Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

The Decision Taken by the Cabinet on Implementation of Recommendations of 3rd PRC on Pay Revision of Executives and Non-unionised Supervisors of CPSEs. - Department of Public Enterprises - MoHI&PE - GoI

Caricato da

sudeepjoseph0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

65 visualizzazioni8 pagine3rd PRC

Copyright

© © All Rights Reserved

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documento3rd PRC

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

65 visualizzazioni8 pagineThe Decision Taken by the Cabinet on Implementation of Recommendations of 3rd PRC on Pay Revision of Executives and Non-unionised Supervisors of CPSEs. - Department of Public Enterprises - MoHI&PE - GoI

Caricato da

sudeepjoseph3rd PRC

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 8

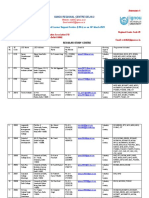

No. W-08/0003/2017-DPE (WC)

Government of India

Ministry of Heavy Industries & Public Enterprises

Department of Public Enterprises

Public enterprises Bhawan

Block No. 14, CGO Complex, Lodhi Road,

New Delhi, Dated: 14” August, 2017

Te

or indum

Subject: Cabinet decision on implementation of the recommendations of 3°

Pay Revision Committee (3° PRC) on pay revision of Executives and

Non-Unionized Supervisors of Central Public Sector Enterprises

(CPSEs)

The undersigned is directed to inform that the Cabinet has approved the

proposal of Pay Revision of Executive (Board level executives, below Board level

executives) and Non-Unionized Supervisors of Central Public Sector Enterprises

(CPSEs) w.e.f. 1.1.2017 in its meeting held on 19.07.2017. Accordingly, two OMs

dated 3 August and 4" August, 2017 have been issued by this Department. In this

regard, it is requested to give wide publicity of the decision taken by the Government

as per the ‘brief enclosed (in English & Hindi).

(Samsul Haque)

Under Secretary

Phone- 011-24360823

Encl: As above

To

1. The Press Information Bureau for publicity on Television and National/

Regional/ Local Newspapers, Bulletin on AIR News/AIR FM/Private FM Radio

Stations (small write-up for electronic media also enclosed)

2. To all Administrative Ministries concerned with CPSEs for disseminating

through their respective social media accounts (Facebook & Twitter)

3. All the Ministries/ Departments of the Government of India and CPSEs for

circulation of the ‘brie?

4. NIC for uploading on the website of Department of Public Enterprises

rief

The Union Cabinet chaired by the Prime Minister Shri Narendra Modi has approved

the pay revision of Executives and Non-Unionised Supervisors of Central Public Sector

Enterprises (CPSEs) based on the recommendations of 3 Pay Revision Committee. The pay

revision will come into effect from 1.1.2017,

2, AS against 23 months wait at the time of implementation of 2™ PRC

recommendations, the 3" PRC recommendations are being implemented within about 7

months from the due date.

3. The 3rd PRC was headed by Justice Satish Chandra (Retd.) and its other members

were Shri Jugal Mohapatra, Ex-lAS officer, Prof. Mano] Panda, Director, Institute of

Economic Growth Delhi, Shri Shailendra Pal Singh, Ex-Director (HR), NTPC Ltd. and Secretary,

Department of Public Enterprises (DPE).

4, Onthe basis of decisions taken by the Cabinet two OMs dated 3.8.2017 and 4.8.2017

have been issued by DPE for implementation of pay revision of Executives and Non-

Unionised Supervisors of Central Public Sector Enterprises which inter-alia include the

following:

|) There is focus on affordability of a CPSE to implement the pay revision without its

impact being detrimental to its financial sustainability. The additional financial

impact in the year of implementing the revised pay package in a CPSE should not

be more than 20% of the average Profit Before Tax (PBT) of the last 3 financial

years preceding the year of implementation,

ii) A uniform fitment benefit of 15% of Basic Pay (BP) plus Dearness Allowance (DA)

in case the additional financial impact of the pay revision is within 20% of the

average PBT of the last 3 financial years has been approved. Besides, part

fitments of 10% & 5% for those CPSEs in which the additional financial impact of

pay revision on the average PBT of last three financial years is likely to be more

than 20%, has also been approved. Subsequent to the implementation,

profitability of a CPSE would be reviewed after every 3 years.

