Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Money Times Dec5

Caricato da

Rajesh KumarCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Money Times Dec5

Caricato da

Rajesh KumarCopyright:

Formati disponibili

Caution: Please note that your copy/access to our website is for your exclusive use only.

Any attempt to share your access to our website or forwarding your copy to a

non-subscriber will disqualify your membership and we will be compelled to stop your supply and forfeit your subscription thereafter without any refund to you.

T I M E S

A TIME COMMUNICATIONS PUBLICATION

VOL XXVII No.9 Monday, 1 – 7 January 2018 Pgs.22 Rs.20

Market ends the year near historic Money Times to cost Rs.20 per week

highs From this issue, Money Times Weekly will be priced

at Rs.20 per copy and the subscription rates are

By Sanjay R. Bhatia revised as follows:

The overall market trend remained tepid last week with action 1 year: Rs.1000; 2 years: Rs.1900; 3 years: Rs.2700

mainly in small-cap and mid-cap stocks. The FIIs turned net

buyers in the cash and derivatives segment after a long time. The DIs, however, were seen booking profits and remained

net sellers during the week. The breadth of the market remained positive amidst high volumes indicating selling

pressure in mainline stocks. Crude oil prices rose on the back of an unexpected fall in US production as well as a fall in

commercial crude inventories, which in turned stoked buying support.

Technically, the prevailing positive technical conditions helped

the markets make fresh historic highs. The MACD, RSI and KST Believe it or not!

are all placed above their respective averages on the daily and

Nahar Capital & Financial Services

weekly charts. The Stochastic is placed above its average on the

recommended at Rs.153.95 in TF last week,

weekly chart. Moreover, the Nifty is placed above its 50-day

SMA, 100-day SMA and 200-day SMA. The Nifty’s 50-day SMA is

hit a high of Rs.227 fetching 47% returns in

placed above its 100-day and 200-day SMA, its 100-day SMA is just 1 week!

placed above its 200-day SMA indicating a ‘golden cross’ Avonmore Capital & Management

breakout. These positive technical conditions could lead to Services recommended at Rs.35.55 in EE

follow-up buying support. last week, hit a high of Rs.51.10 fetching

The prevailing negative technical conditions, however, still hold

44% returns in just 1 week!

good and are likely to weigh on the market sentiment at the Kamadgiri Fashion recommended at

higher levels. The Stochastic is placed below its average on the Rs.133.50 in TF last week, hit a high of

daily chart and in the overbought zone on the weekly chart, Rs.188 fetching 41% returns in just 1 week!

which could lead to regular bouts of profit-booking and selling Omax Autos recommended at Rs.85.80 in

pressure, especially at the higher levels. TT last week, hit a high of Rs.107.20

The -DI is placed above the +DI line and is already placed above fetching 25% returns in just 1 week!

the ADX line. Further, it is placed above the 25 level. But it has Veer Healthcare recommended at Rs.16.06

come off its recent highs, which indicates that the sellers are in TT last week, hit a high of Rs.19.98

covering shorts regularly. However, the ADX line continues to fetching 24% returns in just 1 week!

languish below 16, which indicates that the current trend lacks

strength and the markets are likely to remain volatile and (EE – Expert Eye; TF – Techno Funda; TT – Tower Talk)

choppy. This happens only in

The market sentiment remains cautiously positive ahead of the Money Times!

start of the New Year. The Nifty too has touched a fresh historic

high and closed the year around it, which augurs well for the

Now in its 27th Year

markets. It is important for follow-up buying support to

A Time Communications Publication 1

materialize at the higher levels. Intermediate bouts of profit-booking and selling pressure are likely to be witnessed at

the higher levels due to overbought conditions.

The forthcoming earnings season is likely to influence the

markets going forward along with the news flow on the

Budget. In the meanwhile, the markets will take cues from the

Parliament session, global markets, Dollar-Rupee exchange

rate and crude oil prices.

Technically, the Sensex faces resistance at the 34500 and

35000 levels and seeks support at the 34000, 33750, 33300,

33000, 32325, 32000, 31610 and 30921 levels. The resistance

levels for the Nifty are placed at 10553, 10575 and 10650

while its support levels are placed at 10495, 10400, 10325,

10270, 10200 and 10120.

BAZAR.COM

2018: A year of socio-political realities

The market tends to spring surprises and 2017 was a year of

Now follow us on Instagram, Facebook &

pleasant surprises. Beginning from the pains of demonetisation

Twitter at moneytimes_1991 on a daily basis

till the early launch of GST, the Indian markets were among the

to get a view of the stock market and the

three emerging markets apart from Hungary and South Korea

happenings which many may not be aware of.

that gained more than 35% in 2017 (in dollar terms). In local

currency terms, the Sensex rose 28% hitting 34000 for the first time. Its market cap surged 46% to $2.29 tn in 2017

thereby making it the eight largest market in the world.

Mid-cap and small-cap stocks outperformed the large-caps for the fourth consecutive year, fetching over 40% returns.

This rally was led by the consumer durables sector, which gained 101%, real estate 91% and metals 42%. Almost 40% of

the BSE 500 stocks gained over 50% during 2017.

Such a rise was never expected at

the beginning of the year, but the

robust domestic liquidity made it The new ratnas at Panchratna!

possible. Domestic inflows at

After the sad demise of Mr. G. S. Roongta on 2nd July 2017, we were at a loss to

Rs.1.15 lakh crore were higher

replace our crown jewel. But so good is our team of analysts that their first

than foreign portfolio investments

(FPIs), which were pegged at Panchratna issue of 1st October has already clocked in results even before the

Rs.48349 crore (much lower than quarter is over. Given below is their maiden score and we are sure this team will

its ten year average of Rs.58910 improve as we go along.

crore). Was demonetisation the

Sr. Date Scrip Name Recom. Highest % Gain

reason behind this or was it the

No. Rate (Rs.) since (Rs.)

prevailing low interest rates? 1 October Williamson Magor & Company 74.5 108.3 45

Well, the answer is obvious. 2017 Goldiam International 77.7 93 20

The question now is how will PTC India Financial Services 37.05 44.1 19

2018 unfold and where will it take Sintex Plastics Technology 90.95 100 10

the market. It is almost a Firstsource Solutions 41.7 45.6 9

unanimous opinion that the th st

current rally is bereft of the

16 Edition of ‘Panchratna’ releasing on 1 January 2018

underlying fundamentals. The So hurry up and book your copy now!

sentiment will bow down to the Subscription Rate: Rs.2500 per quarter; Rs.4000 for two quarters; Rs.7000 per annum.

fundamentals in the New Year. You can contact us on 022-22616970, 22654805 or moneytimes.support@gmail.com

The lower realization of revenues

via GST is a big matter of concern for the government at a time when it is preparing to handle the agrarian crisis and win

over rural India. Faced by the painful situation of revenue shortfall arising out of a continuous slide in tax receipts, the

government decided to begin the New Year with an additional Rs.50000 crore borrowings, a move that could widen the

fiscal deficit to 3.5% from 3.2% estimated earlier. Such a move has already begun to dent the market sentiment and the

A Time Communications Publication 2

pain will be seen further with each passing day. The Union Budget, too, will be aimed at recovering higher revenues from

industries and services to bail out the agriculture segment. The trimming of small savings interest rate by 20 bps is a

step ahead on this painful path.

The government has limited choices in wooing the farmers and all of them are nothing but big ticket dole outs in view of

the ensuing elections in four states and preparing for the general elections in 2019.

Brand ‘Modi’ remains the only consolation for the markets to keep going. The Gujarat election results have proved

beyond doubt that NaMo still commands the attention and the need for continuing good governance and this will give

him the edge. But this time, winning a simple majority on its own may be a tall order but a smooth sail with NDA allies

may be a reality. Will such a coalition keep pace with the current momentum of reforms or will it jeopardize it in the

wake of coalition realities? Will the speed of GDP growth face compulsive bumps by the new political equation? Will the

revenue figures rise in coming months or will the government take strict measures against the traders who are yet to toe

the line of the organised GST set up? Will the Rain God smile again and boost rural consumption? Will the income of

farmers increase? Will inflation be tamed? Will the Parliament pass the bills necessary for growth? Will the narratives of

the next poll speeches be less abusive and more programme and manifesto oriented? Will the government present a

budget to woo the masses both rural and urban? Last but not the least, will the government walk the talk of reducing

corporate taxes? Will the FM play with long-term capital gain exemption and impact the sentiment? Will enough

incentives of development rebate come in to kick start the private sector capex? These are some of the painful realities

which need to be addressed.

The year 2018 will begin with a bitter dose of medicine followed by healing at a distant date. Pray that there is no

unpleasant surprise of a corrective year in the offing and even if there is, let the pain be bearable with proper healing in

the years to follow. Happy 2018 to all our readers!

TRADING ON TECHNICALS

2017 momentum to continue in 2018

By Hitendra Vasudeo

Sensex Daily Trend DRV Weekly Trend WRV Monthly Trend MRV

Last Close 34056 Up 33584 Up 32382 Up 30251

Last week, the Sensex opened at 33980.76, attained a low at 33752.03 and moved to a high of 34137.96 before it closed

the week at 34056.82 and thereby showed a net rise of 116 points on a week-to-week basis.

