Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

PNX Foo - Application To Purchase

Caricato da

yamaleihsTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

PNX Foo - Application To Purchase

Caricato da

yamaleihsCopyright:

Formati disponibili

Underwriters /Selling Agents Control #:

APPLICATION TO PURCHASE

1st Copy Registrar

2nd Copy Underwriter / Selling Agent

3rd Copy Applicant

P-H-O-E-N-I-X Petroleum Philippines, Inc.

Offer for Subscription of up to 20,000,000 Preferred Shares consisting of 10,000,000 cumulative, non-voting,

non-participating, non-convertible, Philippine peso-denominated, Perpetual Preferred shares with an

Oversubscription Option for up to an additional 10,000,000 Preferred Shares having the same features

at an Offer Price of P100.00 per preferred share

This Application to Purchase (Application) is an application to subscribe to P-H-O-E-N-I-X Petroleum Philippines, Inc. (PPPI or the Company) Series 3A and 3B Preferred Shares (the Shares). Capitalized terms used herein shall have the

meanings ascribed to them in the Prospectus of PPPI dated November 26, 2015 (Prospectus).

This Application, in triplicate copies, together with full payment and all required attachments listed on the reverse side of this form, must be received by (i) a Joint Lead Underwriter (Underwriter) not later than 12 noon, Manila Time on the last day of

the Offer Period, or (ii) a selling agent appointed by the Underwriter (Selling Agent) not later than 12 noon Manila Time on December 11, 2015. Applications received thereafter, improperly or incompletely accomplished or without the required

documents and/or full payments will be rejected. The Company, through the Underwriters, shall have the unrestricted and unqualified right to accept or reject any Application. Applications shall be considered irrevocable upon submission to any

Underwriter or Selling Agent, and shall be subject to the terms and conditions of the Offer as stated in the Prospectus and in this Application. Applicants are advised to read the Prospectus before subscribing to the Shares. Copies of the Prospectus are

available through any of the Underwriters and Selling Agents, throughout the Offer Period during business hours. Applicants may also obtain copies of the Prospectus from the Company at Stella Hizon Reyes Road, Bo. Pampanga, Lanang, Davao,

Philippines, +6382 235 8888 or from www.phoenixfuels.ph.

Name of Applicant: (Last, First, M.I / Business Name)* Type of Investor:

I/ we hereby irrevocably apply to subscribe to the following number of Shares, subject to the terms and conditions set out in the Prospectus:

Series Amount of Shares Applied For Number of Shares TOTAL SUBSCRIPTION AMOUNT (Total Number of

Shares x Offer Price per Share)

0 Series 3A __________________________________________________ __________________________________________________

0 Series 3B __________________________________________________ __________________________________________________

(Number of Shares for each Subseries must be a minimum of Five Hundred (500) Shares, and thereafter, in multiples of one hundred (100) Shares. The subscription and/or purchase of

the Shares shall become effective only upon the issuance of the Shares.)

Mode of Payment for the Shares:

0 RTGS

0 Debit peso current/savings account number ______________________ _______________ with ___________ _____________ branch ____________________

Regular Bank Check-Metro Manila clearing Managers/Cashiers/Corporate/Personal Check drawn against a bank account with a BSP-authorized agent bank in Metro Manila and dated as of submission of this

0

Application covering the entire number of Shares covered by this Application. Please issue check payable to Phoenix Preferred Shares Offer. Please provide check details as follows :

Drawee Bank _______________________________ Check No. ________________________ Amount _________________________________________________________

Permanent Address:* Present Mailing Address (if different from Permanent Address):*

Telephone Number/s: Email Address (Please fill-in only if you specifically consent to e-mail communications in receiving notices,

statements or other communications. Provisions on Communications under this Application and in the Terms &

Fax Number/s: Conditions will apply):

Primary Contact Person (if other than Applicant): Relationship to Applicant:

Date of Birth / Incorporation (mm/dd/yyyy):* Place of Birth / Incorporation:*

Nationality:* Tax Identification Number:*

Nature of Work or Business:* Name of Employer/ Business:*

Sources of income:* Tax Status:

0 Taxable 0 Reduced Tax Treaty of %**

** Subject to submission of documentary proof of exemption or

0 Tax Exempt**

reduced taxation, as applicable.

Statement, Notices & Correspondence Delivery Mode:

0 Send to email address indicated above

0 Delivery via courier (Metro Manila area only) or registered mail to mailing address indicated above.

If a Corporation, please fill up Additional Required Information: (Please use additional sheets if necessary.)

Name of Parent Company, if Any:

Names of Directors:* Name of Stockholders Owning at Least 2% of the Authorized Capital Stock:*

Name of Beneficial Owners of Applicant, if any:* Address of Beneficial Owner:

* Required to be filled up under Republic Act No. 9160, Republic Act No. 9194 and BSP Circular Nos. 251, 253 and 279, and all other amendatory and implementing law, regulation, jurisprudence, notice or order of any Philippine governmental body relating

thereto.

FORM, TITLE AND REGISTRATION OF THE PREFERRED SHARES

The Shares will be issued in scripless form through the electronic book-entry system of BDO Unibank, Inc. Trust and Investments Group ( Registrar) as registrar for the Offer, and lodged with the Philippine Depository and Trust Corporation (PDTC)

as depository agent on listing date through PSE trading participants nominated by the Applicants. For this purpose, please provide in the space below the name of the PSE trading participant under whose name the Shares will be registered. THE

ISSUANCE OF THE SHARES SHALL BE SUBJECT TO CERTAIN CONDITIONS PRESCRIBED HEREIN, WITHOUT PREJUDICE TO THE RIGHT OF THE JOINT LEAD UNDERWRITERS TO REJECT OR SCALE DOWN EACH APPLICATION ON

BEHALF OF PPPI.

