Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Are You Ready

Caricato da

FuckoffCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Are You Ready

Caricato da

FuckoffCopyright:

Formati disponibili

united States at North America:

The Congress shall have Power To lay and collect Taxes, Duties, Imposts and

Excises, to pay the Debts and provide for the common Defence and general Welfare of

the United States; but all Duties, Imposts and Excises shall be uniform throughout

the United States;

As affirmed and secured by Article I Section IX of the 1789/1791 Republican

Constitution for the united States at North America:

No Bill of Attainder or ex post facto Law shall be passed. No Capitation, or other

direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein

before directed to be taken.*5

1. What constitutionally valid American law has changed or made void the above

cited Federal Coinage Act of 1792, regarding the original Money of account of the

United States, regarding payments to DEPARTMENT OF TREASURY, and when was such

constitutionally valid law enacted?

2. What constitutionally valid American law has changed or made void the above

cited the Supreme Law.

3. Identify the Constitutionally valid law that allows Constitutionally valid

authority to convert the Money of Account of the United States, into some substance

or thing, other than that of the Money of Account of the United States pursuant to

its own Federal Coinage Act of 1792.

4. What is the name and address of the location where the undersigned can bring

my Legal Tender cash to exchange for my Original Instrument, held by DEPARTMENT OF

TREASURY?

5. *ceo**, must herein provide a true and certified copy of the complete audit

trail of account of the alleged debt. Furthermore, in order for *ceo**, to

validate the debt;

6. Please provide verification through audit certification of debt entry in

accordance with Generally Accepted Accounting Principles (G.A.A.P.), International

Financial Reporting Standards (I.F.R.S.), in Accordance with Basel 3 Accord and

United Nations Commission on International Trade Law (U.N.C.I.T.R.A.L.)

Conventions.

7. Introduce into evidence a copy of your Tax Registration certificate!

8. Introduce into evidence Form 1040A, Form 1040V, 1041, 1041T, 1099, 1009A,

1099 OID

9. Please introduce into evidence the Profit and Loss statement from the alleged

�creditor� you have contracted with in regards to the alleged loan in controversy.

10. Introduce into evidence the amount you claim I owe you; No lawful or legal

binding contract exist between I Muhammad Bey, my Estate, in association with

you**ceo** ad your private for profit corporation **corps name**. *Ceo*, and the

representatives of **corps**possess neither express, written authorization, nor

consent, from I, the Authorized Representatives for using,

revealing/disclosing/divulging/sharing/trading with any third party any secured

information,

documentation, data, property, effects, and the like of my Estate.

11. Introduce into evidence the Fiduciary Tax Estimate and the Fiduciary Tax

Return for this claim

12. Explain and show me how you have computed the amount.

13. Send me the copies of any documents that prove I agreed to pay the alleged

amount.

14. Identify the original alleged creditor and introduce into evidence a proof of

Assignment of the alleged debt in controversy.

15. Confirm that the account has not crossed the Statute of Limitation period.

16. Prove that you're a licensed debt collector

Potrebbero piacerti anche

- 44Documento6 pagine44FuckoffNessuna valutazione finora

- 44Documento6 pagine44FuckoffNessuna valutazione finora

- 6Documento36 pagine6FuckoffNessuna valutazione finora

- 44Documento6 pagine44FuckoffNessuna valutazione finora

- 6Documento36 pagine6FuckoffNessuna valutazione finora

- 44Documento6 pagine44FuckoffNessuna valutazione finora

- 44Documento6 pagine44FuckoffNessuna valutazione finora

- 6Documento36 pagine6FuckoffNessuna valutazione finora

- 112Documento21 pagine112Fuckoff100% (1)

- 3Documento3 pagine3FuckoffNessuna valutazione finora

- 6Documento36 pagine6FuckoffNessuna valutazione finora

- 4Documento2 pagine4FuckoffNessuna valutazione finora

- 6Documento36 pagine6FuckoffNessuna valutazione finora

- 1Documento3 pagine1FuckoffNessuna valutazione finora

- 5Documento20 pagine5FuckoffNessuna valutazione finora

- 2Documento3 pagine2FuckoffNessuna valutazione finora

- 3Documento3 pagine3FuckoffNessuna valutazione finora

- 4Documento7 pagine4FuckoffNessuna valutazione finora

- 1Documento2 pagine1FuckoffNessuna valutazione finora

- 5Documento4 pagine5FuckoffNessuna valutazione finora

- 1Documento5 pagine1FuckoffNessuna valutazione finora

- 4Documento21 pagine4FuckoffNessuna valutazione finora

- 2Documento5 pagine2FuckoffNessuna valutazione finora

- 2Documento12 pagine2FuckoffNessuna valutazione finora

- Advaced Age1Documento3 pagineAdvaced Age1FuckoffNessuna valutazione finora

- Zero 4Documento2 pagineZero 4FuckoffNessuna valutazione finora

- Advaced Age4Documento4 pagineAdvaced Age4FuckoffNessuna valutazione finora

- 3Documento21 pagine3FuckoffNessuna valutazione finora

- Zero 5Documento2 pagineZero 5FuckoffNessuna valutazione finora

- Zero Down-3Documento1 paginaZero Down-3FuckoffNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- CHAPTER 4 SEC. 3 Arts. 1270-1274Documento4 pagineCHAPTER 4 SEC. 3 Arts. 1270-1274Kelsey De GuzmanNessuna valutazione finora

