Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Small Business Resource

Caricato da

jazzybuttonsDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Small Business Resource

Caricato da

jazzybuttonsCopyright:

Formati disponibili

BUSINESS

SmALL

WESTERN

PENNSYLVANIA

RESOURCE

Helping

Small Business

Start, Grow

and Succeed

PAGE

9 Getting Started in Western Pennylvania

PAGE

22 Getting Approved

PAGE

34 Government Contracting

WWW.SBA.GOV • YOU R SMALL B USI N ESS R ESOU RCE

contents

SMALL BUSINESS R ENI

Publishing 150 Third Street, S.W.

Winter Haven, FL 33880-2907

Publishers of Small Business Resource

Advertising

Phone: 863-294-2812 • 800-274-2812

Fax: 863-299-3909 • www.sbaguides.com

Staff

2010 PITTSBURGH President/CEO

Joe Jensen jjensen@reni.net

FEATURES English Small Business Resource Advertising

Nicky Harvey nharvey@reni.net

4 Introduction 39 Disaster Recovery

Martha Theriault

John Beward

mtheriault@reni.net

jbeward@reni.net

• 4 Administrator’s Letter There are several types of

assistance available to

• 6 Director’s Message

qualified applicants.

9 Getting Started 40 Advocacy

SBA’s Marketing Office:

The Small Business Resource Guide is published

Find out about the outside under the direction of SBA’s Office of Marketing and

Everything you need to know

Customer Service.

about setting up, marketing research for the small business

owners. Director

and managing the revenue of

Laura Fox laura.fox@sba.gov

your business.

42 Other Sources of Editorial Content

Robert Dillier robert.dillier@sba.gov

Assistance

17 Regulations Chambers of Commerce can be

Graphic Design

Gary

Common requirements that a vital resource for the small Shellehamer gary.shellehamer@sba.gov

business owner.

affect small businesses. SBA’s participation in this publication is not an

endorsement of the views, opinions, products or

45 Lender Listing services of the contractor or any advertiser or other

22 Getting Approved participant appearing herein. All SBA programs and

services are extended to the public on a

Financing Options nondiscriminatory basis.

to Start or Grow Your Business. Printed in the United States of America

While every reasonable effort has been made to

ensure that the information contained herein was

34 Contracting Opportunities accurate as of the date of publication, the information

is subject to change without notice. Neither the

SBA is working to ensure small contractor, the federal government, or agents thereof

businesses obtain fair share of shall be held liable for any damages arising from the

government contracts and use of or reliance on the information contained in this

publication.

subcontracts with a number

of programs.

“Everything you need to know SBA Publication # MCS-0018

This publication is provided under SBA Contract

about setting up, marketing # SBAHQ05C0014.

and managing the revenue of

your business. ”

2 — Small Business Resource PITTSBURGH Visit us online: www.sba.gov/pa/pitt

The U.S. Small Business Administration

FROM THE ADMINISTRATOR

ur job at the SBA is to This year, we’re building on this progress with a

O

support small businesses.

In this guide, you’ll find

out about everything you need to

special effort to increase America’s small business

exports. We’re looking to increase the number of

small business exporters as well as expand their reach

start and grow your business. If into more international markets. We’re working with

you’re thinking about exporting, our partners across the federal government to identify

we can offer you a loan. If you’re and prepare small businesses who want to export,

thinking about becoming a while promoting tools such as SBA’s Export Working

government contractor, we can Capital Program loans, which you can read about in

help you get that first contract. If you’re thinking this guide.

about writing a business plan, we have counselors

standing by. If you have any questions, contact your local SBA field

office or one of our resource partners. We’re here to

From the stores on Main Street that we visit every day help, because we know that America’s small

to the high-growth, high-impact firms that drive businesses will lead us toward economic recovery, as

innovation and global competitiveness, small they’ve done time and time again throughout our

businesses everywhere are thriving and creating jobs nation’s history.

by working with the SBA.

With warm regards,

The Recovery Act continues to play an important role

in helping small businesses drive our recovery. In its Karen G. Mills

first year, Recovery Act programs helped the SBA Administrator

provide more than 50,000 loans that put $21.9 billion Small Business Administration

into the hands of entrepreneurs and small business

owners. Our borrowers reported that these loans

helped them save and create hundreds of thousands

of jobs. And, across the country, we continue to get

Recovery Act resources into the hands of small

businesses so they can drive local economic growth

and create jobs.

About the SBA

www.sba.gov

Your Small Business Resource

Every day, the U.S. Small Business Administration and its nationwide • Growing a Business

network of partners help millions of potential and current small • Opportunities in Contracting

business owners start, grow and succeed. • Recovering From Disaster

• A Voice for Small Business in Government

Resources and programs targeting small businesses provide an

advantage necessary to help small businesses effectively compete in Visit SBA online at www.sba.gov for 24/7 access to small business

the marketplace and strengthen the overall U.S. economy news, information and training for entrepreneurs.

SBA offers help in the following areas: All SBA programs and services are provided on a nondiscriminatory

• Starting a Business basis.

• Financing a Business

4 — Small Business Resource PITTSBURGH Visit us online: www.sba.gov/pa/pitt

Message From The District Director

PITTSBURGH

SBA Staff Listing

Rules For Success

www.sba.gov/pa/pitt Utilize the SBA and its multitude of resources to keep

your business on track and growing.

412-395-6560

District Director Deputy District Director

Carl B. Knoblock Barbara A. Fisher

“Ability is what you are capable of doing. 4. Common Sense – One of your most

Ext. 106 Ext. 119

carl.knoblock@sba.gov barbara.fisher@sba.gov Motivation determines what you do. Attitude important assets.

determines how well you do it,” Lou Holtz – 5. Problem Solver – Outside the Box

thinking.

Business Development District Director retired college football coach. This is so true

Assistant Freedom of Information when we deal with small businesses. The Small

This resource guide offers an easy-to-read

Karan L. Waigand Act Coordinator Business Administration (SBA) is focused on

Ext. 107 Carl B. Knoblock format on finding resources to meet and help

offering the three C’s: Capital, Contracting and

karan.waigand@sba.gov Ext. 106 you face the daily challenges of running or

Counseling.

carl.knoblock@sba.gov starting a small business. Our office works in

Business Development conjunction with our resource partners to

Specialist Administrative Division The resources that are available to small

consolidate this information into this

International Trade Karan L. Waigand businesses are bountiful and plenty. The

publication. SBA would like to thank all of

Officer Ext. 107 problem is helping small businesses find those

those that assisted in making this publication

Stephen R. Drozda karan.waigand@sba.gov resources to help them face these challenging

Ext. 114 available to small businesses.

economic times. In the Western Pennsylvania

stephen.drozda@sba.gov Program Support

District area, we have 27 counties with

Assistant The resource guide provides information on

Business Development Karen. M. Leezer approximately 275,000 small businesses. The

SBA programs in the following areas: financing,

Specialist Ext. 101 small businesses in rural and urban areas have

government contracting, exporting, advocacy,

Judith Kirby karen.leezer@sba.gov unique challenges, but the resources are

disaster assistance, and technical assistance.

Ext. 123 available to all of them.

judith.kirby@sba.gov Information Technology Small businesses have some very unique

Specialist opportunities in government contracting and

Women have an excellent support partner, the

Business Development Marianne B. Fischer international trade.

Specialist Ext. 126

Women Business Center (WBC). The veterans

Marisa L. Fentzel marianne.fischer@sba.gov have a very good partner the Veteran Business

Small businesses starting or growing to the next

Ext. 109 Outreach Center (VBOC). In addition, the

level please use the resource guide to help you.

marisa.fentzel@sba.gov SCORE-Pittsburgh State of Pennsylvania economic development

I invite you to call our office at 412-395-6560 for

Chapter- Counselors to organizations, Small Business Development

Business Development America’s Small Business assistance. In addition, please visit the following

Centers (SBDC), SCORE, Procurement

Specialist Ext. 130 websites: www.sba.gov or www.business.gov.