Name of Nominated PSE Trading Participant: ________________________________________________________

TO BE COMPLETED BY PSE TRADING PARTICIPANT

We confirm that we are a PSE Trading Participant and that the Applicant(s) named in this Application is our bona fide client and

we have done the necessary know-your-customer procedures to verify the identity of our client.

_________________________________________

Authorized Signatory(ies)

PDTC Participant Code ___________________________

PDTC Participant Sub-Account Code: ________________

Upon listing of the Shares, Applicants may request BDO Unibank, Inc. Trust and Investments Group, through their nominated PSE Trading Participants, to (a) open a scripless registry account and have their holdings of the Shares registered under

their name (name-on-registry account), or (b) issue stock certificates evidencing their holdings of Shares. Any expense to be incurred in relation to such registration or issuance shall be for the account of the requesting Applicant.

I/we hereby represent and warrant that I/ we have read and understood the Prospectus, the terms and conditions of both this Application and the Shares, and I/ we unconditionally accept such terms and conditions. Furthermore, I/ we warrant that I/we

possess the requisite legal capacity to enter into the purchase transaction contemplated by this Application and that all information provided herein and in the required attachments to this Application are true and correct. I/we understand that no person

has been authorized to give information or to make any representation with respect to the Shares other than those specified in the Prospectus. In executing this Application, the Applicant represents and warrants, under penalty of law, that all information

contained herein (including its tax status) and the required attachments are true and correct and that the signatures thereon are genuine, properly authorized, and obtained without use of fraud, coercion or any other vice of consent. The Applicant

agrees to immediately notify the Company and the Registrar, either directly or through the Underwriters or Selling Agent, if anything occurs which renders or may render untrue or incorrect in any respect any of the information given herein (including

information given with respect to the Applicants tax status) or any of its representations or warranties. The Applicant understands that the Underwriter, the Registrar and the Company will rely solely on its representations and warranties set forth herein

including, without limitation, its declaration of its tax status, and, if applicable, its tax-exempt status in processing payments due to it under the Shares. The Applicant agrees to indemnify and hold the Underwriter, the Registrar, and the Company free

and harmless against any and all claims, actions, suits, damages, and liabilities resulting from the non-withholding of the required tax due to the representations as indicated in this Application, any misrepresentation contained herein or any reliance on

the confirmations contained herein. The Applicant likewise authorizes the Registrar to verify the information stated in this Application from any and all sources and in any and all manner, including but not limited to, requesting information contained

herein from the Underwriter regarding the Applicants account/s with the said Underwriter. By giving authority to the Registrar and by signing this application, the Applicant hereby waives its right to privacy of information or confidentiality that may exist

by law or by contract, solely and exclusively for the limited purpose of enabling the Registrar to update the information contained herein. The Applicant also agrees to be bound by the rules and procedures of the Registrar. The Applicant further agrees

that the completion of this Application constitutes an instruction and authority from the Applicant to the Company and/or Underwriter to execute any application form or other documents and generally to do all such other things and acts as the Company

and/or Underwriter may consider necessary or desirable to effect registration of the Shares in the name of the Applicant.

APPLICANTS FULL NAME/NAME(S) OF AUTHORIZED SIGNATORY/IES (IN PRINT): __________________________________________

APPLICANTS SIGNATURE(S): __________________________________________

NOT TO BE FILLED UP BY APPLICANT

ACKNOWLEDGMENT AND ACCEPTANCE

Underwriters / Selling Agents Certification/Endorsement:

We received this Application, with all the required attachments below, at ______ a.m. / p.m. on ________________________________________.

We hereby warrant that: (a) The necessary know-your-client process was conducted on the Applicant pursuant to the Anti-Money Laundering Act and the amendments thereto ("AMLA") as well as its implementing rules and regulations ("IRR") and our

own internal policies; (b) The identity of the Applicant was duly established pursuant to the AMLA and its IRR; (c) To the best of the undersigneds knowledge, all information provided to the Company and the Registrar regarding the Applicant are true,

complete, current and correct; and (d) The Applicants signature contained herein is genuine and authentic and was executed freely and voluntarily.

Application received by: ______________________________________________________ Application accepted and approved by: ______________________________________________________

Name of Underwriter / Selling Agent: ______________________________________________________ Total Number of Shares: ______________________________________________________

Signature of Underwriter / Selling Agent: ______________________________________________________ Total Subscription Price: ______________________________________________________

Amount of refund, if any: ______________________________________________________

By: ______________________________________________________

Date: ______________________________________________________

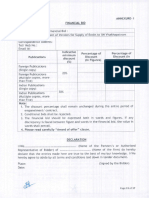

CERTAIN RELEVANT INFORMATION CONCERNING THE OFFERING OF THE SERIES 3A and 3B PREFERRED SHARES

Unless otherwise expressly stated or the context provides otherwise, all terms used herein shall have the meaning ascribed to them in the Prospectus. The information set forth below is only a summary of certain terms of the Offer and the Shares and such information is qualified by

the Prospectus in every respect. Applicants wishing to subscribe to the Shares should read the Prospectus. No Underwriter or any other person has been authorized by the Company and the Underwriters to give any information or to make any representation in respect of the Offer.

THE OFFER. PPPI, through the Joint Lead Underwriters, is conducting a Follow-on Offering and thereby offering for subscription up to 20,000,000 Preferred Shares (the Offer). The Shares will be issued in two (2) series: Series 3A (PNX3A) and Series 3B (PNX3B).

OFFER PRICE. The Shares are being offered at a price of P100.00 per share.

OFFER PERIOD. The offer period shall commence on December 7, 2015 at 9 a.m. and end on December 11, 2015 at 12 noon (the Offer Period). PPPI and the Joint Lead Underwriters reserve the right to extend or terminate the Offer Period with the approval of the SEC and the PSE.

