Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Valuation Rantapuska Lecture5

Caricato da

Hanan AKTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Valuation Rantapuska Lecture5

Caricato da

Hanan AKCopyright:

Formati disponibili

Lecture 5

Forecasting Income Statement and

Balance Sheet

Group valuation company, bonus points,

signup for case presentations

• Group Valuation Project company is Ekokem

• Use class activity points section at MyCourses to track

your activity: mark down your comment there

– Instructors will add their own judgement when deciding on the

final bonus points

• 1 Group = 1 case discussion in any of the four exercise

sessions

– Sign up via MyCourses

Elias Rantapuska / Aalto BIZ Finance 2

Operating leases: recipe for Carrefour

case

• Operating Lease is 1 Forecast leasing payments

like rental, Financial

Lease is like buy with

debt 2 Calculate PV of lease

• Big idea of operating Forecast new lease agreements for financial

lease capitalization: 3

year

– Treat operating

lease as if debt 4 Calculate depreciation schedule for leased asset

would have been

issued to Calculate net change in leased assets and

5

purchase the resulting balance sheet values for each year

leased asset

6 Take out lease payment from COGS

– Move lease

payment from

operating costs 7 Calculate interest part of lease payment

to interest

payments and 8 Rest is amortization

depreciation

– Add leased asset 9 Calculate deferred tax asset

to both sides of

balance sheet

Elias Rantapuska / Aalto BIZ Finance 3

Learning objectives for today

• After today’s lecture, you should know how to:

– Set up revised income statement for forecasting

– Know how to forecast sales and operating profit

– Understand how the income statement forecasts

link to balance sheet

– In short: be able to start building your group

valuation project model

Elias Rantapuska / Aalto BIZ Finance 4

Structure of discussion today

•H&M example: structuring revenue tree

•Where do we start from: simplified and revised income

statement

•Forecasting income statement and balance sheet: "theory"

•Forecasting income statement and balance sheet: case

Finnair

•It all seemed very easy, any more tricks of the trade?

Elias Rantapuska / Aalto BIZ Finance 5

Structuring H&M revenue growth tree

Elias Rantapuska / Aalto BIZ Finance 6

H&M: first possible solution

Market area Country Business

UK Retail

EMEA

France Wholesale

(Weekday brand)

Germany

Italy

H&M

Americas Etc.

Observations:

• Although H&M is run by

country rather than regional

managers, may make sense to

aggregate on market area level

for the purposes of

Asia & communicating results later

Oceania • Third level is country, fourth

level business: could also be

other way around depending

on data availability

Elias Rantapuska / Aalto BIZ Finance 7

H&M: second possible solution

Market area Country Region

UK Region 1

EMEA

France Region 2

Germany Region 3

Italy

H&M

Americas Etc.

Observations:

• Entirely geography-driven

approach

• Most appropriate if data

Asia-Pacific available on regional level

• Stay on country level if regional

level data not available

Elias Rantapuska / Aalto BIZ Finance 8

H&M: third possible solution

Product target

Market area Country groups

UK Females 13-18

EMEA

France Females >18

Germany Males 13-18

Males >18

Italy

Females <13

H&M Males <13

Americas

Etc.

Observations:

• Fourth level based on product

target groups

• Makes sense if:

Asia-Pacific • Target groups have very

different growth rates

• Data available on

product level

Elias Rantapuska / Aalto BIZ Finance 9

Structure of discussion today

•H&M example: structuring revenue tree

•Where do we start from: simplified and revised income

statement

•Forecasting income statement and balance sheet: "theory"

•Forecasting income statement and balance sheet: case

Finnair

•It all seemed very easy, any more tricks of the trade?