Daily Chart

The daily chart has critical support at 33752-33707-33600. As long as 33600 is not violated on the daily chart,

consolidation and sideways volatility can eventually lead to a rally for a new high.

Weekly Chart

Last week, the movement was indecisive and therefore, the

trading guide for next week’s directional movement is

outside the band of last week’s high/ low. A spinning top

candle was formed as a result of the movement last week,

which suggests that the directional movement next week

may be outside the high/ low of last week.

If the Sensex sustains above the Monday’s opening and

above 34138, then expect the week to show a positive

movement unless an immediate fall below 33752 is

witnessed.

If the Sensex sustains below the Monday’s opening and

below 33752, then expect the week to show a negative

movement unless post a breakdown below 33752, we see a

rise to record a new high.

A Time Communications Publication 3

Monthly Chart

The month of November 2017 was a doji. December 2017 closed at 34056 with a positive candle above November’s high

of 33865, which indicates a breakout for the month of January 2018. The December month showed a gain of 2.73% over

November 2017.

December 2017 was out bar to the November 2017 movement, which suggests that an upside momentum is likely to be

witnessed with intra-month volatility.

Support range for January 2018 will be 33586-32565 while the higher range will be 34608-36180.

Quarterly Chart

The October–December 2017 quarter showed a 8.86% gain over the July-September 2017 quarter. The July-September

2017 quarter had an inverted hammer and the high of that quarter (32686) was crossed for a breakout.

For the next quarter i.e. January–March 2018, the higher range for the Sensex will be 34983-37680. Support during the

quarter will be at 33211-32285.

Yearly Chart

The year 2017 shows a breakout over the sideways movement doji of the years 2016 and 2015 with their respective

highs as resistance initially. The high recorded in 2015 was 30024 and in 2016 was 29077. The year 2017 ended with a

bullish candle post a breakout above the highs of 2014, 2015 and 2017, which had created a cluster of resistance in the

28822-30024 zone. So, the year 2017 is the breakout year of consolidation between 2015-2016.

The Sensex gained 27.9% in 2017 over the closing of 2016.

The higher range for the year 2018 is 36647-44338. Support during the year when a correction sets in will be at 31547-

28956-26447. On occurrence of any unforseen event, the market may test 31547. In case of a normal movement, the

correction bottom will be higher above 31547.

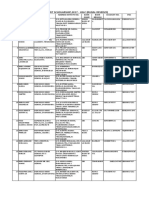

Indices - Upper and Support Range for the year 2018

Min.

Correction

Security Name Dec-17 L1 L2 CP L3 L4 Potential

(%)

Gain (%)

Nifty 50 10531 6507 8926 9739 11344 13763 7.52 7.72

Nifty Bank 25539 12140 20262 23108 28385 36508 9.52 11.14

S&P BSE Sensex 34057 21266 28957 31547 36648 44338 7.37 7.61

S&P BSE Mid-Cap 17822 8095 13937 15894 19779 25622 10.82 10.98

S&P BSE Small-Cap 19231 7268 14452 16857 21636 28820 12.34 12.51

Trend based on Rate of Change (RoC)

The ROC trend is up on all time frames, which suggests that the strength is restored after minor hitches.

Daily chart:

1-Day trend - Up

3-Day trend - Up

8-Day trend - Up

Weekly chart:

1-Week trend - Up

3-Week trend - Up

8-Week trend - Up

Monthly chart:

1-Month trend - Up

3-Month trend - Up

8-Month trend - Up

Quarterly chart:

1-Quarter trend - Up

3-Quarter trend - Up

A Time Communications Publication 4

8-Quarter trend - Up

Yearly

chart:

1-Year trend Releasing on 1st January 2018…

- Up Winners of 2018

3-Year trend 31 stocks set to perform with quarterly review:

- Up Here is the Performance Review of ‘Winners of 2017’

8-Year trend Top performers of Winners of 2017

- Up Sr. Name Closing on Closing on % Gain on High in % Gains

No 30/12/16 22/12/17 Closing 2017 on

BSE Mid- 22/12/17 High 2017

Cap Index 1 Rain Industries 54.90 360.20 556.10 402.65 633.42

Weekly 2 Panama Petrochem 59.03 259.50 339.61 264.00 347.23

chart: 3 KEC International 140.45 375.90 167.64 391.45 178.71

4 Remsons Industries 50.50 122.20 141.98 146.80 190.69

1-Week 5 Gujarat Narmada Valley 213.60 480.30 124.86 548.50 156.79

trend - Up Fertilizers & Chemicals

3-Week 6 Archidply Industries 58.20 120.65 107.30 124.00 113.06

trend - Up 7 Chambal Fertilisers & 71.05 146.50 106.19 157.50 121.67

Chemicals

8-Week 8 Sundram Fasteners 290.50 583.00 100.69 598.00 105.85

trend - Up 9 KNR Constructions 172.75 308.00 78.29 314.25 81.91

A strong 10 Solar Industries India 674.90 1173.00 73.80 1272.80 88.59

rally to 11 Asian Hotels (North) 102.35 176.00 71.96 177.95 73.86

18300- 12 Steel Strips Wheels 617.70 1050.40 70.05 1100.95 78.23

18500 is 13 NBCC (India) 159.38 254.00 59.37 291.30 82.77

likely to be 14 Dwarikesh Sugar Industries 32.06 47.75 48.92 80.40 150.78

15 Hindustan Petroleum 294.35 429.25 45.83 492.80 67.42

witnessed

Corporation

from the 16 Mukand 62.60 88.95 42.09 109.35 74.68

current level 17 Tube Investments of India 584.80 793.20 35.64 862.00 47.40

of 17822. Till 18 RPP Infra Projects 231.45 311.80 34.72 362.75 56.73

16600 is not 19 Procter & Gamble Hygiene 7084.05 9385.00 32.48 9900.00 39.75

violated, any & Health Care

correction 20 Mangalore Refinery & 98.20 128.45 30.80 146.70 49.39

can be used Petrochemicals

an 21 Jain Irrigation Systems 58.40 75.40 29.11 79.25 35.70

22 Bharat Petroleum 423.88 536.50 26.57 551.55 30.12

opportunity

Corporation

to 23 National Aluminium 65.30 82.15 25.80 97.60 49.46

accumulate Company

stocks from 24 Sutlej Textiles & Industries 80.19 97.40 21.47 98.80 23.22

the BSE Mid- 25 Ccl Products (India) 265.45 300.75 13.30 372.00 40.14

Cap index. 26 Balrampur Chini Mills 125.25 139.00 10.98 182.50 45.71

BSE Small- 27 Zydus Wellness 866.15 951.10 9.81 988.00 14.07

28 NTPC 164.75 179.95 9.23 188.00 14.11

Cap Index

29 RPG Life Sciences 480.25 492.00 2.45 536.20 11.65

1-Week 30 J B Chemicals & 351.30 318.40 -9.37 367.95 4.74

trend - Up Pharmaceuticals

3-Week 31 Electrotherm (India) 197.55 176.95 -10.43 308.00 55.91

trend - Up Most of the gains of 2017 were lost in the last quarter due to market conditions.

The average gains are now 5.6% from an average of 29.3% at the highest

8-Week

Rain Industries Ltd stands out with 633.42% gain

trend - Up

A rally to

21300 is For just Rs.6000, book your copy of the 13th edition and welcome the New Year in the

likely to be company of ‘Winners of 2018’!

witnessed For subscription details contact us on 022-22616970 or email us at moneytimes.support@gmail.com

from the

A Time Communications Publication 5

current level of 19230 in the short-to-medium-term.

A deep correction and major weakness could resume only on a fall and weekly close below 17600. A correction may take

place on intra-week basis considering the sharp rise last week.

Strategy for the week

Traders long on the Sensex and Sensex-related stocks may revise up their stop loss to 33700 to lock profits and trading

loss as a deep correction could set in on a fall and close below 33700 on the weekly chart. As long as 32500 is not

violated, short-to-medium-term investors can use a correction to 33364 or below for accumulation.

A sustained breakout on the weekly chart above 34138 can set a rise towards 34600.

For long-term investors, a correction of 7-8% creates an opportunity for investing. Expect the Sensex to attain the 36648

level with volatility in due course of time.

WEEKLY UP TREND STOCKS

Let the price move below Center Point or Level 2 and when it move back above Center Point or Level 2 then buy with whatever low

registered below Center Point or Level 2 as the stop loss. After buying if the price moves to Level 3 or above then look to book profits as

the opportunity arises. If the close is below Weekly Reversal Value then the trend will change from Up Trend to Down Trend. Check on

Friday after 3.pm to confirm weekly reversal of the Up Trend.

Note: SA-Strong Above, DP-Demand Point, SP- Supply Point, SA- Strong Above

Weekly Up

Scrip Last Level Level Center Level Level Relative

Reversal Trend

Close 1 2 Point 3 4 Strength

Value Date

Weak Demand Demand Supply Supply

below point point point point

VAKRANGEE 421 401 401.3 420.7 440.3 479.3 77.7 392.7 13-10-17

GRAPHITE INDIA 710 649 664.7 694.3 739.7 814.7 75 674.3 08-12-17

RADICO KHAITAN 293.35 277 281 289.3 301.7 322.3 74.8 282.4 22-12-17

PC JEWELLER 456.60 438 440.1 454.5 470.9 501.7 71.9 440.1 10-11-17

GVK POWER

INFRASTRUCTURE 18.55 17.4 17.5 18.4 19.4 21.3 71.6 16.9 15-12-17

*Note: Up and Down Trend are based of set of moving averages as reference point to define a trend. Close below

averages is defined as down trend. Close above averages is defined as up trend. Volatility (Up/Down) within Down

Trend can happen/ Volatility (Up/Down) within Up Trend can happen. Relative Strength (RS) is statistical

indicator. Weekly Reversal is the value of the average.

