Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

12 302 PDF

Caricato da

Fagner Magrinelli RochaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

12 302 PDF

Caricato da

Fagner Magrinelli RochaCopyright:

Formati disponibili

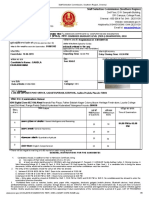

PRINT FORM CLEAR FORM

12-302

(Rev.2-17/19)

Texas Hotel Occupancy Tax Exemption Certificate

Provide completed certificate to hotel to claim exemption from hotel tax. Hotel operators should request a photo ID, business card or

other document to verify a guest’s affiliation with the exempt entity. Employees of exempt entities traveling on official business can

pay in any manner. For non-employees to be exempt, the exempt entity must provide a completed certificate and pay the hotel with

its funds (e.g., exempt entity check, credit card or direct billing). This certificate does not need a number to be valid.

Name of exempt entity Exempt entity status (Religious, charitable, educational, governmental)

Address of exempt organization (Street and number)

City, State, ZIP code

Guest certification: I declare that I am an occupant of this hotel on official business sanctioned by the exempt organization named

above and that all information shown on this document is true and correct. I further understand that it is a criminal offense to issue

an exemption certificate to a hotel that I know will be used in a manner that does not qualify for the exemptions found in the hotel

occupancy tax and other laws. The offense may range from a Class C misdemeanor to a felony of the second degree.

Guest name (Type or print) Hotel name

Guest signature Date

Exemption claimed

United States Federal Agencies or Foreign Diplomats. Details of this exemption category are on back of form.

This category is exempt from state and local hotel tax.

Texas State Government Officials and Employees. (An individual must present a Hotel Tax Exemption Photo ID

Card). Details of this exemption category are on back of form. This limited category is exempt from state and local

hotel tax. Note: State agencies and city, county or other local government entities and officials or employees are not

exempt from state or local hotel tax, even when traveling on official business.

Charitable Entities. (Comptroller-issued letter of exemption required.) Details of this exemption category are on back

of form. This category is exempt from state hotel tax, but not local hotel tax.

Educational Entities. Details of this exemption category are on back of form. This category is exempt from state

hotel tax, but not local hotel tax.

Religious Entities. (Comptroller-issued letter of exemption required.) Details of this exemption category are on back

of form. This category is exempt from state hotel tax, but not local hotel tax.

Exempt by Other Federal or State Law. Details of this exemption category are on back of form. This category is

exempt from state and local hotel tax.

Permanent Resident Exemption (30 consecutive days): An exemption certificate is not required for the permanent resident

exemption. A permanent resident is exempt the day the guest has given written notice or reserves a room for at least 30 consecutive

days and the guest stays for 30 consecutive days, beginning on the reservation date. Otherwise, a permanent resident is exempt on

the 31st consecutive day of the stay and is not entitled to a tax refund on the first 30 days. Any interruption in the resident’s right to

occupy a room voids the exemption. A permanent resident is exempt from state and local hotel tax.

Hotels should keep all records, including completed exemption certificates, for four years.

Do NOT send this form to the Comptroller of Public Accounts.

Form 12-302 (Back)(Rev.2-17/19)

Texas Hotel Occupancy Tax Exemptions

See Rule 3.161: Definitions, Exemptions, and Exemption Certificate for additional information.

United States Federal Agencies or Foreign Diplomats (exempt from state and local hotel tax)

This exemption category includes the following:

• the United States federal government, its agencies and departments, including branches of the military, federal credit

unions, and their employees traveling on official business;

• rooms paid by vouchers issued by the American Red Cross and the Federal Emergency Management Agency; and

• foreign diplomats who present a Tax Exemption Card issued by the U.S. Department of State, unless the card specifically

excludes hotel occupancy tax.

Federal government contractors are not exempt.

Texas State Government Officials and Employees (exempt from state and local hotel tax)

This exemption category includes only Texas state officials or employees who present a Hotel Tax Exemption Photo Identification

Card. State employees without a Hotel Tax Exemption Photo Identification Card and Texas state agencies are not exempt.