- Assignment EnronDocumento4 pagineAssignment EnronMuhammad Umer100% (2)

- UPSUMCO Vs CA CaseDocumento2 pagineUPSUMCO Vs CA CaseJohnson YaplinNessuna valutazione finora

- Reeve Flooring - Terms and Conditions of TradingDocumento5 pagineReeve Flooring - Terms and Conditions of TradingReeveFlooringNessuna valutazione finora

- BPI vs. SPS Yu DigestDocumento3 pagineBPI vs. SPS Yu DigestMary Louisse RulonaNessuna valutazione finora

- Kedudukan Hukum Kreditur Yang Tidak Terverifikasi Dalam Undang Undang KepailitanDocumento15 pagineKedudukan Hukum Kreditur Yang Tidak Terverifikasi Dalam Undang Undang KepailitanVictor TumbelNessuna valutazione finora

- The Gold Standard Journal 12Documento13 pagineThe Gold Standard Journal 12ulfheidner9103Nessuna valutazione finora

- Ind-Bharath (V1)Documento4 pagineInd-Bharath (V1)Saurabh ChawlaNessuna valutazione finora

- Appointment of ReceiversDocumento8 pagineAppointment of ReceiversNur Un NaharNessuna valutazione finora

- Law On Chattel MortgageDocumento17 pagineLaw On Chattel MortgageRojohn ValenzuelaNessuna valutazione finora

- Public Debt and The ConstitutionDocumento6 paginePublic Debt and The Constitutionrenushi100% (1)

- Borrowing Powers of CompanyDocumento37 pagineBorrowing Powers of CompanyRohan NambiarNessuna valutazione finora

- Corporate Liquidation and Reorganization PRESENTATIONDocumento42 pagineCorporate Liquidation and Reorganization PRESENTATIONkimjoonmyeon220% (1)

- Ajax Marketing v. CADocumento1 paginaAjax Marketing v. CAJC AbalosNessuna valutazione finora

- Specific Remedies in Land TitsDocumento10 pagineSpecific Remedies in Land Titsaquanesse21Nessuna valutazione finora

- Bill Newland Fidelity Lender Processing ServicesDocumento325 pagineBill Newland Fidelity Lender Processing ServicesForeclosure FraudNessuna valutazione finora

- Makati Leasing and Finance Corporation V Wearever Textile MillsDocumento1 paginaMakati Leasing and Finance Corporation V Wearever Textile MillsAnn QuebecNessuna valutazione finora

- Corp Liquidation - QuizDocumento5 pagineCorp Liquidation - QuizKj Banal0% (1)

- RetentionofTitle StefanRamel&GerardMcMeelDocumento22 pagineRetentionofTitle StefanRamel&GerardMcMeelVu Phuong ThuyNessuna valutazione finora

- Credit Transactions Final ReviewerDocumento5 pagineCredit Transactions Final ReviewerJumen Gamaru Tamayo100% (1)

- 011-015 DigestDocumento5 pagine011-015 DigestJed CaraigNessuna valutazione finora

- Umali V CADocumento10 pagineUmali V CAChristelle Ayn BaldosNessuna valutazione finora

- Metropolitan Bank & Trust Company vs. ASB Holdings, Inc.Documento16 pagineMetropolitan Bank & Trust Company vs. ASB Holdings, Inc.Maria Nicole VaneeteeNessuna valutazione finora

- Form OC-10 Appl 4 FRNDocumento51 pagineForm OC-10 Appl 4 FRNBenne James100% (4)

- Chapter 3 SlidesDocumento144 pagineChapter 3 Slidesanalie villaNessuna valutazione finora

- C10WWWWDocumento3 pagineC10WWWWTess De LeonNessuna valutazione finora

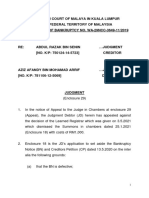

- BANKRUPTCY - Abdul Razak Senin-Appeal Ag BN - PublishDocumento12 pagineBANKRUPTCY - Abdul Razak Senin-Appeal Ag BN - Publishhafeez benignNessuna valutazione finora

- Special Proceedings RianoDocumento31 pagineSpecial Proceedings RianoBab LyNessuna valutazione finora

- Winding Up of A Company: Paradigm Change in View of Insolvency and Bankruptcy CodeDocumento15 pagineWinding Up of A Company: Paradigm Change in View of Insolvency and Bankruptcy CodeTaruna Shandilya100% (1)

- Secured Transactions: UCC Title 9Documento17 pagineSecured Transactions: UCC Title 9Rebel X86% (7)