Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Advisory Services

Caricato da

priyankamahaleDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Advisory Services

Caricato da

priyankamahaleCopyright:

Formati disponibili

Advisory Services:

•Credit Reports - CARE offers credit reports on companies based on published information

and CARE's in-house data base. These confidential credit reports are useful to entities

considering financing options, joint ventures, acquisitions and collaborations with Indian

companies.

•Sector Studies - CARE from time to time conducts studies on select sectors of the Indian

economy, particularly those which were largely government controlled and funded till

recently, but have been thrown open for private investment. Studies on the Indian Power

Sector, Fertilizer Industry and Municipal Finances have been completed. CARE has also

prepared reports on twelve of the larger states of the Indian Union, which account for the

bulk of foreign direct investment into India. CARE also regularly prepares reports on

important segments of the Indian economy. These reports are used by industry

participants, financial intermediaries and also by analysts in CARE for their rating

reports.

Project Advisory Services - For financing its infrastructure, India is increasingly relying

on private sector participation. CARE uses the expertise gained in evaluating the credit

risk of projects in areas such as roads, ports, power and telecom to advise investors and

banks about the regulatory framework, the specific project risks and the ways of risk

mitigation. CARE has helped independent power producers in India understand the

functioning of the principal power purchasers, the State Electricity Boards and evaluate

options for mitigating purchaser risk. CARE has also worked closely with project

sponsors to structure their debt securities based on estimates of cash flows.

Financial Restructuring - The business risk faced by Indian companies increased following

the liberalisation of Indian economy in 1991. To compete in the changed environment,

companies have had to reassess their capital structures. CARE uses its knowledge about

various industry sectors to advise companies about the optimal capital structure and the

financial restructuring options.

•Valuation - CARE carries out enterprise valuations for company managements,

prospective and exisiting business partners or large investors. The Disinvestment

Commission, Government of India, has used CARE's services for valuing 20 state owned

enterprises.

•Credit Appraisal Systems - CARE helps banks and non banking

finance companies to set up or modify their credit appraisal systems.

•Debt Market Review - CARE's Advisory division also publishes a

monthly bulletin "debt market review" on the happenings in the debt

market and general development in the economy in the previous month

Credit Rating Services

-CARE's Credit Rating is an opinion on the relative ability and willingness of an issuer to

make timely payments on specific debt or related obligations over the life of the

instrument.

-CARE rates rupee denominated debt of Indian companies and Indian

subsidiaries of multinational companies.

-CARE undertakes credit rating of all types of debt and related obligations (all types of

medium and long term debt securities such as debentures, bonds and convertible bonds

and all types of short term debt and deposit obligations such as commercial paper, inter-

corporate deposits, fixed deposits and certificates of deposits).

-CARE also rates quasi-debt obligations such as the ability of insurance

companies to meet policyholders obligations.

-CARE's preference share ratings measure the relative ability of a

company to meet its dividend and redemption commitment

Investment Information and Credit Rating

Agency of India

In addition to being a leading credit rating agency with expertise in virtually

every sector of the Indian economy, ICRA has broad-based its services for the

corporate and financial sectors, both in India and overseas, and currently

offers its services under the following banners:

–Rating Services Information.

–Grading and Research Services.

–Advisory Services.

–Economic Research Outsourcing.

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- 12th Commerce Book Keeping AccountancyDocumento24 pagine12th Commerce Book Keeping AccountancypriyankamahaleNessuna valutazione finora

- Net Test Sample PaperDocumento40 pagineNet Test Sample PaperZenith Education67% (3)

- Legal and Regulatory Environment of Mutual Funds inDocumento12 pagineLegal and Regulatory Environment of Mutual Funds inpriyankamahaleNessuna valutazione finora

- LeasingDocumento44 pagineLeasingpriyankamahale100% (5)

- Marketing Channel Strategy and ManagementDocumento38 pagineMarketing Channel Strategy and ManagementpriyankamahaleNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

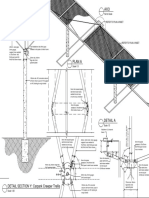

- TrellisDocumento1 paginaTrellisCayenne LightenNessuna valutazione finora

- Meriam Mfc4150 ManDocumento40 pagineMeriam Mfc4150 Manwajahatrafiq6607Nessuna valutazione finora

- Student Exploration: Digestive System: Food Inio Simple Nutrien/oDocumento9 pagineStudent Exploration: Digestive System: Food Inio Simple Nutrien/oAshantiNessuna valutazione finora

