Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Project Six's 2016 Tax Return / IRS Form 990

Caricato da

The Watchdogs0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

4K visualizzazioni26 pagineProject Six filed this Form 990 with the Internal Revenue Service for 2016.

Titolo originale

Project Six's 2016 tax return / IRS Form 990

Copyright

© © All Rights Reserved

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoProject Six filed this Form 990 with the Internal Revenue Service for 2016.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

4K visualizzazioni26 pagineProject Six's 2016 Tax Return / IRS Form 990

Caricato da

The WatchdogsProject Six filed this Form 990 with the Internal Revenue Service for 2016.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 26

990 Return of Organization Exempt From Income Tax — |-2 #2"

For Under section 201) 527, oF 47a} of he ntrna Revere Code xcept phate foundation

cesta ney > Donot enter sci securty numbers on this om as I'may be made publ.

Tropacton

ia ne > Information sbout Form 900 and its instructions is at wa re gov/lorm00.

‘A For the 2016 ealondar year or tax year beginning ‘end ending

8 gray, [eNeme otorganzaton [D Employer identication namber

ists | PROJECT SIX

Dong busness as 81-2327719

‘Number ana steet (FU bari mai rol davered a set aoares) [oom [E Telephone number

53 W JACKSON BLVD 424 269-544-0322

‘Gly town, sate or promnce. court, and ZIP or Toragh postal code [a connacns 634,341.

CHICAGO, IL 60604

Ha) ths a roup rau

FE Name and address of pmopalotiew PALSAL KHAN forsubordnater?— ]ves Ono

SAME AS _C_ABOVE HD) swat wocarnes ectowerl—lves [Ino

TTaxoomptettue (XT son) T1501 Greoina) LSM ALTE] Ne, atach alt foe metnctons)

Tis WH THESECREST CON EIN gern cergten noms

Form of organzavon KT Comporaion _[__1 Tast_{_[Resseaton [Tomar [Lar storaien: 201 fw St stops conaeTE

fpartt Summary

“1 Bnslly dasertoa he organaaton's masion or mast ageicantaciwtes PROJECT SIX IS AN INDEPENDENT,

NONPROFIT ORGANIZATION DEDICATED TO INVESTIGATING, EXPOSING AND

‘Check ns box BP Ll te arganzaton chacontrved is operations or asposed of more than 25% of tana ants

"Number of voting members ofthe govemng body Part Vl. ine Ya) 3

[Number of ndependont voting members ofthe governing body (Par I tno 18) 4

Tota rambo of newuals employed m calendar yoar 2016 Part V, le 25) s

Total umber of voluntaers (estate f necessary) ‘

77 Total unrelated business verve ror Part Vl cokumn (©) S012 ra

bb Net unestag buanees taxable neome from Form 990, ine 34 [rol

Adel J.

Por Year argh Yor

Contours and grants Pet ne 1) S30

© Progam seve eve Pa re 29)

10 rvestmert nce Pat Vcc 3, 8, 0478)

11 ther reverue (Pat cols ies 5, 6, 8, 10 and)

$2. otareverue- 203s 8 nvoug 1 (ust equal Par Vi colune ne

79 Grants and senor aroun ped Parca ines +3)

14 Benes pdt orfr mater (Pat okarn nw 8

48. Solares, cher compencaton, employee tenets Pa coker ies 10) a

180 Proacsoa rrr les Pat clara re) 0

b Toaltuncrasen OPERA mee) be 70,433.

2 iter eres ED ic tou 30 598

18 Toa expenses. Adkighe17 ft oq Pat burn (oe 25) aT 13a:

49 _ Revenue less expen$es. Sublist hd 19 G47 ine | Said.

rs z eghig a Gan Vor | End vor

20 Tolassts Patt ney 38, 9257

3 outaoitee pabcmea@DEN, UT 52708:

22 Ne ase or ung bares Suber ioe 71 ee Z0 T3217

ar | Signature Block

Revenue

i

4

Expenses

[peice

‘Ua penates of perry | alr a hav rand ar ning SeooMpunnGSRCGAES an Tae, dae Deak rs RoweOe wa BOT A

te caret and complete Declan gf prepare (oer ha ofc) bast ona nlrmaton of whch prepare has ny krowedoe

eee aye

D saath Taher

Sion wat

Here FAISAL KHAN, PRESIDENT

Typecast

rity preparers mame Preparers sana a oa CIN

nit. ENNIS K. WEISS, CPA ence 8 Wesae, CPA \)8/14/17| ee 01330013

‘resuer [Fumstane yD. K. WETSS € ASSOCIATES, PLLC fansthy 30-0022324

teeny [Frmsadswssy 4660 WN. BRETON COURT, SUITE 102 ——————}

KENTWOOD, MI_49508 ronan 616-871-1233

‘Haye cscs a retun wth preparer shown above Sse nauchons) Tiles 1 The

Chow is Lik For Papert Reton At Nc, she separate HERR ran BBO ay

WED AUG? 8 207

at

q

i

SEE SCHEDULE O FOR ORGANIZATION MISSION STATEMENT CONTINUATION

av

Fem quis PRosECT Six 81-2327719 pags?

[Partin Staremont or Program Service Recomplahments

Chet Schedule O contans 2 respense or note to any Ine ths Par irl

7 ely cesenbe tne organzation's asin

PROJECT SIX IS AN INDEPENDENT, NONPROFIT ORGANIZATION DEDICATED TO

INVESTIGATING, EXPOSING AND ENDING GOVERNMENT CORRUPTION IN CHICAGO

AND_ACROSS ILLINOIS.

2D the ergancaton undertake any egnicant program serves dung the year whch wore notated the

‘prox Form 990 or 990-627 Coves Gil no

it¥es," describe these now serves on Schedule 0.

‘80x the erganzaton cease conducting, or make sgnftcant changes in how t conducts ny program sevices? ves Glo

"Yes." describe these changes on Schedule O.

4 Desenbe the organatons rogram sernce accomplnmant or each offs tee largest program serves, as measured by expenses

Section 501(2K) and 501(¢)orgarwatons are requred 1 report the amount of gars and alocatons to others, the total expenses. and

revenue any, foreach program service reported

Coe Yemen 342,805 age T pean

PROJECT Six CONDUCTS INVESTIGATIONS ATMED_AT EXPOSING CORRUPTION-AND

WASTE OCCURRING IN CHICAGO AND ILLINOIS. SINCE ITS INCEPTION IN2016,

PROJECT SIX UNVEILED STIGATIONS INTO CORRUPTION IN CHICAC

RAISED SIGNIFICANT INTEREST AND QUESTIONS ABOUT THE CONDUCT OF OUR

ELECTED OFFICIALS AND THE CONSEQUENCE OF THEIR ACTIONS. IN ITS FIRST

YEAR, PROJECT SIX RECEIVED 106 TIPS FROM WHISTLEBLOWERS AND CITIZENS

AND PRODUCED 27 REPORTS. CAMPAIGN FINANCE FRAUD WAS REPORTED,

TAX-DOLLAR WASTE WAS QUESTIONED, A HIGH-LEVEL CITY EMPLOVEE RESIGNED

BECAUSE OFA CONFLICT OF INTEREST, AND A NUMBER OF REFERRALS WERE MADE

TO GOVERNMENT AGENCIES RESPONSIBLE FOR ETHICS AND CRIMINAL OVERSIGHT AS

R_RESULT OF THESE INVESTIGATIONS. BY INFORMING AND EDUCATING

TAXPAYERS, ENGAGING WITH OUTSIDE MEDIA, LEGAL AND GOVERNMENT AGENCIES,

een oer egret Y Bom 7

eae Veonens) proreners 7 fen 7

“2d Other program senices (Descnbe m Schedule 0}

(omnes navi at 1 frome

To Total program sence oxpenees 347,805

Foon 880 2056)

cen ve SEE SCHEDULE 0 FOR CONTINUATION(S)

3

15510814 798302 1500L 2016.04013 PROJECT SIX 1500L_1

Forms 03 PRogzcT six 81-2327719 aes

[Pantlv [cnecunat or Required Schedules

rac

11 etna xpanatondesroed sack SOV) 447A (share a pat finda?

