Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Villareal V Ramirez

Caricato da

StefanRodriguezTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Villareal V Ramirez

Caricato da

StefanRodriguezCopyright:

Formati disponibili

VILLAREAL v RAMIREZ

July 14 2003 | Panganiban, J. | Petition for Review on Certiorari | Settling of Accounts & Liquidation

PETITIONER: Luzviminda Villareal, Diogenes Villareal, Carmelito Jose

RESPONDENT: Donaldo Efren Ramirez & Spouses Cesar and Carmelita Ramirez

SUMMARY: The partnership involved in this case is Aquarius Food House & Catering Services. The partners at the

time of dissolution were 2 of the petitioners and respondent Donaldo. After dissolution, Donaldo requested the return of

his P250k capital contribution, but this was unheeded by the other partners because of alleged business losses. Donaldo

& his parents filed a complaint for collection of sum of money against the other individual partners. RTC found for

petitioners. CA, however, computed respondents share (Capital Contribution Outstanding Obligation) / 3) & adjudged

this as the petitioners liability. SC set aside the CAs decision.

DOCTRINE:.Total capital contribution is not the same w/ gross assets. The capital contribution at the beginning of the

partnership does not remain intact, unimpaired and available for distribution or return to the partners. In the pursuit of a

partnership business, its capital is either increased by profits earned or decreased by losses sustained.

FACTS: of the partnership accounts for liquidation purposes

1. July 1984: Luzviminda Villareal, Carmelito Jose, and & no sufficient evidence was presented to show

Jesus Jose formed a partnership for the operation of a financial losses, the CA computed liability by

restaurant and catering business under the name of deducting P240, 658 (representing the partnerships

Aquarius Food House and Catering Services. The outstanding obligations) from P1 Million

partnership had P750K capital. In September, (partnerships remaining capitalization), which

Respondent Donaldo Ramirez joined as a partner. His yielded P759, 342. The said amount was divided into

P250k capital contribution came from his parents, 3 shares. Each partner was entitled to P253, 114 each.

also respondents. 7. Petitioners question (1) why the CA ordered the

2. In Jan 1987, Jesus Jose withdrew from the distribution of the capital contribution, instead of the

partnership and his P250k capital contribution was net capital after the dissolution and liquidation of a

refunded to him in cash by agreement of the partners. partnership and (2) that the amount of P253, 114 they

In the same month, without the respondents prior were ordered to pay was not supported by evidence.

knowledge, petitioners closed down the restaurant

because of an alleged rental increase. The restaurant ISSUE/S:

furniture and equipment were deposited in the 1. WON Petitioners (individual partners) are liable to

respondents house for storage. respondents for latters share in the partnership NO.

3. On March 1 1987, respondent spouses wrote 2. WON CAs computation of P253, 114 as

petitioners, saying they were no longer interested in respondents share is correct NO.

continuing their partnership or in reopening the

restaurant, and that they were accepting the latter's RULING: Petition GRANTED. Decision & Resolution

offer to return their capital contribution. By October, SET ASIDE, w/o prejudice to proper proceedings for

Carmelita Ramirez informed petitioners of the accounting, liquidation, and distribution of remaining

deterioration of the restaurant furniture and partnership assets, if any.

equipment stored in their house & reiterated the

request for the return of their 1/3 share in the equity RATIO:

of the partnership. The repeated oral and written 1. Dissolution of the partnership took place when

requests were, however, left unheeded. respondents informed petitioners of the intention to

4. Respondents filed for the collection of a sum of discontinue it b/c of the formers dissatisfaction &

money against petitioners in the RTC. Petitioners loss of trust in the latters management of the

contended that respondents had called for dissolution partnership affairs.

of the partnership, respondents were paid upon the 2. Respondents have no right to demand from

turnover to them of P400,000 worth of furniture and petitioners the return of their equity share. Except as

equipment, and that respondents had no right to managers of the partnership, petitioners did not

demand a return of their equity because their share, personally hold its equity or assets. The partnership

together with the rest of the partnership capital, has has a juridical personality separate and distinct from

been spent because of irreversible losses. that of each of the partners. Since the capital was

5. RTC: Partnership was clearly intended to be contributed to the partnership, not to petitioners, it is

dissolved upon closing of the restaurant. Respondents the partnership that must refund the equity of the

liable for actual damages to petitioners. retiring partners.