Technical Assistant Centers (PTAC), USDA

Public Information

Rural Development, US Commercial Service,

Officer Small businesses must stay ahead. Will Rogers

Janet M. Heyl Main Street programs, and Certified

stated it best, “Even if you’re on the right track,

Ext. 103 Development Companies (CDC) are the tip of

you’ll get run over if you just sit there.” “During

janet.heyl@sba.gov the iceberg for offering assistance. They can

these times it is imperative to keep moving.

help you become stronger in your weakest place.

Please remember SBA is here to help you stay in

front.”

Five basic things to think about whether starting

a business, surviving, or growing your business:

All the best,

1. Persistence – Biggest obstacle is your

mindset.

2. Website/Social Networking (Facebook,

Linked In, etc.) – Marketing yourself at a Carl B. Knoblock

low cost way.

3. International – If #2 is done, you are District Director of

global. SBA's Pittsburgh District Office

6 — Small Business Resource PITTSBURGH Visit us online: www.sba.gov/pa/pitt

The SBA helps business

Doing Business in Western Pennsylvania

owners grow and expand

their businesses every day.

on starting, better operating or expanding

a small business through the Counselors

to America’s Small Business (SCORE),

Small Business Development Centers

(SBDC) and Women's Business Centers

(WBC). They also conduct training events

throughout the district - some require a

nominal registration fee.

Assistance to businesses owned and

controlled by socially and economically

disadvantaged individuals is provided

through the Business Development

Program.

A Women's Business Ownership

Representative is available to assist

women business owners. Please contact

Barbara Fisher at 412-395-6560 ext. 119 or

e-mail: barbara.fisher@sba.gov.

THE PITTSBURGH DISTRICT OFFICE CONTACTING THE PITTSBURGH

The Pittsburgh District Office is DISTRICT OFFICE Special loan programs are available for

responsible for the delivery of SBA's many For program, service or finance businesses involved in international trade.

programs and services in Western information, please dial 412-395-6560.

Pennsylvania under the leadership of A Veterans Affairs Officer is available to

District Director Carl B. Knoblock. The assist veterans. Please contact Carl

SERVICES AVAILABLE Knoblock at 412-395-6560 ext. 106 or

District Office is located at 411 Seventh

Financial assistance for new or existing e-mail: carl.knowlock@sba.gov.

Avenue, Suite 1450, Pittsburgh, PA. Office

businesses through guaranteed loans

hours are from 8:00 AM until 4:30 PM,

made by area bank and non-bank lenders.

Monday through Friday.

Free counseling advice and information

SUcceSS STORY money.

spent his summers in both high school and

college laying roofing; siding and drywall to earn

Before starting his own company, Morosky

We Welcome Your

Shaka, Inc. put his degree in health and physical education

Questions

General Contractor from Slippery Rock University to work at Penn

Hills High School, his alma mater. But while For extra copies of this publication or

Morosky loved teaching, the work wasn’t steady. questions please contact:

JC Kono Morosky “They weren’t hiring at the time so I was picking

President up work as a substitute teacher or a one-year Pittsburgh District Office

contract,” he explained. “When I got married in

411 Seventh Avenue, Suite 1450

When J.C. Kono Morosky of Jeannette strolls 1980, I needed steady employment, so I began

past the David L. Lawrence Convention Center the process to become a state trooper.” Pittsburgh, PA 15219

in downtown Pittsburgh, he often stops to Morosky graduated from the state police

admire his handiwork. Morosky’s general academy in 1983 and enjoyed a 21-year-career Tel.: 412-395-6560 Fax: 412-395-6562

construction firm, Shaka, Inc., helped to furnish that saw him on the road, serving as a minority TDD: 412-395-6563

and install sidewalks; roadways and retaining recruiter, negotiating hostage situations, being a

walls, as well as the building’s centerpiece – the member of scuba team, instructing physical

Website: www.sba.gov/pa/pitt

water feature that flows outdoors between two education at the academy and, finally, as a patrol

roadways. supervisor.

Morosky isn’t alone in appreciating the Five years into his career as a state trooper, an

center’s unique water element. Convention opportunity led Morosky to turn his hands-on

attendees often stop to gaze at the waterfall construction experience into a part-time venture.

nestled among the concrete. “I had heard there might be an opportunity for

“It’s really neat to see your work, to say ‘This work with the Pittsburgh Parking Authority,”

is ours, we built this,’” Morosky said. “That’s the Morosky said. “So, I joined the carpenters’ union,

good thing about construction...it’s a physical laborers’ union and the cement finishers’ union

object that you can see and show your kids.” to work in the city of Pittsburgh.”

For most of his life, the 57-year-old Morosky His moniker for the company was Shaka, Inc.

has been able to admire his work from afar. He “Shaka means to ‘hang loose’ in Hawaiian and

continued on page 26

Visit us online: www.sba.gov/pa/pitt PITTSBURGH Small Business Resource — 7

INTRODUCTION

GettinG Started

The SBA Can Help You Start And Expand Your Business

information about SCORE, SBDCs, WBCs

and VBOCs is detailed at:

www.sba.gov/services.

These professionals can also help with

writing a formal business plan, locating

sources of financial assistance, managing

and expanding your business, finding

opportunities to sell your goods or services

to the government, and recovering from

disaster.

Sba’S reSource partnerS

Score

SCORE, “Counselors to Americas Small

Businesses” is composed of 10,500-active

and retired volunteer business

professionals. With more than 40 years

very day, the U.S. Small • More than 23 free online courses and experience helping small businesses

E Business Administration and its workshops available succeed, SCORE matches volunteer

nationwide network of resource • Online, interactive assessment tools are business counselors with clients in need of

featured and used to direct clients to expert advice. SCORE has advisers with

partners help millions of appropriate training. expertise in nearly every area of business

potential and current small Course topics include a financial primer and maintains a national skills roster to

business owners start, grow and succeed. keyed around SBA’s loan-guaranty help identify the best counselor for a

Whether your target market is global or programs, a course on exporting, and particular client. Volunteer counselors,

just your neighborhood, the SBA and its courses for veterans and women’s whose collective experience spans the full

resource partners can help at every stage of contracting as well as an online library of range of American enterprise, share their

turning your entrepreneurial dream into a business publications and articles. management and technical expertise with

thriving business. Find the SBTN at: www.sba.gov/training. both current and prospective small

If you’re just starting, the SBA and its

business owners.

resources can help you with loans and Where To Go To Get Started Volunteers work in or near their home

business management skills. If you’re Our resources include the SBA’s district communities providing management

already in business, you can use the SBA’s offices serving every state and territory, mentoring and training to first-time

resources to help manage and expand your nearly 400 chapters of SCORE – Counselors entrepreneurs and current small business

business, obtain government contracts, to America’s Small Businesses, owners. They meet with clients at a SCORE

recover from disaster, find foreign markets, approximately 900 Small Business community location, such as at a Chamber

and make your voice heard in the federal Development Centers, approximately 110 of Commerce, bank, an SBA office or at the

government. Women’s Business Centers and eight client's place of business.

You can access SBA help online 24 hours Veterans Business Outreach Centers Every effort is made to match a client's

a day at www.sba.gov or visit one of our located across the country. More needs with an adviser experienced in a

local offices for assistance. comparable line of business. All individual

SBA’s Online Training

SBA’s Small Business Training Network • You get to be your own boss.

is an Internet-based training site. It • Hard work and long hours directly benefit you, rather

provides small businesses with free online ON THE UPSIDE than increasing profits for someone else.

courses, workshops, learning tools and

It’s true, there are a lot of reasons • A new venture is exciting.

business-readiness assessments.

