Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

A Handbook of Practical Auditing

Caricato da

Prabir Kumer Roy100%(5)Il 100% ha trovato utile questo documento (5 voti)

4K visualizzazioni336 pagineA Handbook of Practical Auditing

Copyright

© © All Rights Reserved

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoA Handbook of Practical Auditing

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

100%(5)Il 100% ha trovato utile questo documento (5 voti)

4K visualizzazioni336 pagineA Handbook of Practical Auditing

Caricato da

Prabir Kumer RoyA Handbook of Practical Auditing

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 336

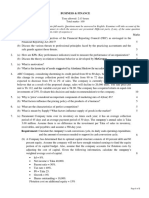

A HANDBOOK

PRACTICAL AUDITING

Ry

Dr, B. N, TANDON”

M.A, eon, LL, (Agra), Moa. Com, (Gab),

B. Com, (fom.), Ph.D, Reon, (Munich),

Dep srtrer of Gomoirece usiness Administration,

Dull Polslezhesic, Dethi,

Ferurly of Meerut College, Meerst.

1958

8 CHAND &CoO.

DELI - JULLUNDUR - LUCKNOW

5S. CHAND & Co.,

AsfAti Road —. NEW DELHI

Fountain _ DELHI

Mai Hiran Gate —~ JULLUNDUR

Lal Bagh LUCKNOW

Rs. 10f-

hed by G, 5,

Sharma, for 5, Chand & Co., Fountain, Dethi, and

Printed by §. p, Dhawan at the Central Electric Pye ,

ic Press,

60-D, Kamla Nagar, Delaj. °

PREFACE

I think, I owe an explanation for bringing out yet another

book on auditing when there are so many already in the market. I

have taught this subject for many years and have always felt the

need for a book which will not only be useful to the students for

examination purposes but will also be useful from practical point of

view.

The book docs not claim any originality in regard to matter

and facts since I had to depend for these on standard books published

in India and outside on the subject. I have, however, tried to

present the facts in such a way as to make it easy for the students to

comprehend them.

T have taken special care to incorporate the latest Companies and

other Acts as they refer to auditors and auditing. Legal cases have

also been discussed at Iength. At the end of cach chapter, questions

set by Universities and Professional Bodies are given. I hope the

book will prove to be useful not only to the students who are to take

university examinations but also to candidates who take professional

and competitive examinations in the subject.

I take this opportunity to thank my esteemed colleague and

friend Mr. A. Dasgupta, Head of the Commerce Department, Delhi

Polytechnic and Professor of Business Administration, Delhi School

of Economics, Delhi University, without whose encouragement it

would not have been possible for me to bring out this book.

Suggestions for the improvement of the book from practising

accountants, teachers and students will be very much appreciated.

Decur. B. N. Tanpon.

CONTENTS

Carrer I, Introduction.

Origin of Audit—Definition of Audit—Difference be-

tween Accountancy and Auditing— Qualities of an Auditor

—Objects of an Audit—Advantanges of an Audit—Differ-

ent classes of Audits and their relative advantages—Con-

duct of an Audit—Continuons Audit--Periodical or Final

Audit—Procedure.

Typical Questions.

Carrer II. Internal Check or Control.

Meaning of Internal Check—Objects of Internal

Check—Auditor’s duty in regard to Internal Check—

Considerations at the commencement of a new Audit—~

Division of work between Senior and Junior Audit Clerks

~-Ticks—Audit Programme—Audit Note Book.

Typical Questions.

Cmartrr III. Vouching of Cash Transactions.

Vouching—Its Meaning—Voucher—Points to be

noted in a Voucher—Internal Check as regards cash—

Vouching the debit and credit side of the Cash Book—

Petty Cash Book.

Typical Questions.

CuapreR IV. Vouching of Trading Transactions,

Purchases—Internal Check System as regards Pur-

chases—Duty of an Auditor in connection with Credit

Purchases—Purchases Returns—Credit Sales—Internal

Check as regards Credit Sales—Duty of an Auditor in

connection with Credit Sales—Sales Returns—Goods Sold

on Sale or Return System—Goods sent on Consignment

—Packages and Emptics—Journal—Bought Ledger—

Sales Ledger—Total Accounts and Scctional Balancing,

. Typical Questions.

Cnapter V. The Audit of Impersonal Ledger,

Outstanding Assets and Liabilities—Allocation of

Expenditure between Capital and Revenue—Contingent

Liabilities—Contingent Assets.

Typical Questions.

Craprer VI. Verification and Valuation of Assets and Liabili-

ties,

“ Meaning of Verification—~Valuetion of Assets —

Fixed Assets—Modc of Valuation of Fixed Assets—Floatir

Paces

119

20—27

28—50

5I1—65

66—8¢

81-119

a

Lee

:

\

’

(vi)

© Current Assets—Mode of Valuation of Floating

‘Assots—Wasting Asseis~Valuation of Wasting Assets—

Auditor’s position as regards the Valuation of Asscts—

Verification and Valuation of different classes of Asscts-~

Stock in hand—Methods used in the Valuation of diffee-

ent classes of goods—Duty of an Auditor in connection

with Stock in trade ~Book Debts —Goodwill-—Verification

of Liabilities~Share Capital~Trade Creditors—Bills Pay-

able—Outstanding Expenses.

‘Yypical Questions.

Guarrer VIL. Depreciation.

General—Definition—Causes of Depreciation—Wear

and tear-—EMuxion of time—Obsolescence—Exhaustion—

Pifference between Depreciation and Fluctuation ~

Necessity for providing Depreciation—Measure of Depreci-

ation—Plant Rewister—Principal methods of providing

Depreciation—Fixed Instalment or Straight-line Mcthod—

Reducing Instalment Method—Insurance Policy Method

—Revaluation—Use or Mileage Method—Efficiency-hour

Method—Global Mcthod—Depletion Unit Method or

Production Unit Method—Auditor’s duty as regards De-

preciation—Repairs and Renewals—Legal aspect of De-

preciation—Legal decisions considered.

Typical Questions.

Cuaprer VIL

Reserves,

Meaning — General Reserve — Specific Reserve —

DiFerence between Gencral and Specific Reserves—Re-

serves for Bad Debts—Reserves for Discount on Debtors

and Creditors—Sinking Tund—How is Sinking Fund

crcated—Difference between Sinking Fund for the Re-

demption of a Liability and Sinking Fund for the Re-

placement ofan Asset—Duty of an Auditor as regards

Sinking Fund— Reserve or Development Funds — Capital

Reserve—Duties ofan Auditor in connection with the

Capital Reserve—Secret Reserve—Definition—Objects of

~Secret Reserve ~How Secret Reserve is created ~—Dangers

or Objections to Secret Reserve—Duty of an Auditor

connection with the Secret Reserves.

Typical Questions.

/Cuarrer IX. The Audit of Limited Companies.

