Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Obli Doctrines p3

Caricato da

Zarah JeanineCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

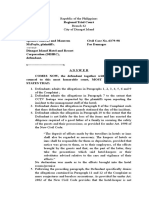

Obli Doctrines p3

Caricato da

Zarah JeanineCopyright:

Formati disponibili

SOLIDARITY MAY EXIST EVEN THOUGH DEBTORS ARE NOT

BOUND IN THE SAME MANNER AND FOR THE SAME PERIODS

UNDER THE SAME CONDITION

Article 1211 of the Civil Code

Solidarity may exist although the creditors and the debtors may not

be bound in the same manner and by the same periods and conditions

Debtors obligated themselves in solidum therefore creditor

can bring action to any of them

2nd Contract DOES NOT LEAD to conclusion that solidary

stipulation in 1st Contract is broken

An obligation to pay a sum of money is not novated in a

new instrument wherein the old is ratified, by changing

ONLY the term of the payment and adding other

obligations not incompatible with 1st Contract

AS TO SOLIDARITY OF CONTRACTS

Obligations are generally considered as joint except when

otherwise expressly stated or when the law or the nature

of the obligation requires solidarity.

However, obligations arising from tort are by nature always solidary.

In a joint obligation, each obligor answers only for his

part of the whole liability.

In a solidary obligation, the relationship between the

active and passive subjects is so close that each of them

must comply with or demand the fulfillment of the whole obligation.

Liability of Continental specific performance and tort

Liablility of Lim and Mariano only based on tort

Art. 1211 Solidarity may exist although the creditors and the

debtors may not be bound in the same manner and by the same

periods and conditions.

Art. 1222 A solidary debtor may, in actions filed by the creditor,

avaiil itself of all defenses which are derived from the nature of the

obligation and of those which are personal to him, or pertain to his

own share. With respect to those which personally belongs to

others, he may avail himself thereof only as regards that part of the

debt for which the latter are responsible.

ROGERO, ALTHOUGH JUST A SURETY FOR DAYANDANTE, WAS

BOUND SOLIDARILY WITH HIM THE IN THE PAYMENT OF OBLIGATION

Being a surety and a solidary creditor, Rogero was liable

for the FULL AMOUNT of obligation WITHOUT any right to

demand the exhaustion of the property of the principal

debtor previous to its payment

Position of Rogero, even just a surety, was exactly the same

as if she had been the principal debtor

MEANING OF JOINTLY AND SEVERALLY

It enables the creditor to sue any one of the debtors

or all together at pleasure

PAYMENTS BY 3rd PERSONS

Payment may be made by any person, whether he has an interest

in the performance of the obligation or not, and whether the

payment is known and approved by the debtor or whether he is

unaware of it. One who makes a payment for the account of

another may recover from the debtor the amount of the

payment, unless it was made against his express will. In the

latter case he can recover from the debtor only in so far as the

payment has been beneficial to him.

PAYMENTS AGAINST WILL OF DEBTOR

The provision in Art 1158, that the payor "may only recover

from the debtor insofar as the payment has been beneficial

to him," when made against his express will, is a defense

that may be availed of only by the debtor, not by the

Bank-creditor, for it affects solely the rights of the former.

In order that the rights of the payor may be subject to

said limitation, the debtor must oppose the payments

before or at the time the same were made,

not subsequently thereto.

The question whether the payments were beneficial or not

to the debtor, depends upon the law, not upon his will.

Joint obligation each of the debtors is liable only for a

proportionate part of the debt and each creditor is entitled only to a

proportionate part of the credit

Solidary obligation each debtor is liable for the entire obligation

and each creditor is entitled to demand the whole obligation

Art. 1214 states that the debtor may pay any of the

solidary creditors; but if any demand, judicial or extrajudicial, has

been made by any one of them, payment should be made to him.

