Result (Addendum)Malay ManiyarNessuna valutazione finora

- District E-Governance Society (Jodhpur) : Receipt No: 18143876733 Receipt Date/Time: 20/09/2018 18:23:34Documento1 paginaDistrict E-Governance Society (Jodhpur) : Receipt No: 18143876733 Receipt Date/Time: 20/09/2018 18:23:34Bhoor Singh RathoreNessuna valutazione finora

- March ZebuDocumento15 pagineMarch ZebuTHIRUNAVUKKARASU ENessuna valutazione finora

- Sadasivam P - (NIA2D6481840) : The New India Assurance Co. Ltd. (Government of India Undertaking)Documento2 pagineSadasivam P - (NIA2D6481840) : The New India Assurance Co. Ltd. (Government of India Undertaking)muruguandcoNessuna valutazione finora

- Brave (1) - 230708 - 181014Documento3 pagineBrave (1) - 230708 - 181014AattakaariNessuna valutazione finora

- British Commercial Computer Digest: Pergamon Computer Data SeriesDa EverandBritish Commercial Computer Digest: Pergamon Computer Data SeriesNessuna valutazione finora

- BR pcs7 2013 en PDFDocumento96 pagineBR pcs7 2013 en PDFRavivarman ThirunavukkarasuNessuna valutazione finora

- CV AnnuRawat APCDocumento4 pagineCV AnnuRawat APCAnnuRawatNessuna valutazione finora

- CVDocumento3 pagineCVpankaj sharmaNessuna valutazione finora

- CVDocumento3 pagineCVpankaj sharmaNessuna valutazione finora

- Instrumentation PankajDocumento3 pagineInstrumentation Pankajpankaj sharma100% (1)

- Instrument CVDocumento25 pagineInstrument CVpankaj sharmaNessuna valutazione finora

- Success-Story QZ 5-2002 MH enDocumento2 pagineSuccess-Story QZ 5-2002 MH enpankaj sharmaNessuna valutazione finora

- 2 Loadcell CablingDocumento8 pagine2 Loadcell CablingTong Van NgocNessuna valutazione finora

- Comprehensive Maintenance Plan 052005Documento39 pagineComprehensive Maintenance Plan 052005Feroz GullNessuna valutazione finora

- Device DVC6200P PDFDocumento148 pagineDevice DVC6200P PDFDilip DubeyNessuna valutazione finora

- Ref Ohsas 18001Documento7 pagineRef Ohsas 18001norliyatiNessuna valutazione finora

- (01 - 16 MK) Insprction and Mainteance Instruments PDFDocumento6 pagine(01 - 16 MK) Insprction and Mainteance Instruments PDFNambi RajanNessuna valutazione finora

- Success-Story QZ 5-2002 MH enDocumento2 pagineSuccess-Story QZ 5-2002 MH enpankaj sharmaNessuna valutazione finora

- GS33K05D10 50e PDFDocumento16 pagineGS33K05D10 50e PDFpankaj sharmaNessuna valutazione finora

- Oil and Gas Abbreviator PDFDocumento666 pagineOil and Gas Abbreviator PDFpankaj sharmaNessuna valutazione finora

- US Plugins Acrobat en Motion Support Processing h244 HydrAcidDocumento1 paginaUS Plugins Acrobat en Motion Support Processing h244 HydrAcidpriyasha123Nessuna valutazione finora

- FP3W04Documento9 pagineFP3W04pankaj sharmaNessuna valutazione finora

- Instrumentation and Control Technician: National Occupational AnalysisDocumento133 pagineInstrumentation and Control Technician: National Occupational Analysispankaj sharmaNessuna valutazione finora

- GS33K05D10 50e PDFDocumento16 pagineGS33K05D10 50e PDFpankaj sharmaNessuna valutazione finora

- 16 e Doc Rec 2008Documento56 pagine16 e Doc Rec 2008meddou100% (1)

- Instrumentation PankajDocumento3 pagineInstrumentation Pankajpankaj sharma100% (1)

- Annual Presentation 18 19 EILDocumento41 pagineAnnual Presentation 18 19 EILPartha Pratim GhoshNessuna valutazione finora

- English Examination 1-Bdsi-XiDocumento1 paginaEnglish Examination 1-Bdsi-XiHarsuni Winarti100% (1)

- Comparison of Offline and Online Partial Discharge For Large Mot PDFDocumento4 pagineComparison of Offline and Online Partial Discharge For Large Mot PDFcubarturNessuna valutazione finora

- Provable Security - 8th International Conference, ProvSec 2014Documento364 pagineProvable Security - 8th International Conference, ProvSec 2014alahbarNessuna valutazione finora

- Jharkhand August 2014Documento61 pagineJharkhand August 2014Ron 61Nessuna valutazione finora

- Digital Economy 1Documento11 pagineDigital Economy 1Khizer SikanderNessuna valutazione finora

- User Manual - Wellwash ACDocumento99 pagineUser Manual - Wellwash ACAlexandrNessuna valutazione finora

- SrsDocumento7 pagineSrsRahul Malhotra50% (2)

- Luigi Cherubini Requiem in C MinorDocumento8 pagineLuigi Cherubini Requiem in C MinorBen RutjesNessuna valutazione finora

- Acc 13 Februari 23 PagiDocumento19 pagineAcc 13 Februari 23 PagisimbahNessuna valutazione finora

- Urban LifestyleDocumento27 pagineUrban LifestyleNindy AslindaNessuna valutazione finora

- Eat Something DifferentDocumento3 pagineEat Something Differentsrajendr200100% (1)

- International Beach Soccer Cup Bali 2023 October 4-7 - Ver 15-3-2023 - Sponsor UPDATED PDFDocumento23 pagineInternational Beach Soccer Cup Bali 2023 October 4-7 - Ver 15-3-2023 - Sponsor UPDATED PDFPrincess Jasmine100% (1)

- Control Flow, Arrays - DocDocumento34 pagineControl Flow, Arrays - DocHARIBABU N SEC 2020Nessuna valutazione finora

- LLB IV Sem GST Unit I Levy and Collection Tax by DR Nisha SharmaDocumento7 pagineLLB IV Sem GST Unit I Levy and Collection Tax by DR Nisha Sharmad. CNessuna valutazione finora

- 127 Bba-204Documento3 pagine127 Bba-204Ghanshyam SharmaNessuna valutazione finora

- CP AssignmentDocumento5 pagineCP AssignmentMSSM EngineeringNessuna valutazione finora

- Yusuf Mahmood CVDocumento3 pagineYusuf Mahmood CVapi-527941238Nessuna valutazione finora

- Role of Quick Response To Supply ChainDocumento15 pagineRole of Quick Response To Supply ChainSanuwar RashidNessuna valutazione finora

- Transportation Engineering Unit I Part I CTLPDocumento60 pagineTransportation Engineering Unit I Part I CTLPMadhu Ane NenuNessuna valutazione finora

- Revised Study Material - Economics ChandigarhDocumento159 pagineRevised Study Material - Economics ChandigarhvishaljalanNessuna valutazione finora

- Unknown 31Documento40 pagineUnknown 31Tina TinaNessuna valutazione finora

- CAKUTDocumento50 pagineCAKUTsantosh subediNessuna valutazione finora