Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Preqin Infrastructure Renewable Energy January 2017

Caricato da

aasgroupCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Preqin Infrastructure Renewable Energy January 2017

Caricato da

aasgroupCopyright:

Formati disponibili

RENEWABLE ENERGY INFRASTRUCTURE

alternative assets. intelligent data.

RENEWABLE ENERGY

INFRASTRUCTURE

We provide an overview of the renewable energy infrastructure industry, including deals, fundraising and institutional investors

targeting this increasingly prominent segment of the asset class.

191

renewable energy deals were completed

326

renewable energy deals were completed

384

renewable energy deals were completed

in 2016 for US assets, the highest in 2016 for solar assets, the highest in 2016 for greenfield assets, the highest

number of any single country. number of any single sub-industry. number of any single sub-industry.

Fig. 1: Completed Renewable Energy Infrastructure Deals, Fig. 2: Completed Renewable Energy Infrastructure Deals by

2009 - 2016 Region, 2009 - 2016

800 250 800

700 700

Aggregate Deal Value ($bn)

200

600

600

No. of Deals

500 150

No. of Deals

500

400

100 400

300

200 300

50

100 200

0 0 100

2009 2010 2011 2012 2013 2014 2015 2016

0

No. of Deals 2009 2010 2011 2012 2013 2014 2015 2016

Reported Aggregate Deal Value ($bn)

Estimated Aggregate Deal Value ($bn) North America Europe Asia Africa Australasia Latin America

Source: Preqin Infrastructure Online Source: Preqin Infrastructure Online

Fig. 3: Completed Renewable Energy Infrastructure Deals by Fig. 4: Renewable Energy-Focused Unlisted Infrastructure

Sub-Industry, 2009 - 2016 Fundraising, 2009 - 2016

800 35 33

700 30 29

600 25 24

500 20 19

No. of Deals

18

14 15

400 15 14.0

12.8

10 11.4

300 10 8.0 7.4

200 4.9 4.1

5 3.9

100 0

2009 2010 2011 2012 2013 2014 2015 2016

0

2009 2010 2011 2012 2013 2014 2015 2016 Year of Final Close

Biomass/Biofuel Hydropower Solar Power Wind Power Other No. of Funds Closed Aggregate Capital Raised ($bn)

Source: Preqin Infrastructure Online Source: Preqin Infrastructure Online

1 2017 Preqin Ltd. / www.preqin.com

RENEWABLE ENERGY INFRASTRUCTURE

alternative assets. intelligent data.

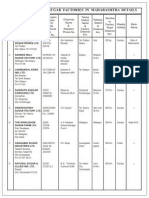

Fig. 5: Five Largest Renewable Energy Deals in 2016

Asset Location Industry Investor(s) Deal Size (mn) Stake (%) Deal Date

Diga di Rogun Dam Project Tajikistan Hydropower Impregilo 3,900 USD 100 Jul-16

Koysha Dam Project Ethiopia Hydropower Impregilo 2,500 EUR 100 May-16

Baltic Srodkowy III Offshore

Poland Wind Power Kulczyk Investments 2,576 USD 100 Aug-16

Wind Farm

940MW Vietnam Wind Project Vietnam Wind Power Mainstream Renewable Power 2,200 USD - Nov-16

Brookfield Renewable Energy

Isagen Colombia Hydropower 2,200 USD 57.6 Jan-16

Partners, Unidentified Investor(s)

Source: Preqin Infrastructure Online

Fig. 6: Infrastructure Industries Targeted by Institutional Fig. 7: Regions Targeted by Institutional Investors in Renewable

Investors in the Next 12 Months Energy Infrastructure over the Next 12 Months

70% 65% 70%

61% 61%

Proportion of Fund Searches

60% 60%

Proportion of Fund Searches

50% 48%

50%

43%

40% 35%

40%

30% 32% 32%

22% 24%

30%

20%

11% 20%

10% 14%

11%

0% 10%

Telecoms

Energy

Renewable

Logistics

Transport

Utilities

Social

Energy

0%

North Europe Asia-Pacific Rest of Emerging Global

America World Markets

Industry Targeted Region Targeted

Source: Preqin Infrastructure Online Source: Preqin Infrastructure Online

Fig. 8: Sample Institutional Investors Targeting Renewable Energy Infrastructure in the Next 12 Months

Investor Location Type Investment Plans in the Next 12 Months

Will continue to invest in the renewable energy sector

Lrernes Pension Hellerup, Denmark Public Pension Fund through primary unlisted fund commitments and direct

investments targeting Europe.

Favours renewable energy and utilities assets with power

purchase agreements or feed-in tariffs, targeting primary

Hyundai Insurance Seoul, South Korea Insurance Company and debt/mezzanine investments in developed markets.

However, it is cautious towards Europe due to the political

risk in the year ahead.