BECAUSE THE PROMISSORY NOTE INVOLVED EXPRESSLY

STATED THAT THE THREE SIGNATORIES ARE JOINTLY AND

SEVERALLY LIABLE, ANY ONE, OR SOME, OR ALL OF THEM MAY

BE PROCEEDED AGAINST FOR THE ENTIRE OBLIGATION. THE

CHOICE IS LEFT TO THE SOLIDDARY CREDITOR TO DETERMINE

AGAINST WHOM IT HE WILL ENFORCE THE OBLIGATION

Solidary or Joint and several obligation: one in which

each debtor is liable for the entire obligation and each

creditor is entitled to demand the whole obligation.

When there are two or more debtors in one and the same

obligation, the presumption is that the obligation is joint so

that each of the debtors is liable only for a

proportionate part of the debt

Solidary obligation exists when it expressly so states, when

the law provides, or when the nature of the obligation so requires.

Article 1148 of the Civil Code

"The solidary debtor may utilize against the claims of the creditor all

the defenses arising from the nature of the obligation and those

which are personal to him. Those personally pertaining to the others

may be employed by him only with regard to the share of the debt f or

which the latter may be liable.

DEFENSE AVAILABLE TO GREGORIO YULO

None of the installments payable under Parties of 2nd

Contracts obligation has yet matured (1st payment to

mature on June 30, 1912) - He can use this as defense.

Since the reduction of debt applied to him, then the

maturity date or terms should also be applied to him.

EFFECTS

Reduction of debt applied to him

The part of the debt for which Parties of the 2nd Contract is

3/6 of P225,000 or 112,500 (not yet demandable for them)

then it should also yet to be demanded to him wholly

even if hes on default.

He should not pay the additional interest

for the default of payment of P112,500.

The obligation of Sps. Alipio and Sps. Manuel is joint.

Art. 1207 - The concurrence of two or more creditors or of two or

more debtors in one and the same obligation does not imply

that each one of the former has a right to demand, or that each one

of the latter is bound to render, entire compliance with the

prestation. There is a solidary liability only when the obligation

expressly so states, or when the law or the nature of the obligation requires solidarity.

When there are 2 or more creditors/debtors, the obligation is presumed to be joint.

In joint obligations, the debt is divided into as many equal shares

as there are debtors, each debt considered distinct from one another.

ABB IS LIABLE TO PAY THE PENALTY STIPULATED IN THE

CONTRACT OF SERVICE

Based on the records, although Klin Drive Motor was done

on March 31, 1991, the said motor was actually delivered

to CCC as early as January 7,1991

The installation and testing was done only on March 13,

1991 upon the request of CCC; hence, the load testing

had to be postponed

Under Article 1226 of the Civil Code, the penalty clause

takes the place of indemnity for damages and the payment

of interests in case of noncompliance with the obligation,

unless there is a stipulation to the contrary.

In this case, since there is no stipulation to the contrary, the

penalty in the amount of P987.25 per day of delay covers

all other damages claimed by CCC against ABB

As a rule on damages, competent proof and a reasonable

degree of certainty are needed.

SPECIAL CONDITION IN DEED OF SALE WAS ACTUALLY AN

OBLIGATION; TO SECURE THIS, THE PENAL CLAUSE WAS INSERTED

The penal clause in this case was inserted not to

indemnify the MDC for any damage it might suffer as a

result of a breach of the contract but rather to compel

performance of the so-called "special condition" and

thus encourage home building among lot owners

in the Urdaneta Village.

While true, in obligations with a penal sanction, the penalty

takes the place of damages and the payment of interest in

case of non-compliance and that the obligee is entitled to

recover upon the breach of the obligation without the need

of proving damages, it is nonetheless true that in

certain instances a mitigation of the obligor's liability

is allowed (the lessening of the surety bond amount).

Article 1229 of the Civil Code states:

The judge shall equitably reduce the penalty when the

principal obligation has been partly or irregularly

complied with by the debtor. Even if there has been no

performance, the penalty may also be reduced by the

courts if it is iniquitous or unconscionable.

The house had already been completed more than 50%

by April 1961, hence there was partial performance

and very little delay.

Art 1226 provides In obligations with a penal clause,

the penalty shall substitute the indemnity for damages and

the payment of interests in case of non-compliance, if there

is no stipulation to the contrary. Nevertheless, damages

shall be paid if the obligor refuses to pay the penalty or is

guilty of fraud in the fulfillment of the obligation. The

penalty may be enforced only when it is demandable in

accordance with the provisions of this Code.

