Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

RIL's Super Long Bonds: Samir Goyal B17046 BM Section-A

Caricato da

PrathameshTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

RIL's Super Long Bonds: Samir Goyal B17046 BM Section-A

Caricato da

PrathameshCopyright:

Formati disponibili

RIL’s Super Long

Bonds

-SAMIR GOYAL

B17046

BM SECTION-A

Samir Goyal (B17046)

Case Background

In 1997, Reliance Industries announced that they received offers amounting to

$250 million for its $100 million, 100-year external commercial borrowings issued

in the US market. The bonds, with the longest maturity offering by an Indian

sovereign or corporate body, had been priced at a yield of 10.6 per cent. These

bonds were issued as unsecured and had been raised without recourse to any

guarantees from government, banks or institutions. These bonds helped the

company to reduce its overall cost of capital. The 100-year bond did not give a put

option to the lenders. However, due to the enormous size of the company, RIL

became the first Indian private company to be rated by the international rating

agencies. RIL had already raised more than $900 million in the international fixed

income markets before issuing the super-long bonds in 1997.

RIL also tapped the US debt market with its five Yankee Bond issues for a total

sum of US $614 million. The maturities ranged from 10 to 100 years. Hence,

Reliance became the first corporate issuer of 50 to 100 year bonds from Asia; it

became the first issuer with split rating (due to the constraint of India’s sovereign

rating) in the world to issue a 100 year bond, to be among less than 30 issuers in

the world who have accessed the 100 year market in the last 4 years.

Discussion Questions:

Q1) How the RIL Super Bonds are expected to react to the interest changes

that are expected in the market?

Answer:

The market price of an individual bond will fluctuate in the opposite

direction of interest rates. For example, if you purchase a $10,000 bond at par

value (or face value) with a coupon (yield) of 4%, your annual income is $400. If

interest rates rise and a newly issued bond with an identical rating pays 4.5%, the

market value of your bond declines to $8,889. The market value declines so that if

you sell your bond, the buyer, who will be receiving $400 in interest per year, will

have a yield of 4.5% on his or her investment to match the prevailing market rate.

RIL Super Bonds are expected to react to the interest changes in the same way.

However, the effect will be muted since the maturity period is a long one (100

years) and the risk will spread over the entire period, thus making them safer to

fluctuations than the case of normal bonds.

Samir Goyal (B17046)

Q2) The fixed income investment professionals were still divided over whether

the 100-year bond issue was an indicator of a trend and evidence of confidence

in the economy or issuer, or merely a novelty item?

Answer:

100-year bond issuance can definitely be an indicator of an evidence of

confidence in the issuer company, otherwise who would buy a 100-year bond from

a company they didn't believe would last. For example, if there was especially high

demand for Disney's 100-year bond, this could mean that many people believe that

the company will still be around to pay out the bond in a century.

Q3) Why there is no put option or call option attached to the RIL’s 100-year

Super Long Bond?

Answer:

A put option on a bond is a provision that allows the holder of the bond the

right to force the issuer to pay back the principal on the bond. A put option gives

the bond holder the ability to receive the principal of the bond whenever they want

before maturity for whatever reason. If the bond holder feels that the prospects of

the company are weakening, which could lower its ability to pay off its debts, they

can simply force the issuer to repurchase their bond through the put provision. It

also could be a situation in which interest rates have risen since the bond was

initially purchased, and the bond holder feels that they can get a better return now

in other investments. The interest rate risk which is being borne by the bondholder

would have to be compensated by a higher yield-to-maturity. As a result, the Yield

to Maturity of bonds with a call option is higher when compared to a similar bond

without the call option. Thus, if put feature is present in a bond the risk for the

issuer increases, hence, corporations generally don’t give the put option if they are

able to raise funds easily.

Q4) what will be the income component and capital gain or loss component of

the bonds? How this can affect the decision to subscribe or not to subscribe

the bonds?

Answer:

Capital gain or loss

Any change in the interest rate brings about fluctuations in the bond prices,

mostly in the opposite direction. If the bondholder keeps the bond till maturity,

there will not be any capital loss or gain. However, if he/she decides to sell the

same, there will be a capital loss or gain depending upon the prevailing rates and

the yield to maturity rate.

Samir Goyal (B17046)

Interest Income

Interest is paid to the issuer depending on the coupon rate of the bonds. The

interests are paid annually or semi-annually, depending upon the terms and

conditions of the bonds. Here, in the case of super long bonds of RIL, 10.25%

interest is paid up every year on the face value to every bondholder. This is over

and above the premiums or discounts that are adjusted due to various reasons.