Elias Rantapuska / Aalto BIZ Finance 10

Refresher: Income Statement

Income Statement

Sales

Cost of Sales

Gross profit

SG&A Before proceeding to actual

Other operating income, net of expense forecasting, you should have

Operating profit simplified, standard accounts

Net interest expense (income) at the worksheet:

Investment income

Profit before tax • Necessary adjustments

Tax expense done at least to last year’s

Profit after tax financials

Minority interest • Simplified or detailed on

Net profit appropriate detail: start high-

level and add detail

Additional info on items by nature

Cost of materials

Personnel expenses

Depreciation

Elias Rantapuska / Aalto BIZ Finance 11

Structure of discussion today

•H&M example: structuring revenue tree

•Where do we start from: simplified and revised income

statement

•Forecasting income statement and balance sheet:

"theory"

•Forecasting income statement and balance sheet: case

Finnair

•It all seemed very easy, any more tricks of the trade?

Elias Rantapuska / Aalto BIZ Finance 12

Forecasting: "theory" how to do it

• Aim is to develop an integrated set of financial forecasts that reflect the

company’s expected performance. We must have an idea on:

1. The appropriate level of detail:

a. Typical forecast has at least two periods: explicit forecast and

continuing value

b. Level of detail "as simple as possible, but not simpler". Very

detailed predictions of individual accounting items seldom

make sense: use your time on getting value drivers and their

forecasts right

2. Building a well-structured spreadsheet model:

a. Raw inputs, computations, and outputs as separate sheets

b. Flows from one worksheet to the next and handles multiple

scenarios

Elias Rantapuska / Aalto BIZ Finance 13

Level of detail goes down the longer you

forecast

Phase 1: Explicit and Phase 2: Phase 3:

detailed Explicit Steady state

• A detailed 3- to 7 (usually • A simplified forecast for • Value the remaining

5) year forecast additional 3-7 years years by using

• Develops high-level, but terminal value

• Focus on a few important

complete balance sheets formula, multiples,

variables, such as

and income statements or liquidation value

revenue growth, margins,

• Revenues should be

and capital turnover

forecasted using real

value drivers • Can be combined with

• Other items either link to phase 1 if value drivers

real drivers or as % of available beyond phase 1 Detailed next page

revenues: use judgment

Elias Rantapuska / Aalto BIZ Finance 14

Steady state is when your forecast turns

into a perpetual motion machine

• Modeling shorthand: very few things can be

really forecasted beyond 10 (or even 5) years

• Assumes the following state:

Constant growth and reinvestment of

operating profits

Constant ROIC

• Important to have at least one business cycle

(and model it explicitly) in your explicit

forecast period

Otherwise value understated for

companies at the bottom of the cycle

Overstated for companies at the peak of

the cycle (why do most of the M&A

happen in booms?)

Elias Rantapuska / Aalto BIZ Finance 15

Modeling: some best practices

In your model, data

• Valuation models become easily messy,

should generally flow in

especially for beginners

• Structuring well early saves time later one direction

Raw historical data

• Good valuation models have certain Adjusted financials

Revenues and costs

characteristics. Forecasted financials

Discount rate

• First, original data and user input are Valuation summary

collected in only a few places

• Denote raw data (my pick: blue) or user

input (my pick: green) in a different color

than calculations (my pick: black)

• Never hard-code numbers in a formula:

all formulas must refer to cells which

have input

• Delete all information that is non-

essential to prevent model bloating

Elias Rantapuska / Aalto BIZ Finance 16

Modeling: example worksheet structure

• Many spreadsheet designs are possible. In the Finnair FCF valuation

example to follow, the Excel workbook contains seven worksheets:

1. Raw historical data from company financials

2. Adjusted financials based on raw data

1. Based on how detailed your analysis must be

2. Match at least revenues, operating profit and profit for the financial

year with latest available reported numbers

3. Start with aggregate numbers, disaggregate until the level of detail

is sufficient (in the Finnair example, we have rather aggregate

numbers)

3. Revenue and cost forecasts with drivers matched for latest year and

forecasts

4. Forecasted income statement, FCF, and balance sheet (may be each on

separate sheet depending on level of detail)

5. Calculation of discount rate

6. Valuation summary

Elias Rantapuska / Aalto BIZ Finance 17

Forecasting: six steps to success

Although the future is unknowable, careful analysis can yield insights into how a

company may develop. We break the forecasting process into six steps:

1. Prepare and analyze historical financials. Before forecasting future financials,

build and analyze historical financials. Often reported financials either too simple

or too complex. When this occurs, rebuild financial statements with the right

balance of detail for your model

2. Build the revenue forecast. Almost every line item will rely directly or indirectly

on revenue. You can estimate future revenue by using either a top-down (market-

based) or bottom-up (customer-based) approach. Forecasts should be consistent

with growth history and insights on market volume development and company

ability to gain market share (faster/slower than market growth) and price

development

3. Forecast the income statement. Use the appropriate economic drivers to

forecast all line items, with appropriate level of detail

Elias Rantapuska / Aalto BIZ Finance 18

Forecasting: six steps to success

We break the forecasting process into six steps:

4. Forecast the balance sheet:

a. Forecast the balance sheet: invested capital and non-operating capital

b. Forecast the balance sheet: investor funds. Complete the balance sheet

by computing retained earnings and forecasting other equity accounts. Use

cash and/or debt accounts to balance the cash flows and balance sheet.

5. Calculate discount rate

6. Calculate FCFF / FCFE and discount to get value

a. To complete the forecast, calculate free cash flow as the basis for valuation.

Future FCF should be calculated the same way as historical FCF.

b. Calculate ROIC to assure forecasts are consistent with economic principles,

industry dynamics, and the company’s competitive advantage.

c. Make cool output graphs from your model to summarize key outcomes,

impress everybody and ensure the output behavior makes sense (e.g., no

unexplained jumps in key variables, no negative value of equity etc.)

Elias Rantapuska / Aalto BIZ Finance 19

Structure of discussion today

•H&M example: structuring revenue tree

•Where do we start from: simplified and revised income

statement

•Forecasting income statement and balance sheet: "theory"

•Forecasting income statement and balance sheet: case

Finnair

•It all seemed very easy, any more tricks of the trade?

Elias Rantapuska / Aalto BIZ Finance 20

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

Prepare historical financials

• Collect raw historical data and build the financial statements in a spreadsheet

• Understand most recent historical data: do not mix operating and financial items

(although companies sometimes do), take out non-recurring items and focus on

largest items (in practice, forget items <1% of revenues / total balance sheet)

• Often makes sense to consolidate historical financials into more aggregate structure

(as in the Finnair model), unless the analyst has true insight on more detailed line

items

Need to resort to

segment reporting

to build more

detailed sales

forecast

Operational leases

are accounted for

operating expense

Elias Rantapuska / Aalto BIZ Finance 21

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

Reported profit good only as starting

point

Firm’s Non-recurring

Comparables Operating leases R&D expenses

financials items into

into debt into asset

separate item

”Normalized” revenues

Clean up operating items,

and profit

e.g.:

•Business cycle

•Financial expenses

•Structural changes

•Capital expenses

•Be skeptical to pro-forma

•Non-recurring expenses

adjustments

Revenues and operating

profit as basis for

forecasting

Update:

•Quarterly/monthly data

•Earnings guidance

•Voiceovers from the

management

Elias Rantapuska / Aalto BIZ Finance 22

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

Accounting is ruled by law, your

numbers by logic

Financial expenses not hidden into operating expenses

• Financial expense: a commitment that is tax deductible that you Your revenue

have to meet no matter what and operating

• Example: operating leases can be operating expenses, they are cost baseline

really financial expenses and need to be reclassified as such. should be

This has no effect on Net income or FCFE but does change ruled by logic

EBITDA/EBIT/FCFF to make

accurate

No capital expenses in operating expenses and vice versa forecasts.