PENALTY ON DIFFERENT FORMS:

If the parties stipulate penalty apart monetary interest,

two are different and distinct from each other

and may be demanded separately.

If stipulation about payment of an additional interest

rate partakes of the nature of a penalty clause which is

sanctioned by law:

Art 2209: If the obligation consists in the

payment of a sum of money, and the debtor incurs

in delay, the indemnity for damages, there being

no stipulation to the contrary, shall be the

payment of the interest agreed upon, and in the

absence of stipulation, the legal interest, which is

six per cent per annum.

In case at bar, penalty charge 2% per month to accrue

from time of default. He is liable for both stipulated

monetary interest and stipulated penalty charge.

OBLIGATIONS WITH A PENAL CLAUSE

Penal clause an accessory obligation by which the

parties attach to a principal obligation for the purpose of

insuring the performance thereof by imposing on the

debtor special prestation in case the obligation is not

fulfilled or is irregularly or inadequately fulfilled.

General rule: The penalty shall substitute the indemnity

for damages and the payment of interests in case of noncompliance.

Exceptions:

1. When there is a stipulation to the contrary

2. Obligor is sued for refusal to pay the agreed penalty

3. Obligor is guilty of fraud

In all cases, the purpose of the penalty is to punish the

obligor

Obligee can recover from the obligor not only the penalty

but also the damages resulting from the non-fulfillment or

defective performance of the principal obligation

NARIC IN BAD FAITH HENCE LIABLE FOR DAMAGES

Liability stems not only from inability to meet the requirement

provided by the bank, but also from entering into contractual

obligations despite full awareness of its incapacity to

undertake the prestation.

When it agreed to pay immediately by means of irrevocable,

confirmed, and assignable letter of credit, despite its financial

capacity, it similarly bound itself to answer for all the

consequences that would result from the representation.

Article 1170: any manner contravene the tenor thereof

Includes any illicit act which impairs the strict and faithful

fulfillment of the obligation or every kind of defective performance.

Payment in US dollars not allowed

R.A. 529 prohibits payment in the form of other coins and/or

currencies that is not Philippine currency.

There is a difference as to the application of R.A. 529

between obligations incurred before the said laws passing and

obligations incurred after the said laws passing

OBLIGATIONS PRIOR TO R.A. 529 Payment in foreign

currency shall be made in Philippine pesos

on the basis of the current rate of exchange

at the time when the obligation is incurred.

OBLIGATIONS AFTER R.A. 529 was passed - Payment in

foreign currency shall be made in Philippine pesos

on the basis of the current rate of exchange

at the time of payment.

THE SALE HAD BEEN CONSUMMATED BY VIRTUE OF

PAYMENT BUT CHECK MADE BY THE PENARROYO AND VALENCIA;

NON-ENCASHMENT OF CHECK AFTER THE LAPSE OF 10 YEARS IS

TANTAMOUNT TO VALID PAYMENT

After more than ten (10) years from the payment in part by

cash and in part by check, the presumption is that

the check had been encashed.

Granting that petitioner had never encashed the check, his

failure to do so for more than ten (10) years undoubtedly

resulted in the impairment of the check through his

unreasonable and unexplained delay.

RULE ON EFFECT OF PAYMENT BY CHECK

While it is true that the delivery of a check produces the effect

of payment only when it is cashed, pursuant to Art. 1249 of

the Civil Code, the rule is otherwise if the debtor is prejudiced

by the creditors unreasonable delay in presentment.

This is in harmony with Article 1249 of the Civil Code under

which payment by way of check or other negotiable

instrument is conditioned on its being cashed, except when

through the fault of the creditor, the instrument is impaired.

PENARROYO AND VALENCIA CAN LAWFULLY COMPEL PAPA TO

DELIVER TO THEM THE TITLE OF THE SUBJECT PROPERTY

Since the buyers had fulfilled their part of the contract of sale

by delivering the payment of the purchase price, they can

lawfully compel Papa to deliver to them the title of the

property and the peaceful possession of the subject property.