DIVIDEND RATE. As and if cash dividends are declared by the Board of Directors of the Company (the Board), cash dividends on the Shares shall be paid at fixed rates of (i) Series 3A (PNX3A): 7.4278% per annum; and (ii) Series 3B (PNX3B): 8.1078% per annum, in all cases calculated in respect of

each Share by reference to the Offer Price thereof in respect of each Dividend Period (each, the Dividend Rate for the relevant series).

DIVIDEND RATE STEP-UP. Unless the Offer Shares are redeemed by the Company, the Dividend Rate will be adjusted as follows:

For Series 3A (PNX3A): the Dividend Rate plus 2.00% per annum on the 5th anniversary of the Listing Date; and

For Series 3B (PNX3B): the Dividend Rate plus 2.00% per annum on the 7th anniversary of the Listing Date.

DIVIDEND PAYMENT DATES. Subject to limitations set out in the Prospectus, cash dividends on the Shares will be payable once for every Dividend Period on such date set by the Board at the time of declaration of such dividends (each a Dividend Payment Date) in accordance with the terms and

conditions of the Shares., A Dividend Period shall refer to the period commencing on the Issue Date and having a duration of three (3) months and thereafter, each of the successive periods of three (3) months commencing on the last day of the immediately preceding Dividend Period up to but

excluding the first day of the immediately succeeding Dividend Period. Subject to limitations described in this Prospectus, dividends on the Offer Shares shall be payable on March 18, June 18, September 18 and December 18 of each year (each a Dividend Payment Date).

The dividends on the Shares shall be calculated on a 30/360-day basis and shall be paid quarterly in arrears on the last day of each 3-month Dividend Period based on the Offer Price calculated in respect of each share for each Dividend Period, as and if declared by the Board.

If the Dividend Payment Date is not a Banking Day, dividends shall be paid on the next succeeding Banking Day, without adjustment as to the amount of dividends to be paid.

OPTIONAL REDEMPTION DATE. As and if declared by the Board, the Company may redeem the Shares as follows:

For Series 3A (PNX3A): on the third (3rd) anniversary of the Listing Date; and

For Series 3B (PNX3B): on the fifth (5th) anniversary of the Listing Date

(the Optional Redemption Date) or on any Dividend Payment Date thereafter subject to a minimum of ninety (90) days written notice to all holders of the Shares prior to the Optional Redemption Date, at a redemption price equal to the Offer Price of P100.00 per share plus accrued and unpaid dividends

for all dividend periods, if any, up to the date of actual redemption by the Company.

EARLY REDEMPTION DUE TO TAXATION. PPPI may also redeem the Shares, in whole but not in part, on any Dividend Payment Date at the Offer Price of One Hundred Pesos (P100.00) per share plus all accrued and unpaid dividends, if any if dividend payments become subject to additional or

increased tax or any new tax as a result of certain changes in law, rule or regulation or accounting standards, or in the interpretation thereof, and such change cannot be avoided by the use of lawful measures available to PPPI: Provided, that notice must be given to all holders of the Shares at least thirty

(30) days but not more than sixty (60) days prior to the Redemption Date.

MINIMUM SUBSCRIPTION. Each Application must be for a minimum of 500 Shares, and thereafter, in multiples of 100 Shares. No Application for multiples of any other number of Shares will be considered.

ELIGIBLE INVESTORS. The Shares may be purchased, owned or subscribed to by any natural person of legal age, or any corporation, association, partnership, trust account, fund or other entity. Due to the constitutional limit on foreign ownership applicable to the Company, foreign shareholdings in the

Company cannot exceed forty percent (40%) of the issued and outstanding capital stock thereof. The Company reserves the right to reject or scaledown ATPs received from foreign applicants if acceptance of such ATPs will result in a violation by the Company of foreign ownership restrictions applicable to

it.

PROCEDURE FOR APPLICATION. All applications to purchase the Shares shall be evidenced by this Application duly executed in each case by the Applicant or an authorized signatory thereof, as the case may be, and accompanied by the corresponding payment for the Shares covered by this

Application and all other required documents enumerated below under the heading Required Attachments to this Application. The duly executed Application and required documents should be submitted to the Underwriters at or prior to 12 noon Manila time on the last day of the Offer Period, or to the

Selling Agents at or prior to 12 noon Manila time of December 11, 2015.

PAYMENT TERMS. The Shares must be paid in full.

ACCEPTANCE/REJECTION OF APPLICATIONS. The actual number of the Shares that an Applicant will be allowed to subscribe to is subject to the confirmation of the Underwriters. The Company reserves the right to accept or reject, in whole or in part, or to reduce any application due to any

grounds specified in the Underwriting Agreement to be entered into by the Company and the Underwriters. Applications which were unpaid or where payments were insufficient and those that do not comply with the terms of the Offer shall be rejected. Moreover, any acceptance or receipt of payment

pursuant to this Application does not constitute approval or acceptance by PPPI of this Application. An Application, when accepted, shall constitute an agreement between the Applicant and PPPI for the subscription to the Shares at the time, in the manner and subject to terms and conditions set forth in this

Application and those described in the Prospectus for the Offer. Notwithstanding the acceptance of any Application by PPPI, the actual subscription by the Applicant for the Shares will become effective only upon listing of the Shares on the Exchange and upon the obligations of the Underwriters under the

Underwriting Agreement becoming unconditional and not being suspended, terminated or cancelled on or before the Listing Date in accordance with the provision of said agreement.

REFUND OF PAYMENTS DUE TO SCALE DOWN OR REJECTION. In the event that the number of the Shares to be allotted to an Applicant, as confirmed by an Underwriter or Selling Agent, is less than the number covered by its Application, or if an Application is wholly or partially rejected by PPPI, then

PPPI shall refund, without interest, within five (5) Banking Days from the end of the Offer Period, all or the portion of the payment corresponding to the number of the Shares wholly or partially rejected. All refunds shall be made through the Underwriter or Selling Agent with whom the Applicant has filed this

Application at the risk of the Applicant.