WEEKLY DOWN TREND STOCKS

Let the price move above Center Point or Level 3 and when it move back below Center Point or Level 3 then sell with whatever high

registered above Center Point or Level 3 as the stop loss. After selling if the prices moves to Level 2 or below then look to cover short

positions as the opportunity arises. If the close is above Weekly Reversal Value then the trend will change from Down Trend to Up Trend.

Check on Friday after 3.pm to confirm weekly reversal of the Down Trend.

Note: SA-Strong Above, DP-Demand Point, SP- Supply Point, SA- Strong Above

Weekly Down

Scrip Last Level Level Center Level Level Relative

Reversal Trend

Close 1 2 Point 3 4 Strength

Value Date

Demand Demand Supply Supply Strong

point point point point above

MULTI COMMODITY

EXCHANGE OF INDIA 912.80 843.3 894.7 928.1 946.2 961.5 36.59 952.06 22-12-17

CENTRAL BANK OF INDIA 72.60 67.4 71.2 73.7 75 76.1 41.17 75.65 17-11-17

GODFREY PHILLIPS INDIA 987 947.7 975.7 992.3 1003.7 1009 44.28 993.75 29-12-17

BOMBAY RAYON FASHIONS 124.55 97 117.7 131.5 138.4 145.3 44.71 176.59 22-12-17

COAL INDIA 263 247.4 258.6 265.4 269.8 272.3 45.65 266.20 22-12-17

*Note: Up and Down Trend are based of set of moving averages as reference point to define a trend. Close below

averages is defined as down trend. Close above averages is defined as up trend. Volatility (Up/Down) within Down

Trend can happen/ Volatility (Up/Down) within Up Trend can happen.

A Time Communications Publication 6

EXIT LIST

Note: SA-Strong Above, DP-Demand Point, SP- Supply Point, SA- Strong Above

Scrip Last Close Supply Point Supply Point Supply Point Strong Above Demand Point Monthly RS

MAGMA FINCORP 160.60 163.32 165.55 167.78 175 144.4 51.87

BUY LIST

Note: SA-Strong Above, DP-Demand Point, SP- Supply Point, SA- Strong Above

Scrip Last Close Demand point Demand point Demand Point Weak below Supply Point Monthly RS

JINDAL STEEL & POWER 204.95 188 182.23 176.45 157.75 237 74.83

HINDUSTAN COPPER 100.90 98.30 96.05 93.80 86.50 117.4 71.21

UNITED SPIRITS 3671 3489.27 3428.50 3367.73 3171 4004.3 68.34

STEEL AUTHORITY OF INDIA 92.15 86.46 84.22 81.99 74.75 105.4 67.95

PUNTER PICKS

Note: Positional trade and exit at stop loss or target whichever is earlier. Not an intra-day trade. A delivery based trade for a possible time frame

of 1-7 trading days. Exit at first target or above.

Note: SA-Strong Above, DP-Demand Point, SP- Supply Point, SA- Strong Above, RS- Strength

Weak RS-

Scrip BSE Code Last Close Demand Point Trigger Supply point Supply point

below Strength

LASA SUPERGENICS 540702 179.70 179.10 188.05 167.25 200.9 221.7 77.66

KAYA 539276 955.05 940.25 970.55 922.30 1000.4 1048.6 75.83

JOHNSON CONTROLS-HITACHI AIR

CONDITIONING INDIA 523398 2674 2604 2700 2466 2844.6 3078.6 66.95

GANESH ECOSPHERE 514167 417.15 413 424.30 398.85 440 465.5 62.23

GRINDWEL NORTON 506076 543.05 534.05 549.40 530 561.4 580.8 58.75

VARDHMAN TEXTILES 502986 1368 1323 1399 1314 1451.5 1536.5 51.53

CROMPTON GREAVES CONSUMER

ELECTRICALS 539876 275.60 270.10 278 263.50 287 301.5 50.13

TOWER TALK

Shrimp feed producer Waterbase is set for a big blast. Buy this stock immediately for excellent returns in the next

few days.

Hero Motocorp has hiked prices of its motorbike. A positive for the company.

Reliance Industries has partnered with e-commerce player Myntra to co-brand its denim collection under Mast &

Harbour. Another feather in its cap. Buy.

Tech Mahindra has acquired 22.14% stake in Comviva Technologies for Rs.227 crore. A safe bet.

The government plans to invest another Rs.20 lakh crore to modernise railways. Buy Titagarh Wagons.

Rising volumes at Wockhardt suggest that it is ready to breakout from its current range. Long-term investors will

gain.

Marathon Nextgen Realty is contemplating buying some assets of its group company on slump sale basis. The stock

can be bought on selective basis.

Kolte Patil Developers is raising Rs.600 crore through QIP placements for huge realty development work in Pune.

Buy.

Tiger Logistics (India) aims to double its turnover in the next two years. The management sounded sanguine while

speaking to the media recently. Accumulate.

Crude oil prices are soaring. It would be prudent to buy Selan Exploration Technology. The stock is rangebound

since it is currently in the T2T segment. Do not miss this golden opportunity.

Cineline India has entered into an uncharted territory. The stock is poised to make new highs. Buy immediately.

Necter Lifescience is slowly coming out of the conjunction zone. Its current working is better and rising volumes

suggest a breakout. A good buy.

A Time Communications Publication 7

Jindal Saw is faring extremely well. Accumulate.

Aluminium prices are at a record high. A good time to accumulate National Aluminium Company and Hindalco

Industries.

Reliance Jio may buy the stressed assets of Reliance Communications (RCom). This could delay or stop insolvency

proceedings, but it cannot put RCom into profitability. Stay away.

Larsen & Toubro has obtained construction orders worth ~Rs.1125 crore. Its swelling order book indicates better

times ahead. A good buy for the long-term.

State Bank of India plans to raise Rs.8000 crore via multiple sources primarily to absorb shocks arising out of

financial and economical stress. A positive for the company.

Sun Pharmaceuticals Industries has received USFDA approval for its new drug application. The company is

becoming stronger on the back of multiple approvals. A must buy.

Prestige Estates Projects has purchased 67% stake in its group company - Red Fort India, for Rs.324 crore. A big

positive for this investor-friendly company.

TVS Motor Company is competing with

Bajaj Auto by launching premium bikes in Profitrak Weekly

the international market. A good long-term

bet. A complete guide for Trading and Investments based on Technicals

Tata Steel is seeking $5.1 bn to help Check the sample file Before Subscribing Features a State of Art

refinance debt. A safe bet with better times Technical Product P/E Based Level - Working as Support and

Resistance

ahead.

What you Get?

Bharti Airtel is likely to give Jio a tough

fight by offering free TV content in one of 1) Weekly Market Outlook of -

its apps. A positive for the company. Sensex

Copper prices are again on the rise. Nifty

Accumulate Hindustan Copper. Bank Nifty Features

2) Sectoral Review

After its consumer business, N. Chandra

Outperforming, Market Performing and Under

(Tata's) will consolidate the fragmented Performing

EPC/infra businesses. Artson Engineering Stand Alone Weekly Signal for Up Trend and Down Trend

is a potential multibagger. Stock Wise New Addition and Follow Up Chart Comments

Ramco Industries holds 20% stake (worth Selection Process Based on Multi Time Frame Trend and

~Rs.2500 crore) in Ramco Cements as well RS

as Ramco Systems. Its market cap is 3) Multi Time Frame Yearly Chart

Rs.2500 crore, which means its building Stock Filtration

materials business is available for free. The One Annual In Jan-Dec

stock can easily double from the current From March running Yearly Filtration- March to March

level. 4) Sectoral View of Strong/Weak/Market Perfomer indices

5) Weekly Trading Signals

Holding companies are back in vogue and 6) Stock Views and Updates every week

Tata Investments seems to be the 7) Winners for trading and investing for medium-to-long-term

cheapest from the lot. till March 2018

MTNL’s merger with BSNL will unlock land 8) Winners of 2017 with fresh Weekly Signals on the same

value for MTNL. The stock may see a rally

On Subscription

similar to that of R.Com. Training and usage application of the Product

Tanla Solutions has not participated in the Application of this product can be explained on the Telephone or via

bull run as yet despite its strong Skype or Team Viewer.

fundamentals. It is expected to notch an

For 1 full year with interaction,

EPS of Rs.4-4.5 in FY18 and Rs.5.5 in FY19.

Rush and Subscribe to Profitrak Weekly Comprehensive Product

The stock could rise by 40%. From 2018 Product Price will be Rs.24000/- for 1-Year

Heavy investment buying was reported in If subscribed before 31st December 2017.