• Any expense expected to generate benefits over multiple periods Accounting

is a capital expense (e.g., drug development personnel costs) choices do not

always follow

• R&D is typically obscure to an outsider: failed and discontinued the logic you

R&D is an expense, whereas successful R&D should be would like

capitalized. Often impossible to tell for an outside analyst

Elias Rantapuska / Aalto BIZ Finance 23

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

Finnair segment reporting structure in

Annual Report 2014

Segment Subsidiary

Cargo

Airline Flight

business academy

Aircraft

Finnair finance

Travel services

Elias Rantapuska / Aalto BIZ Finance 24

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

First step in making a revenue forecast is

to make a sensible revenue tree

Business Revenue driver:

area Business simple model

Passenger volume

Passenger

growth

World trade

Cargo growth

Cargo

Cargo terminal World trade

operations growth

Finnair

Flight <Modeled with

academy passenger>

Aviation <Modeled with

services passenger>

Aircraft

services

Aircraft <Modeled with

finance passenger>

Passenger volume

Travel services

growth

Elias Rantapuska / Aalto BIZ Finance 25

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

Even more detailed revenue forecast

requires time, data, and insight

Business Revenue driver:

area Business detailed model

• Passenger miles offered

Passenger • Load factor

• Price per passenger mile delivered

• World trade growth (volume) per

Cargo market area

Cargo

• Price growth in air cargo per

market area

Cargo terminal • Cargo volume growth at Helsinki-

Finnair operations Vantaa

Flight • Price per cargo ton charged at

academy Helsinki-Vantaa

• Passenger and cargo growth

Aviation

Aircraft services

services

Aircraft • Passenger and cargo volume

finance • Leasing price per aircraft growth

• Passenger volume growth at airports

Travel services • Average spend per airline passenger

for travel services

Elias Rantapuska / Aalto BIZ Finance 26

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

Revenue forecasting: principles

• Create a good revenue forecast as it drives most other items in your model

• Dynamic forecast; constantly re-evaluate as new information becomes available (e.g.,

quarterly earnings releases, CMD presentations, earnings guidance)

• Bottom-up forecast is more appropriate in B2B contexts, but can be used in B2C if bottom up

forecast done by product or market area

3. Extend short-term

Top-down 1. Estimate size of total addressable

revenue forecasts to

revenue market (per business)

long-term

forecast

2a. Estimate market share

and pricing strength 2. Estimate new

based on competition customer wins and

and competitive turnover / growth per

advantage area / growth per

product

2b. OR alternatively, use 1. Project demand

latest revenue as basis from existing

Bottom-up

and use revenue growth customers/products/

revenue

rates market area

forecast

Elias Rantapuska / Aalto BIZ Finance 27

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

Revenue forecasting: link your forecast

to drivers

Revenue drivers:

• Passenger traffic growth

from Boeing,

• GDP (trade) growth from

OECD forecasts

Margin drivers:

• Subjective forecasts

• Based on Finnair’s track

record in achieving cost

savings

Elias Rantapuska / Aalto BIZ Finance 28

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

Income statement: fix drivers and

predict

• With revenue forecast, next forecast income statement:

1. Decide what economic force drives the line item. For most items, revenue is

appropriate

2. Adjust financials and match latest financial statement to the drivers

3. Estimate the forecast ratio. Since cost of goods sold is tied to revenue, estimate

COGS as a percentage of revenue.

4. Multiply the forecast ratio by an estimate of its driver. For instance, since most line

items are driven by revenue, most forecast ratios, such as COGS to revenue, should be

applied to estimates of future revenue.

Revenue forecasts built

bottom-up by business

Operating costs driven by

operating margin forecasts

Financial income and

expenses driven by latest

yield for short-term financial

assets and liabilities

Elias Rantapuska / Aalto BIZ Finance 29

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

Income statement: some forecast ratios

• Choice for a forecast driver depends on the company and the industry

• Some guidance on typical forecast drivers and forecast ratios for the most common financial statement line items

Income Statement Forecast Ratios

Recommended Recommended

Line item forecast driver forecast ratio

Operating • Cost of goods sold (COGS) • Revenue • COGS / revenue Simplifi-

• Selling, Gen, Admin (SG&A) • Revenue • SG&A / revenue cation:

• Depreciation • Prior year net • Depreciation / net PP&E forecast

property, plant, and operating

profit

equipment (PP&E) margin

Non • Non-operating income • Appropriate non- • Non-operating income / non-

operating operating asset, if any operating asset

• Prior year total debt • 0 if extraordinary item

• Interest expense • Interest expenset /

• Prior year excess cash total debtt-1

• Interest income • Interest expenset-1 /

excess casht-1

Elias Rantapuska / Aalto BIZ Finance 30

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

Income statement: depreciation

Forecasting depreciation Example: Forecasting depreciation

• Either forecast depreciation as a

Depreciation 2013 19

percentage of revenue or as a Forecast Ratio = = = 7.9%

Revenues 2013 240

percentage of property, plant, and

equipment Depreciati on 2014E = Forecast Ratio ´ Revenues 2014E

• In Finnair example, depreciation

is not explicitly modeled

• Rather, it is (implicitly) assumed

that depreciation + change in

operating assets = investment in

fixed capital

• Depreciation is included in

calculating operating profit

Elias Rantapuska / Aalto BIZ Finance 31

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

Forecasting balance sheet assets

• With balance sheet, start with noncurrent assets (=tangible assets and intangible assets)

• When forecasting balance sheet items, using the stock method (balance sheet

item/revenue) vs. flow method (change in balance sheet item / revenue)

• For many items, go through the notes to understand what will drive the level of the balance

sheet asset. For many non-operating assets (e.g., land owned for development purposes)

having zero growth is reasonable with lack of better information

• Excess cash: it the company holds too much cash, it should be a current asset and added

to company value (think that excess cash could be paid out now as dividend)

Cash ~4% of

balance sheet in line

with industry

averages

Elias Rantapuska / Aalto BIZ Finance 32

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

Balance sheet: some forecast ratios

Typical forecast driver Typical forecast ratio

Operating line items

Accounts receivable Revenue Accounts receivable / revenue

Inventories Cost of goods sold Inventories / COGS

Accounts payable Cost of goods sold Accounts payable / COGS

Accrued expenses Revenue Accrued expenses / revenue

Net PP&E Revenue Net PP&E / revenue

Goodwill Acquired company revenues Goodwill / acquired company revenue

Non-operating line items

Non-operating assets None Growth in non-operating assets / zero

Pension assets or liabilities None Trend towards zero

Deferred taxes Adjusted taxes Change in deferred taxes / adjusted taxes

For non-operating assets, one possibility to value separately similar cash (e.g., shares in

publicly listed stocks) with zero growth

Elias Rantapuska / Aalto BIZ Finance 33

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

Forecasting balance sheet liabilities

• Change in retained earnings (equity) from clean surplus accounting: RE t+1 =

RE t + Net Income – Dividends (DO NOT FORECAST BASED ON SALES!) For dividend

• Deferred tax-liability: read the notes. In case of Finnair, these come from selling payout ratio,

assets to Flybe in 2011. Assume that eventually Finnair will pay taxes and this use guidance

liability is realized from annual

report

• Long-term liabilities: the plug. Total Assets – Total Liabilities ex. Long-term debt

• Short-term borrowings: forecast based on sales

• Trade payables and other liabilities: forecast based on sales

Elias Rantapuska / Aalto BIZ Finance 34

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

Forecasting balance sheet liabilities:

plug

• The plug can be also something else than long-term debt:

• Simple models use long-term debt as the plug (use “newly issued debt” as a

separate line item if needed for clarity)

• Advanced models use excess cash or newly issued debt, to prevent debt from

becoming negative

• Even more advanced model would have target leverage ratio and switch

between excess cash and long-term debt based on leverage ratio

Balance Sheet

The Plug Excess cash Newly issued debt The plug

(use IF/THEN (for simple

statement for models)

advanced Existing debt

Remaining

models) Shareholder’s equity

assets

Elias Rantapuska / Aalto BIZ Finance 35

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

Discount rate: proudly apply everything

you have learned so far

Discounting cash flows to equity Discounting cash flows to firm

• CAPM: • WACC

– 12 month EURIBOR most – Do not discount cash flows to

common choice for rf equity, such as dividends, with

– Beta: use weekly/monthly data WACC. Ever.