Qualifications and Appointment of an itor—

Remuneration ofan Auditor Different classes of Audion

~Auditors appointed on behalf of different classes of

shareholders—Auditor’s Powers and Duties—Rights of an

Auditor—Auditor’s Lien—His Duties—Status of an Au-

ditor—Preliminaries to be gone through before the actual

PAGES

120-41

142—157

158—229

(vii)

work is begun by the auditer—Whether his appointment is

in order—Inspection of the books, documents ctc.—Memo-

randum of Association—Articles of Association—Prospec-

tus—Minute Books—Last Balance Sheet and the Auditor’s

Report — List of Officers — Audit of Share Capital —

Shares issued at a Premium—Duty of an Auditor—Shares

issued at a Discount—Shares issued for consideration

other than cash—Bonus Shares—Forfeited Shares—Audit

of Share Transfer-—Brokerage and Underwriting Commis-

sion~—Debentures—Debentures and Share Capital— Issue

of Debentures—- Different Classes of Debentures—Different

ancthods of the Issue of Debentures—Fixed and Floating

Charge—Redemption of Debentures—Duty of an Auditor

in case of Redemption of Debentures—-Mortgages—Preli-

minary Expenses—Auditor’s Duty—~Interest paid out of

Capital — Statutory Meeting, Report and Audit ~ Profits

prior to Incorporation — Directors — Remuneration of

Directors—Managing Directors—Loans to and from

Directors—Managing Agents—Dividends—Interim and

Final Dividends—Position of an Auditor in connection

with the Payment of Dividends—Reorganisation of Capi-

tal — Auditor’s Report — Qualified report ~ Private

Limited Companies— ‘Their Privileges — Their, Audit —

Holding Companies—Subsidiary Companies —Require-

ments of the Companies Act regarding Holding and

Subsidiary Companies -- Auditor of such, Companies—

Audit of Banking Gompanies— Capital of a Banking Com-

pany—Banking Companies Act, 1949—~Internal Check

—Publication of Accounts — Audit of Insurance Com-

panies, ee

Typical Questions.

Carter X. Audit of Partnership Accounts,

Introduction—Procedure to be followed by a newly

appointed auditor of a partnership—Audit on behalf of

different classes of partners.

Typical Questions,

EuaprTer XI. Divisible Profits.

What are Profits—Difficultics in the Determination

of Profit—Who are affected if profit is not correctly deter-

mined—Consequences of Incorrect Valuation of profits—

Relevant clauses of Table A re Dividends—Whecher Capital

Profits are available for Dividends—Whether all the surplus

made by a company engaged in working a Wasting Assct is

available for Dividends—Whether the loss of fixed asset

must be made good before the distribution of the surplus

—Whether profits made prior to incorporation are available

PAGES

230—236

237-261

for dividends—Loss prior to

considered.

'ypical Questions.

SuapTer XII. Investigation,

Definition—Difference

(uit)

PAGES

Inenrporation—Legal cases

262—2%

between Investigation and

Auditing—-Report of Investigator—Different classes of Tne

vestigation—Investigation on behalf of a Purchascr to

ascertain the carning capacity—Investigation on behalf of

an incoming Partner—Investig:

of.

gar ih :

ofa company—Valuat ion o|

Companies Act, 1956.

Typical Questions.

ation on behalf of a Lender

shen Fraud is suspected—Investi-

who wishes to purchase shares

{shares—Investigation under the

_ Sp rrR XI. Liabilities of an Auditor. 217~298

Liability ofan Auditor appointed bya private concern

—Liability of an Auditor under the Companies Act-~Civil

Liability of an Auditor—Criminal Liability ofan Auditor

—Liability of an Auditor to third parties—Liability of an

Honorary Auditor—Dual Ar

Liability of Auditor for libe” -*-

Typical Questions,

Guapter XIV. Typical Audi

Preliminary Work—Cash Book—Petty Cash Book—

Tr sal Auditor—

« "considered.

it Programmes. 299—319

Purchases and Sales Journals—~Purchases Returns—Sales

Book—Sales Returns—~Wages Book—Bills Receivable and

Payable Books —Journal —Purchases Ledger—Sales Ledger

Nominal Ledger—Audit Programme for the Statutory

Report—General Audit Programme for Limited Com-

panies.

Special Features of the Audit of Non-Trading Con-

cerns:->Charitable Institutions—Clubs—Educational Insti-

tutions—Hospitals.

. Special Features of the

Audit of Trading Concerns :-

‘ranches —~ Bus Companies — Cinemas, Theatres, Cir-

cuses ctc,—Collieries—Contractors and Builders~Co-

operative Societies — Electric and Gas Companies —Executors

and Trustees—Finance and Trust

Newspapers and Periodicals—Pub|

nies—Retailers—Rubber,

Typical Questions.

Index

st_ Companics~ Hotels—

lishers—Railway Compa-

Ss! Tea and Coffee Plantations—

Shipping Companics—Solicitors. antations

321

CHAPTER I

INTRODUCTION

Origin of Audit. —

The origin of audit may be traced to middle ages but the

audit in the present sense can be traced after the introduction of

large-scale production in consequence of Industrial Revolution during

the 18th century. Before this era, goods were produced by indivi-

duals on small scale. There was not much capital, The individual

who invested the capital, usually himself maintained the accounts

and therefore there was no necessity of checking them.

Again stabilised governments, expansion of banking facilities

and new means of communication have widened the scope of

investment and business. The investor would naturally like to

see that his investment is safe. For this purpose the accounts

must be checked and audited especially in case of joint-stack compa-

nies, where the shareholders are drawn from far-off places, and who

have no hand in the actual running of the business. It is but

essential to get the accounts audited in order to assure them that

their investment is safe and that the Directors and the Managing

Agents etc., who handled the capital and accounts, presented true

and correct accounts, Itis not possible for the shareholders to

check the accounts of the company. ‘The shareholders appoint a

person who would audit the accounts on their behalf. Formerly

such a person used to be one of the shareholders who might not have

technical knowledge of accountancy. To havean effective check,

the custom to apoint professional auditors began to develop.

Definition of Audit, —

The word ‘‘audit” is derived from the Latin word “audire”

which means to hear. In olden times, whenever the owners of

a business suspected fraud, they appointed certain persons to

check the accounts. Such persons sent for the accountants and

“heard” whatever they had to say in connection with the

accounts. It was an Italian, Luca Pacialo, who first published his

treatise on double entry system of book-keeping for the first time in

1494. He mentioned and described the duties and responsibilities

ofan auditor. Since then there have been lot of changes in the

‘scope and definition of audit and the duties and responsibilities of an

auditor,

«

2 A HANDBOOK OF PRACTICAL AUDITING

‘As has been indicated above, the original object of an aut

was principally to sce whether the accounting party had propery

accounted for the receipts and payments of cash. _Thus it wa :

only a Cash Audit, but as will be seen later on, the principal objec

of modern audit is to sce whether the Balance Sheet exhibits a truce

and fair view of the state of affairs of a company. Since the Ba

Sheet incorporates all personal and impersonal accounts and the

palance of Profit and Loss Account, which in its turn incorporates

fictitious transactions, we may safely say that the Balance Sheet for

a particular period incorporates all the transcations which took place

during the period for which the Balance Sheet is prepared. ;

Spicer and Pegler have defined an Audit as “such an examuna~

tion of the books, accounts and vouchers of a business, a shall

enable the auditor to satisfy himself whether or not the balance

sheet is properly drawn up, so as to exhibit a true and correct

view of the state of the affairs of the business, according to the best

of his information and explanation given to him and as shown by the

books ; and if not, in what respect it is untrue or incorrect.”

Another writer has given the definition: “Auditing may be

defined as careful searching of the books of accounts by comparing

them with the documents and papers from which they have been

written up; and thus trying to find out whether the profit or loss for

a particular period and the financial position, as shown by the Final

Account are correct and truc.”

Yet another writer says : “Official examination and verification

of accounts or claims; especially an examination of accounts

by proper officers, or persons appointed for that purpose, whe

compare the charges with the vouchers, cxamine witnesses, and state

the result.”

From the above definitions, it would be seen, that an auditor

has not only to see the arithmetical accuracy of the books of accounts

but has to go further and. find out whether the transactions entered ir

\the books of original entry are correct or not. How is he to find it

“1? The answer is by inspecting, comparing, checking, reviewing,

satinising the vouchers supporting the transactions in the books of

vunts and the correspondence, minutes books of the shareholders

and directors, memorandum of association and articles of association et

Difference between Accountancy and Auditing.

jore ¥V it i ‘

De nee between Accountancy and

_

INTRODUCTION 3

1. Accountancy means keeping the books of accounts in such

a way that one is in a position to know the state of affairs

of the business, while auditing means the checking of such

accounts to find out their accuracy.