ites compute Schedan A six

2. te tmecrncaon equed econo Sched 8, Shade of Cotnbuere 21x

3. Date egnaaton engage m rector et peal canpagn ates nha orm oppoeton candor

pubic cee? "as" compete Schcie© Pon o| [x

4 Secon S01} eraunetons. Oe anaaton encagen kbbyng ats, ore asaten Oi acten meet

thoe he tn yeu? Ween compte Scale Pat «| |

5 te recreation a acon SH) S01, oF OH} rgnzaton atrecoes abi ss, estore or

Sintr amounts 0 dees nRevrue Proce 861977 an conpeeSchedue GP it s|_|x

© Othe eganaston mart on dare sowed tds ays nds ocr fr whch dons hve the rt to

provaseavesen he detutonertvesmen ct amants such aes raccosts? encore Scheaie yet! | s | |X

17 Daltw ogrtaton eco otis conaton ence weuig exponents pee open spe

tre enna montages, oto sectaer? "es compete eee Pat rx

8. Date ogantatonmantan sotcors ot won of at hotel anew. the tar aces? "en" cite

Somat Poti! o| |x

©. Dd be oyeraton mpertan aroun Pa ne 21, eno of cutlass cutee

trots ott Pat ron cod coer, da marae ep Se mettonses”

tye" compe Seneau at alle

10 Od tnecsaneten orth eth ate rancor, hl seen enpaay este endownens pemarent

noes gcsonnmerts fan crite che 2 PatY w| |x

11 tne orpancat's newer tay fhe falowng euestonee "Ye hen ample Sched D Pas Vl, ork

aswel

«2 Ovtnecrpnaaten oor an ane fad bugs ae equoment Pa Xr 1071 "Yes compte eee 2

ae sul x

be thersanzton ee an ant for mesons esc nPaX ne 2th 8 5% orf ts ea

sous eporodn Pat ke 16> "compiteScheaue 0 Pat Vi |_| x

¢ Date oganaaton wp an amour or nevnets-proyomreatedn Pat ne 1h 5 o mae of ett

toda epted mPa kw 10? in compsSchea Pa Vl we|_[x

4 Datta ngonaton pet en au forober anes Par re 1 9% ore off lass epoed n

Part ne 16? Ys compla ScheeB Pa w| |x

« Dutrs osancaton pat an evurtor oer tates Pat XI 257 Yen cont Schecle 0, Pat tof X

1 Datwoenatons copter conchae rare! dave retary ecu aon et esos

treorgeuaien's laity lr incetantexpostonunée FNAB ASC TSOP" combate Sole. Patk [au X

tan Datre orpanaten clan sepana, nepennt aued areal statert te tx yea? Yes compete

Scheu Pars nd a ral [x

We ie crpancabn netue mn conckld nependent sted nance somes for thts ya?

{tee rete orator creed Notte To an comply Sto Pat Mand te pteal |r| |x

13 isthe crgmcatonaechoa desorbed ston 17OGNIYAK? i "es compe Sea st 1x

‘a Ode rpanaton maar anctce employes or agers ated the Une Saar? ried

Onin crgenzaton have pee eveucs or eperes omer an $10000 fn ganinakr,tindrasig, buon

tesa on propen sve acoereutae we ues Sls or aay mertera vale S100 200

trimer Yes compue Scheu. Pat and so| |x

418. Da the rpanaton reprton Pat cau Se 3s han SSO00 tran r ater arstace torr ay

terog taraaton ve comptie Sched Fats and «| |x

1 Dystecrgaeaton parton Pa stem) ne 3a tan 88.001 ayes rte asstarc ta

trtortegr nema? Ys compte Scheu F.Pats lend” «| |x

17 bustnecigaeaton pe fee than $1 00! eon cesar aang secs en Pat

luna (en Gard? es compite Scheie Pat a| |x

18 Dutnecrpremon ep rere nan $1000 lof tanuen rt gots coe rd corebors on Pa es

Ae andeaPl "Yu corel Schedue Pat wl! |x

18 Date rganztoneportmor tan $1000 of goss came om arg aces on Pat. eS "Yo"

corouts Sena Pat wl |x

Form BD 2015

15510814 798302 1500L

4

2016.04013 PROJECT SIX

1500L_1

Foms90 01 PROJECT SIX 81-2327719 _ Page

[Part iv Checklist ot Required Schedules conmoea

[Yes] No.