(The state employee must pay hotel tax, but their state agency can apply for a refund.)

Charitable Entities (exempt from state hotel tax, but not local hotel tax)

This exemption category includes entities that have been issued a letter of tax exemption as a charitable organization and their

employees traveling on official business. See website referenced below.

A charitable entity devotes all or substantially all of its activities to the alleviation of poverty, disease, pain and suffering by

providing food, clothing, medicine, medical treatment, shelter or psychological counseling directly to indigent or similarly

deserving members of society.

Not all 501(c)(3) or nonprofit organizations qualify under this category.

Educational Entities (exempt from state hotel tax, but not local hotel tax)

This exemption category includes in-state and out-of-state school districts, private or public elementary, middle and high schools,

Texas Regional Education Service Centers and Texas institutions of higher education (see Texas Education Code Section

61.003) and their employees traveling on official business.

A letter of tax exemption from the Comptroller of Public Accounts as an educational organization is not required, but an

educational organization might have one.

Out-of-state colleges and universities are not exempt.

Religious Organizations (exempt from state hotel tax, but not local hotel tax)

This exemption category includes nonprofit churches and their guiding or governing bodies that have been issued a letter of

tax exemption from the Comptroller of Public Accounts as a religious organization and their employees traveling on official

business. See website referenced below.

Exempt by Other Federal or State Law (exempt from state and local hotel tax)

This exemption category includes the following:

• entities exempted by other federal law, such as federal land banks and federal land credit associations and their employees

traveling on official business; and

• Texas entities exempted by other state law that have been issued a letter of tax exemption from the Comptroller of

Public Accounts and their employees traveling on official business. See website referenced below. These entities

include the following:

• nonprofit electric and telephone cooperatives,

• housing authorities,

• housing finance corporations,

• public facility corporations,

• health facilities development corporations,

• cultural education facilities finance corporations, and

• major sporting event local organizing committees.

For Exemption Information

A list of charitable, educational, religious and other organizations that have been issued a letter of exemption is online at

www.comptroller.texas.gov/taxes/exempt/search.php. Other information about Texas tax exemptions, including applications, is

online at www.comptroller.texas.gov/taxes/exempt/index.php. For questions about exemptions, call 1-800-252-1385.

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Affinity Design in Action PDFDocumento37 pagineAffinity Design in Action PDFFagner Magrinelli Rocha100% (6)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Employee Handbook JCBDocumento70 pagineEmployee Handbook JCBJanhvi SaxenaNessuna valutazione finora

- N400 InstructionsDocumento18 pagineN400 InstructionsMantenimientos A Domicilio100% (1)

- Office Order No. 2011-20Documento25 pagineOffice Order No. 2011-20ciryajamNessuna valutazione finora

- KYC/AML Policy SummaryDocumento45 pagineKYC/AML Policy SummaryAkash100% (1)

- RCBC Plaza House Rules and Regulations SummaryDocumento38 pagineRCBC Plaza House Rules and Regulations SummaryYan Lean DollisonNessuna valutazione finora

- Company Establishment (Pma) Desk Top Reference: 2020 EDITIONDocumento49 pagineCompany Establishment (Pma) Desk Top Reference: 2020 EDITIONharya100% (1)

- Bach Violin Concerto BWV1041 KeyboardDocumento9 pagineBach Violin Concerto BWV1041 KeyboardFagner Magrinelli RochaNessuna valutazione finora

- Saint-Saens Cello Concerto No1 PianoDocumento23 pagineSaint-Saens Cello Concerto No1 PianoFagner Magrinelli RochaNessuna valutazione finora

- Vivaldi G Minor Violin ConcertoDocumento7 pagineVivaldi G Minor Violin ConcertoFagner Magrinelli RochaNessuna valutazione finora

- Marcha Nupcial-Wedding March-Viola PDFDocumento1 paginaMarcha Nupcial-Wedding March-Viola PDFFagner Magrinelli RochaNessuna valutazione finora