Key Features of the SBTN: not to start your own business. But • Earnings and growth potential are unlimited.

• Training is available anytime and for the right person, the advantages

anywhere—all you need is a computer of business ownership far outweigh • Running a business will provide endless

with Internet access. the risks. variety, challenge and opportunities to learn.

Visit us online: www.sba.gov/pa/pitt PITTSBURGH Small Business Resource — 9

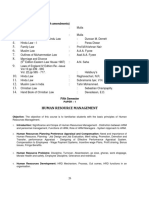

1. Clarion University SBDC

3 2. Duquesne University SBDC

Erie 12 3. Gannon University SBDC

14 Warren McKean 4. Indiana University of PA SBDC

Crawford

5. Penn State University SBDC

6. Saint Francis University SBDC

Forest

Venango

Elk Cameron 7. Saint Vincent College SBDC

1 8. University of Pittsburgh SBDC

Mercer

Clarion

9. Altoona-Blair County SCORE Chapter

Jefferson

10. Central Pennsylvania SCORE Chapter

Lawrence Clearfield

Centre

11. Clearfield SCORE Location

Butler

11

Armstrong 5 10 12. Erie SCORE Chapter

Beaver 13. Huntingdon SCORE Location

2 8

Indiana 6 14. Meadville Area SCORE Branch Office

4 Cambria 9

Allegheny 7 Huntingdon

15. Pittsburgh SCORE Chapter

Blair

15 17 18 16. Uniontown SCORE Chapter

13

Westmoreland 17. Westmoreland County SCORE Chapter

Washington 18. Seton Hill University’s E-Magnify® Women’s

16 Bedford Business Center

Fayette Somerset

Greene

and team counseling is free; there may be a Alleghenies SCORE Chapter 575 Pittsburgh SCORE Chapter 7

nominal fee for workshops and seminars. Devorris Center for Business Development 411 Seventh Ave., Ste. 1450

Through in-depth mentoring and 3900 Industrial Park Dr., Ste. 6 Pittsburgh, PA 15219

training, SCORE volunteers help Altoona, PA 16602 412-395-6560 ext.130 • 412-395-6562 Fax

prospective and established small business 814-942-9054 • 814-569-1146 Fax www.scorepittsburgh.com

www.alleghenies.scorechapter.org

owners and managers identify problems, Uniontown SCORE Chapter 472

determine the causes and find solutions. Central Pennsylvania SCORE Chapter 618 140 N. Beeson Ave.

Any small business can obtain help from Industry and Technology Center Uniontown, PA 15401

SCORE. Whether you are considering 2820 E. College Ave., Ste. E 724-437-4222 • 724-437-5922 Fax

starting your own business, have a State College, PA 16801 www.fayettecountypa.org/score

business that is experiencing problems, are 814-234-9415 • 814-234-9415 Fax

ready to expand, or need some other type www.scorecpa.org Westmoreland County SCORE

of advice, SCORE can help. The approach is Chapter 555

confidential and personal. You don't need Clearfield SCORE Location Saint Vincent College, Aurelius Hall

650 Leonard St. 300 Fraser Purchase Rd.

to be applying for or have an SBA loan to

Clearfield, PA 16830 Latrobe, PA 15650

participate in the program. In fact, an idea 814-765-8987 724-539-7505 • 724-539-1850 Fax

is all that is necessary; consultation and www.scorecpa.org www.westmorelandscore.org

mentoring before a business opens its doors

is an important part of SCORE's service. Erie SCORE Chapter 193 SCORE Can Troubleshoot

SCORE can also be found on the Internet 120 W. Ninth St.

Erie, PA 16501 Your Business

at: www.score.org.

814-871-5650 • 814-871-7530 Fax Small businesses may not be aware that

Business owners use the Web to fulfill

www.scoreerie.org SCORE representatives are available to

their needs for information and advice.

counsel entrepreneurs who may be

SCORE is primed to meet requests for help

Huntingdon SCORE Location exploring the possibility of expanding their

by offering e-mail counseling, maps to local c/o Greater Huntingdon existing operations or may be experiencing

SCORE chapters, hotlinks to other business Chamber of Commerce some problems which are affecting the cash

resources on the Internet and more. E-mail Hunt Tower, 500 Allegheny St. flow of the business. If you would like to

counseling is provided by the Cyber- Huntingdon, PA 16652 discuss your concerns confidentially with a

chapter, which now includes more than 814-643-3126

www.scorecpa.org

SCORE counselor, please feel free to contact

1,200 online members. You can choose from

one of the SCORE Chapters in Western

almost 800 unique skills to find the cyber

Meadville SCORE Branch Pennsylvania.

counselor who best suits your specific

needs, including counseling for veterans, 628 Arch St./P.O. Box A201

Meadville, PA 16335

service-disabled veterans and Reserve 814-337-5194

component members. SCORE also offers

more than 30 online training workshops on

topics for small businesses.

10 — Small Business Resource PITTSBURGH Visit us online: www.sba.gov/pa/pitt

Small buSineSS development Gannon University SBDC

120 W. Ninth St.

Saint Francis University SBDC

117 Evergreen Dr.

centerS Erie, PA 16501 Loretto, PA 15940

Small Business Development Centers Debra Steiner, Director Ed Huttenhower, Director

meet the needs of small businesses and 814-871-7232 • 814-871-7383 Fax 814-472-3200 • 814-472-3202 Fax

steiner001@gannon.edu ehuttenhower@francis.edu

promote economic development in local

www.sbdcgannon.org www.francis.edu/sbdc/

communities by helping to create and Counties: Erie, Crawford, Mercer and Counties: Cambria, Blair, Somerset, Bedford,

retain jobs. Partially funded by a Warren. Huntingdon and Fulton.

cooperative agreement with SBA, SBDCs

are focused on providing long-term Indiana University of Pennsylvania SBDC Saint Vincent College SBDC

counseling to clients to help them grow 108 Eberly College of Business 300 Fraser Purchase Rd., Aurelius Hall

successful businesses. The SBDC network Indiana, PA 15705 Latrobe, PA 15650

provides counseling and training to more Tony Palamone, Director James Kunkel, Director

than 550,000 existing or start-up businesses 724-357-7915 • 724-357-5985 Fax 724-537-4572 • 724-537-0919 Fax

annually. iup-sbdc@iup.edu jkunkel@stvincent.edu

SBDCs assist with development of www.iup.edu/business/sbdc www.stvincent.edu/sbdc

Counties: Indiana Counties: Westmoreland and Fayette.

business plans, provide manufacturing,

financial packaging, surety bonds, Penn State University SBDC University of Pittsburgh SBDC

contracting and international trade The Pennsylvania State University Wesley W. Posvar Hall, Ste. 1800

assistance. Special emphasis areas include The 329 Bldg., Ste. 417 230 S. Bouquet St.

e-commerce, technology transfer, IRS, EPA University Park, PA 16802 Pittsburgh, PA 15260

and OSHA regulatory compliance, research Heather Fennessey, Director Ray Vargo, Director

and development, Defense Economic 814-863-4293 • 814-865-6667 Fax 412-648-1542 • 412-648-1636 Fax

Transition Assistance, export assistance, heatherf@psu.edu rvargo@katz.pitt.edu

disaster recovery assistance and market www.sbdc.psu.edu www.entrepreneur.pitt.edu/sbdc/

research. SBDCs also provide special Counties: Centre and Mifflin Counties: Allegheny, Greene and

Washington.

assistance to veterans and help with energy

efficiency under new program initiatives.

