Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

People V Go CD

Caricato da

GeeanTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

People V Go CD

Caricato da

GeeanCopyright:

Formati disponibili

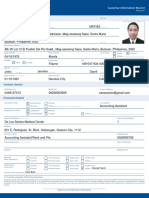

PEOPLE v JOSE GO

G.R. No. 191015 August 6, 2014

FACTS:

In 1998, BSP ordered closure of the Orient Commercial Banking Corporation (OCBC) and place it under

receivership of the Philippine Deposit Insurance Corporation (PDIC) which took charge of its assets and

liabilities.

PDIC began collecting OCBC’s past due loans receivable which include Timmy’s Inc and Asia Textile Mills,

Inc for P10M each. Both company’s representative denied having applied such loan.

PDIC’s investigation revealed that such loans were released in the form of manager’s checks in the name

of other companies, which were allegedly deposited to the savings account of the Jose C. Go with OCBC

and were automatically transferred to his current account to finance his dishonored checks. PDIC then

filed a complaint for estafa1.

The accused were acquitted after the RTC judge found the Demurrer to Evidence meritorious.

CA ruled that the order was deemed final and executory as MR was filed 2 days late.

ISSUE: WON grave abuse of discretion was committed by judge in granting the demurrer to evidence

HELD: Yes.

Judge´s order caused substantial injury to the banking industry and public interest. It effectively failed to

1

weigh the evidence against the respondents, which it was duty-bound to do as a trier of facts.

Obviously, a bank takes its depositors’ money as a loan, under an obligation to return the same; thus, the

term "demand deposit."

The contract between the bank and its depositor is governed by the provisions of the Civil Code on simple

loan. Article 1980 of the Civil Code expressly provides that "x x x savings x x x deposits of money in banks

and similar institutions shall be governed by the provisions concerning simple loan." There is a debtor-

creditor relationship between the bank and its depositor. The bank is the debtor and the depositor is the

creditor. The depositor lends the bank money and the bank agrees to pay the depositor on demand. x x x

The fiduciary nature of banking requires banks to assume a degree of diligence higher than that of a good

father of a family. This is deemed written into every deposit agreement.

The bank money which came to the possession of petitioner was money held in trust or administration by

him for the bank, in his fiduciary capacity as the President of said bank.

Said cases are ordered REINSTATED for the continuation of proceedings.

1The elements of estafa through abuse of confidence under Article 315, par. 1(b) of the Revised Penal Code are: "(a) that

money, goods or other personal property is received by the offender in trust or on commission, or for administration, or under

any other obligation involving the duty to make delivery of or to return the same; (b) that there be misappropriation or

conversion of such money or property by the offender, or denial on his part of such receipt; (c) that such misappropriation or

conversion or denial is to the prejudice of another; and (d) there is demand by the offended party to the offender."

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1091)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Fee ScheduleDocumento39 pagineFee Scheduleapi-127186411Nessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Mocha Swiss Roll RecipeDocumento3 pagineMocha Swiss Roll RecipeGeeanNessuna valutazione finora

- Training Plan: Learning Outcome Learning ResourcesDocumento9 pagineTraining Plan: Learning Outcome Learning ResourcesGeeanNessuna valutazione finora

- Comparative Analysis of Different Insurance ProductsDocumento53 pagineComparative Analysis of Different Insurance Productsgsaraogi85% (39)

- Sales ReviewerDocumento16 pagineSales ReviewerAriel Maghirang0% (1)

- CASE DIGESTS-evidenceDocumento6 pagineCASE DIGESTS-evidenceGeeanNessuna valutazione finora

- SME Smart ScoreDocumento35 pagineSME Smart Scoremevrick_guyNessuna valutazione finora

- Citibank N.A. & Investors Finance Corporation v. SabenianoDocumento1 paginaCitibank N.A. & Investors Finance Corporation v. SabenianoShiela Pilar100% (1)

- Stone Container Case DiscussionDocumento7 pagineStone Container Case DiscussionMeena83% (6)

- Stress Testing of DBBLDocumento76 pagineStress Testing of DBBLMosarraf Rased100% (1)

- Writing Effective Business CorrespondenceDocumento28 pagineWriting Effective Business CorrespondenceGeean100% (1)

- 58 PNB v. RodriguezDocumento3 pagine58 PNB v. RodriguezJustin ParasNessuna valutazione finora

- FACILITIES in ONGC (Updated From Time To Time)Documento13 pagineFACILITIES in ONGC (Updated From Time To Time)ramchander100% (1)

- Writing MemorandaDocumento12 pagineWriting MemorandaGeeanNessuna valutazione finora

- Self AssessmentDocumento6 pagineSelf AssessmentGeeanNessuna valutazione finora

- Writing A RUBRICDocumento41 pagineWriting A RUBRICGeeanNessuna valutazione finora

- Law On Taxation Review.-Chapter 1Documento17 pagineLaw On Taxation Review.-Chapter 1GeeanNessuna valutazione finora

- Resignation LetterDocumento8 pagineResignation LetterGeeanNessuna valutazione finora

- Letter of InquiryDocumento8 pagineLetter of InquiryGeeanNessuna valutazione finora

- SociolinguisticsDocumento35 pagineSociolinguisticsGeeanNessuna valutazione finora