6. CA: Although respondents had no right to demand 3. Since it is the partnership, as a separate and distinct

the return of their capital contribution, partnership entity, that must refund the shares of the partners, the

was nonetheless dissolved when petitioners lsot amount to be refunded is necessarily limited to its

interest in continuing the restaurant business. total resources. In other words, it can only pay out

Because petitioners never gave a proper accounting what it has in its coffers, which consists of all its

assets. However, before the partners can be paid their 5. Petitioners argue that respondents acted negligently

shares, the creditors of the partnership must first be by permitting the partnership assets in their custody

compensated. After all the creditors have been paid, to deteriorate to the point of being almost worthless.

whatever is left of the partnership assets becomes & that the latter should have liquidated these sole

available for the payment of the partners' shares. tangible assets of the partnership and considered the

As applied, the exact amount of refund proceeds as payment of their net capital. They claim

equivalent to respondents' 1/3 share in the partnership that the turnover of the remaining partnership assets

cannot be determined until all partnership assets have to respondents was precisely the manner of

been liquidated in other words, sold and converted liquidating the partnership and fully settling the

to cash and all partnership creditors, if any, paid. latter's share in the partnership. But the delivery of

CA's computation of the amount to be refunded to the store furniture and equipment to private

respondents was erroneous for the ff. reasons: respondents was clearly for the purpose of storage.

They were unaware that the restaurant would no

(1) Total capital contribution =/= Gross Assets longer be reopened by petitioners. Hence, the former

cannot be faulted for not disposing of the stored items

CA erroneously equated total capital contribution w/ the to recover their capital investment.

gross assets to be distributed to the partners at the time of

the dissolution of the partnership. However, the capital

contribution at the beginning of the partnership does not

remain intact, unimpaired and available for distribution or

return to the partners. In the pursuit of a partnership

business, its capital is either increased by profits earned or

decreased by losses sustained.

Here, the financial statements showed that

business had meager profits. Notably, there was no

provision for depreciation of the furniture & equipment,

nor was the amortization of good will (initially valued at

P500k reflected. Properly taking these non-cash items

into account will show that the partnership was actually

sustaining substantial losses, decreasing the capital of the

partnership. TC & CA, while recognizing the decrease of

the partnership assets to almost nil, failed to recognize the

consequent corresponding decrease of the capital.

(2) CA's finding that the partnership had an P240,

658 outstanding obligation is not supported by

evidence. The RTC found that the P240, 658

obligation did not belong to the partnership. A

Certification issued by Mercator Finance shows

that it was the Spouses Villareal (petitioners)

who obtained a P355k loan on Oct. 1983, when

the original partnership was not yet formed.

(3) CA failed to reduce the capitalization by P250k,

which the partnership paid Jesus Jose when he

withdrew from the partnership

4. Because of the above-mentioned transactions, the

partnership capital substantially dwindled. The

original amount of P250,000 which they had invested

could no longer be returned to them, because 1/3 of

the partnership properties at the time of dissolution

did not amount to that much. The law does not

relieve parties from the effects of unwise, foolish or

disastrous contracts they have entered into with all

the required formalities and with full awareness of

what they were doing.

Potrebbero piacerti anche

- Digest - Villareal vs. RamirezDocumento1 paginaDigest - Villareal vs. RamirezPaul Vincent Cunanan100% (1)

- Eufracio D. Rojas V. Constancio B. Maglana, G.R. No. 30616, December 10, 1990, J. PARASDocumento3 pagineEufracio D. Rojas V. Constancio B. Maglana, G.R. No. 30616, December 10, 1990, J. PARASJon HilarioNessuna valutazione finora

- Aurbach Vs Sanitary Wares DigestDocumento3 pagineAurbach Vs Sanitary Wares DigestMarry Lasheras100% (3)

- Soriamont Steamship Agencies Inc. (Puertos)Documento2 pagineSoriamont Steamship Agencies Inc. (Puertos)Tim PuertosNessuna valutazione finora