Based on client needs, SBDCs tailor their

services to meet the evolving needs of the

local small business community.

SBDCs deliver management and

technical assistance to prospective and

existing small businesses using an effective

business education network of 948 service-

center locations contracted to manage a

broad-based SBDC program. SBDCs are

located throughout the U.S., District of

Columbia, Guam, American Samoa, Puerto

Rico and the U.S. Virgin Islands.

For more information, visit the Web site

at: www.sba.gov/aboutsba/sbaprograms/

sbdc/index.html.

WESTERN PA SBDC CENTERS ARE

LISTED BELOW:

Clarion University SBDC

330 North Point Dr., Ste. 100

Clarion, PA 16214

Dr. Woodrow Yeaney, Director

814-393-2060 • 814-393-2636 Fax

wyeaney@clarion.edu

www.clarion.edu/sbdc/

Counties: McKean, Cameron, Elk, Forest,

Clarion, Armstrong, Indiana, Jefferson,

Clearfield, Venango and Potter.

Duquesne University SBDC

108 Rockwell Hall, 600 Forbes Ave.

Pittsburgh, PA 15282

Dr. Mary McKinney, Director

412-396-6233 • 412-396-5884 Fax

mckinney@duq.edu

www.duq.edu/sbdc

Counties: Allegheny, Beaver, Butler and

Lawrence.

Visit us online: www.sba.gov/pa/pitt PITTSBURGH Small Business Resource — 11

Women’S buSineSS centerS Some business owners burn out quickly

The SBA’s Women Business Center

Program is a network of 110 community-

WEBSITE from having to carry all the responsibility

for the success of their business on their

based centers which provide business Business plan help own shoulders. Strong motivation will

help you survive slowdowns and periods

training, counseling, mentoring and other of burnout.

assistance geared toward women, Find your nearest SCORE chapter at:

www.score.org. • How will the business affect your

particularly those who are socially and family? The first few years of business

economically disadvantaged. Partially For business plan help at the SCORE Web

site, click on “Business Tools” from the left-hand start-up can be hard on family life. It's

funded through a cooperative agreement important for family members to know

with the SBA, WBCs are located in nearly menu, then click on “Template Gallery.”

what to expect and for you to be able to

every state and U.S. territory. trust that they will support you during

To meet the needs of women You can find the nearest VBOC at:

www.sba.gov/vets. this time. There also may be financial

entrepreneurs, the WBCs offer services at

difficulties until the business becomes

convenient times and locations, including

To find WBCs, click on: www.sba.gov/services/ profitable, which could take months or

weekends. Some offer child care during

and choose “Women’s Business Centers” from the years. You may have to adjust to a lower

training and many provide assistance and

“Counseling and Assistance” heading at the standard of living or put family assets at

materials in different languages, depending

bottom. risk in the short-term.

on the needs of the individual communities

Once you’ve answered those questions,

they serve. WBC services create local

You can also find business-plan help on the SBA’s you should consider what type of business

economic growth and vitality; in fiscal

Web site at: you want to start. Businesses can include

2009, the WBC Program counseled and

http://www.sba.gov/smallbusinessplanner/ franchises, at-home businesses, Web-based

trained more than 155,000 clients.

then choose “Writing a Business Plan” from the businesses or brick-and-mortar stores.

WBC training courses are often free or

“Plan Your Business” menu along the bottom.

are offered at a small fee with scholarships

often available to those who need them. A FrancHiSinG

number of WBCs also provide courses and business - but you can improve your There are more than 3,000 business

counseling via the Internet, mobile chances of success with good planning, franchises. The challenge is to decide on

classrooms and satellite locations. preparation, and insight. Start by

one that both interests you and is a good

To find the nearest SBA WBC or to learn evaluating your strengths and weaknesses

as a potential owner and manager of a investment. Many franchising experts

more about SBA programs and services, suggest that you comparison shop by

visit the SBA’s Web site small business. Carefully consider each of

the following questions: looking at multiple franchise opportunities

http://www.sba.gov/idc/groups/public/docum before deciding on the one that's right for

• Are you a self-starter? It will be entirely

ents/sba_program_office/sba_ro_do_wbc.pdf you.

up to you to develop projects, organize

your time, and follow through on details. Some of the things you should look at

WESTERN PA WOMEN’S BUSINESS when evaluating a franchise: profitability,

CENTER: • How well do you get along with

different personalities? Business effective financial management and other

Seton Hill University E-Magnify owners need to develop working controls, a good image, integrity and

One Seton Hill Dr. relationships with a variety of people commitment, and a successful industry.

Greensburg, PA 15601-1599 including customers, vendors, staff, In the simplest form of franchising, while

Jayne H. Huston, Director bankers, and professionals such as you own the business, its operation is

724-830-4625 • 724-834-7131 Fax governed by the terms of the franchise

lawyers, accountants, or consultants. Can

info@e-magnify.com agreement. For many, this is the chief

www.e-magnify.com you deal with a demanding client, an

Counties: 27 Western PA counties unreliable vendor, or a cranky benefit for franchising. You are able to

receptionist if your business interests capitalize on a business format, trade name,

are You riGHt For Small demand it?

• How good are you at making

trademark and/or support system

provided by the franchisor. But you operate

buSineSS oWnerSHip? decisions? Small business owners are as an independent contractor with the

Most new business owners who succeed required to make decisions constantly - ability to make a profit or sustain a loss

have planned for every phase of their often quickly, independently, and under commensurate with your ownership.

success. Thomas Edison, the great pressure. If you are concerned about the risk

American inventor, once said, “Genius is 1 • Do you have the physical and involved in a new, independent business

percent inspiration and 99 percent emotional stamina to run a business? venture, then franchising may be an option

perspiration.” That same philosophy also Business ownership can be exciting, but for you. Remember that hard work,

applies to starting a business. it's also a lot of work. Can you face six or dedication and sacrifice are key elements in

First, you’ll need to generate a little bit of seven 12–hour workdays every week? the success of any business venture,

perspiration deciding whether you’re the • How well do you plan and organize? including a franchise.

right type of person to start your own Research indicates that poor planning is For more information visit the SBA Web

business. site at: http://www.sba.gov/smallbusiness

responsible for most business failures.

Good organization — of financials, planner/start/ and click on “Buy a

iS entrepreneurSHip For You? inventory, schedules, and production — Franchise” from the menu on the right side

In business, there are no guarantees. can help you avoid many pitfalls. or call your local SBA office.

There is simply no way to eliminate all the • Is your drive strong enough? Running a

risks associated with starting a small business can wear you down emotionally.

12 — Small Business Resource PITTSBURGH Visit us online: www.sba.gov/pa/pitt

Home-baSed buSineSSeS • Can I switch from home responsibilities

to business work?

Some general areas include:

• Zoning regulations. If your business

Going to work used to mean traveling • Do I have the self-discipline to maintain operates in violation of them, you could

from home to a plant, store or office. Today, be fined or shut down.

schedules?

many people do some or all their work at • Product restrictions. Certain products

• Can I deal with the isolation of working

home. cannot be produced in the home. Most

Garages, basements and attics are being from home?

states outlaw home production of

transformed into the corporate • Am I a self-starter? fireworks, drugs, poisons, explosives,

headquarters of the newest entrepreneurs – sanitary or medical products and toys.

home-based business owners. Finding Your Niche Some states also prohibit home-based

Choosing a home business must be businesses from making food, drink or

Getting Started approached carefully. clothing.

Before diving headfirst into a home- Be sure to consult an attorney and your

based business, you must know why you Ask yourself: local and state departments of state, labor

are doing it. To succeed, your business • Does my home have the space for a and health to find out which laws and

must be based on something greater than a business? regulations will affect your business.

