Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Present Scenario

Caricato da

rgkusumba0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

10 visualizzazioni3 paginegg

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentogg

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

10 visualizzazioni3 paginePresent Scenario

Caricato da

rgkusumbagg

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

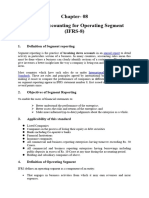

The Present scenario

Mutual Fund industry in India is in a very nascent stage.

Still growing, still evolving. There have been various

initiatives on various fronts and now the industry has

reached close to Rs 8 lakh crore. But if compared with the

size of mutual fund industries of most developed countries

such as China and Australia, we are much smaller in size.

When the Prime Minister took over the Finance Ministry

from Pranab Mukherjee on his election as the President of

the country, one of the first points the PM raised was that

the mutual fund industry needs to be re-energised. Before

this there had been various discussions which culminated

into a circular issued by the Securities and Exchange

Board of India on September 13, 2012.

The most important aspect of this circular is the

introduction of a new cadre of distributors and also the

rule on Top-15 and Beyond Top-15 cities. Thus the thrust

would be towards penetration of mutual fund products into

smaller towns. To support this initiative, AMFI quickly

took a decision to reduce the registration fees for

individuals from Rs 5,000 to Rs 3,000 from November

2012.

Remember, the fee of Rs 3000 is for three years, which

amounts to only Rs 1,000 a year. For the new cadre of

distributors introduced, the fee prescribed is Rs 1,500 for

three years. Here the fee is only Rs 500 per year. During

the quarter Oct-Dec 2012, we saw more than 700 new

registrations.

To give further impetus to the whole exercise, AMFI

decided to provide a window during which we would

waive off the fees completely making the registration free

of cost. This would mean that any individuals either in the

normal cadre or the new cadre can register themselves as a

distributor for the first time free of cost during five months

from February 1, 2013 to June 30, 2013. All required

formalities for registration, like passing the required

certification, etc, need to be completed for registration.

Under the new cadre, the following two categories have

also being included:

1) Intermediaries/Agents engaged in distribution of

financial products e.g. Insurance agent, FD agent,

National Savings Scheme products, PPF, etc

registered with any other Financial Services

Regulator.

2) Business correspondents

The new cadre that has been announced is a very

interesting move. This cadre is allowed to sell only

performing Diversified Equity Funds, Fixed Maturity

Plans and Index Funds. These category funds come with

low risk. Therefore, for the new cadre, who will undergo a

very simple examination specially devised by NISM. With

only simple products available for this cadre, they would

be able to reach out to more people to sell these less risky

products.

At present, we have close to 50,000 distributors registered

with AMFI. With this move, we expect that about one

lakh more distributors may be added to the fold. With such

large force, the industry would then be in a position to

grow, expand and penetrate into smaller towns. We also

expect that the smaller towns will contribute more in the

new cadre of distributors.

The market sentiments have improved. In a long-term

perspective, there is no doubt about growth of Indian

economy. In such a scenario, an important initiative that

will do well for the development of the industry will be

penetration by more feet on Street. With the introduction

of the new type and the announcement of free registration

will support in achieving this objective of more feet on

street to sell mutual fund.

I.J.E.M.S., VOL.4(2)2013:223-226 ISSN 2229-600X

225

Major Changes and Future Expectations

There have been some major changes by SEBI for the

mutual fund industry in the recent past. Entry load

abolished in May 2009. Introduction of Direct schemes

apart from the ongoing schemes in which less expense

ratio will be charged for the former one resulting in better

returns for the direct investors. Whole of the India is being

divided into top 15 cities and beyond 15 cities in term of

Asset under management, in which higher brokerages will

be paid to the distributors of beyond 15 cities and lesser

for top 15 so as to lure retail participation and promote

mutual fund in remote areas. Stricter KYC norms for

investors so as to check money laundering and black

money. Proposed demarcation between advisor and agent

in which advisor will be charging fees directly from

investors and agent will get commission from the AMC.

In this regard, a single person cant be both advisor and an

agent.

The subprime crisis of USA shattered the stock markets

across the globe. Indian stock market also succumbed to

the pressure and sensex which was trading above 21000 in

January 2008 came down to 8000 taking away wealth of

thousand of investors. Mutual fund industry also faced the

same fate and crores of rupees of investor lost in that

period. FII inflows which are the backbone of Indian

market came down. In fact it became negative in the years

2008 and 2009.