Q5) Based on the issued price of the bonds, what is the market acceptable

interest rate for a 100 year-borrowing? How this bond is expected to be in

demand on varying interest rate and inflation rate regimes?

Answer:

The super long bonds issued by RIL paid a coupon rate of 10.25% with a

maturity of 100 years and were subscribe at the YTM of 10.6%. Given these

details, it can be safely assumed that the market acceptable interest rates of these

bonds, for a corporation with the same credit rating, will be 10.6% at the prevailing

interest rates, or we can say that the spread of such a bond issue will be 3.8% over

the benchmark of US treasury bills rate.

In an era when long term interest rates are greater than the short term

interest rates, a bondholder holding these bonds will able to have a greater income

by investing in these bonds as compared to the shorter term securities. Also when

the expectation of inflation is higher the interest rates on longer term securities go

up, which will also increase the returns for the bondholder. Hence, when either

longer term interest rates or expected inflation or both is higher, the demand for

these bonds would be higher.

However, if the expected inflation or longer term interest rates or both is

low, the interest income on short term securities would be more attractive for the

investors and the demand of these securities would then be low during those times.

Q6) How these bonds value are going to get affected by volatile FOREX rates?

How investors will protect themselves from this?

Answer:

Though it might not be perfectly right to say, but the Bond price and the

Currency moves share High correlation due to the fact that the Bond prices are

mainly driven by the aftershocks of currency moves.

When a high yielding currency (like AUD) drops, the value of its Bond

prices might rise and vice versa. The same is the case when there prevails a global

risk-off sentiment. During these times, high yielding currencies gain and the Bond

prices drop as some of the market players would have already liquidated the higher

Samir Goyal (B17046)

yielding bonds with the fear that central bankers might intervene to control the

currency moves.

Hence, Both the Bond prices and Currency are inversely related but to say

that in isolation isn’t a wise advise.

Currency risk does not arise only from holding a foreign currency bond

issued by an overseas entity. It exists any time an investor holds a bond that is

denominated in a currency other than the investor’s domestic currency, regardless

of whether the issuer is a local institution or a foreign entity.

Q7) Why RIL launched these bonds in the international market denominating

in USD? Is it that Indian market was not matured enough or large enough to

accommodate these bonds?

Answer:

Lower interest rates, increasing investor appetite for Indian papers and a

strategy to diversify exposures into different currencies have prompted many

Indian companies to make their debut in international bond markets. The

international debt markets are easily accessible to large Indian corporates who are

also widening currencies of issuance to tap a wider investor base.

In this case too, RIL must have been looking to tap on the low interest rate

of the US Market. Also, the risk appetite and funding capability of foreign markets

is much more than the Indian Market. This might have prompted RIL to go for the

launching bond in the international market denominating in USD.

Q8) What if the 100-year RIL Bonds was designed as a ZCB?

Answer:

A zero coupon bond is a type of bond that doesn't make a periodic interest

payment. In bond investing, the term 'coupon' refers to the interest rate repaid

periodically to the bondholder. When Tom buys the bond, it will have a face value,

which represents how much money he'll receive from the bond issuer at maturity.

Since Tom won't be receiving any periodic interest payments, the only time he'll

receive payment from the issuer is when the bond matures. When the bond is

originally issued, the purchase price is intentionally set low to motivate investors to

buy.

Maturity dates and interest rates dictate the price of zero coupon bonds.

When interest rates are high, the purchase price is lower. A maturity date far off in

the future will also cause the zero coupon bond to have a lower price compared to

Samir Goyal (B17046)

one that's maturing sooner. The interest rate remains fixed throughout the life of

the zero coupon bond, so the price to buy the bond has to change throughout its life

to match equivalent yields already out there in the market.

Zero coupon bond prices are typically calculated using semi-annual periods

(twice a year) because bonds that offer a coupon often pay interest twice a year.

So, calculating the price of a zero coupon bond this way allows Tom to compare

investing in this zero coupon bond to investing in a traditional bond.

If these 100year long bonds are issued at the YTM of 10.6 as Zero Coupon

Bonds (ZCB) RIL would only get USD4.21 as proceeds for a USD100,00 of face

value. As coupon payments are implied in the face value that is repaid at the time

of redemption the value of a ZCB is very close to zero as compared to a bond that

pays a coupon.

As a result, if ZCB are issued the proceeds will be insufficient to fund the

projects that the company wishes to invest in.

Q9) How the price-yield curve of RIL bonds (as stated in exhibit 1) differ

from each other?

Answer:

The price-yield curve relates the annual yield on a coupon bond to its price.

Coupon payments are a fixed percentage of the face value of a bond and are

typically paid semi-annually. At maturity, the holder of a bond receives the last

coupon payment, in addition to the face value.