• Can I identify and describe the business I Additionally, check on registration and

desire to be your own boss. You must plan

want to establish? accounting requirements needed to open

and make improvements and adjustments

• Can I identify my business product or

along the road. service?

your home-based business. You may need

Working under the same roof where • Is there a demand for that product or a work certificate or license from the state.

your family lives may not prove to be as service? Your business name may need to be

easy as it seems. It’s important to work in a • Can I successfully run the business from registered with the state. A separate

professional environment. One suggestion home? business telephone and bank account are

is to set up a separate office in your home to good business practices.

create this professional environment. Legal Requirements Also remember, if you have employees

Ask yourself these questions – and A home-based business is subject to you are responsible for withholding

remember, there are no best or right reasons many of the same laws and regulations income and social-security taxes, and for

for starting a home-based business. But it is affecting other businesses. complying with minimum wage and

important to understand what the venture employee health and safety laws.

involves:

Visit us online: www.sba.gov/pa/pitt PITTSBURGH Small Business Resource — 13

If you’re convinced that opening a Operations languages. They provide training in

home-based business is for you, it’s time to • Explain how the business will be finance, management, marketing, and the

create your business plan. The SBA and its managed day-to-day. Internet, as well as access to all of the SBA’s

resource partners, such as SCORE, SBDCs • Discuss hiring and personnel procedures. financial and procurement assistance

and WBCs can help make the process • Discuss insurance, lease or rent programs.

agreements, and issues pertinent to your SBA also reaches out to women

easier.

business. entrepreneurs through women’s business

• Account for the equipment necessary to ownership representatives in every SBA

WritinG a buSineSS plan produce your goods or services. district office who coordinate services,

After you’ve thought about what type of • Account for production and delivery of provide access to business training and

products and services. counseling, to credit and capital, and

business you want, the next step is to

develop a business plan. Think of the marketing opportunities, including federal

business plan as a roadmap with

Concluding Statement contracts.

Summarize your business goals and

milestones for the business. It begins as a

pre-assessment tool to determine

objectives and express your commitment

to the success of your business. Once you veteranS and reServiStS

profitability and market share, then

expands as an in-business assessment tool

have completed your business plan, buSineSS development

review it with a friend or business The SBA offers a variety of services to

to determine success, obtain financing and associate and professional business

determine repayment ability, among other American veterans who have made or are

counselor like SCORE or SBDC

factors. representatives, SBA district office seeking to make the transition from service

Creating a comprehensive business plan business development specialists or member to small business owner. Each of

can be a long process, and you need good veterans business development SBA's 68 district offices has designated a

advice. The SBA and its resource partners, specialists. veterans business development officer to

including Small Business Development Remember, the business plan is a help veterans prepare, plan and succeed in

Centers, Veterans Business Outreach flexible document that should change as entrepreneurship.

Centers, SCORE and Women’s Business your business grows.

Centers, have the expertise to help you craft Veterans Business Outreach

a winning business plan. reacHinG underServed Centers

In general, a good business plan

contains:

audienceS Eight Veterans Business Outreach

Centers located in Massachusetts, New

Women business owners York, Pennsylvania, Florida, Michigan,

Introduction Women entrepreneurs are changing the Texas, Missouri and California provide

• Give a detailed description of the face of America's economy. In the 1970s, online and face to face entrepreneurial

business and its goals. women owned less than five percent of the development services for veterans and

• Discuss ownership of the business and its

nation’s businesses. Today, they are reservists such as business training,

legal structure.

majority owners of about a third of the counseling and mentoring, pre-business

• List the skills and experience you bring to

the business.

nation’s small businesses and are at least plan workshops, feasibility analysis, and

• Discuss the advantages you and your equal owners of about half of all small referrals to additional small business

business have over competitors. businesses. SBA serves women resources.

entrepreneurs nationwide through its During fiscal 2009, VBOC’s counseled or

Marketing various programs and services, some of trained 122,901 veteran entrepreneurs. To

• Discuss the products and services your which are designed especially for women.

learn more about the Veterans Business

company will offer. The SBA’s Office of Women’s Business

Outreach program or find the nearest SBA

• Identify customer demand for your Ownership serves as an advocate for

women-owned business and oversees a VBOC, visit the SBA Web site at

products and services.

nationwide network of more than a www.sba.gov/vets.

• Identify your market, its size and

locations. hundred women’s business centers that SBDCs and SCORE also provide targeted

• Explain how your products and services provide business training, counseling and management assistance to veterans who

will be advertised and marketed. mentoring geared specifically to women, are current or prospective small business

• Explain your pricing strategy. especially those who are socially and owners. SCORE also provides resources

economically disadvantaged. The program and counseling services online at:

Financial Management is a public-private partnership with locally- www.score.org.

• Develop an expected return on based nonprofits and each tailors its The SBA offers special assistance for

investment and monthly cash flow for the services to meet the needs of its community. small businesses owned by activated

first year. Women’s Business Centers serve a wide Reserve and National Guard members.

• Provide projected income statements, and diversity of geographic areas, population Any self-employed Reserve or Guard

balance sheets for a two-year period. densities, and economic environments, member with an existing SBA loan can

• Discuss your break-even point. including urban, suburban, and rural. request from their SBA lender or SBA

• Explain your personal balance sheet and Local economies vary from depressed to

method of compensation. district office, loan payment deferrals,

thriving, and range from metropolitan interest rate reductions and other relief

• Discuss who will maintain your areas to entire states. Each Women’s

accounting records and how they will be after they receive their activation orders.

Business Center tailors its services to the Additionally, the SBA offers special low-

kept.

needs of its individual community, but all

• Provide “what if” statements addressing interest-rate financing to small businesses

alternative approaches to potential

offer a variety of innovative programs,

when an owner or essential employee is

problems. often including courses in different

14 — Small Business Resource PITTSBURGH Visit us online: www.sba.gov/pa/pitt

called to active duty. The Military Reservist reduces your regulatory risks, it can help financial assistance; on-site pollution

Economic Injury Disaster Loan Program you become more efficient and reduce your prevention and energy efficiency

provides loans to eligible small businesses operating costs. The Pennsylvania Small assessments; and environmental training

to cover operating costs that cannot be met Business Development Centers (SBDCs) workshops. Work with the SBDCs to look

due to the loss of an essential employee are available to provide you with for ways to meet your environmental

called to active duty in the Reserves or confidential assistance for understanding compliance requirements and improve

National Guard. Small businesses may your environmental compliance profitability. SBDC environmental staff will

apply for MREIDLs of up to $2 million if requirements. help you look for ways to minimize waste,

they have been financially impacted by the The EMAP services include free and prevent pollution, and improve energy

loss of an essential employee. The SBA has confidential assistance with identifying and efficiency to reduce operating expenses.

created a special Web page specifically for

understanding environmental permit and The SBDCs also provide a state-wide on-

Reserve and Guard members at:

compliance requirements; liaison to line service, the Pennsylvania Material

http://www.sba.gov/aboutsba/sbaprograms/r

regulatory enforcement agencies; links to Trader, to promote the exchange of reusable

eservists/index.html.

To ensure that veterans, service-disabled additional sources of technical and materials which have traditionally been

veterans and Reserve and National Guard

member entrepreneurs receive special

consideration in all its entrepreneurial

programs and resources, the SBA has

established an Office of Veterans Business

Development. OVBD develops and

distributes informational materials for

entrepreneurship such as the Veterans

Business Resource Guide, VETGazette,

Getting Veterans Back to Work. Veterans

may access these resources and other

assistance from OVBD by visiting the Web

site at: www.sba.gov/VETS/.

For more information or special

assistance with government contracting,

including programs for veterans and

service-disabled veterans, please check the

Contracting Opportunities section of this

publication, and the Web site above.