A uniform rate of 3% of BP will be applicable for both annual increment as well as

promotion increment.

Wv) The Board of Directors of CPSEs are empowered to decide on the perks and

allowance admissible to the different categories of the executives, under the

concept of ‘Cafeteria Approach’, subject to a ceiling of 35% of BP.

v) The house rent allowance to the employees of CPSEs will be 24%, 16% and 8% for

X-class City, Y-class City and Z-class city respectively. The rates of HRA will be

revised to 27% 18% & 9% for X, Y and Z class cities respectively when IDA crosses

25% and further revised to 30% 20% and 10% when IDA crosses 50%.

vi)

vii)

viii)

ix)

xi)

xii)

xii)

—U

The payment of work based hardship duty allowance upto 12% of Basic Pay shall

be admissible for the period the executives / non-unionized supervisors has

actually performed one of the following hardship duty:-

a) For performing duty in Underground mines, and

b) For performing duty at Offshore exploration site

Regarding Performance Related Pay, the overall ceiling of 5% of the year’s profit

from core business activities has been continued. The ratio of relevant year's

profit to incremental profit for working out PRP has been however, revised to

65:35 as against 60:40 earlier. Besides, CPSE’s and individual performance,

weightage will also be given to team’s performance while determining the PRP

payable to an executive.

The 3rd PRC's recommendation for discontinuation of “Bell curve” to the extent

that the forced rating of 10% as below par /poor performer should not be made

mandatory, has been accepted.

The existing provisions regarding superannuation benefits have been retained and

‘as per which CPSEs can contribute upto 30% of BP plus DA towards Provident

Fund (PF), Gratuity, Post-Superannuation Medical Benefits (PRMB) and Pension of

their employees. The ceiling of gratuity of the executives and non-unionised

supervisors of the CPSEs would be raised from Rs 10 lakhs to Rs 20 lakhs with

effect from 01.01.2017 and the funding for the entire amount of Gratuity would

be met from within the ceiling of 30% of BP plus DA. Beside, ceiling of gratuity

shall increase by 25% whenever IDA rises by 50%. Further, the existing

requirement of superannuation and of minimum of 15 years of service by a CPSE

employee will not be mandatory for the pension, whereas Post-Retirement

Medical Benefits will continue to be linked to requirement of superannuation and

minimum of 15 years of continuous service (except for Board level Executives)

The corpus for post-retirement medical benefits and other emergency needs for

‘the employees of CPSEs who have retired prior to 01.01.2007 would be created by

contributing the existing celling of 1.5% of PBT, The formulation of suitable

scheme in this regard by CPSEs has to be ensured by the administrative

Ministries/Departments.

The revision of scales of pay for Non-unionized Supervisory staff would be decided

by the respective Board of Directors.

‘An Anomalies Committee consisting of Secretaries of Department of Public

Enterprises (DPE), Department of Expenditure and Department of Personnel &

Training has been constituted for a period of two years to look into further

specific issues/problems that may arise in implementation of the Government's

decision on 3" pay revision Committee's recommendations.

The expenditure on account of pay revision is to be entirely borne by the CPSEs

out of their earnings and no budgetary support will be provided.

eneee

‘Small write-up for electronic media

The Union Cabinet chaired by the Prime Minister Shri Narendra Modi has approved

the pay revision of Executives and Non-Unionised Supervisors of Central Public

Sector Enterprises based on the recommendations of 3 Pay Revision Committee.

The pay revision will come into effect from 01.01.2017. As against 23 months wait at

the time of implementation of 2° PRC recommendations in 2008, the 3° PRC

recommendations are being implemented within about 7 months from the due date

i.e, 01.01.2017.

. Affordability of a CPSE to implement the pay revision without its impact being

detrimental to its financial sustainability will be an important criterion to effect the

pay revision. A uniform fitment benefit of 15% of Basic Pay(BP) plus Dearness

Allowance (DA) in case the additional financial impact of the pay revision is within

20% of the average PBT of the last 3 financial years has been approved.