- Kayser Violin Etude #4Documento1 paginaKayser Violin Etude #4Fagner Magrinelli RochaNessuna valutazione finora

- All Region Cuts 18-19Documento4 pagineAll Region Cuts 18-19Fagner Magrinelli RochaNessuna valutazione finora

- Wohlfart Viola Etude 2 and 3Documento1 paginaWohlfart Viola Etude 2 and 3Fagner Magrinelli RochaNessuna valutazione finora

- Joy To The World HarmoniesDocumento15 pagineJoy To The World HarmoniesFagner Magrinelli RochaNessuna valutazione finora

- Handel - Violin Sonata in F MajorDocumento19 pagineHandel - Violin Sonata in F MajorFagner Magrinelli Rocha100% (1)

- Berlioz Hungarian MarchDocumento21 pagineBerlioz Hungarian MarchFagner Magrinelli RochaNessuna valutazione finora

- 4tet PDFDocumento1 pagina4tet PDFFagner Magrinelli RochaNessuna valutazione finora

- ASTA Why Strings Brochure IADocumento2 pagineASTA Why Strings Brochure IAFagner Magrinelli RochaNessuna valutazione finora

- IMSLP302993-PMLP45537-08. Tschaikovsky Sleeping Beauty Cornet I PDFDocumento5 pagineIMSLP302993-PMLP45537-08. Tschaikovsky Sleeping Beauty Cornet I PDFFagner Magrinelli RochaNessuna valutazione finora

- 2 Octave Scales With Fingerings For Double BassDocumento9 pagine2 Octave Scales With Fingerings For Double BassFagner Magrinelli RochaNessuna valutazione finora

- Brahms ScherzoDocumento13 pagineBrahms ScherzoFagner Magrinelli RochaNessuna valutazione finora

- Choir Piece PDFDocumento7 pagineChoir Piece PDFFagner Magrinelli RochaNessuna valutazione finora

- Mozart Violin Sonata E Minor KV304 PianoDocumento10 pagineMozart Violin Sonata E Minor KV304 PianoFagner Magrinelli RochaNessuna valutazione finora

- Chicago StyleDocumento24 pagineChicago StyleFagner Magrinelli RochaNessuna valutazione finora

- 2014-2015 Academic Calendar: Classes Begin Aug. 25 Jan. 14 June 2 July 7Documento1 pagina2014-2015 Academic Calendar: Classes Begin Aug. 25 Jan. 14 June 2 July 7Fagner Magrinelli RochaNessuna valutazione finora

- Documents Form Student Cert TXDocumento1 paginaDocuments Form Student Cert TXFagner Magrinelli RochaNessuna valutazione finora

- 2014-2015 Academic Calendar: Classes Begin Aug. 25 Jan. 14 June 2 July 7Documento1 pagina2014-2015 Academic Calendar: Classes Begin Aug. 25 Jan. 14 June 2 July 7Fagner Magrinelli RochaNessuna valutazione finora

- Gabrieli Sonata PandF ScoreDocumento11 pagineGabrieli Sonata PandF ScoreFagner Magrinelli RochaNessuna valutazione finora

- Tutti Violin 14 15Documento8 pagineTutti Violin 14 15Fagner Magrinelli RochaNessuna valutazione finora

- Eugene Ysaye - 6 Solo Sonata Op.27 For Violin PDFDocumento55 pagineEugene Ysaye - 6 Solo Sonata Op.27 For Violin PDFChinenn DaangNessuna valutazione finora

- Rachmaninov - Vocalise (Flute or Violin - Piano)Documento4 pagineRachmaninov - Vocalise (Flute or Violin - Piano)eburgaz100% (3)

- Piazzolla FiveTangoSensationsDocumento53 paginePiazzolla FiveTangoSensationsGabrielaNessuna valutazione finora

- Mesias 1 ADocumento50 pagineMesias 1 AFrancisca Ávila UrrejolaNessuna valutazione finora