- 24 Martinez V Ong Pong CoDocumento1 pagina24 Martinez V Ong Pong CoRaven Claire MalacaNessuna valutazione finora

- 06 Arbes Vs PolisticoDocumento2 pagine06 Arbes Vs PolisticoMark Anthony Javellana SicadNessuna valutazione finora

- La Compania Maritima V Francsico MunozDocumento3 pagineLa Compania Maritima V Francsico MunozJennyNessuna valutazione finora

- Digest Primelink vs. MagatDocumento2 pagineDigest Primelink vs. MagatXing Keet Lu100% (4)

- Sunga Vs ChuaDocumento2 pagineSunga Vs ChuaOke Haruno100% (1)

- Martinez v. Ong Pong CoDocumento1 paginaMartinez v. Ong Pong CoSamantha Nicole100% (1)

- Idos V CADocumento2 pagineIdos V CARussell Marquez Manglicmot100% (2)

- 48 Soncuya Vs de LunaDocumento1 pagina48 Soncuya Vs de LunaNichole LanuzaNessuna valutazione finora

- Evangelista v. Abad Santos - DigestDocumento4 pagineEvangelista v. Abad Santos - DigestJaysieMicabaloNessuna valutazione finora

- 92 Angeles v. Secretary of JusticeDocumento2 pagine92 Angeles v. Secretary of JusticeIldefonso Hernaez100% (1)

- Lim Tanhu V RamoleteDocumento3 pagineLim Tanhu V Ramoleteannlorenzo100% (1)

- Digest For Fernandez Vs Dela RosaDocumento2 pagineDigest For Fernandez Vs Dela RosaJenifer PaglinawanNessuna valutazione finora

- Teague vs. Martin, 53 Phil. 504Documento1 paginaTeague vs. Martin, 53 Phil. 504Ella Tho100% (1)

- Villareal VS RamirezDocumento6 pagineVillareal VS RamirezJane BandojaNessuna valutazione finora

- Emnace v. CA - DigestDocumento2 pagineEmnace v. CA - Digestkathrynmaydeveza100% (4)

- Partnership-CIR Vs Suter Case DigestDocumento2 paginePartnership-CIR Vs Suter Case DigestDesiree Jane Espa Tubaon100% (1)

- Kiel vs. Estate of SabertDocumento1 paginaKiel vs. Estate of SabertMis DeeNessuna valutazione finora

- Mod1 - 7 - GR No. 127405 - Tacao vs. CA.Documento3 pagineMod1 - 7 - GR No. 127405 - Tacao vs. CA.Ojie SantillanNessuna valutazione finora

- Fernandez vs. Dela RosaDocumento2 pagineFernandez vs. Dela RosaCeCe Em50% (4)

- Primelink Properties & Devt. Corp. vs. Lazatin-MagatDocumento2 paginePrimelink Properties & Devt. Corp. vs. Lazatin-MagatAlexandrea Sagutin100% (1)

- Primelink Properties and Devt Corp VDocumento3 paginePrimelink Properties and Devt Corp VCamille BritanicoNessuna valutazione finora

- Del Rosario V. Abad 104 PHIL 648 (1958) FactsDocumento2 pagineDel Rosario V. Abad 104 PHIL 648 (1958) FactsVian O.Nessuna valutazione finora

- Partnership DigestsDocumento3 paginePartnership DigestsManuel Villanueva100% (1)

- Mendoza V PauleDocumento3 pagineMendoza V PauleJeahMaureenDominguezNessuna valutazione finora

- 139 Bonnevie v. HernandezDocumento3 pagine139 Bonnevie v. HernandezKevin Hernandez100% (1)

- Lichauco V LichaucoDocumento2 pagineLichauco V LichaucoNerissa BalboaNessuna valutazione finora

- George Litton V Hill and Ceron, G.R. No. L45624, April 25, 1939-DigestedDocumento1 paginaGeorge Litton V Hill and Ceron, G.R. No. L45624, April 25, 1939-DigestedRaymer OclaritNessuna valutazione finora

