Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

GS Financials Positioning For The Next Leg of The Rally

Caricato da

fodriscollDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

GS Financials Positioning For The Next Leg of The Rally

Caricato da

fodriscollCopyright:

Formati disponibili

April 7, 2010 United States: Financial Services

Financials DESKTOP

Positioning for the next leg of the rally

Fundamentals suggest further upside Best Buy ideas

We see the best opportunities in Large Cap Banks, We focus investors on our top stock ideas

Brokers, Asset Managers, and Homebuilders including JPM and BAC in large-cap banks; STI,

given the backdrop of low rates, higher asset CMA, FITB and KEY in regional banks; UNM, XL

prices, moderating credit costs and improving PGR, and ACE in insurance; BEN and BX in asset

capital markets activity. Higher interest rates and managers; EVR, LAZ and PJC in brokers; NDAQ

regulatory overhang are the big downside risks. and CME in market structure; CBG in Real Estate

and DHI in Homebuilders. In credit, we favor BAC,

Our investment framework LLOYDS, BPCEGP, STANLN in Banks and Farmers,

Four themes guide us: (1) Potential for consumer CNA and RDN in Insurance.

provision leverage, (2) a focus on those

Jessica Binder, CFA

companies that can return capital to shareholders, Best Sell ideas (212) 902-7693 | jessica.binder@gs.com

(3) improving capital market activity in 2010 and We remain concerned on CRE given the long-tail Goldman Sachs & Co.

(4) stabilizing real estate prices as the hunt for nature of losses; avoid BRE, REG, DRE and ESS.

yield hits real assets. Prime jumbo losses likely to worsen; avoid HCBK. Richard Ramsden

(212) 357-9981 | richard.ramsden@gs.com

Goldman Sachs & Co.

Financials as a part of your portfolio What we are watching

Financials are now the second largest sector in We highlight four sections of this report for PMs: Brian Foran

(212) 855-9908 | brian.foran@gs.com

the S&P 500 and we think there is further upside (1) an in-depth analysis of mutual fund

Goldman Sachs & Co.

as we move towards normalized returns given positioning across the Financials sector (p. 5); (2)

attractive valuation. Investors have moved a closer look at the idea of Financials being Louise Pitt

towards a neutral weighting in the sector, but are “cheap cyclicals” (p. 7); (3) capital management (212) 902-3644 | louise.pitt@gs.com

underweight regional banks. The best performers across the sector (p. 14); (4) initial thoughts Goldman Sachs & Co.

YTD have been the most underweighted sectors. around Basel III (p. 30).

The Goldman Sachs Group, Inc. does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of

interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification, see the

end of the text. Other important disclosures follow the Reg AC certification, or go to www.gs.com/research/hedge.html. Analysts employed by non-US affiliates are not

registered/qualified as research analysts with FINRA in the U.S.

The Goldman Sachs Group, Inc. Global Investment Research

Goldman Sachs Global Investment Research 1

April 7, 2010 United States: Financial Services

Table of contents

Portfolio Manager Summary: Life after the crisis 3

Thinking about Financials in the context of a portfolio 5

A return to micro from macro 10

Theme #1: Provision leverage in consumer loan portfolios 11

Theme #2: Capital management is beginning to be a key differentiator across the sector 14

Theme #3: Capital market should bounce from a disappointing 4Q2009 17

Theme #4: Real estate prices are stabilizing as the hunt for yield hits real assets 20

Short rates are likely to stay lower for longer, but have to go up eventually 26

Regulatory issues likely to remain a topic for the foreseeable future 30

Sector views: Attractive Large Banks, Asset Managers, Homebuilders and Brokers 34

Disclosures 37

GS Financials Equity Research Team

Banks Insurance Asset Managers Market Structure & Real Estate/REITs Homebuilders

Brokers

Richard Ramsden Christopher M. Neczypor Marc Irizarry Dan Harris, CFA Jonathan Habermann Joshua Pollard

Brian Foran Christopher Giovanni Alexander Blostein, CFA Jason Harbes, CFA Sloan Bohlen Anto Savarirajan

Adriana Kalova Eric Fraser Neha Killa Jehan Mahmood

Quan Mai Cooper McGuire Siddharth Raizada

Vikas Jain

GS Financials Credit Research Team Financials Specialist

Banks Insurance and Financials Sector

Managed Care Specialist

Louise Pitt Donna Halverstadt Jessica Binder, CFA

Amanda Lynam

Goldman Sachs Global Investment Research 2

April 7, 2010 United States: Financial Services

Portfolio Manager Summary: Positioning for the next leg of the rally

We remain bullish on Financials given the backdrop of low rates, higher asset prices, moderating credit costs and improving

capital markets activity and see the best opportunities in Large Cap Banks, Brokers, Asset Managers, and Homebuilders.

Higher interest rates and the regulatory overhang are the biggest downside risks, although appear manageable near-term.

Financials are now the second largest sector in the S&P 500, and we think there could be further upside given attractive valuation

levels even after the rally. While investors have largely closed out underweight positions from last year, they remain underweight

many of the regional banks. Positioning has been a big driver of returns thus far this year, and correlation across stocks in the

sector has fallen dramatically since the start of the year.

We highlight four key themes for stock-picking across the sector:

Provision leverage in consumer loan portfolios: The credit cycle is moderating as non-performing asset formation is slowing

and reserves are closer to peak levels. The improvement is most clear in consumer and in commercial (C&I) loans, and should

current trends continue, we see the potential for reserve releases later this year. Key stock ideas: BAC, JPM. Avoid HCBK.

Returning capital to shareholders: Buybacks and dividends have become a bigger differentiator across the sector. We

highlight companies that screen well on these metrics and highlight potential new entrants, which could result in significant

relative outperformance. Within the banks sector, high free cash yields imply dividend yields should be attractive once

regulatory pressure eases. Key stock ideas: BEN, JPM, NDAQ, UNM, XL.

Capital market should bounce from a disappointing 4Q: Trading activity was weaker than many expected in the first quarter,

but FICC should show qoq improvement. Investment banking got off to a slow start this year, but has recently started to pick

up. We believe this is just the beginning of a multi-year recovery in M&A. Smid-cap brokers and alternative asset managers

are well-positioned to benefit, as are some of the large-cap banks. Key stock ideas: BAC, BEN, BX, CBG, EVR, JPM, NDAQ.

Real estate prices are stabilizing as the hunt for yield hits real assets: While we may just be in the eye of the storm, low

interest rates have helped push some issues further into the future. Homebuilders are well positioned to benefit from an

improvement in new home sales from the depressed levels of 2009. Shadow inventory remains a concern, but is more likely to

limit the strength of the recovery rather than creating another downturn in the very short-term. On the commercial side,

sentiment is better than reality; the few recent transactions that have occurred imply that prices are recovering faster than the

fundamentals would suggest. Key stock ideas: BAC, CBG, DHI, JPM, MTG, STI, BX. Avoid BRE, REG, DRE and ESS.

Despite this positive backdrop, investors remain focused more on potential downside risks:

Rates: Low rates have unquestionably helped to stimulate the economy, not only by lowering funding costs, but also by

supporting housing demand and boosting capital market activity. The improvement in credit can in part be attributed to low

rates, given that the majority of loans in the United States are floating rate. Our economists forecast the Fed Funds rate will

stay near-zero through 2011. However, even if rates were to increase, we expect money market outflows to continue. Avoid FII.

Regulatory outlook: While it is difficult to know what the exact timing and impact of regulation will be, it is clear this is an

area of focus for the foreseeable future. Banks are likely to be the most impacted across the space, and issues fall within two

areas right now: the potential impact on normalized earnings, and the push for companies to hold more capital. One potential

beneficiary will likely be exchanges if volume is pushed towards exchanges and clearinghouses. Other sectors where new

regulatory proposals are likely to have an impact are Insurance, Rating Agencies and some Asset Managers/Discount Brokers

that have money market funds.

Goldman Sachs Global Investment Research 3

April 7, 2010 United States: Financial Services

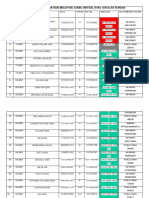

Exhibit 1: Top Ideas across the Financials sector

Stock ideas from the Financials business unit; priced as of the market close of April 7; $ millions, except per-share data

Key Financials investing themes

Upside/downside Provision Capital Capital

Company name Ticker Sector Market cap (current) Price Target price to target price Leverage Allocation Markets Real Estate

Buy

Bank of America Corporation BAC Banks 185.0 18.62 20.00 7%

Franklin Resources, Inc. BEN Asset Managers 25.9 112.83 130.00 15%

The Blackstone Group L.P. BX Asset Managers 16.6 14.68 18.00 23%

CB Richard Ellis Group Inc. CBG REITS 3.9 16.23 18.00 11%

D.R. Horton, Inc. DHI Homebuilders 3.8 11.93 17.00 42%

Evercore Partners Inc. EVR MktStructure 1.2 30.68 40.00 30%

J.P. Morgan Chase & Co. JPM Banks 178.7 45.32 54.00 19%

The Nasdaq Stock Market, Inc. NDAQ MktStructure 4.6 21.42 25.00 17%

SunTrust Banks, Inc. STI Banks 14.2 28.53 35.00 23%

Unum Group UNM Insurance 8.4 25.36 26.00 3%

XL Capital Ltd. XL Insurance 6.7 19.47 23.00 18%

Sell

BRE Properties, Inc. BRE REITS 1.9 37.05 25.00 -33%

Duke Realty Corp. DRE REITS 3.0 13.01 10.00 -23%

Essex Property Trust, Inc. ESS REITS 2.6 94.92 72.00 -24%

Federated Investors, Inc. FII Asset Managers 2.7 26.52 21.00 -21%

Hudson City Bancorp, Inc. HCBK Banks 7.5 14.20 13.00 -8%

Regency Centers Corporation REG REITS 2.6 38.12 33.00 -13%

For important disclosures, please go to http://www.gs.com/research/hedge.html.