PALS PAYMENT TO SHERIFF REYES DID NOT SATISFY DEBT TO

TAN; DID NOT EXTINGUISH OBLIGATION OF PAL

The checks were issued in the name of the MIA Sheriff Reyes.

It should have been in Tans name.

The payment made by the petitioner to the absconding sheriff

was not in cash or legal tender but in checks. The checks

were not payable to Amelia Tan or Able Printing Press but

to the absconding sheriff.

Art 1249 The delivery of promissory notes payable to order, or

bills of exchange or other mercantile documents shall produce the

effect of payment only when they have been cashed, or when

through the fault of the creditor they have been impaired.

FOR PAYMENT TO BE EFFECTIVE, MUST BE MADE TO PROPER

PERSON, ART 1240 OF CIVIL CODE

must be made to the obligee himself or to an agent having

authority, express or implied, to receive the particular payment.

The receipt of money due on a judgment by an officer

authorized by law to accept it will, therefore, satisfy the debt.

CHECK IS NOT A LEGAL TENDER; CHECK IN PAYMENT OF DEBT

NOT A VALID TENDER OF PAYMENT; CREDITOR MAY REFUSE

Since a negotiable instrument is only a substitute for

money and not money, the delivery of such an instrument

does not, by itself, operate as payment.

Art 1254 of the Civil Code which states that:

When the payment cannot be applied in accordance with

the preceding rules, or if application cannot be inferred

from other circumstances, the debt which is most

onerous to the debtor, among those due, shall be deemed

to have been satisfied.

If the debts due are of the same nature and burden, the

payment shall be applied to all of them proportionately.

However, the said provision only applies to a person owing several

debts of the same kind to a single creditor but CANNOT BE MADE

APPLICABLE to a person whose obligation as a mere surety is both

contingent and singular.

DEBTOR MUST SPECIFY WHICH AMONG HIS VARIOUS

OBLIGATIONS IS TO BE SATISTFIED

Article 1252. He who has various debts of the same kind in favor

of one and the same creditor, may declare at the time of making

the payment, to which of them the same must be applied. Unless

the parties so stipulate, or when the application of payment is

made by the party for whose benefit the term has been constituted

application shall not be made as to debts which are not yet due.

If the debtor accepts from the creditor a receipt in which an

application of the payment is made, the former cannot complain of

the same, unless there is a cause for invalidating the contract.

CONSENT MUST BE CLEAR AND SILENCE IS NOT

TANTAMOUNT TO CONSENT

There was no clear assent by Paculdo to the change in the

manner of application of payment.

No meeting of the minds. Though an offer may be made, the

acceptance of such offer must be unconditional and

unbounded in order that concurrence can give rise

to a perfected contract.

GUIDELINES IF THE DEBTOR DID NOT DECLARE, AT THE TIME OF

THE PAYMENT, TO WHICH OF HIS DEBTS WITH THE CREDITOR

IS TO BE APPLIED

No payment is to be made to a debt that is not yet due and

the payment has to be applied first to the debt most

onerous to the debtor.

ALR IS NOT PAYMENT BY CESSION UNDER ARTICLE 1255

There is only ONE creditor DBP

Article 1255 contemplates the existence of two or more

creditors and involves the assignment of all the debtors property.

ALR IS NOT A DATION IN PAYMENT ARTICLE 1245

Property is alienated to the creditor in satisfaction of a debt in

money, shall be governed by the law on sales.

It bears stressing that the ALR, being in its essence a

mortgage, was but a security and not a

satisfaction of indebtedness.

CONDITION NO. 12 OF ALR DID NOT CONSITUTE

PACTUM COMMISSORIUM

Elements of pactum commissorium:

1. There should be a property mortgaged by way of security for

the payment of the principal obligation

2. There should be a stipulation for automatic appropriation by

the creditor of the thing mortgaged in case of non-payment of

the principal obligation within the stipulated period.

DBPS ACT OF APPROPROATING CUBAS LEASEHOLD RIGHTS WAS

VIOLATIVE OF ARTICLE 2088

ART. 2088. The creditor cannot appropriate the things given by way of

pledge or mortgage, or dispose of them. Any stipulation to the contrary

is null and void.