. Besides, part fitments of 10% & 5% for those CPSEs in which the additional financial

impact of pay revision is likely to be more than 20% of average PBT of last three

financial years has also been approved. Subsequent to the implementation,

profitability of a CPSE would be reviewed after every 3 years. Other benefits like

Perks & Allowances based on “cafeteria approach” upto 35% of BP and

Superannuation Benefits upto 30% of BP+DA have been approved.

The house rent allowance to the employees of CPSEs will be 24%, 16% and 8% for X-

Class City, Y-class City and Z-class city respectively. The rates of HRA will be revised to

27% 18% & 9% for X, Y and Z class cities respectively when IDA crosses 25% and

further revised to 30% 20% and 10% when IDA crosses 50%,

aaa

arate wert ft ata adh ft wecear af Sefte iPwes & dhe aa

diate afte & Rrefteit oe anita afta acarht ate serait (ittteats) & ardarest

afte arate wdecarat & ea wetter at reper we Pear 8 Bar tery 11.2017 & ar

am

2 Bere Bere aatery PRA A reel aerateaera # 23 are A ote At aoe

eet Bere eaters afte Ay Perarteett at Pretfte Rear & cere 7 are that feat

‘fear aT TET

3. tere Sere aietrerr aft srerar earanyfet after ear (ar Fga) a athe st ge

aera aoyg artes afer, st. at srsr, Rte, easfteye ate warifine a,

Reet, ft tere a fig, qed Pea (estar), crete PR. ate afea, ate sere rare

(erie) eae acer ah

4, aPriee are fre my fa a onere ae atte aca ate seni & arava ote

areaa Taare aot deter Ft ay Cte dda F ire sem fear are Rate

03.08.2017 att 04.08.2017 % at araters arer are Pry are & fea aor ara Hare -

ara Fraferfers at emitter rar rare:

(i) rar setters Ft a et fore titers A tts saa ox TET THT ert

fae sett a aroha sare car aor Bi atte Fete Aaa Ae a aT

weer ard arfatitae facta are finer 3 ak a gga afte Atta aul ata

acd re (ste Aeate Bae ar teh) ot 20% & arf at dtr aTfeT

(il) ae Rea ote mee eH ar ar 15% area Peds arm aga Par mar &, ore

area setters ar afftas Paeia are fee te Patt aa Be ater tet 20%

orae Oem after oa attteaée & fore 10% ate 5% aT aifire Prete ot

argeitaa fra ara @, Stet Starr eietters ar after Patter are Frere da tt

at & aera ET 20% & Sarat BF A dara 81 waters Hare hits

areata ft wet 3 set are after A arefti

(iy aes ert af 3 ara-are aereahe Sor BAS % fore ar Aas 3% AH TTT

gfe ac at aeptite fen ar al

(iv) attri & Peerage at eRe arse At aire siete aor Bras 35%

#1 arfitners ter arene priarert A ffir afore fr orga aera we

aeat aise & foie aa ar afer art 2

(v) attests & aatarfeat & fey ware Prcrar rar X - Aft rae, Y - Ff atee, Z -

Groh orex % fore wer: 24%, 16%, 8% FT! TaareT Ft act A X, Y, ZH erat F

fore aisitfiter ax % ae: 27%, 18% she 9% Far sre, wa aed 25% F afer

Bare ate wa ares 50% & afi St mre at Fax a eivitfits Fe 30%, 20% afte

10% we Fear aT

(vi) artarerat) area Tears % Pre ae ert 12% aa nek rents erefers aye

aa ft aernft va aa % fire aque eth Brat weit Prafafed aréfire at

& Pret oa an areafan ea 8 roars fer at

) atta ara # at wea & fer, ste

ww) arate waa eat ae eat ae fer

(vil) raved % dae F ope orrerfirs afafataat & StF are aril are 5% At TT

rr rare eesti sett, rere after act fern defer at are ate

oftafifer ort % eieter % arquret at fase % 60:40 A Gera F eeitfltr TH 65:35

rar war 8 cer fata, wrtarern at Sa Frere a Fretted are aE

va sifere arifrones & ara ara dtr ered Ft ft arete fear are

(vill) or ea ae ser Ata oem rT wee A ree Aare atte aARAT AT Prater Pe

10% eer at ae A ARvacra arifterer & fre aftard a aaa ore, a

afPravest # ara frat a

(ix) Farfrgier ore sae sa tae wasnt Ft arf car @, ere aqare dha

are aharftat A after AY (dee), degh, saghe care PA aT

(tareadh) atte Gers & fer aa Aas + aeaTE WAH 30% oH aT atreTA Fa ST

arret 81 atime & ardent oa aces test At dogs At ater dtr aT

01.01.2017 % 10 ara wat & agree 20 are era Far ore ate Togs A TT

cafe & wearg qa Aaa + Haare wa H 30% Ft ater % fae At ohhh ea

fatten, arédte 50% Ft afer at oe dogs At after after HF 25% Ft af

Bit cake afeticee tert & fare aarhaghy A ater ork ate etter A apr 15.

ad ft far aa aftard at entt oath dang hy orca Refer are at dary

ae (ats ere arora & eae fre) rare 15 ae A Peta Arar At ard TT

cat Ft ard car STAT .

(x) 1.1.2007 4 a & targa atari 8q Aan Rafa sacte Pare are ste ger

arate araeerasit % fore free AY 1.5% of Premera dtr & area are TT

me

afte Pear orem aitfierés are ee eae H oagee eft tare eer arf aT

garafee dareai/faanit are afters Pear sre

(xi) aera Bere aaarfat Pre aa art & Seiten date He fate afiret

fate Heer arc fer aT

(ail) tert Brae Sater re area Probe erates oe aver Fates qetTTeATa

ait bee ere St ak A rae Pere ow Paetahs aia aro at ot aT Fe

ear 2 fare aw sere ore, oe Prare (Stae) atte sins Paes efter aT

(ity rr tore pre TT are ae wt ae TE Tee a art a A aE HT

ae até aorta serra ware et AT TAT

wtragtte aitfear & feng after er

ret Aer aiettert afea A Aenea ge arenes Fate wea ate seri

(fttteeés) B arrtrrerst ire areberas eters Ara etter At arate eres At es

art A aemerar & ate aver F ates ve Rear 8) Aa deters 1.4.2017 8 ary

drm aE 2008 H gare Sart eter ARE A RRrenftett raters H 23 wre A ten Ft

ear efteret era aieitere fhe At rorftett a Frit Peeriw arahq 01.01.2017 &

ara 7 Bre & stare fratiera rar ar cer ah

2, aera At Patter rar re Ag arcrenes ara sre Aa Ser Hatters wT reife

ae ay gear areas aes setters ay wea fre ww agent ares eh Ye Aaa

wrgarg wee att wr 15% sare Pete ara ages Pear var & af Aer eather a

apfatftcre Patter ware Frege afte cttcr ait 3s ater HAE 20% 7 RT AI

3, Tah aera, oa Beate sonnet ait seret Pre 10% we 5% aT fle Prete Farr

aan dette ar after faite are feet Ate Piette sat & atrera ete 20% 4 afr

UR ore BB at etter Poe ar ert para etree A arreaTfeaT A

sein 3 oe are wetter A arch “RRS aT aire" oe aTeTfea Aer Serr 35% aH AAT

care S&P ager afte wrath ger Aer at THT HETTE AT 30% aH aerate art FT

areata Firat a 8

44, Aer 3h aaferfRatt Fre ware Rrere ar x - Aft ere, Y - Aft are, Z - A

arg Fare HAM: 24%, 16%, 8% Sr TAHT A AAT FTX, Y, ZH araet & Fre sehr

a wa: 27%, 18% she 9% Fay ore, wa aredte 25% 4 afin st are ste oa

aredie 50% & after St areata Pine & steitfire He 30%, 20% atte 10% He Feat TERT

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- 81-03-0053-00e (General Arrangement Cd42-T1a Stainless Steel Screw Cap Transmitter Assembly) Rev ADocumento1 pagina81-03-0053-00e (General Arrangement Cd42-T1a Stainless Steel Screw Cap Transmitter Assembly) Rev AsudeepjosephNessuna valutazione finora