For methodology and risks associated with our price targets, please see our previously published research.

Source: Goldman Sachs Research estimates.

Exhibit 2: GS Financials: Summary of rankings by sub-sectors Exhibit 3: Financials have underperformed since October

19 1300

Equity Coverage Views Performance

Attractive Neutral Cautious 17

6-Mar-09 13-Oct-09 6-Mar-09

1200

13-Oct-09 7-Apr-10 7-Apr-10

Asset Managers Credit Cards Life Insurance XLF 146% 7% 165%

Brokers Discount Brokers Specialty Finance 15 SPX 57% 10% 73% 1100

Homebuilders Insurance Brokers

Large-cap Banks Market Structure 13 1000

Mortgage Insurance

11 900

Non-Life Insurance

Regional Banks 9 800

REITs

Trust Banks 7 700

Credit Coverage Views 5 600

Attractive Neutral Cautious

7-May-09

7-Nov-08

7-Mar-09

7-Apr-09

7-Aug-09

7-Nov-09

7-Mar-10

7-Apr-10

7-Oct-08

7-Dec-08

7-Jan-09

7-Feb-09

7-Jun-09

7-Jul-09

7-Sep-09

7-Oct-09

7-Dec-09

7-Jan-10

7-Feb-10

US Banks Insurance

European Banks Mortgage Insurance

Source: Goldman Sachs Research. Source: Bloomberg, Goldman Sachs Research.

Goldman Sachs Global Investment Research 4

April 7, 2010 United States: Financial Services

Thinking about Financials in the context of a portfolio

This section was Mutual funds generally outperformed their benchmarks in 2009, due largely to an underweight position in Financials, and in

written in conjunction particular, an underweight position in large-cap banks. However, they have not fared as well this year, and as of March 31,

with David Kostin and

those funds in the Lipper Large-Cap Core Index were trailing the benchmark by about 80 bp on average. Within the Financials

the Portfolio Strategy

sector at least, part of this is due to the fact that they were underweight the sectors that have performed the best, including

team.

Regional Banks, Life & Health Insurance and REITs, and as investors have increased their weights towards those sectors, they have

driven them even higher. As a result, we view the recent rally as largely positioning-driven and over time, think fundamentals will

once again become the bigger driver. Our favorite sectors are Large-Cap Banks, Asset Managers, Brokers and Homebuilders. See

Exhibit 4.

Exhibit 4: The ‘pain trade’ in Financials: those sectors that were most underweight have rallied the most year-to-date

40 Current Current SPX Current (bp)

y = -0.1x + 14.2 Mutual Fund Weight Overweight/

Regional Banks

35 R2 = 0.3 S&P 500 Sub-sector Weight (bp) (bp) (Underweight)

Property & Casualty Insurance 280 209 71

30 Consumer Finance 138 78 60

Life & Health Insurance Asset Management & Custody Banks 185 127 58

25 Investment Banking & Brokerage 173 144 30

Total Return YTD

Multi-line Insurance Real Estate Services Diversified Banks 223 206 17

20 Residential REITs Diversified Banks Real Estate Services 7 4 3

Office REITs

Other Diversified

Multi-Sector Holdings 5 4 0

Specialized Finance 42 44 -1

15 Financial Services Diversified REITs

Specialized REITs Office REITs 6 10 -4

Retail REITs Insurance Brokers

Industrial REITs 1 6 -4

10 Consumer Finance Multi-line Insurance 35 40 -5

Multi-Sector Holdings Property & Casualty

Asset Management & Thrifts & Mortgage Finance 6 12 -6

Industrial REITs Insurance

5 Custody Banks Diversified REITs 1 11 -11

Investment Banking & Insurance Brokers 9 23 -14

Specialized Finance

0 Brokerage

Thrifts & Mortgage

Residential REITs 3 19 -16

Retail REITs 8 29 -21

Finance

-5 Regional Banks 74 109 -34

Life & Health Insurance 79 114 -35

-100 -50 0 50 100 150 200

Specialized REITs 5 48 -43

Mutual Fund Overweight/(Underweight) as of 12/31/09 Other Diversified Financial Services 370 413 -43

Source: Lionshare via FactSet and Goldman Sachs ECS Research.

Despite the outperformance of Regional banks, most mutual funds remain underweight the group. While funds have

increased their weighting in certain regionals over the last few months, they have not been able to keep up with the

benchmark. While a large part of this is due to an underweight in BBT, which tends to have a large retail ownership base, mutual

funds appear to be underweight every single regional bank with the exception of Marshall & Ilsley. The stocks that have seen the

biggest increase in mutual fund ownership are MI, RF, STI, CMA, KEY and MTB. However, funds have largely closed out their

underweights in the large-cap banks sector over the last few quarters. Funds are now much closer to a benchmark weight. The

big increases have been in BAC and WFC, while mutual funds have taken down their exposure to JPM and C. See Exhibits 5-8.

Goldman Sachs Global Investment Research 5

April 7, 2010 United States: Financial Services

Exhibit 5: Mutual funds are still underweight regional banks Exhibit 6: How mutual funds are positioned within Regional Banks

200 Position Size (bp) Change in

Current Current Current (bp) Mutual Fund Wgt

150

Mutual Fund SPX Weight Overweight/ Jun-09 to Current

100 Weight (bp) (bp) (Underweight) (bp)

BBT 3 21 -18 -7

50

FITB 3 10 -7 1

Mutual Fund SPX

PBCT 0 5 -5 0

0

RF 5 9 -4 4

Jan-06

Jul-06

Jan-07

Jul-07

Jan-08

Jul-08

Dec-08

Jun-09

Dec-09

Current

CINF 1 4 -3 -1

0

HCBK 3 6 -3 -2

Overweight/(Underweight) FHN 0 3 -3 -1

-20

STI 10 13 -3 4

-40

CMA 4 6 -3 3

-60

HBAN 1 4 -3 1

-80 KEY 4 6 -2 3

-100 MTB 4 6 -2 3

-120 ZION 2 3 -1 0

-140 SNV 0 0 0 0

Jan-06

Jul-06

Jan-07

Jul-07

Jan-08

Jul-08

Dec-08

Jun-09

Dec-09

Current

FNFG 0 0 0 0

CYN 0 0 0 0

MI 6 4 2 5

Source: Lionshare via FactSet and Goldman Sachs ECS Research Source: Lionshare via FactSet and Goldman Sachs ECS Research

Exhibit 7: Mutual funds have largely closed out their underweight position Exhibit 8: How positioning has changed within large-cap banks since last

in Large-cap banks summer

1200 Position Size (bp) Current (bp) June-09 (bp)

1000 Overweight/ Overweight/ Change

800 (Underweight) (Underweight) (bp)

600 BAC 2 -46 47

400 WFC 21 -2 24

200

Mutual Fund SPX USB -15 -20 5

0 MS 6 7 -1

PNC -1 2 -3

Jan-06

Jul-06

Jan-07

Jul-07

Jan-08

Jul-08

Dec-08

Jun-09

Dec-09

Current

JPM 8 27 -19

0 C -53 -10 -43

-50 Overweight/(Underweight)

-100

-150

-200

-250

-300

Jan-06

Jul-06

Jan-07

Jul-07

Jan-08

Jul-08

Dec-08

Jun-09

Dec-09

Current

Source: Lionshare via FactSet and Goldman Sachs ECS Research Source: Lionshare via FactSet and Goldman Sachs ECS Research

Goldman Sachs Global Investment Research 6

April 7, 2010 United States: Financial Services

Financials are currently the second largest sector of the S&P 500, accounting for 16.5% of the total market cap. This is up

from a low of 11% in January 2009, but it still a fraction of the 22% weight at the peak. While much of this increase stems from the

relative outperformance of the sector since the market bottom, the sector weighting has also been boosted by the addition of

Berkshire Hathaway to the S&P 500 Index. Berkshire is now the fourth largest company in the sector, and the largest company by

far in Non-Life Insurance. Looking at the sector, almost half the market cap is in the Banks sector, with Bank of America, JP Morgan

and Wells Fargo accounting for 30% of the sector market cap alone.

