Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Statement Analysis

Caricato da

cara09250 valutazioniIl 0% ha trovato utile questo documento (0 voti)

42 visualizzazioni2 pagineReviewer

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoReviewer

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

42 visualizzazioni2 pagineFinancial Statement Analysis

Caricato da

cara0925Reviewer

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

Management accounting o SEMI-VARIABLE: with fix and variable

- accumulation and preparation of financial components

reports for internal users only

- needed by management in planning, ANALYZING MIXED COSTS

controlling and evaluating the entity’s o Scattergraph:

operations - subjective and inexact

- produce budgets, performance evaluations - simple and intuitive

and cost reports o High-low method:

- subjective, relevant, future oriented - uses only two data points, which may

- reports as needed not represent the general trend in the

- decision making data

o Least square regression:

Financial accounting - requires more data and assumptions

- concerned with recording of business - proper interpretation of results is

transactions and the eventual preparation critical

of financial statements - uses all data points

- intended for internal and external users

- produce financial statements according to ACCOUNTING PERIOD

GAAP o Capital expenditure:

- objective, reliable, historical - benefit more than one accounting

- reports periodically periods

- company as a whole - asset

o Revenue expenditure:

COST CONCEPTS AND BEHAVIOR - benefit current period only

- expense

Cost: cash or cash equivalent value sacrificed for

goods and services that are expected to bring a PLANNING AND CONTROL

current or future benefit to the organization o Standard costs:

- predetermined cost for DM, DL & FO

DIRECT INDIRECT o Opportunity cost:

Can be directly and Cannot be directly - benefit given up when one alternative is

conveniently traced to the and conveniently chosen over the other

cost object traced to the object o Differential cost:

MANUFACTURING/ NON- - cost that is present under one

PRODUCT MANUFACTURING/ alternative but absent in whole or part

Producing a physical PERIOD under another alternative

product Running the o Relevant cost:

o Direct materials: business and selling - potential to influence a decision; it must

material inputs that can the product occur in the future and differ between

be directly and o Distribution the alternatives

conveniently traced to costs o Out of pocket cost:

each unit of product o Administrative - cost that requires the payment of money

o Direct labor: expenses (or other assets)

employees who o Finance costs o Sunk cost:

physically convert - a cost of which an outlay has already

materials to finished been made and it cannot be changed by

products any or present future decision

o Manufacturing

overhead: indirect COST VOLUME PROFIT ANALYSIS

costs incurred to

produce products. o Contribution Margin Income Statement

Sales

TOTAL MANUFACTURING COST= direct Variable cost

materials + direct labor+ manufacturing overhead Contribution Margin

(Fixed costs)

Prime cost= direct materials + direct labor Net income

o Focuses on interactions between the five

Conversion cost= direct labor + manufacturing elements:

overhead - price of products

- volume or level of activity

COST CLASSIFICATION - variable cost per unit

- total fixed costs

o VARIABLE: change in total, in relation to - mix of products sold

volume

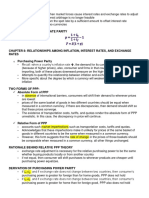

o FIXED: remain constant, in total, 𝑾𝒆𝒊𝒈𝒉𝒕𝒆𝒅 𝒂𝒗𝒆𝒓𝒂𝒈𝒆 𝑪𝑴 = 𝑪𝑴 𝒙 𝒓𝒂𝒕𝒊𝒐

irrespective of the volume

MARGIN OF SAFETY

- the amount by which sales could decrease

before losses are incurred

𝑀𝑂𝑆 = 𝐴𝑐𝑡𝑢𝑎𝑙 𝑠𝑎𝑙𝑒𝑠 – 𝐵𝑟𝑒𝑎𝑘𝑒𝑣𝑒𝑛 𝑠𝑎𝑙𝑒𝑠

𝑀𝑂𝑆

𝑀𝑂𝑆 𝑅𝑎𝑡𝑖𝑜 =

𝐴𝑐𝑡𝑢𝑎𝑙 𝑆𝑎𝑙𝑒𝑠

OPERATING LEVERAGE

- potential effect of the risk that sales will fall

short of planned levels as influenced by the

relative proportion of fixed to variable

manufacturing costs

𝐶𝑜𝑛𝑡𝑟𝑖𝑏𝑢𝑡𝑖𝑜𝑛 𝑀𝑎𝑟𝑔𝑖𝑛

𝐷𝑂𝐿 =

𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒

PREDETERMINED OVERHEAD RATE

𝑷𝑶𝑹

𝑬𝒔𝒕𝒊𝒎𝒂𝒕𝒆𝒅 𝒕𝒐𝒕𝒂𝒍 𝒎𝒂𝒏𝒖𝒇𝒂𝒄𝒕𝒖𝒓𝒊𝒏𝒈 𝒐𝒗𝒆𝒓𝒉𝒆𝒂𝒅 𝒓𝒂𝒕𝒆

=

𝑬𝒔𝒕𝒊𝒎𝒂𝒕𝒆𝒅 𝒕𝒐𝒕𝒂𝒍 𝒄𝒐𝒔𝒕 𝒅𝒓𝒊𝒗𝒆𝒓

𝑨𝒑𝒑𝒍𝒊𝒆𝒅 𝑴𝑶 = 𝑷𝑶𝑹 𝒙 𝑨𝒄𝒕𝒖𝒂𝒍 𝒄𝒐𝒔𝒕 𝒅𝒓𝒊𝒗𝒆𝒓

Potrebbero piacerti anche

- FINALS - Global FinDocumento11 pagineFINALS - Global Fincara0925100% (1)

- QuestionsDocumento1 paginaQuestionscara0925Nessuna valutazione finora

- Business EthicsDocumento3 pagineBusiness Ethicscara0925Nessuna valutazione finora

- Global FinanceDocumento3 pagineGlobal Financecara0925Nessuna valutazione finora

- CHAPTER 8 - Global FinDocumento2 pagineCHAPTER 8 - Global Fincara0925Nessuna valutazione finora

- International Corporate FinanceDocumento10 pagineInternational Corporate Financecara0925Nessuna valutazione finora

- International Corporate FinanceDocumento10 pagineInternational Corporate Financecara0925Nessuna valutazione finora

- FSA - Cost Accounting ReviewerDocumento2 pagineFSA - Cost Accounting Reviewercara0925100% (1)

- LawDocumento15 pagineLawcara0925Nessuna valutazione finora

- Business EthicsDocumento3 pagineBusiness Ethicscara0925Nessuna valutazione finora

- CHAPTER 8 - Global FinDocumento2 pagineCHAPTER 8 - Global Fincara0925Nessuna valutazione finora

- CFA Questions and SolutionsDocumento16 pagineCFA Questions and Solutionsvip_thb_2007100% (1)

- Chap007 HWK 2Documento14 pagineChap007 HWK 2cara0925Nessuna valutazione finora

- LogisticsDocumento38 pagineLogisticscara0925Nessuna valutazione finora

- BankingDocumento2 pagineBankingcara0925Nessuna valutazione finora

- Obli ConDocumento16 pagineObli Concara0925Nessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Fitch Downgrades GOL's IDRs To 'CCC-'Documento10 pagineFitch Downgrades GOL's IDRs To 'CCC-'Rafael BorgesNessuna valutazione finora

- 2017-02-24 Margarita Mares Rescission LetterDocumento1 pagina2017-02-24 Margarita Mares Rescission Letterapi-360769610Nessuna valutazione finora

- Financal MathematicsDocumento41 pagineFinancal MathematicsGeorge PauloseNessuna valutazione finora

- 152276Documento73 pagine152276Shofiana IfadaNessuna valutazione finora

- Construction Industry Payment and Adjudication Act Form 1 - Payment ClaimDocumento3 pagineConstruction Industry Payment and Adjudication Act Form 1 - Payment ClaimBrandy H.100% (1)

