Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Data For Ratio Detective Exercise

Caricato da

maritaputriTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Data For Ratio Detective Exercise

Caricato da

maritaputriCopyright:

Formati disponibili

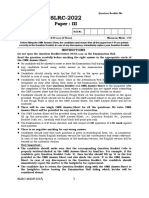

Exhibit 1.

2

Data for Ratio Detective Exercise

Company Numbers

Balance Sheet at End of Year (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) (13) 1. Advertising agency

Cash and Marketable Securities 0.7% 19.1% 9.0% 0.9% 11.9% 1.6% 4.4% 22.7% 5.1% 14.4% 245.6% 1.0% 25.20% 2. Aerospace manufacturer (significant government contracts)

Current Receivables 0.2% 4.5% 16.3% 4.9% 15.2% 36.2% 13.5% 21.3% 13.2% 70.6% 11.90% 7.8% 562.5% 3. Beer brewery

Inventories 7.5% - 11.9% 5.6% 13.2% 14.4% 21.7% 13.0% 10.5% 7.5% - 11.4% - 4. Computermanufacturer

Property, Plant, and Equipment

Cost

17.0% 0.8% 42.90% 79.40% 54% 37.50% 25.30% 65.90% 162.5% 18.40% 3.60% 398.4% 70.8% 5. Department store chain

Accumulated Depreciation -5.5% -1% -21.0% -21.7% -26.9% -12.0% -11.8% -27.4% -80.5% -9.3% -1.8% -109.6% -21.4% 6. Distiller of hard liquor

Net 11.5% 0.1% 21.9% 57.7% 27.1% 25.5% 13.5% 38.5% 82.0% 9.1% 1.8% 288.8% 49.4% 7. Electric utility

Other Assets 1.40% 23.20% 12.50% 6.90% 8.70% 2.20% 31.80% 16.7% 4.0% 22.1% 51.9% 8.7% 57.5% 8. Finance company (also involved in leasing)

Total Assets 21.3% 47% 71.6% 76.0% 76.1% 79.9% 84.9% 112.2% 114.8% 123.7% 311% 317.7% 694.6% 9. Grocery store chain

10. Life insurance company

Current Liabilities 7.8% 21.0% 32.7% 13.2% 22.3% 35.1% 15.3% 43.6% 12.5% 87.1% 203.9% 30.4% 437.5% 11. Pharmaceutical company

Long-term Debt 3.6% - 6.3% 14.7% 8.7% 11.6% 17.4% 3.3% 18.0% 4.3% 21.4% 126.0% 196.1% 12. Professional basketball franchise (a partnership)

Other Noncurrent Liabilities 1.4% 15.6% 5.5% 14.2% 4.9% 6.8% 10.8% 12.9% 5.0% 7.8% 8.4% 23.1% 12.2% 13. Steel manufacture

Owners' Equity 8.5% 10.3% 27.1% 33.9% 40.2% 26.4% 41.4% 52.4% 79.3% 24.5% 77.5% 138.2% 48.8%

Total Equities 21.3% 46.9% 71.6% 76.0% 76.1% 79.9% 84.9% 112.2% 114.8% 123.7% 311.2% 317.7% 694.6%

Income Statement for Year

Sales 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

Cost of Goods Sold ( excluding

depreciation ) or Operating 76.9% 61.8% 74.8% 62.0% 71.1% 72.1% 46.5% 26.60% 86.10% 89.60% 86.60% 57.80% 21.80%

Expenses

Depreciation 1.4% 0.1% 4.1% 3.6% 6.8% 2.6% 2.0% 4.20% 6.60% 2.60% 0.90% 10.20% 14.80%

Interest 0.4% 1.9% 0.7% 0.8% 0.5% 1.3% 2.0% 1.10% 1.80% 1.20% 3.40% 10.10% 47.30%

Advertising 3.6% 0.5% - 8.0% - 3.3% 11.2% 4.00% - - - - -

Research and Development - - 3.5% - 7.7% - - 11.20% - - - - -

Income Taxes 1.1% - 4.5% 5.5% 2.8% 2.9% 6.6% 9.90% -4.10% 3.90% 2.50% 8.20% 7.00%