The appropriation of the leasehold rights, being

contrary to Article 2088 of the Civil Code and to public policy,

cannot be deemed validated by estoppel.

DACION EN PAGO transmission of the ownership of a thing

by the debtor to the creditor as an accepted equivalent of the

performance of the obligation.

The essential elements of a contract of sale

(CONSENT, OBJECT, and CAUSE) must all be present

for a dacion en pago to exist.

IN THE PRESENT CASE, there is no consent on the part of

Filinvest that the return of the mortgaged car would

extinguish the obligation of Phil. Acetylene.

SINGH SUBSTANTIALLY COMPLIED WITH THE TERMS AND

CONDITIONS OF THE COMPROMISE AGREEMENT

The deposit of the balance of the purchase price was made in

good faith. The failure of Singh to deposit the purchase price

on the date specified was due to De Guzman who also

made no claim that they had sustained damages because of

the two days delay, there was substantial compliance with the

terms and conditions of the compromise agreement.

TENDER OF PAYMENT V CONSIGNATION

Tender an act preparatory to the consignation, which is the

principal, and from which are derived the immediate

consequences which the debtor desires or seeks to obtain.

Consignation act of depositing the thing due with the court

whenever the creditor cannot accept/refuses to accept

payment, and generally requires a prior tender of payment.

Tender of payment = extrajudicial,

while consignation = judicial,

and the priority of the first is the attempt to make a private

settlement before proceeding to the solemnities of consignation

Tender and consignation, where validly made, produces

the effect of payment and extinguishes the obligation.

Civil Code 1256: If the creditor to whom tender of payment has

been made refuses without just cause to accept it, the debtor

shall be released from responsibility by the consignation

of the thing or sum due.

PRIOR TENDER BY PCGG FOR THE PAYMENT OF RENTALS WAS

UNJUSTLY REFUSED BY MCPC

MPCPs refusal to accept the same, on the ground merely

that its lease-purchase agreement with PIMECO

had been rescinded, was unjustified.

CONSIGNATION is the act of depositing the thing due with the court

or judicial authorities whenever the creditor cannot accept or refuses

to accept payment and it generally requires a prior tender of

payment. In order that consignation may be effective,

the debtor must show that:

1) There was a debt due;

2) The consignation of the obligation had been made because the

creditor to whom tender of payment was made refused to

accept it, or because he was absent or incapacitated, or because

several persons claimed to be entitled to receive the amount

due or because the title to the obligation has been lost;

3) Previous notice of the consignation had been given to the

person interested in the performance of the obligation;

4) The amount due was placed at the disposal of the court; and

5) After the consignation had been made the person interested

was notified thereof. Failure in any of these requirements is

enough ground to render a consignation ineffective

It is obvious that the reason for respondents non-acceptance

of the tender of payment was the alleged insufficiency thereof

and not because the said check was not tendered to

respondent, or because it was in the form of managers check.

THE CIVIL CODE AUTHORIZES THE RELEASE OF AN OBLIGOR

WHEN THE SERVICE HAS BECOME DIFFICULT AS TO BE

MANIFESTLY BEYOND THE CONTEMPLATION OF THE PARTIES

RATIONALE FOR ARTICLE 1267:

General Rule: Impossibility of performance releases the obligor.

Exception: When the services has become so difficult as to be

manifestly beyond the contemplation of the parties, the courts

should release the obligor in whole or in part.

Intention of the parties should govern and if it appears

that the service turns out to be so difficult as beyond their

contemplation, it would be doing violence to that intention

to hold the obligor still responsible.

Equity and good faith demand that when basis of the contract

disappears, the prejudiced party has a right to relief.

In the case at bar, the obligation of CASURESCO consists in

allowing NATELCO to use its post in Naga City. It is not

a requirement that the contract be for future services with

future unusual change. Rather, it speaks of unforeseen events

wherein parties stipulate in the light of certain prevailing

conditions and once these conditions cease to exist,

the contract also ceases.

Supervening event in this case: NATELCOS increase in subscribers

DOCTRINE OF REBUS SIC STANTIBUS

In public international law parties stipulate in light of

prevailing conditions and once these conditions cease to exist

the contract also ceases to exist.