- Magdusa Vs AlbaranDocumento1 paginaMagdusa Vs Albaranzombie214Nessuna valutazione finora

- Fue Leung V IACDocumento2 pagineFue Leung V IACd2015memberNessuna valutazione finora

- Lichauco V LichaucoDocumento4 pagineLichauco V LichaucoJennyNessuna valutazione finora

- Goquiolay v. Sycip GR No. L-11840 July 26, 1960 FactsDocumento2 pagineGoquiolay v. Sycip GR No. L-11840 July 26, 1960 FactsJoesil Dianne SempronNessuna valutazione finora

- Digest of Yu v. NLRC (G.R. No. 97212)Documento2 pagineDigest of Yu v. NLRC (G.R. No. 97212)Rafael Pangilinan100% (5)

- Topic Digested By: Title of The Case: 3B 2019-2020: Stratplan For PrelimsDocumento1 paginaTopic Digested By: Title of The Case: 3B 2019-2020: Stratplan For PrelimsKennedy GaculaNessuna valutazione finora

- Case Digest Hrs of Tan Eng Kee Vs CADocumento3 pagineCase Digest Hrs of Tan Eng Kee Vs CAHannahboi G Descky100% (2)

- 1788 - Uy vs. Puzon, 79 SCRA 598 - DIGESTDocumento2 pagine1788 - Uy vs. Puzon, 79 SCRA 598 - DIGESTI took her to my penthouse and i freaked it100% (1)

- Philex Mining Corp Vs CIRDocumento2 paginePhilex Mining Corp Vs CIRWilliam Christian Dela Cruz100% (2)

- CATALAN Vs Gatchalian-DigestDocumento1 paginaCATALAN Vs Gatchalian-Digestfred_barillo09100% (1)

- Catalan vs. Gatchalian 105 Phil. 1270Documento2 pagineCatalan vs. Gatchalian 105 Phil. 1270jhammy100% (1)

- Partnership Cases DigestedDocumento6 paginePartnership Cases DigestedgretchengeraldeNessuna valutazione finora

- Cir Vs SuterDocumento2 pagineCir Vs Suter001nooneNessuna valutazione finora

- 42 Ramnani Vs CADocumento2 pagine42 Ramnani Vs CANichole LanuzaNessuna valutazione finora

- Dan Fue Leung v. IACDocumento3 pagineDan Fue Leung v. IACMarichu Castillo HernandezNessuna valutazione finora

- PNB v. LoDocumento2 paginePNB v. LoHana Chrisna C. RugaNessuna valutazione finora

- CIR Vs Juan Isasi Et AlDocumento2 pagineCIR Vs Juan Isasi Et AlBernard StevensNessuna valutazione finora

- Partnership (Case Digests)Documento17 paginePartnership (Case Digests)Lou Ann AncaoNessuna valutazione finora

- Goquiolay v. SycipDocumento6 pagineGoquiolay v. Sycipkim_santos_20Nessuna valutazione finora

- Ramnani Vs Court of AppealsDocumento2 pagineRamnani Vs Court of AppealsCarlo Talatala50% (2)

- Island Sales Vs United Pioneers 65 SCRA 554Documento2 pagineIsland Sales Vs United Pioneers 65 SCRA 554Sam Fajardo100% (3)

- Digest - Wolfgang Aurbach Vs Sanitary WaresDocumento1 paginaDigest - Wolfgang Aurbach Vs Sanitary WaresremraseNessuna valutazione finora

- Title G.R. NO. G.R. No. 135813 Date of Promulgation Ponente FactsDocumento3 pagineTitle G.R. NO. G.R. No. 135813 Date of Promulgation Ponente FactsRhett Vincent De La rosaNessuna valutazione finora

- Villareal vs. RamirezDocumento2 pagineVillareal vs. RamirezmaggiNessuna valutazione finora

- Villareal v. RamirezDocumento8 pagineVillareal v. RamirezJoseph Raymund BautistaNessuna valutazione finora

- Partnership - Villareal - v. - Ramirez20210424-14-11rqc2bDocumento11 paginePartnership - Villareal - v. - Ramirez20210424-14-11rqc2bMiltoniusKNessuna valutazione finora

