Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

PBT 01 EFT Overview

Caricato da

satya narayana murthyCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

PBT 01 EFT Overview

Caricato da

satya narayana murthyCopyright:

Formati disponibili

Payments Basic Training

Module 1: EFT Overview

Copyright 2009. S1 Global Ltd. All rights reserved.

Module Introduction

Introduction to Payments Basic Training (PBT)

EFT Concepts

Payments System Overview

Course duration

o day (3 hours)

Copyright 2009. S1 Global Ltd. All rights reserved.

Section 1: Introduction to PBT

Overview

Training structure

Module scope

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

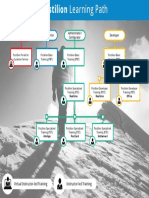

Training Structure

Overview

Three types of courses

Payments Basic Training (PBT)

Payments Specialized Training (PST)

Payments Development Training (PDT)

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Training Structure

Core Modules

Module 1: EFT Overview

Module 2: Realtime

Module 3: PostCard

Module 4: Office

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Training Structure

Elective Modules

Additional modules environment specific

Module 5: ATM Driving

Module 6: eSocket.POS

Module 7: TermApp

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Module Scope

Main Sections

EFT Concepts

EFT concepts (incl. S1-specific concepts)

Payment cards (PANs and routing)

Payment flows (consumer transactions and settlement)

EFT protocols (draft capture and ISO 8583 messages)

Payments System Overview

S1 payments product family

S1 payments solutions

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Evaluation and Certification

Evaluation and Certification

PBT Certificate

o Questions from modules 15

Scoring

o Less than 64% Attendance

o Between 65% and 84% Competence

o 85% and greater Achievement

Copyright 2009. S1 Global Ltd. All rights reserved.

Section 2: EFT Concepts

Introductory concepts

Point-of-sale environment

ATM environment

Cards and routing

Payment cycle

Basic S1 payments terminology

EFT protocols

Transaction integrity

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Introduction

Terminology 1

Electronic funds transfer (EFT)

Card acceptor (merchant)

Acquirer (merchant account provider)

Card association ( EFT network)

Issuer

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Introduction

Terminology 2

Authorization and capture

Downstream versus upstream

On-us, not-on-us, remote on-us

Protocol

Primary account number (PAN)

Bank identification number (BIN)

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Point-of-Sale Environment

Entities in a Point-of-Sale (POS) Environment

Cardholder Merchant Acquirer (or merchant Card association Issuer

(or card acceptor) Account provider) (or network)

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

ATM Environment

Entities in an ATM Environment

Cardholder Card acceptor Acquirer Network Issuer

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

ATM Environment

On-us Transactions

Cardholder Issuer-owned ATM Issuer

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

ATM Environment

Not-on-us Transactions

Cardholder Acquirer- Acquirer Network Issuer

owned ATM

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Cards and Routing

Routing

Routing

o Acquirer: on-us or not-on-us?

o Network: which issuer?

o Issuer: which account?

Routing mechanism

o Primary Account Number (PAN)

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Cards and Routing

Cards PAN

PAN

PAN primary account number

Usually 16 or 19 digits

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Cards and Routing

Cards BIN

BIN

BIN bank identification number

First 6 digits

Identifies card issuer

Issued by card association or national standards body

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Cards and Routing

Cards IID

IID

IID individual account ID

Remaining digits (excluding the last digit)

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Cards and Routing

Cards Check Digit

Luhn formula (Modulus 10)

Primarily of use in manual PAN entry

Detects single-digit errors and transpositions of

adjacent digits

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Cards and Routing

Cards Tracks

Track 1

Track 1

o Cardholder details (name and courtesy title)

o Used by terminals not used by EFT processors

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Cards and Routing

Cards Tracks

Track 3

Track 3

o Seldom used

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Cards and Routing

Cards Tracks

Track 2

Track 2

o PAN + essential EFT data

o Numeric; Maximum 37 digits

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Cards and Routing

Cards Track 2

5412345678901234 = 0612 101

PAN (max 19 digits)

Field separator

Expiry date (YYMM)

Service restriction code

Additional data (PVV/CVV)