Considering practical needs and the demands of equity and

good faith, the disappearance of the basis of a contract

gives rise to a right to relief in favor of the party prejudiced.

Art. 1266 The debtor in obligations to do shall also be

released when the prestation becomes legally or physically

impossible without fault of the obligor.

Art. 1267 When the service has become so difficult as to be

manifestly beyond the contemplation of the parties, the

obligor may also be released therefrom, in whole or in part.

Art. 1267, however, enunciates the doctrine of unforeseen

events and is not an absolute application of the principle

of rebus sic stantibus

As a general rule, the motive or particular purpose of a party

entering into the contract does not affect the validity

or existence of the contract.

The exception is when the realization of such motive

or purpose has been made a condition upon which

the contract is made to depend.

FOOD FEST IS NOT RELIEVED FROM ITS RESPONSIBILITY TO

PAY MONTHLY RENTS ON GROUND OF REBUS SIC STANTIBUS

Food Fest was able to secure the permits, licenses and

authority to operate when the lease contract was executed. Its

failure to renew these permits, licenses and authority for the

succeeding year, does not, however, suffice to declare the

lease functus officio, nor can it be construed as an unforeseen

event to warrant the application of Article 1267.

Contracts, once perfected, are binding between the

contracting parties. Obligations arising therefrom have the

force of law and should be complied with in good faith.

Article 1270, par 2:

One and the other kind shall be subject to the rules which govern

inofficious donations. Express condonation shall, furthermore,

comply with the forms of donation.

DONATION & ACCEPTANCE OF A MOVABLE,

IF VALUE is greater than P5K = MUST BE MADE IN WRITING OR ELSE VOID

Article 748, par 3:

If the value of the personal property donated exceeds P5K,

the donation and the acceptance shall be made in writing.

Otherwise, the donation shall be void.

Hence, if the remaining balance of P266K was actually

condoned by PR, it should have been made in writing.

If respondent corporation really condoned the disputed amount,

the petitioners should have asked for a certificate of full payment

from respondent corporation, as they did

in the case of their first IGLF loan.

CONDONATION; APPOINTMENT OF RECEIVER

SUSPENDS AUTHORITY OF CORPORATION

RECEIVER: person appointed by the court in behalf of all the parties to

the action for the purpose of promoting and conserving the property

in litigation and preventing its possible destruction or dissipation, if it

were left in the possession of any of the parties.

The guiding principle in the appointment of a receiver

is the prevention of imminent danger to the property.

The appointment of a receiver operates to suspend the

authority of a corporation and of its directors and officers over

its property and effects, such authority being reposed in the receiver.

Sobrepeas had no authority to condone the debt,

since the alleged agreement to condone the amount in question,

was supposedly entered into by the parties sometime in July 1986

which was AFTER respondent corporation had been placed under receivership.

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Federal Civil Rights SuitDocumento19 pagineFederal Civil Rights Suitlegalmatters100% (16)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Question & Answer Negotiable Instrument LawDocumento5 pagineQuestion & Answer Negotiable Instrument Lawmamp05100% (14)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Intro To Law MidtermsDocumento10 pagineIntro To Law MidtermsZarah JeanineNessuna valutazione finora

- BP 22 ResearchDocumento4 pagineBP 22 ResearchRey BicolNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- OBLI Digest Nov 28Documento20 pagineOBLI Digest Nov 28Zarah JeanineNessuna valutazione finora

- Sample Motion To Compel Responses To Interrogatories in United States District CourtDocumento3 pagineSample Motion To Compel Responses To Interrogatories in United States District CourtStan Burman50% (2)

- Types of GovernmentDocumento16 pagineTypes of GovernmentRupesh 1312Nessuna valutazione finora

- Tables Void, Voidable and Legal SeparationDocumento9 pagineTables Void, Voidable and Legal SeparationFrances Abigail Buban100% (1)

- Sample Answer For Civil CaseDocumento3 pagineSample Answer For Civil CaseKelsey Olivar Mendoza88% (8)