- The College of Maasin: Nisi Dominus FrustraDocumento6 pagineThe College of Maasin: Nisi Dominus FrustraGeeanNessuna valutazione finora

- Developing English Language Skills For Vietnamese Learners of English Through Raising Their Awareness of The Contrastive Linguistic FeaturesDocumento32 pagineDeveloping English Language Skills For Vietnamese Learners of English Through Raising Their Awareness of The Contrastive Linguistic FeaturesGeeanNessuna valutazione finora

- Defining ReligionDocumento29 pagineDefining ReligionGeeanNessuna valutazione finora

- How The Refrigerator WorksDocumento1 paginaHow The Refrigerator WorksGeeanNessuna valutazione finora

- How Do You Make Paper From A TreeDocumento1 paginaHow Do You Make Paper From A TreeGeeanNessuna valutazione finora

- Importance of Knowledge of Laws in The HospitalityDocumento7 pagineImportance of Knowledge of Laws in The HospitalityGeeanNessuna valutazione finora

- Apple PieDocumento1 paginaApple PieGeeanNessuna valutazione finora

- Labor Review Assigment 2Documento8 pagineLabor Review Assigment 2GeeanNessuna valutazione finora

- Poetic TechniquesDocumento16 paginePoetic TechniquesGeeanNessuna valutazione finora

- Far East Vs Gold PalaceDocumento4 pagineFar East Vs Gold PalaceGeeanNessuna valutazione finora

- Evidence-Second AssignmentDocumento3 pagineEvidence-Second AssignmentGeeanNessuna valutazione finora

- Menu For Accreditation (20-25 Pax) TECH 302 Day Am Snacks Lunch PM Snacks DinnerDocumento1 paginaMenu For Accreditation (20-25 Pax) TECH 302 Day Am Snacks Lunch PM Snacks DinnerGeeanNessuna valutazione finora

- Chocolate CakeDocumento3 pagineChocolate CakeGeeanNessuna valutazione finora

- Credit Trans Cases MortgagesDocumento33 pagineCredit Trans Cases MortgagesonlineonrandomdaysNessuna valutazione finora

- Foreclosure Prevention Response Program Final ReportDocumento3 pagineForeclosure Prevention Response Program Final ReportnarwebteamNessuna valutazione finora

- Syndicated Loan Vs BondDocumento37 pagineSyndicated Loan Vs BondAli Attarwala100% (2)

- Introduction To Retail BankingDocumento88 pagineIntroduction To Retail Bankingchulbulpandey31Nessuna valutazione finora

- Chapter 2 Exercises and Solutions: Exercise 2.1Documento3 pagineChapter 2 Exercises and Solutions: Exercise 2.1BobNessuna valutazione finora

- IRAC Norms & NPA ManagementDocumento29 pagineIRAC Norms & NPA ManagementSarvar PathanNessuna valutazione finora

- Synopsis GurpratapDocumento16 pagineSynopsis GurpratapGurpratap GillNessuna valutazione finora

- Concurrent Audit References 28-12-2012Documento12 pagineConcurrent Audit References 28-12-2012Sj RaoNessuna valutazione finora

- Bates V Post Office Claimants' Appendix of AuthoritiesDocumento93 pagineBates V Post Office Claimants' Appendix of AuthoritiesNick WallisNessuna valutazione finora

- Newsletterv7feb 2015Documento3 pagineNewsletterv7feb 2015api-272320822Nessuna valutazione finora

- R.A 8367 PDFDocumento6 pagineR.A 8367 PDFreshell100% (1)

- Franchise FormDocumento4 pagineFranchise Formapi-90253929Nessuna valutazione finora

- Subhekhya Finance CoDocumento6 pagineSubhekhya Finance CoJeetendra TripathyNessuna valutazione finora

- Comprehensive Examinations 2 (Part I)Documento13 pagineComprehensive Examinations 2 (Part I)Yander Marl BautistaNessuna valutazione finora

- Form 28PHFA Form 28 Hello Goodbye LetterDocumento2 pagineForm 28PHFA Form 28 Hello Goodbye LetterRicharnellia-RichieRichBattiest-Collins0% (1)

- BBG-CIR-Personal-09-06-2017 (BDO Open Account Form) PDFDocumento2 pagineBBG-CIR-Personal-09-06-2017 (BDO Open Account Form) PDFiam cjNessuna valutazione finora

- Prime Bank LTD Ratio AnalysisDocumento30 paginePrime Bank LTD Ratio Analysisrafey201Nessuna valutazione finora

- Neston Local Feb 2011Documento32 pagineNeston Local Feb 2011Talkabout PublishingNessuna valutazione finora

- 1st Set Full Text Plus CDE of OutlineDocumento129 pagine1st Set Full Text Plus CDE of Outlinednel13Nessuna valutazione finora

- Marshalling and Contribution in MortgageDocumento4 pagineMarshalling and Contribution in Mortgage18212 NEELESH CHANDRANessuna valutazione finora

- Now You Can Pay Your BSNL Mobile Bills at Any BSNL Retailer's OutletDocumento1 paginaNow You Can Pay Your BSNL Mobile Bills at Any BSNL Retailer's OutletAlagu MurugesanNessuna valutazione finora