Exhibit 9: Financials as a percentage of the S&P 500 Exhibit 10: Sub-sector breakdown of the Financials sector

25%

Insurance Brokers

1% Discount Brokers

Market Structure

1% Specialty Finance

20%

SPX Weight 2%

1%

Asset Managers

4%

15% Banks: Trust

4%

Specialty Finance

10% Credit Cards Banks: Large-cap

4% 48%

Banks: Regional

5% 6%

LifeInsure

6%

0%

REITS

Dec-74

Dec-76

Dec-78

Dec-80

Dec-82

Dec-84

Dec-86

Dec-88

Dec-90

Dec-92

Dec-94

Dec-96

Dec-98

Dec-00

Dec-02

Dec-04

Dec-06

Dec-08

Dec-10

8%

NonLifeInsurance

15%

Source: Compustat and Goldman Sachs Research. Source: Compustat and Goldman Sachs Research.

One of the big questions that comes up is whether Financials can outperform further, and potentially even become the

largest sector of the market again. We see more room to run as Financials returns continue to recover towards normalized

levels and there is room for multiple expansion. Many financial sub-sectors are trading at a discount to historical valuations (see

Exhibit 11). In comparison, other cyclical sectors are now back to trading at a premium to their historical valuation, which has led

some to suggest that Financials, and in particular the banks, are “cheap” cyclicals that offer leverage to the market recovery.

One pushback to this argument is that Banks should trade at a discount to history as it is unlikely that returns ever reach historical

levels. However, based on our estimates, we expect banks to generate a normalized return on tangible equity of 15%, which is still

lower than average returns in the 2000s, but in-line with the early-1990s. If this were the case, it suggests that banks should trade at

2.5x tangible book, significantly higher than the current 1.4x multiple they are currently trading at. Even if returns end up being

below that 15% level, there is still room for multiple expansion, as Exhibit 12 shows. In thinking about the normalized return on

tangible equity, one key factor is leverage, which is an increasingly regulated metric. We have more comfort in our sustainable

ROA forecast, which we expect to be 1.1%, lower than the average over the last 15 years (1.18%), but higher than the average since

Goldman Sachs Global Investment Research 7

April 7, 2010 United States: Financial Services

1934 (75 bp). To get to 15% return on tangible equity, we assume that banks are required to hold 8% Tier 1 common capital,

although this is clearly still an area of debate among regulators.

Exhibit 11: Financials mostly trade at a discount to history Exhibit 12: Even adjusting for lower ROE, banks trade at a discount to

history

Current Historical avg Premium / Discount to 25%

multiple multiple historical average R2 = 73%

Mortgage Insurance (2) 1.2x 1.2x 0% Eventually should get back here

Life insurance (2) 0.9x 1.7x -48% 20%

2003 2006

2005 1999

Banks (1) 1.9x 2.7x -30% 2004

2002

Non-life insurance (2) 0.9x 1.6x -43% 19941993 1996 2000 1997 1998

Return on Tangible Equity

2001

15%

Market structure 13.3x 23.3x -43% 1995

Normalized 2007

1992

Asset Managers 17.0x 18.0x -6%

Discount brokers 20.8x 18.4x 13% 10%

REITs (3) 15.9x 12.2x 30% 1991

1990 We may never see this again

Average -- -- -16%

5% 2010

Current Historical avg Premium / Discount to

2008

multiple multiple historical average 2009

0%

Price to Earnings

Industrials 17.7x 11.8x 51%

Materials 17.8x 12.8x 39% -5%

Discretionary 16.8x 13.2x 27% 50% 100% 150% 200% 250% 300% 350% 400% 450%

Energy 13.4x 11.4x 17% Price to Tangible Book

Info Tech 15.5x 18.5x -16%

Average (P/E) 16.2x 13.5x 24%

(1): Price / Tangible Book; (2) Price / Book; (3) Price/FFO

Source: Goldman Sachs Research estimates. Source: Goldman Sachs Research estimates.

One other issue that investors are wrestling with is the impact of dilution on earnings. The dilution in Financials stocks has been

extreme over the last two years, particularly when compared to other sectors in the market. We calculate that shares are up

60% on average across Financials, with most of the dilution being caused by the Banks. Despite the increase in shares, most banks

have not seen a comparable increase in earning assets. Citigroup exemplifies this story; even if pre-provision were to return to its

previous run-rate, earnings per share would still be significantly depressed due to the increase in share count. But in many cases, C

is an extreme example, and even adjusted for dilution, most banks are still trading at a substantial discount to the historical

average. We believe the large caps are trading at a bigger discount to their long-term average earnings multiples than regionals

and thus rate the large cap banks Attractive and the regionals Neutral. See Exhibits 13-15.

Goldman Sachs Global Investment Research 8

April 7, 2010 United States: Financial Services

Exhibit 13: There has been significant dilution in Financials over the last Exhibit 14: Pre-provision shrinkage and increase in share count has resulted

year in a big decline in normalized earning power

Change in Share Count (2007-2009) 40,000 Gov't announced its intention to convert

Average* Median

Shares (mm)

into common shares

30,000

Consumer Discretionary -3% -1%

20,000

Information Technology -3% -2%

Consumer Staples -3% -3% 10,000

Telecom Services -1% -1% 0

Industrials 0% 0% 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09

Energy 1% 2%

Health Care 3% 0%

$4.30

Implied Normalized EPS

Materials 4% 1%

$3.80

Utilities 5% 4%

$3.30

Financials 59% 12%

$2.80

* market-cap weighted $2.30

$1.80

$1.30 Pro-forma for gov't conversion

$0.80 $0.65 $0.62

$0.30 $0.39

1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09

Source: Goldman Sachs Research estimates. Source: Company data, Goldman Sachs Research estimates.

Exhibit 15: Large banks and regionals are trading at a 24% discount to long-term multiples

price to normalized EPS by bank, GS-coverage

18.0x Indicates "Buy" rated stock

16.0x

14.0x

Price to Normalized EPS

12.0x Price to Earnings

Normalized Long-term Avg Difference

10.0x Large banks 8.5x 11.2x -24%

Regionals 10.4x 12.8x -19%

8.0x

Average 9.5x 12.0x -21%

6.0x Note: regionals ex Northeast. Long-term avg since 1985 where available.

4.0x

2.0x

0.0x

FNFG

NTRS

FITB

JPM

FHN

ZION

PNC

PBCT

COF

HCBK

DFS

MI

STI

WFC

RF

STT

USB

CMA

MS

CYN

HBAN

BBT

AXP

BK

KEY

BAC

WAL

Source: FactSet, Goldman Sachs Research estimates..

Goldman Sachs Global Investment Research 9

April 7, 2010 United States: Financial Services

A return to micro from macro

Financials are often considered one of the most macro-driven sectors in the market, with many of the stocks trading in lock-step

with one another (see Exhibit 16). While that has certainly been the case over the last few years, correlation across the group has

started to fall dramatically in recent days (see Exhibit 17). In some ways, this is not surprising; as regulatory fears from earlier this

year dissipate, investors are starting, once again, to concentrate on the fundamental issues, and realize that there are many ways to

differentiate across the group. While we still see some key themes helping drive returns, many of these are more stock-specific and

cut across sectors (consumer provision leverage and capital management) as opposed to being large macro themes. The upcoming

earnings season should provide investors with evidence as to these differentiating trends and provide opportunities for generating

alpha.

Exhibit 16: Financials tend to be one of the most highly correlated sectors Exhibit 17: Financials correlation is at the lowest level since 2006

ranked by 5-year percentile realized correlation across stocks

1-year 1-year 5-year 5-year

100%

ETF S&P Sector Current median percentile median percentile

90%

S&P 500

XLF Financials 0.29 0.59 0.02 0.60 0.03

80% Financials

XLY Discretionary 0.19 0.40 0.02 0.40 0.11

70%

XLU Utilities 0.34 0.61 0.03 0.54 0.13

XLV Healthcare 0.25 0.48 0.02 0.44 0.14 60%

XLB Materials 0.27 0.40 0.09 0.42 0.16 50%

XLE Energy 0.62 0.63 0.38 0.70 0.21 40%

XLP Staples 0.26 0.33 0.38 0.33 0.32

30%

XLK Technology 0.47 0.54 0.22 0.52 0.34

XLI Industrials 0.64 0.60 0.60 0.58 0.65 20%

SPX S&P 500 0.46 0.38 0.69 0.34 0.76 10%

0%

Jun-06

Oct-06

Dec-06

Feb-07

Jun-07

Oct-07

Dec-07

Feb-08

Jun-08

Oct-08

Dec-08

Feb-09

Jun-09

Oct-09

Dec-09

Feb-10

Jun-10

Note: The percentile is the rank of the current value as a percentage of the total observations.

Apr-06

Aug-06

Apr-07

Aug-07

Apr-08

Aug-08

Apr-09

Aug-09

Apr-10

Source: Goldman Sachs Research. Source: Goldman Sachs Research.