Hinduja Global Solutions. It is expected to Get 1 +1 = 2year = Rs.26000/-

For more details, contact Money Times on

notch an EPS of Rs.105 in FY18. A

022-22616970/4805 or moneytimes.support@gmail.com.

reasonable P/E of 12.5x will take its share

price to Rs.1312.

A Time Communications Publication 8

Tata Motors has reported excellent H1FY18 results with an EPS of Rs.16.7. Most analysts expect an EPS of Rs.33-35

for FY18. A reasonable P/E of 17.5x will take its share price to Rs.580 in the medium-term.

B N Rathi Securities recently proposed to merge with B N Rathi Commodities. The stock trades at 8x to

FY19E earnings as against the industry P/E of 45x. The stock may rise by 50% within a year.

An Ahmedabad-based analyst recommends Alpa Laboratories, Cybertech Systems & Software, Maan

Aluminium, Munjal Auto Industries, Phyto Chem (India), Rishabh Digha Steel & Allied Products, Sakthi

Finance, Super Crop Safe and Sunflag Iron Steel Company. From his last week’s recommendations, Alankit

appreciated 21% from Rs.57.75 to Rs.69.70 while Salona Cotspin appreciated 15% from Rs.181.45 to Rs.209.30 in

just 1 week! From his previous recommendations, Kamadgiri Fashion appreciated 58% from Rs.119.20 to Rs.188

while Cosco (India) appreciated 39% from Rs.319.10 to Rs.442.9 in just 2 weeks!

BEST BET

Best Bet

HIL Ltd

(BSE Code: 509675) (CMP: Rs.1496.10) (FV: Rs.10)

By Amit Kumar Gupta

Incorporated in 1946, HIL Ltd (Hyderabad Industries Ltd) is the flagship company of the CK Birla group and a market

leader in the building products segment having led the cement industry for over five decades. It is a multi-product,

multi-location organization with a network of branches,

depots, stockists and personnel across India.

For the busy investor

HIL is a market leader in roofing and it derived ~70% of

its FY17 revenue from this segment. It sells fibre cement Fresh One Up Trend Daily

and steel roofing sheets. Aerocon, its building solutions Fresh One Up Trend Daily is for investors/traders who are

brand, offers AAC blocks, boards and panels, pipes and keen to focus and gain from a single stock every

fitting. AAC blocks offer effective and practical solutions trading day.

for current building regulations and are manufactured

using the latest technologies. Boards and panels are used With just one daily recommendation selected from

for building partitions, pre-fabricated structures and stocks in an uptrend, you can now book profit the same

mezzanine floors. It offers CPVC and UPVC pipes and day or carry over the trade if the target is not met. Our

fittings, which are more eco-friendly products. review over the next 4 days will provide new exit levels

HIL’s wide distribution network reduces its dependence while the stock is still in an uptrend.

on a few states. Fibre cement sheets are largely used in This low risk, high return product is available for online

the rural areas and hence, depend on the monsoon to a subscription at Rs.2500 per month.

great extent. HIL’s presence in multiple states diversifies

Contact us on 022-22616970 or email us at

this risk. It also reduces seasonality in sales since there

are two distinct seasons for rains in different parts of moneytimes.suppport@gmail.com for a free trial.

India.

The fibre cement roofing sheets segment is a cash cow for HIL. It launched ‘colored steel sheets’ in 2016, which reported

revenues of Rs.72 crore in FY17. We expect colored steel sheets to register a CAGR of 19% over FY17-FY20. The

management plans to launch a new product in FY18 in this segment to boost its profitability. It also plans to enhance

capacity in the pipes and fittings segment to 20,000 MT from 7,555 MT currently, which will lead to strong revenue

growth going forward. We expect the pipes and fittings segment to grow at 62% CAGR over FY17-FY20.

We expect AAC blocks, boards and panels businesses to grow at 12% Valuations:

and 38% respectively over FY17-20 as we expect increased

Particulars FY17 FY18E FY19E FY20E

acceptance of these lower costing, faster to install products within

P/E 19.1 18.3 12.8 10.5

the builder community.

P/BV 0.9 1.6 1.4 1.5

We expect CAGR growth in revenues/EBITDA/PAT of

EV/Sales 0.6 1 0.8 0.7

12%/21%/22% over FY17-20. ROE and ROCE are expected to grow

EV/EBITDA 5.9 8.5 6 5.1

by 350 bps to 14.9% and by 480 bps to 18.3% respectively. The key

reason for margin expansion is growth prospects in the pipes and ROE (%) 11% 11% 15% 17%

fittings segment due to capacity expansion and higher contribution ROCE (%) 13% 17% 18% 24%

A Time Communications Publication 9

from blocks, boards and panels.

Technical Outlook: The HIL stock looks very good on the daily chart for medium-term investment. It has formed a

rounding pattern while making a higher high and higher low on the daily chart with a strong uptrend. Every correction

in its share price has been bought out at lower levels. The stock trades above the important DMA level on the daily chart.

Start accumulating at this level of Rs.1496.10 and on dips to Rs.1411 for medium-to-long-term investment and a

possible price target of Rs.1750+ in the next 12 months.

STOCK WATCH

By Amit Kumar Gupta

REVIEW:

JK Paper Ltd Godawari Power & Ispat recommended at

Rs.298.55 last week, hit a high of Rs.378.70

(BSE Code: 532162) (CMP: Rs.136.85) (FV: Rs.10) (TGT: Rs.180+) fetching 27% returns in just 1 week!

Incorporated in 1960, New Delhi based JK Paper Ltd (JKPL), formerly

Central Pulp Mills Ltd, manufactures and sells various types of papers. It offers a range of office documentation papers

such as photocopy and multi-purpose papers for use in desktop, inkjet and laser printers, fax machines, photocopiers

and multi-functional devices; and premium watermarked and laid-marked business stationery papers for corporate

customers and individuals. It also provides uncoated writing and printing (W&P) papers, MICR cheque papers and pulp

boards as well as bond, ledger and parchment grades; maplitho papers; coated papers and boards; coated packaging

boards for the packaging industry; and imported coated art papers. It exports to ~40 countries.

JKPL is the market leader in the branded copier paper segment and among the top two players in Coated Paper and high-

end Packaging Boards. According to Crisil, the demand for W&P paper is projected to grow at ~4-5% CAGR in the next

five years led by higher growth in both coated as well as uncoated paper. Consumption of W&P paper is closely linked to

population growth, literacy levels, increase in office printing and private and public spending on education.

Wood is the key raw material for W&P paper manufacturers. JKPL enjoys operating efficiencies because of its integrated

production capacities due to which a significant portion of woodpulp (pulp capacity of 276,000 TPA) and power

requirements (major cost components) are met through captive production. Further, for long-term continuous source of

raw materials (~52% of total raw material consumption), JKPL is running social forestry and farm forestry programmes

in Orissa, Gujarat, Maharashtra and Andhra Pradesh, covering a total area of 1,50,000 hectares.

In early FY15, JKPL had expanded its capacity from 290,000 TPA to 455,000 TPA, which led to 14.8% CAGR in net sales

between FY14-FY17, as it had achieved more than 100% capacity utilisation. We expect net sales to register a CAGR of

6.3% over FY15-20E. We expect EBITDA to register a CAGR of 18.5% over FY15-20E. Further, we expect PAT to improve

due to conversion of Foreign Currency Convertible Bonds (FCCBs) to equity and refinancing of project loan with long

tenure loan, which will lead to saving of finance cost of ~Rs.100 crore for FY18-FY20E. Going forward, we believe that

JKPL will reduce its debt to 0.3x over FY18E-20E.

Technical Outlook: The JKPL stock looks very good on

the daily chart for medium-term investment. It has formed Free 2-day trial of Live Market Intra-day Calls

a rounding bottom pattern on the daily chart and a A running commentary of intra-day trading

breakout with good volumes can push the stock to a recommendations with buy/sell levels, targets, stop loss

higher level. The stock trades above all important levels on your mobile every trading day of the moth along with

on the daily chart like the 200 DMA level. pre-market notes via email for Rs.4000 per month.

Start accumulating at this level of Rs.136.85 and on dips to Contact Money Times on 022-22616970 or

Rs.117 for medium-to-long-term investment and a moneytimes.support@gmail.com to register for a free trial.

possible price target of Rs.180+ in the next 6 months.

*******

Dilip Buildcon Ltd

(BSE Code: 540047) (CMP: Rs.986.80) (FV: Rs.10) (TGT: Rs.1200+)

Incorporated in 1988, Bhopal-based Dilip Buildcon Ltd (DBL), together with its subsidiaries, is engaged in the

development of infrastructure facilities on engineering, procurement and construction (EPC) basis. It operates through

two segments - EPC Projects and Toll Operations. It undertakes state and national highway, city road, culvert, bridge,

irrigation, urban development, dam, canal, tunnel, water supply, coal mining, water sanitation and sewage, irrigation,

A Time Communications Publication 10

industrial, commercial and residential buildings and other projects. It is also involved in the maintenance of road

infrastructure facilities and toll operations.