- G.R. No. 144214 - Villareal v. RamirezDocumento5 pagineG.R. No. 144214 - Villareal v. RamirezKimmy May Codilla-AmadNessuna valutazione finora

- Case 1Documento3 pagineCase 1CleinJonTiuNessuna valutazione finora

- Villareal v. RamirezDocumento2 pagineVillareal v. Ramirezd2015memberNessuna valutazione finora

- 03 Traders Royal Bank v. CADocumento1 pagina03 Traders Royal Bank v. CAStefanRodriguezNessuna valutazione finora

- 04 PNB V RodriguezDocumento2 pagine04 PNB V RodriguezStefanRodriguezNessuna valutazione finora

- 04 PNB V RodriguezDocumento2 pagine04 PNB V RodriguezStefanRodriguezNessuna valutazione finora

- Pacheco vs. CADocumento2 paginePacheco vs. CAStefanRodriguezNessuna valutazione finora

- Pacheco vs. CADocumento2 paginePacheco vs. CAStefanRodriguezNessuna valutazione finora

- 03 Traders Royal Bank v. CADocumento1 pagina03 Traders Royal Bank v. CAStefanRodriguezNessuna valutazione finora

- 02 Virata v. NG WeeDocumento2 pagine02 Virata v. NG WeeStefanRodriguez100% (2)

- 02 Virata v. NG WeeDocumento2 pagine02 Virata v. NG WeeStefanRodriguez100% (2)

- Yu V NLRCDocumento2 pagineYu V NLRCStefanRodriguezNessuna valutazione finora

- 62 Gonzales Vs PCIBDocumento2 pagine62 Gonzales Vs PCIBStefanRodriguezNessuna valutazione finora

- 01 Rivera vs. ChuaDocumento1 pagina01 Rivera vs. ChuaStefanRodriguez100% (1)

- Rojas V. Maglana: ND ST NDDocumento3 pagineRojas V. Maglana: ND ST NDStefanRodriguezNessuna valutazione finora

- Canon 1Documento8 pagineCanon 1StefanRodriguezNessuna valutazione finora

- Us Vs Ah Chong DigestDocumento2 pagineUs Vs Ah Chong DigestStefanRodriguezNessuna valutazione finora

- Lantoria v. BunyiDocumento2 pagineLantoria v. BunyiStefanRodriguez100% (3)

- Ong v. BognalbalDocumento2 pagineOng v. BognalbalStefanRodriguez100% (3)

- Fujiki vs. MarinayDocumento3 pagineFujiki vs. MarinayStefanRodriguezNessuna valutazione finora

- CIR vs. TMX Sales Inc.Documento1 paginaCIR vs. TMX Sales Inc.StefanRodriguezNessuna valutazione finora

- Birth of The MestizoDocumento5 pagineBirth of The MestizoStefanRodriguezNessuna valutazione finora

- Birth of The MestizoDocumento5 pagineBirth of The MestizoStefanRodriguezNessuna valutazione finora

- 32 - Salonga vs. Cruz-Pano DIGESTDocumento2 pagine32 - Salonga vs. Cruz-Pano DIGESTStefanRodriguez67% (3)

- Non vs. Judge DamesDocumento2 pagineNon vs. Judge DamesStefanRodriguezNessuna valutazione finora

- Numerical Simulation of Turbulent Flow Over Surface Mounted Obstacles With Sharp Edges and CornersDocumento19 pagineNumerical Simulation of Turbulent Flow Over Surface Mounted Obstacles With Sharp Edges and CornersHelen ChoiNessuna valutazione finora

- Labor Case Digest MidtermsDocumento219 pagineLabor Case Digest MidtermsMvapsNessuna valutazione finora

- Primal Grow Pro Supplement Review - Does It Work or Scam?Documento3 paginePrimal Grow Pro Supplement Review - Does It Work or Scam?Rakib0% (1)

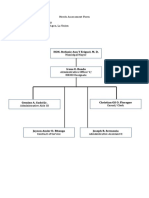

- Needs Assessment Form Company Name: HRMO Address: Sta. Barbara Agoo, La UnionDocumento2 pagineNeeds Assessment Form Company Name: HRMO Address: Sta. Barbara Agoo, La UnionAlvin LaroyaNessuna valutazione finora

