Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Decision Tree

Caricato da

Angel Kitty LaborCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Decision Tree

Caricato da

Angel Kitty LaborCopyright:

Formati disponibili

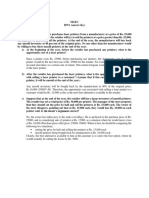

An art dealer has a client who will buy the masterpiece Rain Delay for $50,000.

The dealer can buy the painting now

for $40,000 (making a pro_x000C_t of $10,000). Alternatively, he can wait one day, when the price will go down to

$30,000. The dealer can also wait another day when the price will be $25,000. If the dealer does not buy by that

day, then the painting will no longer be available. On each day, there is a 2/3 chance that the painting will be sold

elsewhere and will no longer be available.

(a) Draw a decision tree representing the dealers decision making process.

(b) Solve the tree. What is the dealers expected proit? When should he buy the painting?

(c) What is the Expected Value of Perfect Information (value the dealer would place on knowing when the item will

be sold)?

PF = Profit

(a)

10000 PF 20000 PF 25000 PF

Buy Buy Buy

Avail

Avail

Dont Dont Dont

0 PF

Sold

2/3 % Sold

2/3 %

(b) The value is 10, for an expected pro t of $10,000. He should buy the painting immediately.

(c) With probability 2/3, the painting wil l be sold on the 1rst day, so should be bought immediately. With

probability 1/3(2/3) it wil l be sold on the second day, so should be bought after one day. Final ly, with probability

1/3(1/3) it wil l not be sold on the _x000C_rst two days, so should be bought after two days. The value of this is

2/3(10)+1/3(2/3)20+1/3(1/3)25 = 13.89. The EVPI is therefore $3,889.

Potrebbero piacerti anche

- CSTR Notes 1-5 (Gaurav Pansari)Documento9 pagineCSTR Notes 1-5 (Gaurav Pansari)Jai KamdarNessuna valutazione finora

- MKDM Gyan KoshDocumento17 pagineMKDM Gyan KoshSatwik PandaNessuna valutazione finora

- ME - End Term Answer KeyDocumento7 pagineME - End Term Answer KeyShubham Agarwal50% (2)

- Sample Problems-DMOPDocumento5 pagineSample Problems-DMOPChakri MunagalaNessuna valutazione finora

- Eco 4Documento5 pagineEco 4SamidhaSinghNessuna valutazione finora

- Question-Set 2: How Did You Handle The Ambiguity in Your Decision-Making? What WasDocumento6 pagineQuestion-Set 2: How Did You Handle The Ambiguity in Your Decision-Making? What WasishaNessuna valutazione finora

- Gyaan Kosh Term 2: Competitive StrategyDocumento23 pagineGyaan Kosh Term 2: Competitive StrategySatwik PandaNessuna valutazione finora

- DMUU Assignment 1 - GroupCDocumento4 pagineDMUU Assignment 1 - GroupCJoyal ThomasNessuna valutazione finora

- DMOP Homework 1 Q6Documento1 paginaDMOP Homework 1 Q6khushi kumariNessuna valutazione finora

- HW1 SolutionsDocumento8 pagineHW1 SolutionsAnujain JainNessuna valutazione finora

- Cottle Taylor Case StudyDocumento10 pagineCottle Taylor Case StudyParth DhingraNessuna valutazione finora

- Singapore Metal CaseDocumento5 pagineSingapore Metal Caseshreyabatra100% (1)

- EC2101 Practice Problems 8 SolutionDocumento3 pagineEC2101 Practice Problems 8 Solutiongravity_coreNessuna valutazione finora

- HWDocumento6 pagineHWaarushiNessuna valutazione finora

- DMOP Gyan KoshDocumento24 pagineDMOP Gyan Kosh*Maverick*Nessuna valutazione finora

- Sample Midterm SolutionsDocumento12 pagineSample Midterm SolutionsAnyone SomeoneNessuna valutazione finora

- BARCO Case AssignmentDocumento1 paginaBARCO Case AssignmentTanyaNessuna valutazione finora