20a DW he erganzaton operate ene or mors hosptal facies? I "Yes," complete Schedule H al 1X

b I-Yee" to ine 20a, dt the axganaaton attach a copy of ts audited nancial statement to th atu? 200

2101 the erganzaton report more than $5,000 grants er ther assistance o any domestic organzation oF

‘domestic goverment on Part IX, clu (A), ne 121 "Yes" complete Schedule, Pats and a} |x

1s the ergaizaten por more than $5,000 of grants or cher assstance to or for domeste etuals on

Part, column ke 2? IY," complete Schedule Parts and i! al |x

1s the erganzaton angwer "Yee to Patt VI Sacton A, tne, 4 or 5 about compensation of the organization's cent

_and former oftcere, rector, trustees, key employees, and highest compensates employees? IYes," complete

‘Schade al |x

‘24a Dad the organzaton havea tax-exempt bond issue wih an outstanding pencpl amount of more than $100,000 2s othe

last day of he year that was esuod ater December 31, 20027 f Yes," answer ines 240 though 24¢ ard compete

Schedule K 11°No", goto ine 252 240

bd the cxganzation nvest any proceeds of taxexemt bonds beyond a temporary perod exception? 20

‘© Dad the organization mantan an eferow account ctr than a retunding escrow at any tme due the year to delease

any taxexorpt bonds? | 24

4 De the orgenzation act as an “on behal omer or bonds outstanding at ary ime dung the year?

25a Section 501cK3}, 501(eK8), and 501(2K20) organizations. ithe organcaton engage n an excess benefit

‘wansacton wan a dsqualfied person durng the year? "Yes," complete Scedue L, Pat

Is the organzaton aware tat engagod mn an excess bent ansacton with a squalfied person a pro year, and

‘that the trarsacton has not been reported en any ofthe exganzaton's paer Forms 990 or 990EZ? "Yes," complete

‘Seneduiet,Part |

28 De the organzaten report any amaunt on Pa, Ine 5, 6, oF 22 for racawables rom ar payables to any cure or

former oficers, drector, trustees, key employees, Nghest compensated employees, or csquakid persons? "Yes,"

‘compete Schedule , Parti | |x

27D the organzaton provide a grantor other assistance oan ocer,drecter, rusts, key employee, substantial

contributor or employee thereof, gra electon comattes member, orto a 38% contaled anty or famy member

e

‘of any ofthese persone? I -Yes," complete Schedule L, Pat ii a| |x

128 Was the organization a party o a business transaction wh one ofthe folowng parts (see Schedule L, Part V

\natructions fr applied fing threshold, conditions, and exceptens)

18 Aeurent or former oticer. actor, rustee, or key employee? I Yes," compote Sched, Part IY {25a} | x_

Atamiy member ofa curent or fore ofteer, director, ste, orkay ampoyea? If"Ys,"comptte Schedule, Pav [20] |X.

© Anantty of whch a currant or former ofr, cretor, ste, okey employee (a fay member thera was an ofcer,

‘rector, tuste, or rect or ndract owner? "Yes, complete SchaduoL, Part IV jane] | x.

29 Did the organzatonreceve more than $25,000 m nan cash cantnoutions if "Yes," complete Schedule M 2X

‘30D the erganaatenrecenve contrbstons of, storcal assures, o other sar assets, oF qualita consenation

‘contbutons If "Yes," compiate Schedule M aol |x

31 Dud he organzaten quite, termnste, dissolve and cease operations?

Yes complete SchesuleN, Par | o x

32D he oxganaaten sal, exchange, dispose ctor wansfer more than 25% of snot assets? "es," complete

Schedule N, Par al |x

‘32 Dad te orgenzaton awn 100% ofan enttycarogarde as Separate rom the oxganaaton under Regulations

sections 901.77082 and 20 7701-97 If Yes,” complete Schodue R, Part | a] |x

‘94 Was the organization related o any tax exempt o taxable ely? 1 "Ys," complete Schedule , Par Ii, oF, and

Part, ine? au] |x

{Sa_Ox the organization have a contoed entty wth the meaning of secton 512(0K13)? asa |X

'b I*Yes" tone 36a, id the organeaton recene any payment ram or engage m ay Wansacton wit a contraled ent

‘win the meaning ot action 5120)? Yes." complete Sedu R, PV, tne 2 28

{96 Section 5011) organizations. Oc the organzaton make any anstor to an exams non chartable related organzaton?

es," compete Schedule, Pat V, tne 2 wl |x

{37 Dad the organaton conduct more tan S% oft aces through an entity that not a related organaaton

and thats treated as a partners for federal ncome tex purposaa” "Yes," complete Schedule R Pat VI ar| |x

‘38, Did the oxganzaton complete Schedule O and prone explanations n Schedule O fr Part ines 11 and 182

Note, Al Form 990 tlre are requred to compte Schedule O wlx|

Form 980 (076)

5

15510814 798302 1500L 2016.04013 PROJECT SIX 1500L__1.