- Grade 9 WorkbookDocumento44 pagineGrade 9 WorkbookMaria Russeneth Joy NaloNessuna valutazione finora

- TMPRO CASABE 1318 Ecopetrol Full ReportDocumento55 pagineTMPRO CASABE 1318 Ecopetrol Full ReportDiego CastilloNessuna valutazione finora

- M.Plan SYLLABUS 2022-24Documento54 pagineM.Plan SYLLABUS 2022-24Mili DawsonNessuna valutazione finora

- Innovativ and Liabl :: Professional Electronic Control Unit Diagnosis From BoschDocumento28 pagineInnovativ and Liabl :: Professional Electronic Control Unit Diagnosis From BoschacairalexNessuna valutazione finora

- Packet Unit 3 - Atomic Structure-Answers ChemistryDocumento11 paginePacket Unit 3 - Atomic Structure-Answers ChemistryMario J. KafatiNessuna valutazione finora

- Rare Malignant Glomus Tumor of The Esophagus With PulmonaryDocumento6 pagineRare Malignant Glomus Tumor of The Esophagus With PulmonaryRobrigo RexNessuna valutazione finora

- Freshers Jobs 26 Aug 2022Documento15 pagineFreshers Jobs 26 Aug 2022Manoj DhageNessuna valutazione finora

- Health and Safety For The Meat Industry: Guidance NotesDocumento198 pagineHealth and Safety For The Meat Industry: Guidance NotesPredrag AndjelkovicNessuna valutazione finora

- Process Strategy: Powerpoint Slides by Jeff HeylDocumento13 pagineProcess Strategy: Powerpoint Slides by Jeff HeylMuizzNessuna valutazione finora

- The BetterPhoto Guide To Creative Digital Photography by Jim Miotke and Kerry Drager - ExcerptDocumento19 pagineThe BetterPhoto Guide To Creative Digital Photography by Jim Miotke and Kerry Drager - ExcerptCrown Publishing GroupNessuna valutazione finora

- Calculus HandbookDocumento198 pagineCalculus HandbookMuneeb Sami100% (1)

- Ac1025 Exc16 (1) .PDFTTTTTTTTTTTTTTTTTTTDocumento50 pagineAc1025 Exc16 (1) .PDFTTTTTTTTTTTTTTTTTTTHung Faat ChengNessuna valutazione finora

- Vedic Maths Edited 2Documento9 pagineVedic Maths Edited 2sriram ANessuna valutazione finora

- AcousticsDocumento122 pagineAcousticsEclipse YuNessuna valutazione finora

- Water Tanker Check ListDocumento8 pagineWater Tanker Check ListHariyanto oknesNessuna valutazione finora

- Catálogo MK 2011/2013Documento243 pagineCatálogo MK 2011/2013Grupo PriluxNessuna valutazione finora

- Britannia Volume 12 Issue 1981 (Doi 10.2307/526240) Michael P. Speidel - Princeps As A Title For 'Ad Hoc' CommandersDocumento8 pagineBritannia Volume 12 Issue 1981 (Doi 10.2307/526240) Michael P. Speidel - Princeps As A Title For 'Ad Hoc' CommandersSteftyraNessuna valutazione finora

- Jurnal Ekologi TerestrialDocumento6 pagineJurnal Ekologi TerestrialFARIS VERLIANSYAHNessuna valutazione finora

- Le Chatelier's Principle Virtual LabDocumento8 pagineLe Chatelier's Principle Virtual Lab2018dgscmtNessuna valutazione finora

- 01 - A Note On Introduction To E-Commerce - 9march2011Documento12 pagine01 - A Note On Introduction To E-Commerce - 9march2011engr_amirNessuna valutazione finora

- Centrifuge ThickeningDocumento8 pagineCentrifuge ThickeningenviroashNessuna valutazione finora

- War at Sea Clarifications Aug 10Documento4 pagineWar at Sea Clarifications Aug 10jdageeNessuna valutazione finora

- Power System Planning and OperationDocumento2 paginePower System Planning and OperationDrGopikrishna Pasam100% (4)

- AFAR - 07 - New Version No AnswerDocumento7 pagineAFAR - 07 - New Version No AnswerjonasNessuna valutazione finora

- List of The Legend of Korra Episodes - Wikipedia PDFDocumento27 pagineList of The Legend of Korra Episodes - Wikipedia PDFEmmanuel NocheNessuna valutazione finora

- Homework 1Documento8 pagineHomework 1Yooncheul JeungNessuna valutazione finora