All Other Items (net) 15.5% -0.7% 7.2% 13.4% 6.5% 13.5% 23.5% 25.10% 6.40% -1.30% -1.20% -5.50% -

Total Expenses 98.9% 63.6% 94.8% 93.3% 95.4% 95.7% 91.8% 82.1% 96.8% 96.0% 92.2% 80.8% 90.9%

Net Income 1.1% 36.4% 5.2% 6.7% 4.6% 4.3% 8.2% 17.9% 3.2% 4.0% 7.8% 19.2% 9.1%

Cash Flow from Operations +

1.22% - 2.95% 1.17% 1.09% 1.09% 5.20% 5.20% 1.36% 3.06% 44.80% 0.95% 0.80%

Capital Expenditures

Dupont

Earnings available for common sta 1.1% 36.4% 5.2% 6.7% 4.6% 4.3% 8.2% 17.9% 3.2% 4.0% 7.8% 19.2% 9.1%

Net profit margin 1.1% 36.4% 5.2% 6.7% 4.6% 4.3% 8.2% 17.9% 3.2% 4.0% 7.8% 19.2% 9.1%

Total Asset Turnover

Potrebbero piacerti anche

- Syndicate 3 - Analisa Ratio IndustriDocumento5 pagineSyndicate 3 - Analisa Ratio IndustriMarkus100% (1)

- Finance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BDocumento4 pagineFinance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BrizqighaniNessuna valutazione finora

- Fonderia Di TorinoDocumento23 pagineFonderia Di TorinopradinaNessuna valutazione finora

- Krakatau Steel A Study Cases Financial M PDFDocumento8 pagineKrakatau Steel A Study Cases Financial M PDFZulkifli SaidNessuna valutazione finora

- 29116520Documento6 pagine29116520Rendy Setiadi MangunsongNessuna valutazione finora

- Ayustinagiusti - Developing Financial Insights - Using A Future Value (FV) and A Present Value (PV) ApproachDocumento10 pagineAyustinagiusti - Developing Financial Insights - Using A Future Value (FV) and A Present Value (PV) ApproachAyustina GiustiNessuna valutazione finora

- Integrative Approach Blemba 62Documento26 pagineIntegrative Approach Blemba 62sofia harwanaNessuna valutazione finora

- Fonderia Di Torino SDocumento15 pagineFonderia Di Torino SYrnob RokieNessuna valutazione finora

- TN38 Primus Automation Division 2002Documento11 pagineTN38 Primus Automation Division 2002mylittle_pg100% (1)

- Quality Control at PolaroidDocumento8 pagineQuality Control at PolaroidFez Research LaboratoryNessuna valutazione finora

- Class Activity: Individual AssignmentDocumento7 pagineClass Activity: Individual AssignmentBudy s RaharjaNessuna valutazione finora

- Krakatau Steel A - Syndicate 5Documento12 pagineKrakatau Steel A - Syndicate 5I Nyoman Sujana GiriNessuna valutazione finora

- Case Krakatau Steel (A) Financial Performance Syndicate 8Documento8 pagineCase Krakatau Steel (A) Financial Performance Syndicate 8Tegar BabarunggulNessuna valutazione finora

- Correlation Analysis Multiple Linear Regression With All 3 AnalystsDocumento3 pagineCorrelation Analysis Multiple Linear Regression With All 3 AnalystsEdward BerbariNessuna valutazione finora

- Krakatau Steel A ReportDocumento6 pagineKrakatau Steel A ReportSoniaKasellaNessuna valutazione finora

- (PIO YP64B) Dina Rizkia Rachmah - Mid TestDocumento5 pagine(PIO YP64B) Dina Rizkia Rachmah - Mid TestDina Rizkia RachmahNessuna valutazione finora

- Fonderia Di TorinoDocumento9 pagineFonderia Di TorinobiancanelaNessuna valutazione finora

- An Introduction To Debt Policy and Value - Syndicate 4Documento9 pagineAn Introduction To Debt Policy and Value - Syndicate 4Henni RahmanNessuna valutazione finora