- Introducers Agreement O.I.L.Ahmedabad and AEC PuneDocumento4 pagineIntroducers Agreement O.I.L.Ahmedabad and AEC PunerutujaNessuna valutazione finora

- Reseller AgreementDocumento16 pagineReseller AgreementZarah JeanineNessuna valutazione finora

- Re Letter of The UP Law Faculty 2011 DigestedDocumento4 pagineRe Letter of The UP Law Faculty 2011 DigestedZarah JeanineNessuna valutazione finora

- Brgy Tax OrdinanceDocumento3 pagineBrgy Tax OrdinanceLouie Ivan Maiz94% (50)

- Yangco Case DIgestDocumento2 pagineYangco Case DIgestJustin Loredo100% (2)

- DBP V Clarges CorpDocumento2 pagineDBP V Clarges CorpRaven Claire MalacaNessuna valutazione finora

- Obligations and Contracts Outline 2017 PDFDocumento28 pagineObligations and Contracts Outline 2017 PDFZarah Jeanine0% (1)

- Criminal Law 1 Art. 1-3 Reviewer MidtermsDocumento5 pagineCriminal Law 1 Art. 1-3 Reviewer MidtermsZarah JeanineNessuna valutazione finora

- University of The Philippines College of Law: G.R. Nos. L-74053-54 January 20, 1988Documento3 pagineUniversity of The Philippines College of Law: G.R. Nos. L-74053-54 January 20, 1988Maribel Nicole LopezNessuna valutazione finora

- Consti2-Atty. Jamon (Yhang, Wenky and Garcia, Zhai) Edited by de Leon, MarvinDocumento36 pagineConsti2-Atty. Jamon (Yhang, Wenky and Garcia, Zhai) Edited by de Leon, MarvinZarah Jeanine100% (1)

- CONSTI CasesDocumento41 pagineCONSTI CasesMaria Diory Rabajante100% (11)

- Civil Law Partnership Agency TrustsDocumento47 pagineCivil Law Partnership Agency TrustsStephany Polinar100% (1)

- Obli Digest Oct 3Documento14 pagineObli Digest Oct 3Zarah JeanineNessuna valutazione finora

- ASHRAE Standard 55-2010 - ASHRAE-55-2010Documento44 pagineASHRAE Standard 55-2010 - ASHRAE-55-2010AlejandroNessuna valutazione finora

- Herminio de Guzman v. Tabangao Realty IncorpDocumento2 pagineHerminio de Guzman v. Tabangao Realty IncorpKara Russanne Dawang AlawasNessuna valutazione finora

- Application With Prayer For The Issuance of Provisional Authority Without Passenger Insurance (MyTaxi - PH, Inc.) (GLR 26-2-18)Documento4 pagineApplication With Prayer For The Issuance of Provisional Authority Without Passenger Insurance (MyTaxi - PH, Inc.) (GLR 26-2-18)Cyrene Mae Valdueza Lasquite50% (2)

- Bernardo Vs Soriano 2Documento1 paginaBernardo Vs Soriano 2Juan Doe100% (2)

- Col Juris Doctor Regular CurriculumDocumento2 pagineCol Juris Doctor Regular CurriculumJc IsidroNessuna valutazione finora

- Natres Moot Court Dec. 14Documento2 pagineNatres Moot Court Dec. 14Zarah JeanineNessuna valutazione finora

- Lee V Court of Appeals G.R. NO. 117913. February 1, 2002Documento12 pagineLee V Court of Appeals G.R. NO. 117913. February 1, 2002Zarah JeanineNessuna valutazione finora

- Sept. 14 Additional Cases From Khe Hong Cheng To Araneta-OBLIDocumento10 pagineSept. 14 Additional Cases From Khe Hong Cheng To Araneta-OBLIZarah JeanineNessuna valutazione finora

- Obli Digest Dec 7Documento8 pagineObli Digest Dec 7Zarah JeanineNessuna valutazione finora

- Civil Code Philippines Obligation ContraDocumento26 pagineCivil Code Philippines Obligation ContraZarah JeanineNessuna valutazione finora

- Natres MootDocumento1 paginaNatres MootZarah JeanineNessuna valutazione finora

- Case DigestDocumento13 pagineCase DigestZarah JeanineNessuna valutazione finora