Goldman Sachs Global Investment Research 10

April 7, 2010 United States: Financial Services

Theme #1: Provision leverage in consumer loan portfolios

The credit cycle is clearly moderating, as non-performing asset formation is slowing and reserves are closer to peak levels.

The improvement is most clear in consumer and commercial (C&I), and should current trends continue, we see potential for

reserve releases later this year. On the other hand, some prime jumbo mortgages and CRE continue to get worse. See

Exhibits 18-21.

Exhibit 18: Credit card delinquencies have been better thus far in 2010 Exhibit 19: C&I defaults have started to slow down as well

Credit Card Leveraged Loans (proxy for C&I)

60 12%

Lagging 12-month Default Rate

Avg chg delinquency Ann. Defaults $ #

50 2Q09 -13bps 1Q09 19.8% 8.2%

Month over month change

10%

40 3Q09 +4bps 2Q09 16.8% 12.1%

4Q09 +3bps 8% # of defaults

30 3Q09 5.0% 8.7%

1Q10 -12bps 4Q09 8.4% 8.3%

20 6% 1Q10 TD 3.6% 6.5%

10

4% $ of defaults

0

-10 2%

-20 0%

Jan-99

Jan-00

Jan-01

Jan-02

Jan-03

Jan-04

Jan-05

Jan-06

Jan-07

Jan-08

Jan-09

Jan-10

-30

July 09

Jan 06

Apr 06

Jul 06

Jan 07

Apr 07

Jul 07

Jan 08

Apr 08

Jul 08

Jan 09

Apr 09

Jan 10

Oct 06

Oct 07

Oct 08

Oct 09

Source: Company data, Loanperformance, Trepp, S&P LCD, Goldman Sachs Research. Source: Company data, Loanperformance, Trepp, S&P LCD, Goldman Sachs Research.

Exhibit 20: Within resi mortgages, prime jumbo is getting worse Exhibit 21: CRE delinquencies continue to trend up

MBS (2006 & 2007 vintages) CMBS

1Q08 2Q08

CMBS - MoM change, 60+ Delinquency

700 bps 70 bps

QoQ Change in 30+ Delinquency

3Q08 3Q09 Avg chg in delinquency

600 bps 60 bps

1Q09 2Q09 1Q09 +19bps

500 bps 3Q09 4Q09 50 bps 2Q09 +32bps

400 bps 1Q10 TD

3Q09 +37bps

300 bps 40 bps

4Q09 +56bps

200 bps 30 bps 1Q10 TD +80bps

100 bps

20 bps

0 bps

-100 bps 10 bps

-200 bps 0 bps

-300 bps

-10 bps

-400 bps

May-

May-

Mar-08

Nov-08

Mar-09

Nov-09

Dec-07

Jan-08

Feb-08

Apr-08

Jun-08

Jul-08

Aug-08

Sep-08

Oct-08

Dec-08

Jan-09

Feb-09

Apr-09

Jun-09

Jul-09

Aug-09

Sep-09

Oct-09

Dec-09

Jan-10

Feb-10

Subprime Op ARM Alt-A Prime Home FRE/FNM

Jumbo Equity

Source: Company data, Loanperformance, Trepp, S&P LCD, Goldman Sachs Research. Source: Company data, Loanperformance, Trepp, S&P LCD, Goldman Sachs Research.

Goldman Sachs Global Investment Research 11

April 7, 2010 United States: Financial Services

Consumer credit, in particular, continues to improve, as evident in the most recent credit card master trust data. Total

delinquency was down 6 bp month on month while early delinquencies are down for the fourth straight month (see Exhibit 22).

Since the peak in October, early delinquencies are down 14%. We continue to believe high but stable unemployment leads to lower

delinquency, while seasonally March to May are always strong on tax refunds and other factors. Delinquencies usually fall 8% over

those months. On this theme, we favor the large banks and credit card issuers vs. the regional banks. In particular, BAC and JPM

are our best ideas given leverage to consumer credit improvement and attractive valuation at 7X our normalized earnings

estimates.

Exhibit 22: Scorecard – stocks with leverage to US consumer credit moderation

US consumer credit cost as % of US consumer credit cost as % of US consumer credit as % of

of revenue total credit cost * normalized earnings **

DFS 70% DFS 100% DFS 70%

COF 35% AXP 85% COF 60%

AXP 23% COF 77% JPM 30%

BAC 6% JPM 51% AXP 30%

JPM 5% BAC 47% BAC 25%

USB 3% USB 40% USB 20%

WFC 2% WFC 29% WFC 15%

Average 16% Average 62% Average 28%

Source: Company reports, FactSet, Goldman Sachs Research.

Looking ahead to earnings, bank charge-offs typically fall over 20% in 1Q relative to 4Q based on data since 1985. Half of this

seasonal decline is driven by declines in commercial charge-offs (C&I) with the remainder driven by commercial real estate and

auto. This year losses look set to fall although by a smaller degree, as C&I is likely in-line with historical seasonal patterns based on

commercial bankruptcies and leveraged loan defaults (although as a caveat, this regression approach tends to undershoot as

losses are peaking), and auto charge-offs have tracked down 12% using monthly data through February from Capital One and

AmeriCredit. Commercial real estate may be the one outlier in seasonality as delinquency data from the CMBS market implies that

commercial mortgage issues are still increasing. See Exhibit 23.

Goldman Sachs Global Investment Research 12

April 7, 2010 United States: Financial Services

Exhibit 23: The seasonality of credit – losses typically fall over 20% in 1Q vs. 4Q, with improvement in C&I, CRE and auto

avg quarter over quarter change in net charge-offs since 1985; left chart on dollar losses, right table on % NCOs (1992 = 1Q 92 vs. 4Q 91)

Year 4Q FY0 1Q FY1 1Q vs. 4Q (bps)

40% 1992 1.86% 1.25% -61 bps

1990 1.90% 1.30% -60 bps

1987 1.33% 0.76% -57 bps

30% 1993 1.41% 0.86% -55 bps

1986 1.26% 0.75% -51 bps

1991 1.65% 1.20% -45 bps

20% 1989 1.20% 0.76% -44 bps

Avg QoQ change since 1985

1988 1.32% 0.89% -43 bps

1994 0.92% 0.49% -43 bps

2006 0.64% 0.34% -30 bps

10%

2004 0.90% 0.65% -25 bps

2002 1.30% 1.08% -22 bps

2001 0.91% 0.71% -20 bps

0% 2003 1.06% 0.88% -18 bps

1Q vs. 4Q 2Q vs. 1Q 3Q vs. 2Q 4Q vs. 3Q 1995 0.55% 0.38% -17 bps

2000 0.70% 0.56% -14 bps

-10% 2005 0.62% 0.49% -13 bps

1999 0.70% 0.60% -10 bps

1998 0.69% 0.61% -8 bps

1997 0.64% 0.58% -6 bps

-20%

1996 0.62% 0.56% -6 bps

2007 0.53% 0.48% -5 bps

2009 2.04% 2.00% -4 bps

-30% 2008 0.86% 0.95% 9 bps

Average 1.07% 0.79% -28 bps

Source: Federal Reserve, Goldman Sachs Research.

Goldman Sachs Global Investment Research 13

April 7, 2010 United States: Financial Services

Theme #2: Capital management is beginning to be a key differentiator across the sector

While banks tend to receive a lot of focus for their inability to pay dividends, many Financials have accumulated excess

capital positions and are increasingly willing to put cash to work, either by paying dividends or by buying back stock. M&A is

also a possibility, but has to date largely been limited in the sector.

The dividend yield of the sector has fallen from an average of 2.5% in the years leading up to the crisis to about 1.5% currently (see

Exhibit 24). REITs are still one of the highest yielding sectors, and are expected to increase dividends by 7% this year. Large banks

are still at the low end of the spectrum and bring down the sector average, but could start to normalize in 2011. Exhibit 25

highlights the 28 companies across our coverage universe that are expected to grow dividends by 5% this year. Companies in the

Insurance, REIT and Asset Manager sectors screen especially well on this metric.

Exhibit 24: Financials sector dividend yield Exhibit 25: Companies expected to grow their dividend by 5%+ this year

3.5%

70%

3.0%

CBL

AB

2.5% 60%

Dividend Yield

2.0%

Dividend Growth (2009-2010)

50% CNS

1.5%

CLMS

1.0% 40%

0.5%

DUF PL

0.0% 30%

REITs

Market Structure

Mortgage Insurance

Insurance Brokers

Regional Banks

Credit Cards

Trust Banks

Homebuilders

Specialty Finance

Non-Life Insurance

Financials

Brokers

Large Banks

Life Insurance

Asset Managers

BXP

20%

EVR PSA

PTP LAZ MHP

10% TROW VR

UNM PRE

MS RE TRV VNO

AON AWH ACE CB

0%

0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0%

Dividend Yield (2009)

Source: Goldman Sachs Research estimates. Source: Goldman Sachs Research estimates.