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Cards and Routing

Credit Card Statistics

2008 Global market share (in terms of purchase

volumes)

o Visa 60.25%

o MasterCard 28.33%

o Amex 10.04%

o JCB 0.94%

o Diners 0.44%

2008 Visa Transactions in US

o Purchase volume $823.7 billion (2003: $540 billion)

o Purchase transactions 9.2 billion (2003: 6.5 billion)

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Cards and Routing

Chip Cards 1

Integrated circuit chip (ICC)

Bigger storage capacity

Perform cryptographic calculations

o Offline PIN verification

Also known as EMV cards

o Europay

o MasterCard

o Visa

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Cards and Routing

Chip Cards 2

Same basic information

o PAN

o Expiry date

o Service restriction code

Supports the same routing mechanism as magnetic stripe

cards

Compatible with existing EFT

network structure

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Cards and Routing

Chip Card Statistics

As of May 2008

o 622 million chip cards issued

o MasterCard: 310 million ( of global portfolio)

o Visa: 262 million

o 8.2 million EMV acceptance points globally

o 68% of European POS points

o 56% of European ATMs

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Payment Cycle

Introduction

How money (value) flows between EFT entities

Two phases

o Consumer

Value flows to the consumer.

Consumer receives cash or goods/services.

EFT processors (e.g. S1 payments system)

EFT protocols (ISO 8583)

o Settlement

Value flows from the consumer (closes the cycle)

Merchant or terminal owner receives payment

Automated clearing houses or similar

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Payment Cycle

Not-on-us ATM Transaction

1: Cardholders

Request: Amount + surcharge account debited

Cardholder Card acceptor Acquirer Network Issuer

(Bank B) (Bank A) (Bank B)

2: Money

dispensed

3: Amount + surcharge +

interchange (switch) fee

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Payment Cycle

Not-on-us POS Transaction

1: Cardholders

Request: Transaction amount account debited

Acquirer Network Issuer

Cardholder (Bank A) (Bank B)

(Bank B)

2: Goods

4: Amount

Merchant

3: Amount

merchant fee

5: Interchange

(discount rate)

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Basic S1 Payments Terminology

Realtime and External Entities

Downstream Source interface Sink interface Upstream

POS device Store server Realtime Network Issuer

(source entity) (sink entity)

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

ISO 8583

ISO 8583

o Most widely used EFT protocol

o Used by Realtime

Specifies

o Message content

o Message Format

o Rules of exchange draft capture protocols

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

Draft Capture Protocols

Consumer phase two components

o Authorization

Verifies cardholder has sufficient funds

Funds reservation

Adjusts available balance (not ledger balance)

o Capture

Cardholders account debited

Ledger balance adjusted

Transaction completed/secured

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

Draft Capture Protocols

Four draft capture protocols (DCP)

o Paper

o Batch

o Store-and-forward

o Online

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

Paper Draft Capture

Auth request

Auth response

Terminal Acquirer Issuer

End of day: File

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

Batch Draft Capture

Auth request

Auth response

Batched advices

End of day

Advice responses

Merchant Acquirer Issuer

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

Store-and-Forward Draft Capture

Auth request

Auth response

Advice

End of day

Advice response

Merchant Acquirer Issuer

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

Online Draft Capture Single Message Pair

Tran request

Tran response

ATM Acquirer Issuer

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

Online Draft Capture Dual Message Pair

Tran request

Tran response

Completion

Completion

ATM response Acquirer Issuer

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

Summary of Draft Capture Flows

Paper Batch Store and Online

Forward

Time

EOD

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

ISO 8583 Messages

Flexible message format

Accommodates new requirements

Multiple variants

Protocol translation required between variants

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

ISO 8583 Messages

0200 101100110101 MAC

4 Bytes 8 (or 16) Bytes Variable length

Message type identifier

Bitmap

Data elements

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

Message Classes

Message class (first 2 digits)

01xx authorization

02xx transaction

03xx file update

04xx reversal

05xx reconciliation

06xx administration

08xx network management

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

Message Functions

Message function (last 2 digits)

xx00 request

xx20 advice

xx02 completion

Add 10 for response Add 1 for repeat

xx10 request response xx21 advice repeat

xx30 advice response xx03 completion repeat

xx12 completion response See page 123

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

Message Type Categories

Real-time messages

o Cardholder waits for transaction to complete

e.g. transaction requests

o No response time out

Store-and-forward messages

o Transaction complete from cardholders point-of-view

e.g. advices, completions, and reversals

o No response message repeated till response is received

o Inform recipient of final state of transaction

o Placed in S&F queue

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

Bitmaps

10110010101

1st bit indicates presence of bitmap 2

3rd bit Indicates presence of field 3, etc.