- Assignment 3 MBA Supply ChainDocumento1 paginaAssignment 3 MBA Supply ChainChRehanAliNessuna valutazione finora

- Sample ProblemsDocumento9 pagineSample ProblemsDoshi VaibhavNessuna valutazione finora

- Marketing Decision Making: Gyaan Kosh Term 4Documento18 pagineMarketing Decision Making: Gyaan Kosh Term 4Avi JainNessuna valutazione finora

- GEMS TDDocumento4 pagineGEMS TDMarissa BradleyNessuna valutazione finora

- Assignment: Individual Assignment 4 - Philips: Lighting Up Eden GardensDocumento5 pagineAssignment: Individual Assignment 4 - Philips: Lighting Up Eden GardensVinayNessuna valutazione finora

- NPDM Case QuestionsDocumento2 pagineNPDM Case QuestionsPulkit MehrotraNessuna valutazione finora

- MGEC2 MidtermDocumento7 pagineMGEC2 Midtermzero bubblebuttNessuna valutazione finora

- HW 3 Answer KeyDocumento2 pagineHW 3 Answer KeyHemabhimanyu MaddineniNessuna valutazione finora

- WAC-P16052 Dhruvkumar-West Lake Case AnalysisDocumento7 pagineWAC-P16052 Dhruvkumar-West Lake Case AnalysisDHRUV SONAGARANessuna valutazione finora

- CMR Enterprises: Presented by - Division B - Group 10Documento9 pagineCMR Enterprises: Presented by - Division B - Group 10Apoorva SomaniNessuna valutazione finora

- Barco Case AnalysisDocumento2 pagineBarco Case Analysisaparna jethaniNessuna valutazione finora

- Stats ProjectDocumento9 pagineStats ProjectHari Atharsh100% (1)

- Heidi Roizen - Case Study: MBA ZG515 - Consulting & People SkillsDocumento7 pagineHeidi Roizen - Case Study: MBA ZG515 - Consulting & People Skillsnihal agrawalNessuna valutazione finora

- Indian School of Business Decision Models and Optimization Assignment 1Documento11 pagineIndian School of Business Decision Models and Optimization Assignment 1NANessuna valutazione finora

- GE Health Care Case: Executive SummaryDocumento4 pagineGE Health Care Case: Executive SummarykpraneethkNessuna valutazione finora

- Uniliver in Brazil Essay PDFDocumento21 pagineUniliver in Brazil Essay PDFpawangadiya1210Nessuna valutazione finora

- Amazon Vase Competitive StrategyDocumento1 paginaAmazon Vase Competitive StrategyAdityaNessuna valutazione finora

- Case AnalysisDocumento3 pagineCase AnalysisVIPUL TUTEJANessuna valutazione finora

- GLEC Assignment-Country Report (Spain)Documento15 pagineGLEC Assignment-Country Report (Spain)Sohil AggarwalNessuna valutazione finora

- Case Study On "Unilever in Brazil-Marketing Strategies For Low Income Consumers "Documento15 pagineCase Study On "Unilever in Brazil-Marketing Strategies For Low Income Consumers "Deepak BajpaiNessuna valutazione finora

- Group30 Assignment 1Documento7 pagineGroup30 Assignment 1Rajat GargNessuna valutazione finora

- Business Analytics - Prediction ModelDocumento3 pagineBusiness Analytics - Prediction ModelMukul BansalNessuna valutazione finora

- Assignment 2Documento5 pagineAssignment 2Vishal Gupta100% (1)

- Key Characteristics: Session 1Documento6 pagineKey Characteristics: Session 1KRISHI HUBNessuna valutazione finora

- Heidi Roizen - Group 6Documento7 pagineHeidi Roizen - Group 6Josine JonesNessuna valutazione finora

- Mgec HW4Documento3 pagineMgec HW4Akash YadavNessuna valutazione finora

- Term2 EndTerm ExamDetailsDocumento1 paginaTerm2 EndTerm ExamDetailseternal4321Nessuna valutazione finora

- DMUU Assignment2 - GroupCDocumento4 pagineDMUU Assignment2 - GroupCJoyal ThomasNessuna valutazione finora