While banks are currently limited in terms of how much capital they are able to return to shareholders in the form of

buybacks and dividends, we believe that once regulatory uncertainty clears, the potential payouts may be substantial. In our

opinion, dividends are much more likely than buybacks, at least initially. That being said, some companies (such as BAC) have

expressed a desire to buy back stock and reduce some of the dilution that occurred as a result of large capital raises in 2009.

Some banks, such as JPM, USB and NTRS, have already expressed a desire to increase the dividend back to a more “normalized”

level. In order to estimate what the yield could potentially be, we look at historical payout ratios and apply them to our normalized

EPS levels. Historically, payout ratios averaged 37% since 1992, but more recently have been closer to 45%. This implies that

dividend yields could be 5%-6%, significantly higher than the current S&P 500 average of 1.9% (see Exhibits 26-27).

Goldman Sachs Global Investment Research 14

April 7, 2010 United States: Financial Services

Exhibit 26: Banks pay 30-40% of earnings in dividend Exhibit 27: Normalized dividend yields could be significant

55.0% Div Payout Ratio* Normalized Div Yield on Normal Div

GS

50.0%

Normalized Peak LT Avg Peak LT Avg Peak LT Avg

2004-2007 average = 45% EPS

45.0%

BAC $2.40 45% 37% 1.08 0.89 6% 5%

40.0% Long-term average = 37%

WFC $4.35 45% 37% 1.96 1.61 6% 5%

35.0%

JPM $6.50 45% 37% 2.93 2.41 6% 5%

30.0%

USB $2.85 45% 37% 1.28 1.05 5% 4%

25.0%

PNC $6.50 45% 37% 2.93 2.41 5% 4%

20.0%

AVG 6% 5%

Jan-92

Jan-93

Jan-94

Jan-95

Jan-96

Jan-97

Jan-98

Jan-99

Jan-00

Jan-01

Jan-02

Jan-03

Jan-04

Jan-05

Jan-06

Jan-07

Source: Goldman Sachs Research. Source: Goldman Sachs Research.

Buybacks have also picked up recently – since the start of the year, nine companies in Financials have announced new

buyback programs, primarily in the Non-Life Insurance, Market Structure and Asset Management space. We highlight the

groups and stocks that have the highest remaining authorized share repurchases as a percentage of market cap (see Exhibits 28-29).

For these names, completion of these programs has the potential to drive upside and significant EPS accretion.

Exhibit 28: Sectors with the largest remaining repurchase authorizations as Exhibit 29: Buy and Neutral rated companies with the largest remaining

a percentage of market cap repurchase authorizations as a percentage of market cap

14.0% Remaining

Remaining buyback authorization / market cap

12.0% buyback

authorization /

10.0%

Company Name Ticker Sector market cap

8.0%

The Travelers Companies, Inc. TRV NonLifeInsurance 25.5%

6.0% Arch Capital Group Ltd. ACGL NonLifeInsurance 25.3%

4.0%

Janus Capital Group Inc. JNS Asset Managers 23.2%

Validus Holdings, Ltd. VR NonLifeInsurance 21.8%

2.0% Moody's Corporation MCO Specialty Finance 20.9%

0.0% Meritage Homes Corp. MTH Homebuilders 19.8%

Aon Corp. AON Insurance Brokers 19.6%

REITs

Market Structure

Mortgage Insurance

Insurance Brokers

Credit Cards

Trust Banks

Regional Banks

Homebuilders

Specialty Finance

Non-Life Insurance

Financials

Large Banks

Brokers

Life Insurance

Asset Managers

The PMI Group, Inc. PMI Mortgage Insurance 17.7%

Knight Capital Group, Inc. NITE Market Structure 17.0%

Platinum Underwriters Holdings PTP NonLifeInsurance 15.5%

Source: Goldman Sachs Research estimates. Source: Goldman Sachs Research estimates.

Goldman Sachs Global Investment Research 15

April 7, 2010 United States: Financial Services

Our focus on buybacks in the context of capital allocation is largely aimed at identifying supports to both the market and

company stock prices. With these as a backdrop we are aware of investor focus on the impact of buybacks on stocks. Recent

analysis by John Marshall of our Cross-Product team suggests that stocks that announced buybacks during the past year

outperformed the S&P 500 by 290 bp in the four days around the buyback announcement (see Exhibit 30). We have seen this in the

financial space as well. For example, UnumProvident (UNM) and StanCorp (SFG) are smid-cap life insurance companies with

similar underlying businesses (i.e., disability insurance), and while the two traded together for most of the year, SFG can be shown

to have significantly outperformed UNM following the announcement of its share repurchase (see Exhibit 31).

There are a number of stocks that we expect will begin to buyback stock this year, including Unum Group (UNM), XL Capital

(XL) and Public Storage (PSA).

Exhibit 30: Stock reactions around share repurchase announcements Exhibit 31: Shares have reacted favorably to SFG’s buyback announcement

Through February, 2010

Stock return (%) Stock return (%) - SPX return (%) 4.0

9%

4 day return (%) around authorization

SFG

8% 3.5

Indexed Price Performance

7%

6% 3.0

UNM

5%

2.5

4%

3% 3%

3%

2.0

2%

Increased buyback

1% 1.5 program

Announces intention to

0%

resum e share repurchases

-1% 1.0

03/09/2009

03/24/2009

04/08/2009

04/24/2009

05/11/2009

05/27/2009

06/11/2009

06/26/2009

07/14/2009

07/29/2009

08/13/2009

08/28/2009

09/15/2009

09/30/2009

10/15/2009

10/30/2009

11/16/2009

12/02/2009

12/17/2009

01/05/2010

01/21/2010

02/05/2010

02/23/2010

03/10/2010

03/25/2010

Mar- Apr- May- Jun- Jul- Aug- Sep- Oct- Nov- Dec- Jan- Feb- AVG

09 09 09 09 09 09 09 09 09 09 10 10

Source: Biryini Associates, Goldman Sachs Research. Source: Factset.

Goldman Sachs Global Investment Research 16

April 7, 2010 United States: Financial Services

Theme #3: Capital market should bounce from a disappointing 4Q2009

While 1Q2010 did not shape up quite as strongly as many had hoped or expected, we remain upbeat regarding trends for the

remainder of 2010. FICC results this quarter should show a seasonal improvement, driven primarily by volume increases in rates

and credit, while F/X and commodities have lagged somewhat. Low interest rates and a steep yield curve should continue to

support a variety of carry trade strategies this year, and the Goldman Sachs economists do not expect much of a change over the

course of 2010. However, equities appear to be off to a very slow start this year despite the fact that 1Q is typically the strongest

quarter of the year. Sluggish equity volumes and low volatility has hurt commission growth, and issuance has been weaker than

expected, also hurting revenues. Equities could pick up over the course of this year if we start to see inflows into US domestic

funds, which has started to occur very recently, but it is too soon to call it a trend. See Exhibits 32-33.

Exhibit 32: Client activity across various products remains strong in 1Q2010 Exhibit 33: Although equity trading is down year-over-year

AVD volumes; debt issuance for 1Q10 is quarter-ized; QTD change for indices average daily trading volumes for Tape A/B/C shares in bn

40% 12

38% 4Q09 Tape C

Tape B

35% 1Q10

Tape A

30% 9

25%

20% 19%

17%

QoQ change

6

14%

15%

10%

6%

4% 4% 3

5%

1%

0%

-5% -2% 0

-4%

1Q07

2Q07

3Q07

4Q07

1Q08

2Q08

3Q08

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

-10%

Debt issuance Interest Rate FX volumes Commodities Credit indices

volumes volumes

Source: CME, Dealogic, Markit, Goldman Sachs Research. Source: BATS, Goldman Sachs Research.

The big focus area is M&A, which started off the year slowly but has picked up in recent weeks. We remain optimistic that

trends will improve over the course of this year, helped by rising global GDP, improving sentiment, CEO confidence and

access to credit markets. Thus far in 2010, announced global M&A volumes are up 12% vs. the same period in 2009, with notable

improvement in Asia-based activity outweighing an 11% yoy decline in European volumes. We expect US-based M&A to increased

10-20% over 2009, using a three-factor regression model based on business fixed investment, real GDP, and unemployment trends

as the input variables. Since 1982, these three variables have had a 90% correlation (81% R-squared) to US M&A volumes, and in all

but three of the years (1989, 1996, 2000) the model accurately predicted at least the directionality of announced US M&A.

Goldman Sachs Global Investment Research 17

April 7, 2010 United States: Financial Services

Given our belief that we are in the first year of a multi-year recovery in global M&A volumes, we remain Attractive on the

smid-cap brokers and boutiques, which are the most leveraged to a rebound. Lazard has the largest backlog across the smid-

cap broker space, and notably, Evercore has advised on some of the largest transactions of the past year, including BNSF/Berkshire

and ACS/Xerox. Larger firms, such as Morgan Stanley and JPMorgan, have less exposure to M&A as a percent of their overall

revenues (6% and 3%, respectively) given their more diversified business models, but we note that M&A has likely benefited their

other businesses, such as lending, underwriting, and trading. See Exhibits 34-35.