NHAI ordering is likely to be scaled up in H2FY18 with awards of nearly 5,000-6,500 km expected in the next six months

with higher share of HAM projects expected in these. Under the Bharatmala project, the government will develop 34,000

km of roads at an investment of Rs.5.35 tn while remaining projects of 48,877 km worth Rs.1.57 tn are also to be taken

up by NHAI/MoRTh. We expect DBL to actively participate in the upcoming bids and expect its order inflow to grow

from Rs.70 bn in FY18E to Rs.115 bn in FY20E. Its order book as at Q2FY18 was Rs.142 bn with government projects

contributing 84% to the total order book. Its current order book provides a revenue visibility for 2.5 years and with

increased focus on execution post sharp inflow in FY17, we expect revenues to grow at 23.6% CAGR between FY17-20.

DBL has signed a term sheet with the Chhatwal Group Trust (Shrem Group) to divest its entire stake in 24 road BOT

(Build-Operate-Transfer) assets for Rs.16 bn (1.05x P/BV). It will continue to do the EPC of the 10 projects under

construction and O&M worth Rs.40 bn. With the sale of road assets, DBL is now well funded to focus on EPC projects as

well as upcoming HAM opportunities.

With strong operating margins of over 18% and improvement expected in net working capital, we expect DBL to

generate sufficient cash flows to sustain investments in the upcoming projects. Post stake sale in BOT assets, leverage is

likely to reduce to 0.8x/0.5x by FY19/20 and

ROE/ROCE to be strong at 23.1%/26.5% by

FY20 respectively. FOR WEEKLY GAINS

Refinancing of interest rates is likely to be

witnessed for DBL in the coming quarters. It Fast...Focused…First

is likely to be done by rating improvement Fresh One Up Trend Weekly

since it has divested its BOT assets and has

improved its balance sheet quality. It is also A product designed for short-term trading singling out one

likely to issue CPs/NCDs, which will stock to focus upon.

Fresh One Up Trend Weekly (formerly Power of RS Weekly) will

effectively reduce its interest rates. Average

identify the stop loss, buy price range and profit booking levels

interest rate for its borrowings is likely to along with its relative strength, weekly reversal value and the

come down by 100 bps. start date of the trend or the turndown exit signals. This

With a strong bid pipeline and expected recommendation will be followed up in the subsequent week with

order inflows, we expect revenues to grow at the revised levels for each trading parameter.

23.6% CAGR between FY17-20. Operating Subscription: Rs.2000 per month or Rs.18000 per annum

margins are likely to remain strong at 18.5% Available via email

owing to superior control over execution, For a free trial call us on 022-22616970 or email at

early completion bonus and no moneytimes.support@gmail.com

subcontracting. With reduction in

borrowings and interest rates, we expect PAT

to grow at 32% CAGR between FY17-20.

Technical Outlook: The DBL stock looks very good on the daily chart for medium-term investment. It is making a

higher high and higher low formation on the daily chart with a strong uptrend. Every correction in its share price has

been bought out at lower levels. The stock trades above all important levels on the daily chart like the 200 DMA level.

Start accumulating at this level of Rs.986.80 and on dips to Rs.926 for medium-to-long-term investment and a possible

price target of Rs.1200+ in the next 6 months.

STOCK ANALYSIS

Stock Analysis

Salona Cotspin Ltd

(BSE Code: 590056) (CMP: Rs.206) (FV: Rs.10)

By Rahul Sharma

Incorporated in 1994 by Mr. Shyamlal Agarwala, Chairman and MD, Salona Cotspin Ltd (SCL) is engaged in textiles i.e.

spinning of yarn and knitted fabrics. Its state–of–the–art plant is situated in Tamil Nadu with an installed capacity of

about 24,336 Spindles producing 100% cotton combed hosiery yarn, knitted fabrics and garments. The unit has an

automatic humidification plant supplied by Coimbatore ABC Control System. It also has 6 wind turbines for wind based

A Time Communications Publication 11

power generation used for captive consumption. These turbines have a total capacity of 4.45 MW. Captive consumption

of wind electricity results in lower power cost and boosts margins.

SCL’s product portfolio includes 100% Cotton Yarn, 100% Viscose Blended Yarn, Polyester Cotton Yarn, Ring Spun Yarn

and Compact Yarn. It specializes in producing 100% cotton combed hosiery yarn and compact yarn with count ranging

from 20s to 40s from ~24,340 spindles. Its finished products such as combed hosiery yarn and knitted fabrics are

exported as well. It primarily sells its products in the Tirupur hosiery market and its major customers are exporters of

apparels. It makes direct and merchant sales for export of yarn and fabrics to Sri Lanka, Bangladesh, Hong Kong, South

Korea, Germany, Mexico, South America, Russia, etc.

The textile industry is a major export earner for the country. The

revival in economy in the overseas market will add stimulus to Relative Strength (RS)

the industry. GST benefits for the textile industry will help boost

signals a stock’s ability to perform in a

the demand for the knitted fabrics industry. Government

dynamic market.

initiatives like the Pradhan Mantri Credit Scheme, providing

Knowledge of it can lead you to profits.

margin money subsidy for knitwear projects, setting up new

knitwear services centers on the PPP model, etc. will boost the POWER OF RS - Rs.3100 for 1 year:

knitting industry thereby benefitting SCL.

In Q2FY18, SCL reported Total Income of Rs.216 mn, EBITDA of What you get -

Financials: (Rs. in mn) Most Important- Association for 1 year

Particulars Q2FY18 Q1FY18 Q2FY17 FY17 FY16 at just Rs.3100!

Total Income 216 240.4 218.3 1215.3 1004 1-2 buy / sell per day on a daily basis

EBITDA 22.2 29.4 36.1 87.1 88.5 1 buy per week

PAT 3.2 10.4 17.8 33.4 22.7 1 buy per month

EPS (Rs.) 0.60 1.98 3.39 6.35 4.31 1 buy per quarter

Rs.22.2 mn and PAT of Rs.3.2 mn. Its FY17 performance was also

1 buy per year

commendable as PAT jumped 47% to Rs.33.4 mn, which is

indicative of a strong performance in the coming quarters as well. For more details, contact Money Times on

At the CMP, the stock trades at a P/E of 48.15x on its EPS (TTM) 022-22616970/4805 or

moneytimes.support@gmail.com.

of Rs.4.27. The stock is available at a discount compared to the

S&P BSE Small-Cap P/E of 114.6x and Nifty Small-Cap 250 P/E of

91.4x. Therefore, we have a Buy on the stock with a long-term price target of Rs.400.

STOCK BUZZ

South Indian Bank: Next generation bank

(BSE Code: 532218) (CMP: Rs.31.05) (FV: Re.1)

By Subramanian Mahadevan

Incorporated in 1928, South Indian Bank (SIB) was the first private sector bank in Kerala to become a Scheduled

Commercial Bank in 1946 under the RBI Act. Mr. V. G. Mathew is the CEO and Managing Director of the bank. The bank

has strong presence in South India with 80+ branches. As at June 2016, it had a network of 838 branches and 1,291

ATMs.

Over the past few years, the bank has achieved considerable progress in terms of bringing profitability focus among

branches, re-energizing employees, improving asset quality and creating greater brand awareness and technology

coverage. Its re-branding exercise has created greater brand recall and awareness among customers. We believe that its

present management is innovative and dynamic.

This ninety-year old bank with strong deposit franchise, robust loan growth, superior business model and great asset

quality is one of the cheapest mid-sized private sector stocks that trades at 1.1x FY18E and 1x FY19E adjusted book

value v/s 2.5x of City Union Bank, which is the closest listed peer half its size in terms of business. Gulf-based billionaire

MA Yusuff Ali, LIC of India and the Government of Singapore besides private equity giants like Cinnamon Capital, CX

Partners hold significant stake in the bank. We firmly believe that this stock could turn into a multibagger in two years

with very limited downside. Investors are advised to accumulate this stock on every decline during broad market

corrections for double-digit returns.

A Time Communications Publication 12

MARKET REVIEW

Equity markets: Expect the best in 2018

By Devendra A Singh

The Sensex settled at 34056.83 while the Nifty closed at 10530.7 for the week ending Friday, 29 December 2017.

The GST data for December 2017 showed a slide in revenue receipts. The government on Wednesday signaled that it

may breach its fiscal deficit target of 3.2% of GDP by expanding its market borrowing programme for this financial year

by Rs.50000 crore. This may force FM Arun Jaitley to recalibrate his fiscal consolidation roadmap of achieving a fiscal

deficit of 3% of GDP by FY19. In the budget, the government had pegged its aggregate gross market borrowing at Rs.5.8

tn. With Wednesday’s revision, the number now stands at Rs.6.3 tn.

M Sabnavis, Chief Economist at Care Ratings, said that the government is preparing the market for a fiscal slippage.

Though higher disinvestment accruals and dividend receipts from public sector units may act as mitigating factors this

year, fiscal deficit may still go up by 30 bps to 3.5% as a result of the Rs.50000 crore additional borrowing.

Aditi Nayar, principal economist at ICRA, said that the government’s proposal does not rule out a fiscal slippage in the

current financial year. A fiscal slippage, if any, may get funded through higher-than-budgeted small savings collections.

Separately, the government also cut the interest rate on small savings schemes such as Public Provident Fund, Kisan

Vikas Patra and Sukanya Samriddhi by 0.2 percentage point for the January-March quarter.

GST receipts are a cause for concern. Total GST collection including taxes on inter-state supplies and the cess on certain

items added up to Rs.80808 crore in December, a 14% drop from receipts in August.