– Empirical issues discussed in – Apply tax-shield either at WACC

detail on “empirical issues” - or at FCF calculation (more on

lecture this next lecture), not both

• Multifactor models: – More useful to discount cash

– Fama-French rE = rf + rB + rSMB + flows to firm when predictions on

rHML dividend policies are

– Pastor-Stambaugh factor for inappropriate (e.g., high growth

liquidity companies)

– Carhart momentum: should it be

added or not?

• Doctor Stetson

Surface scratch today, lecture 10

will deal with these topics in detail

Elias Rantapuska / Aalto BIZ Finance 36

Historical Revenue Income Balance Discount Valuation

1

financials forecast statement sheet rate

Finally, we get a value for the firm

• With completed income statement and balance sheet forecasts, calculate FCF for

each forecast year.

• Since a full set of forecasted financials are available, copy the two calculations

across from historical financials to projected financials

• Discount cash flows: you learned how to do this in your first finance course, but it

took a while to get here…

Elias Rantapuska / Aalto BIZ Finance 37

Structure of discussion today

•H&M example: structuring revenue tree

•Where do we start from: simplified and revised income

statement

•Forecasting income statement and balance sheet: "theory"

•Forecasting income statement and balance sheet: case

Finnair

•It all seemed very easy, any more tricks of the trade?

Elias Rantapuska / Aalto BIZ Finance 38

Other issues in forecasting

1. Operating drivers, like volume and productivity are next step of detail after

predicting aggregate volume growth:

• In airline industry labor and fuel have increased as a percentage of

revenue. Fuel is a greater percentage because oil prices have been rising.

Labor also up as percentage of revenue per seat mile has been dropping

• In B2B applications with relatively few end customers, it makes sense to

forecast revenues per account (customer) rather than with growth rates:

think companies like Metso or Areva

2. Fixed and variable costs. The distinction between fixed and variable costs at

the company level is usually unimportant because most costs are variable in the

long-term. For individual production facilities, most costs are fixed: the smaller

the unit of observation and shorter the time horizon, the more likely a cost is

fixed

3. Inflation. If cost of capital is often in nominal terms, forecast in nominal terms.

High inflation will distort historical analyses

Elias Rantapuska / Aalto BIZ Finance 39

Forecasting: what did we learn?

• Valuation is easy, although time-consuming. First understand, then structure,

forecast, build financials and discount

• First step in modeling is to get a simple model (like the Finnair model) roughly

right. Then start adding level of detail. Beware getting tangled up with details at

the beginning

• Cross-check your results against industry forecasts, expert opinions, and

common sense. If your company will grow faster than industry, be ready to explain

why. If the margin is going to grow, have a story where the margin improvement is

coming from

• Break down forecasts and add line items only if you have insight. Do not break

down revenue into 20 product groups or geographic areas, if you are using same

growth rate everywhere

Elias Rantapuska / Aalto BIZ Finance 40

Postscript: Finnair Annual Report 2015

Elias Rantapuska / Aalto BIZ Finance 41

Potrebbero piacerti anche

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Rastogi (2013) Working Capital Management Nasional FertilizerDocumento4 pagineRastogi (2013) Working Capital Management Nasional FertilizerRahmadhani PutriNessuna valutazione finora

- Business Plan Indu. - DocxDocumento30 pagineBusiness Plan Indu. - DocxYonatan YirgaNessuna valutazione finora

- Descon Chemicals Limited Swot Analysis BacDocumento6 pagineDescon Chemicals Limited Swot Analysis BacAamir HadiNessuna valutazione finora

- Key Chapter 11Documento3 pagineKey Chapter 11JinAe NaNessuna valutazione finora

- Analiza Corporate CafminDocumento9 pagineAnaliza Corporate CafminyayaNessuna valutazione finora

- Worksheet On Cash Flow Statement (Board Exam Questions)Documento14 pagineWorksheet On Cash Flow Statement (Board Exam Questions)Cfa Deepti BindalNessuna valutazione finora