In our case, 5 Yankee bonds were issued by RIL, each with a different

coupon rates, maturity period and amount. The price-yield curve for each would

vary. There might also be fluctuations due to the changes in the interest rates.

Q12) Which of the bonds in Exhibit 1, will have the greatest price volatility,

assuming that each bond is trading to offer the same YTM?

Answer:

The change in the price of the bonds with higher maturity period is higher

as compared to others. Also, it can be observed that the volatility of the price

changes is the least when the YTM of the bond is close to the coupon rate paid by

the bond.

Thus, if we assume that all the bonds currently trade at the YTM of 9%, we

can say that volatility of price changes would be the highest in either of the bonds

with a coupon of 10.25%, 10.375% or 10.5%. Also, if we take into consideration

the time to maturity the super long bonds with the maturity of 100 years would

have the highest volatility among these bonds. Hence, the price volatility of super

long bonds is the highest among the bonds issued by RIL.

Samir Goyal (B17046)

Potrebbero piacerti anche

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2Da EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2Nessuna valutazione finora

- (Document Title) : Financial Management 1Documento11 pagine(Document Title) : Financial Management 1AmanNessuna valutazione finora

- A BondDocumento3 pagineA Bondnusra_t100% (1)

- Ma'am MaconDocumento7 pagineMa'am MaconKim Nicole Reyes100% (1)

- c10.pdf InvestmentDocumento6 paginec10.pdf InvestmentevanaannNessuna valutazione finora

- Bonds and Stocks (Math of Investment)Documento2 pagineBonds and Stocks (Math of Investment)RCNessuna valutazione finora

- Bonds and Their ValuationDocumento32 pagineBonds and Their ValuationSherwin Francis MendozaNessuna valutazione finora

- What Are Bonds?: Bonds Debt Principal Face Value Par Value Corporate Bond Municipal BondDocumento11 pagineWhat Are Bonds?: Bonds Debt Principal Face Value Par Value Corporate Bond Municipal BondyrockonuNessuna valutazione finora

- Kiran Uprety 2017621218Documento6 pagineKiran Uprety 2017621218Sekhar UpretyNessuna valutazione finora

- Fin 480 Exam2Documento14 pagineFin 480 Exam2OpheliaNiuNessuna valutazione finora

- Fin MarDocumento11 pagineFin MarYes ChannelNessuna valutazione finora

- Chapter 4Documento46 pagineChapter 4Lakachew GetasewNessuna valutazione finora

- Strip Bonds FinalDocumento10 pagineStrip Bonds FinalameyawarangNessuna valutazione finora

- What Are Corporate Bonds?: Investor BulletinDocumento6 pagineWhat Are Corporate Bonds?: Investor BulletinKuch biNessuna valutazione finora

- BONDSDocumento19 pagineBONDSABHISHEK CHAKRABORTYNessuna valutazione finora

- Dr. Hem Shweta RathoreDocumento9 pagineDr. Hem Shweta RathoreAkshay LodayaNessuna valutazione finora

- All Chapter QuizDocumento32 pagineAll Chapter QuizRebecaNessuna valutazione finora

- Mahindra and Mahindra CaseDocumento11 pagineMahindra and Mahindra CaseShubham RichhariyaNessuna valutazione finora

- Summary Chapter 7 Bond and Their Valuation: Level of Interest RatesDocumento7 pagineSummary Chapter 7 Bond and Their Valuation: Level of Interest RatesmikaelNessuna valutazione finora

- Name-Gurpreet Kaur SECTION - R1813 ROLL NO.-B27 Assignment Of-Pfp Submitted To-Mr - Vikas AnandDocumento7 pagineName-Gurpreet Kaur SECTION - R1813 ROLL NO.-B27 Assignment Of-Pfp Submitted To-Mr - Vikas AnandPari SiddiqueNessuna valutazione finora

- Exam QuestionsDocumento55 pagineExam QuestionsCharlie Maurer67% (3)

- Chapter 3Documento4 pagineChapter 3Mohammad AnikNessuna valutazione finora

- BondsDocumento27 pagineBondsaanchalabn100% (1)

- Corporate Finance Week6,7Documento10 pagineCorporate Finance Week6,7DAFFOO Status'sNessuna valutazione finora

- Bond Valuation PresentationDocumento16 pagineBond Valuation PresentationJACOB GAMUNessuna valutazione finora

- Chapter 6Documento9 pagineChapter 6bobby brownNessuna valutazione finora

- Bonds: What Is A Bond?Documento14 pagineBonds: What Is A Bond?Veronica CealnicNessuna valutazione finora