- SpiceJet - E-Ticket - PNR Z9C9KW - 21 Oct 2015 Delhi-Varanasi For MR. SINHADocumento2 pagineSpiceJet - E-Ticket - PNR Z9C9KW - 21 Oct 2015 Delhi-Varanasi For MR. SINHAVasant Kumar SinhaNessuna valutazione finora

- UGC NET June 2020 Admit CardDocumento4 pagineUGC NET June 2020 Admit CardTunisha VarshneyNessuna valutazione finora

- Infonavit - Doc Registration FormatDocumento2 pagineInfonavit - Doc Registration FormatScribdTranslationsNessuna valutazione finora

- BVN CorrectedDocumento14 pagineBVN CorrectedRasheed Onabanjo DamilolaNessuna valutazione finora

- Jury Reporting 6 09Documento6 pagineJury Reporting 6 09lkysamNessuna valutazione finora

- AX033220 Nanteza SharonDocumento7 pagineAX033220 Nanteza SharonNanteza SharonNessuna valutazione finora

- Ormoc City Hall COVID-19 guidelinesDocumento7 pagineOrmoc City Hall COVID-19 guidelinesPJFilm-ElijahNessuna valutazione finora

- Eligibility Conditions: Advertisement For Regular Commission in Pakistan Army Through 136 Pma Long CourseDocumento5 pagineEligibility Conditions: Advertisement For Regular Commission in Pakistan Army Through 136 Pma Long CourseHusnain IshtiaqNessuna valutazione finora

- ZKBioSecurity device firmware and software version guideDocumento3 pagineZKBioSecurity device firmware and software version guideYawani Abraham Gómez SánchezNessuna valutazione finora

- Momina Khatun ImranDocumento1 paginaMomina Khatun ImranAbhi RajputNessuna valutazione finora

- KSQ Enrolment Form V2aDocumento2 pagineKSQ Enrolment Form V2aDavid OkonkwoNessuna valutazione finora

- IASbaba's March Monthly Magazine PDFDocumento203 pagineIASbaba's March Monthly Magazine PDFsmilealways20Nessuna valutazione finora

- EYOWF Brasov 2013 - Final Report PDFDocumento129 pagineEYOWF Brasov 2013 - Final Report PDFAdriana ConwayNessuna valutazione finora

- Bus TicketDocumento2 pagineBus Ticketsenthilshunmugam6432Nessuna valutazione finora

- Joining InstructionsDocumento30 pagineJoining InstructionsMuthike WachiraNessuna valutazione finora

- RAP - New Student Visa Application Process Flow PDFDocumento9 pagineRAP - New Student Visa Application Process Flow PDFPortgas D. Ace AceNessuna valutazione finora

- Ticket Seefeld Muenchen 3049493289Documento2 pagineTicket Seefeld Muenchen 3049493289Zia HaqueNessuna valutazione finora

- The Visa RulesDocumento10 pagineThe Visa RulesThe WireNessuna valutazione finora

- Application For Seafarers Document: Please Read The Guidance Notes Before Completing This FormDocumento4 pagineApplication For Seafarers Document: Please Read The Guidance Notes Before Completing This FormYorga ImandantoNessuna valutazione finora

- CGLDocumento6 pagineCGLCharan KumarNessuna valutazione finora

- Division-Memorandum s2021 351Documento29 pagineDivision-Memorandum s2021 351Noci Nusa OciomilNessuna valutazione finora

- 2023 Big Game Digest v13Documento65 pagine2023 Big Game Digest v13Diego GonzálezNessuna valutazione finora

- Heritage Yachtcover Proposal Form: Currency Please Answer All Questions FullyDocumento3 pagineHeritage Yachtcover Proposal Form: Currency Please Answer All Questions FullyDarrell PlayerNessuna valutazione finora

- Las Piñas Court Annex B DocumentsDocumento5 pagineLas Piñas Court Annex B DocumentsKenneth Abarca SisonNessuna valutazione finora