- Arari An Cases For DigestDocumento1 paginaArari An Cases For DigestZarah JeanineNessuna valutazione finora

- ITL Important ProvisionsDocumento1 paginaITL Important ProvisionsZarah JeanineNessuna valutazione finora

- Obli Doctrines p2Documento12 pagineObli Doctrines p2Zarah JeanineNessuna valutazione finora

- Obli Doctrines p2Documento12 pagineObli Doctrines p2Zarah JeanineNessuna valutazione finora

- DocxDocumento45 pagineDocxZarah JeanineNessuna valutazione finora

- Consti Midterms ReviewerDocumento2 pagineConsti Midterms ReviewerZarah JeanineNessuna valutazione finora

- Voidable Marriages Nov 2016Documento46 pagineVoidable Marriages Nov 2016Zarah JeanineNessuna valutazione finora

- Obligation Cases 8-29Documento1 paginaObligation Cases 8-29Zarah JeanineNessuna valutazione finora

- StatCon BLK 4 4 Nov 2016 CoverageDocumento2 pagineStatCon BLK 4 4 Nov 2016 CoverageZarah JeanineNessuna valutazione finora

- CONSTI 1 - Midterms Decoded CodalDocumento4 pagineCONSTI 1 - Midterms Decoded CodalZarah JeanineNessuna valutazione finora

- 2018 CLAT PG PaperDocumento42 pagine2018 CLAT PG PaperRaushan SinhaNessuna valutazione finora

- Abella V AbellaDocumento3 pagineAbella V AbellaRamon EldonoNessuna valutazione finora

- THE MUNICIPALITY OF DUMANGAS, ILOILO, Applicant and Appellee, vs. THE ROMAN CATHOLIC BISHOP OF JARODocumento6 pagineTHE MUNICIPALITY OF DUMANGAS, ILOILO, Applicant and Appellee, vs. THE ROMAN CATHOLIC BISHOP OF JAROcelestialfishNessuna valutazione finora

- Project of Torts PDFDocumento4 pagineProject of Torts PDFAvinash BhargavNessuna valutazione finora

- Otis Stokes v. L. Geismar, S.A. Modern Track MacHinery Incorporated, and Stihl Incorporated Andreas Stihl Stumec, 16 F.3d 411, 4th Cir. (1994)Documento5 pagineOtis Stokes v. L. Geismar, S.A. Modern Track MacHinery Incorporated, and Stihl Incorporated Andreas Stihl Stumec, 16 F.3d 411, 4th Cir. (1994)Scribd Government DocsNessuna valutazione finora

- Case Digests EvidenceDocumento17 pagineCase Digests EvidenceDianaVillafuerte100% (1)

- Rural Bank of Bombon (Camarines Sur), Inc. vs. Court of AppealsDocumento9 pagineRural Bank of Bombon (Camarines Sur), Inc. vs. Court of AppealsXtine CampuPotNessuna valutazione finora

- MEEDocumento2 pagineMEEGraile Dela CruzNessuna valutazione finora

- Salonga Vs Pano Full AcaseDocumento21 pagineSalonga Vs Pano Full AcaseKristanne Louise YuNessuna valutazione finora

- Police Blotter Law and Legal DefinitionDocumento2 paginePolice Blotter Law and Legal DefinitionChing EvangelioNessuna valutazione finora

- MPP Appeal To Ninth CircuitDocumento3 pagineMPP Appeal To Ninth CircuiterivlinnNessuna valutazione finora

- Law Enforcement Code of EthicsDocumento2 pagineLaw Enforcement Code of Ethicsrasausar9150Nessuna valutazione finora

- Compromise ReportDocumento11 pagineCompromise ReportAnonymous LZgIlI0YqTNessuna valutazione finora

- Canete v. Genuino Ice Company GR 154080 PDFDocumento5 pagineCanete v. Genuino Ice Company GR 154080 PDFSilver Anthony Juarez PatocNessuna valutazione finora

- Troscript - 6 15 10Documento5 pagineTroscript - 6 15 10willNessuna valutazione finora