- 1explain The RiDocumento5 pagine1explain The RiWilliam MuhomiNessuna valutazione finora

- BONDDocumento9 pagineBONDJennyNessuna valutazione finora

- Terms You'Ll Often See in Fixed Income InstrumentsDocumento4 pagineTerms You'Ll Often See in Fixed Income InstrumentsdididinaNessuna valutazione finora

- Capital Market SecuritiesDocumento21 pagineCapital Market Securitiesfiza alviNessuna valutazione finora

- Financial Economics NotesDocumento56 pagineFinancial Economics NotesNa-Ri LeeNessuna valutazione finora

- Everything You Need To Know About Bonds - PIMCODocumento12 pagineEverything You Need To Know About Bonds - PIMCOrthakkar97Nessuna valutazione finora

- 308-Chapter-01 Questions and Answer-1Documento14 pagine308-Chapter-01 Questions and Answer-1Mohammad Anik100% (1)

- Bonds - 1Documento6 pagineBonds - 1YVONNE LANDICHONessuna valutazione finora

- Bond MarketDocumento13 pagineBond MarketHonorine Awounou N'DriNessuna valutazione finora

- Business Finance DefinationsDocumento6 pagineBusiness Finance DefinationsAhmed SaeedNessuna valutazione finora

- Bond and Its ValuationDocumento37 pagineBond and Its ValuationSummit MirzaNessuna valutazione finora

- Investment in BondsDocumento4 pagineInvestment in BondsAnkit PandyaNessuna valutazione finora

- Unit-III Bond Prices, Rates, and YieldsDocumento36 pagineUnit-III Bond Prices, Rates, and YieldsAnu ShreyaNessuna valutazione finora

- Bond InvestmentDocumento5 pagineBond InvestmentRosalyn MauricioNessuna valutazione finora

- What Is A Bond?: Fixed Income Instrument I.O.U. LenderDocumento8 pagineWhat Is A Bond?: Fixed Income Instrument I.O.U. LenderKidMonkey2299Nessuna valutazione finora

- Valuation of Debt and EquityDocumento8 pagineValuation of Debt and EquityhelloNessuna valutazione finora

- Critical Financial Problems: 1. Volatility in Interest Rate and Its Impact On Bond PriceDocumento2 pagineCritical Financial Problems: 1. Volatility in Interest Rate and Its Impact On Bond PriceKshitishNessuna valutazione finora

- The Benefits and Risks of Corporate Bonds Oct - 13 - 2010 ReportDocumento11 pagineThe Benefits and Risks of Corporate Bonds Oct - 13 - 2010 ReportstefijNessuna valutazione finora

- Bonds: Types, Trading & SettlementDocumento52 pagineBonds: Types, Trading & SettlementraviNessuna valutazione finora

- Corporate Finance 6Documento3 pagineCorporate Finance 6Mujtaba AhmadNessuna valutazione finora

- MODULE 3.2 Lecture Notes (Jeff Madura)Documento10 pagineMODULE 3.2 Lecture Notes (Jeff Madura)Romen CenizaNessuna valutazione finora

- BONDSDocumento5 pagineBONDSKyrbe Krystel AbalaNessuna valutazione finora

- Yield - Concept, Theories and MeasuresDocumento10 pagineYield - Concept, Theories and Measurespriyanka mehtaNessuna valutazione finora

- Bonds and Interest RateDocumento31 pagineBonds and Interest Rateeiraj hashemiNessuna valutazione finora

- Xheniii 222Documento9 pagineXheniii 222Ekonomiste EkonomisteNessuna valutazione finora

- Faii Chapter Vi - 0Documento16 pagineFaii Chapter Vi - 0chuchuNessuna valutazione finora

- Finance and Management NotesDocumento243 pagineFinance and Management NotesJYOTI PRAKASH SINGHNessuna valutazione finora

- Rohit DubeyDocumento4 pagineRohit DubeyRohit DubeyNessuna valutazione finora

- Eun Resnick Chapter 6 STudy NotesDocumento6 pagineEun Resnick Chapter 6 STudy NotesWai Man NgNessuna valutazione finora

- SFU Assignment 2Documento3 pagineSFU Assignment 2Hein Zaw Zaw NyiNessuna valutazione finora

- High Yield Bond MarketDocumento6 pagineHigh Yield Bond MarketYash RajgarhiaNessuna valutazione finora

- Bond MarketDocumento5 pagineBond MarketSundaresan DharmarajNessuna valutazione finora

