Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

The Cash Receipts Journal

Caricato da

Randy AlbutraDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

The Cash Receipts Journal

Caricato da

Randy AlbutraCopyright:

Formati disponibili

The Cash Receipts Journal

11 and the Cash Payments Journal

DEMONSTRATION PROBLEM

Elegant Jewelry, a retail store, sells merchandise (1) for cash, (2) on charge accounts, and

(3) on bank credit cards. The store uses a sales journal, a purchases journal, a cash receipts

journal, a cash payments journal, and a general journal. The store engaged in the following

selected transactions:

June 16 Sold merchandise on account to T. Morgan, sales ticket no. 1230, $9,757, plus

$790.32 sales tax.

17 Sold merchandise paid by bank credit cards, $2,271, plus $183.95 sales tax. The

bank charges 4 percent of the total sales plus sales tax.

18 Bought merchandise on account from Gem Central, invoice no. D109, dated

June 16; $4,542; terms 1/10, n/30; FOB shipping point, freight prepaid and

added to the invoice, $60 (total $4,602).

19 Received credit memorandum no. 926 from Gem Central for merchandise return,

$529.

22 Paid Gem Central, their invoice no. D109, Ck. No. 5901, $4,032.87. ($4,542 less

$529 return and less 1 percent cash discount. $4,542.00 – $529.00 = $4,013.00;

$4,013.00 × .01 = $40.13; $4,013.00 – $40.13 = $3,972.87; $3,972.87 + $60

freight = $4,032.87.)

24 Bought supplies on account from Todd Company, their invoice no. 990, dated

June 22; net 30 days; $459.

29 Paid rent for the month, Ck. No. 5902, $1,980.

30 Bought merchandise on account from The Box Company, their invoice no.

10002, dated June 29; list price $2,950 less 40 percent trade discount; terms

2/10, n/30; FOB shipping point.

30 Paid freight bill to Fast Freight, Ck. No. 5903, for merchandise received from

Todd Company, $110.

30 Issued Ck. No. 5904 for $258.36 to customer L.O. Sherry, for merchandise re-

turned, $239, plus $19.36 sales tax.

Instructions

1. Journalize the transactions.

2. Total and rule the journals.

3. Prove the equality of the debits and the credits at the bottom of each journal.

Copyright © Houghton Mifflin Company. All rights reserved. 1

Solution

SALES JOURNAL

ACCOUNTS SALES TAX

TKT. POST. RECEIVABLE PAYABLE SALES

DATE NO. CUSTOMER'S NAME REF. DEBIT CREDIT CREDIT

1 20— 1

2 June 16 1230 T. Morgan 10,547.32 790.32 9,757.00 2

3 30 10,547.32 790.32 9,757.00 3

4 4

Debits Credits

$10,547.32 $ 790.32

— 9,757.00

$10,547.32 $10,547.32

PURCHASES JOURNAL

ACCOUNTS

SUPPLIER'S INV. INV. POST. PAYABLE FREIGHT IN PURCHASES

DATE NAME NO. DATE TERMS REF. CREDIT DEBIT DEBIT

1 20— 1

2 June 18 Gem Central D109 6/16 1/10, n/30 4,602.00 60.00 4,542.00 2

3 30 Todd Company 1002 6/29 2/10, n/30 1,770.00 1,770.00 3

4 30 6,372.00 60.00 6,312.00 4

5 5

Debits Credits

$ 60.00 $6,372.00

6,312.00 —

$6,372.00 $6,372.00

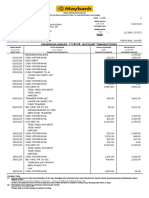

CASH RECEIPTS JOURNAL

OTHER ACCOUNTS SALES TAX CREDIT CARD

ACCOUNT POST. ACCOUNTS RECEIVABLE SALES PAYABLE EXPENSE CASH

DATE CREDITED REF. CREDIT CREDIT CREDIT CREDIT DEBIT DEBIT

1 20— 1

2 June 17 Sales 2,271.00 183.95 98.20 2,356.75 2

3 30 2,271.00 183.95 98.20 2,356.75 3

4 4

Debits Credits

$ 98.20 $2,271.00

2,356.75 183.95

$2,454.95 $2,454.95

Copyright © Houghton Mifflin Company. All rights reserved. 2

CASH PAYMENTS JOURNAL

OTHER ACCOUNTS PURCHASES

CK. POST. ACCOUNTS PAYABLE DISCOUNTS CASH

DATE NO. ACCOUNT DEBITED REF. DEBIT DEBIT CREDIT CREDIT

1 20— 1

2 June 22 5901 Gem Central 4,073.00 40.13 4,032.87 2

3 29 5902 Rent Expense 1,980.00 1,980.00 3

4 30 5903 Freight In 110.00 110.00 4

5 30 5904 Sales Returns and Allowances 239.00 5

6 Sales Tax Payable 19.36 258.36 6

7 30 2,348.36 4,073.00 40.13 6,381.23 7

8 8

Debits Credits

$2,348.36 $ 40.13

4,073.00 6,381.23

$6,421.36 $6,421.36

GENERAL JOURNAL

POST.