Form 990 2016), PROJECT SIX 81-2327719 _ pageS

Part V] Statements Regarding Other IRS Filings and Tax Compliance

Chock SeneauleO contans response or natate any ne thes Par V ob

~ [yes] No

42. Enter the number reported Box: of Frm 1098. Enter 0 rot appicablo 1 3

'bEter the numberof Forme W:2G nclided nine 1a. Ener not applicable En q

{© Dd thecxganizaton comply wih backup winnlding le for repotable payments to vendors and reportable Garang

(gambing) wonngs to prze wrners? se | x

2a, Enter the numberof employees reported on Form W3,Transmttal of Wage and Tax Statements,

ie forthe calendar year ending wih or wth the year covered by tis etn 2 q

1 Ira ast one reported on ine 2a, the orgarwaton teal requved federal employment tax returns? ao | x

Note the sum of nes 1a and 2 8 greater than 260, you may ba required to 6a (se triton)

{32 Da the organzaton have unelates business 708s ncome of $1,009 or more dung the year? al |x

1b Yes has ed a Form 990 for hs yea? f No," to ne 3, prove an explanation m Schedule O 2%

44a At any be dung the calendar eer, di the rganzaton have an eres n, ora signature or other authorty over

financial accountinaforegn county (auch as a bank account, secures account or othe areal account? x

bb 1(-Yea. enter the name ofthe fregn country Pe

See nsinuctons for ing requrements for FRCEN Form 114, Report of Foreign Bank and Fnancal Accounts FEAR)

‘Sa Was te ganization a pany toa prohbted tax sheteransacton at any tee dung the tax yon"? Pies

'b Od any table party notify th organization that was oa party toa prehted tx sheer transaction? oe} 1X

© I1"¥@s, tone Saor 5b, dit the organzaton te Form 8886-7? Se

662 Does the exganzation have anual gross fecepts that are normally greater than $100,000 and dd he organzaton sohet

any contabutons that wee ot tax deductite as chatablacontnoutons? e| |x

bb 1-Yes." cd the organization nchide wth every solctaton an express statement ht such contrbutons orgs

‘were not tax deductible? e

7 Organizations that may receive deductible contributions under section 170(¢.

1 isthe organzaonrecewe a payment exces of $75 made party 6a contibubon ane gat lr gpeds ard sevens rowed the payo?| 7a | |X

» 11-Yee dd the cxganzaton not) the donor atthe value of the goods or services provided? 7

{© id the organization sl exchange, or otherwise dspose of tangible personal propery for winch was requred

ttle Form 82227 ze} |x

6. 1F-¥e5"indeate the numberof Forms 8282 tied dunn the year 7

{De the oxganzaton recave any nds, rectly or ndrocty to pay premsums on a personal benefit convact? rel |x

1 Da the crganzatn, dunn the yee, pay premum, drectly or rcty. on a personal benett contract? mtx

9 the oranaton rece a contnbuton of quatied ntetectul property di the erganaaton fle Form 8809 as requres? | 7g)

fh itt organzaton received a coninbuton of car, boat, arplanes, or other vila, di he organization fe a Farm 1098.6? [7m

{8 Sponering organizations maintaining donor advised funds. Dida donor acwsed fund mamtaned by tho

sponsorng organization have excess business holdings at any te dueng tne year? 2

9 Sponsoring organizations maintaining donor advised funds.

‘2 Othe spensomng exganzaten make ary taxable dstnbutons under secton 4966? 2

'b Datthe sponsomng organization make a dstnbuton to a donor, donor advise, relsted person? ob