Exit of bigger and established fund houses like Fidelity

and Standard Chartered also invoked the wave of

pessimism in the market. Ongoing European Debt Crisis

made people guessing about the future which is affecting

the overall sentiments. Policy paralyses of the government

and slow pace of cut in government spending send a very

negative signal to international community to take

exposure of Indian Market. Now in this scenario the future

of the industry seems to be very bleak and overall scenario

is very negative. There is a strong possibility that we may

witness the increased mortality of mutual fund players

including intermediaries. To contain the existing problems

and disastrous future certain measures are required to be

taken. One of the most important role that is being

required to be played is by the financial planners who

have been in the backseat for a very long time. Financial

planners who are not full fledged agents of mutual fund

but poised to play a very important role in the industry in

future. It will take some time to when the Certified

Financial Planners will emerge as a front runner but the

level of awareness and support from the regulator is

lacking.

Mutual fund Returns and AUM Growth

The growth of the mutual fund industry was because of

the performance and their superiority over other

instruments. The equity funds have played a very

important role in the growth of this industry . Although

the present assets under management of these funds are

very less than 2 lakh crore, it can be improved by giving

better returns. The funds that can stood the test of times

i.e., bull markets, bear markets, bubbles, recessions, global

upheavals, and local turmoil and continue to perform and

produce results. To identify such funds, there has to be

certain criteria like longevity, performance, resilience,

stability and their fund managers. Below is the

performance of some top funds

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Sample DocumentDocumento61 pagineSample DocumentrgkusumbaNessuna valutazione finora

- Mba Project For FinalisationDocumento75 pagineMba Project For FinalisationrgkusumbaNessuna valutazione finora

- Iot Based Surveillance Robot IJERTV7IS030061Documento5 pagineIot Based Surveillance Robot IJERTV7IS030061rgkusumbaNessuna valutazione finora

- Ch-09 Findings, Suggestions & Conclusion GayathriDocumento4 pagineCh-09 Findings, Suggestions & Conclusion Gayathrirgkusumba0% (1)

- Project Report On: "Mutual Funds & Its Impact On Investors"Documento6 pagineProject Report On: "Mutual Funds & Its Impact On Investors"rgkusumbaNessuna valutazione finora

- Understanding Mutual Fund: Chapter-1Documento26 pagineUnderstanding Mutual Fund: Chapter-1rgkusumbaNessuna valutazione finora

- MF Company Wise InformationDocumento36 pagineMF Company Wise InformationrgkusumbaNessuna valutazione finora

- Study Material & Question BankDocumento2 pagineStudy Material & Question BankrgkusumbaNessuna valutazione finora

- Mutual Funds: Chapter-1 Literature OverviewDocumento13 pagineMutual Funds: Chapter-1 Literature OverviewrgkusumbaNessuna valutazione finora

- CH 6Documento6 pagineCH 6rgkusumbaNessuna valutazione finora

- ch-3 Analysis of MFDocumento18 paginech-3 Analysis of MFrgkusumbaNessuna valutazione finora

- Growth and Performance of Indian Mutual Fund Industry During Past DecadesDocumento8 pagineGrowth and Performance of Indian Mutual Fund Industry During Past DecadesrgkusumbaNessuna valutazione finora

- 11 Chapter 3Documento57 pagine11 Chapter 3rgkusumbaNessuna valutazione finora

- Mba Project For FinalisationDocumento71 pagineMba Project For FinalisationrgkusumbaNessuna valutazione finora

- 3 Program CodeDocumento15 pagine3 Program Codergkusumba100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Taking Stock - Adding Sustainability Variables To Asian Sectoral Analysis (February 2006)Documento288 pagineTaking Stock - Adding Sustainability Variables To Asian Sectoral Analysis (February 2006)IFC SustainabilityNessuna valutazione finora

- 177.higher ClinicDocumento18 pagine177.higher Clinicabel_kayelNessuna valutazione finora

- IFM - Problem On BopDocumento6 pagineIFM - Problem On BopSatya KumarNessuna valutazione finora

- NDICs Deposit Insurance Scheme in Nigeria - Problems Prospects PDFDocumento17 pagineNDICs Deposit Insurance Scheme in Nigeria - Problems Prospects PDFDaniel AdegboyeNessuna valutazione finora