Emerging markets have also become an increasingly important area for M&A. Since 1996, Asia has had the most growth in M&A

volumes, with an annual CAGR of 18%, compared with 8% in EMEA and just 3% in the United States. JPMorgan and Morgan

Stanley are among the strongest large-cap participants in Asia-based M&A thus far in 2010, and Lazard and Blackstone increased

their presence as well, as evidenced by their recently announced advisory mandates for Prudential plc’s pending acquisition of AIA.

Exhibit 34: The pace of M&A announcements has quickened in the past six Exhibit 35: …and the boutiques are the most leveraged to M&A trends

months, led by a recovery in the Americas… advisory revenues as % of total revenues, 2006-9

1,600,000

Announced Global M&A Deal Volumes ($ mn) 100%

Americas EMEA Asia-Pac

1,400,000

90%

1,200,000 80%

1,000,000 70%

60%

800,000

50%

600,000

40% Average = 36%

400,000

30%

200,000 20%

0 10%

1Q10 (Q-ized)

1Q98

3Q98

1Q99

3Q99

1Q00

3Q00

1Q01

3Q01

1Q02

3Q02

1Q03

3Q03

1Q04

3Q04

1Q05

3Q05

1Q06

3Q06

1Q07

3Q07

1Q08

3Q08

1Q09

3Q09

0%

EVR GHL LAZ JEF DUF PJC RJF SF

Source: Company reports, Goldman Sachs Research. Source: Company reports, Goldman Sachs Research.

Alternative asset managers are also well-positioned for a recovery considering record levels of dry powder and improving

financing conditions for deals. Despite a soft start to the year, Blackstone remains our top Buy (CL) idea among the alternative

asset managers. BX is well positioned to deploy capital amid improving credit availability and attractive valuation prospects as it

currently has $28 billion in dry powder (29% of AUM). In addition, sponsor-backed IPOs are likely to pick-up given the current

backlog. Over the last two quarters sponsor-backed IPO filings reached $6 billion in value across 31 deals, which could come to

market if conditions continue to stabilize. See Exhibits 36-37.

Goldman Sachs Global Investment Research 18

April 7, 2010 United States: Financial Services

Exhibit 36: Financial sponsor M&A volumes are off to a soft start in 2010 Exhibit 37: …but dry powder remains at record levels

Financial sponsor backed M&A announcements ($ billions) Committed but not yet invested private equity capital globally (as of Dec ’09)

350 25% 600

503

300 501

20% 500

462

Private Equity Dry Powder ($ bn)

62 Asia

Sponsor Volumes ($ bn)

250

379

15% 400 EU

% of total

200

163

150 300

10% 259

100 186

200 178

5% US

50

280

100

0 0%

2000 Q3

2001 Q1

2001 Q3

2002 Q1

2002 Q3

2003 Q1

2003 Q3

2004 Q1

2004 Q3

2005 Q1

2005 Q3

2006 Q1

2006 Q3

2007 Q1

2007 Q3

2008 Q1

2008 Q3

2009 Q1

2009 Q3

2010 Q1

-

2003

2004

2005

2006

2007

2008

2009

Sponsor Volumes ($ mn) - left axis % of total M&A - right axis

Source: Dealogic, Goldman Sachs Research. Source: Prequin, Goldman Sachs Research.

Goldman Sachs Global Investment Research 19

April 7, 2010 United States: Financial Services

Theme #4: Real estate prices are stabilizing as the hunt for yield hits real assets

While we may just be in the eye of the storm, as there is still the risk from ARM resets and CRE debt re-financing, low interest rates

have pushed these issues further out into the future. On the residential side, prices have recently shown more stability, aided by a

lower mix of distressed sales. On the commercial side, sentiment appears to have moved ahead of the fundamentals, but there is

potential for more transactions over the course of 2010 and into 2011.

Residential real estate showing signs of stabilization

Homebuilders are well positioned to benefit from an improvement in new home sales from the very depressed levels of

2009. Better industry figures and significant share shift to the large public builders and away from small, private developers sets

the stage for better equity prices across the builder space. We expect three distinct periods of sales activity for the group.

The strong spring selling season (late January-end of April): We expect positive macro and micro data points suggesting

that the Spring, when 50-60% of a builder’s annual deliveries are pre-ordered, is going well. We have already heard plenty of

positive micro data points and expect the macro data to reflect this soon.

The brief slowdown (May-June): As the tax credit draws to a close, we expect 1-2 months of pulled-forward demand due to

the expiration of the government’s homebuyer tax credit. The likely effect is a much strong March and April than expected but

a more subdued May and June.

The resumption of growth (July-December): We expect new home sales to return to positive growth as three factors drive

growth: (1) the Goldman Sachs economists are expecting non-farm payrolls to begin to grow in March and to continue to do so

throughout 2010; (2) we expect mortgage rates to remain low; and (3) we expect stability in house prices as lenders continue to

work with borrowers to avoid foreclosures. All in, affordability combined with a return of jobs and confidence sets the stage for

higher sales from current trough levels. See Exhibits 38-39.

Exhibit 38: New home sales are unsustainably low Exhibit 39: Great affordability sets the stage for better sales ahead

60%

55%

50%

45%

40%

35%

30%

25%

20%

15%

1975

1977

1979

1981

1983

1985

1987

1989

1991

1993

1995

1997

1999

2001

2003

2005

2007

2009

Affordability = Mortgage/Income +1 SD Average - 1 SD

Source: US Census Bureau. Source: US Census Bureau.

Goldman Sachs Global Investment Research 20

April 7, 2010 United States: Financial Services

Historically, new home sales have doubled off the bottom over a two-year period. The high level of shadow inventory has

the potential to make this adjustment this cycle take a lot longer. Consider:

There are 18.5 months of total inventory across the United States today with an approximate split of 1:2, with 6.5 months of

“regular inventory” and 12 months of “shadow”. While it may seem that we have never had these levels of inventory we note

that there were 16 months ahead of the 1982-84 doubling of new home sales. Although we are not expecting a quick doubling

of sales, we continue to believe that these currently low levels of housing starts and new home sales will not be sustained in a

growing economy. One big question on this topic is what the impact of rates will be, as rates feel in the early 80’s but are

unlikely to fall from current levels. See Exhibit 40.

The cash on banks’ balance sheets is at much higher levels than ever before, creating lower urgency to move distressed

properties from a bank perspective (see Exhibit 41). After liquidating many foreclosed properties in 2008 banks are much more

sensitive to home prices driving lower supply to the market than would otherwise be the case. Our conversations with banks

and distressed real estate investors suggest that further accommodative policies are being implemented internally. We have

seen principal reductions and mortgage term extensions grow as percentage of usage in aggregate loan modifications.

Historically, banks have not been price sensitive with delinquent and foreclosed properties but we believe this time is different,

given the magnitude of the potential issues if a bank’s entire balance sheet had to be written down to reflect another material

decline in home prices.

Within the homebuilder space, DR Horton (DHI) is our favorite name. It is one of the few builders that will be profitable in

2010, and the number of spec homes it has should enable the company to take share from other builders.

Exhibit 40: Inventory is about 18 months, only slightly higher than in 1982 Exhibit 41: Cash at banks has created low urgency in moving distressed

Current + shadow inventory properties at lower prices

25.0 1,400

Total Months Supply of Home Inventory

Adjusted m onths' supply w as Cash at $1.3TN = 11% of total assets

21.5 as of 3Q09 * 1,200

20.0

US Banking Industry Cash Assets ($bn)

1,000

15.0

800

Foreclosures

10.0

600

90D+

5.0 400

Norm al Supply

200

0.0

Mar-94

Feb-96

Jul-86

Jun-88

May-90

Jan-98

Dec-99

Nov-01

Oct-03

Jul-09

Sep-82

Sep-05

Aug-84

Apr-92

Aug-07

0

01/03/73

01/03/75

01/03/77

01/03/79

01/03/81

01/03/83

01/03/85

01/03/87

01/03/89

01/03/91

01/03/93

01/03/95

01/03/97

01/03/99

01/03/01

01/03/03

01/03/05

01/03/07

01/03/09

Note: Data based on quarterly filings; however, monthly data points suggest recent decline as sales have

increased.

Source: US Census Bureau. Source: Federal Reserve.

Goldman Sachs Global Investment Research 21

April 7, 2010 United States: Financial Services

While shadow inventory continues to grow, it theoretically does so in part due to anticipation of successful mortgage

modifications. While not yet material to the overall 4.5 million borrowers behind on their payments, the most recent data point

(January HAMP report from the Treasury) suggests some early signs of success (see Exhibit 42). Specifically, cumulative

permanent modifications increased to 160,000, a 75% increase in one month. Furthermore, there are an additional 76,000 loans

which have been permanently modified by the servicers and are pending final borrower approval. While the sum of these two

(192,000) is a mere 3.5% of delinquent mortgages (60 day+), the rate of acceleration is meaningful. In addition, recent news from

Bank of America that they are willing to forgiveness principal for borrowers where loan-to-value ratios are above 120% imply that

banks are willing to work with some borrowers, particularly in those circumstances where losses are likely to be significant anyway.