DATE DESCRIPTION REF. DEBIT CREDIT

1 20— 1

2 June 19 Accounts Payable, Gem Central 529.00 2

3 Purchases Returns and Allowances 529.00 3

4 Credit memo no. 926. 4

5 5

6 24 Supplies 459.00 6

7 Accounts Payable, The Box Company 459.00 7

8 Packing supplies, invoice no. 990, 8

9 dated June 22, net 30 days. 9

10 10

11 11

12 12

13 13

14 14

Copyright © Houghton Mifflin Company. All rights reserved. 3

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Services Quality Analysis in SBI BankDocumento110 pagineServices Quality Analysis in SBI Bankvinodksrini007100% (4)

- Delayed: Intermediaries, They CollecDocumento16 pagineDelayed: Intermediaries, They CollecNadeesha UdayanganiNessuna valutazione finora

- Aswath Damodaran - Investment PhilosophyDocumento4 pagineAswath Damodaran - Investment Philosophyprasaddhake14910% (1)

- Varanasi DCCB Par 31.03.2023Documento28 pagineVaranasi DCCB Par 31.03.2023Anuj Kumar SinghNessuna valutazione finora

- Tutorial 5Documento1 paginaTutorial 5easoncho29Nessuna valutazione finora

- Solution To Ch02 P14 Build A ModelDocumento4 pagineSolution To Ch02 P14 Build A Modeljcurt8283% (6)

- Risk Management Solution Chapters Seven-EightDocumento9 pagineRisk Management Solution Chapters Seven-EightBombitaNessuna valutazione finora

- Cash Flow StatementDocumento19 pagineCash Flow Statementasherjoe67% (3)

- Assignment QuestionDocumento3 pagineAssignment QuestionMohd Tajudin DiniNessuna valutazione finora

- Maintaining Price Stability Ensuring Adequate Flow of Credit To The Productive Sectors of The Economy To Support Economic Growth Financial StabilityDocumento54 pagineMaintaining Price Stability Ensuring Adequate Flow of Credit To The Productive Sectors of The Economy To Support Economic Growth Financial Stabilityfrancis reddyNessuna valutazione finora

- FI - Reading 44 - Fundamentals of Credit AnalysisDocumento42 pagineFI - Reading 44 - Fundamentals of Credit Analysisshaili shahNessuna valutazione finora

- Finance Lecture 2: TVM: Time LineDocumento5 pagineFinance Lecture 2: TVM: Time LinedfsdfsdfdsNessuna valutazione finora

- Statement Ending 11/30/2022: Summary of AccountsDocumento4 pagineStatement Ending 11/30/2022: Summary of AccountsGrégoire TSHIBUYI KATINANessuna valutazione finora

- Vietnam Investment HandbookDocumento34 pagineVietnam Investment HandbookThi Phuong Thoa LaNessuna valutazione finora

- Example of Muet WritingDocumento6 pagineExample of Muet WritingZulhelmie ZakiNessuna valutazione finora

- 112380-237973 20190331 PDFDocumento5 pagine112380-237973 20190331 PDFKutty KausyNessuna valutazione finora

- Capital Allocation Between The Risky and The Risk-Free AssetDocumento14 pagineCapital Allocation Between The Risky and The Risk-Free AssetSekhar SharmaNessuna valutazione finora

- 03 - Literature Review PDFDocumento12 pagine03 - Literature Review PDFPreet kaurNessuna valutazione finora

- In Class Problem Solving - 3 - With AnswersDocumento13 pagineIn Class Problem Solving - 3 - With AnswersAmeya Talanki100% (1)

- Mohamed Ismail Mohamed Riyath - An Overview of Asset Pricing Models (2005, GRIN Verlag)Documento39 pagineMohamed Ismail Mohamed Riyath - An Overview of Asset Pricing Models (2005, GRIN Verlag)EVERYTHING FOOTBALLNessuna valutazione finora

- British Council Online Refund Form.Documento1 paginaBritish Council Online Refund Form.Irene PinedaNessuna valutazione finora

- The Balance Sheet Items For CIBDocumento1 paginaThe Balance Sheet Items For CIBKhalid Al SanabaniNessuna valutazione finora

- Moving To Portugal, Buy Property, Portugal, d7 Visa, RelocatingDocumento1 paginaMoving To Portugal, Buy Property, Portugal, d7 Visa, RelocatingAshraful IslamNessuna valutazione finora

- MEcon - Presentation - MihailDocumento13 pagineMEcon - Presentation - MihailMisho IlievNessuna valutazione finora

- 15 International FinanceDocumento16 pagine15 International FinanceRishabh SehrawatNessuna valutazione finora

- Q2 1 BM CommissionDocumento34 pagineQ2 1 BM CommissionAbbygail MatrizNessuna valutazione finora

- Chapter 1 (Structure of Malaysian Financial System)Documento13 pagineChapter 1 (Structure of Malaysian Financial System)niena ZLNessuna valutazione finora

- Assignment Chapter 6Documento15 pagineAssignment Chapter 6Nicolas ErnestoNessuna valutazione finora

- No Dues Certificate - 19 - 47 - 18Documento2 pagineNo Dues Certificate - 19 - 47 - 18chenchu kuppaswamyNessuna valutazione finora

- IAS 40 Investment Property PresentationDocumento29 pagineIAS 40 Investment Property PresentationNollecy Takudzwa BereNessuna valutazione finora