String of bits (ones or zeros) indicating the presence or absence of data

elements

Each bitmap is 8 bytes (64 bits) long

Bitmap 1 relates to fields 264

Bit 1 of bitmap 1 indicates the presence/absence of bitmap 2

Bit 2 indicates the presence of field 2, etc.

Bitmap 2 relates to fields 65128

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

Data Elements

Fields may be

o Fixed length (e.g. Field 3 processing code)

o Variable length (e.g. Field 2 PAN)

Length indicated by first 13 digits

o Numeric (e.g. Field 4 tran amount)

o Alphanumeric (Field 45 track 1 data)

o Mandatory (e.g. Field 7 transmission date/time)

o Conditional (e.g. Field 35 track 2 data)

o Optional (e.g. Field 28 transaction fee)

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

Important Fields

Field number Description

2 Primary Account Number

3 Processing Code

4 Amount, Transaction

7 Transmission Date and Time

11 Systems Trace Audit Number

35 Track 2 data

39 Response Code

49 Currency Code, Transaction

52 Personal Identification Number (PIN) Data

127 Reserved for Private Use (S1-specific)

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

EFT Protocols

Field 127

Up to 999,999 bytes long

Used extensively by Realtime

Divided into subfields (239 sequentially)

Bitmap indicates which subfields are present

See page 128 for a list of more commonly used S1-specific subfields

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Transaction Integrity

Introduction to Transaction Integrity

Customers view of a transaction = issuers view

ISO 8583 ensures transaction integrity in two situations:

o Lost responses

o Protocol translation

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Transaction Integrity

Transaction Integrity: Lost Response

Downstream EFT Entities are primarily responsible for recovery

from failure upstream

o Comms failures en route to upstream entity

o Failure of upstream entity

o Comms failure affecting response message

If failure occurs downstream, responsibility usually lies with the

entity further downstream

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Transaction Integrity

Upstream Failure

Online, no stand-in authorization

Downstream Processor Upstream

entity entity

0200 0200

Timed out

0210

Declined

0420 0420

Timed out

0421

0430

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Transaction Integrity

Upstream Failure

Online, with stand-in processing

Downstream Processor Upstream

entity entity

0200 0200

Timed out

0210

Approved

0420 0420

0430

0220

0220

0230

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Transaction Integrity

Late Response

Online, no stand-in authorization

Downstream Processor Upstream

entity entity

0200 0200

0210 Timed out

Declined

0420 0420

Late rsp 0210

ignored

0430

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Transaction Integrity

Downstream Failure

Online

Downstream Processor Upstream

entity entity

0200 0200

0210 0210

Timed out

0420

0430

0420 0420

0430

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Transaction Integrity

EFT Protocol Translation 1

Online Store-and-forward

Downstream Processor Upstream

entity entity

0200 0100

0210 0110

Potential loss of transaction integrity when performing protocol

translation

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

Transaction Integrity

EFT Protocol Translation 2

Online Store-and-forward

Downstream Processor Upstream

entity entity

0200 0100

0210 0110

0220 0220

0230

Copyright 2009. S1 Global Ltd. All rights reserved.