Exhibit 42: HAMP continues to grow which could begin to meaningfully benefit MI losses on a go-forward basis

Mortgage Insurance Industry Participation in Home Affordable Modification Program

120,000 116,297

HAMP Permanent Mods (# of loans)

MTG

RDN

PMI

100,000 GNW

Other MIs

Incremental 1Q2010 Reserve Implied Cure

80,000 ► X =

Jan. Mods Implied Mod Per Loan Benefit

66,465

MTG 1,874 5,623 $26,773 $150,546,621

60,000 RDN 1,312 3,936 $19,421 $76,444,116

PMI 1,221 3,662 $18,611 $68,150,613

40,000 GNW 1,499 4,498 $19,265 $86,665,198

20,000

17,860

10,207

MIs = 15%

MIs = 15%

0

Implied

Mortgage

HAMP HAMP Mortgage

Insurers

Insurers

4Q 2009 Jan. 2010

Source: United States Treasury Department, Goldman Sachs Research, company commentaries.

One issue that has come up a lot more recently is rep and warranty charges, which are likely to be a risk to banks earnings this year.

Recent data points suggest continued acceleration of put-back requests from the GSEs. Fannie Mae has been driving most of the

volume and the focus is still on the 2007 vintage. A big swing factor, therefore, is whether Freddie Mac steps up its put back rate.

More importantly, this issue will likely last for several quarters / years as it’s still unclear how much ultimately gets put back at this

point. See Exhibit 43.

Goldman Sachs Global Investment Research 22

April 7, 2010 United States: Financial Services

Exhibit 43: Bank repurchases continue to increase, although data is skewed by GNMA put-backs where underlying risk is guaranteed by HUD

$25 bn Estimated Gov't Insured Mortgage Repurchases

Estimated Non Gov't Insured Mortgage Repurchases

Provisions ($mn) Reserves ($mn)

$19.7 bn

$20 bn

Amount of Mortgage Repurchases

Repuchases by Vintage * Ticker 3Q09 4Q09 Ticker 3Q09 4Q09

Vintage % of Total

Pre-2007 20% BAC * 322 450 JPM nr 1,500

2007 60%

$15 bn 2008 20% JPM * 300 400 STI 123 200

*: based on JPM, STI and FHN. WFC 146 316 FHN 61 106

STI 136 220 FITB 10 nr

$10 bn

FHN 26 59 BAC * nr nr

$7.9 bn

Total 930 1,445

*: mgmt indicated that the reserves were

$4.9 bn original established as part of the CFC

$5 bn $4.1 bn 2006 origination share 49%

acquisition and are currently "in the billions".

$2.8 bn

Implied market run rate 2,950

$1.9 bn

$1.3 bn

$0.4 bn

*: 4Q09 estimated.

$0 bn

1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09

Note: estimates based on BAC's 3Q and 4Q disclosure of gov't vs. non-gov't insured repurchases.

Source: SNL DataSource, Goldman Sachs research, and company data.

CRE pricing stabilizing but on low volume; refi gap remains a question

In the current low rate environment, the commercial real estate crisis seems to be on hold and in certain examples pricing

and fundamentals have improved from the bottom. That said, data points are limited thus far as asset transaction and lease

activity to date has been low. We maintain that CRE values are highly dependant on funding costs as rent and occupancy growth

should be modest beyond 2010. Lastly, “extend and pretend” loan modifications by banks remain prevalent, which make timing of

CRE loan losses difficult to predict.

We maintain our Neutral coverage view on REIT equities as current valuation has already discounted a robust recovery

in fundamentals. REITs now trade at 17x our 2010 FFO estimates vs. a long-term average of 12x.

Similarly, we maintain our Neutral coverage view on Regional Bank stocks. Capitalization has improved across the sector but

on average, CRE as a percentage of total risk based capital remains high at 107%.

Pricing – It has been difficult to assess a base level of CRE pricing as financing remains limited (lack of CMBS) and transactions

volumes are off 80% from peak levels of 2007 (see Exhibit 44). That said, recent data points indicate that CRE prices have tightened

as it seems that there is too much capital chasing too few deals for high-quality assets (see Exhibit 45). While this is encouraging,

we believe there should be a bifurcation in pricing for Class A assets vs. properties with more challenging capital or leasing hurdles.

Goldman Sachs Global Investment Research 23

April 7, 2010 United States: Financial Services

Exhibit 44: CRE values are still off 30-40% but may be inflecting Exhibit 45: Spreads still wide but recent deals show tighter bids can be hit

indexed as of YE-2000 as of March 2010

10-Year Treasury avg cap rate spread (bps)

10% 200

12.0% 600

8%

6% 180 10.0% 500

4% 8.0% 400

2% 160

6.0% 300

0%

-2% 140 4.0% 200

-4% 2.0% 100

J A J O J A J O J A J O J A J O J A J O J A J O J A J O J A J O J A J O J

-6% 120 '01 '02 '03 '04 '05 '06 '07 '09 '10

-8%

Recent CRE Transactions

-10% 100

Asset Value Date Cap rate Buyer Seller

Dec-00

Dec-01

Dec-02

Dec-03

Dec-04

Dec-05

Dec-06

Dec-07

Dec-08

Dec-09

Jun-01

Jun-02

Jun-03

Jun-04

Jun-05

Jun-06

Jun-07

Jun-08

Jun-09

Griffin Towers (office) $90.0mn Mar-10 8.1% Angelo Gordon JV Maguire Properties

Columbia Uptown (apt) 11.8mn Mar-10 5.0% Van Metre Compaies Pennrose Properties

The Palatine (apt) 118.0mn Feb-10 4.5% Crescent Heights Monument Realty

Monthly Price Change Index Value (Right Axis) 8599 Rochester Ave (ind) 12.3mn Jan-10 7.3% KTR Capital Partners Panattoni Dev'l

Source: Moody’s, Real Capital Analytics. Source: Real Capital Analytics, Bloomberg.

Fundamentals – In most markets, signs of the bottom for rents and occupancy are emerging and we expect comparisons to

improve on a quarterly basis over the course of this year. For REITs specifically, we expect FFO growth to be flat by year-end and

turn positive in early 2011. Market rents have started to flatten out after a period of steep declines in late 2008 and much of 2009.

That being said, a true recovery may take longer than in prior cycles, as our economists expect the unemployment rate to pick up

over the course of this year and not peak until the first half of 2011. See Exhibits 46-47.

Exhibit 46: FFO year-on-year growth comparison to improve incrementally Exhibit 47: CRE fundamentals lag the broader economy – we do not

in 2010 anticipate a recovery until 2012 / 2013

20%

FFO growth by sector 1Q10E 2Q10E 3Q10E 4Q10E 2010E 2011E Office

CRE fundamentals typically lag the

Regional Malls -32.9% -16.5% -10.2% -9.5% -18.3% 7.3% 18%

economy by 18-24 months

Retail

Vacancy Rate, by sector

Office -20.6% -19.6% -7.2% 2.6% -16.1% 2.6% 16%

Apartments -20.0% -22.7% -14.1% -2.5% -16.4% 3.8% 14% Industrial

Industrial -41.3% -19.9% -15.7% -12.4% -25.7% 5.8% 12%

Shopping Centers -30.6% -18.6% -15.4% -1.7% -18.2% 3.0% M ultifamily

10%

REIT Average -29.1% -19.5% -12.5% -4.7% -18.9% 4.5%

8%

6%

We expect FFO growth to improve on

quarterly basis going into 2010 with modest 4%

recovery in 2H and 2011.

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

Source: Goldman Sachs Research estimates. Source: PPR.

Goldman Sachs Global Investment Research 24

April 7, 2010 United States: Financial Services

Bank losses – The key concern for banks are what losses may ultimately total. To date, banks have recognized losses of about 2.5%,

a fraction of the 7% we expect them to eventually realize. Part of the issue is persistency – given the long-tailed nature, we expect it

could take up to 15 years for banks to fully realize the losses on CRE. See Exhibits 48-49.

Exhibit 48: Banks recognized losses are a fraction of what they may Exhibit 49: It will take 10 years to reach cumulative default

ultimately end up being

100%

8.0%

99%

99%

99%

98%

97%

Cumulative recognized to date by banks

95%

93%

91%

100%

88%

7.0%

85%

83%

Commercial Mortgage Losses:

90%

79%

CRE cumulative default profile

6.0%

74%

80%

69%

64%

5.0% 70%

57%

60%

4.0%

47%

50%

38%

3.0%

40%

28%

2.0% 30%

18%

1.0% 20%

9%

10%

2%

0%

0.0%

0%

3Q07

4Q07

1Q08

2Q08

3Q08

4Q08

1Q09

2Q09

3Q09

4Q09

GS est

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

Years since origination

Source: Goldman Sachs Research estimates. Source: PPR.