- 1.1 Assignment Personal Net Worth & Accounting EquationDocumento2 pagine1.1 Assignment Personal Net Worth & Accounting EquationOrkun OzkanNessuna valutazione finora

- Autocallable Contingent Income Barrier Notes: HSBC Usa Inc. $2,920,000Documento19 pagineAutocallable Contingent Income Barrier Notes: HSBC Usa Inc. $2,920,000caslusNessuna valutazione finora

- Comparative Analysis of HDFCDocumento18 pagineComparative Analysis of HDFCgagandeepsingh86Nessuna valutazione finora

- CV Format For A BankerDocumento2 pagineCV Format For A BankerNurun Nobi100% (1)

- Capital Budgeting and Risk AnalysisDocumento7 pagineCapital Budgeting and Risk Analysisapi-3734401Nessuna valutazione finora

- A2 Sitxfin003 JassiDocumento43 pagineA2 Sitxfin003 Jassitisha naharNessuna valutazione finora

- JPMDocumento13 pagineJPMJason Jeongmin SeoNessuna valutazione finora

- CFA Level 1, June, 2016 - Study PlanDocumento3 pagineCFA Level 1, June, 2016 - Study PlanWilliam KentNessuna valutazione finora

- Finanace Assignment 1Documento13 pagineFinanace Assignment 1waelNessuna valutazione finora

- Harmonic Trading - AflDocumento3 pagineHarmonic Trading - Aflpg_hardikarNessuna valutazione finora

- Proforma Invoice: Jiangsu Longest Technology Co., LTDDocumento1 paginaProforma Invoice: Jiangsu Longest Technology Co., LTDJuanita Correal FloresNessuna valutazione finora

- Chapter-08-Ideas On Operating SegmentsDocumento12 pagineChapter-08-Ideas On Operating Segmentsmdrifathossain835Nessuna valutazione finora

- Chap29 PremiumDocumento34 pagineChap29 PremiumNGOC HOANG BICHNessuna valutazione finora

- Final Excel Sheet - HulDocumento34 pagineFinal Excel Sheet - HulSakshi Jain Jaipuria JaipurNessuna valutazione finora

- Example Proforma and Short NotesDocumento2 pagineExample Proforma and Short NotesMaisarah MazlanNessuna valutazione finora

- Liu JunDocumento45 pagineLiu JunjjruttiNessuna valutazione finora

- China Strategy 2011Documento178 pagineChina Strategy 2011Anees AisyahNessuna valutazione finora

- Wahlen Int3e EX03-11Documento3 pagineWahlen Int3e EX03-11林義哲Nessuna valutazione finora

- Templeton Global Bond Fund: Key Investor InformationDocumento2 pagineTempleton Global Bond Fund: Key Investor Informationspsc059891Nessuna valutazione finora

- Schroders Natural Capital Insights - Reconfiguring Supply To Unlock DemandDocumento11 pagineSchroders Natural Capital Insights - Reconfiguring Supply To Unlock DemandEric SchwabNessuna valutazione finora

- CHAPTER 7 - MATHEMATICS of FINANCE, Seventh Edition by Robert L. Brown, Steve Kopp and Petr Zima (Z-Lib - Org) - 261-289Documento29 pagineCHAPTER 7 - MATHEMATICS of FINANCE, Seventh Edition by Robert L. Brown, Steve Kopp and Petr Zima (Z-Lib - Org) - 261-289Tisha YatolNessuna valutazione finora

- Credit RiskDocumento15 pagineCredit RiskjoshdreamzNessuna valutazione finora

- SMU MBA 4th Sem Information Systems Management AssignmentsDocumento3 pagineSMU MBA 4th Sem Information Systems Management AssignmentsPooja Upreti PandeyNessuna valutazione finora

- Principles of Investments 1st Edition Bodie Solutions ManualDocumento35 paginePrinciples of Investments 1st Edition Bodie Solutions Manualdesight.xantho1q28100% (27)

- Case 8. The Company Provided The Following InformationDocumento2 pagineCase 8. The Company Provided The Following InformationVannesaNessuna valutazione finora

- International Finance 5Documento25 pagineInternational Finance 5Rahul BambhaNessuna valutazione finora