REGISTRATION AND LODGEMENT OF SHARES WITH BDO-TIG AND PDTC. Once the Shares are listed on the PSE, the Shares will be issued in scripless form through the electronic book-entry system of BDO Unibank, Inc. Trust and Investments Group as registrar for the Offer (the

Registrar). Upon approval by the PSE of the Companys listing application, the Shares shall be lodged with PDTC as Depository Agent on Listing Date through PSE Trading Participants nominated by the Applicants. After Listing Date, shareholders may request the Registrar, through their

nominated PSE Trading Participant, to (a) open a scripless registry account and have their holdings of the Shares registered under their name, or (b) issue stock certificates evidencing their investment in the Shares. Any expense that will be incurred in relation to such registration or issuance shall be for

the account of the requesting shareholder.

LIQUIDATION RIGHTS. In the event of a return of capital in respect of the liquidation, dissolution or winding up of the affairs of PPPI but not on a redemption or purchase by PPPI of any of its share capital, the holders of the Shares at the time outstanding will be entitled to receive in Pesos out of the

assets of PPPI available for distribution to shareholders, together with the holders of any other of the PPPIs shares ranking, as regards repayment of capital, pari passu with the Shares and before any distribution of assets is made to holders of any class of the shares of PPPI ranking after the Shares as

regards repayment of capital, liquidating distributions in an amount equal to the Offer Price of the Shares plus an amount equal to any dividends declared but unpaid in respect of the previous dividend period, and any accrued and unpaid dividends for the then current dividend period up to (and including) the date

of commencement of the winding up of PPPI or the date of any such other return of capital, as the case may be. If, upon any return of capital in respect of the winding up of PPPI, the amount payable with respect to the Shares and any other shares of PPPI ranking as to any such distribution pari passu

with the Shares are not paid in full, the holders of the Shares and of such other shares will share ratably in any such distribution of the assets of PPPI in proportion to the full respective preferential amounts to which they are entitled. After payment of the full amount of the liquidating distribution to which they

are entitled, the holders of the Shares will have no right or claim to any of the remaining assets of PPPI and will not be entitled to any further participation or return of capital in a winding up.

SELLING AND TRANSFER RESTRICTIONS. After listing, the subsequent transfers of interests in the Shares shall be subject to normal selling restrictions for listed securities as may prevail in the Philippines from time to time.

LEGAL TITLE. Legal title to the Shares will be shown in an electronic register of shareholders (the Registry of Shareholders) which shall be maintained by the Registrar. The Registrar shall send a transaction confirmation advice confirming every receipt or transfer of the Shares that is effected in

the Registry of Shareholders (at the cost of the requesting shareholder). The Registrar shall send (at the cost of the Company) at least once every year a Statement of Account to all shareholders named in the Registry of Shareholders, except certificated shareholders and depository participants,

confirming the number of Shares held by each shareholder on record in the Registry of Shareholders. Such Statement of Account shall serve as evidence of ownership of the relevant shareholder as of a given date thereof. Any request by the shareholders for certifications, reports or other documents from

the Registrar, except as provided herein, shall be for the account of the requesting shareholder.

COMMUNICATIONS. The Applicant acknowledges that the Registrar does not guarantee the security of any notice, statement, or other communication transmitted through electronic means, and, thus, agrees that the Registrar is not liable for the complete and timely transmission thereof. The

Applicant agrees to indemnify the Registrar from and against all actions, claims, demands, liabilities, obligations, losses, damages, costs (including without limitation, interest and reasonable legal fees) and expenses of whatever nature (whether actual or contingent) suffered, incurred or threatened against

the Registrar arising from or in connection with electronic transmission of information. By indicating the email address/es in this Application, the Applicant, including its successors or assigns, consent to receive notices and communications via email, and such consent shall operate as a waiver of the

Applicants right and privilege to the secrecy of bank deposits in respect of such statements/notices. The Applicant assumes all risks in relation to the transmission of any electronic communication transmitted to the Applicant and agrees that it shall have no recourse to the Registrar for any liability or

damage arising from or in connection with electronic transmission of information in respect of the Shares, unless said liability or damage was caused by the Registrar's fraud, evident bad faith, gross negligence or wilful omission. The Registrar is not responsible for monitoring and re-sending rejected

electronically transmitted statements, notices and communications. Requests for resending and/or for additional statements, notices and/or advices shall be for the account of the Applicant. Transmittal of statements shall be in the frequency as stipulated by the Company.

FEES. The Applicant understands and agrees that any transaction on the Shares which utilizes other services of the Registrar and/or any service provider, as the case may be, may be subject to such fees and charges for which the Applicant or its counterparty may be accountable. A copy of the

schedule of such fees is available from the appropriate service provider.

BDO UNIBANK, INC. TRUST AND INVESTMENTS GROUP RULES. The Applicant shall hereby be bound by the registry rules and procedures of the Registrar, as the same may be amended from time to time.

OBLIGATIONS LIMITED. The duties and obligations of the Underwriters shall be determined solely by the express provisions of this Application and the Underwriters shall not be liable except for the performance of their duties and obligations specifically set forth herein. The Underwriters make no

representation or warranty nor assumes any obligation and shall be subject to no obligation or liability whatsoever under this Application to the Applicant or any other person, except that the Underwriters agree to perform such obligations and duties as are specifically set forth and undertaken by it herein

without gross negligence or wilful misconduct. No implied covenants or obligations shall be read into this Application against the Underwriters. The Underwriters make no representation or warranty regarding the Company.