2, The spade work is done by the accountant while the

finishing touch is given by the auditor or, as has been said,

that where the work cfan accountant ends, the work of

an auditor begins.

3. Sometimes an auditor is asked to prepare from a set of

books the trial balance, profit and loss account and

balance sheet in which case he would be acting as an

accountant and he would not be required to give his

-certificates at the foot of the BS. He has simply to put

his signature in token of his having prepared such a

profit and loss account and balance sheet that the balance

sheet exhibits a true and correct state of affairs. On the

. other hand, an auditor has not to prepare the Trial

Balance, P & L Account and Balance Sheet. He is to

certify that the balance sheet as has been prepared by an

accountant exhibits a true and correct state of affairs of

the concern.

4. An accountant has to,record the transactions in the books

of accounts while gfauditor has to check and verify such

transactions an@“accounts prepared by an accountant.

Investigation.

Sometimes students get an impression that auditing and

investigation mean the same thing. However, there is a lot of

difference between the two. Investigating means a searching enquiry

into the profit-earning capacity or the financial position of a con-

cern or to find out the extent of the fraud if there is any suspicion

about it.

1, Audit is carried out to find out whether the B.S. is properly

drawn up and exhibits a true and correct state of affairs,

while investigation is carried out with a certain end in

view, ¢.g., the profit-earning capacity, or the financial

position of a concern or to find out a fraud and the extent

thereof.

2. Investigation covers several years, say 3, 5, or 7 years to

find out the average earning capacity, financial position

etc., while audit relates to one year only.

3,

A MABDEGOK OY PRACTICAL APOITRES

Investigation mey he eared outon hehalt af asides

while audit i conducted an behalf of dhe prnpricters ot

However, investigation fs carried ait by propacins a

in some eases where fraud of defateation is suspected,

Qualities of an Auditor,

1

2.

3.

4.

3.

&.

9.

+ , o in

Acis very important for an auditor ta he well versed

5

the fundamental principles and theory of all ranches om

acconnting, cy, Betieral accounting, Cost acenuntint

income tax, ete. [tis not posible fara perioa to At at

the acemants untess he himeelf knows fw fo prepate

them. ,

He should not pass a transaction unless he knows thar it is

correct. ‘This is posible only when one knows thoroughty

well the principles of accounting,

He should be able to gee “quickly technical details of

the business whose accounts he fs auditing. If possible,

he should pay a visit to the works before he undertakes

the work of audit. trib ernnteen

He should be prepared to seck elucidation on technical

questions rather than show a false pride or fear of dis

playing his own ignorance.

He should be quite familiar with the Company Law and

must be complete master of the principles of auditing.

He must be tactfal and honest, as Lord Justice Lindley

has said: ‘An auditor must he honest, ic. he must not

certify what he docs not believe to he truc, and he must

take reasonable care and skill before hic believes what he

certifies is true.” (In re London and General Bank, 1895).

He must not be influenced directly or indirectly by others

in the discharge of his duties.

Sometimes he is put in a very awkward position when his

duties to his client is opposed to his own interests in

which case he must have the courage to carry out his

duties faithfully and honestly even if such a step harms

him. In we Jong run this policy will be of immense value

to him. He will acquire a rp, i i

which will bring nore business te him. @ for Bis honesty

emus Be Ne ines ene rather than signa balance

h Rot exhibit i

view of the state of affairs and thus gi false

S Zive a false report.

INTRODUCTION 3

10. He should not disclose the secrets of his clients.

11. He must have the tact to put intelligent questions to

extract full information.

12. He must not adopt an attitude of suspicion. Lord Justice

Lope has said : “An Auditor is not bound to be a detective

or as was said, ‘approach his work with suspicion’, or with

foregone conclusion that there is something wrong. He

should behave like a ‘watch dog’ but should not adopt

. the attitude and outlook of a ‘blood hound’.”

13, He must be prepared to hear argument and must be

reasonable.

14, He must be vigilant, cautious, methodical and accurate.

15. He should have the ability to write clearly, forcibly,

concisely and correctly. .

16, He should have an understanding of the general principles

of economics.

17. He should have thorough training in business organisation,

management and finance.

18. Heshould be able to write the report clearly, forcibily

concisely, and correctly. ~

19, Last but not the Ieast, he should have ‘Common Sense’.

Objects of an Audit.

The next point to be considered is the object and extent of an

audit. The objects of an audit may be said to be :—

I. Detection and prevention of errors ; and

II. Detection and prevention of fraud.

IL. Detection of Errors. “4

Errors are generally innocent but sometimes errors which might

appear at first sight as innocent are ultimately found to be due to

fraudulent manipulation and therefore an auditor must pay parti-

cular attention to any error, howsoever innocent it may appear to be

at first sight.

Errors are of three kinds, viz.

1, Clerical crrors which can be sub-divided into

(a) Errors of Omission ; and

(b) Errors of Commission.

2. Errors of Principles.

3. Compensating Errors.

Let us explain these separately in detail,

6 A HANDBOOK OF PRACTICAL AUDITING

(a) Errors ef Cmission.

As the name indicates, the error of omission is one where a

transaction has not leen recorded in the books of accounts chet

wholly or partially. In the former case it will not be casy to detett

the error and it will not affect the Trial Balance. But sometimes?

js apparent from the balance of an account that an entry has beet

omitted, ¢.g. the rent account may show that the rent has been nt

for only 11 months and that the rent for the 12th month has not oe

paid. But there are many other cases where it may not be poss

to detect the omission, c.g. purchases or sales have entirely been

omitted to be entered which error will not affect the Trial Balance

and the omission will not be apparent even.

But if one aspect of the purchase or sales has been entered in

the books, it will affect the Trial Balance and the omission will be

easily detectable. Tt may be due to the fact that the item has not

been posted although entry has been made in the books of original

entry. Ifa transaction has been omitted to be entered in the books

of accounts intentionally, it will affect results shown by the accounts

and affect the ultimate profit or loss.

(b) Errors of Commission.

When a transaction has been recorded but has been wrongly

entered in the books of original cntry or posted in the ledger, error of

commission is said to have been made, e. g. incorrect entries in the

original records, wrong castings, calculations, postings, extensions and

carry forwards. Some of such errors will be detected by the non-

agreement of the Trial Balance. On the other hand, if a mistake has

been committed in the invoice for the sale of goods, the error will

not be detected as the mistake will appear both in the original books

as well as in theledger. °

2. Errors of Principle

Such errors arise when the entries are not passed according to

ans s

the fundamiental principles of accountancy, c.g. wrong allocation

of expenditure between capital and revenue, }

assets and liabilities, valuation of assets a.

gnoring the outstanding

book-keeping.

gainst the principles of

| Such errors may be committed either intentionally, or uninten-

tionally. Ifthey are committed intentionally, the object is to falsify

and aaenipalate the accounts cither to shaw more profits or less profits

than they actually are. Such errors ulti

timately aff

Sheet. Therefore, it is very § ii wat ane Balance

: 2 '¥ important for an auditor to pay particular

ae

INTRODUCTION 7

attention towards this type of error. Such an error is not disclosed

by the Trial Balance or by routine checking. It can be detected only

by a searching enquiry and independent checking.

3, Compensating Errors.

A compensating error is one which is counter-balanced by any

other crror or errors, ¢,g., if A’s AJC was to be debited for Rs. 100 but

was debited for Rs. 10 while B’s A/G which was to be debited for

Rs. 10 was debited for Rs. 100. Thus both the accounts have been

debited for Rs. 110 which amounts ought to have been debited.