Section 3: S1 Payments System Overview

S1 payments product family

S1 payments solutions

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

S1 Payments Product Family

The S1 Payments Product Family

ATM POS File

Voice Reconciliation

loads

files

Internet

File

imports

PostCard

eSocket.POS

eSocket.ATM Realtime Office

General

eSocket.web ledger

Network File Reports File

Host extracts Card extracts

systems production ACH

company

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

S1 Payments Product Family

Business Environments

Payments product family suited to several environments:

o Financial Institutions

o Retailers

o Telecom operators (mobile and fixed-line)

o Processors

o Networks

o Independent sales organizations (ISOs)

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

S1 Payments Product Family

Business Solutions

Driving ATMs

Performing card processing

Authorizing transactions (stand-in and full authorization)

Managing card production and PIN generation

Driving point-of-sale devices

Providing mobile and internet payment/banking

Switching transactions

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

S1 Payments Product Family

Realtime

Core of installation

Realtime manages

o Online transaction processing

o Transaction security

o Integrity management

o Routing

o Card processing

o Currency conversion

o Batch reconciliation

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

S1 Payments Product Family

Realtime Interfaces

Interact with external entities

Provide protocol translation

Provide terminal driving capability

o Source interfaces only

o AtmApp Diebold and NCR ATMs

o TermApp POS terminals

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

S1 Payments Product Family

Realtime Consoles

Transaction querying

Terminal monitoring

Event logging

Transaction tracing

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

S1 Payments Product Family

PostCard

Card management system

Provides the following services to issuers

o Card production management

o PIN management

o Card activation

o Validation and authorization services

o Risk profile management

o Not an account management system

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

S1 Payments Product Family

Office

Transfers transaction data from Realtime to its own database

Provides post-transaction processing:

o Automatic reconciliation (match-and-kill)

o Extraction of transaction data

o Multi-party settlement including creation of payment (ACH) files

o Report generation

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

S1 Payments Product Family

eSocket

Provides easy integration of third-parties with the S1

payments system

Components installed on foreign systems

Web servers and IVR eSocket.Web

Web-enabled ATMs eSocket.ATM

POS devices eSocket.POS

Enables systems to

Process EFT transactions (including EMV)

Switch transactions to Realtime

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

S1 Payments Solutions

Example Payments Solutions

ATM driving

Retail payments

Mobile prepay

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

S1 Payments Solutions

ATM Driving

Monitoring and

configuration

Advanced-function ATMs Pager alerts

Issuing

Realtime banks

WAN

Office Networks

Conventional ATMs:

Diebold 911/912 Reports

Triton

Tranax

NCR NDC+ ATM processors payments system

Tidel

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

S1 Payments Solutions

Retail Payments

Monitoring and

configuration

Pager alerts

Issuing

Realtime banks

WAN

Office Networks

Reports

POS with

eSocket.POS

Retailers payments system

Copyright 2009. S1 Global Ltd. All rights reserved.

Introduction | EFT Concepts | Payments System Overview

S1 Payments Solutions

Mobile Prepay

Monitoring and

configuration

Pager alerts

POS terminal Issuing

Realtime banks

WAN

Prepay host

Mobile Office

Network

Reports

Mobile phone

Mobile operators payments system

Copyright 2009. S1 Global Ltd. All rights reserved.

Potrebbero piacerti anche

- PBT 03 PostCardDocumento68 paginePBT 03 PostCardCotilda Mussa100% (1)

- PBT 02 RealtimeDocumento133 paginePBT 02 RealtimeEDGAR RICARDONessuna valutazione finora

- Postilion Developer ExternalDocumento2 paginePostilion Developer ExternalMwansa MachaloNessuna valutazione finora

- ISO-TP Course PresentationDocumento14 pagineISO-TP Course PresentationSarfaraz Barkat AliNessuna valutazione finora

- Transaction Processing Rules PDFDocumento313 pagineTransaction Processing Rules PDFDipanwita BhuyanNessuna valutazione finora

- Postilion Developer External PDFDocumento2 paginePostilion Developer External PDFMwansaNessuna valutazione finora

- ISO8583 Transaction Types ExplainedDocumento6 pagineISO8583 Transaction Types ExplainedMalarNessuna valutazione finora

- HyperCom Payment Server Software Development Kit (SDK)Documento152 pagineHyperCom Payment Server Software Development Kit (SDK)Kishor NannawareNessuna valutazione finora

- Connectivity Endpoint and TypeDocumento4 pagineConnectivity Endpoint and Typerajeeva001Nessuna valutazione finora

- EMV Contactless PDFDocumento111 pagineEMV Contactless PDFhacker509Nessuna valutazione finora