INDEMNITY CLAUSE. Each Applicant agrees to indemnify and hold the Company and the Underwriters, their subsidiaries, affiliates, directors, officers and stockholders free and harmless from any and all losses, claims, damages, liabilities and expenses, or actions with respect thereto, arising out

of or by virtue of any breach or alleged breach of the Applicants representations, warranties or covenants, or any other matter related to the Offer. This indemnity undertaking of each Applicant shall survive and remain in full force and effect notwithstanding completion of the Offer and the complete

performance of the other terms and conditions of this Application.

GOVERNING LAW. The Shares will be issued pursuant to the laws of the Republic of the Philippines.

THE SHARES AND THIS APPLICATION ARE GOVERNED BY, AND SUBJECT TO THE TERMS AND CONDITIONS HEREOF, AS WELL AS THOSE DESCRIBED IN THE PROSPECTUS.

REQUIRED ATTACHMENTS TO THIS APPLICATION

IF THE APPLICANT IS A CORPORATION, PARTNERSHIP OR TRUST ACCOUNT:

(a) a certified true copy of the Applicants latest Articles of Incorporation and By-laws and other constitutive documents, each as amended to date, duly certified by the corporate secretary;

(b) a certified true copy of the Applicants SEC Certificate of Registration or Certificate of Incorporation, duly certified by the corporate secretary; and

(c) a duly notarized corporate secretarys certificate setting forth the resolution of the Applicants board of directors or equivalent body authorizing (i) the purchase of the Shares indicated in this Application, and (ii) the designated signatories for the purpose, including their respective

specimen signatures.

(d) two (2) duly accomplished signature cards per signatory containing the specimen signatures of the Applicants authorized signatories, validated by its corporate secretary or by an equivalent officer/s who is/are authorized signatory/ies, and further validated/signed by the

Underwriter/ Selling Agents authorized signatory/ies whose authority/ies and specimen signatures have been submitted to BDO-TIG.

IF THE APPLICANT IS A NATURAL PERSON:

(a) Identification documents of the Applicant;

(b) Two (2) duly accomplished signature cards containing the specimen signature of the Applicant, validated / signed by the Underwriter / Selling Agents authorized signatory/ies, whose authority/ies and specimen signatures have been submitted to BDO-TIG; and

(c) Such other documents as may be reasonably required by the Underwriter(s) / Selling Agent(s) in implementation of its internal policies regarding know your customer and anti-money laundering.

IDENTIFICATION DOCUMENTS SHALL CONSIST OF:

Any one (1) of the following valid identification documents bearing a recent photo and signature, and which is not expired: passport, drivers license, Professional Regulation Commission ID, National Bureau of Investigation clearance, police clearance, postal ID, voters ID, barangay

verification, Government Service Insurance System e-card, Social Security System card, senior citizen card, Overseas Workers Welfare Administration ID, OFW ID, seamans book, Alien Certification of Registration/Immigrant Certificate of Registration, government office and GOCC ID

(e.g. Armed Forces of the Philippines ID), Home Development Mutual Fund ID, National Council for the Welfare of Disabled Persons certification, Department of Social Welfare and Development certification, Integrated Bar of the Philippines ID, company IDs issued by private entities or

institutions registered with or supervised or regulated either by the Bangko Sentral ng Pilipinas, SEC or Insurance Commission.

Applicants claiming exemption or preferential rate from any applicable tax shall also be required to submit the following documentary proof of its tax-exempt or preferential status together with this Application:

(a) BIR Form No. 0901-D duly filed with the Bureau of Internal Revenue;

(b) A certified true copy of the original tax exemption certificate, ruling or opinion issued by the Bureau of Internal Revenue on file with the Applicant as certified by its duly authorized officer;

(c) With respect to tax treaty relief, proofs to support applicability of reduced tax treaty rates, consularized proof of tax domicile issued by the relevant tax authority of the holder of the Shares, and original or SEC-certified true copy of the SEC confirmation that the relevant entity is not

doing business in the Philippines;

(d) An original of the duly notarized undertaking declaring and warranting its tax exempt status, undertaking to immediately notify the Company and the Registrar of any suspension or revocation of its tax exempt status and agreeing to indemnify and hold the Company and the Registrar

free and harmless against any claims, actions, suits, and liabilities resulting from the non-withholding or reduced withholding of the required tax; and

(e) Such other documentary requirements as may be required under the applicable regulations of the relevant taxing or other authorities.

Unless properly provided with satisfactory proof of the tax-exempt status of an Applicant, the Registrar may assume that said Applicant is taxable and proceed to apply the tax due on the Shares. Notwithstanding the submission by the Applicant, or the receipt by the Company or any of

its agents, of documentary proof of the tax-exempt status of an Applicant, the Company may, in its sole and reasonable discretion, determine that such Applicant is taxable and require the Registrar to proceed to apply the tax due on the Shares. Any question on such determination shall

be referred to the Company.

Potrebbero piacerti anche

- Note Brokering for Profit: Your Complete Work At Home Success ManualDa EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNessuna valutazione finora

- Loan Checklist: Everything You Need for Your ApplicationDocumento5 pagineLoan Checklist: Everything You Need for Your Applicationkhalid khayNessuna valutazione finora

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyDa EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNessuna valutazione finora

- OCP Bacoor Citizen's Charter outlines servicesDocumento4 pagineOCP Bacoor Citizen's Charter outlines servicesRusty Nomad100% (1)

- OCP Bacoor Citizen's Charter outlines servicesDocumento4 pagineOCP Bacoor Citizen's Charter outlines servicesRusty Nomad100% (1)

- Appointment of Executor or AdministratorDocumento5 pagineAppointment of Executor or AdministratoryamaleihsNessuna valutazione finora

- PDIC Property OfferDocumento2 paginePDIC Property OfferElizabeth LabisNessuna valutazione finora