- Special Conditions of Contract For Supply Installation and Commissioning of Temporary and Permanent Cathodic Protection SystemDocumento12 pagineSpecial Conditions of Contract For Supply Installation and Commissioning of Temporary and Permanent Cathodic Protection SystemsudeepjosephNessuna valutazione finora

- Electrical Safety IN Onshore Drilling and Workover Rigs: Oisd - STD - 216 Amended Edition October - 2010Documento27 pagineElectrical Safety IN Onshore Drilling and Workover Rigs: Oisd - STD - 216 Amended Edition October - 2010sudeepjosephNessuna valutazione finora

- RD8100 Locator Spec V3Documento12 pagineRD8100 Locator Spec V3sudeepjosephNessuna valutazione finora

- Special Conditions of Contract For Supply Installation and Commissioning of Temporary and Permanent Cathodic Protection SystemDocumento12 pagineSpecial Conditions of Contract For Supply Installation and Commissioning of Temporary and Permanent Cathodic Protection SystemsudeepjosephNessuna valutazione finora

- Polarization Cell: Paint / Coating Testing Instruments & Inspection KitsDocumento1 paginaPolarization Cell: Paint / Coating Testing Instruments & Inspection KitssudeepjosephNessuna valutazione finora

- Design of Solar Photovoltaic Generation For Residential BuildingDocumento27 pagineDesign of Solar Photovoltaic Generation For Residential BuildingsudeepjosephNessuna valutazione finora

- SL - No. Mainline Chainage Row ConditionDocumento8 pagineSL - No. Mainline Chainage Row ConditionsudeepjosephNessuna valutazione finora

- Basic DA Caf - Allowance Less LFA Less PF Less Yojna Less SABF Less TaxDocumento1 paginaBasic DA Caf - Allowance Less LFA Less PF Less Yojna Less SABF Less TaxsudeepjosephNessuna valutazione finora

- Slim Lean Strong PreviewDocumento14 pagineSlim Lean Strong PreviewsudeepjosephNessuna valutazione finora

- Type) : 1. Type-1 Audio 2. Type-2 Audio & Video 3. Type-3 Villagers GatheringDocumento1 paginaType) : 1. Type-1 Audio 2. Type-2 Audio & Video 3. Type-3 Villagers GatheringsudeepjosephNessuna valutazione finora

- Battery Powered Electromagnet Capable of Holding 500 LbsDocumento9 pagineBattery Powered Electromagnet Capable of Holding 500 LbssudeepjosephNessuna valutazione finora

- Recruitment Engineers 2014 Detail AdDocumento9 pagineRecruitment Engineers 2014 Detail AdShaharukh NadafNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Protocols - An Academic TakeDocumento11 pagineThe Protocols - An Academic TakeDMTitus0% (1)

- Weekly Assignment-1 - Formed The Continental Army Under The Leadership of George WashingtonDocumento10 pagineWeekly Assignment-1 - Formed The Continental Army Under The Leadership of George WashingtonahmedNessuna valutazione finora

- Ignou Regional Centre Delhi-2: Details of Learner Support Centres (LSCS) As On 14 March 2023Documento7 pagineIgnou Regional Centre Delhi-2: Details of Learner Support Centres (LSCS) As On 14 March 2023himanshu nashierNessuna valutazione finora

- Rhetoric in Democracy A Systemic AppreciationDocumento22 pagineRhetoric in Democracy A Systemic AppreciationGlen TacasaNessuna valutazione finora

- Introduction To Colonial ArchitectureDocumento5 pagineIntroduction To Colonial ArchitectureTejal BogawatNessuna valutazione finora

- 10th Social EM - 2nd Revision Test 2022 Model Question Paper - English Medium PDF DownloadDocumento5 pagine10th Social EM - 2nd Revision Test 2022 Model Question Paper - English Medium PDF DownloadGR DesignsNessuna valutazione finora