Will invest adhering to its traditional strategy of targeting a

Real Assets Fund of range of economic infrastructure assets, but primarily within

Sonen Capital San Francisco, US

Funds Manager energy (including renewables), on a global scale through its

real assets fund of funds vehicle.

Source: Preqin Infrastructure Online

INFRASTRUCTURE ONLINE

Preqins Infrastructure Online contains details on 7,330 renewable energy infrastructure deals, including information on asset type,

buyers & sellers and more.

Plus, Infrastructure Online currently tracks 1,350 investors with a preference for renewable energy infrastructure, with detailed

information on their current and target allocations, investment preferences and future plans.

For more information, or to arrange a demonstration, please visit:

www.preqin.com/infrastructure

2 2017 Preqin Ltd. / www.preqin.com

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- NON Negotiable Unlimited Private BondDocumento2 pagineNON Negotiable Unlimited Private Bonddbush277886% (14)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- SEx 2Documento20 pagineSEx 2Amir Madani100% (3)

- Al-Baraka Islamic Bank Internship ReportDocumento69 pagineAl-Baraka Islamic Bank Internship Reportbbaahmad89100% (8)

- Scheme of ArrangementDocumento24 pagineScheme of Arrangementaasgroup100% (1)

- HEIRS OF DR. INTAC vs. CADocumento3 pagineHEIRS OF DR. INTAC vs. CAmiles1280100% (3)

- Civ Pro Q&ADocumento7 pagineCiv Pro Q&ASGTNessuna valutazione finora

- Secretos Indicador TDI MMMDocumento22 pagineSecretos Indicador TDI MMMLuiz Vinhas100% (2)

- Accounting For Intercompany Transactions - FinalDocumento15 pagineAccounting For Intercompany Transactions - FinalEunice WongNessuna valutazione finora

- List of Private Sugar Factories in Maharashtra DetailsDocumento3 pagineList of Private Sugar Factories in Maharashtra DetailsShivam AhujaNessuna valutazione finora

- China's Emerging Hydrogen Economy: Rifs StudyDocumento93 pagineChina's Emerging Hydrogen Economy: Rifs StudyaasgroupNessuna valutazione finora

- Preqin Special Report Infrastructure Deals February 2014Documento8 paginePreqin Special Report Infrastructure Deals February 2014aasgroupNessuna valutazione finora

- Climate Stress TestsDocumento11 pagineClimate Stress TestsaasgroupNessuna valutazione finora

- Preqin UK Infrastructure Market May 2016Documento4 paginePreqin UK Infrastructure Market May 2016aasgroupNessuna valutazione finora

- Preqin SVCA Special Report Singapore ASEAN Private Equity April 2014Documento16 paginePreqin SVCA Special Report Singapore ASEAN Private Equity April 2014aasgroupNessuna valutazione finora

- Milbank Client Alert Japanese SolarDocumento5 pagineMilbank Client Alert Japanese SolaraasgroupNessuna valutazione finora

- Preqin German Infrastructure June 2015Documento3 paginePreqin German Infrastructure June 2015aasgroupNessuna valutazione finora

- LODR Amendement - Dividend DistributionDocumento2 pagineLODR Amendement - Dividend DistributionCauveri RamalingamNessuna valutazione finora

- 5.3 Judy-Li Ernst&Young enDocumento11 pagine5.3 Judy-Li Ernst&Young enaasgroupNessuna valutazione finora

- Countries WwsDocumento202 pagineCountries WwsaasgroupNessuna valutazione finora

- Preqin Infrastructure Renewables September 2016Documento2 paginePreqin Infrastructure Renewables September 2016aasgroupNessuna valutazione finora

- Document 1067957641Documento47 pagineDocument 1067957641aasgroupNessuna valutazione finora

- OXFAM Briefing Paper: An Economy For The 99%Documento48 pagineOXFAM Briefing Paper: An Economy For The 99%RBeaudryCCLENessuna valutazione finora

- Tax On Gifts - All You Want To KnowDocumento2 pagineTax On Gifts - All You Want To KnowaasgroupNessuna valutazione finora

- Report and Recommendation of The President To The Board of DirectorsDocumento15 pagineReport and Recommendation of The President To The Board of DirectorsaasgroupNessuna valutazione finora

- 200 ROD Third Order Auditor's Appointment From AGM 30062016Documento4 pagine200 ROD Third Order Auditor's Appointment From AGM 30062016aasgroupNessuna valutazione finora

- SepEMDocumento48 pagineSepEMaasgroupNessuna valutazione finora

- Can't Sponsor or Won't Sponsor - Dan McCarthy - Pulse - LinkedInDocumento4 pagineCan't Sponsor or Won't Sponsor - Dan McCarthy - Pulse - LinkedInaasgroupNessuna valutazione finora

- OXFAM Briefing Paper: An Economy For The 99%Documento48 pagineOXFAM Briefing Paper: An Economy For The 99%RBeaudryCCLENessuna valutazione finora