- Sarvatra Switch Iso8583 Message SamplesDocumento27 pagineSarvatra Switch Iso8583 Message Sampleskk_mishaNessuna valutazione finora

- Authorization ManualDocumento471 pagineAuthorization ManualRobertoNessuna valutazione finora

- EMV v4.2 Book 4Documento155 pagineEMV v4.2 Book 4systemcoding100% (1)

- EMVCo 3DS SDKSpec 220 122018Documento130 pagineEMVCo 3DS SDKSpec 220 122018klcekishoreNessuna valutazione finora

- EMV Transaction Result AnalysisDocumento3 pagineEMV Transaction Result Analysism_ramesh3167% (3)

- BASE24 DR With AutoTMF and RDF WhitepaperDocumento38 pagineBASE24 DR With AutoTMF and RDF WhitepaperMohan RajNessuna valutazione finora

- Visa Merchant Data Standards Summary of ChangesDocumento120 pagineVisa Merchant Data Standards Summary of ChangesPriyeshJainNessuna valutazione finora

- AN2949Documento7 pagineAN2949archiealfitrosdNessuna valutazione finora

- Card Acceptance Guidelines Visa Merchants PDFDocumento81 pagineCard Acceptance Guidelines Visa Merchants PDFsanpikNessuna valutazione finora

- MChip Advance Common Personalization Specification Version 1.2.1Documento52 pagineMChip Advance Common Personalization Specification Version 1.2.1奇刘Nessuna valutazione finora

- Visa Merchant Data Standards ManualDocumento249 pagineVisa Merchant Data Standards ManualRey Israel Aguilar MaciasNessuna valutazione finora

- H2Hspecs PDFDocumento174 pagineH2Hspecs PDFziaur060382Nessuna valutazione finora

- If PostbridgeDocumento259 pagineIf Postbridgeadenihun Adegbite100% (1)

- ATM Timeout or Command RejectDocumento21 pagineATM Timeout or Command RejectDass HariNessuna valutazione finora

- Transaction Processing RulesDocumento429 pagineTransaction Processing Rulesjulio zevallosNessuna valutazione finora

- EMV CPS v1.1Documento104 pagineEMV CPS v1.1Hafedh Trimeche67% (3)

- RuPay Operating Regulations 1.0Documento114 pagineRuPay Operating Regulations 1.0Amit Bhardwaj50% (2)

- Verifone Vx805 DsiEMVUS Platform Integration Guide SupplementDocumento60 pagineVerifone Vx805 DsiEMVUS Platform Integration Guide SupplementHammad ShaukatNessuna valutazione finora

- JposDocumento53 pagineJposRafael Balest100% (1)

- ISO 8583 - Card Message StandardsDocumento10 pagineISO 8583 - Card Message Standardsgupadhya68Nessuna valutazione finora

- ISO 8583 A Layman's GuideDocumento7 pagineISO 8583 A Layman's GuideFaisal BasraNessuna valutazione finora

- EMV OverviewDocumento51 pagineEMV OverviewManish ChofflaNessuna valutazione finora

- EMV v4.3 Book1 ICC To Terminal Interface 2011113003541414Documento189 pagineEMV v4.3 Book1 ICC To Terminal Interface 2011113003541414ashishkarNessuna valutazione finora

- Mastercard Securecode: Acquirer Implementation Guide 21 March 2017Documento75 pagineMastercard Securecode: Acquirer Implementation Guide 21 March 2017Munkhtsogt TsogbadrakhNessuna valutazione finora

- ECHO ISO 8583 Technical Specification V1.6.5Documento115 pagineECHO ISO 8583 Technical Specification V1.6.5Diego Alejandro Guzman BassNessuna valutazione finora

- ISO Global 2008 3Documento294 pagineISO Global 2008 3developer developer100% (1)

- Acquirer POS Credit and Debit - Test Cases PDFDocumento415 pagineAcquirer POS Credit and Debit - Test Cases PDFTrangNessuna valutazione finora

- SVFE CBS-SpecificationDocumento67 pagineSVFE CBS-SpecificationМихаил Олиярник100% (1)

- ISO 8583 Message ProcessorDocumento79 pagineISO 8583 Message Processormariani2104Nessuna valutazione finora