- The Top 100 Interview Questions For LawyersDocumento4 pagineThe Top 100 Interview Questions For Lawyersyamaleihs100% (1)

- Housing Co Operative Societies 946 PDFDocumento32 pagineHousing Co Operative Societies 946 PDFArchana SahaNessuna valutazione finora

- Republic of The Philippines Regional Trial Court Tarlac City Branch - Roberto Sentry R. ReynaldoDocumento4 pagineRepublic of The Philippines Regional Trial Court Tarlac City Branch - Roberto Sentry R. ReynaldoIngrid Frances CalmaNessuna valutazione finora

- Concubinage, Adultery, BigamyDocumento13 pagineConcubinage, Adultery, BigamyMichael Datucamil100% (1)

- Manual For ProsecutorsDocumento51 pagineManual For ProsecutorsArchie Tonog0% (1)

- Manual For ProsecutorsDocumento51 pagineManual For ProsecutorsArchie Tonog0% (1)

- Pilar Sorsogon Bpls-FormDocumento4 paginePilar Sorsogon Bpls-FormKevin Albert Dela CruzNessuna valutazione finora

- Final Prospectus Dated October 16 2014Documento168 pagineFinal Prospectus Dated October 16 2014yamaleihsNessuna valutazione finora

- Win Business In All Three Levels of Canadian GovernmentDa EverandWin Business In All Three Levels of Canadian GovernmentNessuna valutazione finora

- DIFFERENCE BETWEEN PD 1529 AND PUBLIC LAND ACTDocumento28 pagineDIFFERENCE BETWEEN PD 1529 AND PUBLIC LAND ACTFlorz GelarzNessuna valutazione finora

- READ - Use of A Pre-Trial BriefDocumento14 pagineREAD - Use of A Pre-Trial BriefHomelo Estoque100% (1)

- Annexure - Common Loan Application Form With Formats I, II and III-EnglishDocumento12 pagineAnnexure - Common Loan Application Form With Formats I, II and III-EnglishThe LoanWalaNessuna valutazione finora

- Ace any interview with these top questions and answersDocumento10 pagineAce any interview with these top questions and answersyamaleihs100% (1)

- Ace any interview with these top questions and answersDocumento10 pagineAce any interview with these top questions and answersyamaleihs100% (1)

- Ace any interview with these top questions and answersDocumento10 pagineAce any interview with these top questions and answersyamaleihs100% (1)

- Legal Research Process NotesDocumento3 pagineLegal Research Process NotesRyan Jhay YangNessuna valutazione finora

- Sps. Onesiforo Alinas Vs Sps. Victor AlinasDocumento3 pagineSps. Onesiforo Alinas Vs Sps. Victor AlinasKim Arizala100% (1)

- Gov. Larry Hogan's 'Stay at Home' Order 3.30.20Documento8 pagineGov. Larry Hogan's 'Stay at Home' Order 3.30.20WJZ89% (9)

- Criminal Review ExamDocumento13 pagineCriminal Review ExamEisley Sarzadilla-GarciaNessuna valutazione finora

- Teacher Related CasesDocumento20 pagineTeacher Related Casesyamaleihs100% (1)

- 37-BIR (1945) Certificate of Tax Exemption For CooperativeDocumento2 pagine37-BIR (1945) Certificate of Tax Exemption For CooperativeEditha Valenzuela67% (3)

- (G.R. NO. 151900: August 30, 2005) CHRISTINE CHUA, Petitioners, v. JORGE TORRES and ANTONIO BELTRAN, RespondentsDocumento2 pagine(G.R. NO. 151900: August 30, 2005) CHRISTINE CHUA, Petitioners, v. JORGE TORRES and ANTONIO BELTRAN, RespondentsJamiah Obillo HulipasNessuna valutazione finora

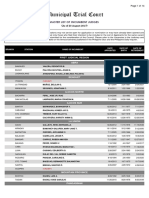

- Municipal Trial Court Master ListDocumento14 pagineMunicipal Trial Court Master ListciryajamNessuna valutazione finora

- Municipal Trial Court Master ListDocumento14 pagineMunicipal Trial Court Master ListciryajamNessuna valutazione finora

- Agency List With Branches 2018.8Documento3 pagineAgency List With Branches 2018.8Jayson Bernard SantosNessuna valutazione finora

- Notary Violated Rules by Not Verifying Signatories' IdentitiesDocumento1 paginaNotary Violated Rules by Not Verifying Signatories' IdentitiesAlvia Aisa MacacuaNessuna valutazione finora

- Great American: FORM TO FILL OUTDocumento8 pagineGreat American: FORM TO FILL OUTMax PowerNessuna valutazione finora

- Know Yor Customer - Addendum: (For Third Party Payment)Documento2 pagineKnow Yor Customer - Addendum: (For Third Party Payment)Shrikant GawhaneNessuna valutazione finora

- Reservation Agreement Form 2019 v1Documento3 pagineReservation Agreement Form 2019 v1mbriones.axaNessuna valutazione finora

- PlainPaper - 04-10-2021 11 - 42 - 39Documento3 paginePlainPaper - 04-10-2021 11 - 42 - 39Nilay KumarNessuna valutazione finora

- Disability Critical Illness Medical Reimbursement or Hospitalization Claim FormDocumento5 pagineDisability Critical Illness Medical Reimbursement or Hospitalization Claim FormAkoSiAudreyNessuna valutazione finora

- Change of Name EnglishDocumento2 pagineChange of Name EnglishdsfNessuna valutazione finora

- Annex UreDocumento8 pagineAnnex UreSiva PrasadNessuna valutazione finora

- SIP Facility Appl Form V 1Documento4 pagineSIP Facility Appl Form V 1DBCGNessuna valutazione finora

- Av Birla Sip FormDocumento1 paginaAv Birla Sip FormVikas RaiNessuna valutazione finora