‘This type of crror will not affect the Trial Balance and will not be

detected easily. Such errors may affect the Profit & Loss Account

or not.

An over-casting of an account may be counter-balanced by the

under-casting of another account to the same extent. This type of

error will not be detected by the Trial Balance.

Location of Differences.

The question is how to locate an error if it is found that there

has been an error. If the following methods are adopted, there will

be no difficulty in finding out an error :—

1, Check the totals of the Trial Balance,

2. Compare the names of the accounts in the Ledger with the

names of the accounts as have been recorded in the Trial

Balance. It is possible that balance of some account might

not have been transferred to the Trial Balance especially

in the case of the balance of Cash Book or some other

subsidiary book.

3. Total the lists of debtors and creditors and compare them

with the Trial Balance.

4, Ifthe books are maintained on the self-balancing system,

sce that the total of different accounts agree with the total

of these accounts with the balance of account as recorded

in the Trial Balance.

5. Whatever the difference is in the Trial Balance, halve it and *

see if there is any item of this value. This is done to

avoid the putting of the debit balance on the credit side

of the Trial Balance or vice versa.

If in spite of the above methods, the error cannot be located,

the error may be due to the following causes :-—

1. An error of say Re. 1 or 10 or 100 etc., ic. a round sum,

may be due to wrong totalling. Ifthe difference is rupees, and

A HANDBOOK OF PRACTICAL AUDITING

pice, it may be due to wrong posting or extracting a wrong

balance.

2. An error which is divisible by 9 may be duc to misplace-

ment or transposition of figures, c.g., 32 for 23, 52 for 25

or 54 for 45 and so on,

Il. Detection and Prevention of Fraud,

Having dealt with the first object of audit, viz., detection and

prevention of errors, Iet us proceed further and discuss the second

object namely :

Detection and Prevention of Fraud.

Detection of fraud is considered to be the mast important duty

ofan anditor. Asa matter of fact, originally audit was conducted,

mainly with a view to detect frauds whenever it was so suspected.

Fraud means false representation or entry made intentionally or

without belief in its truth with a view to defraud the proprictors of

the business. Fraud is of two kinds :

1. Defaleation of money or goods ; and

2. Fraudulent manipulation of accounts not involving the

misappropriation of money or goods.

1. Defalcation of money or goods.

There is a greater possibility of defalcation of money or goods in

a big business honse than in the case of a small proprietary business

where the proprietor has a direct control over the receipts and pay-

ment of cash and purchase and sale of goods. Ina big business

house, the receipt and payment of cash and the purchases and

sale of goods should be so organised that the work of one clerk may

be automatically checked by another clerk which system is known

in auditing as ‘Internal check” system and which will be dealt

with in detail later on. As between the two, namely misappro-

priation of cash and goods, it is casier to misappropriate cash, and

therefore the auditor will do well to pay particular attention

towards cash transactions.

Cash may be misappropriated by

(a) omitting to enter any cash received ; or

& te ane egret than what is actually received sor

book tos s entries on the payment side of the cash

(d)_ entering more amount on the

Payment si

book than what has actually boon, paid, side of the cash

INTRODUCTION 9

In order to discover fraud under (q) and (6) above, the auditor

should check the debit side of the cash book with rough cash book,

salesmen’s reports, counterfoils of the receipt books and other original

records while the fraud under (c) and (d) can be discovered by ref-.

erence to the vouchers, wage sheets, salary book, invoices etc.”

Again fraud may be in respect of goods, i.e,, defalcation and

misappropriation of goods. This type of fraud is very difficult to

detect. Proper methods of keeping accounts in regard to purchases

and sales, stock taking, periodical checking of stocks, the necessity for-

collusion, will help to avoid misappropriation of goods.

2. Fraudulent manipulation of accounts, not involving any

misappropriation of money or goods,

This type of fraud is more difficult to discover as it is usually

committed by directors or managers with the object of

(a) showing more profits, than actually they are (7) so that if”

they get commission on profits, they may get more commis~

sion; or (ii) their service may be retained by showing to the

shareholders that because of their efficiency they have

shown more profits and thus maintain the confidence of the-

shareholders and the public ; or (iti) if they hold shares,

they may sell them at high price by declaring higher divi-

dends ; or (iy) to obtain further credit by showing that the-

position of the business is better than what actually it is ;

or (vy) to attract more subscribers for the shares of the

company etc.

(b) Showing less profit than actually they are (7) in order to-

purchase shares in the market at a Jower price ; or (#/) to-

reduce or avoid the payment of income tax ; or (iii) to give

a wrong impression about the success of the business to.

competitors etc.

Falsification of accounts may be resorted to =

(a) By not providing any depreciation or providing less.

depreciation or providing more depreciation ; of

(b) By under-valuation or over-valuation of assets and

abilities ; or

(c) By including fictitious sales or purchases or returns in

order to show more profits or less profits.

Such frauds are difficult to detect as they are committed by the-

people at the helm of affairs, who are presumed to be trustworthy,.

honest and responsible, and therefore, no suspicion falls on them.

10 A HANDBOOK OF PRACTICAL AUDITING

‘They are very cleverly made and as such, the auditor should be very

careful in detecting such frauds. He should carry out the routine

checking and vouching most carefully and make searching enquiries

intelligently.

Advantages of an Audit.

On account of the following advantages people get their accounts

-audited especially in cases where audit is not compulsory :

1, Errors and fraud are located at an early date and in future

no a(tempt is made to commit such frauds or one is rather

careful not to commit a mistake as the accounts are

audited at regular intervals.

The auditing of accounts keeps the accounts clerks regular

and vigilant as they know that the auditors would comp-

lain against them if the accounts are not prepared up to

date or there is any irregularity.

Audit of accounts by an independent auditor minimises the

chances of dispute amongst the partners.

In the case of joint-stock companies, the shareholders, who

have no hand in the actual running of the business, are

assured that the accounts have been properly maintained

and that the directors have not taken any undue advantage

of their position and thus misappropriated money.

In case of fire, the insurance company may settle the clair

on the basis of the audited accounts of the previou

years.

Money can be borrowed easily on the basis of the pre

vious audited balance sheet.

If the business is to be sold, price can be fixed on th

basis of the previous audited balance sheet.

Income tax authorities generally accept the profit and

loss account which has been prepared by a qualified

auditor and they do not go into details of the accounts.

Ifa new partner is to be taken in or one of the partners

retires or dies, the audited balance sheet will be a good

basis to estimate the value of the capital of such a partner

or partners.

‘Different Classes of Audit and their Advantages,

+ The audit of the accounts of pri indivi

r ie Ptivate individ:

Je 3 proprietor and the advantages derived from ite uals oF a

, 7

af oy

goo Ce

INTRODUCTION lt

When an auditor is asked to audit the accounts of a private

“individual or a sole trader, he must get clear instructions from his

F -elient in writing as to what he is expected to do. As he is appointed

by an individual or a sole trader under an agreement, therefore, his

dutics and the nature of the work will depend upon such an agree-

ment It is very important because if later on any charge of negligence

is levied, he can produce the agreement as to what he was asked

todo. In the case of an auditor to audit the acconnts of joint-stock

‘companies, this question does not arise as his duties are defined by

the Companics Act itself, Sometimes an auditor is appointedby an

individuay to prepare the accounts ors ometimes he is asked to prepare

the accounts for the purpose of presenting them to the income tax

authorities. Therefore. it is very essential that he must know his

-duties and the nature of the work he is called upon to perform.