- CRM EnterprisesDocumento2 pagineCRM EnterprisesDivya YerramNessuna valutazione finora

- MadmDocumento9 pagineMadmRuchika SinghNessuna valutazione finora

- Gyaan Kosh: Global EconomicsDocumento19 pagineGyaan Kosh: Global EconomicsU KUNALNessuna valutazione finora

- Managerial Economics PDFDocumento8 pagineManagerial Economics PDFekta dubeyNessuna valutazione finora

- Sealed Air Corporation's Leveraged RecapitalizationDocumento7 pagineSealed Air Corporation's Leveraged RecapitalizationKumarNessuna valutazione finora

- Managerial Economics Indian School of Business Homework: S B R D B K R KDocumento2 pagineManagerial Economics Indian School of Business Homework: S B R D B K R KPriyanka JainNessuna valutazione finora

- Exercise 1 SolnDocumento2 pagineExercise 1 Solndarinjohson0% (2)

- MGECDocumento8 pagineMGECSrishtiNessuna valutazione finora

- AssignmentDocumento2 pagineAssignmentLindsay SummersNessuna valutazione finora

- Phillips India: Bidding For Floodlighting Eden Gardens: DisclaimerDocumento3 paginePhillips India: Bidding For Floodlighting Eden Gardens: DisclaimerShreshtha SinhaNessuna valutazione finora

- Barilla SpADocumento2 pagineBarilla SpASwati NimjeNessuna valutazione finora

- Group 8 - Business Stats Project - Installment IDocumento16 pagineGroup 8 - Business Stats Project - Installment IAbhee RajNessuna valutazione finora

- Martinez, Althea E. Abm 12-1 (Accounting 2)Documento13 pagineMartinez, Althea E. Abm 12-1 (Accounting 2)Althea Escarpe MartinezNessuna valutazione finora

- indrianiPMAT 3061923023 ESP2Documento6 pagineindrianiPMAT 3061923023 ESP2IndriNessuna valutazione finora

- Corp-Bgt#IUP-X#Sept21#Aldira Jasmine R A#12010119190284Documento4 pagineCorp-Bgt#IUP-X#Sept21#Aldira Jasmine R A#12010119190284aldira jasmineNessuna valutazione finora

- 3 Budgeting ProcessDocumento32 pagine3 Budgeting ProcessAngel Kitty LaborNessuna valutazione finora

- Articles of Incorporation TemplateDocumento4 pagineArticles of Incorporation TemplateAngel Kitty Labor100% (1)

- Answer Key: Unit 1 Making ContactsDocumento29 pagineAnswer Key: Unit 1 Making ContactsAngel Kitty LaborNessuna valutazione finora

- BSD Lecture 7 - Systems AnalysisDocumento23 pagineBSD Lecture 7 - Systems AnalysisAngel Kitty LaborNessuna valutazione finora

- Graphs WordDocumento10 pagineGraphs WordAngel Kitty LaborNessuna valutazione finora

- Advanced Accounting ProblemsDocumento4 pagineAdvanced Accounting ProblemsAjay Sharma0% (1)

- Risk Analysis Decision Making Under Risk and Uncertainty: Project ManagementDocumento70 pagineRisk Analysis Decision Making Under Risk and Uncertainty: Project ManagementAngel Kitty LaborNessuna valutazione finora

- Forecasting1 TimeSeriesModelsDocumento78 pagineForecasting1 TimeSeriesModelsAngel Kitty LaborNessuna valutazione finora

- Cash BudgetingDocumento3 pagineCash BudgetingAngel Kitty Labor67% (3)

- Tracking Signal: Given The Forecast Demand and Demand For Candies, Compute The Tracking SignalDocumento56 pagineTracking Signal: Given The Forecast Demand and Demand For Candies, Compute The Tracking SignalAngel Kitty LaborNessuna valutazione finora

- Income Taxation Answer Key Only 1 1Documento60 pagineIncome Taxation Answer Key Only 1 1Paul Justin Sison Mabao88% (32)