SBA’s Patriot Express Initiative has new

and enhanced programs and services for

veterans and members of the military

community wanting to establish or expand

small businesses. See the Financing section

for more information on Patriot Express.

native american buSineSS

development

The SBA is also working to ensure that

entrepreneurship opportunities are

available for American Indians, Native

Alaskans and Native Hawaiians seeking to

create, develop and expand small

businesses. These groups have full access

to the necessary business development and

expansion tools available through the

agency’s entrepreneurial development,

lending and procurement programs. More

information is at: http://www.sba.gov/

aboutsba/sbaprograms/naa/index.html.

Compliance Assistance and

Strategic En-vironmental

Management

Don’t let government regulations

manage your business. Smart management

of your environmental concerns not only

Visit us online: www.sba.gov/pa/pitt PITTSBURGH Small Business Resource — 15

discarded. Using Material Trader, programming as a result of being

www.materialtrader.org, businesses can designated as a Women's Business Center

potentially save money on their disposal (WBC) by The U.S. Small Business

costs and find new free or inexpensive Administration (SBA). Intended for a five

sources or raw materials to reduce year project period, the center was awarded

production costs. The service is free and the maximum annual allowable grant for a

available to any business or organization. WBC. The only WBC located in Western

Additional information can be found at Pennsylvania, E-Magnify joins forces with

the Pennsylvania SBDC’s website at: the 99 other WBC's that exist nationwide to

http://pasbdc.orgor by calling Lee Ann assist women in starting, growing and

Briggs, REM at 412-396-6233. expanding their small businesses.

Drawing on E-Magnify’s experience in

Advocates of Small Businesses providing innovative programming,

There are nonprofit organizations that essential resources, and networking

were developed to represent, advocate, and opportunities to women entrepreneurs,

work on behalf of small businesses, such as: and fueled by the funding provided

National Association of Development through The U.S. Small Business

Companies. Administration, E-Magnify’s women’s

The National Association of business center programming helps E-

Development Companies (NADCO) is a Magnify reach a wider, more diverse

trade association of Certified Development population serving women located in rural

Companies (CDCs) – companies that have and remote areas of the state; economically

been certified by the Small Business and socially disadvantaged populations;

Administration to provide funding for and veterans as well as active duty military

small businesses under the SBA 504 Loan provide feedback to the SBA for its

personnel.

Program. NADCO provides legislative and programs and policies and, 3) lender

The center will continue its long-

regulatory support for the 504 program on training for SBA products. This, in turn,

standing commitment to supporting

behalf of member CDCs and other program benefits small businesses who work with

women entrepreneurs who want to start,

affiliates. nadco.org/NADCO/welcome.html these lending institutions that can take

grow, or sustain their businesses through:

advantage of the SBA’s various programs • Counseling and Training

National Association of Government to help them grow and succeed. SBA • Educational Programming and Webinars

Guaranteed Lenders, Inc. participating lenders interested in joining • Advocacy Efforts

the organization, please contact WPASGL • Networking Opportunities

The National Association of

President Rebecca MacBlane at • Mentorship Programs

Government Guaranteed Lenders, Inc. • Technical Assistance

(NAGGL) is the premier source of technical 412-471-1030 or visit the organization at:

www.wpasgl.com. The WBC program, established by

information on the SBA 7(a) loan program. Congress in 1988, is administered by the

The mission of NAGGL is to serve the SBA's Office of Women's Business

needs and represent the interests of the

SMC Business Councils

With offices in Pittsburgh and Ownership and promotes the growth of

small business lending community who women-owned businesses through

Harrisburg, SMC Business Councils is the

utilize the SBA’s and other government business training and technical assistance,

premier trade association for smaller

guaranteed loan programs. www.naggl.org and provides access to credit and capital,

businesses in Pennsylvania. Since its

founding in 1944, SMC has been furnishing federal contracts, and international trade

Western Pennsylvania Association opportunities.

member-companies with the products,

of SBA Guaranteed Lenders E-Magnify's service territory covers the

information, and services they need to

WPASGL, the Western Pennsylvania 27 counties in Western Pennsylvania served

compete in the contemporary business

Association of SBA-Guaranteed Lenders by the Pittsburgh District Office: Allegheny,

world. As a nonprofit entity, SMC is

(the Association), is an organization Armstrong, Beaver, Bedford, Blair, Butler,

organized and run by business

comprised of U.S. Small Business Cambria, Cameron, Centre, Clarion,

owner/members and employs a staff of

Administration (SBA) bank, non-bank Clearfield, Crawford, Elk, Erie, Fayette,

professionals to provide services critical to

lending institutions, and support Forest, Greene, Indiana, Jefferson,

the operation of smaller businesses.

organizations that participate and do Lawrence, McKean, Mercer, Somerset,

Thousands of companies throughout

business with the Pittsburgh District office Venango, Warren, Washington and

Pennsylvania have come together and

of the SBA in western Pennsylvania. Westmoreland.

benefited under this banner.

Member-ship is limited to individuals To learn more about the programs and

employed by participating lending

http://www.smc.org/

resources women business owners are able

institutions and individuals employed by to access through E-Magnify, please or call

E-Magnify's Women's Business

organizations who provide services to 724-830-4625.

those lending institutions. The Association

Center Program

In 2006 Seton Hill University's

provides its members numerous benefits

E-Magnify® women's business center

including: 1) providing members with

announced new and expanded

current SBA information, 2) a forum to

16 — Small Business Resource PITTSBURGH Visit us online: www.sba.gov/pa/pitt

REGULATIONS

knoWinG tHe ruleS

Paying Attention to Detail Can Save Time and Money

Sole Proprietorship

One person operating a business as an

individual is a sole proprietorship. It’s the

most common form of business

organization. Profits are taxed as income to

the owner personally. The personal tax rate

is usually lower than the corporate tax rate.

The owner has complete control of the

business, but faces unlimited liability for its

debts. There is very little government

regulation or reporting required with this

business structure.

General Partnership

A partnership exists when two or more

persons join together in the operation and

management of a business. Partnerships

are subject to relatively little regulation and

ven if your consulting service or state permits and professional licenses for are fairly easy to establish. A formal

E hand-knit sweater business is

based from your home, it will

have to comply with many of

the numerous local, state, and

federal regulations. Avoid the temptation to

ignore regulatory details. Doing so may

avert some red tape in the short term, but

businesses.

“Feature Topics” focuses on common

business concerns. It provides context to

the compliance information provided on

the site and helps business owners

understand in plain language the

regulatory requirements their businesses

partnership agreement is recommended to

address potential conflicts such as: who

will be responsible for performing each

task; what, if any, consultation is needed

between partners before major decisions,

and what happens when a partner dies.