The is called upon to perform the full audit, he must see

that the accounts are properly prepared and that the balance

sheet is correct. It is possible that his client might propose to take

a loan on the basis of the balance sheet signed by him. In such a

case if the lender later on finds that the balance sheet does not

represent the true and correct financial position of the individual,

“the auditor might be held responsible to the banker to make good

the loss, In short he snust act strictly according to the instructions

ofhis employer.

Advantages.

1, Th? individual is assured that his accounts are properly

maintained and that he is not being defrauded by the

accountant and his agents. ‘This is specially important

when the proprietor is a landlord and has a large estab-

lishment and consequently cannot have proper control

over it,

2. The accounts which have be2n audited by a qualified

auditor are generally taken as correct by the income tax

authorities and hence an individual does not feel any

difficulty in regard to income tax.

3. The audited books of a deccased are very helpful to the

executors and administrators as such accounts will form

the basis for the preparation of the death duty accounts.

4 Ifthe accounts have been prepared on a uniform basis,

accounts of one year can be compared with other years

and if there isan increase in expenditure, cause may

12 A HANDBOOK OF PRACTICAL AUDITING

be enquired into as to why the expenditure has increased.

and cfforts may be made to reduce the expenditure,

‘

Where agents ate appointed, it is difficult to keep a check

on their accounts and if the auditors are appointed, ine

agents will keep proper accounts. If they have committe

any defalcation etc., these can be easily discovered by the

auditors,

B. The Audit of the Accounts of a Firm.

The auditor of a firm is not appointed under any statute. He

is appointed by the partners and hence his scope of work will ex-

tend according to the terms of appointment and instructions issued

to him. He should strictly adhere to the instructions, Some-

times he is appointed by a firm to prepare the accounts, in which

case he will act more or less like an accountant.

Sometimes an auditor is called for an interview and after

having discussed the work to be done by him and the terms of

appointment, he is verbally asked to begin his work. In such a

case, it will be in the interest of the auditor to get in writing the

nature of his work, to avoid any difficulty later on. Inthe case of

Apfel vs. Annan Dexter & Co., it was held by the court that according

to the instructions issued to the auditors, it was clear that they were

to prepare the accounts for the purpose of income tax and hence

they were not to audit the accounts.

The responsibility of any

fraud will not lic on their head. Therefore

it is very important

that an auditor should get clear instructions from his clients. In

the above-mentioned case, fortunately, the auditors had instructions

in writing and hence they were freed from any responsibility for any

fraud,

This point has clearly been decided in several cases, viz.,

Leech vs. Stokes, the Scarborough Harbour Commissioners vs, Robinson,

Coulson Kirkbey & Co., ctc., where their lordships said that if the

auditors had acted to the clear instructions of their clien's, the

auditors would not be responsible.

The advantages derived by getting the accounts of a.

firm audited.

lL The partners are satisfied with accounts which have been

maintained by one of the Partners This will avoid

any dispute amongst the partners. This is why usuall

Provisions regarding audit of the firm’ de

P a S accounts are

in the Partnership Deeds of most of the firms. . made

INTRODUCTION 13

2. Although there is no provision regarding the sleeping

partner under the Indian Partnership Act of 1930, all

the partners do not take active part in the business. If

the accounts are audited by an auditor such a partner

who did not take active part in the business, will be quite

satisfied that there has been no fraud.

3. ‘Incase of the death or retirement of a partner or when

a new partner comes in, the valuation of goodwill or the

settlement of accounts will become very easy.

4. Negotiation for loans from a bank or an individual will be

much facilitated if the audited accounts are presented.

The bank in such a case can casily form a correct opinion

about the financial position of the firm,

5. The Income Tax authorities generally take such audited

accounts as correct for the purpose of assessment of income

tax,

6. The auditor can sometimes suggest better methods of keep-

ing the accounts.

7. Ifthe business is sold asa going concern, there will not

be much difficulty regarding the valuation of the business

if the accounts had already been audited.

In addition to the above-mentioned particular advantages, a

firm derives all the advantages which are usually derived in getting

the accounts audited.

‘C. The advantages derived bya Joint-Stock Company in getting

the accounts audited.

1. The sharcholders of a company have no access to the

books of accounts and therefore if the accounts which

have been maintained by the directors are audited

by an auditor who is a professional accountant, they are

assured that they have not been defrauded.

2. The audit keeps a check on dishonest employees.

3. The auditor of a company may give sound financial

advice though it is not his duty.

In addition to the above-mentioned particular advantages, a

Company derives all the advantages which are usually derived in

getting the accounts audited.

Distinction between the audit of a Joint-Stock Company and

a Partnership or firm.

i, The audit of joint-stock companies is compulsory under

4 A HANDROOK OF PRACTICAL AUDITING

the Companies Act of 1956 while that of a partnership

is not.

2. The duties, powers, rights etc., of an auditor of a joint-

stock company are defined by the Companies Act, 1956,

while in the case of a partnership they depend upon the

agreement between the auditor and the firm.

3. Inthe casc of a joint-stock company, its auditor must

bea qualified auditor as is laid down under 5. 226 of

the Companies Act, 1956, while in the casc of a partner

ship, its auditor need not hald those qualifications.

D. The Audit of Trust Accounts.

‘Trusts are created for the benefit of some institutions, widows:

minors etc. The trustees look after the propety left over by the testator-

They collect the rents of the property, dividends on the shares

ete. and distribute the income to the beneficiaries according to the

terms of the Trust Deed. As the widows, minors etc. for the

benefit of whom these trusts are created, are not in a position to

have access to the books of accounts and criticise them, they are

often defrauded by the trustees, There have been cases where the

trustees have misappropriated large sums of trust moncy without

the knowledge of the beneficiaries, Sometimes the trustees them-

szlves do not know how to keep accounts or sometimes they do not

do so at all, not because they are dishonest but because they are

ignorant of the trust Jaws and the fundamentals of book keeping

To avoid such a thing, sometimes a provision is made in the Trust

Deed for the appointment of auditors to check the accounts of tht

trust. This step will avoid the misappropriation of money by the

trustees. If the accounts are audited by a qualified auditor, it wil

help both the trustees and beneficiaries. Trustees will be benefitec

because there will be no unnecessary criticism against them, Th

beneficiaries will also be bencfited because they will be assure

that the accounts have been properly maintained and that ther

has been no misappropriation of trust money or fraud.

Conduct of Audit,

Audit may be

Z Continuous, or II, Periodical,

Fes yA Continsous Audit or a detailed audit, as it is. som

imes called, is an audit which involves a detailed examinati

he books of accounts at a regular interval of, sa ee

wonths, ‘The auditor visits » SAy one month or thre

. his clients at regular intervals durin

INTRODUCTION iy

the financial year and checks cach and every transaction. At the-

end of the ycar he checks the profit and loss account and the

balance sheet.

Advantages of Continuons Audit.

a 1, Mistakes and frauds are discovered easily and quickly as

6.

the auditor checks the accounts at regular intervals and

in detail. If he were to check the accounts after one:

year, it would be difficule to locate an error. As the

auditor visits his clients, say after a fortnight or,a month

or so, the number of transactions will be small and hence

the error will be detected easily and quickly.

Since the auditor remains more in touch with the-

business, he is in a position to know the technical details.

of it and hence can be of great help to his clients by

making valuable suggestions.

Most of the checking work having been already performed

during the course of the year, the final audited accounts

can be presented to the shareholders soon after the closing

of the financial year at the annual general meeting.

As the auditor visits the clients at regular intervals, the

clerks will be very regular in keeping the accounts up to

date and they will see that there is no inaccuracy or fraud

as it would be detected by the auditor at his next visit,

and lest the clerk might be taken to task.