The government has so far managed to raise about three-fourths of the targeted Rs.72000 crore through disinvestment.

Net direct tax receipts, however, grew 14.4% to Rs.4.8 tn in the April-November period from a year ago.

Foreign investment inflows to India rose ~$45 bn between April-October 2017 to 20% more than what it was in the

previous corresponding period with improved outlook on the Indian economy, which is undergoing structural reforms.

The rise in dollar inflows amid tightening of monetary policy across major markets including the US and UK is a positive

for India. There may still be a concern for regulators here as 40% of the inflows are short-term.

Fitch Ratings in its latest Global Economic Outlook has cut India’s GDP growth forecast for FY18 to 6.7% from the earlier

projection of 6.9% in September 2017, stating that the rebound in the economy was weaker than expected. It also cut

the forecast for FY19 to 7.3% from 7.4% earlier. The rating firm expects India’s GDP to pick up in the next two years

with the gradual implementation of the structural reform agendas.

“First, a two-year large bank recapitalisation plan (worth Rs.2.1 lakh crore or 1.4% of GDP) for state banks was

announced. The details are not clear yet but the package is likely to help address the capital shortages that have

hindered the banks’ lending capacity. Second, the government unveiled a substantial road construction plan (worth

Rs.6.9 lakh crore or 4.5% of GDP over a five-year horizon). This may encourage the investment growth outlook,” Fitch

added.

Fitch further said that the rupee has also appreciated quite sharply against the dollar since the beginning of this year

despite a narrowing interest rate differential between the US Fed policy rate and the RBI’s. These developments give

headroom for the RBI to keep interest rates quite low in order to help lift the economy.

On the US front, the House of Representatives on Wednesday, 20 December 2017, passed a historic tax bill which they

voted on for the second time due to a technical irregularity the day before. The bill includes a landmark decision with a

slash in the corporate tax rate from 35% to 21%.

On Asian front, the China's central bank raised interest rates on reverse repurchase agreements or reverse repos (RR)

used for open market operations by 5 bps for the 14-day tenor following upward adjustments on other tenors last week.

Indian markets remained closed on Monday, 25 December 2017, on account of Christmas.

Key index gained on Tuesday, 26 December 2017, on fresh buying. The Sensex was up 70.31 points (+0.21%) to close at

34010.61.

Key index fell on Wednesday, 27 December 2017, on profit-booking by traders. The Sensex was down 98.80 points (-

0.29%) to close at 33911.81.

A Time Communications Publication 13

Key index tanked on Thursday, 28 December 2017, on selling by foreign funds. The Sensex was down 63.78 points (-

0.19%) to close at 33848.03.

Key index advanced on Friday, 29 December 2017. The Sensex gained 208.8 points (0.62%) to close at 34056.83.

Events like national and global macro-economic figures as well as the earnings season will dictate the movement of the

markets and influence investor sentiment in the near future.

On India’s economic data, the HSBC

Manufacturing Purchasing Managers’ Index Seminars on Financial Literacy Stock Market

(PMI) and HSBC Services PMI for December Place Date Time Venue Seminar on

2017 is scheduled for release in the first Borivali 30/12/17 6 p.m. Shree Hanuman Share Market &

week of January 2018. (West) Mandir Prarthana Mutual Fund

On the inflation data, the government is Mumbai Sabhagruh, Ram awareness, SIP,

scheduled to release data based on WPI Mandir road, Babhai, Protection to

and CPI for urban and rural India for Borivali-west, investors, On line

December 2017 by mid-January 2018. Mumbai 400092 trading etc

Chinese government is scheduled to release Satara 07/01/18 4.30 p.m. Hotel Radhika Palace, Share Market &

the macro-economic figures for December Radhika road, Satara Mutual Fund

2017 in first week of January 2018. awareness, SIP,

United States macro data for December Protection to

2017 is scheduled for release in the month investors, On line

of January 2018. trading etc

Chandrashekhar Thakur: CDSL BO Protection Fund. Tel: 9820389051;

On the global front, Eurozone CPI data for csthakur@cdslindia.com / csthakur1302@gmail.com;

December 2017 will be released this week. th

BSE Building, 16 Floor, Dalal Street, Fort,

Mumbai - 400001

MARKET OUTLOOK

Be cautious at Nifty 10500

By Rohan Nalavade

The market is moving in a tight range of 10440-10530. If there is any movement on either side on closing basis, the Nifty

will follow that trend. The Nifty is facing strong resistance at the 10550 level. Expect selling pressure below 10470 for

10400-10350-10300 levels.

Profit-booking is being witnessed in the Banking sector. Bank Nifty is not showing strength and it could drag the Nifty

down in the January F&O series. So, be cautious while buying as banking stocks like State Bank of India, ICICI Bank are

showing weakness.

The Union Budget is likely to be agriculture-friendly with more loan waivers and subsidies, which will put pressure on

the budget expenditure. It would be prudent to buy only after the trend becomes strong as we may see a 500 point

downside in the Nifty. Therefore, be cautious while trading in the January F&O series.

Among stocks,

Sell State Bank of India below Rs.315 for downside levels of Rs.305-300 (SL: Rs.321)

Sell ICICI Bank below Rs.315 for downside levels of Rs.302-298 (SL: Rs.324)

Sell Hindalco Industries below Rs.275 for downside levels of Rs.268-264 (SL: Rs.284)

EXPERT EYE

By Vihari

Welspun India Ltd: On the fast track

(BSE Code: 514162) (CMP: Rs.71.15) (FV: Re.1)

Established in 1985, Welspun India Ltd (WIL) is a part of $2.3 bn Welspun group, which is one of the top three home

textile manufacturers globally and the largest home textile company in Asia. It is the largest exporter of home textile

products from India. It has modern manufacturing facilities at Anjar and Vapi in Gujarat where it produces an entire

A Time Communications Publication 14

range of home textiles for the bed and bath category. It has a state-of-the-art, vertically integrated plant from spinning to

confectioning.

WIL was ranked No.1 among

MID-CAP TWINS

home textile suppliers in USA

A Performance Review

(Source: Home Textile Today).

It has a distribution network in Have a look at the grand success story of ‘Mid-Cap Twins’ launched on 1st August 2016

50+ countries including USA, Sr. Scrip Name Recomm. Recomm. Highest % Gain

UK, Europe, Canada and No. Date Price (Rs.) since (Rs.)

Australia. In addition to 1 Mafatlal Industries 01-08-16 332.85 374.40 12

manufacturing facilities, which 2 Great Eastern Shipping Co. 01-08-16 335.35 477 42

predominantly supply to 3 India Cements 01-09-16 149.85 226 51

private labels, it also maintains

4 Tata Global Beverages 01-09-16 140.10 293.70 110

its own brands like Christy,

Hygrocotton, Welhome and 5 Ajmera Realty & Infra India 01-10-16 137.00 355.70 160

Spaces–Home and Beyond. It 6 Transpek Industry 01-10-16 447.00 1455.40 226

has also tied-up with Nautica 7 Greaves Cotton 01-11-16 138.55 178 28

for the North American

8 APM Industries 01-11-16 67.10 84.40 26

markets. It supplies to 17 of the

top 30 global 9 OCL India 01-12-16 809.45 1620 100

retailers and has marquee 10 Prism Cement 01-12-16 93.25 129.80 39

clients like Bed Bath & Beyond, 11 Mahindra CIE Automotive 01-01-17 182.50 266.50 46

Costco, Kohl’s, Wal-Mart and 12 Swan Energy 01-01-17 154.10 204 32

Macy’s. Given its longstanding 13 Hindalco Industries 01-02-17 191.55 278.50 45

relationships and strong

14 Century Textiles & Industries 01-02-17 856.50 1421 66

execution capabilities, we do

not expect the current 15 McLeod Russel India 01-03-17 171.75 248.30 45

imbroglio as featured in later 16 Sonata Software 01-03-17 191.00 247 29

paragraphs to impact its core 17 ACC 01-04-17 1446.15 1869 29

business and key customers.

18 Walchandnagar Industries 01-04-17 142.25 272.90 92

Exports constitute 80% of

sales. 19 Oriental Veneer Products 01-05-17 222.30 540 143

WIL recently forayed into new 20 Tata Steel 01-05-17 448.85 734.90 64

technologies in its technical 21 Sun Pharmaceuticals Industries 01-06-17 501.40 590.75 18

textile business. It commenced 22 Ujjivan Financial Services 01-06-17 307.45 417.40 36

operations at its state-of-the- 23 Ashok Leyland 01-07-17

art Needle Entangled Advance

93.85 133 42

Textile plant at Anjar in mid- 24 KSB Pumps 01-07-17 759.55 931 23

March 2017. This Rs.150 crore 25 IRB Infrastructure Developers 01-08-17 224.95 251 12

facility manufactures multi- 26 JTL Infra 01-08-17 70 125 79

layer composites for various 27 Stock ‘A’ 01-09-17 187.40 308.90 65

applications. It also invested

28 Stock ‘B’ 01-09-17 271.20 317 17

Rs.110 crore to set up a state-of

the-art fully automated cut and 29 Stock ‘C’ 01-10-17 73.65 89.25 21

sew unit in the made-ups 30 Stock ‘D’ 01-10-17 74.10 91.35 23

segment. 31 Stock ‘E’ 01-11-17 206 218.95 6

WIL’s current capacity is 32 Stock ‘F’ 01-11-17 38 57.90 52

72,000 TPA in Towels v/s

Thus ‘Mid-Cap Twins’ has delivered excellent results since its launch with majority of

60,000 TPA at end FY16 and 90

stocks gaining over 30%.

million metres in Bed Linen v/s

72 million metres at end FY16. Next edition of ‘Mid-Cap Twins’ will be released on 1 January 2018.