- Impact of Environmental, Social and Governance Disclosures On Market Reaction - An Evidence of Top50 Companies Listed From ThailandDocumento15 pagineImpact of Environmental, Social and Governance Disclosures On Market Reaction - An Evidence of Top50 Companies Listed From ThailandPoly Machinery AccountNessuna valutazione finora

- CH 5 - 2024 - 1 - Bond ValuationDocumento32 pagineCH 5 - 2024 - 1 - Bond Valuationmarizemeyer2Nessuna valutazione finora

- Schedule III of Companies Act 2013 in Excel Format-2Documento48 pagineSchedule III of Companies Act 2013 in Excel Format-2divya shindeNessuna valutazione finora

- Goldman Sachs Equity Research ReportDocumento2 pagineGoldman Sachs Equity Research ReportSaras Dalmia0% (1)

- CH 03Documento56 pagineCH 03Zelalem GirmaNessuna valutazione finora

- GGRM - Icmd 2009 (B02)Documento4 pagineGGRM - Icmd 2009 (B02)IshidaUryuuNessuna valutazione finora

- Financial Accounting II MinDocumento4 pagineFinancial Accounting II MinAsna Rachal ShibuNessuna valutazione finora

- Negotiable InstrumentsDocumento3 pagineNegotiable InstrumentsMuhammadUmarNazirChishtiNessuna valutazione finora

- The Graph Showing Net Working CapitalDocumento31 pagineThe Graph Showing Net Working CapitalPRATIK PALKHENessuna valutazione finora

- School District Notes To Financial Statements Year Ended June 30, 2021Documento34 pagineSchool District Notes To Financial Statements Year Ended June 30, 2021Jam SurdivillaNessuna valutazione finora

- Estimation Eirr 2014Documento11 pagineEstimation Eirr 2014M iqbalNessuna valutazione finora

- Financial Analysis & Valuation of Godrej Consumer Product LimitedDocumento30 pagineFinancial Analysis & Valuation of Godrej Consumer Product Limitedanshul sinhal100% (1)

- Starbucks Analylsis 2Documento26 pagineStarbucks Analylsis 2api-321188189Nessuna valutazione finora

- Structure of The Balance Sheet and Statement of Cash Flows: Revsine/Collins/Johnson/Mittelstaedt/Soffer: Chapter 4Documento39 pagineStructure of The Balance Sheet and Statement of Cash Flows: Revsine/Collins/Johnson/Mittelstaedt/Soffer: Chapter 4amyNessuna valutazione finora

- SOIC-Financial Literacy 2 1 Lyst9826Documento62 pagineSOIC-Financial Literacy 2 1 Lyst9826bradburywillsNessuna valutazione finora

- Branch Advance MasterDocumento294 pagineBranch Advance MasterSurajit DoraNessuna valutazione finora

- 6Documento30 pagine6Aisar AmireeNessuna valutazione finora

- The Little Book of Valuation Book SummaryDocumento12 pagineThe Little Book of Valuation Book SummaryKapil AroraNessuna valutazione finora

- Finm 693 Asian Paints (2309)Documento10 pagineFinm 693 Asian Paints (2309)Thakur Anmol RajputNessuna valutazione finora

- Nortech Trinity Investors Deck For Coal & Mining 2022Documento7 pagineNortech Trinity Investors Deck For Coal & Mining 2022NORTECH TRINITYNessuna valutazione finora

- MS Accountancy Set 5Documento9 pagineMS Accountancy Set 5Tanisha TibrewalNessuna valutazione finora

- Crypto TradingDocumento22 pagineCrypto TradingSOZEK Loyozu70% (10)

- WILMONTDocumento7 pagineWILMONThadiNessuna valutazione finora

- Pal Corporation and Subdinary Consolidation Workpaper Fo The Year Ended Des 31, 2011Documento8 paginePal Corporation and Subdinary Consolidation Workpaper Fo The Year Ended Des 31, 2011ATIKA ZAHRAHNessuna valutazione finora

- TRS StockvalDocumento2 pagineTRS StockvalUcok DedyNessuna valutazione finora

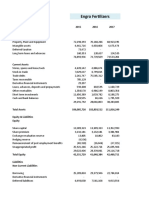

- Engro FertilizerDocumento9 pagineEngro FertilizerAbdullah Sohail100% (1)

- SCF WorksheetDocumento19 pagineSCF WorksheetAngelo Gian CoNessuna valutazione finora

- 66 3 1Documento23 pagine66 3 1bhaiyarakeshNessuna valutazione finora

- Corporate Finance Theory and Practice 10th EditionDocumento674 pagineCorporate Finance Theory and Practice 10th EditionrahafNessuna valutazione finora

- Nolus PresentationDocumento10 pagineNolus PresentationDCMNessuna valutazione finora