Ifthe auditor pays surprise visits, it will have a consider-

able moral check on the clerks preparing the accounts as

they do not know when the auditor may come and check.

the accounts:

The auditor, having more time at his disposal, can check.

the accounts with greater attention and detail.

- Disadvantages of Continuous Audit.

In spite of the above-mentioned advantages of a continuous

audit, there are certain drawbacks of such an audit which are as.

under :

1. Figures in the books of accounts which have already been

2.

3.

checked by the auditor at his previous visit, may be altered

by a dishonest clerk and the frauds may thus be

perpetuated,

The frequent visits by the auditor may disturb his client.

It is an expensive system of audit.

16 A HANDBOOK OF PRACTICAL AUDITING

4, The audit clerk may loose the thread of his work and

the queries which he wanted to make may remain out-

standing.

These disadvantages and dangers may be avoided by taking

some precautions, ¢.g.,

1. No alteration should be allowed to be made after the

transactions have been checked by the auditor, without

his permission.

2. Ifany alteration has to be made, it should be done by

means of a rectifying entry.

3. Checking of a book should be complete as far as possible

at one visit. However, if this is not possible, the auditor

should check the transactions up to a particular date and

make a note of it in his diary and, if possible, he should

make a note of the totals up to that date in his diary or

note-book.

4. Well drawn-up programme by the auditor will prevent

any loose ends.

‘Ul. Periodical Audit or Final Audit or Balance Sheet Audit or

Complete Audit.

Periodical audit is one which is taken up at the close of the

financial or trading period when all the accounts have been balanced

and a Trading and Profit and Loss Account and the Balance Sheet

have been prepared. At this juncture, the auditor gets hold of the

books and checks the accounts. He is in possession of the full facts

relating to accounts for the year under review. In the case of such an

audit, the auditor visits his client only once a year and goes on

checking the accounts until the work for the whole of the period is

completed.

‘This type of audit is verysatisfactory especially in the case of

small concerns. This class of audit is usually adopted by almost all

concerns, But in the case of large concerns, it takes more time to

complete the audit and hence presentation of accounts to the

shareholders is delayed. The share- holders are usually very anxious

for the dividends which cannot be declared until the final accounts

shave been prepared and audited,

. The question often put is, what type of audit is satisfactory

which may be adopted, as both the continuous and periodical audit

ve Advantages as well as drawbacks.

a Itis suggested that an interim audit followed by the final

‘tis the most satisfactory type of audit although it is very

aN

INTRODUCTION 17

expensive. The type of audit to be adopted depends upon the

magnitude of the business.

Procedure.

How to proceed with the work will depend upon the circum-

stances of each case. The method of work varies with the training,

experience, and knowledge of the auditor. Some gencral points are

given below;

Distinctive ticks of different colours for, say additions, postings,

ledger balances, carry forwards etc, should be adopted. The

significance of these ticks should not be made known to the clerks

ofthe client. The same kind of ‘tick’ should not be used for every

firm and for the same kind of transactions or for all the visits. As

far as possible the work of checking of one book should be completed

at one sitting for if it is not done, some fraudulent alterations may

‘be made by the clerks after the audit clerk has left the office for the

day, Onthe next visit, the audit clerk should see thar -there has

been no alteration by rubber or by scratching of the work he had

already checked on the previous visit. If it has been done, he should

get an explanation and check the whole of the work again. If any

adjustment is found to be necessary, it should be made by a journal

entry and no alteration ofa figure should be allowed. Special ticks

should be used for figures which had_already been erased. Pencil

figures should not be accepted. It sometimes so happens that the

clients put the total figures with pencil. The auditor should refuse

to commence his work until these figures are inked. The audit

clerk should not balance the books. {t is not his work. Sometimes

he is asked to balance the books, in which case, he will be acting in

the capacity ofan accountant rather than an auditor. Frequently,

the auditor is asked to begin the audit work even before the

balancing of books, so that the audit may be completed sooner.

‘However, this procedure should be discouraged as there is a danger

of the errors being overlooked because there has been no clerical

test like the preparation of the Trial Balance. No transaction should

‘be passed unless he understands it, for an auditor must not certify

what he does not believe to be true.

The auditor should not discuss anything in regard to the

meaning of different ‘ticks’ etc., lest the client’s staff may know about

the secret meaning and defraud the auditor. Vouching should be

carried out by two clerks, the senior examining the voucher and

calling out the amount and the junior agrecing the amount and

placing a special tick against the item in the Cash Book, When

18 A HANDROOK OF PRACTICAL AUDITING

calling back the figures, the audit clerk must be very clear in

speaking out the figures otherwise mistakes may crop in ¢.g.. when

one clerk calls out the figure as Rs. 60, nP. 9, he might be understood.

as Rs, 69. Therefore the clerk should make a pause between 60 and

9, Similarly there might be confusion between ninety and nincicen,

cighty and cighteen. It would , be advisable to pronounce ninety as

ninetic and so on.

As already mentioned, work done by cach clerk should be

recorded in the Audit Note Book which is known by different names

such as Working Papers, Audit Notes, Memoranda etc. In addi-

tion to the programme mentioned above, it contains full record of

all important notes and queries, which were not satisfactorily ex-

plained, missing vouchers and invoices, all important matters which.

may be useful for future audit, points which have to be mentioned

in the report, answers to queries, together with the names of the

officers who gave such answers. Unimportant and minor matters

should not finda place inthe Audit Note Book. They may be

settled at the spot. These Note Books should never be destroyed

for they may be used for future reference and especially when a

question of the liability of the anditor arises. Such a question may

arise after many years when the clerk responsible for the work might

have resigned or the auditor might have altogether forgotten abour

the particular events. The Audit Note Book will be the best evi-+

dence in favour of the auditor.

QUESTIONS

1, What is an Audit ?- What are its advantages ?

2. Briefly explain the difference between Book-Keeping, Ac~

countancy and Auditing, (Allah. B. Com. 1945)

3. Explain the difference between Auditing and Investigation.

4, State the qualities that are required of an anditor, ,

5. What are the main classes into which errors in the books

of accounts are divided? Briefly explain and illustrate such errors.

6. What are the principal objects of an audit ?

(CG. U. Com. 1939)

7. Explain and illustrate “manipulation or falsification of

accounts,””

8. How is money or goods misappropriated ? Suggest methods

to prevent such a fraud.

9. Mention some of the types of frauds on the part of the

ors which the auditor must be on the look-out for and the

INTRODUCTION 19

precautions he should take so as not to be liable for such frauds.

(C. A. Final, Nov. 1951)

10. What do you mean by “routine checking’? ?

11. Describe the value of an audit for trading and non-trading

concerns,

12. State briefly the difference in principle between the audit

of accounts of a firm or a sole trader or a trust and that of a joint-

stock company.

13, “The auditor of an individual or a firm has no statutory

obligation to comply with.” Discuss briefly the implications and

limitations of this statement.

14. What is a Continuous Audit ? What are its advantages

and disadvantages ?

15. Distinguish between

(a) Complete and Partial Audit.

(b) Continuous or Running and Final or Balance Sheet

Audit.

16, What is your opinion as to the value of an Audit Note

Book ?

17. Write a short note on the “Method of work” and “Check

Marks or Ticks” generally adopted during audit.

18. Isita part ofan auditor’s duty to trace and locate a dif-

ference in the books he is auditing? What steps should be taken

when asked to sign the Balance Sheet if the Trial Balance shows a

difference ?

19. The Trial Balance of a company does ‘not agree. What

steps would you take to locate the error if you are asked to discover

the error or errors ?

20. What isan auditor’s duty in relation toa difference in

books undiscovered at the time of commencing the audit ?

21. Differentiate between

(a) the fundamental principles of auditing, and

(b) the technique of auditing,

Explain why the latter must be subject to change though

the former may remain constant.