- BUS670 O GradyDocumento5 pagineBUS670 O GradyIndra ZulhijayantoNessuna valutazione finora

- This Spreadsheet Supports Analysis of The Case, "The Investment Detective" (Case 18)Documento5 pagineThis Spreadsheet Supports Analysis of The Case, "The Investment Detective" (Case 18)Chittisa Charoenpanich100% (1)

- Fonderia Di Torino's Case - Syndicate 5Documento20 pagineFonderia Di Torino's Case - Syndicate 5Yunia Apriliani Kartika0% (1)

- Investment DetectiveDocumento16 pagineInvestment Detectiveabhilasha_yadav_1100% (2)

- Casa de DisenoDocumento8 pagineCasa de DisenoMarilou Broñosa-PepañoNessuna valutazione finora

- CC2 - The Financial Detective, 2005Documento4 pagineCC2 - The Financial Detective, 2005Aldren Delina RiveraNessuna valutazione finora

- Case 25 Gainesboro-Exh8Documento1 paginaCase 25 Gainesboro-Exh8odie99Nessuna valutazione finora

- SG 2 - GM 9 - The Financial DetectiveDocumento10 pagineSG 2 - GM 9 - The Financial DetectiveMuhammad Wildan FadlillahNessuna valutazione finora

- Developing Professionals-The BCG Way (A)Documento7 pagineDeveloping Professionals-The BCG Way (A)Billie Yandri Firsa0% (1)

- Report TimkenDocumento45 pagineReport TimkenVubon Minu50% (4)

- Exhibit 1: The Investment Detective Project Free Cash Flows (In $ Thousands) 1 2 3Documento15 pagineExhibit 1: The Investment Detective Project Free Cash Flows (In $ Thousands) 1 2 3zanmatto22Nessuna valutazione finora

- Investment DetectiveDocumento1 paginaInvestment Detectiveforeverktm100% (4)

- Tugas Finance Management Individu - MBA ITB - CCE58 2018 ExcelDocumento10 pagineTugas Finance Management Individu - MBA ITB - CCE58 2018 ExcelDenssNessuna valutazione finora

- SG 4 - Answer Form For Assignments of Film Tragedy of Commons and Beautiful MindDocumento3 pagineSG 4 - Answer Form For Assignments of Film Tragedy of Commons and Beautiful MindFadhila HanifNessuna valutazione finora

- Midterm Bisek Chapter 2Documento4 pagineMidterm Bisek Chapter 2FiqriNessuna valutazione finora

- Syndicate 1 - Krakatau Steel (B) - Global Competition - YP64BDocumento16 pagineSyndicate 1 - Krakatau Steel (B) - Global Competition - YP64BrizqighaniNessuna valutazione finora

- Case Study K9FUELBARDocumento2 pagineCase Study K9FUELBARAnonymous xH0aLu100% (1)

- The Financial DetectiveDocumento7 pagineThe Financial DetectivearifhafiziNessuna valutazione finora

- Investment Detective SG8Documento11 pagineInvestment Detective SG8Mr SecretNessuna valutazione finora

- BUS670 O'GradyDocumento4 pagineBUS670 O'GradyLori HughesNessuna valutazione finora

- Answer Form For Assignments of Film Tragedy of Commons and Beautiful MindDocumento1 paginaAnswer Form For Assignments of Film Tragedy of Commons and Beautiful MindFadhila HanifNessuna valutazione finora

- Corporate Finance 2Documento5 pagineCorporate Finance 2Murat OmayNessuna valutazione finora

- Case 26 An Introduction To Debt Policy ADocumento5 pagineCase 26 An Introduction To Debt Policy Amy VinayNessuna valutazione finora

- Eastboro Machine Tools CorporationDocumento19 pagineEastboro Machine Tools CorporationBeatrix X-ChenNessuna valutazione finora

- Business Strategy Classs AssignmentDocumento2 pagineBusiness Strategy Classs AssignmentRaymond Yonathan HutapeaNessuna valutazione finora

- K9FuelBar Case AnalysisDocumento14 pagineK9FuelBar Case AnalysisZuchrizal WinataNessuna valutazione finora