- HIS103 PresentationDocumento7 pagineHIS103 PresentationFARHAN TANJIM AHMED 1712304630100% (1)

- Rafael de La Dehesa Queering The Public Sphere in Mexico and Brazil Sexual Rights Movements in Emerging Democracies PDFDocumento315 pagineRafael de La Dehesa Queering The Public Sphere in Mexico and Brazil Sexual Rights Movements in Emerging Democracies PDFValeria LaraNessuna valutazione finora

- Gender Candidates Shortlisted Not Qualified (Including Absent) QualifiedDocumento57 pagineGender Candidates Shortlisted Not Qualified (Including Absent) Qualifiedsuraj AkulwarNessuna valutazione finora

- Treaty of ParisDocumento2 pagineTreaty of ParisAnne Corine RamosNessuna valutazione finora

- Andhra Pradesh Grama/Ward Sachivalayam Recruitment - 2020Documento2 pagineAndhra Pradesh Grama/Ward Sachivalayam Recruitment - 2020vamsi karnaNessuna valutazione finora

- Assignment Tasks Tuburan JoaDocumento7 pagineAssignment Tasks Tuburan JoaTUBURAN, JOASH JUSTLY M.Nessuna valutazione finora

- The Literature of Jose RizalDocumento18 pagineThe Literature of Jose RizalLuna MoondumpNessuna valutazione finora

- Claremont Review of Books Fall 2023Documento323 pagineClaremont Review of Books Fall 2023harpo800Nessuna valutazione finora

- Lit2 - Literary ReflectionDocumento2 pagineLit2 - Literary ReflectionHediliza TomeldenNessuna valutazione finora

- Company Profile Triple S Organizer 2020 (FILEminimizer)Documento24 pagineCompany Profile Triple S Organizer 2020 (FILEminimizer)Dwijaya PriharyonoNessuna valutazione finora

- History of Lamut IfugaoDocumento4 pagineHistory of Lamut IfugaoLisa MarshNessuna valutazione finora

- Billeting Quarter House RulesDocumento3 pagineBilleting Quarter House RulesWinna Tapia Tabiosa Ubol100% (8)

- S0022216X17000980Documento3 pagineS0022216X17000980Damian HemmingsNessuna valutazione finora

- My Reflection: Maverick RicaldeDocumento1 paginaMy Reflection: Maverick RicaldeAllen ElguiraNessuna valutazione finora

- List of Accredited Shops July 2021Documento3 pagineList of Accredited Shops July 2021misssiaNessuna valutazione finora

- Issues and Concerns of Philippine Education Through The Years, My Reaction PaperDocumento3 pagineIssues and Concerns of Philippine Education Through The Years, My Reaction PaperJemuel LuminariasNessuna valutazione finora

- Stereotype Thesis StatementDocumento7 pagineStereotype Thesis Statementfc5wsq30100% (2)

- Marxism and Neo-MarxismDocumento24 pagineMarxism and Neo-MarxismSADIA SOHAILNessuna valutazione finora

- End of Empires - European Decolonisation, - Thorn, GaryDocumento148 pagineEnd of Empires - European Decolonisation, - Thorn, GaryAntonella CarrosoNessuna valutazione finora

- Dowler and Sharp - 2001 - A Feminist GeopoliticsDocumento13 pagineDowler and Sharp - 2001 - A Feminist GeopoliticsSandra Rodríguez CastañedaNessuna valutazione finora

- New Social Movement TheoriesDocumento24 pagineNew Social Movement TheoriesHafid HarrousNessuna valutazione finora

- FS20 What Is Worthless WEBDocumento204 pagineFS20 What Is Worthless WEBrenata małeckaNessuna valutazione finora

- Narratives of InsecurityDocumento11 pagineNarratives of Insecurityion irauliNessuna valutazione finora

- Group 7 - Ac2.2 - Tunku Abdul RahmanDocumento18 pagineGroup 7 - Ac2.2 - Tunku Abdul RahmandayahNessuna valutazione finora