- Common Transaction FormDocumento7 pagineCommon Transaction FormSSE CNCNessuna valutazione finora

- Electronic Payment (EP) Account Agreement: Things To Know Before You BeginDocumento4 pagineElectronic Payment (EP) Account Agreement: Things To Know Before You BeginandryNessuna valutazione finora

- Fuel Station Bid Form for Pakistan Railways SitesDocumento5 pagineFuel Station Bid Form for Pakistan Railways SitesMianZubairNessuna valutazione finora

- Assignment of Corporate Policy FormDocumento3 pagineAssignment of Corporate Policy FormjedNessuna valutazione finora

- Fcit Agrifin Sbci Proposal 0117 FinalDocumento4 pagineFcit Agrifin Sbci Proposal 0117 FinalwhitneyNessuna valutazione finora

- Name Change FormatDocumento2 pagineName Change FormatJaita MallickNessuna valutazione finora

- Lic Nomura MF Capital Protection Oriented Fund - Series 3: ARN-32141 E047160 M351Documento4 pagineLic Nomura MF Capital Protection Oriented Fund - Series 3: ARN-32141 E047160 M351iqbal100% (1)

- 1700203409_BID FORMSDocumento7 pagine1700203409_BID FORMSBu ManNessuna valutazione finora

- LPGApplication PDFDocumento17 pagineLPGApplication PDFAnkur MongaNessuna valutazione finora

- COBAC Sample FormsDocumento9 pagineCOBAC Sample FormsEm FernandezNessuna valutazione finora

- SIP Application FormDocumento3 pagineSIP Application FormspeedenquiryNessuna valutazione finora

- Association of Mutual Funds in India: Registration Form For CorporateDocumento5 pagineAssociation of Mutual Funds in India: Registration Form For CorporateManish SumanNessuna valutazione finora

- Applicant Information (If More Than One Applicant, Copy Form and Complete For Each)Documento1 paginaApplicant Information (If More Than One Applicant, Copy Form and Complete For Each)NoeNessuna valutazione finora

- Tender Form For Dematerialized Equity Shares Tcs Buyback 2018Documento2 pagineTender Form For Dematerialized Equity Shares Tcs Buyback 2018Ankit LatiyanNessuna valutazione finora

- HDFC Sip Nach FormDocumento6 pagineHDFC Sip Nach FormPraveen KumarNessuna valutazione finora

- SIP Form DebtDocumento6 pagineSIP Form DebtNilesh MahajanNessuna valutazione finora

- Form 1594777111Documento1 paginaForm 1594777111Evcillove Mangubat100% (1)

- Type (Please Check ) : Application For Accreditation As Marketer Philippine Retirement AuthorityDocumento2 pagineType (Please Check ) : Application For Accreditation As Marketer Philippine Retirement AuthorityFranco SalazarNessuna valutazione finora

- Amendment 4Documento3 pagineAmendment 4nehaNessuna valutazione finora

- Prulife UK Application FormDocumento9 paginePrulife UK Application FormjayarcyNessuna valutazione finora

- Pradhan Mantri Fasal Bima Yojna (Pmfby) : Bajaj Allianz General Insurance Company LimitedDocumento2 paginePradhan Mantri Fasal Bima Yojna (Pmfby) : Bajaj Allianz General Insurance Company LimitedRahulSinghNessuna valutazione finora

- Application Form 220319Documento6 pagineApplication Form 220319suppaman1984Nessuna valutazione finora

- Kori Engineering Credit Application FormDocumento6 pagineKori Engineering Credit Application Formaj.ngadaNessuna valutazione finora

- KYC For Beneficial Owner and Third Party PayorDocumento2 pagineKYC For Beneficial Owner and Third Party PayorCarolie BacatanoNessuna valutazione finora

- UTI Floater Fund Application FormDocumento8 pagineUTI Floater Fund Application FormsanjaydeNessuna valutazione finora

- W-8BEN Form for Foreign StatusDocumento1 paginaW-8BEN Form for Foreign StatusMd Abdur RahimNessuna valutazione finora

- Renewal Premium ChallanDocumento1 paginaRenewal Premium Challannagamma cNessuna valutazione finora

- Amc Copy: Enrolment FormDocumento4 pagineAmc Copy: Enrolment FormAhmad ZaibNessuna valutazione finora

- 2-Additional Information Form For ESCertDocumento5 pagine2-Additional Information Form For ESCertSrikar KolukuluriNessuna valutazione finora

- AMFI Registration For Overseas DistributorsDocumento9 pagineAMFI Registration For Overseas DistributorsShah RukhNessuna valutazione finora

- Debit Mandate FormDocumento4 pagineDebit Mandate FormAshishNessuna valutazione finora

- Change of NameDocumento4 pagineChange of Namekiranair4Nessuna valutazione finora

- Edeclaration of Source Funds FormDocumento2 pagineEdeclaration of Source Funds FormRaymond WilliamsNessuna valutazione finora

- FX Primus TerbaekDocumento1 paginaFX Primus TerbaekMaxx KidNessuna valutazione finora

- Application Form For Vendor Registration / Updation AS: "Supplier /service Provider"Documento7 pagineApplication Form For Vendor Registration / Updation AS: "Supplier /service Provider"DataNessuna valutazione finora

- One Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct DebitDocumento2 pagineOne Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct DebitAnand KopareNessuna valutazione finora

- SBI SIP ECS registration formDocumento1 paginaSBI SIP ECS registration formSsr RaoNessuna valutazione finora

- Ion FormDocumento1 paginaIon FormAbhijit DuttaNessuna valutazione finora

- Booking Form CP-1 (1)Documento2 pagineBooking Form CP-1 (1)R SampathNessuna valutazione finora

- Expression of Interest - ImperiaDocumento3 pagineExpression of Interest - ImperiacubadesignstudNessuna valutazione finora