- Everything You Need to Know About EMV FAQsDocumento36 pagineEverything You Need to Know About EMV FAQsFaizan Hussain100% (1)

- HSM I&O Manual 1270A513-3 PDFDocumento202 pagineHSM I&O Manual 1270A513-3 PDFrzaidi921Nessuna valutazione finora

- Visa Chip Simplifying ImplementationDocumento2 pagineVisa Chip Simplifying Implementationjagdish kumarNessuna valutazione finora

- CSR System Monitor Administrator/ Configurator Developer: Virtual Instructor-Led Training Instructor-Led TrainingDocumento1 paginaCSR System Monitor Administrator/ Configurator Developer: Virtual Instructor-Led Training Instructor-Led TrainingTatenda J Zifudzi100% (2)

- BASE24-eps Product UpdateDocumento24 pagineBASE24-eps Product Updatemikhlas100% (1)

- IRDsDocumento4 pagineIRDsArun Kumar Srinivasa Raghavan100% (2)

- Interchange FeeDocumento3 pagineInterchange FeeAnkita SrivastavaNessuna valutazione finora

- EMV-L2 ST100 DraftDocumento72 pagineEMV-L2 ST100 DraftAndali AliNessuna valutazione finora

- DUKPTDocumento19 pagineDUKPTmail4290Nessuna valutazione finora

- VMDS HSM Guide v2.0 PDFDocumento44 pagineVMDS HSM Guide v2.0 PDFThuy VuNessuna valutazione finora

- Payment processor Complete Self-Assessment GuideDa EverandPayment processor Complete Self-Assessment GuideNessuna valutazione finora

- Smart card management system The Ultimate Step-By-Step GuideDa EverandSmart card management system The Ultimate Step-By-Step GuideNessuna valutazione finora

- Transaction Controls Monitoring A Complete Guide - 2021 EditionDa EverandTransaction Controls Monitoring A Complete Guide - 2021 EditionNessuna valutazione finora

- Mastering: Emv & Card Payment SystemsDocumento8 pagineMastering: Emv & Card Payment SystemsGuy Germain MbakiNessuna valutazione finora

- Emv PresentationDocumento8 pagineEmv PresentationTarget2009Nessuna valutazione finora

- Latches and Flip-Flops: Storage ElementsDocumento18 pagineLatches and Flip-Flops: Storage ElementsArnav GuptaNessuna valutazione finora

- Precipitation Hardening: Dr. H. K. Khaira Professor in MSME MANIT, BhopalDocumento42 paginePrecipitation Hardening: Dr. H. K. Khaira Professor in MSME MANIT, Bhopalsatya narayana murthyNessuna valutazione finora

- Amcatsyllabusandsamplepapers 120630092447 Phpapp02Documento11 pagineAmcatsyllabusandsamplepapers 120630092447 Phpapp02Dhwanit MunshiNessuna valutazione finora

- JDBC, Servlet, JSP JAVADocumento484 pagineJDBC, Servlet, JSP JAVAGirish Pampari0% (1)

- CollectionsDocumento15 pagineCollectionsSai Sandeep75% (4)

- Spring TutorialDocumento141 pagineSpring Tutorialsatya narayana murthy100% (1)

- SCJP 1.6 DumpDocumento55 pagineSCJP 1.6 DumpMohanraj N100% (1)

- Transcript ApplicationDocumento2 pagineTranscript ApplicationSwetha ReddyNessuna valutazione finora

- Spring Security: Authentication AuthorizationDocumento4 pagineSpring Security: Authentication Authorizationsatya narayana murthyNessuna valutazione finora

- Spring MVC AnnotationsDocumento3 pagineSpring MVC Annotationssatya narayana murthyNessuna valutazione finora

- Beginners Shell ScriptingDocumento25 pagineBeginners Shell ScriptingSneihil Gopal0% (1)

- Bank Statement PardeepDocumento1 paginaBank Statement PardeepAralt visaNessuna valutazione finora

- Management Information System: (Canara Bank)Documento13 pagineManagement Information System: (Canara Bank)Kukki SengarNessuna valutazione finora