Under a general partnership each partner is

could be an obstacle as your business face. Additional topics are added on a liable for all debts of the business. Profits

grows. Taking the time to research the regular basis in response to the most are taxed as income to the partners based

frequent searches on the site. on their ownership percentage.

applicable regulations is as important as

knowing your market. Bear in mind that

regulations vary by industry. If you're in the buSineSS orGanization Limited Partnership

food-service business, for example, you There are many forms of legal structure Like a general partnership, a limited

will have to deal with the health you may choose for your business. Each partnership is established by an agreement

department. If you use chemical solvents, legal structure offers organizational options between two or more persons. However,

you will have environmental compliances with different tax and liability issues. We there are two types of partners.

suggest you research each legal structure • A general partner has greater control in

to meet. Carefully investigate the

thoroughly and consult a tax accountant some aspects of the partnership. For

regulations that affect your industry. Being and/or attorney prior to making your example, only a general partner can

out of compliance could leave you decision. decide to dissolve the partnership.

unprotected legally, lead to expensive General partners have no limits on the

penalties and jeopardize your business.

cHooSinG Your buSineSS dividends they can receive from profit so

they incur unlimited liability.

buSineSS.Gov Structure • Limited partners can only receive a share

You may operate your business under of profits based on the proportional

Business.gov provides a one-stop shop one of many organizational structures. The amount on their investment, and liability

for federal resources from the agencies that most common organizational structures are is similarly limited in proportion to their

regulate or serve businesses. investment.

sole proprietorships, general and limited

While most businesses in the United partnerships, “C” and “S” corporations and

States are required to obtain a permit, limited liability companies. “C” Corporation

professional license, or identification Each structure offers unique tax and A “C” corporation is a legal entity created

number to operate, finding the right license liability benefits. If you’re uncertain which under state law by the filing of articles of

can be a major challenge for potential business format is right for you, you may incorporation. A corporation is a separate

business owners. Business.gov’s “Permit want to discuss options with a business entity having its own rights, privileges and

Me” feature provides a single source for counselor or attorney. liabilities, apart from those of the

obtaining information about federal and individual(s) forming the corporation. It’s

Visit us online: www.sba.gov/pa/pitt PITTSBURGH Small Business Resource — 17

the most complex form of business business is based. If you are a corporation, consider "key man" insurance. This type of

organization and is comprised of you’ll need to check with the state. policy is frequently required by banks or

shareholders, directors and officers. Since Corporation Bureau (PA) government loan programs. It also can be

the corporation is a separate legal entity in Pennsylvania Department of State used to provide continuity in operations

its own right it can own assets, borrow Commonwealth Avenue & North St.

206 N. Office Bldg. during a period of ownership transition

money and perform business functions caused by the death, incapacitation or

Harrisburg, PA 17120

without directly involving the owners. 717-787-1057 absence due to a Title 10 military activation

Corporations are subject to more www.dos.state.pa.us/corps/site/default.asp of an owner or other "key" employee.

government regulation and offer the Automobile – It is obvious that a vehicle

owners the advantage of limited liability,

but not total protection from lawsuits. buSineSS inSurance owned by your business should be insured

for both liability and replacement

Like home insurance, business insurance

purposes. What is less obvious is that you

Subchapter “S” Corporation protects the contents of your business

may need special insurance (called "non-

Subchapter “S” references a special part against fire, theft and other losses. Contact

of the Internal Revenue Code that permits a owned automobile coverage") if you use

your insurance agent or broker. It is

corporation to be taxed as a partnership or your personal vehicle on company

prudent for any business to purchase a

sole proprietorship, with profits taxed at business. This policy covers the business'

number of basic types of insurance. Some

the individual, rather than the corporate liability for any damage which may result

types of coverage are required by law, other

rate. A business must meet certain for such usage.

simply make good business sense. The

requirements for Subchapter “S” status. Officer and Director – Under most state

types of insurance listed below are among

Contact the IRS for more information. laws, officers and directors of a corporation

the most commonly used and are merely a

may become personally liable for their

starting point for evaluating the needs of

LLCs and LLPs actions on behalf of the company. This type

your business.

The limited liability company is a of policy covers this liability.

relatively new business form. It combines Liability Insurance – Businesses may

Home Office – If you are establishing an

selected corporate and partnership incur various forms of liability in

office in your home, it is a good idea to

characteristics while still maintaining status conducting their normal activities. One of

contact your homeowners' insurance

as a legal entity distinct from its owners. As the most common types is product liability,

company to update your policy to include

a separate entity it can acquire assets, incur which may be incurred when a customer

coverage for office equipment. This

liabilities and conduct business. It limits suffers harm from using the business

coverage is not automatically included in a

liability for the owners. The limited liability product. There are many other types of

standard homeowner's policy.

partnership is similar to the LLC, but it is liability, which are frequently related to

for professional organizations. specific industries. Liability law is

constantly changing. An analysis of your emploYer identiFication

loGiSticS oF StartinG Your liability insurance needs by a competent number

buSineSS professional is vital in determining an

adequate and appropriate level of

An EIN, also known as a federal tax

identification number, is used to identify a

protection for your business. business entity. Generally all businesses

buSineSS licenSeS Property – There are many different need an EIN. You may apply for an EIN in

There are many types of licenses, both types of property insurance and levels of a variety of ways, including online, phone,

state and local as well as professional. coverage available. It is important to fax. Taxpayers can obtain an EIN

Depending on what you do and where you determine the property you need to insure immediately by calling 800-829-4933,

plan to operate, your business may be for the continuation of your business and Monday through Friday, from 7:30 a.m. to

required to have various state and/or the level of insurance you need to replace 5:30 p.m. customer's local time.

municipal licenses, certificates or permits. or rebuild. You must also understand the Taxpayers can fax EIN requests seven

Licenses are typically administered by a terms of the insurance, including any days a week/24 hours a day by dialing the

variety of state and local departments. limitations or waivers of coverage. fax number to one of three IRS campuses

Consult your state or local government for Business Interruption – While property that accept applications. The instructions

assistance. insurance may pay enough to replace on the newly revised Form SS-4,

Corporation Bureau (PA) Application for Employer ID Number,

Pennsylvania Department of State damaged or destroyed equipment or

buildings, how will you pay costs such as indicate which IRS Campus is assigned to

Commonwealth Avenue & North St.

their specific state. Detailed information

206 N. Office Bldg. taxes, utilities and other continuing

Harrisburg, PA 17120 and an electronic SS-4 can be found at the

expenses during the period between when

717-787-1057 IRS Small Business/Self Employed

the damage occurs and when the property

www.dos.state.pa.us/corps/site/default.asp Community Web site at: http://www.irs.gov/

is replaced? Business Interruption (or businesses/small/index. html, click on New

"business income") insurance can provide

FictitiouS buSineSS name sufficient funds to pay your fixed expenses

Businesses. Faxed applications are

processed in four days. These IRS

Registering your business name, after during a period of time when your Campuses accept faxed applications at the

doing a search to make sure that it is not business is not operational. following numbers:

already in use, protects you from others "Key Man" – If you (and/or any other Holtsville, NY 631-447-8960

who might want to use the same name. For individual) are so critical to the operation of Cincinnati, OH 859-669-5760

more information, contact the county your business that it cannot continue in the Philadelphia, PA 215-516-3990

clerk’s office in the county where your event of your illness or death, you should

18 — Small Business Resource PITTSBURGH Visit us online: www.sba.gov/pa/pitt

EINs are also issued automatically will have to pay penalties if it is found that Corporation: You must file a Federal

online. Visit the IRS Web site, you should have been taxing your products Corporation Income Tax return (Form

http://www.irs.gov/businesses/small/article/0, and now owe back taxes to the state. For 1120). You will also be required to report

,id=102767,00.html for more information. information on sales tax issues, contact your earnings from the corporation

your state’s government. including salary and other income such as

dividends on your personal federal income

Federal Bureau of Corporation Taxes

Taxing Division tax return (Form 1040).

SelF-emploYment tax 717-787-1064

Every employee must pay Social Security

www.revenue.state.pa.us Federal paYroll tax

Federal Withholding Tax: Any business

and Medicare coverage. If you are self-

employed, your contributions are made Federal income tax employing a person must register with the

Like the state income tax, the method of IRS and acquire an EIN and pay federal

through the self-employment tax.

paying federal income taxes depends upon withholding tax at least quarterly. File Form

The IRS has publications, counselors and

your legal form of business. The following SS-4 with IRS to obtain number and

workshops available to help you sort it out.

procedures must be considered: required tax forms. Call 800-829-3676 or

For more information, contact the IRS at

Sole Proprietorship: You must file IRS 800-829-1040 if you have questions.