10 Section 50%(¢K7) organizations. Ener

‘2 Intaton fees and captal contsbutons neue en Part Vil ine 12 108

1b Gross recaps, nluded on Form 99, Part Vl ne 12, or ble use of hb faces "108

11 Section S0t{eK 12) ocganizanons. Enter

|2 Gross ncome tom members of shareholders ta

bb Gross ncome from ether sources [Da not nat amounts dv or paid to oer sources apanst

amounts due oreceved em them} 116

122, Section 4947101) non-exempt charitable ust Is the orgenzaton fing Form 990 tau Form 1041? ‘aa

'b 11°Y05" ertr the amount of tx oxompt intrest recone o” accrued dung the year 2

43 Section 50%(c),29) qulifed nonprofit health insurance Issuers.

2 [the organzaton lconsed to rsue qualified health plasm mor than one state? 188

Note See tne nstructons for acinenal ntormaton the organaaton must report on Sched O.

Enter the wrount of reserves the eganzaton is equed te manta by the sttasn which the

crganaation s iconsed to esue quaifiod heath plans $3

Enter the amount of reserves on hand ‘80

“Va the organzaton rece any payments for mdr tanning services durng the tax year? a] 1X

bb i1*¥e5 hast the a Form 720 to rapor these payments? I Na," prowde an explanation m Schedule se

Form 980 (O76)

6

15510814 798302 1500L 2016-04013 PROJECT SIX 1s00L__1

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Rick Telander, Feb. 14, 2011, Chicago Sun-Times ColumnDocumento1 paginaRick Telander, Feb. 14, 2011, Chicago Sun-Times ColumnThe WatchdogsNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Chicago Sun-Times 'Paid To Do Nothing' Initial 2004 'Clout On Wheels' SeriesDocumento14 pagineChicago Sun-Times 'Paid To Do Nothing' Initial 2004 'Clout On Wheels' SeriesThe WatchdogsNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- NunneryStatement 1Documento22 pagineNunneryStatement 1The Watchdogs100% (1)

- Illinois Policy Institute's 2016 Tax Return / IRS Form 990Documento57 pagineIllinois Policy Institute's 2016 Tax Return / IRS Form 990The WatchdogsNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Chris Baines' Arrest RecordDocumento1 paginaChris Baines' Arrest RecordThe WatchdogsNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- ATF Stash-House RulingDocumento73 pagineATF Stash-House RulingSteve Warmbir100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- FBI Expert Dr. J. Scott Denton's ReportDocumento5 pagineFBI Expert Dr. J. Scott Denton's ReportThe Watchdogs100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Willie Biles, Prosecution Exhibits 5A-5GDocumento7 pagineWillie Biles, Prosecution Exhibits 5A-5GThe WatchdogsNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Chicago Public Schools Inspector General's Report On Cook County Jail SchoolDocumento7 pagineChicago Public Schools Inspector General's Report On Cook County Jail SchoolThe WatchdogsNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Thomas Vranas' Request For ProbationDocumento73 pagineThomas Vranas' Request For ProbationThe WatchdogsNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- CSB Case No. 15-03 Denis LawlorDocumento4 pagineCSB Case No. 15-03 Denis LawlorThe WatchdogsNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- July 2017 Exchange Between Tom Dart, Toni Preckwinkle Aides Over Cook County Jail DealDocumento2 pagineJuly 2017 Exchange Between Tom Dart, Toni Preckwinkle Aides Over Cook County Jail DealThe WatchdogsNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- PRB023 - Mary Mitchell - Chicago Sun-Times - Kevin Williams Petition - RedactedDocumento73 paginePRB023 - Mary Mitchell - Chicago Sun-Times - Kevin Williams Petition - RedactedThe WatchdogsNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

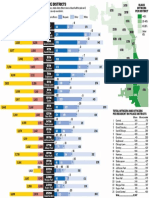

- Chicago Police Districts: Crime, Racial Breakdown of OfficersDocumento1 paginaChicago Police Districts: Crime, Racial Breakdown of OfficersThe WatchdogsNessuna valutazione finora

- Rozelle LawsuitDocumento11 pagineRozelle LawsuitThe WatchdogsNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Key Supt. Garry McCarthy EmailsDocumento52 pagineKey Supt. Garry McCarthy EmailsThe WatchdogsNessuna valutazione finora

- IPRA Poulos ReportDocumento9 pagineIPRA Poulos ReportThe WatchdogsNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)