- The Demand For Sweet Potatoes in The United States: Business EconomicsDocumento8 pagineThe Demand For Sweet Potatoes in The United States: Business EconomicsAlhabu GamingNessuna valutazione finora

- Hill Country Snack Foods CompanyDocumento14 pagineHill Country Snack Foods CompanyVeni GuptaNessuna valutazione finora

- Case Study 1Documento3 pagineCase Study 1asuvaniNessuna valutazione finora

- Merck & Company Product - Decision TreeDocumento11 pagineMerck & Company Product - Decision TreeIgor SoaresNessuna valutazione finora

- Birdie Golf Inc Has Been in Merger Talks With HybridDocumento2 pagineBirdie Golf Inc Has Been in Merger Talks With HybridAmit PandeyNessuna valutazione finora

- Stone Finch Young, Old DivisionDocumento13 pagineStone Finch Young, Old DivisionNitish Chauhan100% (2)

- Kota Fibres LTD: ASE NalysisDocumento7 pagineKota Fibres LTD: ASE NalysisSuman MandalNessuna valutazione finora

- Mercury Athletic Footwear Case (Work Sheet)Documento16 pagineMercury Athletic Footwear Case (Work Sheet)Bharat KoiralaNessuna valutazione finora

- Poloroid ReportDocumento7 paginePoloroid ReportKevin RenellNessuna valutazione finora

- Acova RadiateursDocumento10 pagineAcova RadiateursAnandNessuna valutazione finora

- Syndicate 1 An Introduction To Debt Policy and ValueDocumento9 pagineSyndicate 1 An Introduction To Debt Policy and ValueBernadeta PramudyaWardhaniNessuna valutazione finora

- Finance Detective - Ratio AnalysisDocumento2 pagineFinance Detective - Ratio AnalysisAndhitiawarman NugrahaNessuna valutazione finora

- Data For Ratio DetectiveDocumento1 paginaData For Ratio DetectiveRoyan Nur HudaNessuna valutazione finora

- Ratios Tell A StoryDocumento2 pagineRatios Tell A StoryJose Arturo Rodriguez AlemanNessuna valutazione finora

- The Unidentified Industries - Residency - CaseDocumento4 pagineThe Unidentified Industries - Residency - CaseDBNessuna valutazione finora

- Ratios Tell A StoryDocumento3 pagineRatios Tell A StoryJose Arturo Rodriguez AlemanNessuna valutazione finora

- Laporan Guest LectureDocumento4 pagineLaporan Guest LecturemaritaputriNessuna valutazione finora

- Ikea Kelompok Yang Competitive AdvDocumento2 pagineIkea Kelompok Yang Competitive AdvmaritaputriNessuna valutazione finora

- Laporan Guest LectureDocumento11 pagineLaporan Guest LecturemaritaputriNessuna valutazione finora

- Merck & CoDocumento9 pagineMerck & ComaritaputriNessuna valutazione finora

- CM - Mapeh 8 MusicDocumento5 pagineCM - Mapeh 8 MusicAmirah HannahNessuna valutazione finora

- Ancient History Dot Point SummaryDocumento16 pagineAncient History Dot Point SummaryBert HaplinNessuna valutazione finora

- The Effect of Celebrity Endorsement On Customer Usage Behavior in The Case of Dashen Bank - Copy (Repaired)Documento78 pagineThe Effect of Celebrity Endorsement On Customer Usage Behavior in The Case of Dashen Bank - Copy (Repaired)Eyuael SolomonNessuna valutazione finora

- Understanding Culture, Society, and Politics Quarter 2 - Module 5 EducationDocumento19 pagineUnderstanding Culture, Society, and Politics Quarter 2 - Module 5 EducationMhecy Sagandilan100% (4)

- State of Cyber-Security in IndonesiaDocumento32 pagineState of Cyber-Security in IndonesiaharisNessuna valutazione finora

- Processes of Word Formation - 4Documento18 pagineProcesses of Word Formation - 4Sarah Shahnaz IlmaNessuna valutazione finora

- Lorax Truax QuestionsDocumento2 pagineLorax Truax Questionsapi-264150929Nessuna valutazione finora