Goldman Sachs Global Investment Research 25

April 7, 2010 United States: Financial Services

Short rates are likely to stay lower for longer, but have to go up eventually

Low rates has unquestionably helped to stimulate the economy, not only by cutting funding costs, but also by supporting

housing demand and boosting capital market activity. If and as rates start to increase, we would likely review our

positioning across the sector. Discount brokers are one of the areas that have the most to gain given their sensitivity to the short

end of the curve. Regional banks will also likely see an improvement in margins, although higher rates may hurt credit trends.

While money market funds could also gain as yields move back to normal levels, if rates start to increase because of stronger

growth, outflows are likely to continue as investors move into higher risk-reward assets.

While our economists do expect the Fed to reverse most “technical” factors in the near term, including increasing the spread

between the discount rate and the Fed Funds rate, and reducing the outstanding balances in the Term Auction Facility towards zero,

they forecast the Fed Funds rate to stay near-zero through 2011. Using the CME curve as a proxy, the market expects rates to start

increasing as early as the second half of this year, but investors have tempered their expectations in recent months. See Exhibits

50-51.

Exhibit 50: Fed moving discount rate back toward more normalized levels Exhibit 51: CBOT Fed fund futures now imply 100 bps of Fed rate hikes

relative to Fed Funds through May 2011 (vs prior expectations of such hikes by October 2010)

discount rate vs. target Fed funds Implied Fed funds rate

8.00% Target Fed Funds Discount Rate vs. Target Fed Funds *

2 .5 0

Discount Rate Prior to Yesterday's

7.00% 38 bp

Discount Rate Increase

2003 - 2007 Median 100 bp

6.00%

*: using mid point of target ranges. 2 .0 0

5.00% Febr ua ry 2 01 0 Impl ied

September 2 00 9 Implied

4.00% 1 .5 0

3.00%

2.00%

1 .0 0

1.00%

0.00%

0 .5 0

Jul-03

Jul-04

Jul-05

Jul-06

Jul-07

Jul-08

Jul-09

Jan-03

Oct-03

Jan-04

Oct-04

Jan-05

Oct-05

Jan-06

Oct-06

Jan-07

Oct-07

Jan-08

Oct-08

Jan-09

Oct-09

Jan-10

Apr-03

Apr-04

Apr-05

Apr-06

Apr-07

Apr-08

Apr-09

0 .0 0

FEB M AR APR M AY JUN JLY A UG SEP OC T NOV DEC JAN FEB M AR AP R MA Y JUN JLY AUG SEP OC T NOV DEC JAN

10 10 10 10 10 10 10 10 10 10 10 11 11 11 11 11 11 11 11 11 11 11 11 12

Source: Federal Reserve, Goldman Sachs Research. Source: CME/CBOT, Goldman Sachs Research.

One of the big questions with regards to interest rates is whether an increase will cause a new round of credit problems.

Over 60% of loans in the United States are floating rate, so low rates have helped keep borrowing costs quite low. For example, we

estimate that the rate on home equity loans is as low as 2.75% from some providers and construction loans is around 3%-4%. So

while many properties have loan-to-value readings above 100% as a result of falling prices, debt service coverage has stayed above

1X (see Exhibit 52). In addition, another positive impact of low rates is that as rates on option ARMs reset, it is less likely that there

will be much payment shock. Typically, option ARMs are originated with a fixed teaser rate that is good for a defined period of time,

Goldman Sachs Global Investment Research 26

April 7, 2010 United States: Financial Services

often five years. After that period, the rate is reset and then floats based on a specified index (often the Monthly Treasury Average

(MTA), plus a spread. Currently, payment shock is approximately 30%-40%, which is down considerably from 160% at the end of

2007. Low rates imply that payment shock will fall even further to 20%-30% next year as interest rates stay near zero. Historically,

delinquencies have picked up following the reset, particularly when the payment shock is high. Given that 2010 and 2011 are peak

years for option ARM resets, there is some concern that an increase in rates may result in a new round of losses (see Exhibit 52). A

significant amount of CRE matures over the next few years as well and likely will need to be re-financed.

Exhibit 52: Debt service coverage vs. Loan to value Exhibit 53: Delinquencies positively correlated with payment shock

70%

2007

Today Change

Origination 60%

Annual cash flow 5 4 -20%

% D60 6m after reset

50%

Cap rate 5% 8% 1.6x

Property value 100 50 -50% 40%

Loan 70 70 0% 30%

Loan to value (LTV) 70% 140% 2.0x

20%

Loan rate* 5.50% 1.50% -73%

Annual debt expense 4.8 2.9 -39% 10%

Debt service coverage (DSC**) 1.0x 1.4x 1.3x

0%

1-25% 25-50% 51-75% 76-100% 101+%

*Assume 30y amortization schedule, floating rate LIB+50bp w ith 100bp floor

paym ent shock at reset

**Cash flow divided by debt expense

Source: Goldman Sachs Research Source: Loanperformance.

One of the biggest beneficiaries of rate increases across the space would be the discount brokers. When the Fed does begin to

tighten its fiscal policy and short-term yields begin to shift higher, net interest margins should move back to more normalized levels.

We estimate that the average EPS effect on the Discounters for the first 100 bp move in Fed Funds/Treasury yields will be roughly

24% on our 2011 estimates (see Exhibit 54). Similarly, a rising Fed Funds rate should benefit security lending spreads at trust banks,

as these companies typically invest cash collateral in LIBOR-based securities but pay out Fed Funds-based rates. Exhibit 55

summarizes how we would be positioned should rates start to increase.

Goldman Sachs Global Investment Research 27

April 7, 2010 United States: Financial Services

Exhibit 54: SCHW and TRAD most sensitive to a 100 bp shift higher in rates Exhibit 55: The outlook for different sectors when rates rise

2011E EPS Impact % Change Best Interest Income

Fed Funds Rationale(s)

Performance

Charles Schwab $0.80 $0.33 41%

Discount Brokers Immediate leverage to higher rates

TradeStation $0.40 $0.17 41%

0% - 1% Business model has become more asset sensitive but it is hard to

TD Ameritrade $1.50 $0.28 19% Cards (ex AXP)

pass on to customers with Fed funds above 1%

optionsXpress $1.30 $0.24 18% Below 1%, regionals don't benefit much given interest rate floors

E*TRADE Financial $0.11 ($0.00) (0%) 1% - 3% Regionals Above 3%, deposit mix shift from non-interest bearing to CDs

becomes a headwind

Average 24%

Trust banks benefit most in a high rate environment after the Fed

Above 3% Trust Banks has stopped rising rates. The first few increases in rates are usually

Note: TRAD estimate based on 100 bps increase in US Treasury yield neutral to negative for trust banks NII.

Source: Goldman Sachs Research estimates. Source: Company data, Goldman Sachs Research.

However, higher rates do not necessarily imply that money market outflows will reverse. In the first quarter, money market

funds saw outflows of nearly $325 billion, approximately 10% of total industry assets or 40% annualized organic decay.

This would mark a record quarterly outflow for the industry. The yield differential between money market funds and CDs remains

at the historically wide level of 125 bp, which is likely to keep pushing investors out of money funds. While higher yields should

theoretically also help money market funds given the more attractive yield, what is important is what is driving the higher rates. If

rates are going up because of inflation concerns, then money markets should see inflows as investors flock to safety. But if rates

rise because of better growth expectations, money markets actually see more dramatic outflows as investors move up the risk

curve. FII is one of the most leveraged names to money market funds, and is one of the key reasons behind our CL-Sell rating

on the stock. See Exhibits 56-57.

Goldman Sachs Global Investment Research 28

April 7, 2010 United States: Financial Services

Exhibit 56: Money market funds are on track to see record outflows in 1Q10 Exhibit 57: The yield differential between MMFs and CDs remains wide

Quarterly money market fund flows; 1Q2010 data is quarterized based on 2/18 data 7-day annualized MMF yield versus 1-year CD rate

500,000 50% 6.0%

400,000 40%

5.0%

Annualized Organic Growth Rate

30%

Money Market Flows ($ mm)

300,000

4.0%

20%

200,000

3.0%

10%

100,000

0% 2.0%

0

-10%

1.0%

125 bps

-100,000

-20%

0.0%

-200,000

Oct-06

Dec-06

Feb-07

Apr-07

Jun-07

Aug-07

Oct-07

Dec-07

Feb-08

Apr-08

Jun-08

Aug-08

Oct-08

Dec-08

Feb-09

Apr-09

Jun-09

Aug-09

Oct-09

Dec-09

Feb-10

-30%

-300,000 -40%

Money Market Yield 1-Year CD Rate

1Q09*

1Q01

3Q01

1Q02

3Q02

1Q03

3Q03

1Q04

3Q04

1Q05

3Q05

1Q06

3Q06

1Q07

3Q07

1Q08

3Q08

1Q09

3Q09

Flows (left axis) Organic growth (right axis)

*1Q10 is "quarterized"

Source: Investment Company Institute, Goldman Sachs Research. Source: Bloomberg, Goldman Sachs Research.

Goldman Sachs Global Investment Research 29

April 7, 2010 United States: Financial Services

Regulatory issues likely to remain a topic for the foreseeable future

While most of the focus recently has been on the Senate version of the financial regulatory reform bill, there are also many