- Tony Arnold - Inventory Management CH - 09Documento9 pagineTony Arnold - Inventory Management CH - 09durlitNessuna valutazione finora

- Audit of Cash: Darrell Joe O. Asuncion, Cpa MbaDocumento17 pagineAudit of Cash: Darrell Joe O. Asuncion, Cpa MbaKaila Salem100% (1)

- ITF InventoriesDocumento36 pagineITF InventoriesRisa MonitaNessuna valutazione finora

- Chapter 9-STOCK VALUATION-FIXDocumento33 pagineChapter 9-STOCK VALUATION-FIXRacing FirmanNessuna valutazione finora

- Sbi Afi 2012Documento48 pagineSbi Afi 2012Moneylife FoundationNessuna valutazione finora

- Exam1 Solutions 40610 2008Documento7 pagineExam1 Solutions 40610 2008JordanNessuna valutazione finora

- National Stock Exchange'S Certification in Financial Markets (NCFM)Documento4 pagineNational Stock Exchange'S Certification in Financial Markets (NCFM)hitekshaNessuna valutazione finora

- Origin and Evolution of AuditingDocumento3 pagineOrigin and Evolution of AuditingAntony SanthiyaNessuna valutazione finora

- A Tale of Two LedgersDocumento3 pagineA Tale of Two LedgersManuel Elijah SarausadNessuna valutazione finora

- TCR Active Alpha Fact Sheet 16022017Documento4 pagineTCR Active Alpha Fact Sheet 16022017api-319756580Nessuna valutazione finora

- Derivatives MarketDocumento12 pagineDerivatives MarketShushmita SoniNessuna valutazione finora

- Insider TradingDocumento2 pagineInsider TradingSanju VargheseNessuna valutazione finora

- SamTREND - EquitiesDocumento20 pagineSamTREND - EquitiesPratik PatelNessuna valutazione finora

- The Essentials of An Efficient Market - FinalDocumento30 pagineThe Essentials of An Efficient Market - FinalAnita Kedare100% (1)

- Internship Report Allied Bank Limited NewDocumento63 pagineInternship Report Allied Bank Limited NewMuhammed Bilal AhmadNessuna valutazione finora

- Bond Valuation: Case: Atlas InvestmentsDocumento853 pagineBond Valuation: Case: Atlas Investmentsjk kumarNessuna valutazione finora

- Pengaruh Employee Stock Ownership Program (ESOP) Dan Leverage Terhadap Kinerja Keuangan PDFDocumento8 paginePengaruh Employee Stock Ownership Program (ESOP) Dan Leverage Terhadap Kinerja Keuangan PDFDio ChandraNessuna valutazione finora

- Alpha New Trader GuideDocumento9 pagineAlpha New Trader GuideChaitanya ShethNessuna valutazione finora

- HTGC 2013 Annual ReportDocumento246 pagineHTGC 2013 Annual Reportemirav2Nessuna valutazione finora

- Homework 1Documento3 pagineHomework 1johnny60% (5)

- The American Banker, June 27, 2002Documento2 pagineThe American Banker, June 27, 2002juniorcobraNessuna valutazione finora

- Pembahasan Soal Prakuis 1-5Documento4 paginePembahasan Soal Prakuis 1-5bonitaNessuna valutazione finora

- Practice Fin Man Exam Advanced Wiley 2013 Test Bank Multiple Answer Chapter 13 - 14Documento8 paginePractice Fin Man Exam Advanced Wiley 2013 Test Bank Multiple Answer Chapter 13 - 14rgarbuz155Nessuna valutazione finora

- Call Money MarketDocumento24 pagineCall Money MarketiyervsrNessuna valutazione finora

- Chapter - 4: Business of Combination 4.1 Business of Combination: An Overview 4.1.1 Definition of Business CombinationDocumento32 pagineChapter - 4: Business of Combination 4.1 Business of Combination: An Overview 4.1.1 Definition of Business CombinationYeber MelkemiyaNessuna valutazione finora