- Programa de Formacion: English Dot Works 2Documento4 paginePrograma de Formacion: English Dot Works 2Juan GuerreroNessuna valutazione finora

- Analog and Digital Electronics (Ade) Lab Manual by Prof. Kavya M. P. (SGBIT, BELAGAVI)Documento74 pagineAnalog and Digital Electronics (Ade) Lab Manual by Prof. Kavya M. P. (SGBIT, BELAGAVI)Veena B Mindolli71% (7)

- Cover LetterDocumento16 pagineCover LetterAjmal RafiqueNessuna valutazione finora

- Smart Phone Usage Among College Going StudentsDocumento9 pagineSmart Phone Usage Among College Going StudentsAkxzNessuna valutazione finora

- OCES 1001 - Final Exam Instructions (Please Read BEFORE The Exam)Documento16 pagineOCES 1001 - Final Exam Instructions (Please Read BEFORE The Exam)Heihei ChengNessuna valutazione finora

- DocumentDocumento2 pagineDocumentAddieNessuna valutazione finora

- A Review of The Accounting CycleDocumento46 pagineA Review of The Accounting CycleRNessuna valutazione finora

- 03 Pezeshki-Ivari2018 Article ApplicationsOfBIMABriefReviewADocumento40 pagine03 Pezeshki-Ivari2018 Article ApplicationsOfBIMABriefReviewAdanes1800Nessuna valutazione finora

- 2 - Water Requirements of CropsDocumento43 pagine2 - Water Requirements of CropsHussein Alkafaji100% (4)

- Industrial Training HandbookDocumento26 pagineIndustrial Training HandbookChung tong Betty wongNessuna valutazione finora

- Perez V Monetary BoardDocumento4 paginePerez V Monetary BoardlawNessuna valutazione finora

- Efqm Success-Story-Book LRDocumento34 pagineEfqm Success-Story-Book LRabdelmutalabNessuna valutazione finora

- Qualifications and Disqualifications of CandidatesDocumento3 pagineQualifications and Disqualifications of CandidatesCARLO JOSE BACTOLNessuna valutazione finora

- Case 2:09-cv-02445-WBS-AC Document 625-1 Filed 01/21/15 Page 1 of 144Documento144 pagineCase 2:09-cv-02445-WBS-AC Document 625-1 Filed 01/21/15 Page 1 of 144California Judicial Branch News Service - Investigative Reporting Source Material & Story Ideas100% (2)

- Sharp AR-C172M ServiceM EN PDFDocumento308 pagineSharp AR-C172M ServiceM EN PDFpiaggio_nrgNessuna valutazione finora

- Philippine Metal Foundries v. CADocumento2 paginePhilippine Metal Foundries v. CAMarcus AureliusNessuna valutazione finora

- Intructional Tools With The Integration of TechnologyDocumento44 pagineIntructional Tools With The Integration of TechnologyAlwyn SacandalNessuna valutazione finora

- Sop ECUDocumento5 pagineSop ECUSumaira CheemaNessuna valutazione finora

- Final - Far Capital - Infopack Diana V3 PDFDocumento79 pagineFinal - Far Capital - Infopack Diana V3 PDFjoekaledaNessuna valutazione finora

- PR Status ReportDocumento28 paginePR Status ReportMascheny ZaNessuna valutazione finora

- Business PlanDocumento20 pagineBusiness PlanRona BautistaNessuna valutazione finora

- MCQ Criminal Law 1Documento18 pagineMCQ Criminal Law 1Clark Vincent Ponla0% (1)

- CHAPTER ONE Structural GeologyDocumento46 pagineCHAPTER ONE Structural GeologyAfolabi Eniola AbiolaNessuna valutazione finora

- CN842 HBDocumento15 pagineCN842 HBElif SarıoğluNessuna valutazione finora

- National Population PolicyDocumento12 pagineNational Population Policymuthukumar100% (3)

- Photoshop TheoryDocumento10 paginePhotoshop TheoryShri BhagwanNessuna valutazione finora