(C, A. Final, 1951)

22. Give examples of errors which might still exist in a set of

books after the Trial Balance had been agreed, and state th | ee

auditor would take to detect them.

CHAPTER II

INTERNAL CHECK OR CONTROL

Meaning of Internal Check.

Internal Cheek is a method of organising the accounts system

of an office or factory and the duties of the different clerks in such

away that the work of one person is automatically checked by ane

other and thus the possibility of fraud, or error or irregularity is

minimised unless there is a collusion between the clerks; eg. the

reccipt of cash is entered by the cashier on the debit side of the cash

book ; this entry is carried to the ledger by another clerk ; the

statement of account relating t2 th's transictioa is sent to the cus-

tomer by a third clerk and so on. Thus we sec that the same

transaction has passed through three different hands, and the work

ofone is checked automatically by the other. This minimises the

possibilities of fraud and errors unless all the three join hands in

defrauding their employer. Again, the clerk in charge of a book of

prime entry should not have access to the ledger and vice versa. Self-

balancing ledger system, time recording clocks or automatic tills for

recording cash receipts, are some of the devices by which the com-

mission of fraud may be prevented. No one is allowed to deal with

one book throughout. Under this system, wages sheets are pre-

pated and checked from different records by different clerks. In

case of cash sales, the salesman does not receive the moncy from the

customer, nor does he deliver the goods to him. Cash is received by.

the cashier ; the goods are delivered by the gate-keeperand all the

three, viz. the salesman, the cashier and the gate kecper send their

own statement regarding the sales, receipt of cash and the delivery

of goods in the evening to the Gencral Manager who compares

these statements and if he finds any discrepancy, he makes an in-

vestigation. Under such a system, unless all the three joi hands,

there is no possibility of fraud.

Similarly when the goods are purchased on credit, entries are

made regarding the purchase by the gate-keeper, who records the

name of the supplier, the quantity and the date; another entry is

made by the keeper of the purchases book, the godown keeper etc.

‘Thus the same entry is recorded by different clerks and the possibi-

lity of fraud or mistake is reduced to the minimum.

ook Tt must be

,, 1 Clear here that the students should not confuse between the

i

INTERNAL CHECK OR CONTROL “ at

Internal Check and Internal Audit. The internal audit implies an

audit of the accounts by the employces of the business. The clerks

go on auditing the accounts throughout the year. Itisa kind of a

continuous audit, but conducted by the clerks of the concern.

Tn the case of large concerns like banking companies or local bodies,

they have a separate Internal Audit Department.

The Objects of the Internal Check

The internal check system is organised to achieve the follow-

ing objects :—

1. To prevent the commission of any fraud by a clerk,

2. To prevent the misappropriation of cash or goods by any

clerk by kecping a check on the receipts and payments of

cash and reccipts and delivery of the goods.

3. To throw responsibility on a particular clerk when the

fraud or mistake is detected,

4. To detect a fraud or an error quickly and easily.

5. To have an accurate record of all business transactions,

Auditor’s duty in regard to Internal Check System.

Te what extent should an auditar depend upon the Internat

Check system will depend upon the magnitude of the business

whose accounts he is auditing.

In case ofa concern where there is no internal check system

and the clerk has full control over all the books of accounts, it would

be better if the auditor checks all the transactions from the begin-

ning to the end, irrespective of the fact whether the concern is,

small or big. Of course, it would entail more time but it is worth }*

while to do so. He must not assume that there is no error. Ifhe Bet

does so, he would be running a great risk. neo

In the case ofa big concern where there is a good internat

check system, the auditor may rely upon it and may, toa great

extent, presume the accuracy of the accounts. But he must not be

negligent. He should apply a few test checks, i.e., he should check a

few transactions here and there at random or check fully the

accounts for a few months, say for January, April, July etc,, and

carry out a thorough check of the whole of certain classes of trans-

actions taking place during that particular period, e.g., cash sales, or

cash received or credit purchases during that period. In selecting

certain transactions for ‘test checks’ the auditor should see that

such sample transactions are representatives and true specimens of

such entries throughout the year.

INTERNAL CHECK OR CONTROL 23

books and their specimen signatures. Such a list should

be duly signed by a responsible official of the company.

If internal check system is followed, he should get a written

statement to that effect.

6. He should get a list of the officers of the company together

with their duties and powers.

3. Ifthe business is of a technical nature, he would do well to

visit the works, acquire technical knowledge to some

extent, before he actually commences the business so that

he may put intelligent questions to his clients and may not

ut

appear to be ludicrous by putting absurd questions and pt

may also not be deccived by the clerks who may take

undue advantage of his lack of technical knowledge.

8. He should ask his clients to balance the books, prepare the

final accounts and the balance sheet, file the vouchers in,

ihe order of the occurrence of the transactions, prepare the

2 schedules of the debtors, good, doubtful and bad debts,

creditors, important legal papers, contracts, list of securities

etc., if this has not been done so far. He should never

begin his work until the books have been balanced.

9. He should get the previous year’s balance sheet and see

that the accounts during the current year have been

opened with those balances with appeared in the previous

balance shect.

10. He should get the report of the auditor, ifany, relating to

the accounts of the previous year for information regarding

the state of affairs of the company during that year.

11. He must read those clauses of Memorandum of Association

and Articles of Association of the company which have a

bearing on the accounts or the Articles of Partnership of

the firm whose accounts he is auditing or Will or Trust

Deed in case of an audit of a Trust.

12, Ifit is the first audit of a company, he must go through

the prospectus.

Division of work between Senior and Junior Audit Clerks.

Having considered the above points, the auditor has now to

chalk out a programme and divide the work amongst his assistants as

the chief auditor has simply to supervise and give a finishing touch

to the work already done by his assistants. Of course, it should be

borne in mind that the ultimate responsibility is his,

24 A HANDBOOK OF PRACTICAL AUDITING

The auditor will do well if he allots the audit work ofa concern

toone of his senior audit clerks who in his turn will be assisted

by a few junior clerks selected by him. Sometimes the

senior clerk himself sclects the juniors to help him. Both the

methods have advantages. These junior clerks will get instructions

from their senior audit clerk regarding the work and will be responsi-

ble directly to him under whom they are working. The work,

assigned to the juniors will be of routine nature which requires less

skill and technical knowledge, such as checking of original records

with documentary evidence such as vouchers, casting of subsidiary

books, posting of such books into the ledger, checking of stock and

wages sheets etc. Incase of doubt or difficulty, they should refer

the matter to their senior audit clerk who will get a clarification

from the client.

In selecting the senior and junior audit clerks for the work factors

like expericnce, tact, skill etc, must be borne in mind and one

should not be led by the age of the clerk or the Iength of his

service. It is possible that a clerk with many years of service,

may not be tactful or may not be skilful. The juniors should not

do the work mechanically. They should try to understand the

transactions. They should take lively interest in their work and

suggest ways of improvement to the senior audit clerk under whom

they are working. They should workin full co-operation with the

senior. This is the ground work where they get their initial

training. They should pass no entry which they do not understand.

Notes should be made for such entries to enable the senior to get

further explanation about such entries.

‘The senior audit clerk will supervise the juniors working under

him. He will come in contact with the client or with the manage-

ment. At the outset, the senior in consultation with the auditor,

will chalk out the programme, assign duties to different juniors and

decide as to what work is to be done by himself. Usually the vouch-

ing of the receipts and payments, verification of the cash balance,

verification of the journal entries, adjustments, apportionment of the

capital and revenue items etc., are done by the senior audit clerk.