- Cosmetics & Toiletries Market Overviews 2015Documento108 pagineCosmetics & Toiletries Market Overviews 2015babidqn100% (1)

- SLRC InstPage Paper IIIDocumento5 pagineSLRC InstPage Paper IIIgoviNessuna valutazione finora

- Drugs: Use, Abuse and Addiction - Lesson Plan (Grades 9 & 10)Documento23 pagineDrugs: Use, Abuse and Addiction - Lesson Plan (Grades 9 & 10)Dimple Lasala ElandagNessuna valutazione finora

- Accounting Concepts and Conventions MCQs Financial Accounting MCQs Part 2 Multiple Choice QuestionsDocumento9 pagineAccounting Concepts and Conventions MCQs Financial Accounting MCQs Part 2 Multiple Choice QuestionsKanika BajajNessuna valutazione finora

- Revised Compendium FOR PERSONAL INJURY AWARDS 2018 Revised Compendium FOR PERSONAL INJURY AWARDS 2018Documento52 pagineRevised Compendium FOR PERSONAL INJURY AWARDS 2018 Revised Compendium FOR PERSONAL INJURY AWARDS 2018LavernyaNessuna valutazione finora

- CCP Motivation Letter 2022Documento3 pagineCCP Motivation Letter 2022mohammed ahmed0% (1)

- Apple Case ReportDocumento2 pagineApple Case ReportAwa SannoNessuna valutazione finora

- Bookkeeping BasicsDocumento19 pagineBookkeeping BasicsAbeer ShennawyNessuna valutazione finora

- HSE RMO and Deliverables - Asset Life Cycle - Rev0Documento4 pagineHSE RMO and Deliverables - Asset Life Cycle - Rev0Medical Service MPINessuna valutazione finora

- 雅思口语常用高效表达句型 PDFDocumento3 pagine雅思口语常用高效表达句型 PDFJing AnneNessuna valutazione finora

- C.V ZeeshanDocumento1 paginaC.V ZeeshanZeeshan ArshadNessuna valutazione finora

- Fill in The Blanks, True & False MCQs (Accounting Manuals)Documento13 pagineFill in The Blanks, True & False MCQs (Accounting Manuals)Ratnesh RajanyaNessuna valutazione finora

- Barnacus: City in Peril: BackgroundDocumento11 pagineBarnacus: City in Peril: BackgroundEtienne LNessuna valutazione finora

- Against Open Merit: Punjab Public Service CommissionDocumento2 pagineAgainst Open Merit: Punjab Public Service CommissionSohailMaherNessuna valutazione finora

- Obaid Saeedi Oman Technology TransfeDocumento9 pagineObaid Saeedi Oman Technology TransfeYahya RowniNessuna valutazione finora

- Moodys SC - Russian Banks M&ADocumento12 pagineMoodys SC - Russian Banks M&AKsenia TerebkovaNessuna valutazione finora

- Obsa Ahmed Research 2013Documento55 pagineObsa Ahmed Research 2013Ebsa AdemeNessuna valutazione finora

- BPHC HRSA-23-025 (H8H) FY 2023 Ending HIV Epidemic - FinalDocumento44 pagineBPHC HRSA-23-025 (H8H) FY 2023 Ending HIV Epidemic - FinalTuhin DeyNessuna valutazione finora

- Gacal v. PALDocumento2 pagineGacal v. PALLynne SanchezNessuna valutazione finora

- Chelsea FC HistoryDocumento16 pagineChelsea FC Historybasir annas sidiqNessuna valutazione finora

- Frivaldo Vs Comelec 1996Documento51 pagineFrivaldo Vs Comelec 1996Eunice AmbrocioNessuna valutazione finora

- Meaningful Use: Implications For Adoption of Health Information Technology (HIT) Tamela D. Yount HAIN 670 10/17/2010Documento10 pagineMeaningful Use: Implications For Adoption of Health Information Technology (HIT) Tamela D. Yount HAIN 670 10/17/2010Tammy Yount Di PoppanteNessuna valutazione finora

- Affidavit of GC - Reject PlaintDocumento9 pagineAffidavit of GC - Reject PlaintVishnu R. VenkatramanNessuna valutazione finora