800-829-1040. Federal Form Schedule C along with your

SaleS tax exemption

personal Federal Income Tax return (Form

1040) and any other applicable forms

irS Web productS For Small

certiFicate pertaining to gains or losses in your buSineSSeS

business activity. To provide the most timely and up-to-

If you plan to sell products, you will Partnership: You must file a Federal date tax information, the Small Business

need a Sales Tax Exemption Certificate. It Partnership return (Form 1065). This is Resource Guide (SBRG), formerly a CD-

allows you to purchase inventory, or merely informational to show gross and net ROM, is available exclusively online at

materials, which will become part of the earnings of profit and loss. Also, each http://www.irs.gov/businesses/small/index.

product you sell, from suppliers without partner must report his share of html.

paying taxes. It requires you to charge sales partnership earnings on his individual Designed to equip small business

tax to your customers, which you are Form 1040 based on the information from owners with the skills and knowledge

responsible for remitting to the state. You the K-1 filed with the Form 1065. needed to successfully start and manage a

Visit us online: www.sba.gov/pa/pitt PITTSBURGH Small Business Resource — 19

employee to lose benefits and considerable

trouble for yourself in back tracking to

uncover the error.

Each payday, your employees must

receive a statement from you telling them

what deductions were made and how

many dollars were taken out for each legal

purpose. This can be presented in a variety

of ways, including on the check as a

detachable portion or in the form of an

envelope with the items printed and spaces

for dollar deductions to be filled in.

emploYee conSiderationS

taxes

If you have any employees, including

officers of a corporation but not the sole

proprietor or partners, you must make

periodic payments of, and/or file quarterly

reports about payroll taxes and other

mandatory deductions. You may contact

these government agencies for information,

business, The SBRG covers a wide range of IRS.gov Now Features Audio and assistance and forms.

tax topics Web links to business forms, Video Social Security Administration

publications, other useful governmental IRS is augmenting its curriculum of 800-772-1213

Web sites, and much more. online learning and educational http://www.ssa.gov

products for the small business community

New IRS Applications Make Tax by developing new live broadcasting, Social Security’s Business Services

Information More Accessible to phone forums and webinars, and offering Online

Small Businesses and the audio and video presentations. The Social Security Administration now

Self-employed provides free electronic services online at:

Maximizing the Web’s convenience, Testing Social Media www.socialsecurity.gov/employer/. Once

accuracy and speed, IRS.gov, IRS’s web site, The IRS is testing social media. We have registered for Business Services Online,

now assists millions of individual launched a YouTube video site at YouTube business owners or their authorized

taxpayers, tax professionals, and small - irsvideos's Channel and an iTunes representative can:

business owners to better understand and podcast to help taxpayers take full • file W-2s online; and

meet their tax responsibilities. advantage of the 2009 tax provisions in the • verify Social Security Numbers through

American Recovery and Reinvestment Act. the Social Security Number Verification

The IRS YouTube channel debuted with Service, used for all employees prior to

Updated Virtual Small Business Tax preparing and submitting Forms W-2.

Workshop seven Recovery videos in English and Federal Withholding

The IRS’s Virtual Small Business Tax American Sign Language and eight in U.S. Internal Revenue Service

Workshop (http://www.tax.gov/virtualwork Spanish plus other languages. 800-829-1040

shop) is an interactive resource to help People without an iTunes account can http://www.irs.gov

small business owners learn about their hear those same podcasts, in English and

federal tax rights and responsibilities. This Spanish, on IRS.gov’s Multimedia Center. Employee Insurance

dynamic educational product, available People can also visit the audio site at If you hire employees you may be

online and on CD 24/7 from your iTunes to listen to IRS podcasts about required to provide unemployment or

computer, consists of nine stand-alone ARRA tax credits. workers’ compensation insurance.

lessons that can be selected and viewed in To get the most timely IRS news and

any sequence. A bookmark feature makes it

possible to leave and return to a specific

information about products and services

for small businesses and the self-employed,

Workplace proGram

point within the lesson. Users also have subscribe to e-News on IRS.gov at Americans with Disabilities (ADA): For

access to a list of useful online references http://www.irs.gov/businesses/small/article/0, assistance with the ADA, call 800-669-3362

that enhance the learning experience by ,id=154825,00.html, click “Subscribe or visit: http://www.ada.gov.

allowing them to view references and the Now” at the bottom of the page and enter

video lessons simultaneously. your e-mail address. u.S. citizenSHip and

The Virtual Small Business Tax immiGration ServiceS

Workshop is the first of a series of video

products designed exclusively for small

Social SecuritY cardS The Federal Immigration Reform and

All employees must have a social Control Act of 1986 requires employers to

business taxpayers. A new companion

security card. It must be signed by its verify employment eligibility of new

series called, “Your Guide to an IRS Audit” owner, and you should always ask to see

is in development with plans for a summer employees. The law obligates an employer

and personally record the social security

2010 launch. to process Employment Eligibility

number. Failure to do so may cause your

20 — Small Business Resource PITTSBURGH Visit us online: www.sba.gov/pa/pitt

Verification Form I-9. The U.S. Citizenship

and Immigration Services Office of

bar codinG IRS Programs

The Internal Revenue Service is

Many stores require bar coding on emphasizing its commitment to the small

Business Liaison offers a selection of

packaged products. Many industrial and business community as part of its ongoing

information bulletins and live assistance

manufacturing companies use bar coding modernization effort. In addition, to a wide

through the Employer Hotline. For forms

to identify items they receive and ship. variety of publications and brochures, new

call 800-870-3676, for the Employer Hotline

There are several companies that can assist and existing small business owners in

call 800-357-2099.

businesses with bar-coding needs. You may Pennsylvania now have access to electronic

E-Verify: Employment Eligibility want to talk with an SBDC, SCORE or WBC (online) resources to help them understand

counselor for more information. and comply with their federal tax

Verification responsibilities.

E-Verify, operated by the Department of

Federal Registration of Trademarks The Small Business Corner on the IRS

Homeland Security in partnership with the Digital Daily web site (www.irs.gov) has the

Social Security Administration, is the best--

and Copyrights

Trademarks or service markets are most current tax tips. New small business

and quickest--way for employers to words, phrases, symbols, designs or owners can also order a free copy of Your

determine the employment eligibility of combinations thereof that identify and Business Tax Kit (Publication 3518) by

new hires. It is a safe, simple, and secure distinguish the source of goods. calling 800-829-3676. This kit contains

Internet-based system that electronically Trademarks may be registered at both the various tax forms and publications that are

verifies Social Security number and state and federal level. To register a federal helpful in preparing business tax returns.

employment eligibility information trademark, contact:

reported on Form I-9. E-Verify is voluntary Patent and Trademark Office: Department of Labor

in most states and there is no charge to use P.O. Box 1450 The United States Department of Labor’s

Alexandria, VA 22313-1450 Wage and Hour Division enforces

it. 800-786-9199

If you are an employer or employee and numerous federal labor statutes including

http://www.uspto.gov/

would like more information about the the Fair Labor Standards Act (FLSA), which

Trademark Information Hotline encompasses minimum wage, overtime,

E-Verify program, please visit:

703-308-9000 record keeping and child labor. Other

www.dhs.gov/E-Verify or contact our

statues enforced by the Wage & Hour

Customer Support staff: 1-888-464-4218 Division include the Family Medical Leave

Monday – Friday 8 am – 5 pm. State Registration of a Trademark

Trademarks and service marks may be Act (FMLA), the Service Contract Act

E-mail: e-verify@dhs.gov (SCA), the Davis Bacon Act (DBA), Inc. The

registered in a state.

Caution: Federally registered trademarks local contact for the Department of Labor’s