Its capacity for Rugs and

Carpets is expected to reach 10 Attractively priced at Rs.2000 per month, Rs.11000 half yearly and Rs.20,000 annually,

million sq. metres by end FY17 ‘Mid-cap Twins’ will be available both as print edition or online delivery.

from 8 million sq. metres at end

FY16.

A Time Communications Publication 15

Recently, WIL entered into a strategic agreement with Cotton Egypt Association to promote and market Egyptian cotton

products worldwide. Under this agreement, the two organisations will work together to create programmes for

promotion of Egyptian Cotton logo in the retail markets across the globe. The agreement will also help enhance the

complete supply chain of Egyptian cotton starting from cultivation to the final product, which will also benefit the

Egyptian farmers and the industry as a whole. WIL will invest $3 mn over the next few years to support the joint

initiatives.

For FY17, WIL posted PAT of Rs.362.4 crore on sales of Rs.6721 crore fetching an EPS of Rs.3.62. During Q2FY18, WIL

posted PAT of Rs.145 crore against a loss of Rs.151 crore in Q2FY17 on 10% lower sales of Rs.1630 crore fetching a

consolidated EPS of Rs.1.5. During the quarter, it had incurred a net loss of Rs.145 crore mainly on account of Rs.501

crore penalty in quality related issues with Target Corp. During H1FY18, PAT zoomed 297% to Rs.228.8 crore on 7%

lower sales of Rs.3183 crore fetching a consolidated EPS of Rs.2.3.

With an equity capital of Rs.100.5 crore and reserves of Rs.2297 crore, WIL’s share book value works out to Rs.24. In

Q2FY18, its debt was Rs.3385 crore. With cash, loans given and investments of Rs.667 crore, its net DER works out to

1.1:1. The value of its gross block was Rs.5010 crore. The promoters hold 73.5% of the equity capital, FIIs hold 12.3%,

PCBs hold 3.3% and DIs hold 1.5%, which leaves 9.5% stake with the investing public.

WIL enjoys long-standing relationships with top retailers in USA and Europe and supplies to 14 of the top 30 global

retailers. It commands a lion’s share of home textiles exported out of India. The growing geographical and client

diversification is improving its risk metrics. It has 7 trademarks and has applied for 6 patents till date. It derives ~30%

of sales from innovative products.

WIL is at the end of its massive Rs.2500 crore capex programme it had undertaken in FY14. It incurred capex of Rs.710

crore in FY17 and plans to spend ~Rs.700 crore in FY18 mainly for enhancing its towel capacity to 80,000 MT and for its

on-going flooring solutions project. Flooring is an extension of the bath rugs business and will be a vertically integrated

operation. Its new flooring facility is likely to be ready by Q2FY19/Q3FY19. It commissioned a state-of-the-art 30 MLD

Sewage Treatment Plant (STP) under the Public-Private-Partnership (PPP) mode, as part of its sustainability initiatives.

These initiatives will help WIL meet its FY20 aim of being a $2 bn textiles business company with zero net debt.

Domestically, WIL imports a large proportion of tile carpets, which attracts 25-30% import duty. At full capacity, this

project is expected to contribute incremental revenue of Rs.1000 crore. The management expects the domestic market

size of ~$100 mn to grow to $500 mn.

The $744 bn global textile and apparel market is expected grow at a scorching pace. The textile market is worth $290 bn

whereas the home textile market size is $45 bn. India’s share of 5%, 6% and 11% respectively in these segments offer a

great potential going forward.

WIL is set to post an EPS of Rs.7 in FY19 and Rs.9 in FY20. At the CMP of Rs.71.15, the stock trades at a P/E of 10.16x on

FY19E and 7.90x on FY20E earnings. A reasonable P/E of 15x will take its share price to Rs.105 in the medium-term and

Rs.135 thereafter. The stock’s 52-week high/low is Rs.99.55/60.

*******

Lasa Supergenerics Ltd: For superb gains

(BSE Code: 540702) (CMP: Rs.179.70) (FV: Rs.10)

Lasa Supergenerics Ltd (Lasa) was demerged from Omkar Speciality Chemicals in June 2017 and got listed on the

bourses in September 2017. Lasa is a vertically integrated group spanning the entire veterinary, animal and human

healthcare value chain — from discovery-to-delivery with established credentials in research, manufacturing and global

marketing. The Lasa group is a veterinary API manufacturing entity. Its manufacturing base is located at Mahad in

Maharashtra. It specialises in catalyst chemistry and manufactures anthelmintic/ veterinary API products with the

largest production capabilities and product categories in India. To efficiently control the supply chain, the group

backward integrated its key molecules from discovery research up to full-scale bulk production.

Lasa has alliances with leading domestic and global animal health care conglomerates. From being a single product

company, Lasa today manufactures 15 different products in the veterinary API segment and continues to add new

products to its portfolio. It manufactures benzimidazole, amides, imidazothiazoles, piperazine, albendazole,

fenbendazole, ricobendazole, oxfendazole, galfenol, etc.

Since raw material price fluctuations result in margin fluctuations and dependence on suppliers adds more pressure,

Lasa moved into backward integration for most of its products, which will be fully operational in H2FY18. It expects

around 10-12 of its products to account for ~75% of total sales going forward. Exports account for 40% of total sales. No

customer accounts for more than 5% of total sales. Its process patents pipeline is strong. It has its own R&D unit.

A Time Communications Publication 16

For FY17, Lasa incurred a loss of Rs.0.63 crore on sales of Rs.199.93 crore. During H1FY18, it posted PAT of Rs.15.7

crore on sales of Rs.123.2 crore fetching an EPS of Rs.6.9. During Q2FY18, it posted 23% higher PAT of Rs.8.7 crore on

6% higher sales of Rs.65.88 crore fetching an EPS of Rs.3.8. It added ~Rs.20 crore of assets and claimed accelerated

depreciation of the newly added capacity, which resulted in higher depreciation of Rs.6.1 crore in Q2FY18 v/s Rs.2.4

crore in Q1FY18. PAT during the quarter could have been higher but for the higher prices of its main raw materials,

which are organic derivatives from petrochemicals and crude-based derivatives. But this is a temporary issue according

to the management and it expects OPM to come back to ~22-24% in the coming quarters.

Total debt was ~Rs.68 crore. Lasa plans to reduce interest cost and repay debts in the next 18 months from internal

accruals. It expects 25% CAGR growth in net sales in the next 3 years. The value of its gross block is Rs.179 crore and net

DER is 0.5:1.

With an equity capital of Rs.22.9 crore and reserves of Rs.94.9 crore, Lasa’s share book value works out to Rs.51 as at

H1FY18. The promoters hold 41.2% of the equity capital, FIs hold 4.1%, DIs hold 0.2% and PCBs hold 4.5%, which leaves

50% stake with the investing public.

Lasa has a strong pipeline of process patents for

which it has filed applications. It is focused on What TF+ subscribers say:

developing catalyst based processes, which will

enable it to create entry barriers and help “Think Investment… Think TECHNO FUNDA PLUS”

maintain its competitive edge. Lasa commands Techno Funda Plus is a superior version of the Techno Funda

a decent market share of 35% in the API column that has recorded near 90% success since launch.

veterinary segment. Going forward, it plans to

develop and add new products to its portfolio Every week, Techno Funda Plus identifies three fundamentally

and also focus on backward integration sound and technically strong stocks that can yield handsome

simultaneously. All these strategies will enable returns against their peers in the short-to-medium-term.

it to earn a decent margin across the product Most of our recommendations have fetched excellent returns to

basket. our subscribers. Of the 156 stocks recommended between 11

Lasa’s marketing footprint is entrenched across January 2016 and 2 January 2017 (52 weeks), we booked profit in

developing markets in multiple countries and it 125 stocks, 27 triggered the stop loss while 4 are still open and

expects to augment its export footprint are in nominal red.

significantly. It aims to be a leading force in the Of the 138 stocks recommended between 9 January 2017 and 20

niche animal health care solutions segment. November 2017 (46 weeks), we booked 7-37% profit in 101

The biggest risk for any chemical/ pharma stocks, 23 triggered the stop loss of 2-18% while 14 are still open.

company is the dynamism of the regulatory If you want to earn like this,

norms, which keep on changing. Lasa is subscribe to TECHNO FUNDA PLUS today!

committed towards adopting environment-

friendly and sustainable process technologies For more details, contact Money Times on

so that it can control the discharges from its 022-22616970/22654805 or moneytimes.support@gmail.com.

units. Subscription Rate: 1 month: Rs.2500; 3 months: Rs.6000;

Based on its initiatives, Lasa may post an EPS of 6 months: Rs.11000; 1 year: Rs.18000.

Rs.18 in FY18 and Rs.24 in FY19. At the CMP of

Rs.179.70, the stock trades at a forward P/E of 9.9x on FY18E and 7.4x on FY19E earnings. A reasonable P/E of 12.5x

will take its share price to Rs.225 in the medium-term and Rs.300 thereafter.