- MNRE Biomass Co-Generation PDFDocumento8 pagineMNRE Biomass Co-Generation PDFHousila TiwariNessuna valutazione finora

- 68425Documento83 pagine68425aasgroupNessuna valutazione finora

- Avendus Capital Structured Finance With Rs500 Crore FundDocumento2 pagineAvendus Capital Structured Finance With Rs500 Crore FundaasgroupNessuna valutazione finora

- Report and Recommendation of The President To The Board of DirectorsDocumento15 pagineReport and Recommendation of The President To The Board of DirectorsaasgroupNessuna valutazione finora

- Word - Jump To Next Track Change With Keyboard - CyberText NewsletterDocumento5 pagineWord - Jump To Next Track Change With Keyboard - CyberText NewsletteraasgroupNessuna valutazione finora

- 201 - Companies (Appointment & Remuneration of Managerial Personnel) Amendment Rules - 30062016Documento11 pagine201 - Companies (Appointment & Remuneration of Managerial Personnel) Amendment Rules - 30062016aasgroupNessuna valutazione finora

- Maharashtra Bagasse Power Tariff ReviewDocumento6 pagineMaharashtra Bagasse Power Tariff ReviewaasgroupNessuna valutazione finora

- Acknowledgement: These Slides Have Been Adapted FromDocumento56 pagineAcknowledgement: These Slides Have Been Adapted FromagnesNessuna valutazione finora

- Mergers, Acquisitions and RestructuringDocumento34 pagineMergers, Acquisitions and RestructuringMunna JiNessuna valutazione finora

- Epicor ERP 10 Malaysia Country Specific Functionality Guide 10.0.700Documento30 pagineEpicor ERP 10 Malaysia Country Specific Functionality Guide 10.0.700nerz8830Nessuna valutazione finora

- Bangko Sentral NG Pilipinas Coins and Notes - Commemorative CurrencDocumento4 pagineBangko Sentral NG Pilipinas Coins and Notes - Commemorative Currencrafael oviedoNessuna valutazione finora

- Tamilnadu Pension Calculation ARREARS SoftwareDocumento13 pagineTamilnadu Pension Calculation ARREARS Softwarejayakumarbalaji50% (4)

- Chapter 6 Partnership Formation Operation and LiquidationDocumento6 pagineChapter 6 Partnership Formation Operation and Liquidationanwaradem225Nessuna valutazione finora

- Sub Order LabelsDocumento2 pagineSub Order LabelsZeeshan naseemNessuna valutazione finora

- Understanding Financial Leverage RatiosDocumento17 pagineUnderstanding Financial Leverage RatiosChristian Jasper M. LigsonNessuna valutazione finora

- Departamento de Matemáticas: Mathematics - 3º E.S.ODocumento2 pagineDepartamento de Matemáticas: Mathematics - 3º E.S.OketraNessuna valutazione finora

- 1600 FinalDocumento4 pagine1600 FinalReese QuinesNessuna valutazione finora

- PPC Practice ActivityDocumento4 paginePPC Practice Activityapi-262416934Nessuna valutazione finora

- Management Accounting: 2 Year ExaminationDocumento24 pagineManagement Accounting: 2 Year ExaminationChansa KapambweNessuna valutazione finora

- Bank Nizwa Summary Prospectus (English)Documento13 pagineBank Nizwa Summary Prospectus (English)Mwangu KibikeNessuna valutazione finora

- FM Final ProjectDocumento20 pagineFM Final ProjectNuman RoxNessuna valutazione finora

- College of Accountancy and Business Administration: Partnership Operation Changes in CapitalDocumento6 pagineCollege of Accountancy and Business Administration: Partnership Operation Changes in CapitalVenti AlexisNessuna valutazione finora

- CA Final Old Syllabus PDFDocumento114 pagineCA Final Old Syllabus PDFKovvuri Bharadwaj ReddyNessuna valutazione finora

- Mishkin Econ13e PPT 11Documento39 pagineMishkin Econ13e PPT 11hangbg2k3Nessuna valutazione finora

- MCWQS For All XamsDocumento97 pagineMCWQS For All Xamsvini_anj3980Nessuna valutazione finora

- Oriental Petroleum & Minerals Corporation: Coral Reef Growth Beneath Nido-AP PlatformDocumento28 pagineOriental Petroleum & Minerals Corporation: Coral Reef Growth Beneath Nido-AP PlatformTABAH RIZKINessuna valutazione finora

- Prelio SDocumento55 paginePrelio Sjohnface12Nessuna valutazione finora

- Heller, Jack, CPCUMARPDocumento4 pagineHeller, Jack, CPCUMARPTexas WatchdogNessuna valutazione finora

- RA 6713 ReportDocumento6 pagineRA 6713 Reportydlaz_tabNessuna valutazione finora

- Error Correction (Part 2) - Suspense Accounts (Including RQS)Documento6 pagineError Correction (Part 2) - Suspense Accounts (Including RQS)King JulianNessuna valutazione finora