- Customer Success GlossaryDocumento3 pagineCustomer Success GlossaryRuan PhabloNessuna valutazione finora

- The Profit of A Business During An Accounting Period Is Equal ToDocumento4 pagineThe Profit of A Business During An Accounting Period Is Equal Toabdirahman YonisNessuna valutazione finora

- What Calculations Should Juan Do in Order To Get A Good Grasp of What Is Going On With Quickfix's Performance?Documento7 pagineWhat Calculations Should Juan Do in Order To Get A Good Grasp of What Is Going On With Quickfix's Performance?Cheveem Grace EmnaceNessuna valutazione finora

- Chapter 10 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Documento118 pagineChapter 10 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais Azeemi100% (2)

- Ias 41 Ias 11Documento24 pagineIas 41 Ias 11KM RobinNessuna valutazione finora

- Company Visit ReportDocumento6 pagineCompany Visit ReportRushyanth KRNessuna valutazione finora

- RR 16-05 - AmendmentsDocumento39 pagineRR 16-05 - AmendmentsArchie GuevarraNessuna valutazione finora

- An Analysis of Financial Performance of BRAC Bank LTD - Al SukranDocumento31 pagineAn Analysis of Financial Performance of BRAC Bank LTD - Al SukranAl SukranNessuna valutazione finora

- Ratio Analysis: Prepared By: Zaid Harithah Bin Zainulabid (62288111045) Prepared For: MR Zaid Kader ShahDocumento21 pagineRatio Analysis: Prepared By: Zaid Harithah Bin Zainulabid (62288111045) Prepared For: MR Zaid Kader ShahZaid HarithahNessuna valutazione finora

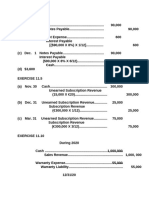

- Revenue and Expense RecognitionDocumento27 pagineRevenue and Expense RecognitioncskNessuna valutazione finora

- The KPIs Cheat Sheet - Oana Labes, MBA, CPADocumento1 paginaThe KPIs Cheat Sheet - Oana Labes, MBA, CPAYonas TeshaleNessuna valutazione finora

- Applications of Derivatives in Business and EconomicsDocumento6 pagineApplications of Derivatives in Business and EconomicsTed Bryan D. Cabagua100% (1)

- Ayala Corporation Statement of Financial Position 2019 2018 in Millions Audited Audited AsssetsDocumento11 pagineAyala Corporation Statement of Financial Position 2019 2018 in Millions Audited Audited AsssetsAlgen SabaytonNessuna valutazione finora

- APED Vol - IDocumento475 pagineAPED Vol - Im_surendra100% (1)

- Ratio Formula Calculation Industry Average CommentDocumento2 pagineRatio Formula Calculation Industry Average Commentjay balmesNessuna valutazione finora

- XP Inc.2Q2022Documento19 pagineXP Inc.2Q2022Joao Pedro Crivellaro de OliveiraNessuna valutazione finora

- Audipra Substantive Test of Liabilities ILLUSTRATION 1 (Classification of Liabilities)Documento5 pagineAudipra Substantive Test of Liabilities ILLUSTRATION 1 (Classification of Liabilities)Girl lang0% (1)

- IAS 18 - RevenueDocumento21 pagineIAS 18 - RevenueMinh Nguyen Thi Hong100% (1)

- BSRM Steels LimitedDocumento2 pagineBSRM Steels Limitedashek ishtiak haqNessuna valutazione finora

- Strategic Tax Management (Final Period Assignment Quiz)Documento4 pagineStrategic Tax Management (Final Period Assignment Quiz)Nelia AbellanoNessuna valutazione finora

- MarkfedDocumento30 pagineMarkfedKarampreet KaurNessuna valutazione finora

- Financial Management Chapter 17 FinanciaDocumento11 pagineFinancial Management Chapter 17 FinanciaKomal Mubeen100% (1)

- American Airlines 2004Documento47 pagineAmerican Airlines 2004edyta182100% (1)

- Marketing PlanDocumento34 pagineMarketing Planjamal19900% (1)