- AGRICULTURE Loan Application FormDocumento9 pagineAGRICULTURE Loan Application FormKasipag LegalNessuna valutazione finora

- Bid Form MatexDocumento18 pagineBid Form Matexankit chauhanNessuna valutazione finora

- HSBC Authority To Remit FundDocumento2 pagineHSBC Authority To Remit FundRainer NagelNessuna valutazione finora

- Forms Janitorial RFQ No. 20-04-3111Documento31 pagineForms Janitorial RFQ No. 20-04-3111Rachel GudezNessuna valutazione finora

- DocumentaaaDocumento19 pagineDocumentaaayamaleihsNessuna valutazione finora

- Final Prospectus Pcor PDFDocumento229 pagineFinal Prospectus Pcor PDFyamaleihsNessuna valutazione finora

- Commonly Asked Interview Questions & Strategies To Answer ThemDocumento6 pagineCommonly Asked Interview Questions & Strategies To Answer ThemaasgroupNessuna valutazione finora

- Articles of Partnership General June2015Documento3 pagineArticles of Partnership General June2015Elaine Mari MuroNessuna valutazione finora

- Articles of Partnership General June2015Documento3 pagineArticles of Partnership General June2015Elaine Mari MuroNessuna valutazione finora

- 10 18Documento5 pagine10 18yamaleihsNessuna valutazione finora

- ALI P15 Billion Bonds Due 2024 Final ProspectusDocumento398 pagineALI P15 Billion Bonds Due 2024 Final ProspectusyamaleihsNessuna valutazione finora

- Preferred Shares FeaturesDocumento13 paginePreferred Shares FeaturesyamaleihsNessuna valutazione finora

- Preferred Shares Survey of FeaturesDocumento9 paginePreferred Shares Survey of FeaturesyamaleihsNessuna valutazione finora

- DigestDocumento2 pagineDigestyamaleihsNessuna valutazione finora

- Philippines establishes alternative dispute resolutionDocumento13 paginePhilippines establishes alternative dispute resolutionyamaleihsNessuna valutazione finora

- Pema LtiesDocumento1 paginaPema LtiesyamaleihsNessuna valutazione finora

- Sps Hing vs. ChoachuyDocumento14 pagineSps Hing vs. ChoachuyyamaleihsNessuna valutazione finora

- DocumentDocumento1 paginaDocumentyamaleihsNessuna valutazione finora

- Joint AO No. 1 S. 1993 IRR of RA 7394Documento7 pagineJoint AO No. 1 S. 1993 IRR of RA 7394yamaleihsNessuna valutazione finora

- Defamation Revised Final ReportDocumento11 pagineDefamation Revised Final ReportMarlon GregoryNessuna valutazione finora

- Barrido v. NonatoDocumento6 pagineBarrido v. NonatoCherish Kim FerrerNessuna valutazione finora

- United States v. Sixty Acres in Etowah County, Evelyn Charlene Ellis, 930 F.2d 857, 11th Cir. (1991)Documento7 pagineUnited States v. Sixty Acres in Etowah County, Evelyn Charlene Ellis, 930 F.2d 857, 11th Cir. (1991)Scribd Government DocsNessuna valutazione finora

- Arbitration AssignmentDocumento10 pagineArbitration AssignmentAlbert MsandoNessuna valutazione finora

- DILG Opinion No. 5, Series of 2018 (Jan 25, 2018) - Effectivity Vs Validity of OrdinancesDocumento1 paginaDILG Opinion No. 5, Series of 2018 (Jan 25, 2018) - Effectivity Vs Validity of OrdinancesJeoffrey Agnes Sedanza PusayNessuna valutazione finora

- Title of The Research Paper: Name of The Student Roll No. Semester: Name of The Program: 5 Year (B.A., LL.B. / LL.M.)Documento23 pagineTitle of The Research Paper: Name of The Student Roll No. Semester: Name of The Program: 5 Year (B.A., LL.B. / LL.M.)Roshan ShakNessuna valutazione finora

- Written Statement - 1 PDFDocumento4 pagineWritten Statement - 1 PDFMinazNessuna valutazione finora

- Bar Qs ('09-'12)Documento39 pagineBar Qs ('09-'12)Joy DalesNessuna valutazione finora

- Chapter 2 Quiz - Business LawDocumento3 pagineChapter 2 Quiz - Business LawRayonneNessuna valutazione finora

- Nda PMGDocumento5 pagineNda PMGKelvin ThengNessuna valutazione finora

- Chapter 5 OBLIGATIONS OF THE VENDEEDocumento6 pagineChapter 5 OBLIGATIONS OF THE VENDEEMarianne Hope VillasNessuna valutazione finora

- Luspo v. PeopleDocumento41 pagineLuspo v. PeopleRaine VerdanNessuna valutazione finora

- FALSE: Accusations On Atty. Chel Diokno of Disbarment Cases ClaimDocumento4 pagineFALSE: Accusations On Atty. Chel Diokno of Disbarment Cases ClaimPrincess Faye De La VegaNessuna valutazione finora

- MBA 101 - Internal & External Institution and Influences of Corp. GovDocumento2 pagineMBA 101 - Internal & External Institution and Influences of Corp. GovLouiene Morisey AcedilloNessuna valutazione finora

- Legal Aspects of Contract LawDocumento62 pagineLegal Aspects of Contract LawAARCHI JAINNessuna valutazione finora

- Cancel at Ion of Sale DeedDocumento61 pagineCancel at Ion of Sale DeedKooraju Raju100% (1)

- Rental Agreement of Infra SolutionDocumento3 pagineRental Agreement of Infra Solutionpraveen kittaNessuna valutazione finora

- CD 10Documento6 pagineCD 10jimmy victoriaNessuna valutazione finora