Having done so, he submits the final accounts tog¢ther with his notes

to the auditor who in his turn certifies the balance sheet, and prepares

‘he report to be submitted to the shareholders of the company. As

tioned above, it is he who is responsible for the whole work and

ss he who signs the balance sheet,

INTERNAL CHECK OR CONTROL 25°

Audit Programme or Audit Note Book

The auditor having selected a senior and the juniors to do a

particular assignment, the senior will chalk out the programme as to

what work is to be done by each junior and by himself and with the

tinie by which the work is to be finished and this is Jaid down in

the Audit Note Book. There are three metheds by which the

programme is carried out, viz.—

1. There isa complete programme on the file from which

the items to be completed by a particular junior are ticked

off and thus the junior hnows what he has to do and by

what date each item is to be completed.

2. In other cases the senior chalks out a programme for each

clerk according to the nature of the business of the client.

In this case there is no previous chalked-out programme.

3. In the third case, the senior never prepares a programme

in advance but may allow it to grow as the work pro-

gresses,

Each worker signs for the work he has performed so that the

responsibility may rest upon him for the work he has done. This

is very important.

Advantages of Audit Programme.

The advantages of such audit programme or Audit Note Books.

may be outlined as below -—

1. The auditor is in a position to know about the progress of

the work done by his assistants.

2. A uniformity of the work can be attained as the same

programme will be followed at subsequent audits.

3. Work of the audit can be divided amongst the different

juniors who will be responsible for their work. In case

a clerk goes on Jeave, his work can be resumed by another

clerk who is jn a position to hnow what work has already-

been done.

4, Incase of a charge of negligence for not having done

some work against the auditor, the auditor can defend

himself that the work had been done by him or his assistant

who had duly signed the Note Book.

3. Itisa kind of guidance to the audit clerk for the work

he has to perform.

26 A HANDBOOK OF PRACTICAL AUDITING

After the above preliminaries are scttled, the senior clerk must

‘inform the clients beforehand that they would begin the work on

-such and such date. Though giving of this information may not he ne-

scessary, it is but in the interest of both the parties. In case he does not

give the information regarding his visit, he may find that the books

are not ready for checking, schedules of debtors and creditors may

‘not have been prepared, vouchers might not have been arranged

“properly, no satisfactory and comfortable room for the audit work

may be available and above all he may find himself unwelcome.

“Loss of time and disappointment may result. To avoid all this, a

previous intimation to the client will result in cordial relations,

mutual co-operation and smooth working.

Ifthe work is to be finished by a particular time, the senior

~must sec that it is done so. Ifnecessary, juniors may be asked to

-do overtime work, S. of

The senior audit assistant equipped with a letter of introduc.

‘tion from the principal auditor, should reach the office of the client

-with his assistants on the dey previously intimated after having

‘gone through the whole of the correspondence which had passed

‘between the auditor and the client and previous year’s balance shect

-and the auditor’s report.

a ‘

QUESTIONS

1, What do you understand by the term “Internal Check” ?

‘Has the auditor any responsibility in regard thereto? Show by

illustrations under what circumstances and to what extent, if any,

he is justified in relying upon it in the course of an audit.

(Agra B. Com. 1944)

2. What are the general principles which should influence

an auditor in deciding whether or not a system of internal check is

-adequate ? (Agra B. Com. 1936)

3. You are appointed auditor to a private firm, the partners

in which devote no time whatever to the books.

You find that the office work is apportioned as follows amongst

“the three clerks :—

| A keeps the Cash Book, pays the wages, fills in the calcula-

‘tions and makes the additions of the wages sheets, and posts the

‘Cash Book and sometimes posts the Sales Book to the Sales Ledger.

B keeps the Sales Book and posts part of it to the Sales

- He also does some correspondence,

INTERNAL GHECK OR CONTROL 27

G keeps the Purchases Book and posts it to the Bought Ledger.

‘He also keeps the Private Ledger (which contains the nominal

-accounts) and does some of the correspondence.

All these clerks make entries in the Returns (in and out)

‘Book.

Do you approve of this arrangement? Ifnot, submit a report

embodying any suggestions you have to make for the protection of

your clients.

4, What is meant by “Internal Check”? What are the

principles upon which you would found a system of “Internal

‘Check’’, and what is the position of an auditor in relation to such

-a system ? (Rajputana Af, Com. 1.950)

5. It is said that an auditor is entitled to rely on the system

-of internal check in force. Is thisa correct statement or does it require

‘any modification ? :

6. Prescribe a system of internal check to your clients, who

sare the proprietors of a big departmental stores, for control of cash

sales.

7. Your client, who conducts an extensive Ready Moncey

‘Business (not Mail Order) requests you to advise him how to protect

himself against losses of cash sales, Outline your recommendations.

8. You have been appointed as an auditor to (a) a firm,

consisting of three persons, and (b) a joint-stock company, both of

which were newly formed. Describe briefly what steps you would

‘take before commencing the detailed work of audit.

9. For the guidance of junior clerks who have been

placed under your control, draft a set of instructions suitable to the

ordinary commercial practice. Mention any matters of importance

upon which you would question them when inspecting their work. ~

10. Outline a system of internal check calculated to prevent

the following types of frauds: (a) a bank manager allows loans

to his friends and shares the proceeds ; (b) stock is written up to

augment profits; and (c) dummy vouchers are printed and

cheques drawn against them. (Bombay B. Com. 1939)

11, What is the object of keeping an audit programme and

maintaining notes during audit ?

CHAPTER HI

‘VOUCHING OF CASH TRANSACTIONS

‘The main objects of the audit of the cash book may be sura-

marised thus:—

1, To ensure that all receipts are accounted for ;

2. To ensure that no fraudulent payments have been made ;

3. To know that all receipts and payments have been properly

recorded ; and

4, To verify the cash in hand and at bank.

Vouching : Its Meaning

A voucher is a documentary evidence in support of a trans-

action in the books of accounts. Vouching is considered to be the

essence of auditing and therefore the auditor should be very careful

while vouching. Vouching means to substantiate an entry in the

books of accounts not only with any documentary evidence such as

an agreements, receipts, counterfoils of a receipt book or paying-in-

book, contracts, but also to sce that the transaction has been properly

authorised, recorded and entered in the books of accounts ; ¢.g., veri-

fication of the entries in the invoice book with the invoices, checking

of the cash receipts with the counterfoils of the receipt book, the

checking of the cash payments with the receipts of the payces and so.

on. Vouching means testing the truth of items appearing in the

books of original entry. The success of an auditor in vouching depends

upon his intelligence, critical bent of mind, common sense, obser-

vation and tact with which he handles his work. He should go behind.

the books of accounts and go to the source of a transaction. If he

simply compares the entry, say on the credit side of the cash book

vith the voucher, it is possible that he might be deceived; ¢.g., the

surchase might not have been for the business or the receipt might

iave been for the previous year. Ifitisa receipt side entry and if

he compares the entry with the counterfoil of the receipt book, it is

possible that Iess amount might have been entered on the counter=

foil than the money which has actually been received. Clever

frauds can be discovered only by proper vouching. Therefore,

it is very important that the auditor should vouch the items with

great care and intelligence. It is through vouching that an auditor

can satisfy himself as to the authenticity and completeness of trans~

‘fons in the books of accounts, In case he is negligent, he will be

‘\ guilty as was decided in the case of Armitage vs. Brewer & Knott.

VOUCHING OF CASIT TRANSACTIONS 29

Vouching also means checking of additions, ledger postings,

extracting of balances in the ledger, etc. The extent to which the

auditor should check will depend upon the size of the business, the

accounts of which he is auditing. If it is a big business, efficient

internal check will be in operation and hence the auditor will be

justified in relying upon a few test checks, while ina small business,

internal check may not be in operation and hence the auditor will