TECHNO FUNDA

By Nayan Patel

IOL Chemicals & Pharmaceuticals Ltd

(BSE Code: 524164) (CMP: Rs.78.25) (FV: Rs.10)

Incorporated in 1986, IOL Chemicals & Pharmaceuticals Ltd (IOL) manufactures and sells industrial organic chemicals

and bulk drugs worldwide. It operates through two segments: Chemicals and Pharmaceuticals.

A Time Communications Publication 17

Chemicals: IOL is among the major manufacturers of speciality organic

chemicals. It is one of the largest producers of ethyl acetate (87,000 REVIEW

TPA) and the second largest producer of iso butyl benzene (IBB) in Indo Thai Securities recommended at

India with 30% global market share. It has forward-integrated this Rs.64.25 on 11 December 2017, zoomed to

vertical into the pharma segment with end products such as ethyl Rs.83.7 last week recording 30%

acetate, IBB, mono chloro acetic acid (MCA) and acetyl chloride used as appreciation.

key raw materials for Ibuprofen. It plans to explore its presence in AVT Natural Products recommended at

other industries such as paints, flexible packaging and glass. In view of Rs.33.8 on 23 January 2017, zoomed to

this, it has successfully added MNC giants to its customer base. Rs.62.15 last week recording 84%

appreciation.

Pharmaceuticals: Over the years, IOL has established itself as a major

player in Ibuprofen (total installed capacity – 7,200 TPA) with 17% of Joindre Capital Services recommended at

the global capacity. It is the world's only backward-integrated Rs.13.5 on 18 July 2016, zoomed to Rs.46

last week recording 241% appreciation.

Ibuprofen producer that manufactures all intermediates and key

starting materials at one location. It has augmented its pharma business PPAP Automotive recommended at

by moving up the value-chain with entry into lifestyle drugs for pain Rs.151.5 on 9 May 2016, zoomed to

Rs.710 last week recording 369%

management, anti-depressant, anti-diabetic, anti-platelet and anti- appreciation.

convulsion etc and is present in 56 countries. It recently obtained

USFDA and EDQM certification for its Ibuprofen plant. Ibuprofen ITL Industries recommended at Rs.45.5 on

14 March 2016, zoomed to Rs.284.7 last

constitutes 85% of the IOL’s pharma revenue. IOL plans to explore week recording 526% appreciation.

opportunities by diversifying its API product portfolio. Apart from its

multipurpose plant, it has a 17 MW power generation plant for captive consumption with adequate backups for trouble-

free operations. Its R&D lab is DSIR approved and is fully equipped to validate the existing processes.

IOL has an equity capital of Rs.56.21 crore supported by reserves of Rs.133.15 crore. The promoters hold 41.19% of the

equity capital, which leaves 58.81% stake with the investing public.

During Q2FY18, IOL’s net profit skyrocketed 352% to Financial Performance: (Rs. in crore)

Rs.4.43 crore on 26% higher sales of Rs.217.79 crore

Particulars Q2FY18 Q2FY17 H1FY18 H1FY17 FY17

fetching an EPS of Re.0.79. During H1FY18, net profit

zoomed 333% to Rs.7.41 crore on 29% higher sales of Sales 217.79 172.63 433.10 334.88 710.65

Rs.433.10 crore fetching an EPS of Rs.1.32 (Cash EPS of PBT 5.84 1.29 9.01 2.33 5.48

Rs.3.89). Tax 1.41 0.31 1.60 0.62 1.25

Besides such fantastic results, IOL announced its PAT 4.43 0.98 7.41 1.71 4.23

expansion plan wherein it plans to pump in ~Rs.200 EPS (in Rs.) 0.79 0.17 1.32 0.30 0.75

crore over the next two years towards capacity expansion. It plans to expand its flagship product – Ibuprofen’s capacity

from 7,200 TPA to 12,000 TPA, keeping in view the recent approvals from USA and Europe. It plans to invest ~Rs.100

crore each year for two years to expand its capacity by 30% each year to meet the rising demand for Ibuprofen. It also

plans to enhance the capacity of its backward integrated products i.e. ISO butyl benzene from 9,000 TPA to 12,000 TPA,

MCA from 7,200 TPA to 10,500 TPA and Acetyl Chloride from 5,200 TPA to 8,400 TPA. It is also setting up a greenfield

facility for producing anti-diabetic products i.e. Metformin, at Barnala in Punjab at a capex of Rs.10 crore, which will be

met by internal accruals and is likely to be completed in the current fiscal. It has already completed and commercialized

unit III to manufacture Fenofibrate, Clopidogrel and Lamotrigine, etc. at an investment of Rs.16.48 crore met through

internal accruals.

Based on its financial parameters and expansion plans, the IOL stock looks quite attractive for investment at the current

level. Investors can buy this stock with a stop loss of Rs.65. On the upper side, it could zoom to Rs.115-125 levels in the

medium-to-long-term.

*******

Walchand Peoplefirst Ltd

(BSE Code: 501370) (Rs.195.80) (FV: Rs.10)

We had recommended this stock at Rs.107.35 on 2 May 2016, where-after it zoomed to Rs.212.

Incorporated in 1920, Mumbai-based Walchand PeopleFirst Ltd (WPL), formerly Walchand Capital Ltd, is a subsidiary of

Walchand & Company Pvt Ltd that provides consulting, talent development and training services to corporates and

professionals. It offers services in the areas of organization effectiveness and strategic initiatives, leadership

development and talent and human resource audit. It also provides consultancy services for performance enhancement

and business skills development as well as offers assessment consultancy services.

A Time Communications Publication 18

WPL has an equity capital of Rs.2.9 crore supported by reserves of Rs.11.48 crore. The promoters hold 55.19% of the

equity capital, which leaves 44.81% stake with the investing public. The promoters have increased their stake by 2.2%

in the last 30 months.

For Q2FY18, WPL’s net profit soared 55% to Rs.1.32 Financial Performance: (Rs. in crore)

crore on sales of Rs.7.69 crore fetching an EPS of

Particulars Q2FY18 Q2FY17 H1FY18 H1FY17 FY17

Rs.4.56. During H1FY18, net profit soared 68% to

Sales 7.69 7 13.20 12.63 23.24

Rs.1.38 crore on sales of Rs.13.2 crore fetching an

EPS of Rs.4.7. PBT 1.76 1.23 1.90 1.26 1.12

Tax 0.44 0.37 0.53 0.44 0.31

Currently, the stock trades at a P/E of 41.86x. Based

on its financial parameters, the WPL stock looks PAT 1.32 0.85 1.38 0.82 0.82

quite attractive at the current level. Investors can EPS (in Rs.) 4.56 2.93 4.74 2.82 2.82

buy this stock with a stop loss of Rs.157. On the upper side, it could zoom to Rs.210-225 levels in the medium-to-long-

term. Its all-time high is Rs.978.58.

BULL’S EYE

Bull’s Eye

Laurus Labs Ltd

(BSE Code: 540222) (CMP: Rs.542.90) (FV: Rs.10)

By Pratit Nayan Patel

Company Background: Incorporated in 2005, Hyderabad-based Laurus Labs Ltd (LLL) is a leading research and

development (R&D) driven pharmaceutical company that manufactures Active Pharmaceutical Ingredients (APIs) for

anti-retroviral (ARV) and Hepatitis C. It also manufactures APIs in oncology and other therapeutic areas. It also develops

and manufactures speciality ingredients for use in nutraceutical, dietary supplements and cosmeceutical products. It

owns 34 patents and has 152 pending applications in several countries. Its strategic and early investments in R&D and

manufacturing infrastructure have enabled it to become a leading supplier of APIs in the ARV therapeutic area. Its API

manufacturing facilities, which have approvals from WHO, USFDA, NIP Hungary, PMDA, KFDA and BfArM, are capable of

large scale commercial production. It has commercialized 59 products since its inception.

LLL is building on its API strength to forward integrate into Fixed Dosage Formulation (FDF). It plans to set up a FDF

manufacturing facility at an investment of Rs.2013.66 mn (as at 31 March 2016). This facility will have a capacity to

manufacture 1 bn tablets per annum expandable to 5 bn tablets per annum for the year after incurring additional

investment.

Financials: With an equity capital of Rs.105.76 crore and reserves of Rs.1224.69 crore, LLL’s share book value works

out to Rs.125.5 as at 31 March 2017. The promoters hold 30.56% of the equity capital, Mutual Funds hold 8.47%, FPIs

hold 10.74%, FIL Capital Management (Mauritius) Ltd holds 11.54% and Bluewater Investment Ltd holds 19.8%, which

leaves 17.33% stake with the investing public.

Performance Review: For Performance Review (Consolidated) : (Rs. in crore)

FY17, LLL posted 46% higher

Particulars Q2FY18 Q1FY18 Q2FY17 H1FY18 H1FY17 FY17 FY16

PAT of Rs.190.28 crore v/s

Rs.130.70 crore in FY16 on 7% Total Income 538.61 478.39 516.5 1017 926.26 1904.65 1783.77

higher sales of Rs.1904.65 PBT 69.6 55.17 65.87 124.77 100.52 235.2 164.58