- Form 121320121631Documento2 pagineForm 121320121631Matthew MonroeNessuna valutazione finora

- Comprehensive ProblemDocumento2 pagineComprehensive ProblemAmieMatira50% (2)

- Setu VFXTH March-2014Documento221 pagineSetu VFXTH March-2014Bagus RinaldiNessuna valutazione finora

- CMRReport 1201090008986610Documento1 paginaCMRReport 1201090008986610Archil JainNessuna valutazione finora

- Farhan Ansari - Tally Viva Project ReportDocumento48 pagineFarhan Ansari - Tally Viva Project ReportFARHAN ANSARINessuna valutazione finora

- HSBC BankDocumento40 pagineHSBC BankPrasanjeet PoddarNessuna valutazione finora

- Class Exercises - Double EntryDocumento2 pagineClass Exercises - Double EntryeshakaurNessuna valutazione finora

- Answer Key Section 1 To 5 Nov2022batchDocumento15 pagineAnswer Key Section 1 To 5 Nov2022batchICS Davao2 (Epyong)100% (1)

- Statement 13feb2023Documento4 pagineStatement 13feb2023lizaNessuna valutazione finora

- Account Statement From 1 Oct 2020 To 30 Sep 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento14 pagineAccount Statement From 1 Oct 2020 To 30 Sep 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAartiNessuna valutazione finora

- Summer Internship Project Report in Reliance Jio - CompressDocumento68 pagineSummer Internship Project Report in Reliance Jio - CompressPrabhjot KaurNessuna valutazione finora

- Updated PayPal and Streaming Bins from Philippines DocumentDocumento36 pagineUpdated PayPal and Streaming Bins from Philippines DocumentKeith cantel25% (4)

- Transferring Funds From Lenders To Borrowers: By: Myla Jenn L. ConstantinoDocumento15 pagineTransferring Funds From Lenders To Borrowers: By: Myla Jenn L. ConstantinoIvy RosalesNessuna valutazione finora

- Capex Flow ST1 V2Documento38 pagineCapex Flow ST1 V2raulNessuna valutazione finora

- Chapter 2 Audit Cash PDFDocumento6 pagineChapter 2 Audit Cash PDFalemayehu100% (2)

- ACCA F3 Financial Accounting Mock Exam QuestionsDocumento73 pagineACCA F3 Financial Accounting Mock Exam QuestionsArsalan Arif Nara0% (1)

- Customer Relationship Management of Birla Sun LifeDocumento72 pagineCustomer Relationship Management of Birla Sun LifeTarun NarangNessuna valutazione finora

- WP Pos Ram Scraper MalwareDocumento97 pagineWP Pos Ram Scraper MalwareAnonymous eXujyZNessuna valutazione finora

- Product Distribution BasicsDocumento8 pagineProduct Distribution BasicsNicol Katherine Sierra RodríguezNessuna valutazione finora

- Local Church Audit ReportDocumento5 pagineLocal Church Audit ReportJennie HastingsNessuna valutazione finora

- Sales Process of HDFC BankDocumento78 pagineSales Process of HDFC Bankmohitnonu100% (1)

- Stages in Life Insurance Policy IssuanceDocumento14 pagineStages in Life Insurance Policy IssuanceRahul RawalNessuna valutazione finora

- EasyGo PresentationDocumento24 pagineEasyGo PresentationzitkonkuteNessuna valutazione finora

- An Introduction To Trade Credit InsuranceDocumento4 pagineAn Introduction To Trade Credit InsuranceBizic Maria LaviniaNessuna valutazione finora

- MacArthur Post Office Meeting Issues AddressedDocumento3 pagineMacArthur Post Office Meeting Issues AddressedHenry FranksNessuna valutazione finora

- Retail Management: A Strategic Approach: Promotional StrategyDocumento32 pagineRetail Management: A Strategic Approach: Promotional StrategySumaiyah AlifahNessuna valutazione finora

- Network Issues in BankingDocumento9 pagineNetwork Issues in BankingKrishnaVkNessuna valutazione finora

- 6.1 Upwork Readiness TestDocumento5 pagine6.1 Upwork Readiness TestRonnie ClarionNessuna valutazione finora